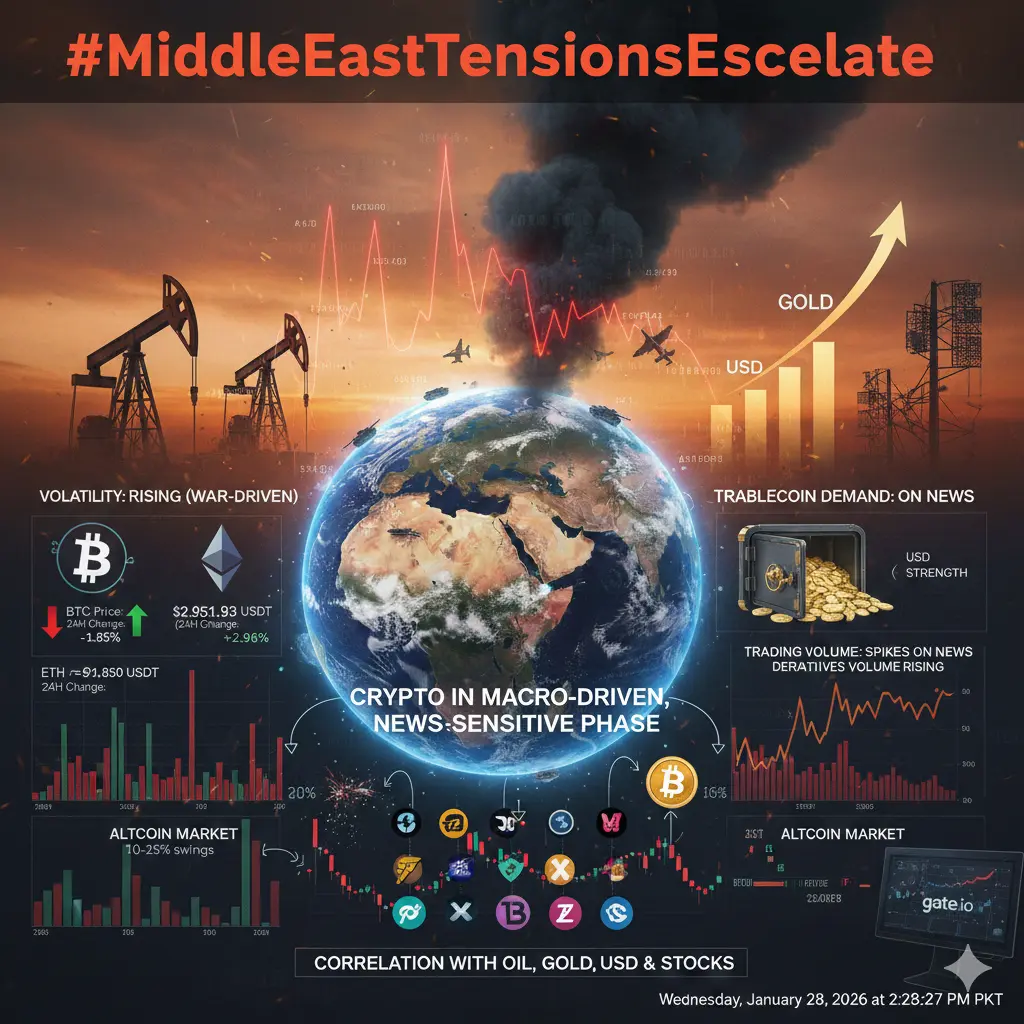

#MiddleEastTensionsEscalate #MiddleEastTensionsImpact 🌍💥

Crypto Markets in the Eye of Geopolitical Storm

The escalating conflict in the Middle East is no longer just a regional concern—it’s now reverberating across global financial markets, and the cryptocurrency ecosystem is feeling it acutely. From liquidity flows and trading volumes to derivatives positioning and investor sentiment, crypto is entering a macro-driven, news-sensitive phase.

