Search results for "NET"

Crypto ETFs Play "Game of Thrones": XRP and Solana ETFs Continue to Attract Funds, Are Institutions Abandoning Bitcoin?

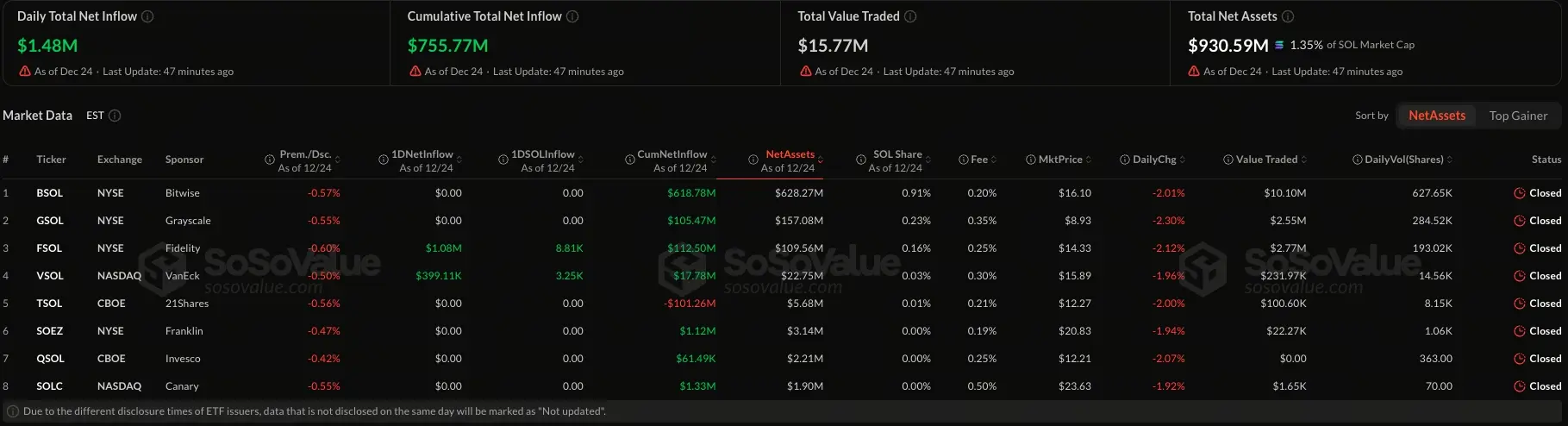

The US ETF market in 2025 set a historic "triple crown" record, with a net capital inflow of up to $1.4 trillion, over 1,100 new products launched, and a total trading volume of $57.9 trillion. However, beneath this prosperity, the crypto asset ETFs are experiencing a fierce rotation of funds. Bitcoin and Ethereum ETFs faced significant outflows in December, totaling over $1.1 billion; in stark contrast, newly launched XRP and Solana ETFs continued to attract funds, with XRP ETF setting an astonishing record of 28 consecutive trading days of net inflows. This phenomenon clearly indicates that beyond the grand narrative of ETFs, institutional investors are becoming more and more selective, shifting their focus from mere "digital gold" to crypto assets with clear regulation and real-world utility. The structural shift in the market may have quietly begun.

MarketWhisper·2h ago

XRP Today News: ETF Draws $1.13 Billion, XRP Drops for Four Consecutive Days, Can the Bull Market Restart in 2026?

