#PreciousMetalsPullBack

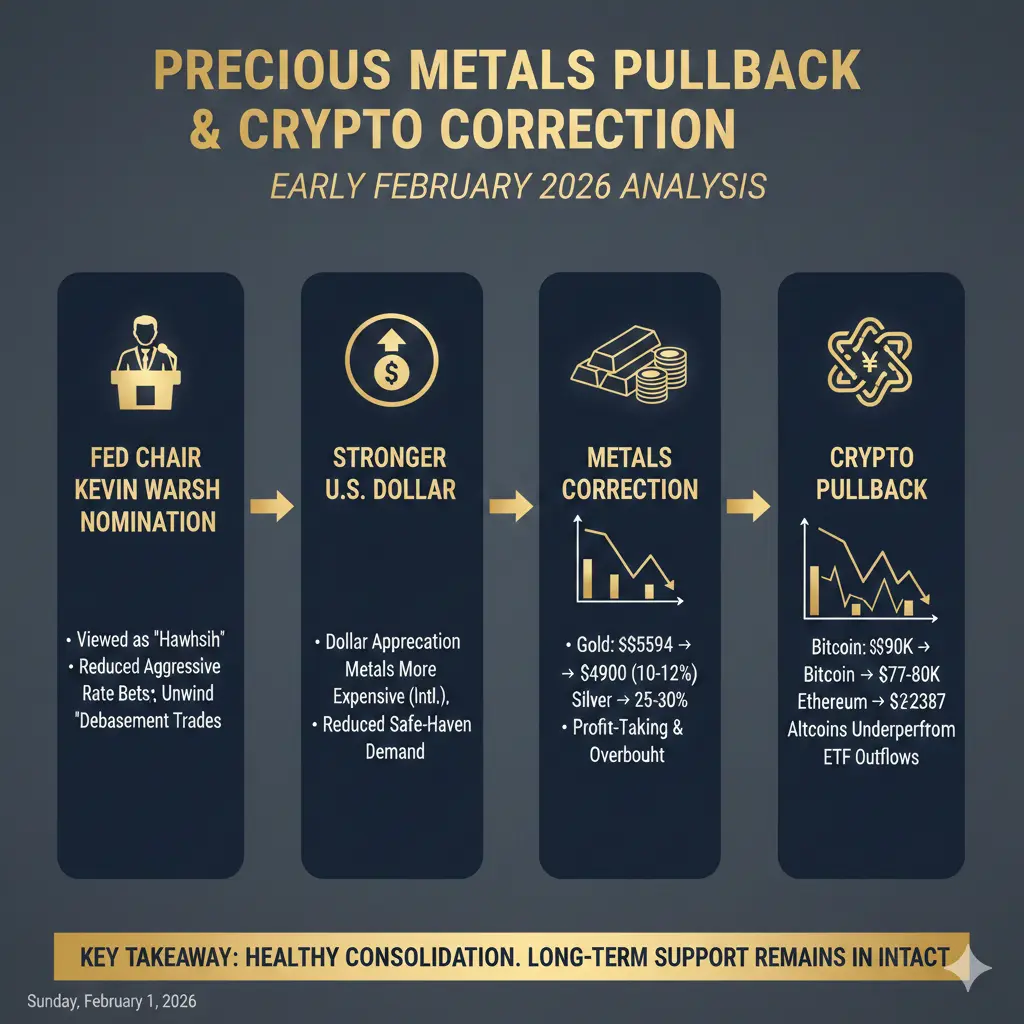

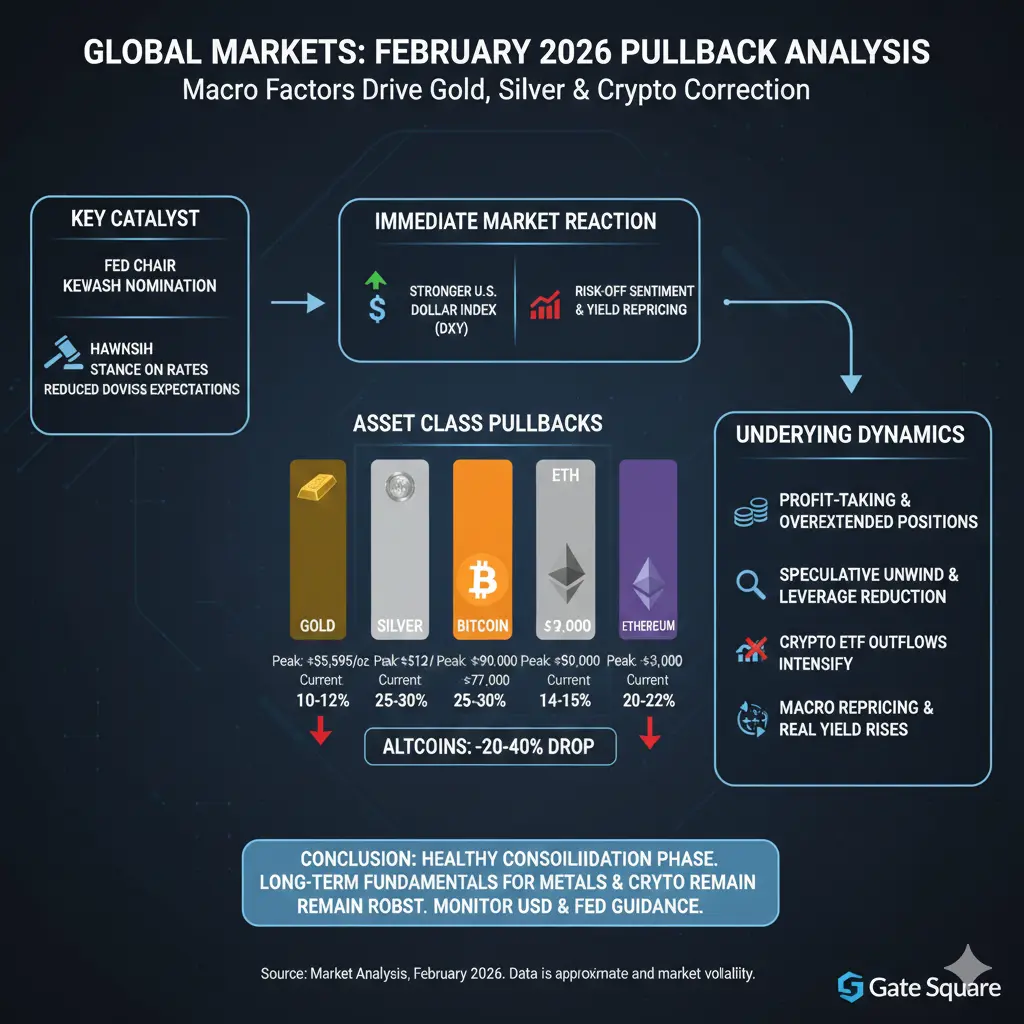

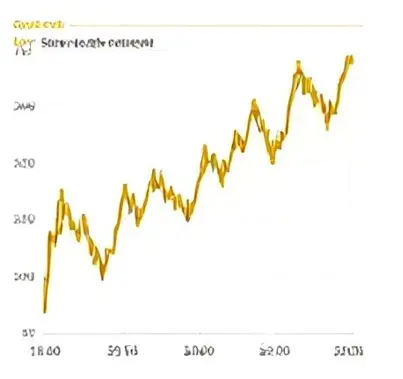

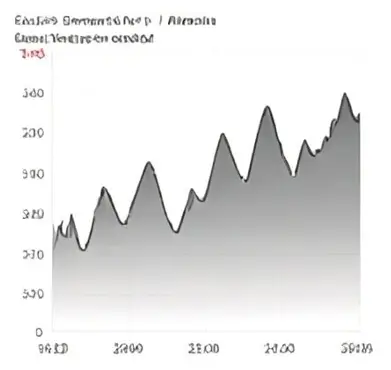

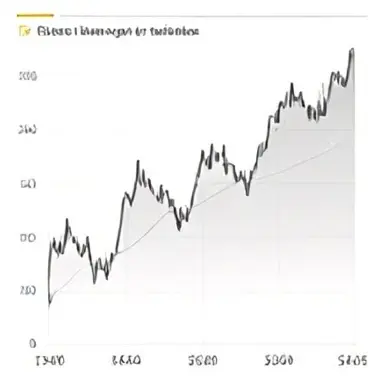

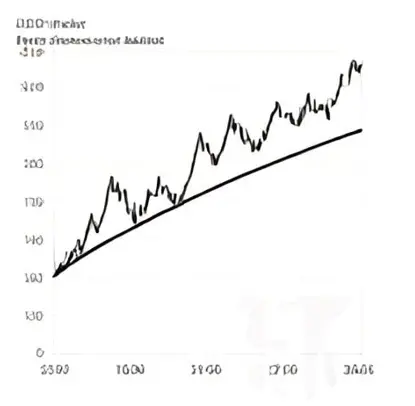

The markets are experiencing a sharp correction in both precious metals and cryptocurrencies following historic rallies in late 2025 and early January 2026. Gold briefly touched ~$5,595/oz and silver ~$121/oz, while Bitcoin peaked near $90,000 and Ethereum above $3,000. Early February 2026 has seen a pronounced pullback across these markets, reflecting profit-taking, overextended positions, and recalibration of expectations, rather than a fundamental reversal of long-term trends.

Understanding the Pullback

A pullback is a significant downward correction in price after a strong rally, where investors take profits or reposition as sentiment shifts. It is not necessarily a long-term trend reversal — more like a temporary retreat within an ongoing uptrend. In early 2026, the pullback in precious metals was unusually steep due to extreme prior gains, speculative positioning, and technical overextension.

Price Movements (Late January 2026):

Gold: Fell to ~$4,900/oz from highs near ~$5,594 — a ~10–12% drop.

Silver: Dropped below ~$90/oz, falling ~25–30% from record highs.

Cryptocurrencies: Bitcoin declined toward ~$77,000–$80,000, Ethereum to ~$2,387, with other altcoins underperforming and crypto ETF outflows intensifying.

Key Drivers

