BTC_POWER_LA

Belum ada konten

BTC_POWER_LA

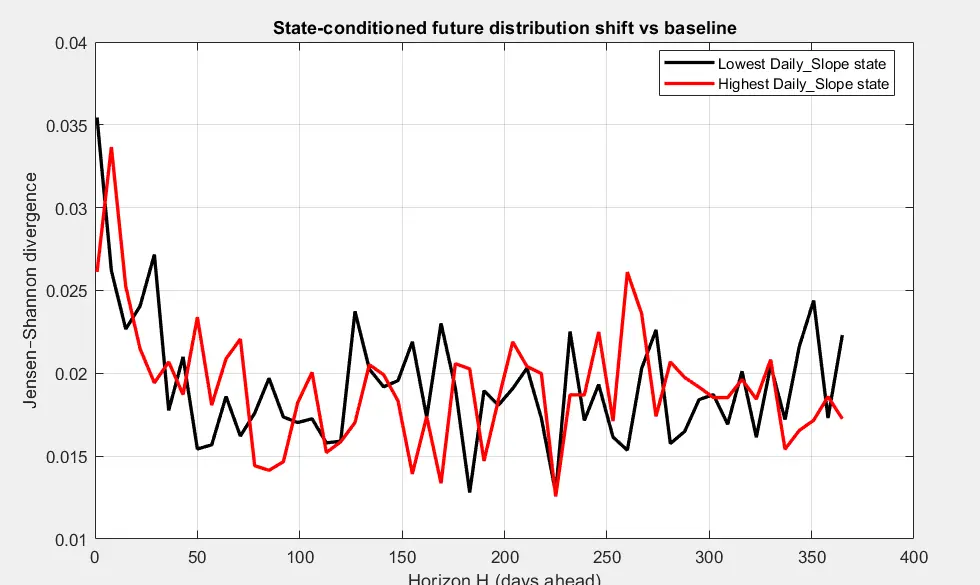

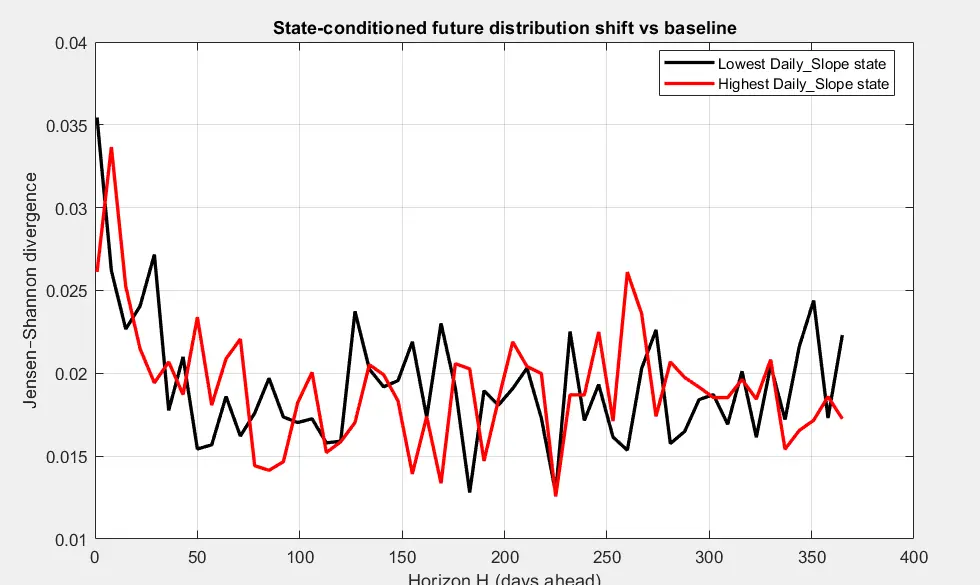

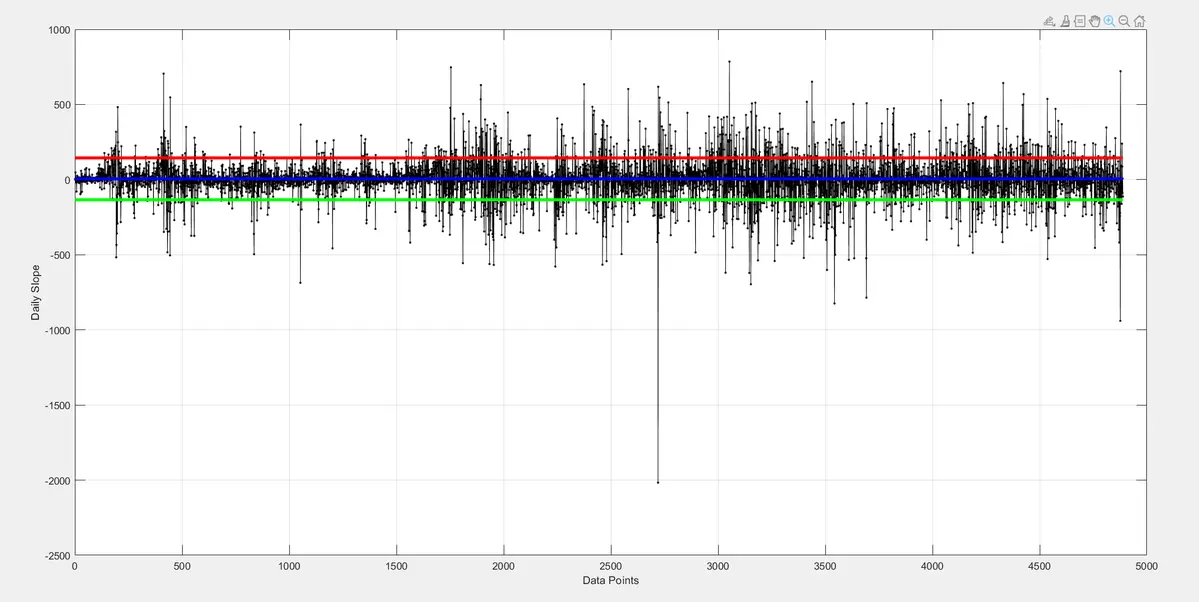

Grafik di bawah menunjukkan divergence Jensen-Shannon untuk Daily Slopes.

Ini adalah apa yang dikatakan ChatGPT tentang hasilnya.

1. Apa yang sebenarnya diukur oleh plot ini (dalam istilah sederhana)

Setiap titik pada kurva adalah divergence Jensen–Shannon (JSD) antara:

distribusi kemiringan harian yang dinormalisasi dalam jendela bergulir dan distribusi referensi (dari jendela baseline awal)

Jadi kurva ini menjawab:

“Seberapa berbeda perilaku statistik saat ini dari pertumbuhan yang dinormalisasi dibandingkan dengan rezim skala awal?”

Penting:

Ini bukan divergence harga.

Ini

Ini adalah apa yang dikatakan ChatGPT tentang hasilnya.

1. Apa yang sebenarnya diukur oleh plot ini (dalam istilah sederhana)

Setiap titik pada kurva adalah divergence Jensen–Shannon (JSD) antara:

distribusi kemiringan harian yang dinormalisasi dalam jendela bergulir dan distribusi referensi (dari jendela baseline awal)

Jadi kurva ini menjawab:

“Seberapa berbeda perilaku statistik saat ini dari pertumbuhan yang dinormalisasi dibandingkan dengan rezim skala awal?”

Penting:

Ini bukan divergence harga.

Ini

BTC-0,25%

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

Bahkan di seluruh gelembung, keruntuhan, institusionalisasi, dan guncangan makro, distribusi kemiringan yang dinormalisasi tidak pernah meninggalkan keluarga statistik yang sama.

Dalam istilah fisika: sistem mengalami renormalisasi fluktuasi tetapi tetap dalam kelas universalisme yang sama

Ini adalah bukti kuat bahwa: Dinamika pertumbuhan Bitcoin dikendalikan oleh rezim proses penskalaan yang stabil perubahan rezim memodifikasi struktur volatilitas tetapi tidak mengubah penarik dasar.

Dalam istilah fisika: sistem mengalami renormalisasi fluktuasi tetapi tetap dalam kelas universalisme yang sama

Ini adalah bukti kuat bahwa: Dinamika pertumbuhan Bitcoin dikendalikan oleh rezim proses penskalaan yang stabil perubahan rezim memodifikasi struktur volatilitas tetapi tidak mengubah penarik dasar.

BTC-0,25%

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

Setiap baris adalah bin keadaan dari kuantil Daily_Slope ( dari very low hingga very high).

Setiap kolom adalah horizon prediksi H (hari ke depan).

Setiap warna piksel adalah divergensi Jensen–Shannon antara:

distribusi masa depan yang dikondisikan pada keadaan tersebut hari ini

vs

distribusi masa depan tanpa syarat pada horizon yang sama.

Jadi setiap sel menjawab:

“Jika Bitcoin berada dalam keadaan pertumbuhan yang dinormalisasi ini hari ini, seberapa berbeda distribusi pertumbuhan yang dinormalisasi H hari di masa depan dari baseline?”

Ini adalah peta memori kondisi-keadaan dari dinamika yan

Setiap kolom adalah horizon prediksi H (hari ke depan).

Setiap warna piksel adalah divergensi Jensen–Shannon antara:

distribusi masa depan yang dikondisikan pada keadaan tersebut hari ini

vs

distribusi masa depan tanpa syarat pada horizon yang sama.

Jadi setiap sel menjawab:

“Jika Bitcoin berada dalam keadaan pertumbuhan yang dinormalisasi ini hari ini, seberapa berbeda distribusi pertumbuhan yang dinormalisasi H hari di masa depan dari baseline?”

Ini adalah peta memori kondisi-keadaan dari dinamika yan

BTC-0,25%

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

Fluktuasi besar memiliki ingatan singkat (sekitar 2 bulan). Mereka mempengaruhi perilaku harga untuk waktu singkat tetapi tidak memiliki konsekuensi jangka panjang.

Perilaku skala dominan adalah apa yang tersisa dan menentukan trajektori jangka panjang.

Lihat AsliPerilaku skala dominan adalah apa yang tersisa dan menentukan trajektori jangka panjang.

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

Peta ini secara independen mendukung:

✔ Hukum skala adalah prinsip pengorganisasian utama

✔ Penyimpangan adalah gangguan terstruktur dengan memori singkat

✔ Tidak ada dinamika kondisi tetap yang persisten

✔ Tidak ada pecahan rezim dalam koordinat yang dinormalisasi

✔ Lembaga meredam ekstrem tetapi tidak mengubah kelas universalnya

Singkatnya:

Ini persis seperti yang seharusnya terlihat dari sistem adaptif kompleks di dekat titik tetap skala.

Lihat Asli✔ Hukum skala adalah prinsip pengorganisasian utama

✔ Penyimpangan adalah gangguan terstruktur dengan memori singkat

✔ Tidak ada dinamika kondisi tetap yang persisten

✔ Tidak ada pecahan rezim dalam koordinat yang dinormalisasi

✔ Lembaga meredam ekstrem tetapi tidak mengubah kelas universalnya

Singkatnya:

Ini persis seperti yang seharusnya terlihat dari sistem adaptif kompleks di dekat titik tetap skala.

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

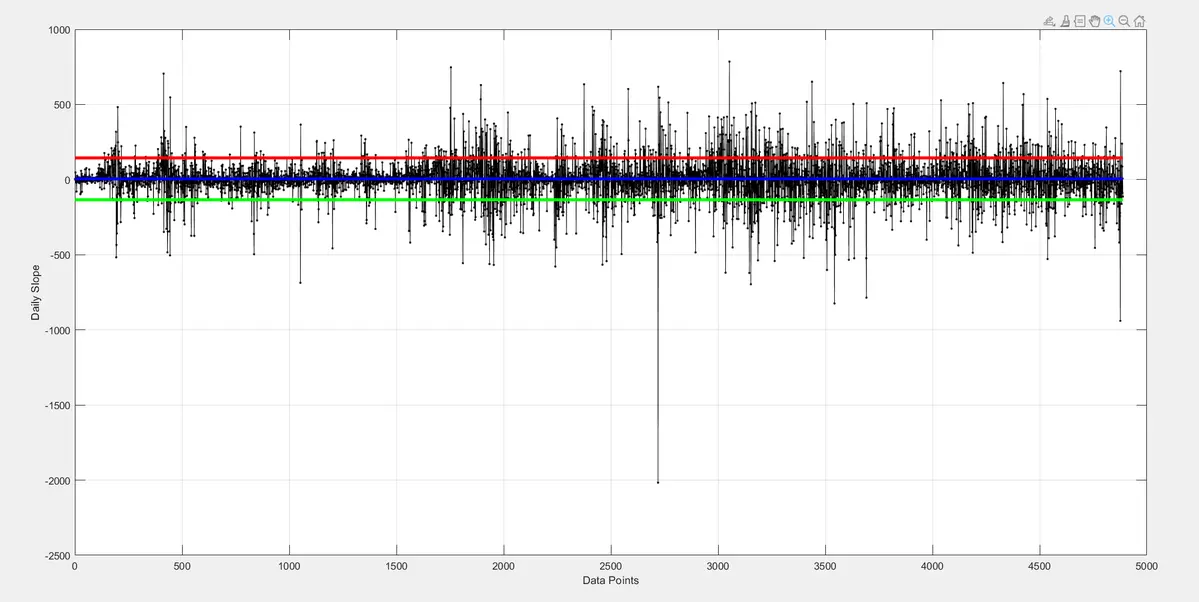

Urutan kemiringan harian atau pengembalian yang dinormalisasi adalah parameter BTC yang paling stabil. Ini memberi tahu kita perilaku inti Bitcoin secara statistik.

Ini mencakup baik perilaku stokastik maupun pertumbuhan deterministik hukum kekuasaan jangka panjang.

Bahkan selama perubahan acak baru-baru ini, parameter ini berperilaku dengan cara yang serupa di masa lalu.

Rata-ratanya sekitar 5,9 yang merupakan kemiringan yang sama yang kita amati menggunakan regresi. Ini cenderung kembali ke rata-rata jika didorong terlalu jauh ke salah satu arah.

Ini mencakup baik perilaku stokastik maupun pertumbuhan deterministik hukum kekuasaan jangka panjang.

Bahkan selama perubahan acak baru-baru ini, parameter ini berperilaku dengan cara yang serupa di masa lalu.

Rata-ratanya sekitar 5,9 yang merupakan kemiringan yang sama yang kita amati menggunakan regresi. Ini cenderung kembali ke rata-rata jika didorong terlalu jauh ke salah satu arah.

BTC-0,25%

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

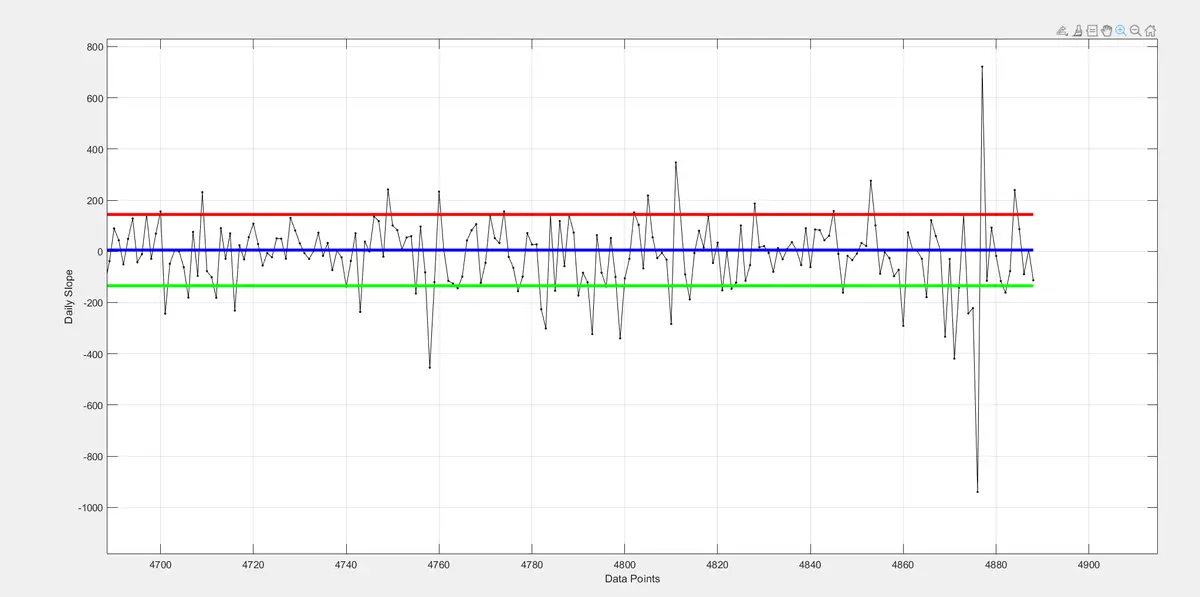

Ini adalah zoom-in dari lereng harian.

Selain lonjakan besar baru-baru ini — yang sebanding dengan beberapa koreksi terbesar yang pernah kita lihat dalam siklus sebelumnya — perilaku keseluruhan tidak berbeda secara mendasar dari rezim historis. Dengan kata lain, volatilitas tingkat pertumbuhan jangka pendek terlihat dramatis secara isolasi, tetapi tetap berada dalam kerangka apa yang telah ditunjukkan Bitcoin sebelumnya.

Yang penting, sistem masih tumbuh sesuai dengan lintasan yang diimplikasikan oleh hukum kekuatan. Yang berubah bukanlah perilaku skala dasar, tetapi tingkat referensi di seki

Selain lonjakan besar baru-baru ini — yang sebanding dengan beberapa koreksi terbesar yang pernah kita lihat dalam siklus sebelumnya — perilaku keseluruhan tidak berbeda secara mendasar dari rezim historis. Dengan kata lain, volatilitas tingkat pertumbuhan jangka pendek terlihat dramatis secara isolasi, tetapi tetap berada dalam kerangka apa yang telah ditunjukkan Bitcoin sebelumnya.

Yang penting, sistem masih tumbuh sesuai dengan lintasan yang diimplikasikan oleh hukum kekuatan. Yang berubah bukanlah perilaku skala dasar, tetapi tingkat referensi di seki

BTC-0,25%

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

Kemiringan harian atau pengembalian yang dinormalisasi adalah parameter BTC yang paling stabil. Ini memberi tahu kita perilaku inti Bitcoin secara statistik.

Parameter ini mencakup baik perilaku stokastik maupun pertumbuhan deterministik hukum kekuasaan jangka panjang.

Bahkan selama perubahan acak baru-baru ini, parameter ini berperilaku serupa dengan masa lalu.

Rata-ratanya sekitar 5.9, yang merupakan kemiringan yang sama yang kita amati menggunakan regresi. Parameter ini cenderung kembali ke rata-rata jika didorong terlalu jauh ke salah satu arah.

Parameter ini mencakup baik perilaku stokastik maupun pertumbuhan deterministik hukum kekuasaan jangka panjang.

Bahkan selama perubahan acak baru-baru ini, parameter ini berperilaku serupa dengan masa lalu.

Rata-ratanya sekitar 5.9, yang merupakan kemiringan yang sama yang kita amati menggunakan regresi. Parameter ini cenderung kembali ke rata-rata jika didorong terlalu jauh ke salah satu arah.

BTC-0,25%

- Hadiah

- 2

- Komentar

- Posting ulang

- Bagikan

Saya pikir semua Bitcoiners serius harus belajar cara melakukan panggilan tertutup, di IBIT atau Bitcoin itu sendiri.

Dengan menggunakan simulasi Monte Carlo terbaru dari indikator kemiringan hukum kekuasaan, seseorang dapat menentukan harga strike yang andal dengan tanggal kedaluwarsa 2 minggu.

Strategi ini bekerja 97 % dari waktu secara statistik dan dimungkinkan untuk mendapatkan hasil Bitcoin sekitar 2 % per bulan dengan mudah.

Dengan menggunakan simulasi Monte Carlo terbaru dari indikator kemiringan hukum kekuasaan, seseorang dapat menentukan harga strike yang andal dengan tanggal kedaluwarsa 2 minggu.

Strategi ini bekerja 97 % dari waktu secara statistik dan dimungkinkan untuk mendapatkan hasil Bitcoin sekitar 2 % per bulan dengan mudah.

BTC-0,25%

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

Selamat ulang tahun, Galileo — sesama warga negara saya yang terkenal yang menunjukkan kepada kita bagaimana memimpin jalan. Cara berpikir dan mengajar Anda membantu saya memahami Bitcoin dengan lebih baik.

BTC-0,25%

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

Bitcoin bukanlah lindung nilai terhadap kekacauan tetapi justru berkembang di tepi kekacauan.

BTC-0,25%

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

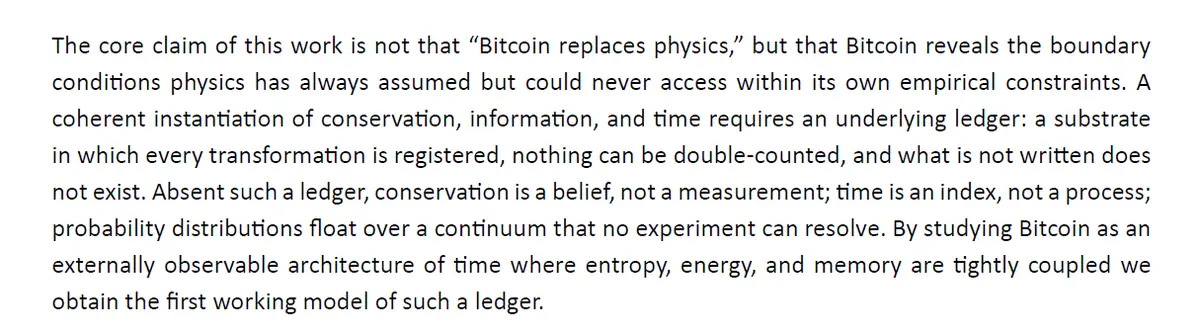

Gagasan inti ini sama sekali tidak buruk. Saya sudah sering mengklaim bahwa buku besar Bitcoin mengingatkan saya pada hukum kekekalan dalam fisika.

Namun, pelaksanaan ide ini sangat penting, sebagian besar persamaan dan pernyataan yang mengikuti memiliki masalah.

Namun, pelaksanaan ide ini sangat penting, sebagian besar persamaan dan pernyataan yang mengikuti memiliki masalah.

BTC-0,25%

- Hadiah

- 1

- 1

- Posting ulang

- Bagikan

repanzal :

:

GOGOGO 2026 👊Bayangkan kita hidup dalam simulasi di mana waktu itu sendiri bekerja seperti waktu blok Bitcoin.

Ada proses konsensus kosmik, dengan analog dari bukti kerja, dan “tick” dari jam hanya terjadi ketika prosedur tertentu berhasil dan sebuah blok “ditambang.” Dalam gambaran ini, realitas maju dalam langkah-langkah diskret, satu blok sekaligus.

Tapi ini sebenarnya tidak menyelesaikan teka-teki konseptual yang terkait dengan waktu. Proses bukti kerja, interaksi kausal yang mengarah pada pembuatan sebuah blok, dan langkah-langkah fisik yang diperlukan untuk menjalankan perhitungan tersebut tetap haru

Ada proses konsensus kosmik, dengan analog dari bukti kerja, dan “tick” dari jam hanya terjadi ketika prosedur tertentu berhasil dan sebuah blok “ditambang.” Dalam gambaran ini, realitas maju dalam langkah-langkah diskret, satu blok sekaligus.

Tapi ini sebenarnya tidak menyelesaikan teka-teki konseptual yang terkait dengan waktu. Proses bukti kerja, interaksi kausal yang mengarah pada pembuatan sebuah blok, dan langkah-langkah fisik yang diperlukan untuk menjalankan perhitungan tersebut tetap haru

BTC-0,25%

- Hadiah

- 1

- 1

- Posting ulang

- Bagikan

repanzal :

:

GOGOGO 2026 👊Ok Tidak butuh waktu lama bagi saya untuk melihat bahwa makalah ini sangat "amatir". Saya mendukung ide mengaitkan Bitcoin dengan fisika (yang telah saya lakukan selama 12 tahun) tetapi harus dilakukan dengan pendekatan yang valid dan dapat dipahami oleh fisikawan lain. Klaim dalam makalah ini sebagian besar tidak valid (dimulai dari proposisi inti). Berikut adalah rincian masalah utama dengan tesis makalah ini: Ini adalah abstrak yang ambisius dan secara retoris kuat — tetapi mencampurkan intuisi tajam dengan beberapa kesalahan kategori yang ceroboh, klaim berlebihan, dan analogi yang lemah.

Lihat Asli- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

Buku sedang berjalan. Tetap ikuti perkembangan.

Lihat Asli

- Hadiah

- 1

- 1

- Posting ulang

- Bagikan

repanzal :

:

LFG 🔥Mengapa begitu banyak referensi lobster dalam AI?

Accelerando adalah novel fiksi ilmiah masa depan dekat hingga pasca-Singularity yang mengikuti tiga generasi dari satu keluarga saat umat manusia bertransisi dari kapitalisme tahap akhir ke peradaban pasca-manusia yang secara radikal diubah, didominasi oleh kecerdasan buatan, upload, dan ekonomi mesin. Novel ini disusun sebagai rangkaian cerita yang saling terkait yang melacak percepatan laju perubahan teknologi—begitu cepat sehingga institusi manusia, nilai-nilai, dan bahkan kognisi biologis pun berjuang untuk mengikuti.

Salah satu elemen

Lihat AsliAccelerando adalah novel fiksi ilmiah masa depan dekat hingga pasca-Singularity yang mengikuti tiga generasi dari satu keluarga saat umat manusia bertransisi dari kapitalisme tahap akhir ke peradaban pasca-manusia yang secara radikal diubah, didominasi oleh kecerdasan buatan, upload, dan ekonomi mesin. Novel ini disusun sebagai rangkaian cerita yang saling terkait yang melacak percepatan laju perubahan teknologi—begitu cepat sehingga institusi manusia, nilai-nilai, dan bahkan kognisi biologis pun berjuang untuk mengikuti.

Salah satu elemen

- Hadiah

- 1

- 1

- Posting ulang

- Bagikan

repanzal :

:

GOGOGO 2026 👊Banyak orang menganggap rata-rata pergerakan 200 minggu sebagai semacam indikator prediktif yang kuat. Pada kenyataannya, itu tidak memiliki kekuatan prediktif intrinsik secara sendiri. Apa yang sebenarnya dilakukan adalah mengungkap struktur dasar yang sudah ada. Bitcoin mengikuti pertumbuhan power-law jangka panjang. Jika Anda menghitung rata-rata harga Bitcoin selama jendela sekitar empat tahun (~208 minggu), Anda secara efektif meratakan osilasi jangka pendek di sekitar tren struktural tersebut. Penyimpangan dari hukum kekuatan ini menjadi mereda, dan pola jangka panjang menjadi lebih bers

BTC-0,25%

- Hadiah

- 2

- 2

- Posting ulang

- Bagikan

repanzal :

:

Ape In 🚀Lihat Lebih Banyak

Topik Trending

Lihat Lebih Banyak207.37K Popularitas

11.62K Popularitas

44.71K Popularitas

85.59K Popularitas

849.15K Popularitas

Hot Gate Fun

Lihat Lebih Banyak- MC:$2.45KHolder:10.00%

- MC:$2.45KHolder:10.00%

- 3

GM

GM

MC:$2.45KHolder:10.00% - MC:$2.45KHolder:10.00%

- MC:$0.1Holder:10.00%

Sematkan