# JapanBondMarketSell-Off

3.36K

Japan’s bond market saw a sharp sell-off, with 30Y and 40Y yields jumping over 25 bps after plans to end fiscal tightening and boost spending. Will this impact global rates and risk assets?

Discovery

#JapanBondMarketSell-Off

The recent sharp sell-off in Japan's bond market is shaking global financial balances! 📉🇯🇵

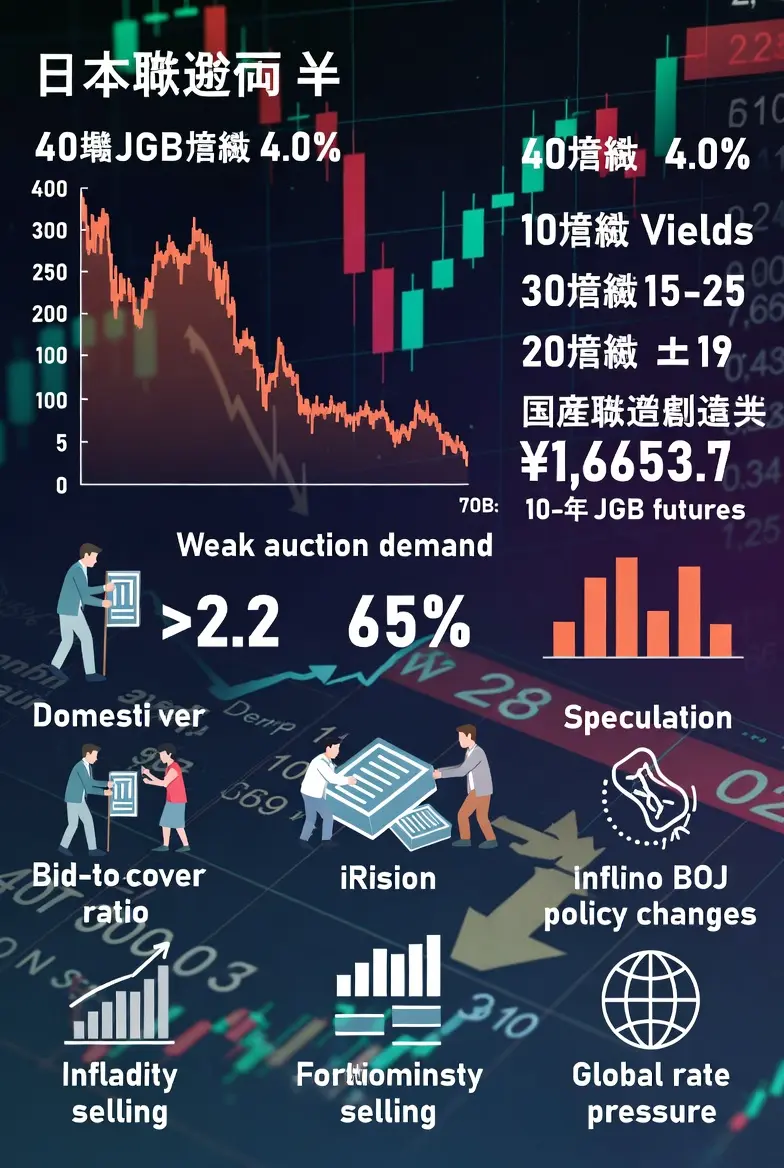

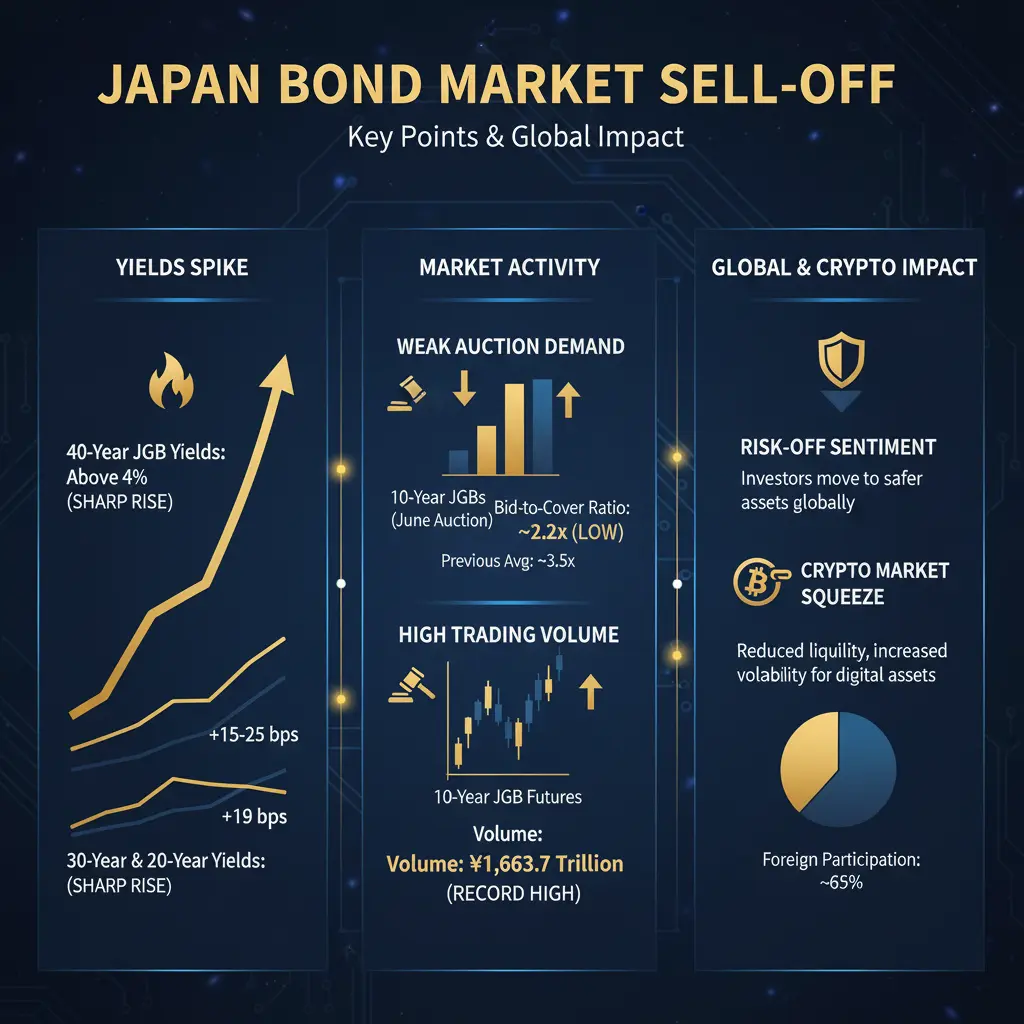

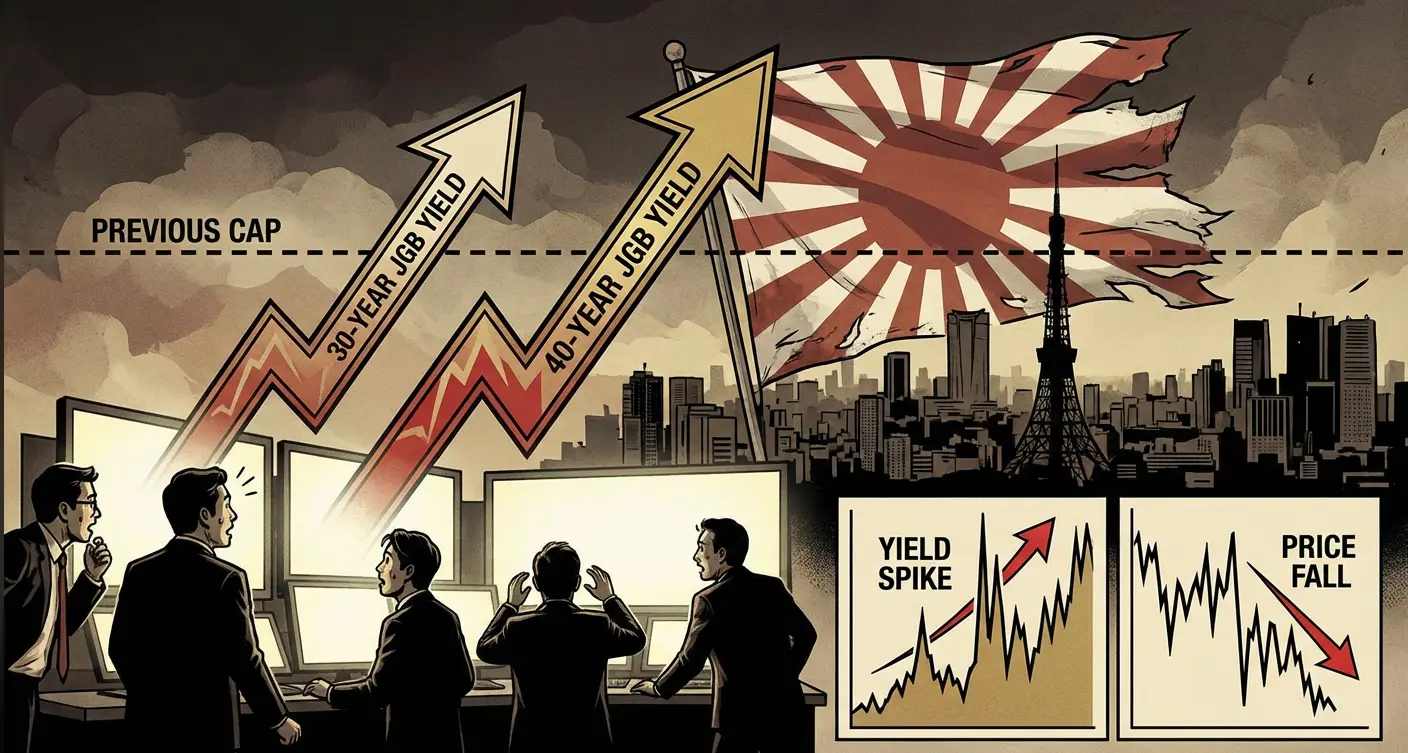

Yesterday, record-high selling was seen in Japanese government bonds (JGB), especially long-term ones. The 40-year bond yield exceeded 4% for the first time, reaching its highest level since 2007, while 30 and 20-year yields jumped by more than 25 basis points. This movement stemmed from Prime Minister Sanae Takaichi's promise to suspend the food consumption tax for two years and increased borrowing concerns following expansionary fiscal policies. Ahead of the snap electio

The recent sharp sell-off in Japan's bond market is shaking global financial balances! 📉🇯🇵

Yesterday, record-high selling was seen in Japanese government bonds (JGB), especially long-term ones. The 40-year bond yield exceeded 4% for the first time, reaching its highest level since 2007, while 30 and 20-year yields jumped by more than 25 basis points. This movement stemmed from Prime Minister Sanae Takaichi's promise to suspend the food consumption tax for two years and increased borrowing concerns following expansionary fiscal policies. Ahead of the snap electio

- Reward

- 21

- 24

- Repost

- Share

CryptoChampion :

:

HODL Tight 💪View More

#JapanBondMarketSell-Off

#JapanBondMarketSell-Off is a macro signal worth watching closely.

A sharp sell-off pushed 30Y and 40Y JGB yields up more than 25 bps after reports of ending fiscal tightening and increasing government spending.

