# TraditionalFinanceAcceleratesTokenization

1.62K

QueenOfTheDay

#TraditionalFinanceAcceleratesTokenization 🌐 Traditional Finance Meets Blockchain: A Paradigm Shift

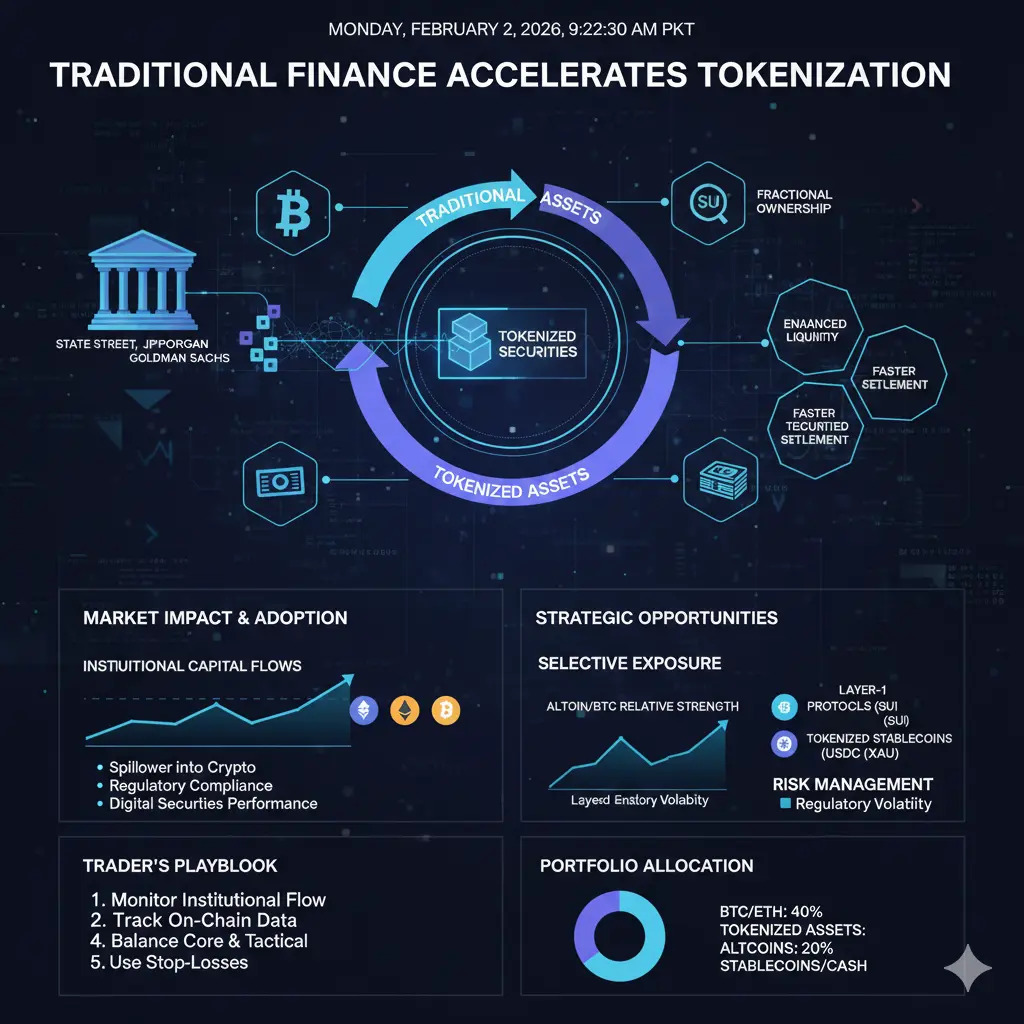

Major financial institutions like State Street, JPMorgan, and Goldman Sachs are actively embracing blockchain technology, launching digital asset platforms to enable asset tokenization. This marks a significant step in bridging traditional finance with the digital asset ecosystem.

💡 Key Insights:

Tokenization of Assets:

Physical and financial assets are being digitized into blockchain-based tokens.

This allows for fractional ownership, easier transfer, and broader accessibility.

Efficiency & L

Major financial institutions like State Street, JPMorgan, and Goldman Sachs are actively embracing blockchain technology, launching digital asset platforms to enable asset tokenization. This marks a significant step in bridging traditional finance with the digital asset ecosystem.

