# JapanBondMarketSellOff

1.67K

ShainingMoon

#TariffTensionsHitCryptoMarket

#JapanBondMarketSellOff — A Turning Point for Global Markets

The Japan bond market sell-off has emerged as one of the most important macroeconomic developments shaking global financial markets. For decades, Japan’s bond market was seen as a symbol of stability, supported by ultra-low interest rates and aggressive intervention by the Bank of Japan (BoJ). Today, that long-standing balance is being tested as yields rise and investors reassess risk.

At the heart of the sell-off lies a shift in expectations around Japan’s monetary policy. Inflation in Japan, once con

#JapanBondMarketSellOff — A Turning Point for Global Markets

The Japan bond market sell-off has emerged as one of the most important macroeconomic developments shaking global financial markets. For decades, Japan’s bond market was seen as a symbol of stability, supported by ultra-low interest rates and aggressive intervention by the Bank of Japan (BoJ). Today, that long-standing balance is being tested as yields rise and investors reassess risk.

At the heart of the sell-off lies a shift in expectations around Japan’s monetary policy. Inflation in Japan, once con

- Reward

- 5

- 9

- Repost

- Share

Yusfirah :

:

2026 GOGOGO 👊View More

#JapanBondMarketSell-Off

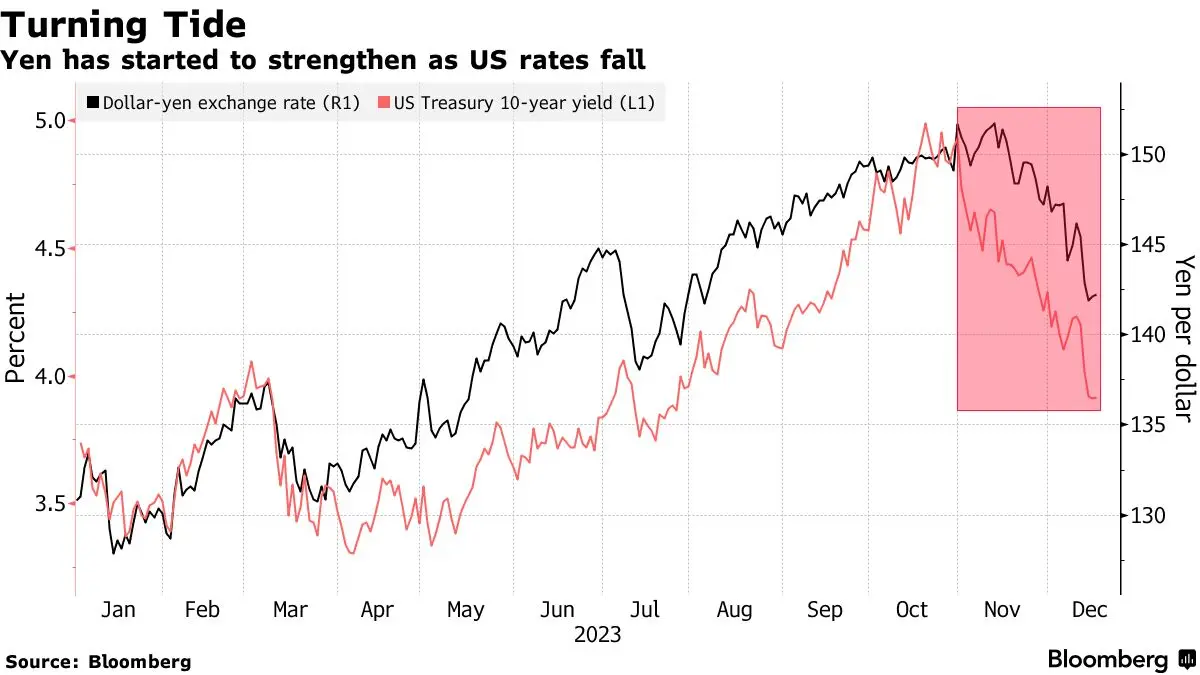

As of January 23, 2026, global financial markets are still digesting a historic Japanese government bond (JGB) shock that reverberated across equities, currencies, safe havens, and cryptocurrencies. What started as a domestic political move in Tokyo quickly became a macro contagion event, testing risk assets worldwide. For Bitcoin (BTC) and other crypto, this episode compounded existing volatility from Trump’s Greenland tariff drama (#TariffTensionsHitCryptoMarket), creating a “double macro whiplash” for risk-on markets.

