LittleQueen

No content yet

LittleQueen

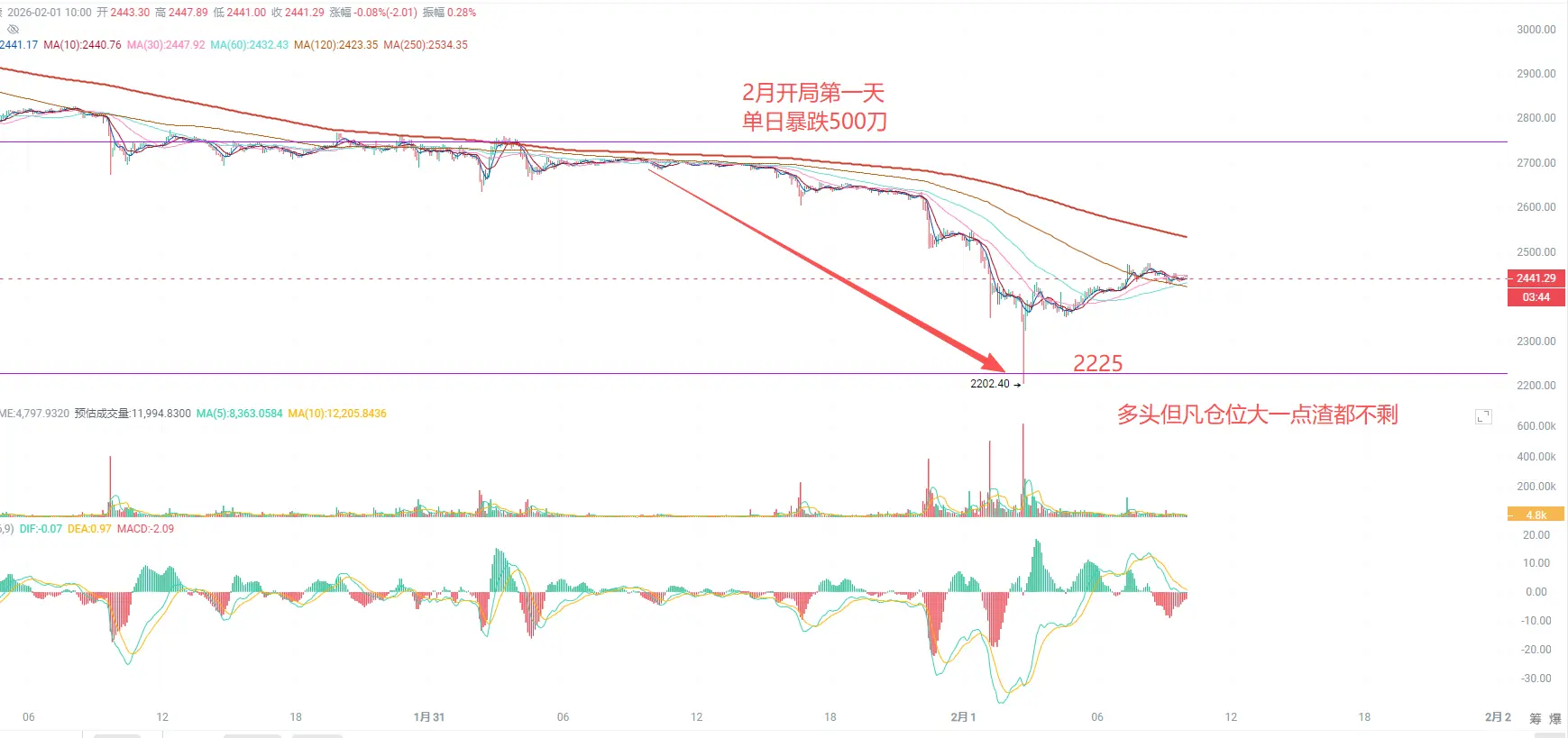

Today Market Analysis – 1 February

🌍 Global Market Sentiment

Global markets are trading in a risk-off environment, with fear dominating investor behavior. Uncertainty around inflation, interest rates, and central-bank policy continues to pressure risk assets. When sentiment stays this cautious, volatility usually remains elevated, especially across equities and crypto.