💡 Key Insights:

Tokenization of Assets:

Physical and financial assets are being digitized into blockchain-based tokens.

This allows for fractional ownership, easier transfer, and broader accessibility.

Efficiency & L

- Reward

- like

- Comment

- Repost

- Share

#TraditionalFinanceAcceleratesTokenization 🚀reflects the growing trend of mainstream financial institutions leveraging blockchain technology to tokenize traditional assets. From equities and bonds to real estate and commodities, major banks, investment funds, and insurance companies are increasingly converting their physical or financial assets into digital tokens. Tokenization allows these assets to be traded, transferred, or fractionalized on blockchain networks, offering unprecedented levels of liquidity, transparency, and accessibility.

📈 How Traditional Finance is Driving Tokenization c

📈 How Traditional Finance is Driving Tokenization c

ETH-4,19%

- Reward

- 1

- 1

- Repost

- Share

DragonFlyOfficial :

:

2026 GOGOGO 👊#TraditionalFinanceAcceleratesTokenization Traditional finance is no longer observing tokenization from a distance. It is actively accelerating toward it. What was once framed as an experimental concept is now becoming a structural strategy as banks, asset managers, and financial institutions seek faster settlement, lower operational costs, and programmable ownership. Tokenization is evolving from a crypto-native idea into a core pillar of modern financial infrastructure.

At its core, tokenization is about efficiency and control. By representing real-world assets on blockchain networks, instit

At its core, tokenization is about efficiency and control. By representing real-world assets on blockchain networks, instit

- Reward

- 4

- 1

- Repost

- Share

LittleQueen :

:

Watching Closely 🔍️#TraditionalFinanceAcceleratesTokenization

Traditional financial institutions are accelerating their adoption of blockchain technology, marking a pivotal shift in the intersection of traditional finance and digital assets. Major players such as State Street, JPMorgan, and Goldman Sachs are launching digital asset platforms aimed at tokenizing conventional financial products, including equities, bonds, and derivatives. This trend not only digitizes traditional assets but also enhances liquidity, transaction speed, and operational efficiency, effectively bridging the gap between legacy financia

Traditional financial institutions are accelerating their adoption of blockchain technology, marking a pivotal shift in the intersection of traditional finance and digital assets. Major players such as State Street, JPMorgan, and Goldman Sachs are launching digital asset platforms aimed at tokenizing conventional financial products, including equities, bonds, and derivatives. This trend not only digitizes traditional assets but also enhances liquidity, transaction speed, and operational efficiency, effectively bridging the gap between legacy financia

- Reward

- 3

- Comment

- Repost

- Share

⚡ Institutional Adoption of Blockchain Accelerates

Current Trend:

Traditional financial institutions such as State Street, JPMorgan, and Goldman Sachs are actively adopting blockchain technology.

They are launching digital asset platforms to tokenize financial products and enhance operational efficiency.

📉 Market Implications: Digitization of Traditional Finance

Adoption Signals:

Blockchain integration allows real-time settlement and increased transparency.

Tokenization enables fractional ownership of assets, improving liquidity and circulation efficiency.

Financial institutions are experimen

Current Trend:

Traditional financial institutions such as State Street, JPMorgan, and Goldman Sachs are actively adopting blockchain technology.

They are launching digital asset platforms to tokenize financial products and enhance operational efficiency.

📉 Market Implications: Digitization of Traditional Finance

Adoption Signals:

Blockchain integration allows real-time settlement and increased transparency.

Tokenization enables fractional ownership of assets, improving liquidity and circulation efficiency.

Financial institutions are experimen

- Reward

- 8

- 6

- Repost

- Share

DragonFlyOfficial :

:

Traditional finance is going digital! Are you exploring tokenized products or observing how institutional adoption will reshape markets? Share your thoughts!View More

#TraditionalFinanceAcceleratesTokenization

Traditional financial institutions are accelerating their adoption of blockchain technology, marking a pivotal shift in the intersection of traditional finance and digital assets. Major players such as State Street, JPMorgan, and Goldman Sachs are launching digital asset platforms aimed at tokenizing conventional financial products, including equities, bonds, and derivatives. This trend not only digitizes traditional assets but also enhances liquidity, transaction speed, and operational efficiency, effectively bridging the gap between legacy financia

