# CryptoMarketWatch

222.14K

Recent market volatility has intensified, with growing divergence between bulls and bears. Are you leaning bullish or cautious on what comes next? What signals are you watching and how are you positioning? Share your views.

HanssiMazak

#CryptoMarketWatch Market Update & Structural Insights

The crypto market is navigating one of its most critical transition phases. Volatility is high, sentiment shifts daily, and price action feels uncertain — yet beneath the surface, long-term structural developments are quietly unfolding. This is more than a correction; it’s a period where positioning, patience, and perspective matter more than speed.

🔹 Bitcoin: Conviction Amid Pullbacks

Even during retracements, long-term holders remain resilient. Large wallets move cautiously, retail participation is hesitant, and this divergence often si

The crypto market is navigating one of its most critical transition phases. Volatility is high, sentiment shifts daily, and price action feels uncertain — yet beneath the surface, long-term structural developments are quietly unfolding. This is more than a correction; it’s a period where positioning, patience, and perspective matter more than speed.

🔹 Bitcoin: Conviction Amid Pullbacks

Even during retracements, long-term holders remain resilient. Large wallets move cautiously, retail participation is hesitant, and this divergence often si

- Reward

- 8

- 5

- Repost

- Share

Yunna :

:

HOLD HOLDView More

#CryptoMarketWatch #CryptoMarketWatch

The crypto market is moving through one of its most important transition phases. Volatility remains high, sentiment shifts daily, and price action feels uncertain — yet beneath the surface, long-term structural developments continue to unfold. This is not just another correction or consolidation. It’s a period where positioning, patience, and perspective matter more than speed.

Bitcoin continues to lead the narrative. Even during pullbacks, long-term holders show resilience, suggesting that conviction in the broader digital asset story remains intact. Larg

The crypto market is moving through one of its most important transition phases. Volatility remains high, sentiment shifts daily, and price action feels uncertain — yet beneath the surface, long-term structural developments continue to unfold. This is not just another correction or consolidation. It’s a period where positioning, patience, and perspective matter more than speed.

Bitcoin continues to lead the narrative. Even during pullbacks, long-term holders show resilience, suggesting that conviction in the broader digital asset story remains intact. Larg

- Reward

- 9

- 7

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊Watching Closely 🔍️Happy New Year! DYOR 🤓View More

#CryptoMarketWatch #CryptoMarketWatch

The crypto market is moving through one of its most important transition phases. Volatility remains high, sentiment shifts daily, and price action feels uncertain — yet beneath the surface, long-term structural developments continue to unfold. This is not just another correction or consolidation. It’s a period where positioning, patience, and perspective matter more than speed.

Bitcoin continues to lead the narrative. Even during pullbacks, long-term holders show resilience, suggesting that conviction in the broader digital asset story remains intact. Larg

The crypto market is moving through one of its most important transition phases. Volatility remains high, sentiment shifts daily, and price action feels uncertain — yet beneath the surface, long-term structural developments continue to unfold. This is not just another correction or consolidation. It’s a period where positioning, patience, and perspective matter more than speed.

Bitcoin continues to lead the narrative. Even during pullbacks, long-term holders show resilience, suggesting that conviction in the broader digital asset story remains intact. Larg

- Reward

- 5

- 4

- Repost

- Share

YingYue :

:

Happy New Year! 🤑View More

#CryptoMarketWatch $DOGE – BULLISH STRUCTURE HOLDS, MEMECOIN MOON MAP STILL IN PLAY 🚀🐶

$BONK is maintaining a bullish market structure after defending key demand near the lower range. Price is consolidating above support while momentum indicators hint at continuation rather than exhaustion. With meme sentiment staying hot and DOGE holding higher lows, the next move favors an upside push toward the upper resistance zones—provided volume expansion confirms the breakout. The “1000x” talk is hype, but technically, DOGE still has room to trend higher this cycle.$SHIB

Trade Setup:

