# PreciousMetalsPullBack

2.98K

Risk assets fell overnight. Gold slid $300 to $5,155/oz, and silver dropped up to 8% to $108.23/oz. Are you buying the dip or cutting exposure? Share your Gate TradFi metals strategy!

MrFlower_

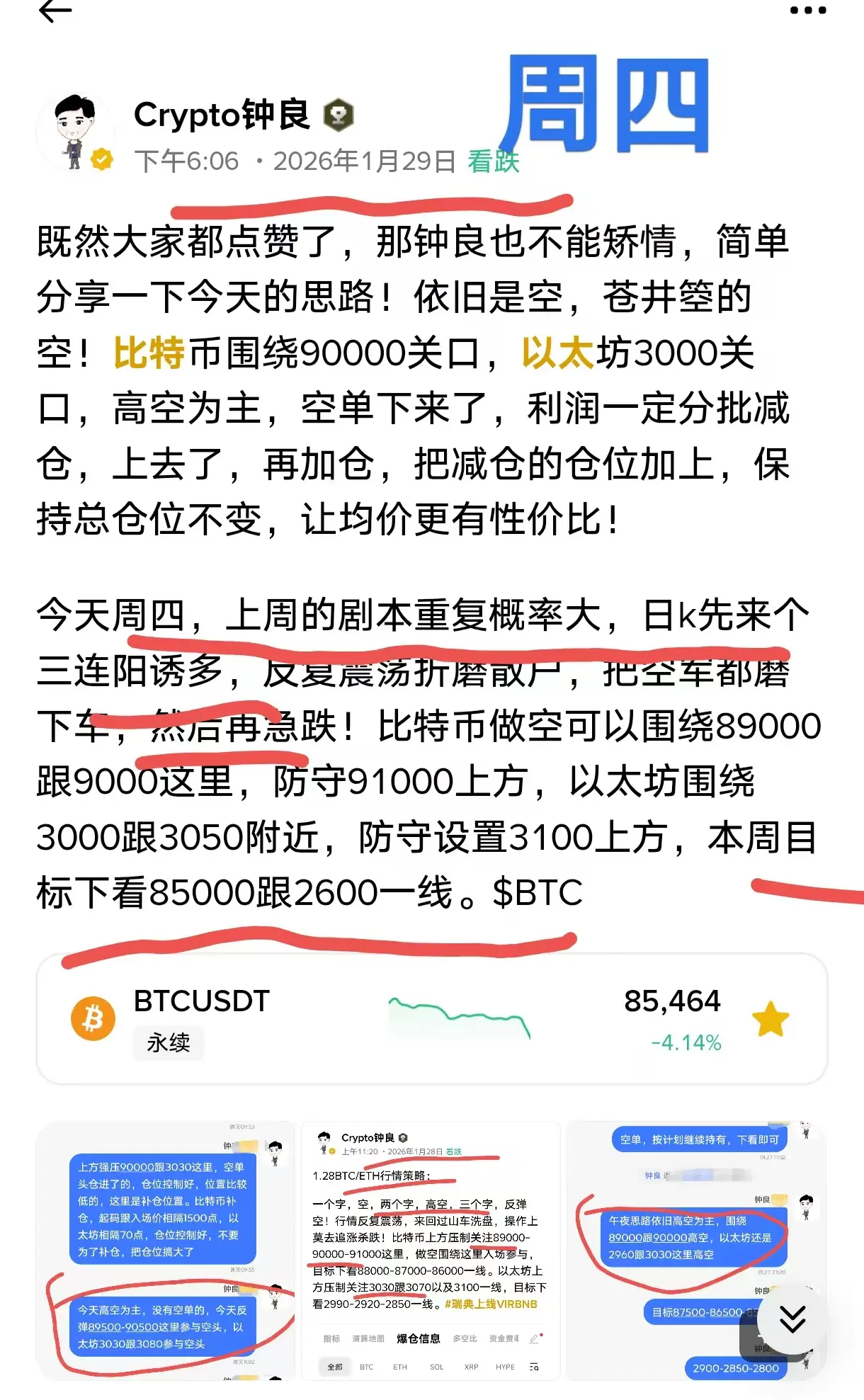

#PreciousMetalsPullBack Bitcoin continues to face heavy pressure as global markets move deeper into a risk-off phase. After dropping sharply on January 29, BTC fell to an intraday low near $83,383, marking its weakest level since November. Although a minor bounce followed, Bitcoin remains trapped in the $84,000–$85,000 range, representing a 33% decline from the October peak near $126,000.