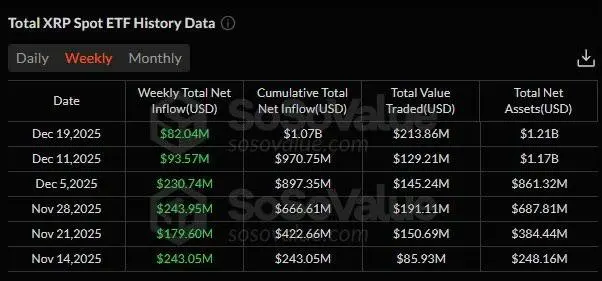

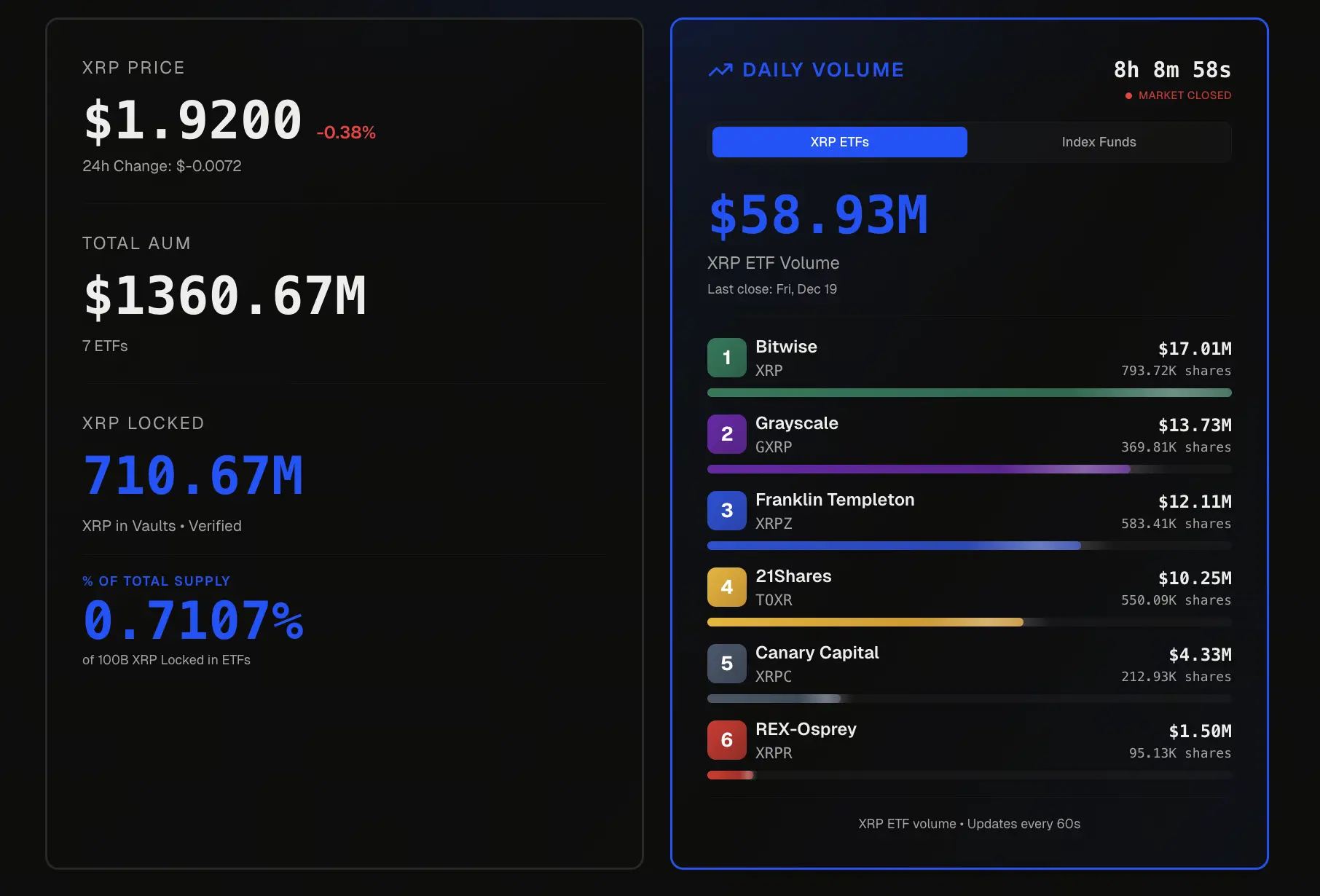

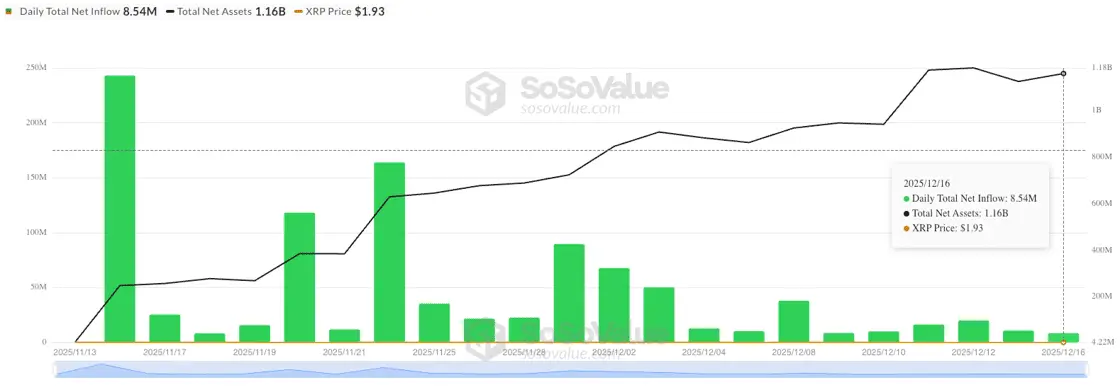

Recently, XRP price movement has entered a technical weakness, recording a fourth consecutive trading day decline on December 24, closing near $1.86, a significant retracement from the July all-time high of $3.66. In stark contrast to the price weakness, its spot ETF has demonstrated remarkable institutional absorption capacity, with 28 consecutive days of net capital inflows since its listing in November, totaling $1.13 billion. This divergence of "price falling, funds flowing in" reveals a deep contradiction between short-term profit-taking pressure and medium- to long-term structural optimism in the market. Looking ahead to 2026, the advancement of crypto-friendly regulatory bills, the potential Fed interest rate cut cycle, and the deepening utility of XRP in cross-border payments collectively form a positive narrative for its price recovery.

XRP1.24%

MarketWhisper·2h ago

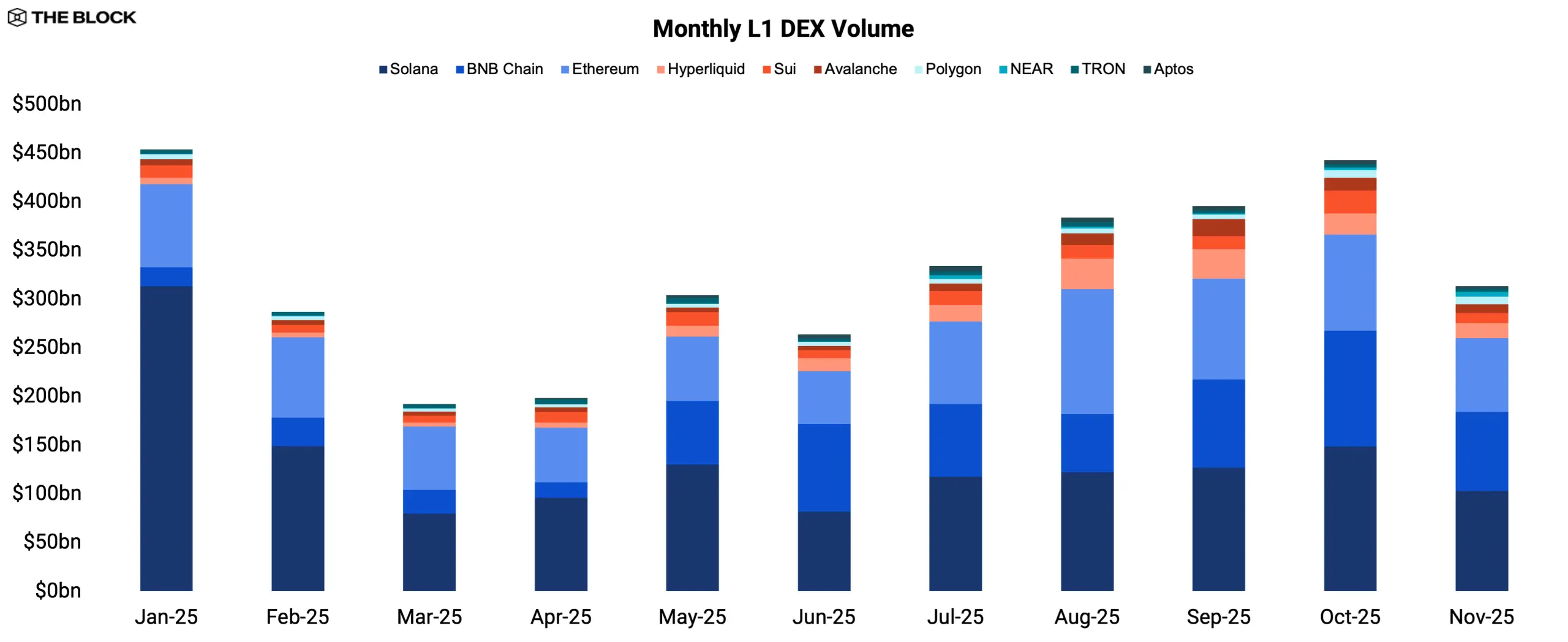

2026 Layer1 Final Prediction: Fragmentation Worsens, Interoperability Becomes the Only Lifeline

The 2025 Layer1 market undergoes a thorough split: Solana and BNB Chain rely on meme coin speculation to attract funds, Ethereum transitions to a settlement layer, and a net increase of $90 billion in stablecoins spurs the creation of dedicated "stable chains." Zcash experiences a surge of 661% due to privacy demands. In 2026, Layer1 accelerates its differentiation into speculative chains, settlement chains, stable chains, privacy chains, and performance chains, with interoperability becoming the only solution to provide a seamless experience.

MarketWhisper·2h ago

2025 Year in Review: Is Wall Street No Longer Trading Stocks? 1,100 ETFs Absorb 1.4 Trillion

In 2025, a smoke-free revolution took place on Wall Street. $1.4 trillion in net inflows into the ETF market, 300 billion dollars more than in 2024, with an annual trading volume reaching an astonishing $57.9 trillion, and 1,100 new ETF products launched throughout the year. These figures mark the end of an era: the era of believing that "the deeper the research, the more you earn" has become history.

MarketWhisper·3h ago

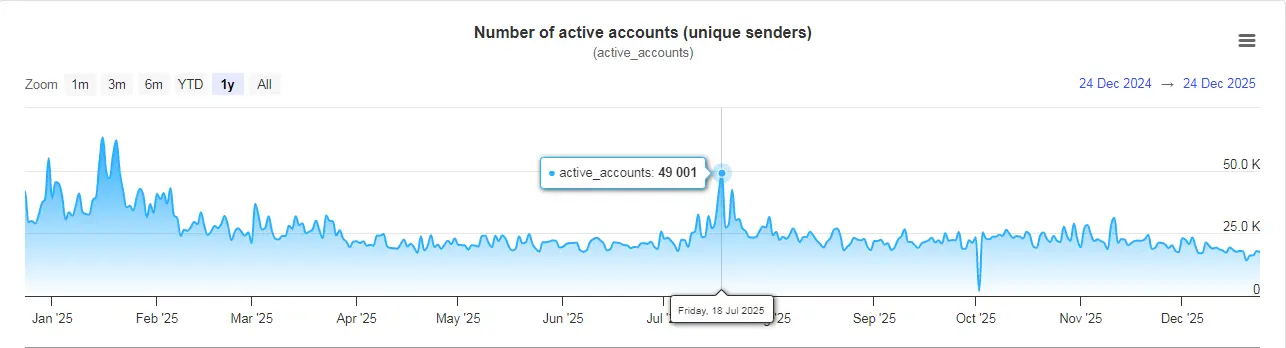

XRP Today News: Whale Sell-Off Causes Active Accounts to Plummet, ETF and Technicals Diverge

XRP drops for the fourth consecutive time to $1.87, with technicals overshadowing bullish fundamentals. Active accounts plummeted in the second half of the year, and after reaching a historical high of $3.66 in July, profit-taking and whale sell-offs caused a 17% decline. However, XRP spot ETF recorded a net inflow of $1.13 billion, with 26 consecutive days of positive inflow. Technicals well below the 50-day and 200-day moving averages indicate a bearish outlook.

