Search results for "RAY"

The stock market hits new highs, so why are most people getting poorer? Ray Dalio: The market illusion under fiat currency devaluation

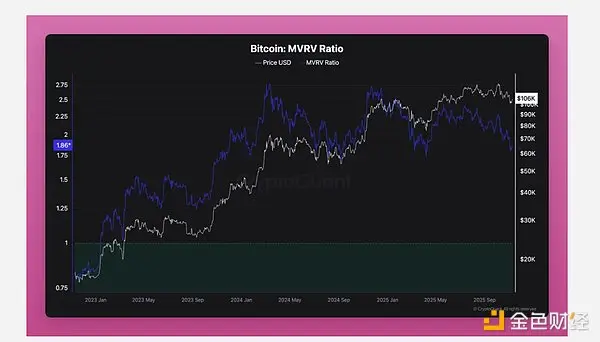

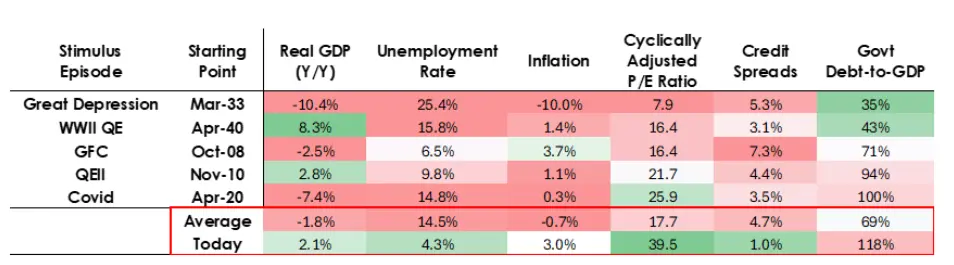

The main theme of 2025 is the victory of the US stock market, especially AI stocks. But the founder of Bridgewater Associates, Ray Dalio, has a completely opposite view. He believes that the biggest investment story of 2025 is not in stocks, but in the collapse of currency values and the change in asset pricing benchmarks. Ray Dalio chooses to review not just a single market or hot industry, but the entire "currency—debt—market—economy" machine and how it has operated over the past year.