The recent downturn is not driven by crypto alone but by a broader shift in global capital flows. Over the past week, Bitcoin spot ETFs recorded five consecutive days of outflows totaling more than $1.1 billi

The recent downturn is not driven by crypto alone but by a broader shift in global capital flows. Over the past week, Bitcoin spot ETFs recorded five consecutive days of outflows totaling more than $1.1 billi

BTC-6,08%

- Reward

- like

- Comment

- Repost

- Share

#PreciousMetalsPullBack #贵金属行情下跌 #贵金属巨震 Markets reminded everyone of a brutal truth today: there is no such thing as a one-way trade.

BTC and ETH collapsed hard.

Altcoins didn’t “correct” — they bled.

US equities slid in unison, risk appetite vanished overnight.

And while crypto traders panicked, gold did something far more dangerous — it shook out weak hands.

Gold plunged nearly $300 to $5,155/oz, silver dropped up to 8% to $108.23/oz.

This wasn’t a random dip. This was forced liquidation + leverage unwind after weeks of crowded long positioning.

Let’s be clear:

If you think this move means “

BTC and ETH collapsed hard.

Altcoins didn’t “correct” — they bled.

US equities slid in unison, risk appetite vanished overnight.

And while crypto traders panicked, gold did something far more dangerous — it shook out weak hands.

Gold plunged nearly $300 to $5,155/oz, silver dropped up to 8% to $108.23/oz.

This wasn’t a random dip. This was forced liquidation + leverage unwind after weeks of crowded long positioning.

Let’s be clear:

If you think this move means “

- Reward

- 4

- 1

- Repost

- Share

ndrettあ :

:

very good information to read#PreciousMetalsPullBack Bitcoin dropped 6.4% to $83,383 on January 29, 2026, due to five consecutive days of ETF outflows totaling $1.137 billion, capital rotation into surging precious metals (gold $5,600, silver $120), US rare earth tariff announcements spiking volatility above 40, and bearish options market positioning with 97% of calls out-of-the-money.

What is the Bitcoin price now?

Bitcoin is trading at $84,233-84,623 as of Thursday, January 29, 2026, after hitting an intraday low of $83,383, the lowest level since November, representing a 33% decline from October's $126,000 peak.

Why is

What is the Bitcoin price now?

Bitcoin is trading at $84,233-84,623 as of Thursday, January 29, 2026, after hitting an intraday low of $83,383, the lowest level since November, representing a 33% decline from October's $126,000 peak.

Why is

BTC-6,08%

- Reward

- like

- Comment

- Repost

- Share

#PreciousMetalsPullBack XAG / Silver

Sell-the-rally bias as price fails to hold post-bounce, confirms lower high below 116–118 supply, and trades firmly under declining EMAs, signaling continuation of short-term distribution.

Bias: SHORT

Entry: 111.0 – 113.0

Stop-Loss: 116.2

TP1: 107.5

TP2: 105.0

TP3: 102.8

As long as price remains below 116.2, downside follow-through is favored and rebounds lack conviction. Acceptance above that level invalidates the setup and shifts bias neutral.

Sell-the-rally bias as price fails to hold post-bounce, confirms lower high below 116–118 supply, and trades firmly under declining EMAs, signaling continuation of short-term distribution.

Bias: SHORT

Entry: 111.0 – 113.0

Stop-Loss: 116.2

TP1: 107.5

TP2: 105.0

TP3: 102.8

As long as price remains below 116.2, downside follow-through is favored and rebounds lack conviction. Acceptance above that level invalidates the setup and shifts bias neutral.

- Reward

- 1

- 1

- Repost

- Share

mrbui07 :

:

Happy New Year! 🤑Important market news ‼️

1. Institutional fund withdrawal: Spot Bitcoin and Ethereum have experienced four consecutive days of net outflows, with a weekly outflow of $1.137 billion. Major funds like BlackRock and Grayscale are showing negative returns, indicating significant profit-taking by institutions.