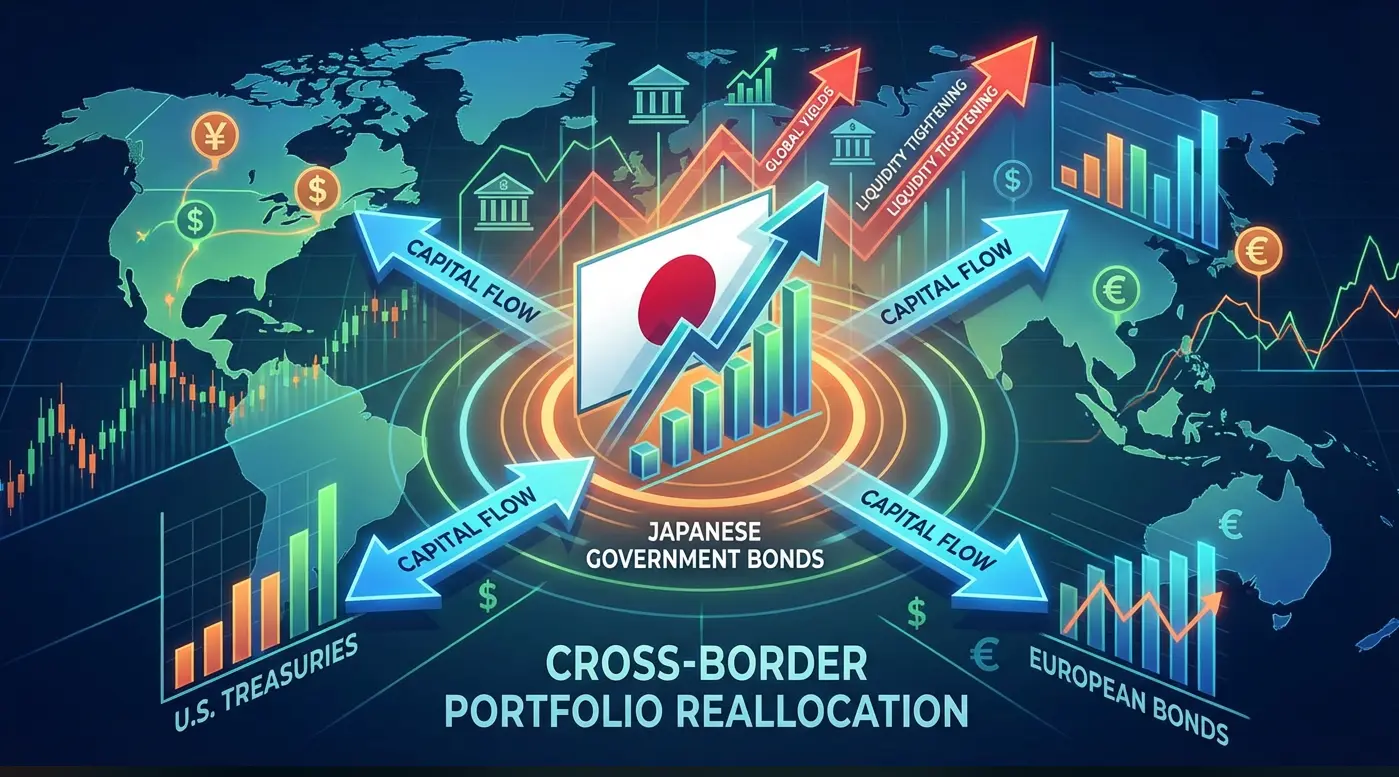

Japan has been a global anchor for low yields, so sudden moves like this can ripple across global bond markets.

If higher Japanese yields persist, capital flows and risk pricing worldwide could start to adjust.

The big question is spillover:

Does this push global rates higher and pressure risk assets, or is it a short-lived domestic reaction?

Markets often re

#JapanBondMarketSell-Off is a macro signal worth watching closely.

A sharp sell-off pushed 30Y and 40Y JGB yields up more than 25 bps after reports of ending fiscal tightening and increasing government spending.

Japan has been a global anchor for low yields, so sudden moves like this can ripple across global bond markets.

If higher Japanese yields persist, capital flows and risk pricing worldwide could start to adjust.

The big question is spillover:

Does this push global rates higher and pressure risk assets, or is it a short-lived domestic reaction?

Markets often re

- Reward

- 5

- 9

- Repost

- Share

AngelEye :

:

Buy To Earn 💎View More

#JapanBondMarketSell-Off

Japan’s government bond market has recently experienced a significant sell-off, sending shockwaves through both domestic and global financial markets. Prices of Japanese Government Bonds (JGBs) have declined sharply, causing yields to rise across the board. While JGBs are traditionally viewed as safe, low-risk assets, recent events highlight how even the most stable markets can experience volatility when macroeconomic and global pressures converge.

1. Current Yields and Percentage Moves

40-year JGB yields surged above 4.0%, hitting record highs — a major breakout in l

Japan’s government bond market has recently experienced a significant sell-off, sending shockwaves through both domestic and global financial markets. Prices of Japanese Government Bonds (JGBs) have declined sharply, causing yields to rise across the board. While JGBs are traditionally viewed as safe, low-risk assets, recent events highlight how even the most stable markets can experience volatility when macroeconomic and global pressures converge.

