# TrumpWithdrawsEUTariffThreats

76.56K

Amid ongoing trade tensions, Trump cancels tariffs on several European countries originally set for Feb 1. Do you think this easing signal will meaningfully impact market trends?

MrFlower_XingChen

#TrumpWithdrawsEUTariffThreats From Confrontation to Calculation: A Strategic Reset in 2026

The opening phase of 2026 delivered a familiar reminder to global markets: political signaling still moves capital faster than economic data. When the United States administration floated the possibility of new customs tariffs on several European nations, market sentiment shifted instantly. The scale of the proposal mattered less than the uncertainty it introduced.

Within hours, investors began repricing geopolitical risk. Equities weakened, crypto markets corrected sharply, and capital rotated toward t

The opening phase of 2026 delivered a familiar reminder to global markets: political signaling still moves capital faster than economic data. When the United States administration floated the possibility of new customs tariffs on several European nations, market sentiment shifted instantly. The scale of the proposal mattered less than the uncertainty it introduced.

Within hours, investors began repricing geopolitical risk. Equities weakened, crypto markets corrected sharply, and capital rotated toward t

- Reward

- 11

- 106

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

#TrumpWithdrawsEUTariffThreats 📊

From Confrontation to Calculation: A Strategic Reset in 2026

The opening weeks of 2026 offered global markets a powerful reminder: political signals still move capital faster than data. When U.S. President Donald Trump announced potential customs tariffs ranging from 10% to 25% on eight European nations — including Germany, France, the UK, and the Nordic bloc — markets immediately began pricing in the return of a transatlantic trade war. The announcement was tied to growing tensions surrounding Washington’s Arctic strategy and the controversial Greenland acqui

From Confrontation to Calculation: A Strategic Reset in 2026

The opening weeks of 2026 offered global markets a powerful reminder: political signals still move capital faster than data. When U.S. President Donald Trump announced potential customs tariffs ranging from 10% to 25% on eight European nations — including Germany, France, the UK, and the Nordic bloc — markets immediately began pricing in the return of a transatlantic trade war. The announcement was tied to growing tensions surrounding Washington’s Arctic strategy and the controversial Greenland acqui

- Reward

- 17

- 151

- Repost

- Share

Yunna :

:

buy to earnView More

#TrumpWithdrawsEUTariffThreats

Trump Withdraws EU Tariff Threats — Will This Easing Signal Meaningfully Move Markets?