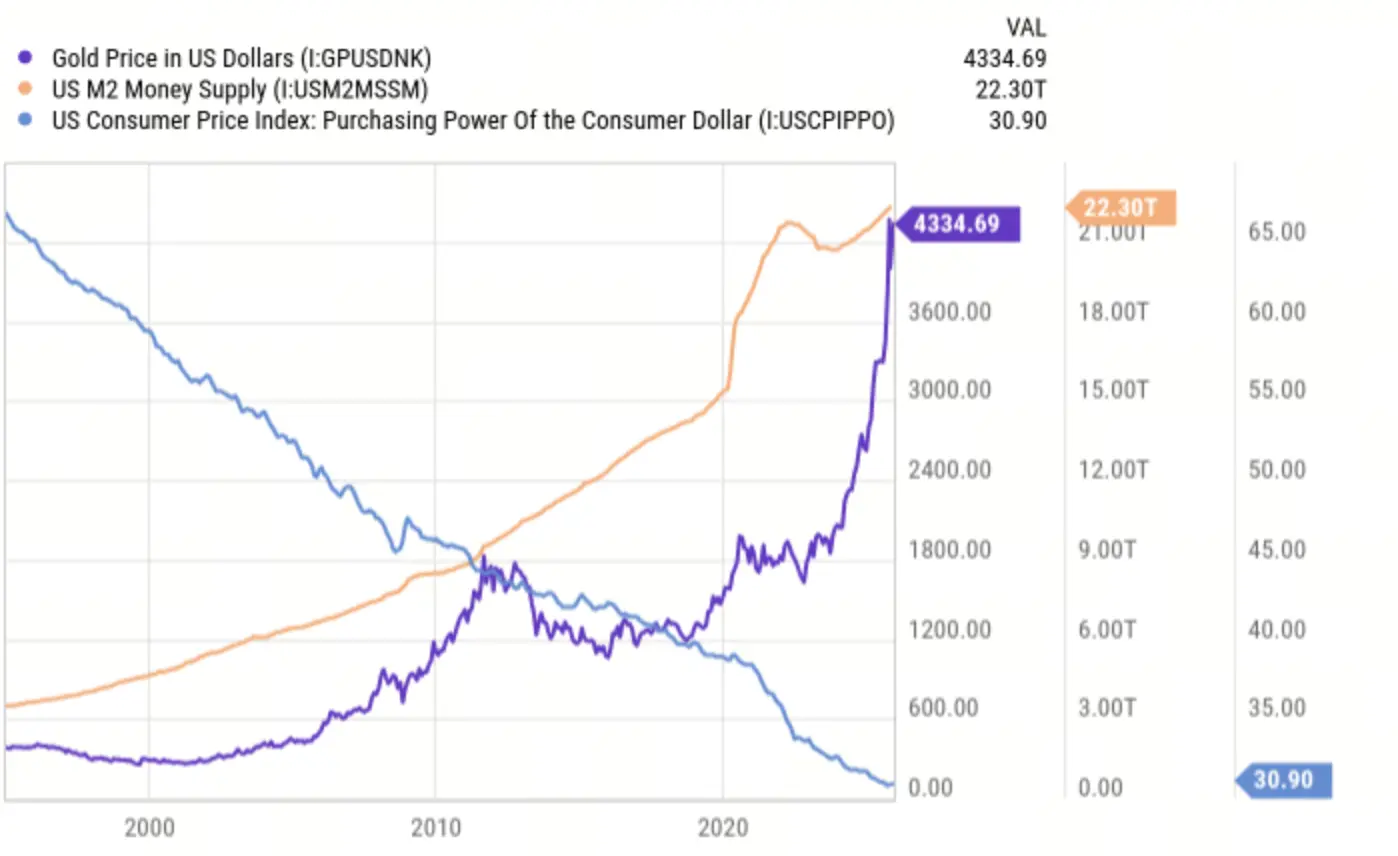

Although the stock market appears to perform well, if we switch from the US dollar standard to the gold standard, the US stock market has actually fallen by 28%. The US dollar has depreciated against gold by as much as 39%.

The biggest gain or loss in 2025: not stocks, but the value of money

Dalio points out that the most undeniable fact in 2025 is: all fiat currencies are depreciating, just at different speeds.

Taking the US dollar as an example, in 2025 the US dollar:

ChainNewsAbmedia·2h ago

Bridgewater's Dalio Annual Report: AI is in the early stage of a bubble. Why are US stocks underperforming non-US stocks and gold?

The world's largest hedge fund, Bridgewater Associates founder Ray Dalio, has released his annual reflection, pointing out that in 2025 the biggest winner will be gold rather than US stocks, as all fiat currencies are depreciating. He also warns that AI is in the early stages of a bubble and predicts that the five major forces—debt, currency, politics, geopolitics, and technology—will reshape the global landscape. This article is compiled, translated, and written by BitpushNews.

(Previous summary: Bridgewater's Dalio: My Bitcoin holdings have remained unchanged! Stablecoins are "not cost-effective" for preserving wealth)

(Additional background: Bridgewater's Dalio calls for dollar decline—"Gold is indeed safer": I feel the market is in a bubble)

Table of Contents

1. Changes in Currency Value

2. US Stocks Significantly Underperform Non-US Markets and Gold

3. Valuations and Future Expectations

4. Changes in Political Order

5. Global Order

動區BlockTempo·9h ago

Why Gold Could Cross $5,000 in 2026 – And How Much You Should Own, Inspired by Ray Dalio

Gold has delivered an extraordinary 67% gain in 2025, far outpacing its long-term average annual return of ~8%. With persistent inflation, ballooning government debt, and geopolitical uncertainty, I predict gold will cross the $5,000 per ounce milestone in 2026.

CryptopulseElite·2025-12-31 08:17

Dalio: Christmas Reflection on the Evolution of Principles and Their Game Theory

Author Ray Dalio discusses the importance of principles as core assets and the impact of the boundaries between good and evil on society. He believes that the lack of shared values leads to societal dilemmas, and individuals should pursue systemic optimality rather than local interests. Despite significant technological advancements, there is a need to reconstruct the principles system to achieve sustainable social development.

PANews·2025-12-30 09:09

The central bank does not loosen housing market regulations! How to interpret Yang Jinlong's statement that "real estate loans return to bank internal controls"? Is the New Youth Security 2.0 causing a stir?

The central bank once again maintains selective credit controls, with real estate experts warning that 2026 will enter a phase of price stagnation and capital dislocation.