🪙 Crypto Market Overview

The crypto market remains under pressure today, with Bitcoin leading the decline. Selling momentum has increased, pushing BTC below key psychological levels and dragging major altcoins lower.

• Broad m

🌍 Global Market Sentiment

Global markets are trading in a risk-off environment, with fear dominating investor behavior. Uncertainty around inflation, interest rates, and central-bank policy continues to pressure risk assets. When sentiment stays this cautious, volatility usually remains elevated, especially across equities and crypto.

🪙 Crypto Market Overview

The crypto market remains under pressure today, with Bitcoin leading the decline. Selling momentum has increased, pushing BTC below key psychological levels and dragging major altcoins lower.

• Broad m

- Reward

- 3

- 3

- Repost

- Share

HeavenSlayerSupporter :

:

Hold on tight, we're about to take off 🛫View More

#USGovernmentShutdownRisk

🇺🇸 What a Government Shutdown Actually Signals

The risk of a US government shutdown is not about economic collapse — it’s about policy uncertainty, operational disruption, and confidence erosion.

Markets don’t fear shutdowns because they are catastrophic.

They fear them because they delay clarity.

📉 Immediate Market Implications

Historically, shutdown risks trigger:

Short-term volatility

Especially in equities and risk-sensitive assets.

Liquidity hesitation

Investors reduce exposure until political clarity improves.

Data blind spots

Key economic reports may be del

🇺🇸 What a Government Shutdown Actually Signals

The risk of a US government shutdown is not about economic collapse — it’s about policy uncertainty, operational disruption, and confidence erosion.

Markets don’t fear shutdowns because they are catastrophic.

They fear them because they delay clarity.

📉 Immediate Market Implications

Historically, shutdown risks trigger:

Short-term volatility

Especially in equities and risk-sensitive assets.

Liquidity hesitation

Investors reduce exposure until political clarity improves.

Data blind spots

Key economic reports may be del

- Reward

- 3

- 3

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

#MiddleEastTensionsEscalate

Bitcoin plunged sharply in the past few days as tensions escalated in the Middle East. At one point, Bitcoin dropped under $78,000 on Saturday, marking a significant decline from its recent price highs.

The main reasons behind this drop were rising geopolitical risks—particularly increased conflict and uncertainty involving Iran and the U.S.—plus growing concerns over U.S. political stability and new tariff threats. Thin weekend liquidity made it even easier for panic selling to push the price down. Just two days earlier, Bitcoin was trading around $84,400; since t

Bitcoin plunged sharply in the past few days as tensions escalated in the Middle East. At one point, Bitcoin dropped under $78,000 on Saturday, marking a significant decline from its recent price highs.

The main reasons behind this drop were rising geopolitical risks—particularly increased conflict and uncertainty involving Iran and the U.S.—plus growing concerns over U.S. political stability and new tariff threats. Thin weekend liquidity made it even easier for panic selling to push the price down. Just two days earlier, Bitcoin was trading around $84,400; since t

BTC-4,75%

- Reward

- 4

- 3

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

- Reward

- 3

- 3

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

- Reward

- 4

- 5

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

#SEConTokenizedSecurities This is a strong, well-structured macro + regulatory brief 👍

It reads like institutional research, not retail commentary. A few high-level takeaways and refinement notes (not criticism—polish):

What You Nailed 💯

Correct SEC framing: You’re spot on that tokenized ≠ exempt. Calling out “same securities laws, new rails” is exactly how regulators think.

Balanced tone: You avoid the common mistake of painting the SEC as anti-innovation. The emphasis on conditional relief and case-by-case exemptions reflects the 2025–26 shift accurately.

Market reaction insight: Different

It reads like institutional research, not retail commentary. A few high-level takeaways and refinement notes (not criticism—polish):

What You Nailed 💯

Correct SEC framing: You’re spot on that tokenized ≠ exempt. Calling out “same securities laws, new rails” is exactly how regulators think.

Balanced tone: You avoid the common mistake of painting the SEC as anti-innovation. The emphasis on conditional relief and case-by-case exemptions reflects the 2025–26 shift accurately.

Market reaction insight: Different

- Reward

- 4

- 4

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

#FedKeepsRatesUnchanged

The Fed kept interest rates steady — and the market response says everything.

No celebration. No collapse. Just a cautious pause loaded with tension.