Context & What Happened

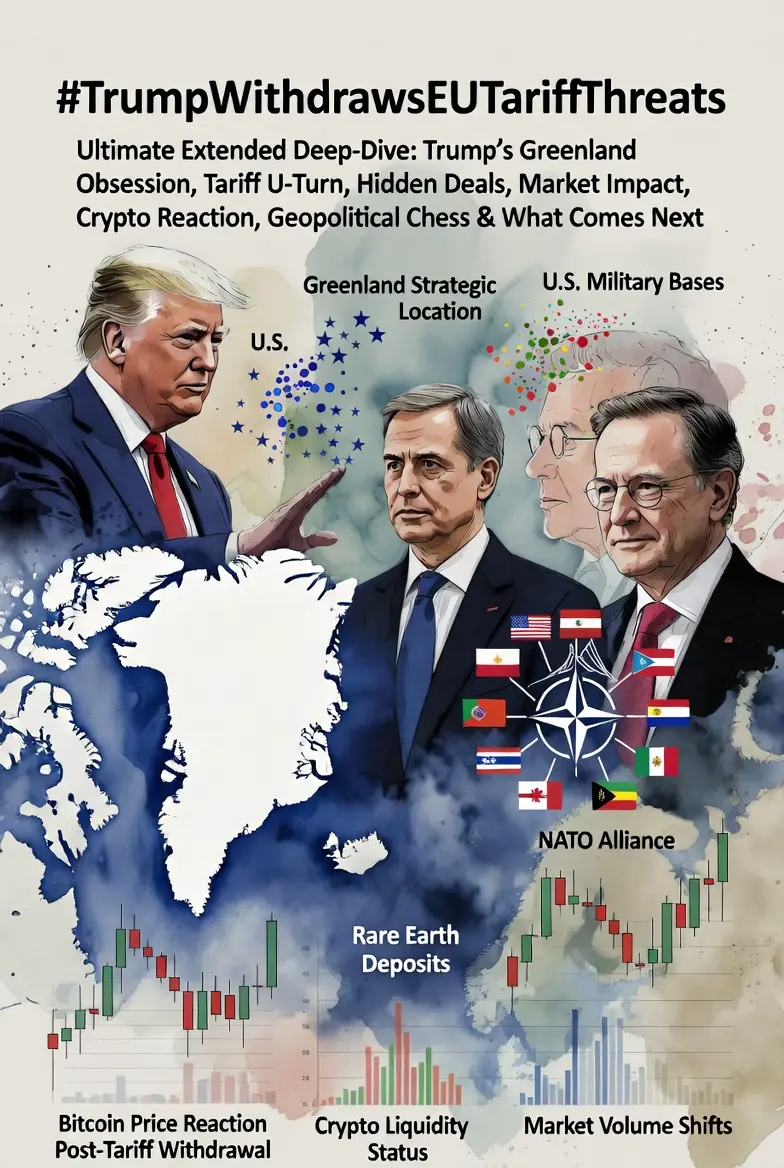

• On January 21–22, 2026, U.S. President Donald Trump cancelled planned tariffs on eight major European allies that had been scheduled to take effect on Feb 1 — originally set at 10% and rising to 25% unless negotiations over Greenland progressed.

• The reversal followed a “framework” agreement reached at the World Economic Forum in Davos with NATO leadership on future Arctic cooperation and de‑escalation of the Greenland dispute.

Immediate Market React

Trump Withdraws EU Tariff Threats — Will This Easing Signal Meaningfully Move Markets?

Context & What Happened

• On January 21–22, 2026, U.S. President Donald Trump cancelled planned tariffs on eight major European allies that had been scheduled to take effect on Feb 1 — originally set at 10% and rising to 25% unless negotiations over Greenland progressed.

• The reversal followed a “framework” agreement reached at the World Economic Forum in Davos with NATO leadership on future Arctic cooperation and de‑escalation of the Greenland dispute.

Immediate Market React

- Reward

- 8

- 124

- Repost

- Share

EagleEye :

:

2026 GOGOGO 👊View More

#TrumpWithdrawsEUTariffThreats

Trump Withdraws EU Tariff Threats — Will This Easing Signal Meaningfully Move Markets?

Context & What Happened

• On January 21–22, 2026, U.S. President Donald Trump cancelled planned tariffs on eight major European allies that had been scheduled to take effect on Feb 1 — originally set at 10% and rising to 25% unless negotiations over Greenland progressed.

• The reversal followed a “framework” agreement reached at the World Economic Forum in Davos with NATO leadership on future Arctic cooperation and de‑escalation of the Greenland dispute.

Immediate Market React

Trump Withdraws EU Tariff Threats — Will This Easing Signal Meaningfully Move Markets?

Context & What Happened

• On January 21–22, 2026, U.S. President Donald Trump cancelled planned tariffs on eight major European allies that had been scheduled to take effect on Feb 1 — originally set at 10% and rising to 25% unless negotiations over Greenland progressed.

• The reversal followed a “framework” agreement reached at the World Economic Forum in Davos with NATO leadership on future Arctic cooperation and de‑escalation of the Greenland dispute.

Immediate Market React

- Reward

- 6

- 106

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

Market Situation:

- Bitcoin around $88,478;

- Ethereum approximately $2,937;

- Fear and Greed Index: 29;

- Bitcoin dominance: 59.70%;

- Altseason Index: 39;

- Market capitalization: $2.96 trillion.

🔼BTC ETF $6.8 million.