XRP1.24%

MarketWhisper·4h ago

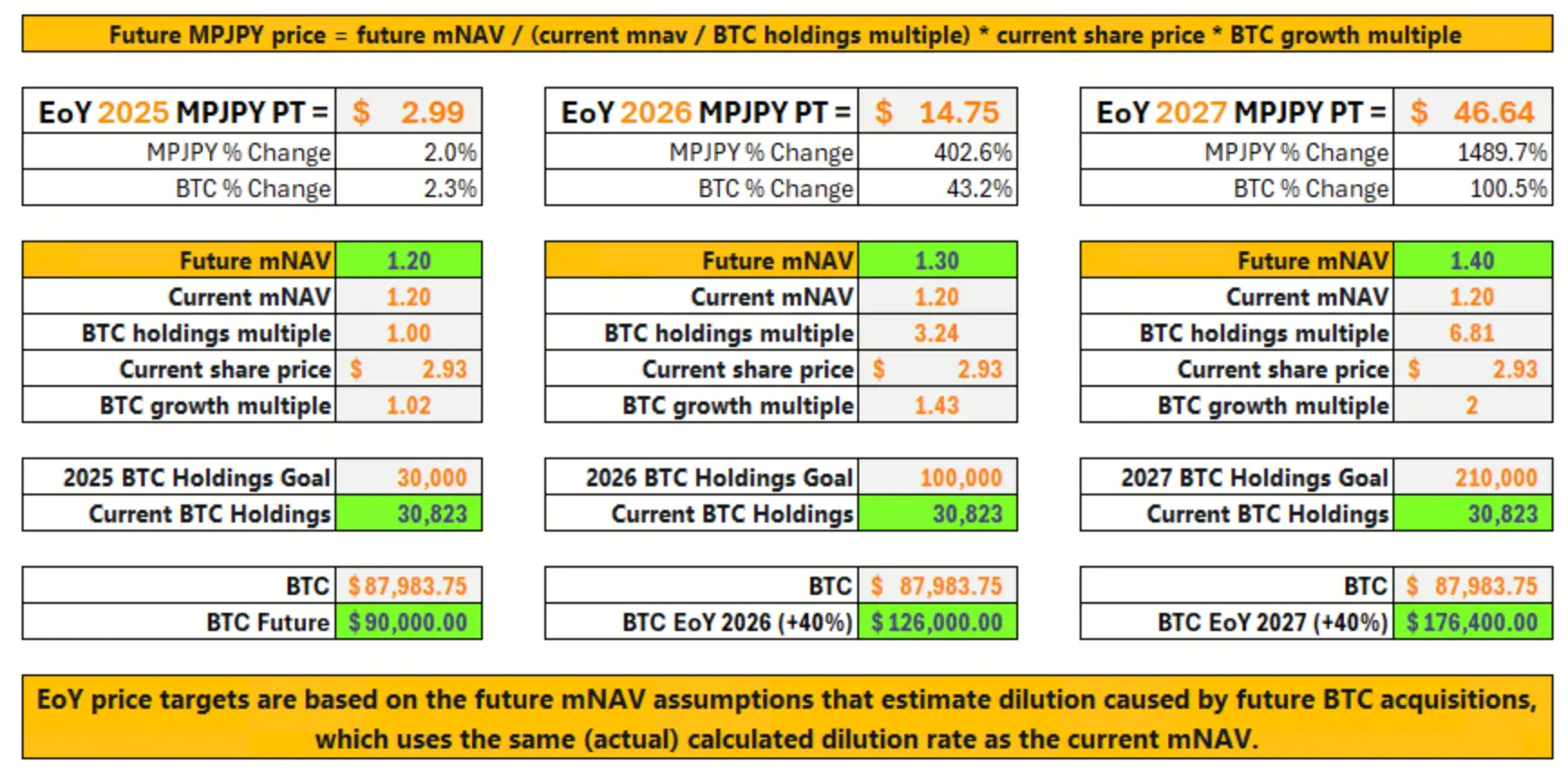

Target of 210,000 BTC! Metaplanet approves the ultimate coin hoarding plan for 2027

Japanese listed company and Asia's largest Bitcoin treasury Metaplanet recently held a special shareholders' meeting and approved an extremely ambitious capital plan. The company's board of directors officially approved the goal of building a massive treasury containing 210,000 Bitcoins (approximately $18.5 billion USD at current market prices) by the end of 2027. To achieve this goal, Metaplanet has designed a complex preferred stock financing scheme, issuing Class A and B shares with floating interest rates, quarterly dividends, and special buyback provisions, aiming to raise funds from global institutional investors while "delaying" rather than avoiding dilution of existing equity. Against the backdrop of a generally sluggish crypto market and most digital asset treasury companies having market values below their net assets, Metaplanet's contrarian accumulation, along with other Japanese DATs, is not only a financial gamble but also a real-world example of financial engineering.

BTC0.88%

MarketWhisper·4h ago

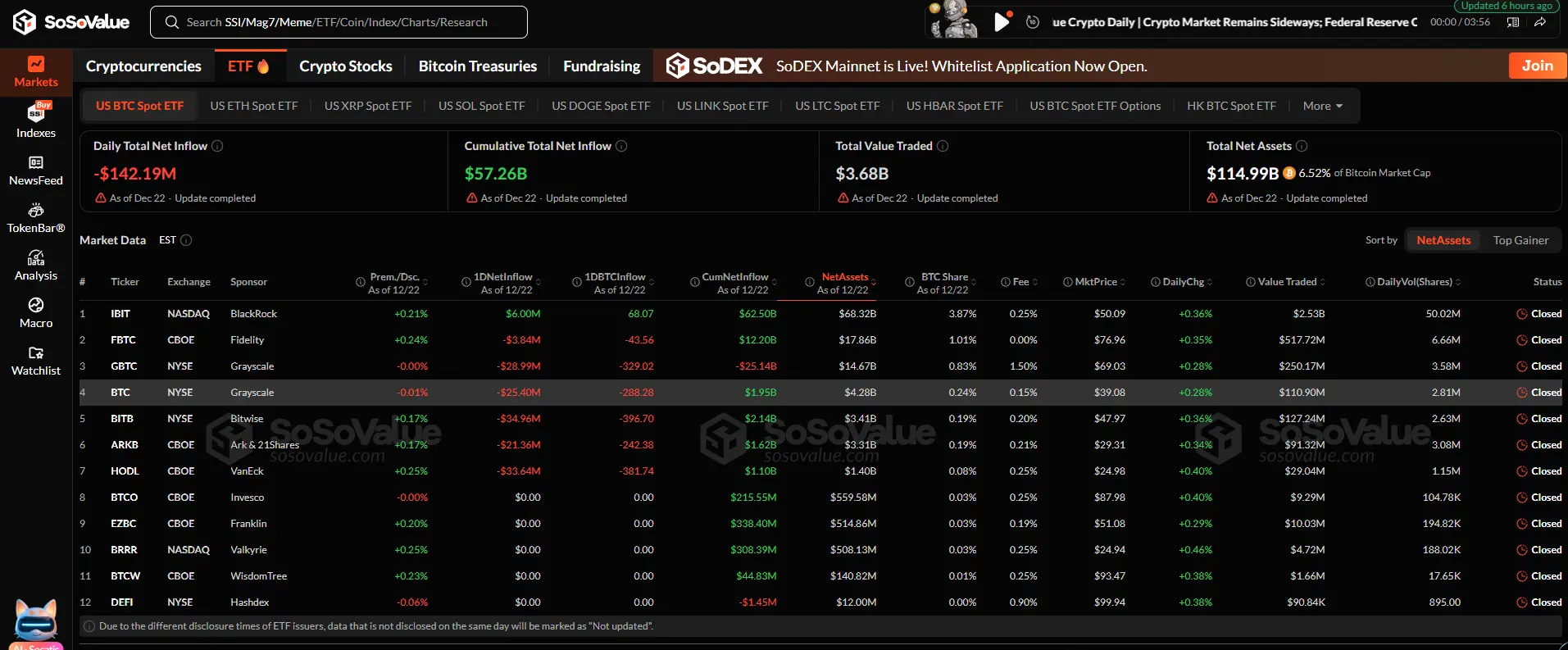

Bitcoin ETF Christmas Heist! IBIT withdraws $157 million in a single day—who's fleeing?