Position: Long

$BONK is maintaining a bullish market structure after defending key demand near the lower range. Price is consolidating above support while momentum indicators hint at continuation rather than exhaustion. With meme sentiment staying hot and DOGE holding higher lows, the next move favors an upside push toward the upper resistance zones—provided volume expansion confirms the breakout. The “1000x” talk is hype, but technically, DOGE still has room to trend higher this cycle.$SHIB

Trade Setup:

Position: Long

- Reward

- 7

- 8

- Repost

- Share

repanzal :

:

2026 GOGOGO 👊View More

#CryptoMarketWatch

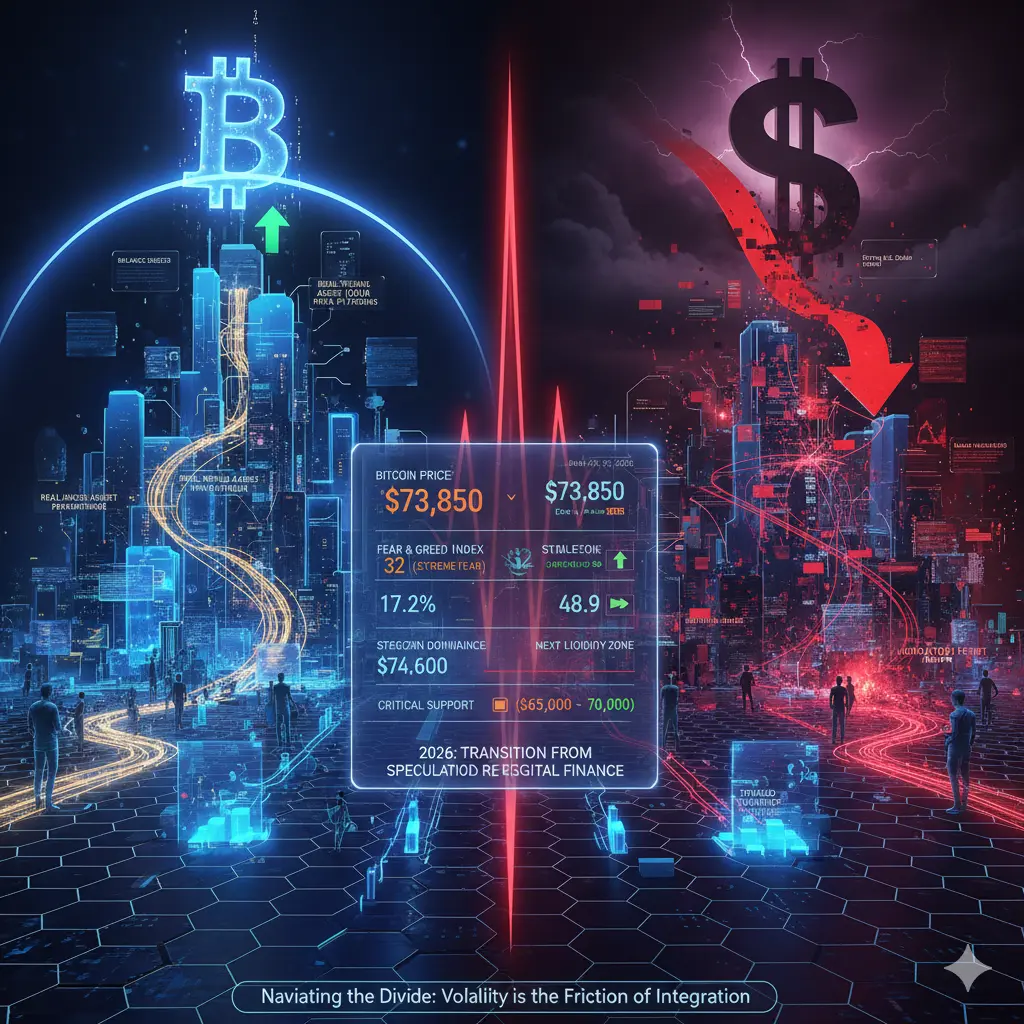

The crypto market in 2026 is witnessing one of the sharpest divergences seen in years. The divide between bulls and bears now extends beyond price expectations into fundamentally different interpretations of what the market itself represents. On one side are those who argue that crypto has finally moved beyond experimentation and is becoming a productive component of the global financial system. On the other, the short-term landscape—marked by aggressive liquidations, fragile liquidity, and increasingly complex correlations with traditional assets—demands caution. The marke