🔼ETH ETF #CryptoRegulationNewProgress million.

⚫ Donald Trump announced that the US will increase tariffs on goods from South Korea from 15% to 25% after Seoul's legislative assembly failed to approve the previously agreed trade deal.

⚫During BTC rebounds to STH-RP, investors holding for 3-6 months lock in positions at break-even instead of transitioning to LTH, and traders

View Original- Bitcoin around $88,478;

- Ethereum approximately $2,937;

- Fear and Greed Index: 29;

- Bitcoin dominance: 59.70%;

- Altseason Index: 39;

- Market capitalization: $2.96 trillion.

🔼BTC ETF $6.8 million.

🔼ETH ETF #CryptoRegulationNewProgress million.

⚫ Donald Trump announced that the US will increase tariffs on goods from South Korea from 15% to 25% after Seoul's legislative assembly failed to approve the previously agreed trade deal.

⚫During BTC rebounds to STH-RP, investors holding for 3-6 months lock in positions at break-even instead of transitioning to LTH, and traders

- Reward

- 1

- 2

- Repost

- Share

allogi :

:

Jump in 🚀View More

#TrumpWithdrawsEUTariffThreats

Ceasefire in Trade Wars: Global Markets Breathe a Sigh of Relief

An announcement from the White House this morning reported that the additional tariffs expected to be imposed on the European Union's automotive, technology, and agricultural products have been "suspended for now." This decision has brought significant relief, particularly to German automakers and French agricultural sectors. Following the news, markets surged as concerns over a global recession eased slightly.

Initial Market Reaction: Green Lights Everywhere

European Stock Markets: The DAX index i

Ceasefire in Trade Wars: Global Markets Breathe a Sigh of Relief

An announcement from the White House this morning reported that the additional tariffs expected to be imposed on the European Union's automotive, technology, and agricultural products have been "suspended for now." This decision has brought significant relief, particularly to German automakers and French agricultural sectors. Following the news, markets surged as concerns over a global recession eased slightly.

Initial Market Reaction: Green Lights Everywhere

European Stock Markets: The DAX index i

- Reward

- 43

- 41

- Repost

- Share

Crypto_Buzz_with_Alex :

:

“Really appreciate the clarity and effort you put into this post — it’s rare to see crypto content that’s both insightful and easy to follow. Your perspective adds real value to the community. Keep sharing gems like this! 🚀📊”View More

#TrumpWithdrawsEUTariffThreats

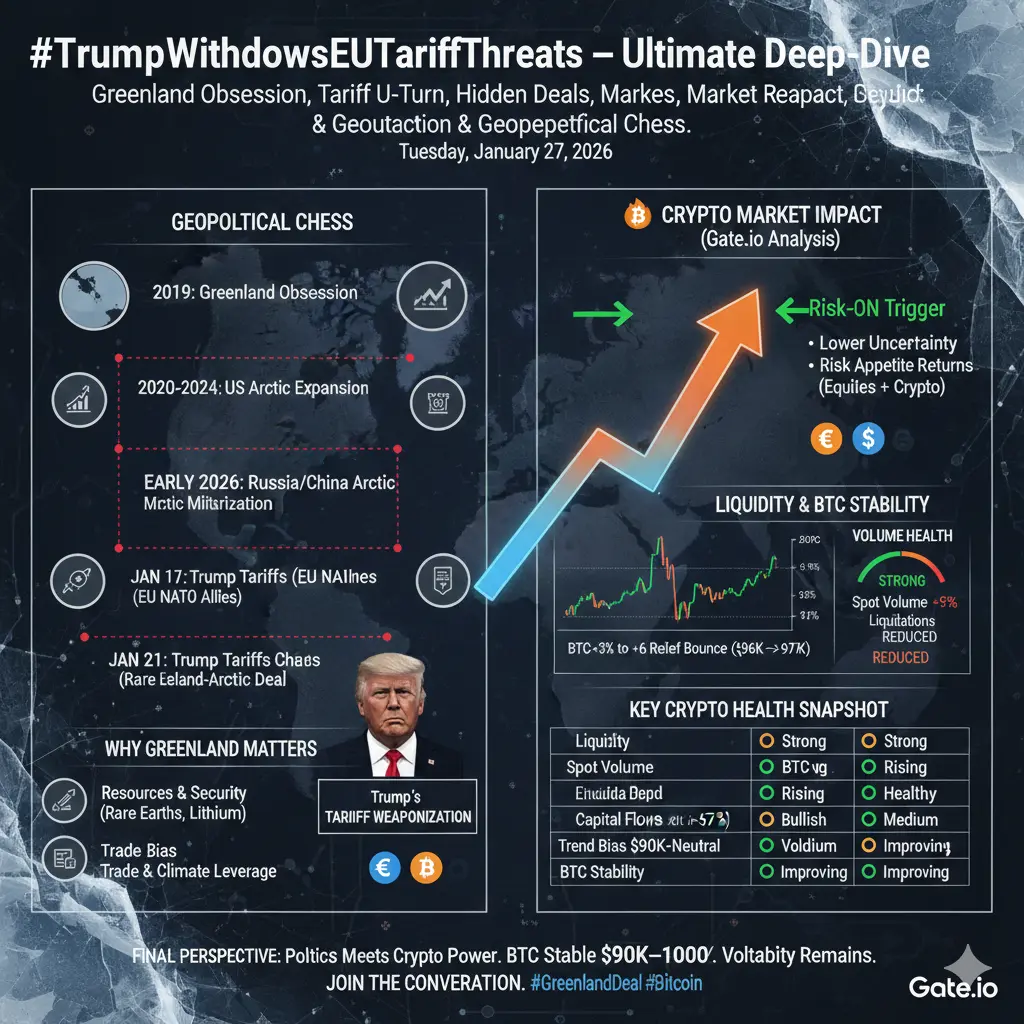

In one of the most dramatic and high-stakes geopolitical episodes of 2026, U.S. President Donald Trump threatened sweeping tariffs on eight European NATO allies — only to abruptly withdraw them days later. The unexpected trigger? Greenland.

This was not just a trade dispute. It was a power play blending tariffs, territorial ambition, Arctic strategy, alliance politics, financial markets, and crypto liquidity dynamics — showcasing how economic weapons are becoming geopolitical tools.

1️⃣ The Full Timeline — From 2019 Greenland Obsession to the 2026 Tariff Crisis

In one of the most dramatic and high-stakes geopolitical episodes of 2026, U.S. President Donald Trump threatened sweeping tariffs on eight European NATO allies — only to abruptly withdraw them days later. The unexpected trigger? Greenland.

This was not just a trade dispute. It was a power play blending tariffs, territorial ambition, Arctic strategy, alliance politics, financial markets, and crypto liquidity dynamics — showcasing how economic weapons are becoming geopolitical tools.

1️⃣ The Full Timeline — From 2019 Greenland Obsession to the 2026 Tariff Crisis

- Reward

- 17

- 20

- Repost

- Share

Crypto_Buzz_with_Alex :

:

“Really appreciate the clarity and effort you put into this post — it’s rare to see crypto content that’s both insightful and easy to follow. Your perspective adds real value to the community. Keep sharing gems like this! 🚀📊”View More

#TrumpWithdrawsEUTariffThreats #TrumpWithdrawsEUTariffThreats 🌍

Markets just found some breathing room.

The decision to pull back from tariff pressure on the EU isn’t just a political headline — it’s a shift in the macro liquidity backdrop.

Why this development matters:

• Risk Sentiment: Confidence improves as trade uncertainty fades

• Equities & Crypto: Risk assets tend to react quickly to easing tensions

• FX & Bonds: Capital flows adjust, influencing dollar strength and yield dynamics

💡 Macro Takeaway:

When geopolitical stress cools, markets often move into relief-mode. Assets like BTC, E

Markets just found some breathing room.

The decision to pull back from tariff pressure on the EU isn’t just a political headline — it’s a shift in the macro liquidity backdrop.

Why this development matters:

• Risk Sentiment: Confidence improves as trade uncertainty fades

• Equities & Crypto: Risk assets tend to react quickly to easing tensions

• FX & Bonds: Capital flows adjust, influencing dollar strength and yield dynamics

💡 Macro Takeaway:

When geopolitical stress cools, markets often move into relief-mode. Assets like BTC, E

- Reward

- 8

- 15

- Repost

- Share

AylaShinex :

:

1000x VIbes 🤑View More

#TrumpWithdrawsEUTariffThreats 🌍

Former U.S. President Donald Trump’s decision to withdraw tariff threats against the European Union marks a notable shift in transatlantic trade dynamics. The move eases immediate concerns over escalating trade tensions and offers temporary relief to global markets that have remained sensitive to policy-driven uncertainty.

By stepping back from punitive tariffs, the development signals a more measured approach toward EU–U.S. trade relations, supporting stability for industries spanning manufacturing, agriculture, and technology. Market participants are viewing

Former U.S. President Donald Trump’s decision to withdraw tariff threats against the European Union marks a notable shift in transatlantic trade dynamics. The move eases immediate concerns over escalating trade tensions and offers temporary relief to global markets that have remained sensitive to policy-driven uncertainty.

By stepping back from punitive tariffs, the development signals a more measured approach toward EU–U.S. trade relations, supporting stability for industries spanning manufacturing, agriculture, and technology. Market participants are viewing

- Reward

- 8

- 12

- Repost

- Share

Crypto_Buzz_with_Alex :

:

“Really appreciate the clarity and effort you put into this post — it’s rare to see crypto content that’s both insightful and easy to follow. Your perspective adds real value to the community. Keep sharing gems like this! 🚀📊”View More

#TrumpWithdrawsEUTariffThreats From Confrontation to Calculation: A Strategic Reset in 2026

The opening weeks of 2026 offered global markets a powerful reminder: political signals still move capital faster than data. When U.S. President Donald Trump announced potential customs tariffs ranging from 10% to 25% on eight European nations — including Germany, France, the UK, and the Nordic bloc — markets immediately began pricing in the return of a transatlantic trade war. The announcement was tied to tensions surrounding Washington’s Arctic strategy and the controversial Greenland acquisition disc

The opening weeks of 2026 offered global markets a powerful reminder: political signals still move capital faster than data. When U.S. President Donald Trump announced potential customs tariffs ranging from 10% to 25% on eight European nations — including Germany, France, the UK, and the Nordic bloc — markets immediately began pricing in the return of a transatlantic trade war. The announcement was tied to tensions surrounding Washington’s Arctic strategy and the controversial Greenland acquisition disc

- Reward

- 9

- 10

- Repost

- Share

Crypto_Buzz_with_Alex :

:

“Really appreciate the clarity and effort you put into this post — it’s rare to see crypto content that’s both insightful and easy to follow. Your perspective adds real value to the community. Keep sharing gems like this! 🚀📊”View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

37.47K Popularity

2.34K Popularity

1.83K Popularity

932 Popularity

698 Popularity

456 Popularity

818 Popularity

1.52K Popularity

67.83K Popularity

109.51K Popularity

76.56K Popularity

19.16K Popularity

43.54K Popularity

36.52K Popularity

192.3K Popularity

News

View MoreA certain whale is 40x long on 377.14 BTC, with an average entry price of $88,030.3.

6 m

Capital B and TOBAM renew agreement for up to €300 million ATM issuance plan

8 m

Data: 2290.91 BTC transferred from an anonymous address, then routed through a relay and sent to another anonymous address

9 m

Pundi AI teams up with MemoLabs: Building the Data Foundation for Open AI

10 m

Base Meme Coin will not be "pumped"? Jesse Pollak openly states that manipulating prices may be illegal

10 m

Pin