Parabolic Rally Leading into Pullback

Metals and crypto had surged aggressively, creating overbought conditions (RSI >80–90) and heavily leveraged positions.

Fed Chair Kevin Warsh Nomination

Before Warsh’s nomination, markets feared a dovish Fed, which would weaken the dollar and support metals and crypto.

Warsh was viewed as relatively hawkish, reducing the likelihood of aggressive rate cuts.

Result: Investors unwound “debasement trades,” prompting metals and crypto to correct.

Key nuance: This didn’t push prices down directly — it removed bullish tail risk, triggering profit-taking in an overextended market.

Stronger U.S. Dollar

Dollar appreciation made metals more expensive for international buyers and reduced safe-haven demand.

Profit-Taking After Extreme Gains

Investors, ETFs, and leveraged traders booked gains, accelerating the decline.

Macro & Market Repricing

Tech stocks and other risk assets declined → risk-off rotation.

Pause in Fed rate-cut expectations increased real yields → non-yielding assets like gold became less attractive.

Silver’s Higher Volatility

Industrial exposure + safe-haven role amplified swings.

Gold-silver ratio widened (~51), reflecting silver’s higher beta risk.

Liquidity & Market Structure Strains

Thin market depth, margin hikes, and ETF outflows amplified volatility.

Speculative Excess & Paper Market Dynamics

Futures and leveraged positions diverged from physical demand, magnifying pullbacks in metals and crypto alike.

Crypto Market Pullback Linked to Macro Factors