The crypto market in 2026 is witnessing one of the sharpest divergences seen in years. The divide between bulls and bears now extends beyond price expectations into fundamentally different interpretations of what the market itself represents. On one side are those who argue that crypto has finally moved beyond experimentation and is becoming a productive component of the global financial system. On the other, the short-term landscape—marked by aggressive liquidations, fragile liquidity, and increasingly complex correlations with traditional assets—demands caution. The marke

- Reward

- 64

- 52

- Repost

- Share

Crypto_Buzz_with_Alex :

:

2026 GOGOGO 👊View More

#CryptoMarketWatch

Solana (SOL) has been one of the major coins hardest hit by the general bear market crash in the crypto market. Its current price is hovering around $74–$79 (having even tested the $70 level with a drop of around 13–18% in the last 24 hours). This level represents a loss of close to 40–45% from the $120–$130 range at the end of 2025/beginning of 2026, and is one of the lowest levels in the last 1–1.5 years. Key Points:

Recent downtrend: Parallel to Bitcoin's decline to around $63,000, SOL experienced sharp selling due to massive liquidations of leveraged positions, long pos

Solana (SOL) has been one of the major coins hardest hit by the general bear market crash in the crypto market. Its current price is hovering around $74–$79 (having even tested the $70 level with a drop of around 13–18% in the last 24 hours). This level represents a loss of close to 40–45% from the $120–$130 range at the end of 2025/beginning of 2026, and is one of the lowest levels in the last 1–1.5 years. Key Points:

Recent downtrend: Parallel to Bitcoin's decline to around $63,000, SOL experienced sharp selling due to massive liquidations of leveraged positions, long pos

- Reward

- 46

- 23

- Repost

- Share

Kai_Zen :

:

Happy New Year! 🤑View More

#CryptoMarketWatch

The crypto market is currently in deep capitulation mode, with aggressive selling pressure across Bitcoin, Ethereum, and the broader altcoin market. Total crypto market capitalization has fallen to approximately $2.45T–$2.5T, down 6–7%+ in the last 24 hours, erasing a large portion of recent gains and confirming a strong risk-off phase.

🔴 Current Price Action Snapshot

Bitcoin (BTC)

Price Range: $67,000–$70,000

Intraday Lows: ~$66,700–$67,200 (varies by exchange)

Drawdown: ~44–47% from the October 2025 ATH near $126,000

Key Note: First sustained move below $70K since Novemb

The crypto market is currently in deep capitulation mode, with aggressive selling pressure across Bitcoin, Ethereum, and the broader altcoin market. Total crypto market capitalization has fallen to approximately $2.45T–$2.5T, down 6–7%+ in the last 24 hours, erasing a large portion of recent gains and confirming a strong risk-off phase.

🔴 Current Price Action Snapshot

Bitcoin (BTC)

Price Range: $67,000–$70,000

Intraday Lows: ~$66,700–$67,200 (varies by exchange)

Drawdown: ~44–47% from the October 2025 ATH near $126,000

Key Note: First sustained move below $70K since Novemb

- Reward

- 29

- 32

- Repost

- Share

neesa04 :

:

2026 GOGOGO 👊View More

#CryptoMarketWatch #CryptoMarketWatch

The cryptocurrency market continues to capture global attention as innovation, volatility, and adoption converge in ways that are reshaping financial systems and digital ecosystems. Market watchers are observing trends across major coins, altcoins, decentralized finance protocols, and emerging technologies to understand the evolving landscape.