Traditional financial institutions are accelerating their adoption of blockchain technology, marking a pivotal shift in the intersection of traditional finance and digital assets. Major players such as State Street, JPMorgan, and Goldman Sachs are launching digital asset platforms aimed at tokenizing conventional financial products, including equities, bonds, and derivatives. This trend not only digitizes traditional assets but also enhances liquidity, transaction speed, and operational efficiency, effectively bridging the gap between legacy financia

- Reward

- 2

- 1

- Repost

- Share

HeavenSlayerSupporter :

:

2026 Go Go Go 👊#TraditionalFinanceAcceleratesTokenization

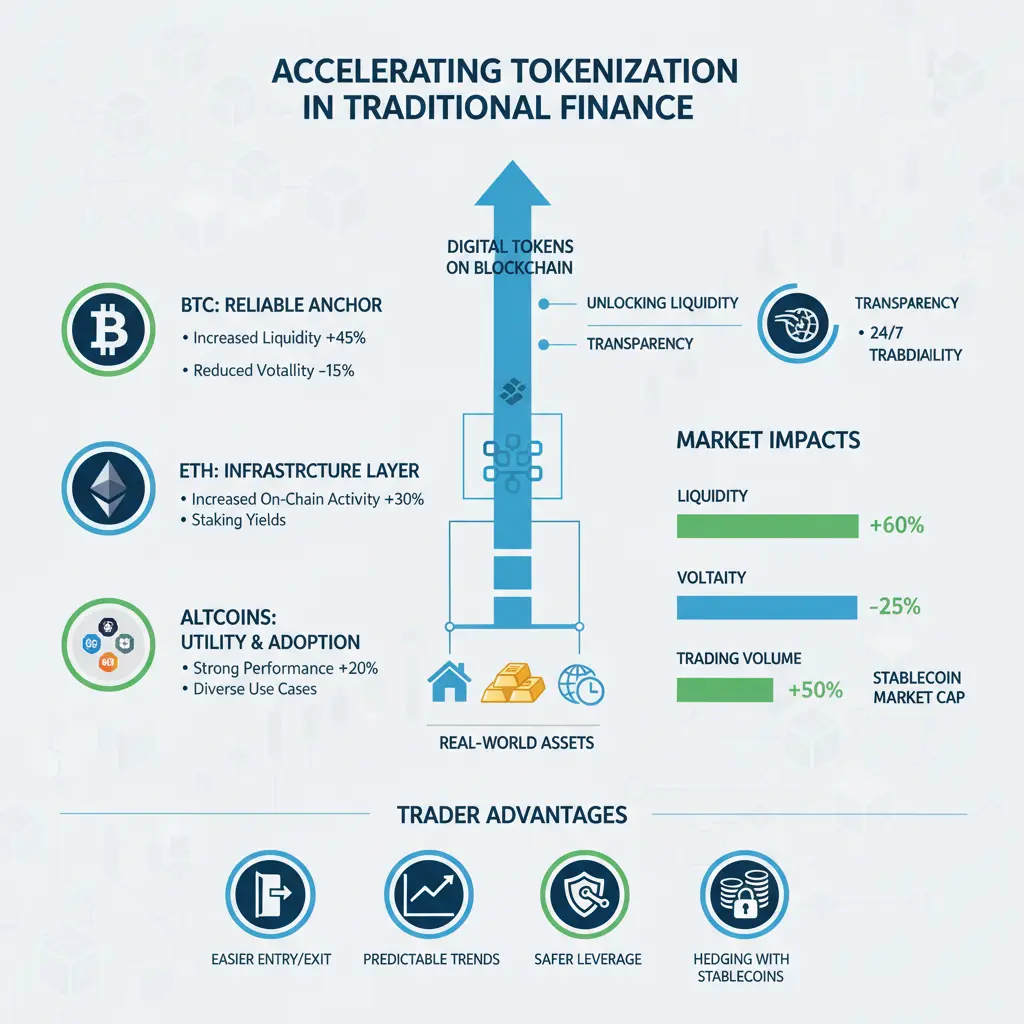

Tokenization is the process of converting real-world assets or financial instruments into digital tokens on the blockchain, unlocking liquidity, transparency, and 24/7 tradability. This is not hype or speculation; it is a structural liquidity event quietly reshaping crypto markets from the inside out. When traditional finance accelerates tokenization, the first changes appear not in headlines, but in capital flow, liquidity deployment, and price stability. Markets evolve quietly, long before public sentiment catches up.