On the eve of the Christmas holiday, the US spot Bitcoin ETF experienced a net outflow of $188 million on Tuesday, marking the fourth consecutive trading day of capital outflows. BlackRock's IBIT suffered the most, with a single-day outflow of $157 million. Ethereum ETFs saw an outflow of $95.5 million on Tuesday, with Grayscale ETHE leading the decline at $50,900,000. Experts point out that year-end portfolio rebalancing, tax-loss harvesting, and reduced holiday liquidity are the main reasons.

MarketWhisper·5h ago

Metaplanet's 3-month hidden scheme to avoid buying coins! $600 million arbitrage harvests retail investors

Metaplanet has stopped purchasing Bitcoin for three months starting in October, effectively initiating an arbitrage strategy. When the market net value drops below 1.0, repurchasing shares becomes more cost-effective than buying coins. The company immediately secured a $100,000,000 mortgage loan and a $500,000,000 repurchase quota. The December shareholders' meeting approved the entire plan, with public support from Norway's $2 trillion bank.

MarketWhisper·5h ago

[Korean Stock Market Opening行情] Korea Composite Stock Price Index · KOSDAQ Index Slightly Down… Samsung Electronics ↓, SK Hynix ↑

The domestic stock market declined slightly, with the KOSPI index falling 0.21%, and individual investors net selling over 700 billion KRW; the KOSDAQ index decreased by 0.47%. The Korean won against the US dollar depreciated, and international gold prices and domestic gold prices also declined.

TechubNews·6h ago

Christmas market hype fizzles out! Bitcoin and Ethereum ETFs lose momentum, analysts: next year's trend depends on post-holiday performance

The Christmas and New Year holidays are approaching, and the crypto market seems to have already entered a "hibernation mode." US Bitcoin and Ethereum spot ETFs collectively lost value on Tuesday, mainly due to year-end asset rebalancing and liquidity tightening before the long holiday, with profit-taking selling pressure clearly increasing.

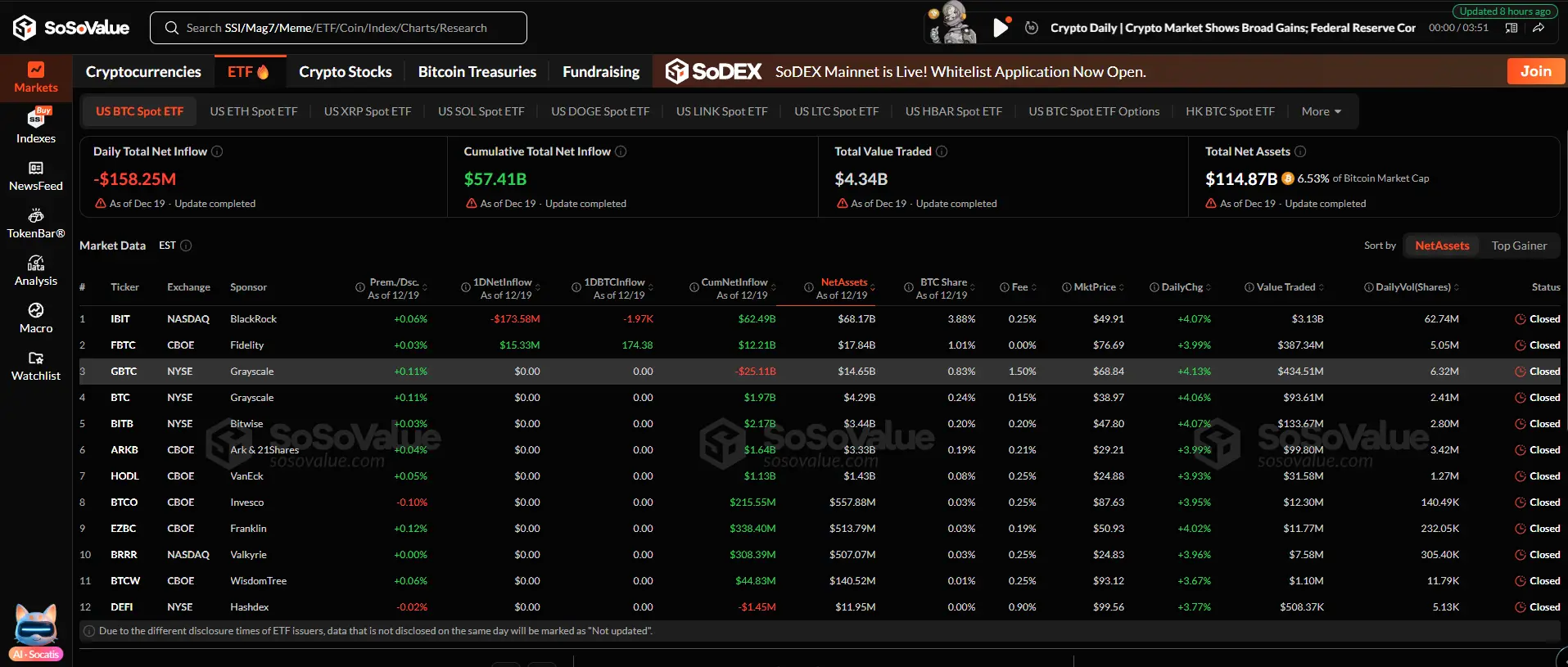

According to SoSoValue data, the US Bitcoin spot ETF experienced a net outflow of $188.6 million on Tuesday, marking the fourth consecutive day of withdrawals. Among them, BlackRock's IBIT suffered the heaviest outflow, with a net outflow of $157.3 million in a single day; Fidelity's FBTC and Grayscale's GBTC also could not escape.

On the other hand, Ethereum spot ETFs also recorded a net outflow of $95.5 million on Tuesday, following a previous day with $84.6 million

区块客·17h ago

Cardano Forecast For Dec 24: Here’s How Low ADA Price Can Go

Cardano (ADA) is experiencing a downtrend, currently priced at $0.3562, with a significant decline over the past week and a bearish market sentiment. Despite short-term buying interest indicated by some net inflows, overall market sentiment remains cautious with net outflows dominating.

TheCryptoBasic·21h ago

Bitcoin ETFs See Outflows as Altcoin Funds Attract Inflows – Year-End Rotation Hits BTC Hardest

U.S. spot Bitcoin ETFs recorded $142 million in net outflows on December 22, 2025, marking the third consecutive day of losses and signaling year-end profit-taking or tax-loss harvesting in the flagship cryptocurrency

CryptopulseElite·12-24 05:50

2025 Cryptocurrency ETF Battle Report: Bitcoin's Dominance Remains Rock Solid, Ether's Share Quietly Expands

In 2025, the crypto assets exchange-traded fund (ETF) market presented a distinct "one strong, one super" pattern. The Bitcoin ETF solidified its position as the preferred choice for institutional deposits with an absolute market share of 70% to 85% throughout the year, attracting a total capital flow of up to $31 billion. Meanwhile, the Ethereum ETF share steadily climbed from the beginning of the year to 15% to 30% in December, indicating that institutional acceptance of the second-largest digital asset is increasing.

However, the unexpected delay of the U.S. "Clarity Act" at the end of the year triggered a net outflow of global crypto ETP funds of up to $952 million in a single week, with Ethereum products under the most pressure, adding a touch of uncertainty to the institutional narrative for 2025. This article will analyze the true preferences of institutional funds through detailed data and interpret how the regulatory process has become the "baton" of short-term market sentiment.

MarketWhisper·12-24 05:23

The era of Bitcoin contracts has arrived! TBC builds the foundation, BTF becomes the first leader sample.

The Bitcoin Contract Layer has experienced a key turning point from concept to implementation. TBC (The Bitcoin Contract), as the native contract base of Bitcoin, establishes programmability for BTC through a verifiable architecture, evolving it from a store of value asset into a programmable financial infrastructure. BTF (Bitcoin Finance) has taken the lead in completing the liquidity closed loop by adopting the Snowball protocol to bind net holdings, liquidity, and long-term incentives into a sustainable structural model.