This decision isn’t neutral.

It’s the Fed admitting the economy is walking a narrow line.

Inflation is easing, but it’s not defeated. Growth is slowing, but not breaking.

So the Fed waits — not because the job is done, but because timing now matters more than action.

For risk assets, this creates a quiet but dangerous environment.

Stable rates reduce immediate liquidity shocks, but they also remove clear direction.

Bitcoin

The Fed kept interest rates steady — and the market response says everything.

No celebration. No collapse. Just a cautious pause loaded with tension.

This decision isn’t neutral.

It’s the Fed admitting the economy is walking a narrow line.

Inflation is easing, but it’s not defeated. Growth is slowing, but not breaking.

So the Fed waits — not because the job is done, but because timing now matters more than action.

For risk assets, this creates a quiet but dangerous environment.

Stable rates reduce immediate liquidity shocks, but they also remove clear direction.

Bitcoin

- Reward

- 3

- 3

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

#CryptoMarketWatch

Most traders think they’re reading the market — in reality, they’re just reacting to candles.

And reaction is expensive.

Right now, crypto is sitting in a dangerous middle zone.

Not fear. Not hype.

Just quiet confidence layered over weak structure.

Bitcoin looks stable, but don’t confuse stability with strength.

Price holding without volume expansion usually means one thing:

Big players are waiting, not buying aggressively.

Smart money never chases momentum.

They wait for liquidity to build, then they move — fast and without emotion.

Ethereum remains the real signal.

ETH isn

Most traders think they’re reading the market — in reality, they’re just reacting to candles.

And reaction is expensive.

Right now, crypto is sitting in a dangerous middle zone.

Not fear. Not hype.

Just quiet confidence layered over weak structure.

Bitcoin looks stable, but don’t confuse stability with strength.

Price holding without volume expansion usually means one thing:

Big players are waiting, not buying aggressively.

Smart money never chases momentum.

They wait for liquidity to build, then they move — fast and without emotion.

Ethereum remains the real signal.

ETH isn

- Reward

- 3

- 4

- 1

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

#MarketUpdate

Over 430,000 liquidations have triggered a massive wave of panic, unexpectedly pushing the market into full high-speed turnover.

At the moment, except for HYPE, all top-10 trading volumes have surged by 50%–100%, clearly showing that liquidity and market participation are strong.

This level of volatility is exactly what market makers thrive on — they are actively using these sharp moves to accumulate positions and absorb chips.

While this zone may not be the absolute bottom, it strongly represents a setup for future profit opportunities.

If the market sees another 1–2 aggressive

Over 430,000 liquidations have triggered a massive wave of panic, unexpectedly pushing the market into full high-speed turnover.

At the moment, except for HYPE, all top-10 trading volumes have surged by 50%–100%, clearly showing that liquidity and market participation are strong.

This level of volatility is exactly what market makers thrive on — they are actively using these sharp moves to accumulate positions and absorb chips.

While this zone may not be the absolute bottom, it strongly represents a setup for future profit opportunities.