Liquidity tightening, institutional outflows, and profit-taking drove Bitcoin, Ethereum, and altcoins lower.

Altcoins may see deeper retracements (20–40% from local highs) under continued risk-off conditions.

Geopolitical & Macro Support Remain Intact

Middle East tensions, tariff uncertainty, inflation, and central bank buying continue to support metals long-term.

The current pullback is likely a healthy consolidation, not a reversal.

Technical & Sentiment Analysis

Gold support: ~$4,600–$4,900

Silver support: ~$70–$90

Bitcoin support: ~$70,000

Ethereum support: ~$2,200–$2,300

Fear/Greed indexes shifted, COT reports show spec long unwinds, and high volume on declines suggests panic-selling, while rebounds initially show weak conviction.

Outlook

Short-term: Neutral-to-bearish; volatility remains elevated.

Mid-to-long-term: Metals retain strong fundamentals — gold could reach $5,000–$6,000+, silver may rebound sharply.

Crypto: Further downside possible if risk appetite remains low, but technical support levels could trigger accumulation.

Conclusion

The pullback in early 2026 reflects:

Profit-taking and overbought market conditions

Expectation recalibration after Fed Chair Warsh nomination

Stronger dollar and macro repricing

Speculative positioning and liquidity constraints

Key takeaway: This is a healthy consolidation phase. Metals and crypto remain structurally supported long-term, and traders should monitor dollar strength, Fed guidance, geopolitical events, and technical support levels before entering new positions.