MarketWhisper·12-24 05:12

XRP Whale Exodus! Holdings evaporated by 8 billion, $1.90 defense line in jeopardy.

XRP price fell below the 1.90 dollar mark, despite the Spot ETF attracting 44 million dollars in a single day on Monday, with a cumulative net inflow reaching 1.12 billion dollars, it still could not stop the downward trend. The key issue is that Whales continue to reduce positions, with Addresses holding more than 100,000 Tokens seeing their value plummet from 191 billion dollars in July to 104 billion dollars, evaporating over 87 billion dollars.

XRP1.24%

MarketWhisper·12-24 02:39

XRP Today News: Price depeg ETF, Yen arbitrage trading and GDP impact long positions

Spot XRP ETF has seen net inflows for 26 consecutive trading days, with a single-day inflow of 43.89 million USD on December 22, yet XRP dropped below 1.90 USD on December 24. This decline is attributed to the Japanese Finance Minister's renewed threat to intervene in the foreign exchange market, raising concerns over yen arbitrage Close Position, while the U.S. Q3 PCE inflation rose to 2.8%, suppressing risk appetite, leading to a sharp drop in market expectations for The Federal Reserve (FED) rate cuts in March next year.

MarketWhisper·12-24 01:49

Encryption Tycoons 2025 Wealth Fluctuation Record: Some people's fortunes doubled while others' assets declined by 50%.

The year 2025 is a dramatic collision of narrative and reality for the crypto assets industry, marking a significant divide in wealth. Despite Bitcoin's price retreating about 6% from its peak earlier in the year, the Bloomberg Billionaires Index shows a stark contrast in the fortunes of industry leaders: stablecoin giants have emerged as the biggest winners, with Circle founder Jeremy Allaire's wealth soaring by 149%, and Tether chairman Giancarlo Devasini's net worth rising 60% to $13.2 billion; meanwhile, the once-prominent "BitShares" pioneer Michael Saylor saw his fortune shrink by 37%, and the Winklevoss twins' wealth plummeted by 59%. Behind this wealth reshuffle lies a profound reflection of the industry's transformation from reckless growth to compliance and foundational services.

BTC0.88%

MarketWhisper·12-24 01:35

[Korea Stock Market Opening Market] The Korean stock market shows mixed performance... KOSPI rises, KOSDAQ falls, and individual investors continue to buy.

On the 24th, the South Korean stock market experienced Fluctuation, with the composite stock price index KOSPI rising by 14.03 points to 4,131.35 points, mainly driven by net purchases from individual and institutional investors. The KOSDAQ index, on the other hand, fell slightly by 0.10%. The Korean won depreciated against the US dollar, and gold prices rose.

TechubNews·12-24 00:43

XRP ETF Extends Daily Inflow as Total Volume Tops $1.2 Billion - Coinspeaker

Key Notes

XRP ETFs have consistently recorded net inflows, a sign of sustained adoption.

The ETF products recorded about $43.9 million in net inflows on December 22.

XRP price is still lagging, a proof of divergent ecosystem metrics for the altcoin.

Spot XRP ETF products have taken the

Coinspeaker·12-23 13:15

XRP ETFs Buck the Trend with $82M Inflows as BTC and ETH Funds Shed Hundreds of Millions

U.S. spot XRP ETFs continued their impressive streak last week, attracting $82 million in net inflows while Bitcoin and Ethereum ETFs suffered significant redemptions amid broader market pressure.

CryptopulseElite·12-23 09:56

PA Daily | Bitcoin ETF has seen net outflows for three consecutive days; Spot silver has broken the $70 barrier for the first time.

Today's news highlights:

Spot silver breaks through the $70 mark for the first time.

CFTC Acting Chair Caroline Pham steps down, Michael Selig is sworn in as the 16th Chair.

Bitcoin spot ETFs saw a net outflow of $142 million yesterday, marking the third consecutive day of outflows.

A certain address staked 1.17 million SOL, worth approximately 174.36 million USD.

BitMine increased its holdings by 98,800 ETH last week, bringing the total to 4.066 million.

Last week, global listed companies net bought $26.35 million in BTC, and Strategy did not increase its holdings.

macroeconomic

Hong Kong Police: 15 people have been arrested in the robbery case of a 1 billion yen virtual currency exchange.

According to Hong Kong media Hong Kong 01, last week two Japanese company employees engaged in virtual currency and luxury goods business took a car to a virtual currency exchange shop in Sheung Wan, planning to exchange 1 billion yen (approximately contained in 4 travel suitcases.

PANews·12-23 09:36

Crypto ETPs Record Nearly $1B in Weekly Outflows Amid Market Volatility

Cryptocurrency exchange-traded products (ETPs) experienced substantial net outflows last week, marking the end of a short-lived inflow streak as investors reacted to regulatory delays and heightened selling pressure.

CryptopulseElite·12-23 09:32

Ether ETFs break outflow streak while XRP products hit multi-week highs

Spot Ether exchange-traded funds (ETFs) in the US recorded $84.6 million in net inflows on Monday, breaking a seven-day outflow streak in one of the biggest single-day reversals this month.

The shift came after over $700 million exited spot Ether (ETH) products last week, highlighting a pause in s

Cointelegraph·12-23 09:21

Cryptocurrency ETF flow: Bitcoin falls while Ethereum and XRP rise

According to data from SoSoValue, on December 22, the Bitcoin spot ETFs in America recorded a total net outflow of 142 million USD, reflecting the cautious sentiment of investors in the short term. Nevertheless, IBIT – BlackRock's Bitcoin spot ETF remains a bright spot as it leads the market with a net inflow of 6 million.

TapChiBitcoin·12-23 08:20

U.S. stocks surpass real estate! American household asset allocation experiences its third reversal in 65 years.

American households are experiencing the third major reversal in asset allocation in 65 years. Data from the second quarter of 2025 shows that stocks and mutual funds have surged to a record high, accounting for 31% of household net worth, while real estate has fallen below 30%. This is not just a simple shift in investment preferences; it is a gamble for high growth in exchange for balance sheet stability. The personal savings rate in the U.S. is at a historical low, and as 31% of wealth turns into stocks that pulse every second, a liquidity massacre is counting down.

MarketWhisper·12-23 06:45

CryptoQuant asserts that "the Bear Market has arrived"! Bitcoin demand momentum has cooled, and it may test $70,000.

CryptoQuant warns that Bitcoin demand has significantly weakened, and the market may have entered a Bear Market, with increased risks of a fall. The report indicates that if the Bitcoin price falls to $70,000, it may occur within 3 to 6 months, while $56,000 could appear in 2026. Market funds are retreating, ETFs have turned into net sellers, and the phenomenon of Large Investors withdrawing is evident, showing characteristics of a Bear Market.

区块客·12-23 06:32

Why is the change in Bitcoin ETF funds still insufficient to determine market trends?

The Bitcoin ETF fund data presents a stark contrast; some clickbait headlines have exaggerated the coming selling wave, but the core data reveals more of a technical adjustment rather than a long-term withdrawal.

Although the current market is in a phase of cyclical pressure, investors have not realized losses of about $100 billion, miners are reducing their hash power, and the stock prices of treasury companies are below the book value of Bitcoin, the ETF market has not shown signs of an apocalyptic scenario.

According to Checkonchain data, although 60% of ETF capital inflows occurred during price increases, the assets under management of Bitcoin-denominated ETFs only saw an outflow of 2.5% (approximately $4.5 billion), which is relatively small compared to the total fund size.

The key point is that the outflow of these funds is synchronized with the reduction of open interest in CME futures and IBIT options, confirming that it is a structural liquidation of basis or volatility trades, rather than a collapse of market confidence.

Last week, capital flows showed two-way fluctuations, with a net flow between inflows and

BTC0.88%

金色财经_·12-23 06:00

2026 crypto market life and death tribulation! After the 57 billion ETF frenzy, can the demand continue?

In 2025, the cumulative net inflow of Spot Bitcoin ETF reached 57 billion USD, but after October, funds turned to outflows, with Bitcoin experiencing a big dump of 30% and Ether crashing by 50%. In 2026, the crypto market faced three major variables: The Federal Reserve (FED) cutting rates by 100 basis points, breakthroughs in U.S. legislation, and AI bubble risks. CoinTelegraph market chief Ray Salmond warned that the first quarter will determine whether the bull run continues or reverses.