This is a full deep dive, timeline, impact anal

As of January 23, 2026, global financial markets are still digesting a historic Japanese government bond (JGB) shock that reverberated across equities, currencies, safe havens, and cryptocurrencies. What started as a domestic political move in Tokyo quickly became a macro contagion event, testing risk assets worldwide. For Bitcoin (BTC) and other crypto, this episode compounded existing volatility from Trump’s Greenland tariff drama (#TariffTensionsHitCryptoMarket), creating a “double macro whiplash” for risk-on markets.

This is a full deep dive, timeline, impact anal

- Reward

- 12

- 15

- Repost

- Share

MissCrypto :

:

HODL Tight 💪View More

#JapanBondMarketSellOff 📉

Japan’s bond market is under pressure as investors sell long-term government bonds, pushing yields to multi-decade highs. This comes amid fiscal uncertainty and political spending promises, raising concerns about Japan’s debt sustainability.

Key Points:

Long-term JGB yields spike as demand weakens.

Bank of Japan is scaling back yield control, leaving markets to price risk freely.

Global ripple: Rising Japanese yields are affecting US and European bond markets.

💡 Investor Tip: Watch for BOJ interventions and upcoming bond auctions — these could stabilize or further s

Japan’s bond market is under pressure as investors sell long-term government bonds, pushing yields to multi-decade highs. This comes amid fiscal uncertainty and political spending promises, raising concerns about Japan’s debt sustainability.

Key Points:

Long-term JGB yields spike as demand weakens.

Bank of Japan is scaling back yield control, leaving markets to price risk freely.

Global ripple: Rising Japanese yields are affecting US and European bond markets.

💡 Investor Tip: Watch for BOJ interventions and upcoming bond auctions — these could stabilize or further s

- Reward

- 6

- 5

- Repost

- Share

QueenOfTheDay :

:

Buy To Earn 💎View More

#JapanBondMarketSellOff 🌏

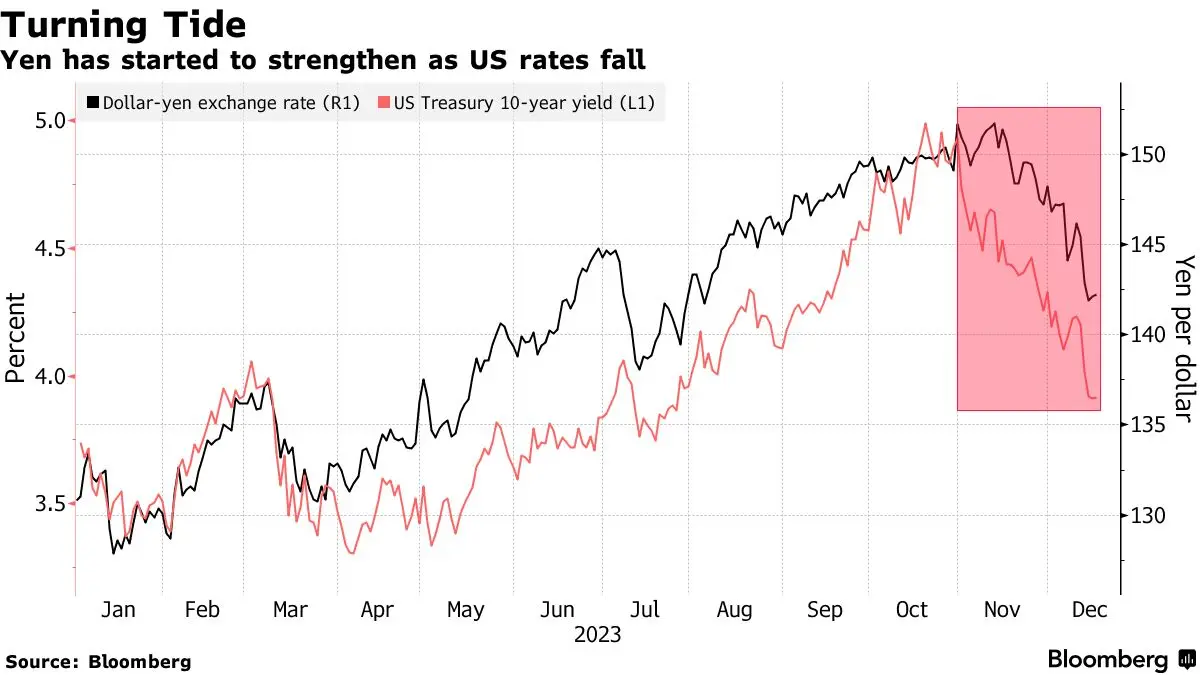

The Yen Carry Trade Unwind Is Quietly Redrawing the Global Map in 2026

A major shift is taking place inside Japan’s financial system — and its ripple effects are starting to reach far beyond bonds, including crypto markets.

🏦 Policy Transition in Japan

After years of ultra-loose monetary policy, the Bank of Japan is moving toward normalization. Rising yields on Japanese Government Bonds are changing behavior across domestic institutions that once sent capital abroad, particularly into U.S. Treasuries.

💧 Capital Is Reallocating

As yields at home become attractive ag

The Yen Carry Trade Unwind Is Quietly Redrawing the Global Map in 2026

A major shift is taking place inside Japan’s financial system — and its ripple effects are starting to reach far beyond bonds, including crypto markets.

🏦 Policy Transition in Japan

After years of ultra-loose monetary policy, the Bank of Japan is moving toward normalization. Rising yields on Japanese Government Bonds are changing behavior across domestic institutions that once sent capital abroad, particularly into U.S. Treasuries.

💧 Capital Is Reallocating

As yields at home become attractive ag

BTC-0,01%

- Reward

- 8

- 8

- Repost

- Share

AylaShinex :

:

Happy New Year! 🤑View More

#JapanBondMarketSellOff: A Wake-Up Call for Global Financial Markets

The recent Japan bond market sell-off has captured the attention of investors worldwide, signaling a potential turning point in one of the most stable and carefully managed financial systems. For decades, Japan’s bond market—especially Japanese Government Bonds (JGBs)—has been considered a global safe haven, supported by ultra-loose monetary policy and strong institutional backing. However, the latest sell-off suggests that even the most predictable markets are no longer immune to global economic pressures.

At the heart of th

The recent Japan bond market sell-off has captured the attention of investors worldwide, signaling a potential turning point in one of the most stable and carefully managed financial systems. For decades, Japan’s bond market—especially Japanese Government Bonds (JGBs)—has been considered a global safe haven, supported by ultra-loose monetary policy and strong institutional backing. However, the latest sell-off suggests that even the most predictable markets are no longer immune to global economic pressures.

At the heart of th

- Reward

- 7

- 8

- Repost

- Share

GateUser-8b80f390 :

:

brokennnnnView More

#JapanBondMarketSell-Off #JapanBondMarketSellOff

The Japanese bond market is breaking — and anyone calling this “temporary volatility” is either uninformed or lying to themselves.

For decades, Japan’s government bond market was treated as untouchable. Predictable. Boring. A financial black hole where yields went to die and capital slept peacefully. That era is now cracking in real time.

The sell-off in Japanese Government Bonds is not noise. It is a structural warning shot.

Let’s be brutally clear about what’s happening.

Japan built its entire financial system on one fragile assumption: rates

The Japanese bond market is breaking — and anyone calling this “temporary volatility” is either uninformed or lying to themselves.

For decades, Japan’s government bond market was treated as untouchable. Predictable. Boring. A financial black hole where yields went to die and capital slept peacefully. That era is now cracking in real time.

The sell-off in Japanese Government Bonds is not noise. It is a structural warning shot.

Let’s be brutally clear about what’s happening.