If the market sees another 1–2 aggressive

- Reward

- 2

- 3

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

- Reward

- 2

- 3

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

- Reward

- 2

- 2

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

#GT $BTC BTC $ETH我的周末交易计划#RiskManagement

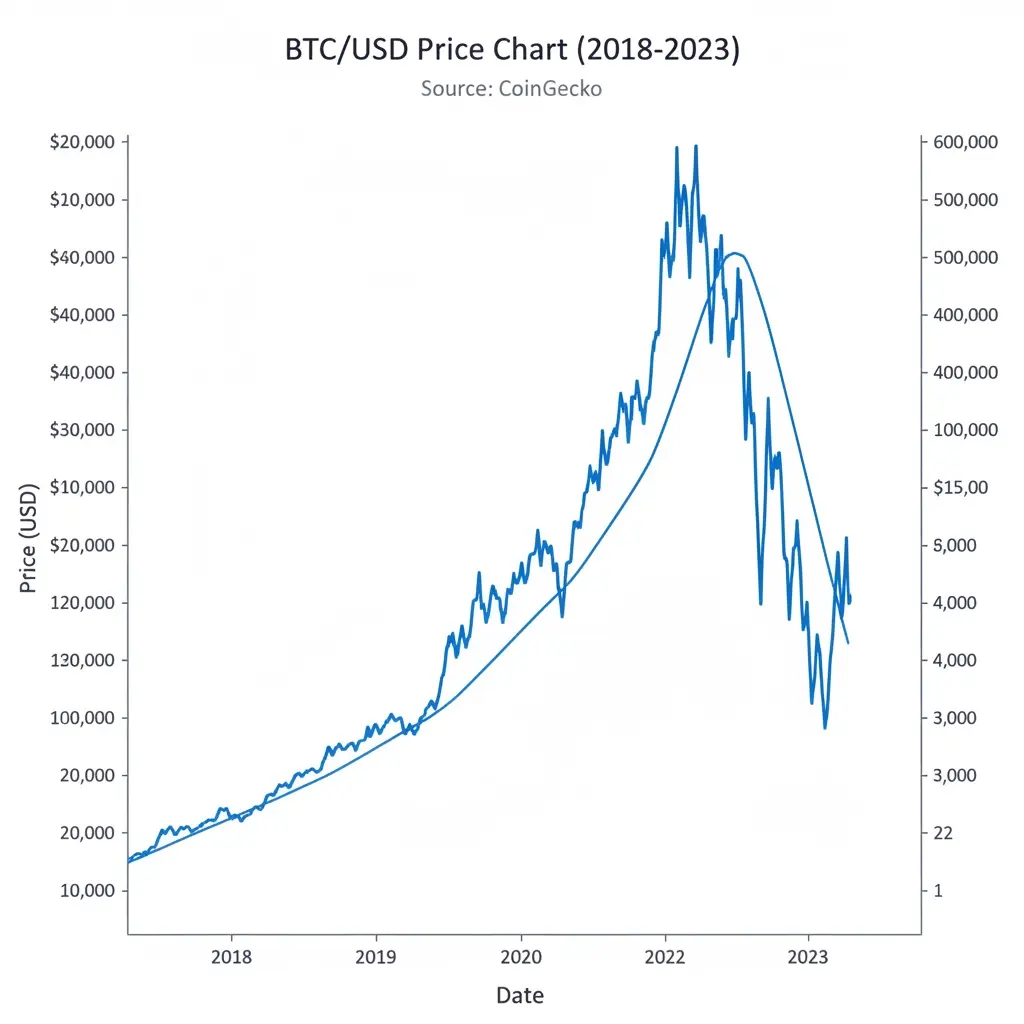

One of the largest single-day liquidation events in crypto history has just been recorded, ranking inside the top ten of all time.

This level of destruction hasn’t been seen since the brutal cycles of 2021, when billions were wiped out in a matter of hours and hundreds of thousands of traders were forced out of the market.

If we review historical liquidation data, it becomes clear that bull markets are not gentle.

In fact, most of the top liquidation events happened during so-called bull runs, where leverage, greed, and overconfidence peaked at the sam

One of the largest single-day liquidation events in crypto history has just been recorded, ranking inside the top ten of all time.

This level of destruction hasn’t been seen since the brutal cycles of 2021, when billions were wiped out in a matter of hours and hundreds of thousands of traders were forced out of the market.

If we review historical liquidation data, it becomes clear that bull markets are not gentle.

In fact, most of the top liquidation events happened during so-called bull runs, where leverage, greed, and overconfidence peaked at the sam

BTC-4,75%

- Reward

- 4

- 6

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

#MyWeekendTradingPlan

Market feels cold, but my conviction stays strong.

I’m holding my core positions patiently — trimmed a bit this week, but the structure remains healthy.

No liquidation pressure, no panic.

Waiting calmly for the right opportunity to add more.

Whether it takes a week, a month, or even half a year — I’m ready.

Smart traders wait; they don’t chase.

The real question is:

When will the market warm up again?

Patience is the plan. Discipline is the edge.

#BTC #ETH #GT #TradingMindset

Market feels cold, but my conviction stays strong.

I’m holding my core positions patiently — trimmed a bit this week, but the structure remains healthy.

No liquidation pressure, no panic.

Waiting calmly for the right opportunity to add more.

Whether it takes a week, a month, or even half a year — I’m ready.

Smart traders wait; they don’t chase.