1. Current Yields and Percentage Moves

40-year JGB yields surged above 4.0%, hitting record highs — a major breakout in l

- Reward

- 15

- 17

- Repost

- Share

DragonFlyOfficial :

:

1000x VIbes 🤑View More

#JapanBondMarketSell-Off

Japan’s government bond market has recently experienced a significant sell-off, sending shockwaves through both domestic and global financial markets. Prices of Japanese Government Bonds (JGBs) have declined sharply, causing yields to rise across the board. While JGBs are traditionally viewed as safe, low-risk assets, recent events highlight how even the most stable markets can experience volatility when macroeconomic and global pressures converge.

1. Current Yields and Percentage Moves

40-year JGB yields surged above 4.0%, hitting record highs — a major breakout in l

Japan’s government bond market has recently experienced a significant sell-off, sending shockwaves through both domestic and global financial markets. Prices of Japanese Government Bonds (JGBs) have declined sharply, causing yields to rise across the board. While JGBs are traditionally viewed as safe, low-risk assets, recent events highlight how even the most stable markets can experience volatility when macroeconomic and global pressures converge.

1. Current Yields and Percentage Moves

40-year JGB yields surged above 4.0%, hitting record highs — a major breakout in l

- Reward

- 3

- 7

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

#JapanBondMarketSell-Off

a much deeper breakdown of the Japan Bond Market Sell-Off — why it’s happening, what it means domestically, and how it’s already shaking global markets

Buyers flee Japanese debt as Takaichi hits the ground spending

Instant View: Japan bond yields soar as election promises stir fiscal fears

1. The Immediate Catalyst: Politics + Fiscal Fear

• Snap election and fiscal promises: Prime Minister Sanae Takaichi’s announcement of a early election with aggressive fiscal pledges — especially a two-year suspension of the food consumption tax worth about ¥5 trillion (US$32 billio

a much deeper breakdown of the Japan Bond Market Sell-Off — why it’s happening, what it means domestically, and how it’s already shaking global markets

Buyers flee Japanese debt as Takaichi hits the ground spending

Instant View: Japan bond yields soar as election promises stir fiscal fears

1. The Immediate Catalyst: Politics + Fiscal Fear

• Snap election and fiscal promises: Prime Minister Sanae Takaichi’s announcement of a early election with aggressive fiscal pledges — especially a two-year suspension of the food consumption tax worth about ¥5 trillion (US$32 billio

- Reward

- 8

- 7

- Repost

- Share

DragonFlyOfficial :

:

HODL Tight 💪View More

#JapanBondMarketSell-Off

Japan Bond Market Sell-Off: A Warning Signal the Global Market Can’t Ignore

A Rare Shock from One of the World’s Most Stable Markets:

The Japan bond market sell-off has caught global investors by surprise. For decades, Japanese government bonds (JGBs) were considered among the most stable and predictable assets in the world. Japan’s ultra-loose monetary policy and yield control framework created a sense of calm and reliability. A sudden sell-off in this market is not just a local event it’s a macro signal with global implications.

Why the Japan Bond Market Matters Glo

Japan Bond Market Sell-Off: A Warning Signal the Global Market Can’t Ignore

A Rare Shock from One of the World’s Most Stable Markets:

The Japan bond market sell-off has caught global investors by surprise. For decades, Japanese government bonds (JGBs) were considered among the most stable and predictable assets in the world. Japan’s ultra-loose monetary policy and yield control framework created a sense of calm and reliability. A sudden sell-off in this market is not just a local event it’s a macro signal with global implications.