Japan built its entire financial system on one fragile assumption: rates

- Reward

- 4

- 3

- Repost

- Share

Discovery :

:

Happy New Year! 🤑View More

#JapanBondMarketSell-Off

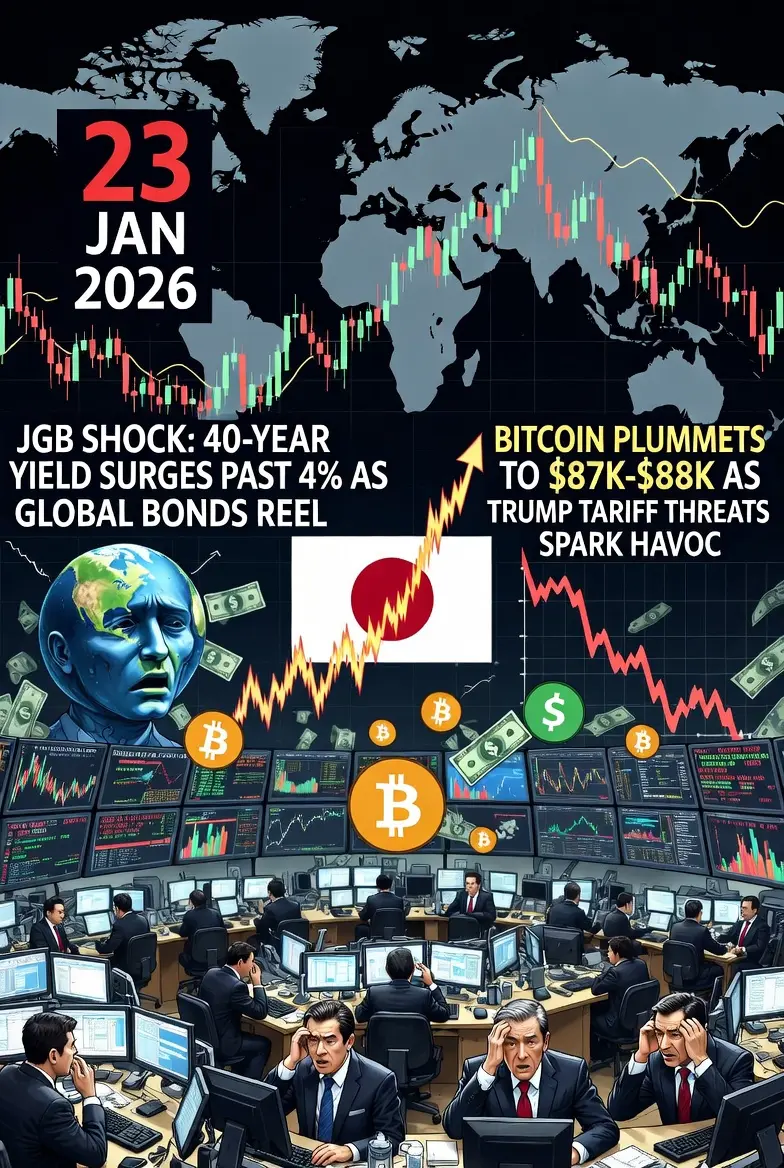

The Japanese government bond (JGB) market has recently experienced intense selling pressure, triggering a sharp rise in yields and heightened volatility. Once considered one of the most stable sovereign debt markets globally, Japan’s bond market is now showing vulnerabilities that have implications for both domestic and international investors. The sell-off affects global bond markets, risk assets, and currency markets, highlighting the sensitivity of financial systems to fiscal and monetary policy signals.

Recent Developments

Historic Surge in Long-Term Yields

Yields

The Japanese government bond (JGB) market has recently experienced intense selling pressure, triggering a sharp rise in yields and heightened volatility. Once considered one of the most stable sovereign debt markets globally, Japan’s bond market is now showing vulnerabilities that have implications for both domestic and international investors. The sell-off affects global bond markets, risk assets, and currency markets, highlighting the sensitivity of financial systems to fiscal and monetary policy signals.

Recent Developments

Historic Surge in Long-Term Yields

Yields

- Reward

- 3

- 3

- Repost

- Share

Discovery :

:

Happy New Year! 🤑View More

#JapanBondMarketSellOff

If you think the Japan bond market sell-off is merely a local issue, you're oversimplifying. This is macro pressure cracking one of the last artificial pillars holding global liquidity. Japan’s bond market has long been manipulated through Yield Curve Control with cheap money, suppressed yields, and enforced stability. That era is visibly ending.