Here’s a detailed breakdown of how this geopolitical escalation is shaping crypto today:

📊 Live Crypto Market Snapshot (Gate.io Reference)

Bitcoin (BTC)

Price: ~$91,850 USDT

24H Change: -1.85%

24H Volume: ~$38.2B

Market Dominance: ~52.4%

Volatility: Rising (war-driven risk sentiment)

Ethereum (ETH)

Price: $2,951.93 USDT

24H Change: +2.96%

24H Volume: ~$780.8M

Trend: Short-term bullish, but near resistance

Liquidity Status: Slightly tightening

Altcoin Market

Average 24H Performance: -3% to +4%

Small-cap Volatility: High (10–25% swings)

Liquidity: Declining in riskier tokens

Liquidity Impact — Capital Turns Defensive

As tensions rise:

Large investors reduce exposure to high-risk assets.

Market makers widen bid–ask spreads.

Leverage capital moves into stablecoins like USDT/USDC.

Altcoin liquidity dries up faster than BTC.

DeFi pools experience temporary capital outflows.

Result:

Thinner order books → faster price spikes & drops

Higher liquidation sensitivity

Trading Volume — News Triggers Surges

Derivatives volume surging due to risk hedging.

Spot trading volumes slightly cooling.

Retail participants becoming cautious.

Outcome:

Sharp intraday volatility

Rapid reversals

High-frequency trading dominates short-term action

Price Impact — Risk-Off vs Hedge Demand

Crypto reacts in two opposing phases:

Risk-Off Selling: BTC dips, altcoins fall harder, stablecoins attract capital.

Hedge Rotation: If crisis deepens, BTC becomes a hedge → dominance rises, altcoins underperform temporarily.

Percentage Volatility — Wider Swings

Middle East risk drives larger intraday price moves:

BTC: 3–8% swings

ETH: 4–10% swings

Altcoins: 10–25% swings

Drivers: war headlines, oil shocks, USD strength, liquidation cascades

Futures & Derivatives — High-Risk, High-Opportunity

Funding rates turning negative during fear

Long liquidations spike on sharp dips

Smart money accumulates on forced sell-offs

Stablecoin Demand — Capital on the Sidelines

Rising USDT inflows into exchanges

Investors preserving capital and preparing for dip-buying

Indicates stored buying power for future rallies

Market Sentiment — Fear Dominates

Panic-driven selling

News-reactive trading

Emotional market reactions accelerate

Psychological cycle: Panic → Capitulation → Dip Accumulation → Trend Continuation

Macro Correlation — Oil, Gold, USD & Stocks

Crypto now reacts strongly to global markets:

Oil ↑ → volatility ↑

Gold ↑ → BTC hedge narrative strengthens

USD ↑ → crypto price pressure

Stocks ↓ → risk-off selling dominates

Institutional Behavior — BTC Favored

Reducing altcoin exposure

Hedging via options/futures

Increasing BTC allocation during volatility

Result: Bitcoin dominance rises in crisis periods

On-Chain Utility — Crisis Strengthens Adoption

Cross-border crypto usage increases

Stablecoin settlements rise

P2P adoption grows in restricted regions

Crypto proves its censorship-resistant, borderless utility

Worst-Case Scenario

Conflict escalates further → extreme volatility

Short-term price drawdowns intensify

BTC outperforms altcoins

Panic liquidations → deep discount buying zones

Best-Case Scenario

Diplomatic resolutions → liquidity returns

Risk appetite rebounds

BTC & ETH resume trend continuation

Market momentum strengthens

Strategic Takeaways

Traders & Investors:

Scalpers: Trade volatility carefully

Swing Traders: Buy fear-driven dips

Long-Term Investors: Accumulate BTC during uncertainty

Altcoin Traders: Wait for BTC dominance stabilization

Conclusion

The Middle East geopolitical escalation is tightening liquidity, amplifying volatility, widening price swings, and shifting capital toward Bitcoin and stablecoins. Emotional market reactions are accelerating short-term inefficiencies—but for long-term investors, opportunities are emerging in the chaos.

Crypto is now more than just a digital assetit’s part of the global macro battlefield. 🌐💹

Crypto Markets in the Eye of Geopolitical Storm

The escalating conflict in the Middle East is no longer just a regional concern—it’s now reverberating across global financial markets, and the cryptocurrency ecosystem is feeling it acutely. From liquidity flows and trading volumes to derivatives positioning and investor sentiment, crypto is entering a macro-driven, news-sensitive phase.