ETH0.2%

MarketWhisper·12-23 03:44

[KOL Index] TON stablecoin inflow surges... A focused interpretation of macro variables and psychological indicators.

The KOL Index is a series of reports based on the community analysis technology of TokenPost and DataMaxiPlus, analyzing the content that has high investor response and attention within Telegram. It diagnoses the investment psychology and trends of the market through topics that were关注 in the KOL community the previous day. [Editor’s Note]

The most discussed topic in the community the previous day was the significant change in stablecoin supply growth data for TON in the last 24 hours. Posts citing data from the on-chain data platform Artemis went viral, drawing attention to a net inflow of approximately $500 million. This topic is seen as an opportunity to examine the possibility of liquidity shifting to a specific chain.

TON stablecoin inflow, observing liquidity transfer across chains

The news of TON stablecoin inflow quickly spread within the community and received a high response. Some posts interpret that this is not just a short-term capital flow but may also indicate the utilization rate of the ecosystem.

TechubNews·12-22 23:56

Bitcoin Rejected at $100K: Fundstrat Eyes $60K Bottom as ETFs Turn Net Sellers

Bitcoin Rejected at $100K defines current market direction as institutional demand weakens and selling pressure grows. Fundstrat’s latest outlook frames a deeper correction by early 2026 amid fading momentum signals. ETF outflows and onchain trends reinforce expectations for a prolonged downside

CryptoDaily·12-22 16:25

Michael Saylor Net Worth 2025: $9.4B Fortune Riding on 650K Bitcoin

Michael Saylor net worth ranges from $7.37B to $9.4B in 2025, driven by his 9.90% Strategy Inc. stake and personal Bitcoin holdings. Strategy owns 649,870 BTC after purchasing 8,178 bitcoin for $836M. This dual leverage means Michael Saylor net worth swings dramatically with Bitcoin price movements.

MarketWhisper·12-22 07:21

ETF cash flow diversified last week: Bitcoin and Ethereum saw capital outflows, while XRP and Solana attracted money back in.

During the period from December 15 to December 19 ( ET), the cryptocurrency ETF market recorded a clear divergence in investor sentiment towards large assets. Spot Ethereum ETFs faced strong selling pressure, with a total net outflow of up to 644 million USD for the week. Notably,

TapChiBitcoin·12-22 06:53

XRP ETFs See 30 Consecutive Days of Inflows, Total Assets Exceed $1 Billion

The U.S. spot XRP ETF market is experiencing accelerated inflows, marking over $1 billion in cumulative net inflows across 30 straight trading days and solidifying its position in the cryptocurrency ETF landscape.

CryptopulseElite·12-22 06:21

XRP Today News: ETF weekly volume falls to 82 million, profit pullback surge.

Today's news focus on XRP is on the significant weakening of ETF capital inflow momentum. In the week of December 19, XRP Spot ETF issuers reported a net inflow of $82.04 million, the lowest level since its launch in November. On December 22, the price of XRP hovered below the psychological threshold of $2, and as the year-end approaches, profit-taking has led to a price fall.

MarketWhisper·12-22 05:30

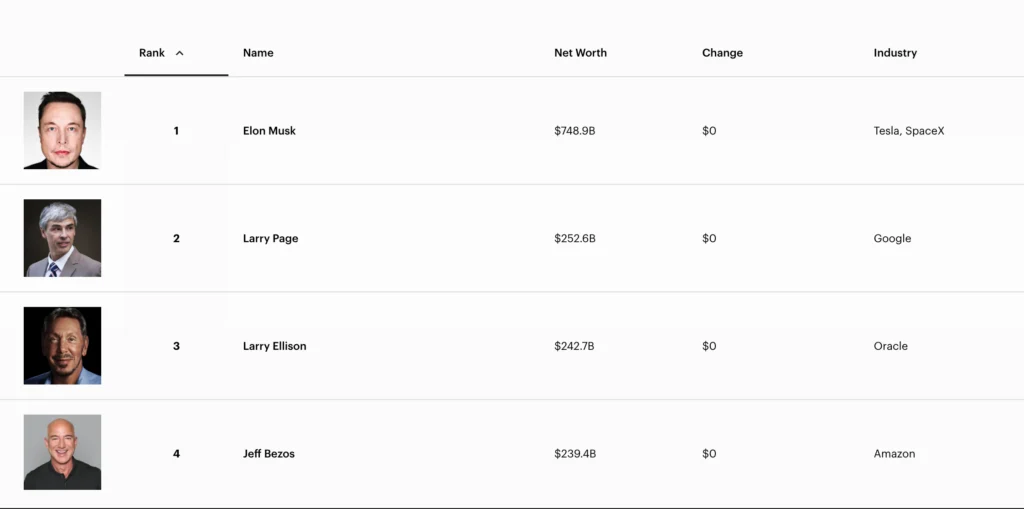

U.S. court reverses its decision! Musk's net worth soars to 749 billion, SpaceX's IPO is set to break a trillion.

Tesla and SpaceX founder Elon Musk's net worth soared to $749 billion, making him the first billionaire in history to surpass $700 billion. The Delaware Supreme Court overturned a lower court ruling, reinstating Musk's 2018 plan for Tesla stock Options worth $139 billion. Rumors are circulating that SpaceX will go public before 2026, pushing Musk's net worth towards the trillion-dollar mark.

MarketWhisper·12-22 03:42

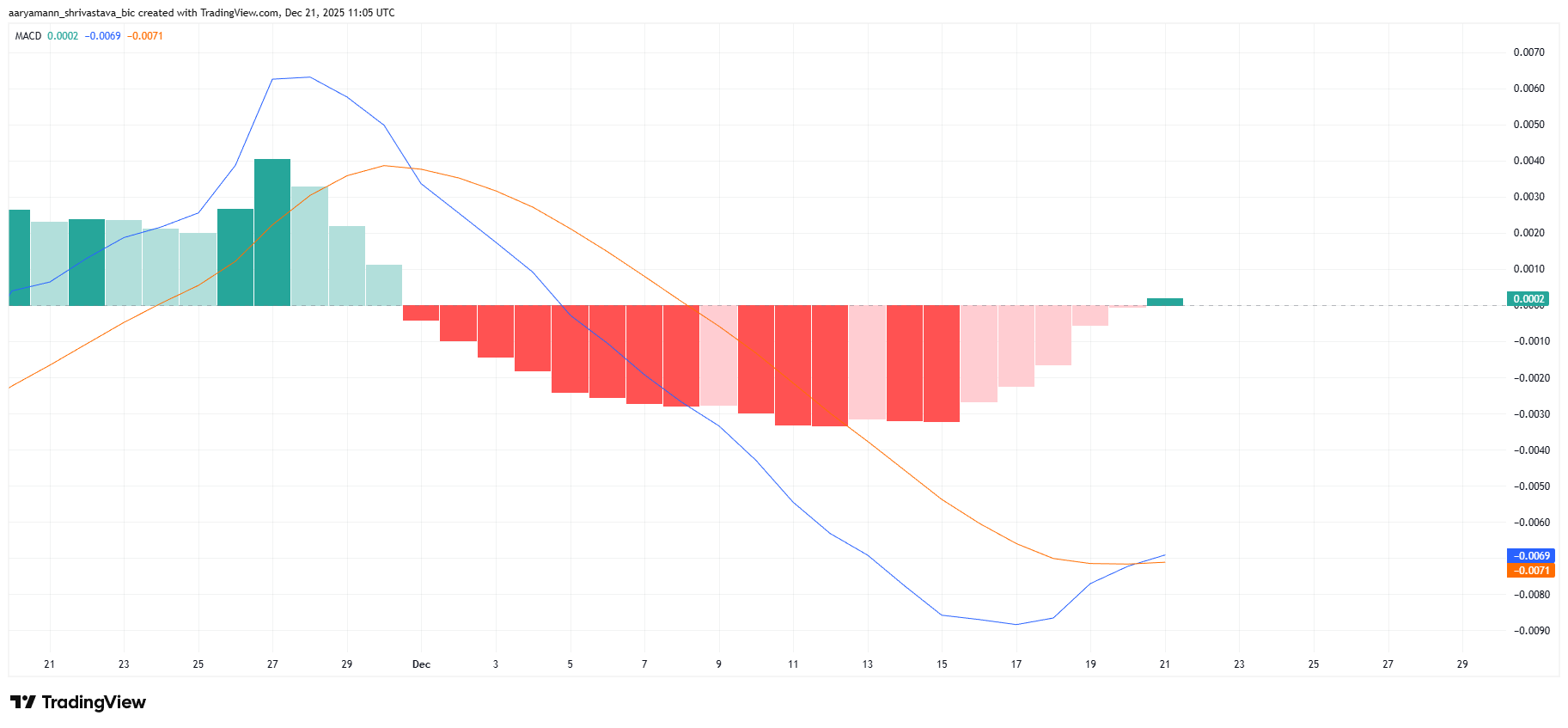

Pi coin price analysis: Falling below $0.2, a desperate counterattack, MACD turns bullish, funds flow back.