Let's clarify: a bond sell-off indicates a loss of confidence, not merely a rate adjustment. Currently, Japanese Government Bonds (JGBs) are being sold off, leading to falling prices and rising yields. This shift means investor

If you think the Japan bond market sell-off is merely a local issue, you're oversimplifying. This is macro pressure cracking one of the last artificial pillars holding global liquidity. Japan’s bond market has long been manipulated through Yield Curve Control with cheap money, suppressed yields, and enforced stability. That era is visibly ending.

Let's clarify: a bond sell-off indicates a loss of confidence, not merely a rate adjustment. Currently, Japanese Government Bonds (JGBs) are being sold off, leading to falling prices and rising yields. This shift means investor

BTC-0,01%

- Reward

- 4

- 2

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

🇯🇵 Japan Bond Market Shock: A Liquidity Event With Global Consequences

Japan’s government bond market just saw a historic liquidity breakdown. The 30-year JGB yield surged 30+ bps to ~3.9%, marking a 27-year high — a six-standard-deviation move not seen since 2003. This was not a routine sell-off, but a true liquidity crisis.

📉 What Happened

Disruption began Jan 20–21

Buyers stepped aside → bond prices collapsed

Liquidity dried up — JGB Liquidity Index hit record lows

Stress spilled into global rates and risk markets

🧠 Why It Matters

Japan has long been a global liquidity provider:

Ultra-l

Japan’s government bond market just saw a historic liquidity breakdown. The 30-year JGB yield surged 30+ bps to ~3.9%, marking a 27-year high — a six-standard-deviation move not seen since 2003. This was not a routine sell-off, but a true liquidity crisis.

📉 What Happened

Disruption began Jan 20–21

Buyers stepped aside → bond prices collapsed

Liquidity dried up — JGB Liquidity Index hit record lows

Stress spilled into global rates and risk markets

🧠 Why It Matters

Japan has long been a global liquidity provider:

Ultra-l

- Reward

- 1

- Comment

- Repost

- Share

#TariffTensionsHitCryptoMarket

#JapanBondMarketSellOff — A Turning Point for Global Markets

The sell-off in Japan’s bond market has become one of the most consequential macro developments shaking global financial markets in 2026. For decades, Japan’s bonds symbolized stability—anchored by ultra-low interest rates and firm intervention from the Bank of Japan (BoJ). That foundation is now being tested as yields rise and investors reassess long-standing assumptions.

🔎 What’s Driving the Shift?

At the core of the sell-off is a fundamental change in expectations around Japanese monetary policy. In

#JapanBondMarketSellOff — A Turning Point for Global Markets

The sell-off in Japan’s bond market has become one of the most consequential macro developments shaking global financial markets in 2026. For decades, Japan’s bonds symbolized stability—anchored by ultra-low interest rates and firm intervention from the Bank of Japan (BoJ). That foundation is now being tested as yields rise and investors reassess long-standing assumptions.

🔎 What’s Driving the Shift?

At the core of the sell-off is a fundamental change in expectations around Japanese monetary policy. In

- Reward

- like

- 1

- Repost

- Share

Alvizehen :

:

very nice article good trade historyLoad More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

17.74K Popularity

328 Popularity

28.34K Popularity

152 Popularity

96 Popularity

61 Popularity

45 Popularity

67.09K Popularity

349K Popularity

15.82K Popularity

49 Popularity

49.7K Popularity

127.84K Popularity

17.8K Popularity

175.38K Popularity

News

View MoreGate Red Bull Trading Tour 2026 First Session Registration Opens, Zero Threshold Sharing 60,000 GT

5 m

"Lightning Reverse" whale shorts 211.71 BTC with 20x leverage, average entry price $89,845

6 m

Yesterday, Bitcoin ETF saw a net outflow of $32.2 million, while Ethereum ETF experienced a net outflow of $42 million.

6 m

Overview of Major Whales: "BTC OG Insider Whale" with unrealized losses of $44 million, "Strategy Opponent" liquidated $210 million worth of BTC long positions

17 m

Castle Island Ventures Partner: X sacrifices access rights to the crypto community, and the battle over digital property rights is coming.

18 m

Pin