The real question is:

When will the market warm up again?

Patience is the plan. Discipline is the edge.

#BTC #ETH #GT #TradingMindset

- Reward

- 5

- 5

- Repost

- Share

Discovery :

:

Happy New Year! 🤑View More

#DOGEETFListsonNasdaq #DOGEETFListsonNasdaq 🚀 Future Outlook: What This Means for Dogecoin and the Crypto Market

The announcement of DOGE ETFs listing on Nasdaq is more than just a headline — it marks a significant turning point in cryptocurrency adoption. From years of experience observing digital assets, ETFs, and institutional flows, one thing is clear: this development has the potential to reshape liquidity, market sentiment, and investor behavior across the entire crypto ecosystem.

Here’s a deeper analysis from an experienced trader’s perspective:

Institutional Access and Legitimacy:

The

The announcement of DOGE ETFs listing on Nasdaq is more than just a headline — it marks a significant turning point in cryptocurrency adoption. From years of experience observing digital assets, ETFs, and institutional flows, one thing is clear: this development has the potential to reshape liquidity, market sentiment, and investor behavior across the entire crypto ecosystem.

Here’s a deeper analysis from an experienced trader’s perspective:

Institutional Access and Legitimacy:

The

DOGE-2,94%

- Reward

- 4

- 4

- Repost

- Share

Discovery :

:

Happy New Year! 🤑View More

#GrowthPointsDrawRound16 Growth Value New Year Lottery Vol.16: How Discipline Turns Into Rewards

The 16th edition of the Growth Value New Year Lottery is not a typical seasonal giveaway. It’s a deliberately designed incentive system that rewards consistency, engagement, and strategic participation within the Gate ecosystem. Unlike traditional lotteries driven purely by chance, this event aligns probability with effort — giving disciplined users a measurable edge.

At its core, the lottery converts everyday platform activity into opportunity. Posts, comments, and likes on Gate Plaza generate gro

The 16th edition of the Growth Value New Year Lottery is not a typical seasonal giveaway. It’s a deliberately designed incentive system that rewards consistency, engagement, and strategic participation within the Gate ecosystem. Unlike traditional lotteries driven purely by chance, this event aligns probability with effort — giving disciplined users a measurable edge.

At its core, the lottery converts everyday platform activity into opportunity. Posts, comments, and likes on Gate Plaza generate gro

- Reward

- 3

- 3

- Repost

- Share

Discovery :

:

Happy New Year! 🤑View More

#CryptoMarketWatch Fear Dominates, But Opportunity Emerges

Global crypto markets are signaling heightened caution as the Crypto Fear & Greed Index plunges to 20, reflecting deep risk aversion among investors. Volatility remains elevated, and traders are carefully weighing their next moves amid uncertainty.

Key Market Highlights:

1️⃣ Gold Surges:

Gold has surpassed $5,000 per ounce, reaffirming its role as a safe-haven asset. Investors are rotating capital into tangible stores of value as macro and geopolitical uncertainty grips markets.

2️⃣ Japan Plans Spot Crypto ETFs:

Regulatory discussions

Global crypto markets are signaling heightened caution as the Crypto Fear & Greed Index plunges to 20, reflecting deep risk aversion among investors. Volatility remains elevated, and traders are carefully weighing their next moves amid uncertainty.

Key Market Highlights:

1️⃣ Gold Surges:

Gold has surpassed $5,000 per ounce, reaffirming its role as a safe-haven asset. Investors are rotating capital into tangible stores of value as macro and geopolitical uncertainty grips markets.

2️⃣ Japan Plans Spot Crypto ETFs:

Regulatory discussions

- Reward

- 5

- 4

- Repost

- Share

Discovery :

:

Happy New Year! 🤑View More

#MyWeekendTradingPlan Controlled Aggression Mode 🛡️📈

1. Market Context

As we head into the weekend, market structure remains fragile. Recent volatility has shaken out weak hands, but confirmation of a sustained trend shift is still missing. This environment favors patience over prediction.

2. Liquidity & Volatility Outlook

Weekend liquidity is expected to stay thin, which increases the probability of stop hunts and fake breakouts. Any sharp move—up or down—should be treated with skepticism until volume confirms it.