2. Geopolitical and macro risks: Iran's Hormuz Strait exercises and escalating Middle East tensions, combined with weakening US stock risk assets, have shifted funds toward gold and other traditional safe-haven assets, impacting the crypto "safe-haven narrative."

3. Sentiment and liquidity: F

View Original1. Institutional fund withdrawal: Spot Bitcoin and Ethereum have experienced four consecutive days of net outflows, with a weekly outflow of $1.137 billion. Major funds like BlackRock and Grayscale are showing negative returns, indicating significant profit-taking by institutions.

2. Geopolitical and macro risks: Iran's Hormuz Strait exercises and escalating Middle East tensions, combined with weakening US stock risk assets, have shifted funds toward gold and other traditional safe-haven assets, impacting the crypto "safe-haven narrative."

3. Sentiment and liquidity: F

- Reward

- 1

- Comment

- Repost

- Share

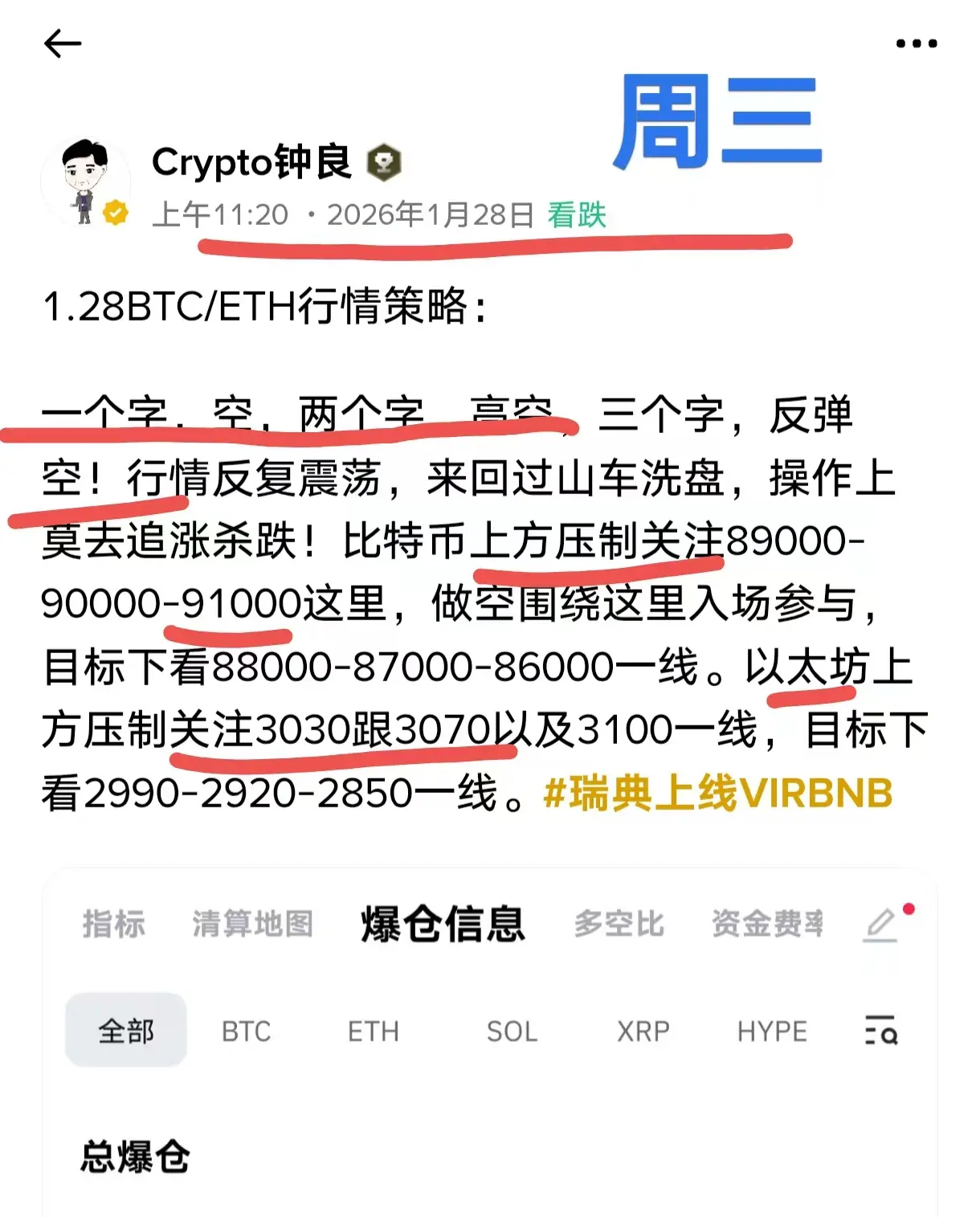

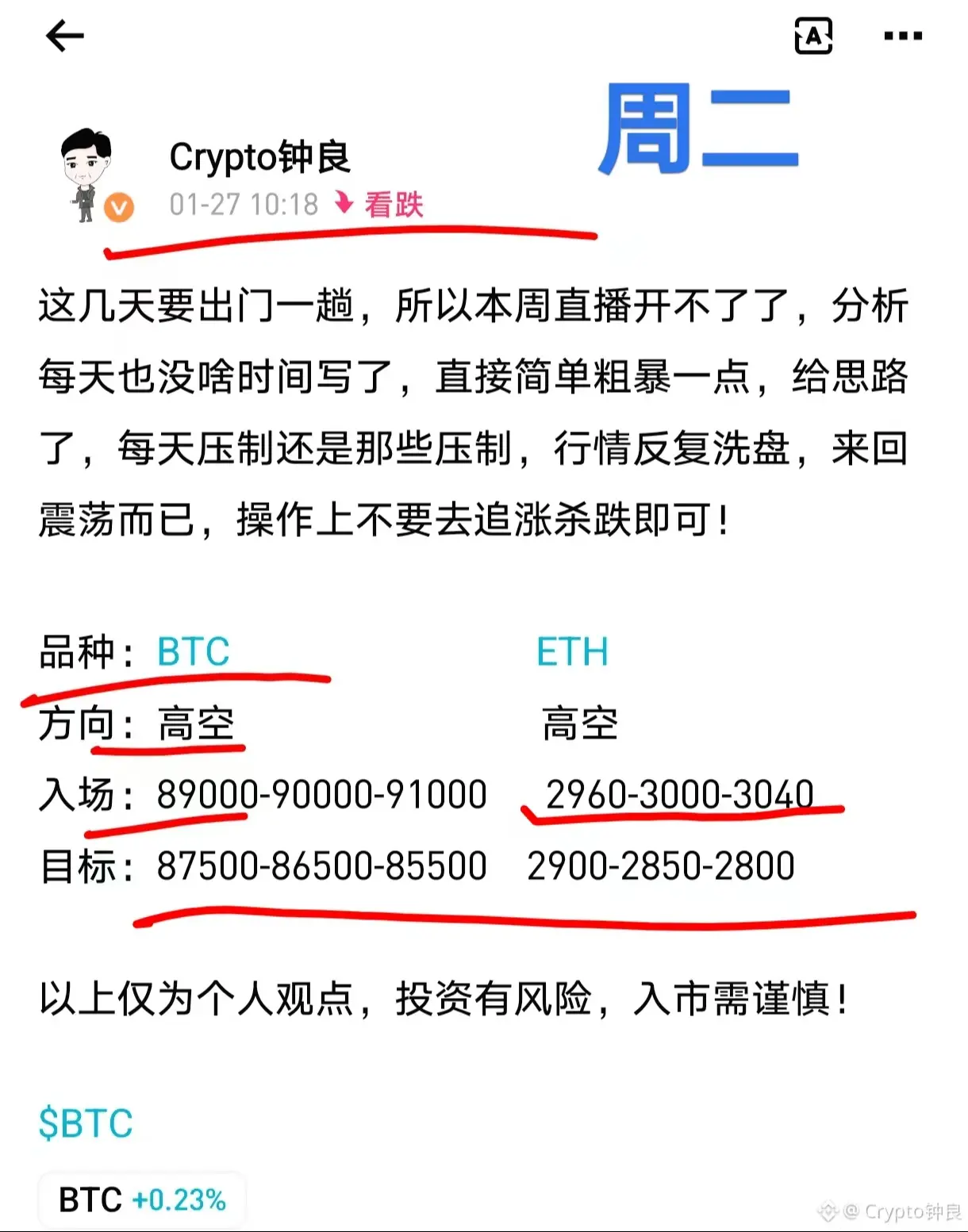

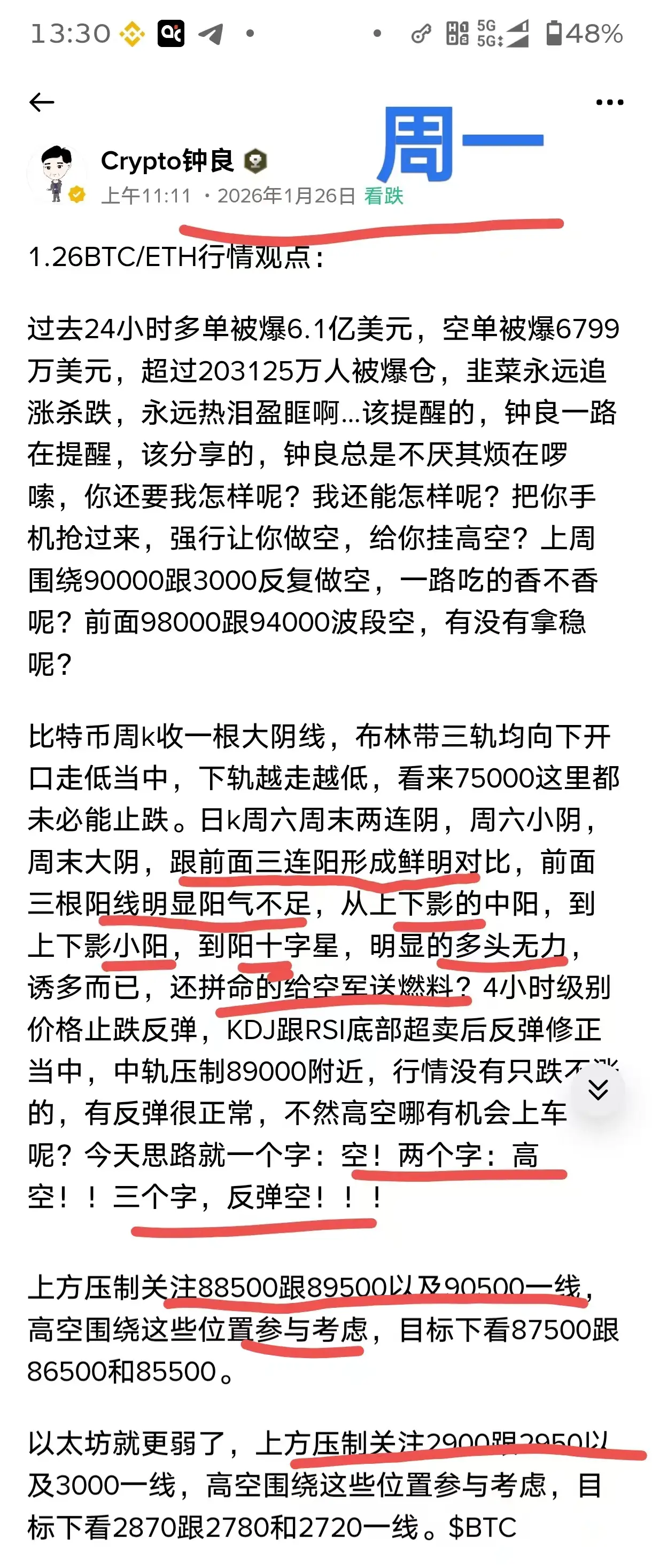

1.30BTC/ETH Market Outlook:

Last night saw a sharp decline, with gold and silver plunging from high levels, and the crypto market also experienced a flood of sell-offs. Since last week, everyone has been repeatedly testing the 90,000 and 3,000 levels, continuously shorting. Yesterday, Thursday afternoon, I explicitly told everyone not to mistake rebounds for reversals, not to be fooled by false signals, and to short towards the 85,000 and 2,600 levels. Those who followed have already made substantial profits!