For traders like Trader Hazrat

Tokenization is the process of converting real-world assets or financial instruments into digital tokens on the blockchain, unlocking liquidity, transparency, and 24/7 tradability. This is not hype or speculation; it is a structural liquidity event quietly reshaping crypto markets from the inside out. When traditional finance accelerates tokenization, the first changes appear not in headlines, but in capital flow, liquidity deployment, and price stability. Markets evolve quietly, long before public sentiment catches up.

For traders like Trader Hazrat

- Reward

- 3

- 5

- Repost

- Share

HighAmbition :

:

Bull runView More

#TraditionalFinanceAcceleratesTokenization

Traditional finance is increasingly embracing blockchain and digital asset innovation, making one of the most significant narratives in 2026. Banks, asset managers, and institutional players are no longer observing from the sidelines they are actively integrating tokenization into their operations, turning conventional financial instruments into digital tokens that can be traded, lent, or collateralized on-chain. This shift is redefining how liquidity, accessibility, and transparency function within established financial markets, while simultaneously

Traditional finance is increasingly embracing blockchain and digital asset innovation, making one of the most significant narratives in 2026. Banks, asset managers, and institutional players are no longer observing from the sidelines they are actively integrating tokenization into their operations, turning conventional financial instruments into digital tokens that can be traded, lent, or collateralized on-chain. This shift is redefining how liquidity, accessibility, and transparency function within established financial markets, while simultaneously

- Reward

- 2

- 8

- Repost

- Share

Falcon_Official :

:

good jobView More

#TraditionalFinanceAcceleratesTokenization

Tokenization — the process of converting real-world assets into digital tokens on a blockchain — is rapidly gaining momentum as traditional finance (TradFi) embraces it. Here’s a breakdown of why this matters:

1️⃣ Real-World Assets Become More Liquid

Tokenization turns assets like real estate, bonds, and commodities into tradable digital tokens. This increases liquidity because fractional ownership becomes easier and markets operate 24/7.

2️⃣ Lower Barriers to Entry for Investors

Instead of needing large capital to invest in an asset (a building or a

Tokenization — the process of converting real-world assets into digital tokens on a blockchain — is rapidly gaining momentum as traditional finance (TradFi) embraces it. Here’s a breakdown of why this matters:

1️⃣ Real-World Assets Become More Liquid

Tokenization turns assets like real estate, bonds, and commodities into tradable digital tokens. This increases liquidity because fractional ownership becomes easier and markets operate 24/7.

2️⃣ Lower Barriers to Entry for Investors

Instead of needing large capital to invest in an asset (a building or a

- Reward

- 7

- 8

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

#TraditionalFinanceAcceleratesTokenization reflects the growing trend of mainstream financial institutions leveraging blockchain technology to tokenize traditional assets. From equities and bonds to real estate and commodities, major banks, investment funds, and insurance companies are increasingly converting their physical or financial assets into digital tokens. Tokenization allows these assets to be traded, transferred, or fractionalized on blockchain networks, offering unprecedented levels of liquidity, transparency, and accessibility.

📈 How Traditional Finance is Driving Tokenization can

📈 How Traditional Finance is Driving Tokenization can

- Reward

- 8

- 9

- Repost

- Share

HighAmbition :

:

Great 👍👍👍View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

378.6K Popularity

7.23K Popularity

7.12K Popularity

4.24K Popularity

2.83K Popularity

4.81K Popularity

2.48K Popularity

3.24K Popularity

2.17K Popularity

23 Popularity

54.45K Popularity

72.42K Popularity

20.38K Popularity

26.61K Popularity

219.71K Popularity

News

View MoreBloomberg: SpaceX is in advanced talks to merge with xAI, and the merger announcement could be made as early as this week.

3 m

Opinion: The crypto bear market cycle is expected to reverse by 2026, with Bitcoin potentially bottoming out around $60,000.

13 m

Michael Saylor: Strategy has accumulated a total of 713,502 BTC, with an average purchase price of approximately $76,052.

15 m

Spot gold prices briefly surged past $4,800 per ounce, breaking through the short-term resistance level.

27 m

Analysis: CME Bitcoin futures show a clear price gap, offering a glimmer of hope for the bulls

31 m

Pin