Pi coin is facing a new round of dumping pressure after breaking below 0.200 USD, and market confidence once fell to a low point. However, recent on-chain indicators show that holders are actively reversing the trend. The Moving Average Convergence Divergence (MACD) has shown a bullish crossover, with the MACD line crossing above the signal line, ending nearly 20 days of falling momentum. More importantly, the Chaikin Money Flow (CMF) has risen above the zero axis, confirming a return of net buying activity.

PI1.49%

MarketWhisper·12-22 03:08

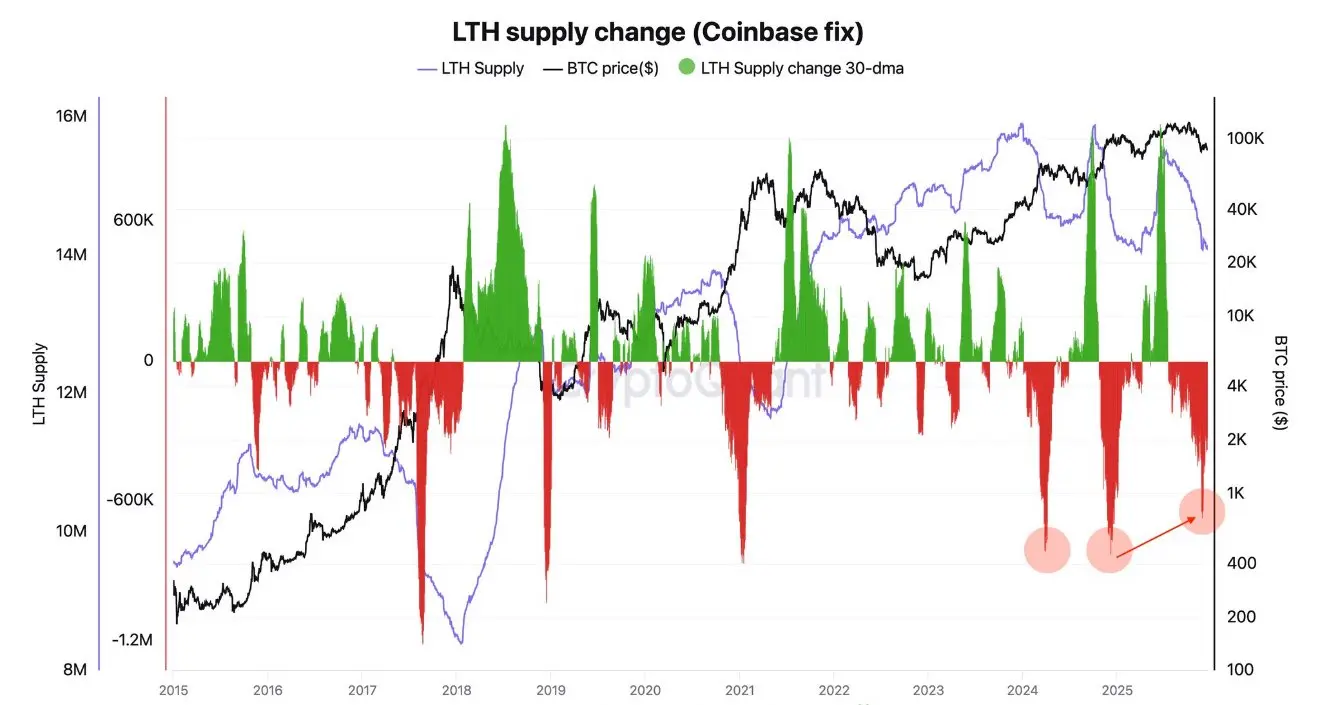

Bitcoin long-term holders are starting to flee! $300 billion in dormant supply is being dumped.

On-chain analyst NoLimitGains has revealed a rare and critical market shift: long-term Bitcoin holders are distributing tokens instead of continuing to hoard. These Bitcoins, held for more than 155 days, have historically remained dormant during periods of significant market fluctuation, but have shown consistent net selling over the past three months. This selling coincides with Bitcoin's price dropping from a high of $126,000 to around $88,000, a decline of 30%.

MarketWhisper·12-22 02:50

XRP吸金 1.2 billion USD! ETF has seen inflows for 32 consecutive days, and is about to break 2.15 USD.

XRP price remains stable around $1.93, with total assets of the XRP Spot ETF launched by institutions such as Grayscale, Bitwise, and Franklin Templeton now exceeding $1.2 billion, and cumulative net inflows exceeding $1.07 billion. Since its launch in November last year, the XRP ETF has achieved net inflows for 32 consecutive trading days.

MarketWhisper·12-22 01:03

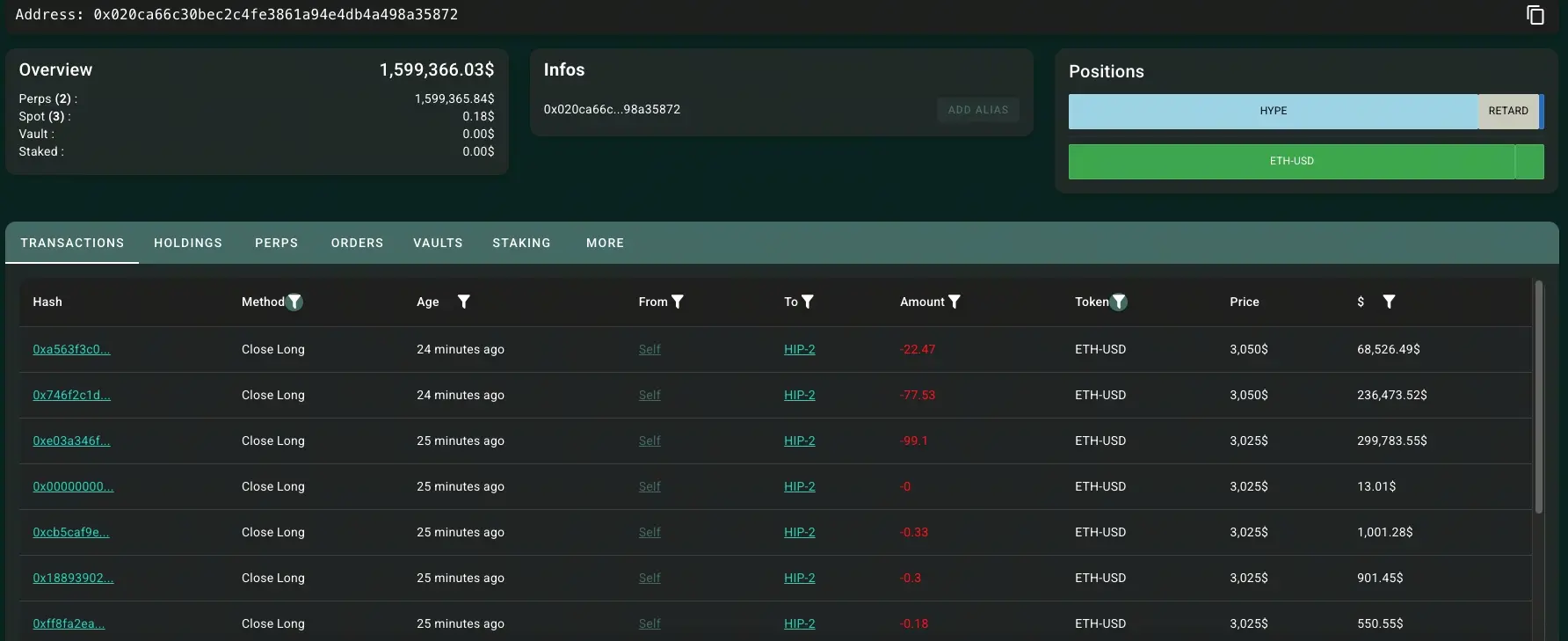

Brother Magi has an 80% win rate but lost 1.46 million USD! A bloody lesson in Margin Trading.