(Previous background: Bridgewater founder Ray Dalio: Bitcoin is not as good as gold; central bank reserves will not choose it)

(Additional background: Full statement from the Bank of Japan: interest rate hike of 25 basis points, with consideration for further adjustments)

Table of Contents

Temporary easing? Actually regulatory upgrade?

2026 Scenario: Capital fasting and price stagnation

Real estate industry fears that if controls continue next year, capital dislocation could lead to a bloodbath.

On December 18, Taiwan’s central bank’s latest board meeting did not deliver the "Christmas gift" that the market was hoping for, but instead fully retained the seventh wave of selective credit controls.

Central Bank Governor Yang Jinlong emphasized that Taiwan’s housing market has not yet stabilized, pointing out that both bank loans and housing prices have not shown sufficient cooling.

The industry is currently

動區BlockTempo·2025-12-24 09:10

Central Bank will not hold a large amount of Bitcoin? Dalio points out two major structural issues: does not meet reserve demand

Ray Dalio pointed out that while Bitcoin has the potential as a store of value, its transparency, technology, and institutional risks make it difficult to become a core reserve asset for central banks, and its positioning still leans more towards being a hedging tool for individual investors.

Transparency and controllability become key, making it difficult for the Central Bank to incorporate Bitcoin into core reserves.

------------------------

Ray Dalio, the founder of Bridgewater Associates, recently stated in a podcast that even though Bitcoin has a fixed supply and is gradually being viewed as a store of value, the possibility of it being held on a large scale by Central Banks is still very low.

He pointed out that the problem is not whether Bitcoin has value, but that its structural characteristics do not meet the core requirements of the Central Bank for reserve assets.

Unlike gold, all Bitcoin transactions are recorded on a public blockchain, providing a high level of traceability. Governments can not only monitor the flow of transactions but may also intervene under specific circumstances.

CryptoCity·2025-12-24 01:06

2026 crypto market life and death tribulation! After the 57 billion ETF frenzy, can the demand continue?

In 2025, the cumulative net inflow of Spot Bitcoin ETF reached 57 billion USD, but after October, funds turned to outflows, with Bitcoin experiencing a big dump of 30% and Ether crashing by 50%. In 2026, the crypto market faced three major variables: The Federal Reserve (FED) cutting rates by 100 basis points, breakthroughs in U.S. legislation, and AI bubble risks. CoinTelegraph market chief Ray Salmond warned that the first quarter will determine whether the bull run continues or reverses.

ETH1,92%

MarketWhisper·2025-12-23 03:44

Ray Dalio Says Bitcoin Unlikely for Central Bank Holdings

Ray Dalio asserts that Bitcoin's transaction transparency and susceptibility to government interference hinder its adoption as a central bank reserve. He contrasts it with gold, which resists control, highlighting Bitcoin's vulnerabilities and regulatory risks.

BTC0,91%

CryptoFrontNews·2025-12-22 15:41

Bridgewater Fund's Ray Dalio: Bitcoin is inferior to gold, Central Banks will not choose it.

Ray Dalio, the founder of the world's largest hedge fund Bridgewater Associates, once again discussed the comparison between Bitcoin and gold. He admitted to holding a small amount of Bitcoin but pointed out that Bitcoin has structural flaws, making it less reliable than gold and more difficult to become the preferred reserve asset for central banks.

(Previous summary: Bridgewater's Dalio: My Bitcoin holding ratio has remained unchanged! Stablecoins are "not worth it" for preserving wealth)

(Background Supplement: Bridgewater's Dalio calls for dollar decline "Gold is indeed safer": I feel the market is in a bubble)

Global renowned hedge fund Bridgewater Associates founder Ray Dalio recently appeared on the podcast "WTF is" hosted by Nikhil Kamath, founder of the Indian online brokerage Zerodha.

BTC0,91%

動區BlockTempo·2025-12-22 13:00

Dalio: Central Banks Will Never Hold Bitcoin, 3 Fatal Flaws That Lose to Gold

Ray Dalio, the founder of Bridgewater Associates, stated that although Bitcoin is scarce and has monetary appeal, it is still not suitable for appearing on central bank balance sheets. He defined Bitcoin as a "spiritual currency," noting that its traceability, susceptibility to interference, and lack of sovereign control are characteristics that make central banks wary. In contrast, once gold is removed from traditional systems, it becomes harder for authorities to control, making it the preferred choice for central bank reserves.