Bitcoin daily chart from Monday to Wednesday closed with consecutive bullish candles,

Last night saw a sharp decline, with gold and silver plunging from high levels, and the crypto market also experienced a flood of sell-offs. Since last week, everyone has been repeatedly testing the 90,000 and 3,000 levels, continuously shorting. Yesterday, Thursday afternoon, I explicitly told everyone not to mistake rebounds for reversals, not to be fooled by false signals, and to short towards the 85,000 and 2,600 levels. Those who followed have already made substantial profits!

Bitcoin daily chart from Monday to Wednesday closed with consecutive bullish candles,

BTC-6,08%

- Reward

- like

- Comment

- Repost

- Share

Bitcoin dropped nearly 10,000 points in one day, #贵金属行情下跌 and the US stock market's decline caused the crypto market to plummet. Ethereum fell nearly 400 points in one day, with $1.5 billion in long positions liquidated in 24 hours. The bearish trend is strong, the rebound is weak, and a short-term downward trend is possible.

View Original

- Reward

- like

- Comment

- Repost

- Share

Bitcoin and Ethereum early morning layout with multiple strategies for current orders. Bitcoin at 84,500 and Ethereum at 2,800 entry points. Although not ideal and did not break out, we have already added positions at 82,000 and 2,700. Currently, our entry points are around 83,300 for Bitcoin and around 2,750 for Ethereum. Based on the current market trend, it is still advisable to hold. Our target is around 85,000-86,000 for Bitcoin and 2,800-2,850 for Ethereum. The weekend market movement is slow, so be patient and wait for the market to rise later. Eating profits is certain, so don't rush.

View Original

- Reward

- 1

- Comment

- Repost

- Share

#贵金属行情下跌 #贵金属巨震 2026.01.30

Market Trends

BTC and ETH plummeted, altcoins broadly declined.

US stocks fell, but SanDisk stored after-hours surged. Gold experienced high volatility, copper and oil soared, and tensions in Iran's geopolitical situation intensified.

There are gains and losses; no asset always goes up!

Market Hotspots:

BTC dropped sharply, with a rebound strength weaker than gold. Perpetual contracts for gold and silver, XAU and XAG, have higher long-earning rates, with annualized returns of 70-80%.

View OriginalMarket Trends

BTC and ETH plummeted, altcoins broadly declined.

US stocks fell, but SanDisk stored after-hours surged. Gold experienced high volatility, copper and oil soared, and tensions in Iran's geopolitical situation intensified.

There are gains and losses; no asset always goes up!

Market Hotspots:

BTC dropped sharply, with a rebound strength weaker than gold. Perpetual contracts for gold and silver, XAU and XAG, have higher long-earning rates, with annualized returns of 70-80%.

- Reward

- 1

- Comment

- Repost

- Share

Compare the three major assets. The strongest trend is the S&P 500, which has started an upward trend on the one-hour K-line. Gold shows a double bottom pattern on the one-hour K-line. Bitcoin's one-hour K-line is a continuous breakdown pattern. The peripheral markets are basically rebounding after being unable to be pushed down. Without external market catalysts accelerating, the crypto market is also likely to begin bottoming out and consolidating#贵金属行情下跌 $BTC

BTC-6,08%

- Reward

- 2

- 6

- Repost

- Share

GateUser-69695ceb :

:

What is this software?View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

2.98K Popularity

20.47K Popularity

18.21K Popularity

7.64K Popularity

45.74K Popularity

4.88K Popularity

18.38K Popularity

6.13K Popularity

81.96K Popularity

28.98K Popularity

89.75K Popularity

26.44K Popularity

18.45K Popularity

15.14K Popularity

186.7K Popularity

News

View More20 Million Wave Hunter continues to reduce positions in BTC, ETH, and HYPE short positions, with an unrealized profit of $6.57 million.

6 m

Trump adopts a "soft and hard" approach towards Iran: increasing troops in the Middle East while signaling willingness to dialogue

15 m

Data: 25 BTC transferred from an anonymous address to Cumberland DRW, worth approximately $2.07 million

21 m

Data: Deribit Bitcoin Volatility Index breaks through 44, recording the largest increase since November 2024

24 m

PI (Pi) down 1.80% in the past 24 hours

25 m

Pin