Bitcoin remains a central focus for the market, often seen as a benchmark for investor sentiment. Its price movements, adoption by institutions, and integration into payment systems continue to influence the broader

The cryptocurrency market continues to capture global attention as innovation, volatility, and adoption converge in ways that are reshaping financial systems and digital ecosystems. Market watchers are observing trends across major coins, altcoins, decentralized finance protocols, and emerging technologies to understand the evolving landscape.

Bitcoin remains a central focus for the market, often seen as a benchmark for investor sentiment. Its price movements, adoption by institutions, and integration into payment systems continue to influence the broader

- Reward

- 10

- 10

- Repost

- Share

MasterChuTheOldDemonMasterChu :

:

Stay strong and HODL💎View More

#CryptoMarketWatch

CryptoMarketWatch

Market Under Pressure As Prices Move Lower

Market Overview

The crypto market is currently facing strong downward pressure and overall sentiment has turned cautious. Over the past sessions, sellers have remained in control, pushing prices lower across Bitcoin, Ethereum, and most major altcoins. This move is not driven by a single event but rather a combination of technical breakdowns, reduced risk appetite, and broader macro uncertainty. When markets enter this type of phase, volatility usually increases and emotional trading becomes more common, which furt

CryptoMarketWatch

Market Under Pressure As Prices Move Lower

Market Overview

The crypto market is currently facing strong downward pressure and overall sentiment has turned cautious. Over the past sessions, sellers have remained in control, pushing prices lower across Bitcoin, Ethereum, and most major altcoins. This move is not driven by a single event but rather a combination of technical breakdowns, reduced risk appetite, and broader macro uncertainty. When markets enter this type of phase, volatility usually increases and emotional trading becomes more common, which furt

- Reward

- 9

- 13

- Repost

- Share

Luna_Star :

:

2026 GOGOGO 👊View More

📈🌐 #CryptoMarketWatch – Stay Ahead of Market Trends

The crypto market continues to evolve rapidly! Traders need to stay updated on price movements, market sentiment, and emerging opportunities to make informed decisions. ⚡

✨ Key Highlights:

Bitcoin & Ethereum trends – track major movements 🪙

Altcoin performance – spot potential growth opportunities 🚀

Market sentiment & analytics – understand trader behavior 📊

💡 Gate.io Insight:

Use Gate.io’s real-time charts, analytical tools, and news updates to navigate the market confidently and seize opportunities. 🛡️

🔗 Watch & Trade on the Gate.io

The crypto market continues to evolve rapidly! Traders need to stay updated on price movements, market sentiment, and emerging opportunities to make informed decisions. ⚡

✨ Key Highlights:

Bitcoin & Ethereum trends – track major movements 🪙

Altcoin performance – spot potential growth opportunities 🚀

Market sentiment & analytics – understand trader behavior 📊

💡 Gate.io Insight:

Use Gate.io’s real-time charts, analytical tools, and news updates to navigate the market confidently and seize opportunities. 🛡️

🔗 Watch & Trade on the Gate.io

- Reward

- 3

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

71.34K Popularity

3.17K Popularity

3.04K Popularity

50.31K Popularity

1.86K Popularity

257.72K Popularity

234.96K Popularity

14.15K Popularity

1.33K Popularity

1.05K Popularity

886 Popularity

1.19K Popularity

1.8K Popularity

30.73K Popularity

News

View MoreMarket News: NVIDIA CEO Jensen Huang will not attend the India Artificial Intelligence Summit next week

1 m

Data: If BTC drops below $66,167, the total long liquidation strength on mainstream CEXs will reach $1.505 billion.

36 m

Data: If ETH drops below $1,971, the total long liquidation strength on major CEXs will reach $839 million.

37 m

Psy Protocol achieves 521,000 TPS, offering a $100,000 bounty for verification

46 m

The American Film Association condemns ByteDance's Seedance 2.0 for lack of effective copyright protection measures

53 m

Pin