Here’s a detailed breakdown of how this geopolitical escalation is shaping crypto today:

📊 Live Crypto Market Snapshot (Gate.io Reference)

Bitcoin (BTC)

Price: ~$91,850 USDT

24H Change: -1.85%

24H Volume: ~$38.2B

Market Dominance: ~52.4%

Volatility: Rising (war-driven risk sentiment)

Ethereum (ETH)

Price: $2,951.93 USDT

24H Change: +2.96%

24H Volume: ~$780.8M

Trend: Short-term bullish, but near resistance

Liquidity Status: Slightly tightening

Altcoin Market

Average 24H Performance: -3% to +4%

Small-cap Volatility: High (10–25% swings)

Liquidity: Declining in riskier tokens

Liquidity Impact — Capital Turns Defensive

As tensions rise:

Large investors reduce exposure to high-risk assets.

Market makers widen bid–ask spreads.

Leverage capital moves into stablecoins like USDT/USDC.

Altcoin liquidity dries up faster than BTC.

DeFi pools experience temporary capital outflows.

Result:

Thinner order books → faster price spikes & drops

Higher liquidation sensitivity

Trading Volume — News Triggers Surges

Derivatives volume surging due to risk hedging.

Spot trading volumes slightly cooling.

Retail participants becoming cautious.

Outcome:

Sharp intraday volatility

Rapid reversals

High-frequency trading dominates short-term action

Price Impact — Risk-Off vs Hedge Demand

Crypto reacts in two opposing phases:

Risk-Off Selling: BTC dips, altcoins fall harder, stablecoins attract capital.

Hedge Rotation: If crisis deepens, BTC becomes a hedge → dominance rises, altcoins underperform temporarily.

Percentage Volatility — Wider Swings

Middle East risk drives larger intraday price moves:

BTC: 3–8% swings

ETH: 4–10% swings

Altcoins: 10–25% swings

Drivers: war headlines, oil shocks, USD strength, liquidation cascades

Futures & Derivatives — High-Risk, High-Opportunity

Funding rates turning negative during fear

Long liquidations spike on sharp dips

Smart money accumulates on forced sell-offs

Stablecoin Demand — Capital on the Sidelines

Rising USDT inflows into exchanges

Investors preserving capital and preparing for dip-buying

Indicates stored buying power for future rallies

Market Sentiment — Fear Dominates

Panic-driven selling

News-reactive trading

Emotional market reactions accelerate

Psychological cycle: Panic → Capitulation → Dip Accumulation → Trend Continuation

Macro Correlation — Oil, Gold, USD & Stocks

Crypto now reacts strongly to global markets:

Oil ↑ → volatility ↑

Gold ↑ → BTC hedge narrative strengthens

USD ↑ → crypto price pressure

Stocks ↓ → risk-off selling dominates

Institutional Behavior — BTC Favored

Reducing altcoin exposure

Hedging via options/futures

Increasing BTC allocation during volatility

Result: Bitcoin dominance rises in crisis periods

On-Chain Utility — Crisis Strengthens Adoption

Cross-border crypto usage increases

Stablecoin settlements rise

P2P adoption grows in restricted regions

Crypto proves its censorship-resistant, borderless utility

Worst-Case Scenario

Conflict escalates further → extreme volatility

Short-term price drawdowns intensify

BTC outperforms altcoins

Panic liquidations → deep discount buying zones

Best-Case Scenario

Diplomatic resolutions → liquidity returns

Risk appetite rebounds

BTC & ETH resume trend continuation

Market momentum strengthens

Strategic Takeaways

Traders & Investors:

Scalpers: Trade volatility carefully

Swing Traders: Buy fear-driven dips

Long-Term Investors: Accumulate BTC during uncertainty

Altcoin Traders: Wait for BTC dominance stabilization

Conclusion

The Middle East geopolitical escalation is tightening liquidity, amplifying volatility, widening price swings, and shifting capital toward Bitcoin and stablecoins. Emotional market reactions are accelerating short-term inefficiencies—but for long-term investors, opportunities are emerging in the chaos.

Crypto is now more than just a digital assetit’s part of the global macro battlefield. 🌐💹