Why the Japan Bond Market Matters Glo

- Reward

- 3

- 5

- Repost

- Share

MissCrypto :

:

2026 GOGOGO 👊View More

#JapanBondMarketSell-Off

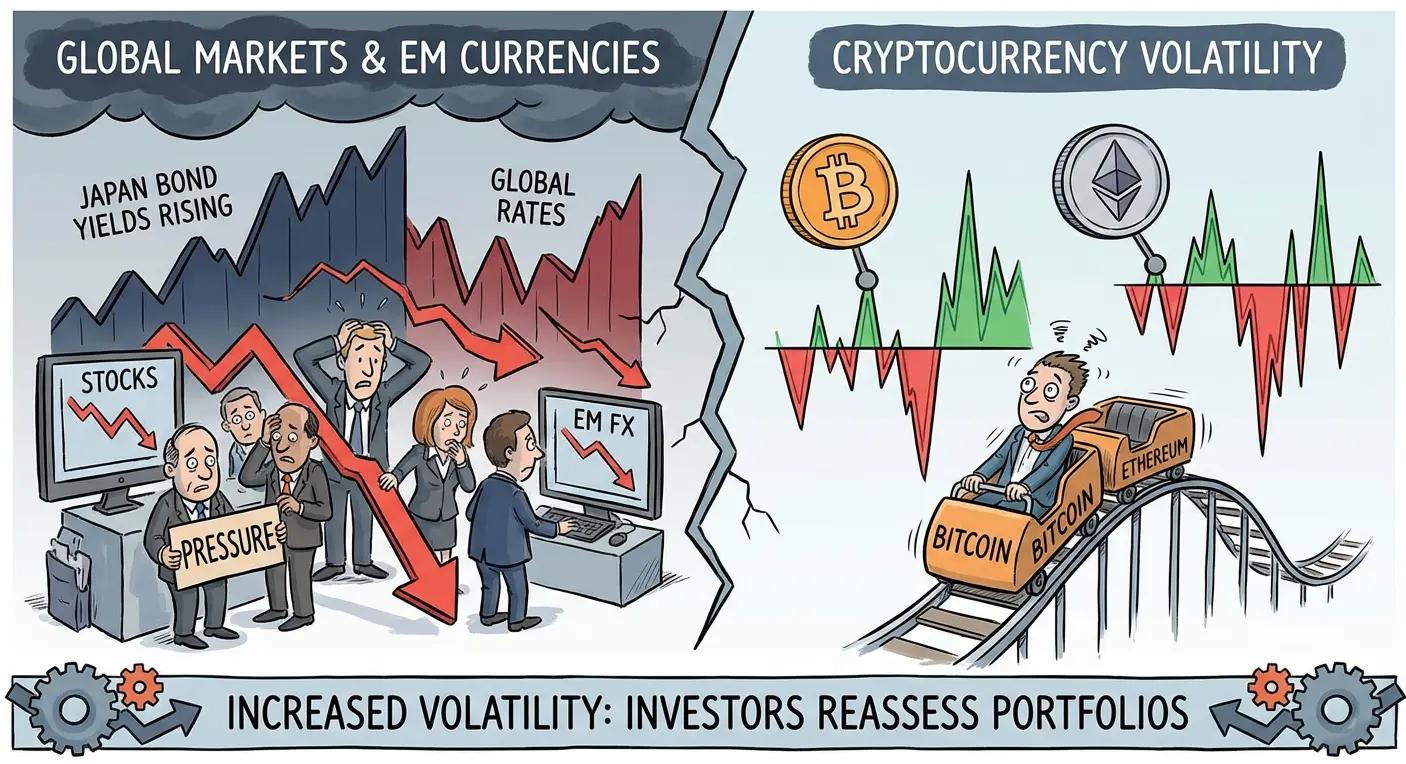

Japan Bond Sell-Off: Global Rates & Risk Assets in Focus

Japan’s bond market experienced a sharp sell-off after the government signaled an end to fiscal tightening and plans to boost spending. Yields on 30-year and 40-year JGBs surged over 25 bps, marking the largest move in years.

Why This Matters

Japan’s Long-Term Yields Jump

The 30Y and 40Y bonds breaking higher signals inflation expectations rising.

This also reflects a shift in monetary/fiscal balance, as investors price in more government borrowing.

Impact on Global Rates

Japan is a major holder of global capita

Japan Bond Sell-Off: Global Rates & Risk Assets in Focus

Japan’s bond market experienced a sharp sell-off after the government signaled an end to fiscal tightening and plans to boost spending. Yields on 30-year and 40-year JGBs surged over 25 bps, marking the largest move in years.

Why This Matters

Japan’s Long-Term Yields Jump

The 30Y and 40Y bonds breaking higher signals inflation expectations rising.

This also reflects a shift in monetary/fiscal balance, as investors price in more government borrowing.

Impact on Global Rates

Japan is a major holder of global capita

- Reward

- 1

- 1

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊#JapanBondMarketSell-Off

Japan’s bond market is under unprecedented stress, sending shockwaves across global finance. The recent sell-off in Japanese Government Bonds (JGBs) is more than routine volatility — it reflects a structural reassessment of long-term risk, fiscal sustainability, and monetary policy in the world’s third-largest economy.

Ultra-Long Bonds Under Pressure

Yields on 30- and 40-year bonds have surged to record levels. Investors are demanding higher returns for holding long-term debt, signaling declining confidence in Japan’s ability to manage growing obligations without stoki

Japan’s bond market is under unprecedented stress, sending shockwaves across global finance. The recent sell-off in Japanese Government Bonds (JGBs) is more than routine volatility — it reflects a structural reassessment of long-term risk, fiscal sustainability, and monetary policy in the world’s third-largest economy.

Ultra-Long Bonds Under Pressure

Yields on 30- and 40-year bonds have surged to record levels. Investors are demanding higher returns for holding long-term debt, signaling declining confidence in Japan’s ability to manage growing obligations without stoki

- Reward

- 2

- 3

- Repost

- Share

Yanlin :

:

2026 GOGOGO 👊View More

The recent decline has been driven by various negative news, including tariffs threats from the US and the EU, disputes over the US wanting to take Greenland, and issues in the Japanese bond market. Global risk assets have been pushed underwater together, and BTC along with many smaller coins are no exception!

In contrast, traditional safe-haven assets like gold have hit new highs, and silver is also dancing wildly. However, the crypto market has been continuously falling. This actually shows many things—when risks start to appear and macro conditions begin to lose control, people still trea

View OriginalIn contrast, traditional safe-haven assets like gold have hit new highs, and silver is also dancing wildly. However, the crypto market has been continuously falling. This actually shows many things—when risks start to appear and macro conditions begin to lose control, people still trea

- Reward

- 3

- 3

- Repost

- Share

IsItEmptyOrNot? :

:

HahahahahahahahahahahahahahahahahahahahahahahahahaView More

#JapanBondMarketSell-Off

The global financial system is witnessing one of the most unexpected ripples of 2026 as Japan’s government bond market long considered a bastion of stability experiences a dramatic sell‑off that is sending shockwaves across international markets. In the past few trading sessions, Japanese Government Bond (JGB) yields have surged sharply, pushing the 40‑year bond yield above a historic 4% level and driving long‑term borrowing costs to heights unseen since the early 2000s. This isn’t just a domestic story the fallout is being felt in sovereign debt markets from Tokyo t

The global financial system is witnessing one of the most unexpected ripples of 2026 as Japan’s government bond market long considered a bastion of stability experiences a dramatic sell‑off that is sending shockwaves across international markets. In the past few trading sessions, Japanese Government Bond (JGB) yields have surged sharply, pushing the 40‑year bond yield above a historic 4% level and driving long‑term borrowing costs to heights unseen since the early 2000s. This isn’t just a domestic story the fallout is being felt in sovereign debt markets from Tokyo t

- Reward

- 4

- 1

- Repost

- Share

CryptoChampion :

:

2026 GOGOGO 👊Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

29.15K Popularity

10.58K Popularity

2.83K Popularity

51.69K Popularity

341.7K Popularity

3.36K Popularity

3.8K Popularity

13.21K Popularity

107.24K Popularity

18.65K Popularity

198.4K Popularity

16.29K Popularity

6.71K Popularity

12.19K Popularity

168.73K Popularity

News

View MoreJPMorgan CEO Dimon: Federal Reserve independence is crucial

1 m

Vietnam has begun to pilot the formal licensing system for cryptocurrency asset trading platforms.

5 m

Gate launches a 5,000,000 USDT market fluctuation bottom support subsidy plan

10 m

Gate CandyDrop launches the全民空投10.0, sharing 30 ETH

10 m

White House official: Trump will not announce the Federal Reserve Chair candidate during the Davos Forum, as he has not made a decision yet

18 m

Pin