3. Short-Term Bias

I’m leaning toward a technical relief bounce rather than a

1. Market Context

As we head into the weekend, market structure remains fragile. Recent volatility has shaken out weak hands, but confirmation of a sustained trend shift is still missing. This environment favors patience over prediction.

2. Liquidity & Volatility Outlook

Weekend liquidity is expected to stay thin, which increases the probability of stop hunts and fake breakouts. Any sharp move—up or down—should be treated with skepticism until volume confirms it.

3. Short-Term Bias

I’m leaning toward a technical relief bounce rather than a

- Reward

- 3

- 3

- Repost

- Share

Discovery :

:

Happy New Year! 🤑View More

#CryptoMarketPullback 🚀Fear vs Structure

1. Market Snapshot🎉

Bitcoin slipping below the $83K mark has rattled market confidence. Fear & Greed has plunged into Extreme Fear, charts are bleeding red, and sentiment is breaking faster than price itself.

2☘️. Emotional Noise vs Market Reality

It’s important to separate emotion from mechanics. Markets don’t move because traders are scared or hopeful — they move due to liquidity, positioning, and leverage.

3. What’s Actually Driving the Pullback

This move isn’t random. We’re seeing ETF inflows cool after a strong expansion phase, excessive leverage

1. Market Snapshot🎉

Bitcoin slipping below the $83K mark has rattled market confidence. Fear & Greed has plunged into Extreme Fear, charts are bleeding red, and sentiment is breaking faster than price itself.

2☘️. Emotional Noise vs Market Reality

It’s important to separate emotion from mechanics. Markets don’t move because traders are scared or hopeful — they move due to liquidity, positioning, and leverage.

3. What’s Actually Driving the Pullback

This move isn’t random. We’re seeing ETF inflows cool after a strong expansion phase, excessive leverage

BTC-4,75%

- Reward

- 4

- 3

- Repost

- Share

Discovery :

:

Happy New Year! 🤑View More

#CryptoMarketPullback Fear vs Structure

1. Market Snapshot

Bitcoin slipping below the $83K mark has rattled market confidence. Fear & Greed has plunged into Extreme Fear, charts are bleeding red, and sentiment is breaking faster than price itself.

2. Emotional Noise vs Market Reality

It’s important to separate emotion from mechanics. Markets don’t move because traders are scared or hopeful — they move due to liquidity, positioning, and leverage.

3. What’s Actually Driving the Pullback

This move isn’t random. We’re seeing ETF inflows cool after a strong expansion phase, excessive leverage being

1. Market Snapshot

Bitcoin slipping below the $83K mark has rattled market confidence. Fear & Greed has plunged into Extreme Fear, charts are bleeding red, and sentiment is breaking faster than price itself.

2. Emotional Noise vs Market Reality

It’s important to separate emotion from mechanics. Markets don’t move because traders are scared or hopeful — they move due to liquidity, positioning, and leverage.

3. What’s Actually Driving the Pullback

This move isn’t random. We’re seeing ETF inflows cool after a strong expansion phase, excessive leverage being

BTC-4,75%

- Reward

- 4

- 4

- Repost

- Share

Discovery :

:

Happy New Year! 🤑View More

#GateLunarNewYearOnChainGala #GateLunarNewYearOnChainGala

The Gate Lunar New Year On-Chain Gala is more than a festive celebration — it reflects how blockchain culture is evolving into a global, community-driven movement. A new lunar cycle represents renewal, opportunity, and progress, which perfectly aligns with the vision of Web3.

On-chain events are changing the way users interact with crypto platforms. Instead of passive participation, communities now actively engage through rewards, NFTs, DeFi activities, and GameFi experiences. This transformation turns celebrations into meaningful ecosy

The Gate Lunar New Year On-Chain Gala is more than a festive celebration — it reflects how blockchain culture is evolving into a global, community-driven movement. A new lunar cycle represents renewal, opportunity, and progress, which perfectly aligns with the vision of Web3.

On-chain events are changing the way users interact with crypto platforms. Instead of passive participation, communities now actively engage through rewards, NFTs, DeFi activities, and GameFi experiences. This transformation turns celebrations into meaningful ecosy

- Reward

- 3

- 3

- Repost

- Share

Discovery :

:

Happy New Year! 🤑View More