MarketWhisper·2025-12-22 05:37

Capitulation Phase Unfolds: 5 Cryptos Offering 3x–5x Trade Setups This Month

Capitulation phases reduce leverage and often precede extended consolidation rather than immediate trend reversals.

QUBIC, TIA, SOL, XTZ, and RAY are trading near historically important structural levels.

Recovery scenarios remain dependent on liquidity conditions and

CryptoNewsLand·2025-12-22 02:26

Ray Dalio Says Bitcoin Unlikely for Central Bank Holdings

Ray Dalio asserts that Bitcoin's transaction transparency and susceptibility to government interference hinder its adoption as a central bank reserve. He contrasts it with gold, which resists control, highlighting Bitcoin's vulnerabilities and regulatory risks.

BTC0,91%

CryptoFrontNews·2025-12-21 15:36

Will silver continue to rise?

Author: Ray Dalio, Source: Dalio Vision

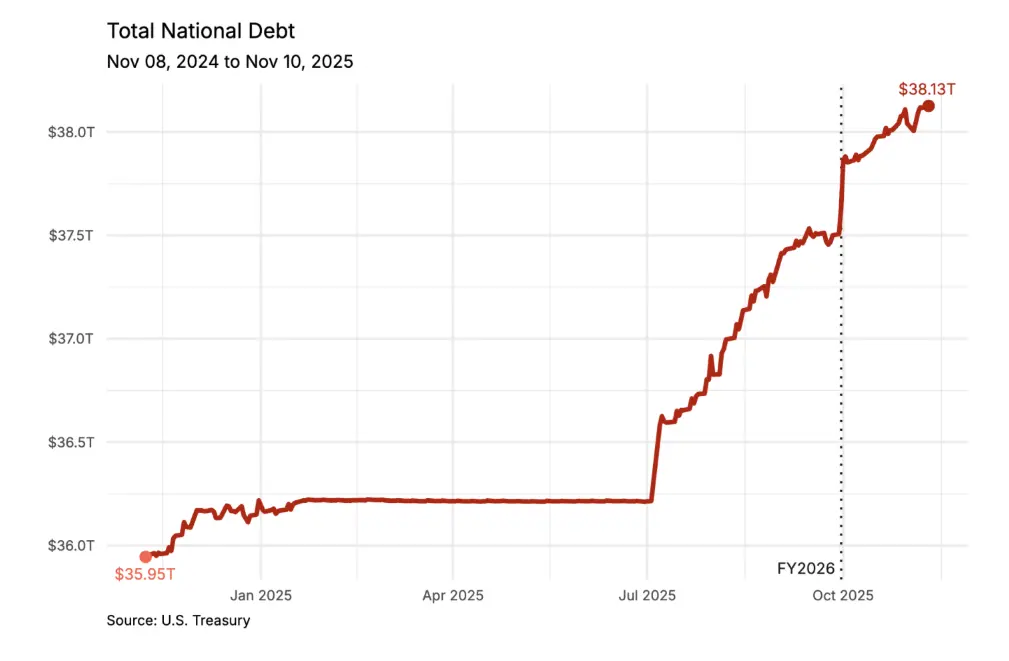

Trade between emerging powers is completely bypassing the US dollar. Meanwhile, the US fiscal situation is deteriorating. National debt has surpassed unsustainable levels, with interest payments already becoming one of the largest items in the budget. When the cost of maintaining debt exceeds productive capacity, history tells us that this cycle is entering its late stage. At that point, investors begin to look for an escape—something real, something scarce, something beyond government control. Silver is at the core of this shift. Unlike digital currencies, it cannot be created by tapping on a keyboard. Unlike fiat currency, it has no counterparty risk. Unlike bonds or stocks, its value does not depend on future promises. It is intrinsic.

The dual nature of silver and the silent shift

What makes silver unique now is that it is both a monetary metal and an industrial metal. As technology

金色财经_·2025-12-19 00:27

Elon Musk on "Trump's Nationwide Spending Spree": There will be no poverty in the future, so there's no need to save money.

Elon Musk responds to "Trump's account": AI will eliminate poverty, and the concept of saving money will disappear.