The markets are experiencing a sharp correction in both precious metals and cryptocurrencies following historic rallies in late 2025 and early January 2026. Gold briefly touched ~$5,595/oz and silver ~$121/oz, while Bitcoin peaked near $90,000 and Ethereum above $3,000. Early February 2026 has seen a pronounced pullback across these markets, reflecting profit-taking, overextended positions, and recalibration of expectations, rather than a fundamental reversal of long-term trends.

Understanding the Pullback

A pullback is a significant downward correction in price after a strong rally, where investors take profits or reposition as sentiment shifts. It is not necessarily a long-term trend reversal — more like a temporary retreat within an ongoing uptrend. In early 2026, the pullback in precious metals was unusually steep due to extreme prior gains, speculative positioning, and technical overextension.

Price Movements (Late January 2026):

Gold: Fell to ~$4,900/oz from highs near ~$5,594 — a ~10–12% drop.

Silver: Dropped below ~$90/oz, falling ~25–30% from record highs.

Cryptocurrencies: Bitcoin declined toward ~$77,000–$80,000, Ethereum to ~$2,387, with other altcoins underperforming and crypto ETF outflows intensifying.

Key Drivers

Parabolic Rally Leading into Pullback

Metals and crypto had surged aggressively, creating overbought conditions (RSI >80–90) and heavily leveraged positions.

Fed Chair Kevin Warsh Nomination

Before Warsh’s nomination, markets feared a dovish Fed, which would weaken the dollar and support metals and crypto.

Warsh was viewed as relatively hawkish, reducing the likelihood of aggressive rate cuts.

Result: Investors unwound “debasement trades,” prompting metals and crypto to correct.

Key nuance: This didn’t push prices down directly — it removed bullish tail risk, triggering profit-taking in an overextended market.

Stronger U.S. Dollar

Dollar appreciation made metals more expensive for international buyers and reduced safe-haven demand.

Profit-Taking After Extreme Gains

Investors, ETFs, and leveraged traders booked gains, accelerating the decline.

Macro & Market Repricing

Tech stocks and other risk assets declined → risk-off rotation.

Pause in Fed rate-cut expectations increased real yields → non-yielding assets like gold became less attractive.

Silver’s Higher Volatility

Industrial exposure + safe-haven role amplified swings.

Gold-silver ratio widened (~51), reflecting silver’s higher beta risk.

Liquidity & Market Structure Strains

Thin market depth, margin hikes, and ETF outflows amplified volatility.

Speculative Excess & Paper Market Dynamics

Futures and leveraged positions diverged from physical demand, magnifying pullbacks in metals and crypto alike.

Crypto Market Pullback Linked to Macro Factors

Liquidity tightening, institutional outflows, and profit-taking drove Bitcoin, Ethereum, and altcoins lower.

Altcoins may see deeper retracements (20–40% from local highs) under continued risk-off conditions.

Geopolitical & Macro Support Remain Intact

Middle East tensions, tariff uncertainty, inflation, and central bank buying continue to support metals long-term.

The current pullback is likely a healthy consolidation, not a reversal.

Technical & Sentiment Analysis

Gold support: ~$4,600–$4,900

Silver support: ~$70–$90

Bitcoin support: ~$70,000

Ethereum support: ~$2,200–$2,300

Fear/Greed indexes shifted, COT reports show spec long unwinds, and high volume on declines suggests panic-selling, while rebounds initially show weak conviction.

Outlook

Short-term: Neutral-to-bearish; volatility remains elevated.

Mid-to-long-term: Metals retain strong fundamentals — gold could reach $5,000–$6,000+, silver may rebound sharply.

Crypto: Further downside possible if risk appetite remains low, but technical support levels could trigger accumulation.

Conclusion

The pullback in early 2026 reflects:

Profit-taking and overbought market conditions

Expectation recalibration after Fed Chair Warsh nomination

Stronger dollar and macro repricing

Speculative positioning and liquidity constraints

Key takeaway: This is a healthy consolidation phase. Metals and crypto remain structurally supported long-term, and traders should monitor dollar strength, Fed guidance, geopolitical events, and technical support levels before entering new positions.