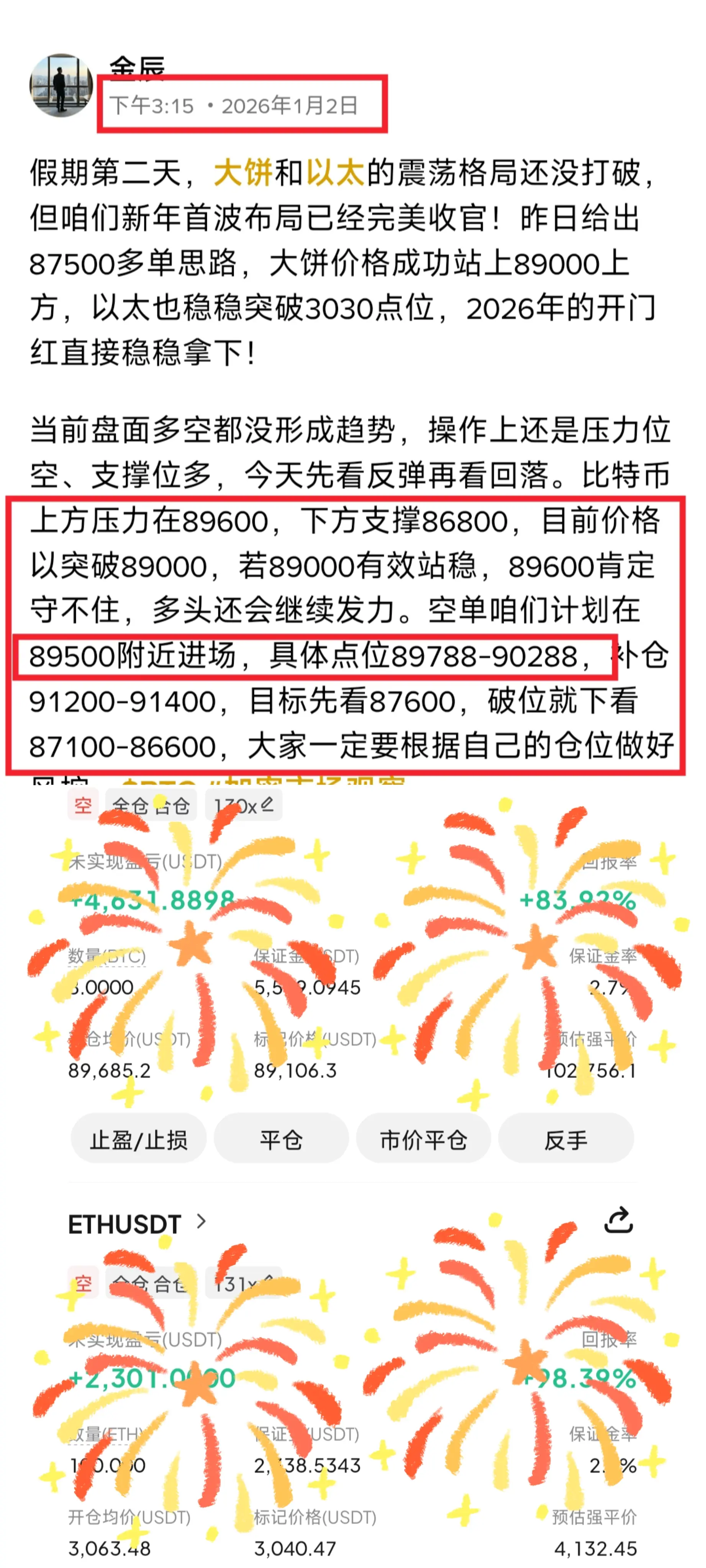

In 2026, at the start of the year, the crypto market has been driven by three main factors: technological breakthroughs, favorable macro environment, and new opportunities. This has reversed the sluggish trend at the beginning of the year and has seen a short-term oscillating upward movement.

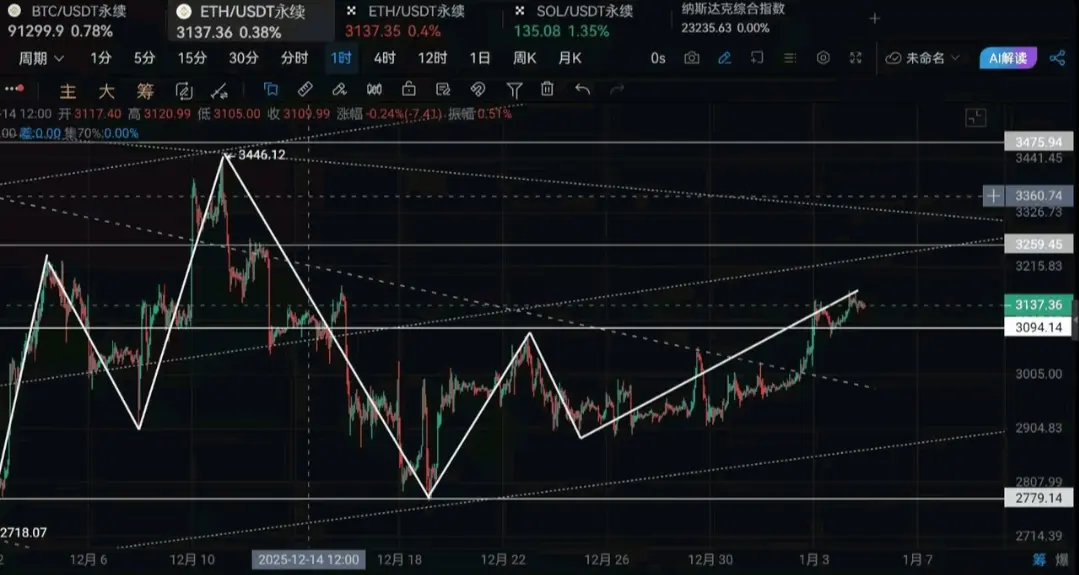

Currently, the market is in a critical phase of upward push, and this week is especially important to test whether the trend can stabilize. Everyone should focus on two key points: first, whether the price can stay stable at the current high levels; second, whether institutional money will continue to flo

Currently, the market is in a critical phase of upward push, and this week is especially important to test whether the trend can stabilize. Everyone should focus on two key points: first, whether the price can stay stable at the current high levels; second, whether institutional money will continue to flo

BTC0,7%