(Background: SpaceX pushes for an IPO! Musk's target is "a valuation of $1.5 trillion" with over $30 billion in fundraising)

(Additional context: Musk regrets it: The government efficiency department "has limited results," and if he could go back in time, he wouldn't do DOGE again)

Tesla founder Elon Musk on the 17th expressed his stance on the "Trump account" for children's donations on the X platform, stating that in the future, AI will eliminate poverty, and "there will be no need to save money anymore."

The full story

The "Trump account" is a children's savings plan launched by the U.S. Treasury Department in 2025. Children born from 2025 to 2028 will receive a seed fund of $1,000, locked into an index fund until adulthood. Recently, Ray Dalio, founder of Bridgewater Associates,

TRUMP1,06%

動區BlockTempo·2025-12-18 09:25

Ray Dalio Matches Donations for Connecticut Children's Savings

Ray Dalio is matching $250 donations for Connecticut children through the Trump Accounts initiative, promoting financial literacy and savings. His initiative aims to provide children with early insights into financial education and the importance of wealth accumulation.

RAY9,15%

CoincuInsights·2025-12-18 08:33

Ray Dalio Endorses Bitcoin as a Portfolio Hedge Against Fiat Devaluation

Ray Dalio supports investing in Bitcoin, suggesting up to 15% of portfolios should include it and gold as protection against fiat devaluation. His approach focuses on macroeconomic risks, positioning Bitcoin as a digital gold for stability among conservative investors.

BTC0,91%

Coinfomania·2025-12-17 12:04

Top 5 Altcoins Set to Outperform As the 2016/2017 Cycle Repeats—But At Double the Pace

The current altcoin cycle mirrors 2016-2017 but is accelerating rapidly. Tokens like TEL, BNB, and CELO demonstrate stability, while RAY and QNT maintain strong momentum, driven by user engagement and network activity. Analysts suggest cautious optimism for future growth.

CryptoNewsLand·2025-12-14 00:55

Dalio: The global economy will be "on the brink" in the next two years; don’t rush to exit just because AI valuations are too high.

Written by: Bao Yilong

Source: Wallstreetcn

Bridgewater founder Ray Dalio has warned that the global economy will face dangerous conditions in the next one to two years, but he advises investors not to rush out of AI investments just because of high valuations, and instead to focus on substantive signals of a bubble bursting.

In an interview with CNBC on Monday, Dalio said that the current market has shown cracks in multiple areas—including private equity, venture capital, and the refinancing debt sector—due to the overlapping impact of three cycles: debt, political conflict, and geopolitics.

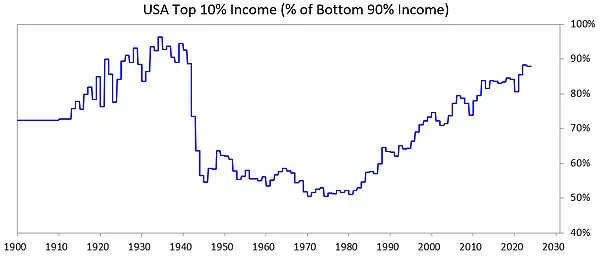

Dalio pointed out that the global debt burden has started to put pressure on parts of the market, and that governments are caught in fiscal distress, unable to raise taxes or cut benefits. This structural conflict is intensifying domestic political polarization, and the rise of both left-wing and right-wing populism means irreconcilable differences.

With the 2026 US midterm elections approaching, Dalio expects political conflict to further intensify

DeepFlowTech·2025-12-09 02:01

Dalio warns: The global economy is "on the brink" in the next two years; don't rush to exit due to AI overvaluation

Ray Dalio, founder of Bridgewater Associates, warns that the global economy will face dangerous conditions over the next one to two years due to the combined impact of debt, political conflict, and geopolitical cycles. He advises investors not to rush out of AI investments solely because of overvaluation, but to pay attention to substantial signals of a bubble bursting. This article is sourced from Wallstreetcn and compiled, translated, and written by ForesightNews. (Previous background: Bridgewater’s Dalio: I own Bitcoin, but it only accounts for 1% of my portfolio; BTC will never become a sovereign reserve currency.) (Additional background: Bridgewater’s Dalio: My Bitcoin holdings ratio has never changed! Stablecoins are “not cost-effective” for preserving wealth.) Dalio believes that although there are already signs of a bubble in the AI industry, it is important to focus on the catalysts that could burst the bubble—such as monetary tightening or forced asset sales to meet debt obligations. