Post content & earn content mining yield

placeholder

HanssiMazak

#SolanaMemeHypeReturns A Structural Revival of Speculation on Solana

The Solana meme coin ecosystem has surged back into market focus, marking one of the most significant speculative revivals of the current crypto cycle. This resurgence is not merely a repeat of past hype phases — it reflects meaningful structural improvements across Solana’s network, liquidity depth, and overall user experience. Today’s momentum is underpinned by stronger fundamentals rather than fleeting excitement.

Unlike earlier meme cycles, which were often fueled by pure emotion and momentum, the current phase is suppor

The Solana meme coin ecosystem has surged back into market focus, marking one of the most significant speculative revivals of the current crypto cycle. This resurgence is not merely a repeat of past hype phases — it reflects meaningful structural improvements across Solana’s network, liquidity depth, and overall user experience. Today’s momentum is underpinned by stronger fundamentals rather than fleeting excitement.

Unlike earlier meme cycles, which were often fueled by pure emotion and momentum, the current phase is suppor

- Reward

- 3

- 2

- Repost

- Share

Peacefulheart :

:

2026 GOGOGO 👊View More

[BTC Prediction and Market Analysis]

- Reward

- 1

- 1

- Repost

- Share

GateUser-37edc23c :

:

Happy New Year! 🤑- Reward

- 1

- 1

- Repost

- Share

Maomaoya :

:

$METIS It's so embarrassing, it's been falling for almost 2 years$METIS It's so embarrassing, it's been falling for almost 2 years$METIS It's so embarrassing, it's been falling for almost 2 years$METIS It's so embarrassing, it's been falling for almost 2 years$METIS It's so embarrassing, it's been falling for almost 2 years$METIS It's so embarrassing, it's been falling for almost 2 years万马奔腾

WMBT

Created By@GateUser-4976386a

Listing Progress

0.00%

MC:

$3.41K

Create My Token

$SOL Public idea reference for today

From the daily chart, $124–125 forms strong intraday support. The pullback has not broken the recent oscillation range lower boundary. The middle band of the 4-hour Bollinger Bands provides effective support, indicating a bullish bias.

sol: Watch for a rebound around 124, with targets near 128-130

#金价突破5200美元 $BTC

View OriginalFrom the daily chart, $124–125 forms strong intraday support. The pullback has not broken the recent oscillation range lower boundary. The middle band of the 4-hour Bollinger Bands provides effective support, indicating a bullish bias.

sol: Watch for a rebound around 124, with targets near 128-130

#金价突破5200美元 $BTC

- Reward

- like

- Comment

- Repost

- Share

The recent rebound of the two coins shows a clear weakening momentum, and the overall structure remains bearish. After spiking to 3038 overnight, the price was again pressured and pulled back. Compared to the previous rebound high of 3045, it has significantly shifted lower, with the highs continuously declining, indicating that the bulls are still lacking strength. The current short-term strategy remains unchanged, mainly focusing on shorting during rebounds. The rebound's significance is more to create space for the subsequent decline.

In terms of operation, pay attention to the resistance a

In terms of operation, pay attention to the resistance a

ETH-1,74%

- Reward

- 1

- Comment

- Repost

- Share

After 10 years, I met my ex on the street. "Hey, it's been so long! How have you been lately?" "Not bad," she said, "After graduating with my bachelor's degree, I continued studying law, and now we're partners at a law firm. Ah, anyway, it's nice to see you. Take care." With that, she walked away. I thought to myself, this woman is still so self-righteous. She didn't ask how I've been recently, nor did she toss a coin into my can... Anyway, hello to all my brothers and sisters. I appreciate your likes and follows whenever you pass by~!

View Original

- Reward

- 1

- Comment

- Repost

- Share

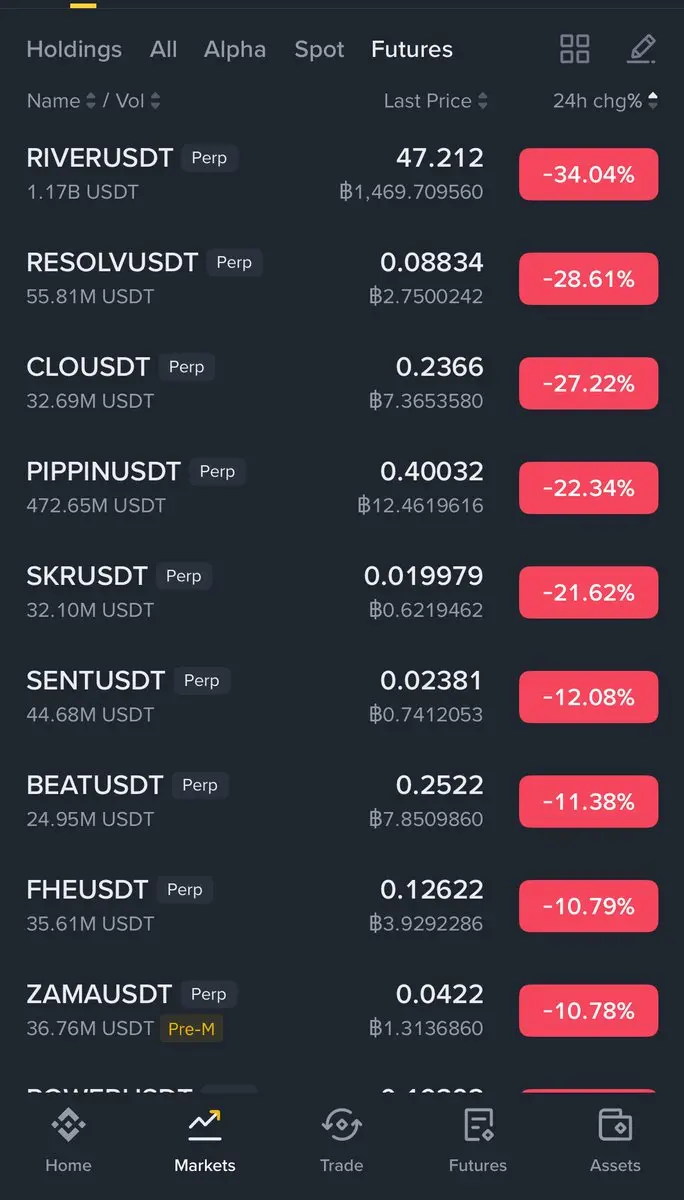

#RIVERUp50xinOneMonth RIVERUp50xinOneMonth Explosive Rally, Momentum, and Structural Dynamics

RIVER has become one of the most talked-about altcoins of early 2026 after delivering an extraordinary performance. The token recently reached an all-time high near $87.7 before pulling back and now trades around $52, entering a consolidation phase after a powerful rally. In just one month, RIVER recorded gains of nearly 1,800–2,000%, translating into approximately 500% growth year-to-date, pushing it firmly into the spotlight for both retail traders and institutional observers.

From a price-action pe

RIVER has become one of the most talked-about altcoins of early 2026 after delivering an extraordinary performance. The token recently reached an all-time high near $87.7 before pulling back and now trades around $52, entering a consolidation phase after a powerful rally. In just one month, RIVER recorded gains of nearly 1,800–2,000%, translating into approximately 500% growth year-to-date, pushing it firmly into the spotlight for both retail traders and institutional observers.

From a price-action pe

- Reward

- 2

- 2

- Repost

- Share

Peacefulheart :

:

2026 GOGOGO 👊View More

$GT BTC

Co launched a luxury watch, but the most important thing is that it can mine Bitcoin!

As long as you have it in your hand, you'll find it mining Bitcoin, and it's expected to bring you $7,000 annually based on today's current Bitcoin situation. They are collaborating with the GoMining platform, and the watch will track your actual Bitcoin share.

They say they only make 100 pieces of it, which is why its price is high at $40,000.

Do you think it's worth it?

View OriginalCo launched a luxury watch, but the most important thing is that it can mine Bitcoin!

As long as you have it in your hand, you'll find it mining Bitcoin, and it's expected to bring you $7,000 annually based on today's current Bitcoin situation. They are collaborating with the GoMining platform, and the watch will track your actual Bitcoin share.

They say they only make 100 pieces of it, which is why its price is high at $40,000.

Do you think it's worth it?

MC:$18.84KHolders:5

50.35%

- Reward

- like

- Comment

- Repost

- Share

Gold hits a new high again

Yesterday below 5100, this morning it surged directly to 5600

Many people have been hesitant to enter in recent days

But starting from 4580, using the RSI indicator strategy I shared for short-term trading every day, I have been profitable daily. Pullbacks are opportunities, small pullbacks are also opportunities because there hasn't been a major correction yet.

⚠️⚠️⚠️ Bitcoin and Ethereum long positions have also been quite profitable these past two days. Currently, Ethereum is supported at the 2955-2980 range. If it breaks below this zone, go short immediately; if

View OriginalYesterday below 5100, this morning it surged directly to 5600

Many people have been hesitant to enter in recent days

But starting from 4580, using the RSI indicator strategy I shared for short-term trading every day, I have been profitable daily. Pullbacks are opportunities, small pullbacks are also opportunities because there hasn't been a major correction yet.

⚠️⚠️⚠️ Bitcoin and Ethereum long positions have also been quite profitable these past two days. Currently, Ethereum is supported at the 2955-2980 range. If it breaks below this zone, go short immediately; if

- Reward

- like

- 1

- Repost

- Share

jkioo :

:

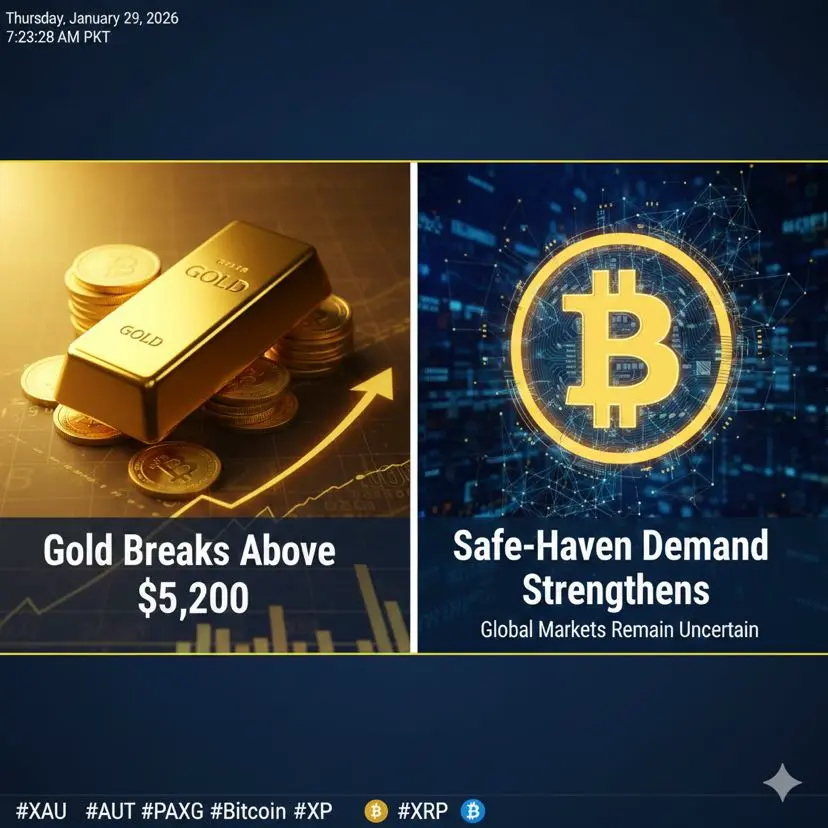

This is indeed a historic moment. On January 28, 2026, the international spot gold price broke through the historic threshold of $5,200/oz, marking a new era in the gold market. Below are the core driving factors and market conditions behind this gold price surge:

1. Core Driving Factors

• "Trust Crisis" in the US Dollar: Recent policy signals from the US government suggest support for a weak dollar, causing the dollar index to fall to its lowest point in nearly four years. Investors are abandoning fiat currencies and turning to gold as a safe-haven asset.

• Geopolitical Turmoil: Uncertainty surrounding trade tariffs (such as new tariff threats against multiple countries) and geopolitical tensions have greatly boosted market risk aversion.

• Federal Reserve Policy Expectations: The market is closely watching the Federal Reserve's policy meeting at the end of January. Although the consensus is to keep interest rates unchanged, expectations of future rate cuts have already triggered a "parabolic" rally in gold prices.

• Central Bank Accumulation: Central banks worldwide (especially emerging markets) are increasingly reducing their dependence on the US dollar and turning to gold as a core reserve asset.

- Reward

- 2

- Comment

- Repost

- Share

Check out Gate and join me in the hottest event! https://www.gate.com/campaigns/3952?ref=VLMXB1LFUQ&ref_type=132&utm_cmp=IYKpDOrs

- Reward

- like

- Comment

- Repost

- Share

龙

龙腾盛世

Created By@ComeWealth,ComeWealth

Subscription Progress

0.00%

MC:

$0

Create My Token

#TrumpWithdrawsEUTariffThreats #TrumpWithdrawsEUTariffThreats #MarketShift #CryptoMomentum

This week proved one thing again:

Markets move on expectations, not just actions.

When the US hinted at new EU tariffs, fear spread instantly. Stocks dipped. Crypto pulled back. Money ran to safety.

Not because policy changed — but because uncertainty increased.

Then came Davos… and the tone flipped.

Tariff threats were paused. Diplomacy took center stage. Suddenly the narrative shifted from trade war risk to strategic negotiation.

And markets reacted just as fast in the opposite direction.

💰 Defensive

This week proved one thing again:

Markets move on expectations, not just actions.

When the US hinted at new EU tariffs, fear spread instantly. Stocks dipped. Crypto pulled back. Money ran to safety.

Not because policy changed — but because uncertainty increased.

Then came Davos… and the tone flipped.

Tariff threats were paused. Diplomacy took center stage. Suddenly the narrative shifted from trade war risk to strategic negotiation.

And markets reacted just as fast in the opposite direction.

💰 Defensive

- Reward

- like

- Comment

- Repost

- Share

Bottom fishing, bottom fishing, bottom fishing, I only say it three times.

In just over ten days since launch, more than a thousand people have reached consensus, and the top ten addresses are 0.

View OriginalIn just over ten days since launch, more than a thousand people have reached consensus, and the top ten addresses are 0.

[The user has shared his/her trading data. Go to the App to view more.]

MC:$31.53KHolders:394

100.00%

- Reward

- like

- Comment

- Repost

- Share

Currently considering buying gold and silver, there are several types of risks to be aware of

First is the macro environment

Once the Federal Reserve shifts to a more hawkish stance

Rising real interest rates often weaken the appeal of precious metals

Additionally, new asset classes like cryptocurrencies are also diverting traditional safe-haven funds

Market choices are more abundant than before

Volatility risk is also significant$ETH

Gold and silver prices are heavily influenced by the US dollar, interest rates, and geopolitical events

Short-term sharp fluctuations are common

Especially silv

First is the macro environment

Once the Federal Reserve shifts to a more hawkish stance

Rising real interest rates often weaken the appeal of precious metals

Additionally, new asset classes like cryptocurrencies are also diverting traditional safe-haven funds

Market choices are more abundant than before

Volatility risk is also significant$ETH

Gold and silver prices are heavily influenced by the US dollar, interest rates, and geopolitical events

Short-term sharp fluctuations are common

Especially silv

ETH-1,74%

- Reward

- like

- Comment

- Repost

- Share

#GoldBreaksAbove$5,200 GoldBreaksAbove$5,200 | Safe-Haven Demand Strengthens as Global Markets Remain Uncertain

#XAU #XAUT #PAXG #Bitcoin

Gold continues to attract strong attention across global financial $markets as investors increasingly move toward safety amid prolonged macroeconomic pressure and unstable risk sentiment. Ongoing uncertainty around global growth, currency weakness, and geopolitical developments has reinforced gold’s role as a primary defensive asset, encouraging both institutional and long-term participants to maintain exposure despite short-term price fluctuations.

The curr

#XAU #XAUT #PAXG #Bitcoin

Gold continues to attract strong attention across global financial $markets as investors increasingly move toward safety amid prolonged macroeconomic pressure and unstable risk sentiment. Ongoing uncertainty around global growth, currency weakness, and geopolitical developments has reinforced gold’s role as a primary defensive asset, encouraging both institutional and long-term participants to maintain exposure despite short-term price fluctuations.

The curr

BTC-1,52%

- Reward

- 2

- 1

- Repost

- Share

HeavenSlayerFaithful :

:

2026 Go Go Go 👊Happy New Year to everyone on the #GoldBreaksAbove$5,200 #MiddleEastTensionsEscalate #GameFiSeesaStrongRebound #CryptoMarketWatch #TrumpWithdrawsEUTariffThreats platform

View Original

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

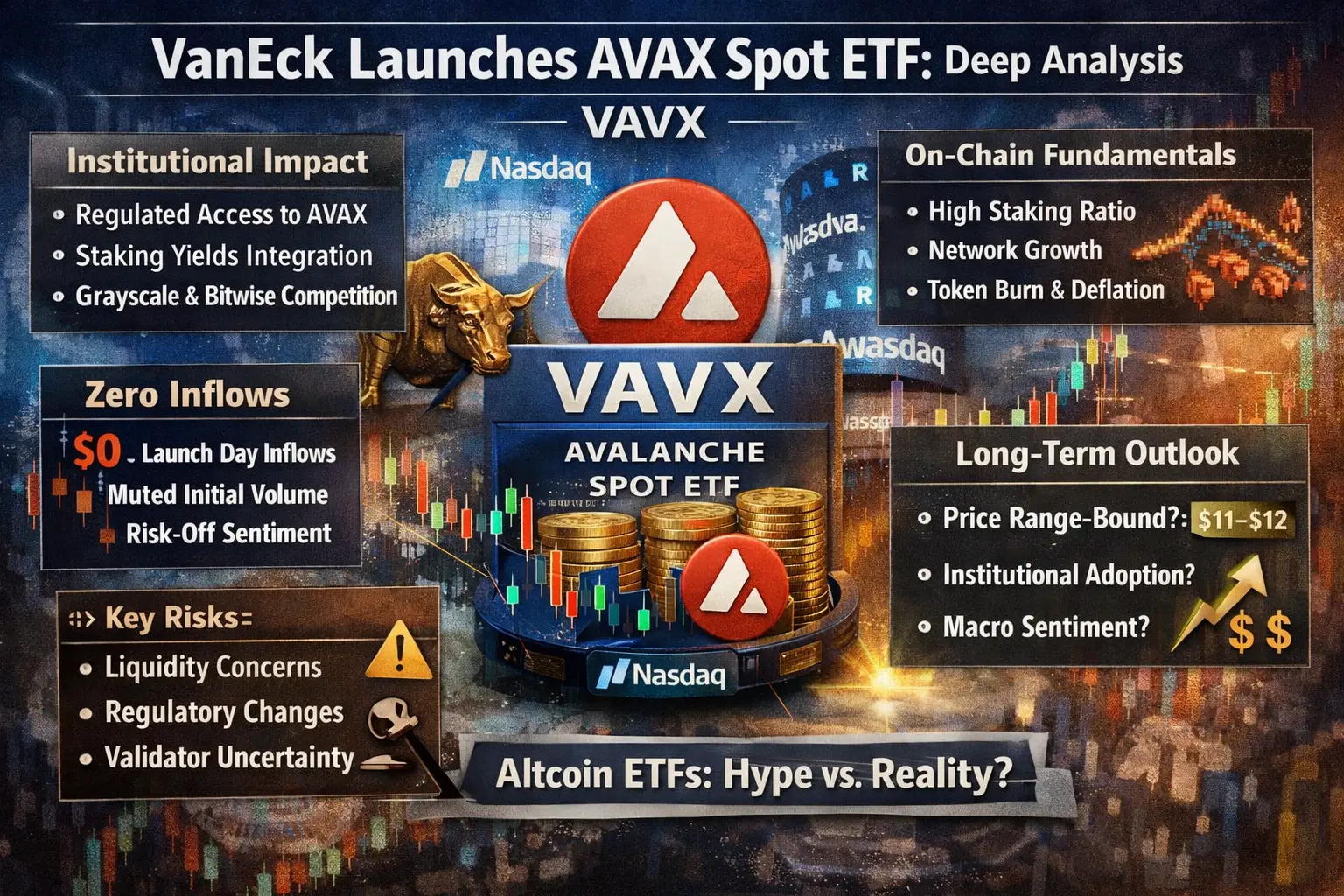

#VanEckLaunchesAVAXSpotETF

#VanEckLaunchesAVAXSpotETF — What It Really Means for AVAX

VanEck’s launch of the first U.S. spot AVAX ETF (VAVX) is a structural milestone, not a short-term hype event.

Key takeaway:

This ETF expands how investors can access AVAX — but it doesn’t automatically guarantee price upside.

🔹 Why this matters

Regulated access: Traditional investors can now gain AVAX exposure via a Nasdaq-listed product.

Institutional framing: AVAX is increasingly treated as an investable digital asset, not just a retail token.

Long-term optionality: Products like this matter more in the

#VanEckLaunchesAVAXSpotETF — What It Really Means for AVAX

VanEck’s launch of the first U.S. spot AVAX ETF (VAVX) is a structural milestone, not a short-term hype event.

Key takeaway:

This ETF expands how investors can access AVAX — but it doesn’t automatically guarantee price upside.

🔹 Why this matters

Regulated access: Traditional investors can now gain AVAX exposure via a Nasdaq-listed product.

Institutional framing: AVAX is increasingly treated as an investable digital asset, not just a retail token.

Long-term optionality: Products like this matter more in the

AVAX-2,31%

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More23.38K Popularity

87.38K Popularity

37.15K Popularity

12.98K Popularity

13.37K Popularity

News

View MoreXRP (XRP Ledger) decreased by 1.38% in the past 24 hours, currently trading at $1.87

1 m

Since October 2025, the giant whale gradually building a position in digital gold has realized a profit of $3,865,000.

2 m

ETH (Ethereum) decreased by 1.72% in the past 24 hours, currently at $2953.36

3 m

NVIDIA, Microsoft, and Amazon are in talks to invest approximately $60 billion in OpenAI

4 m

"Ma Ji" closed the HYPE long position, earning $961,000 in profit.

4 m

Pin