On December 21, on-chain data monitoring showed that "Brother Ma Ji" Huang Li Cheng has closed all his Bitcoin long orders and HYPE long orders. As of now, Brother Ma Ji has made 15 trades in a single week, all of which are long orders, with 12 profitable trades and 3 losing trades, resulting in a win rate of 80%. However, the overall position has a net loss of about 1.46 million USD for the week. Brother Ma Ji has also added 10x ZEC long orders worth 390,000 USD, with an entry price of 439.24 USD.

MarketWhisper·12-22 00:41

Bitcoin Rejected at $100K: Fundstrat Eyes $60K Bottom as ETFs Turn Net Sellers

Bitcoin Rejected at $100K defines current market direction as institutional demand weakens and selling pressure grows. Fundstrat’s latest outlook frames a deeper correction by early 2026 amid fading momentum signals. ETF outflows and onchain trends reinforce expectations for a prolonged downside

CryptoDaily·12-21 16:20

Musk's net worth approaches 750 billion USD, making him the first person in history! Court reinstates sky-high salary, igniting imagination for SpaceX's IPO.

The Delaware Supreme Court of the United States reinstated Musk's $139 billion compensation package, bringing his wealth to $749 billion, making him the first person in history to surpass $700 billion. Tesla's stock Options are back in effect due to the court's reversal, and additionally, SpaceX's valuation has also pumped to $800 billion, further enhancing Musk's status as a billionaire.

DOGE0.4%

動區BlockTempo·12-21 03:00

Ethereum ETFs extend 7-day outflow streak as ETH stalls below $3,000

Ethereum spot ETFs recorded $75.89 million in net outflows on December 19, extending the losing streak to seven consecutive trading days.

Summary

Ethereum ETFs posted $75.89M in outflows, extending the streak to seven days.

BlackRock's ETHA accounted for all redemptions while other ETH ETFs

Cryptonews·12-20 15:54

Cryptocurrency ETFs are diverging: Bitcoin and Ethereum are losing capital, Solana and XRP are attracting funds

On December 19th, the spot cryptocurrency ETF market experienced mixed movements as capital continued to diverge significantly. The total net outflow from Bitcoin spot ETFs reached $158 million, indicating that profit-taking pressure remains present. Notably, only Fidelity's FBTC fund recorded a capital inflow of .

TapChiBitcoin·12-20 07:39

Spot Bitcoin ETFs record $457M inflows in ‘early positioning’ push

Spot Bitcoin exchange-traded funds (ETFs) recorded $457 million in net inflows on Wednesday, marking their strongest single-day intake in more than a month as institutional demand showed signs of re-acceleration.

Fidelity’s Wise Origin Bitcoin Fund (FBTC) led the inflows, recording the largest

Cointelegraph·12-19 11:00

XRP Spot ETFs Extend Daily Inflow Streak as AUM Reaches $1.14B

XRP spot ETFs continue to attract steady institutional capital, even as the token’s price struggles to respond. New data from SoSoValue shows U.S. spot XRP ETFs recorded $30.41 million in net inflows on December 18. That extends their inflow streak to 32 consecutive trading days. Total assets

XRP1.24%

Coinfomania·12-19 09:51

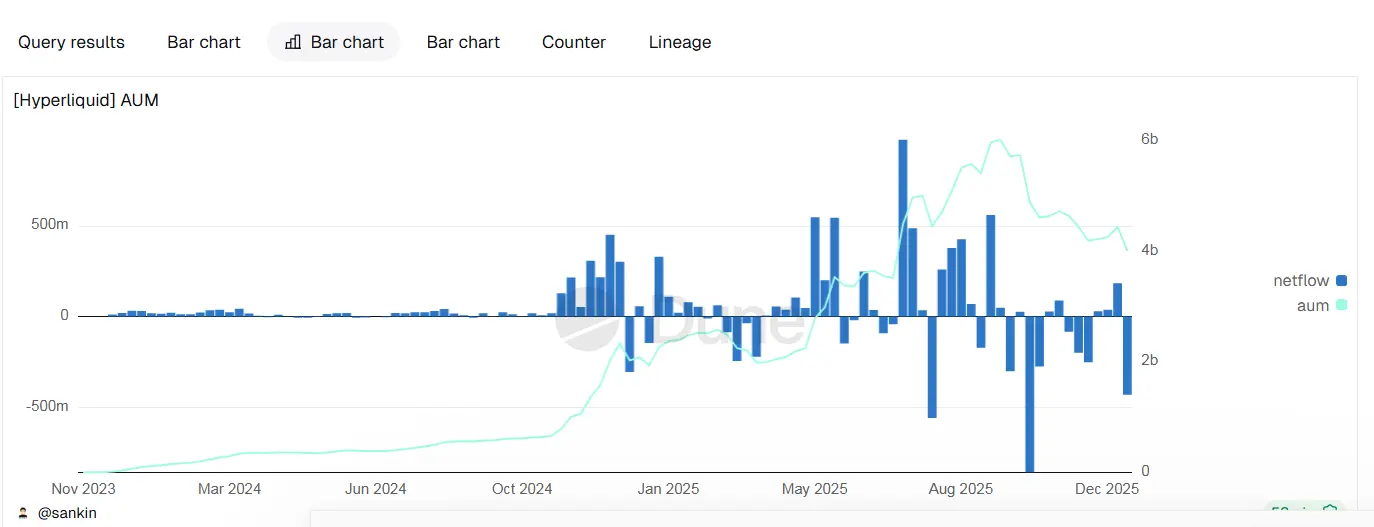

Hyperliquid records over $430 million USD in withdrawals, AUM sharply declines amid competitive pressure

According to data from @sankin\_eth dashboard, Hyperliquid has recorded a net outflow of over $430 million in the past week, marking the third-largest weekly outflow since the platform's launch. This trend indicates increasing pressure on Hyperliquid amid competition in the th

TapChiBitcoin·12-19 09:17

Spot Bitcoin ETFs Record $457M Inflows in 'Early Positioning' Push – Strongest Day in Over a Month

U.S. spot Bitcoin ETFs attracted $457 million in net inflows on Wednesday, December 18, 2025, marking the strongest single-day intake since November 11 and signaling renewed institutional demand amid shifting macro expectations.

BTC0.88%

CryptopulseElite·12-19 05:40

Bitcoin, Gold, and AI ETFs Drive Record $1.28 Trillion Inflows in 2025 – Trends to Watch for 2026

Exchange-traded funds (ETFs) shattered records in 2025, attracting net inflows of $1.28 trillion year-to-date as of mid-December—already surpassing the previous annual high of $1.03 trillion set in 2024.

CryptopulseElite·12-19 05:31

XRP ETFs Reach $1.14 Billion in Assets After Steady Inflows in December 2025

XRP-focused exchange-traded funds (ETFs) have accumulated $1.14 billion in net assets as of mid-December 2025, driven by consistent daily inflows since the category's launch.

CryptopulseElite·12-19 05:27

Bitcoin ETFs Surge to $457M Inflows in Early Market Move

Institutional Interest Resurges as Bitcoin ETF Inflows Reach Over $450 Million

Spot Bitcoin exchange-traded funds (ETFs) demonstrated renewed investor confidence on Wednesday, recording net inflows of $457 million — their most substantial daily increase in over a month. This influx signals a

BTC0.88%

CryptoDaily·12-19 03:19

Load More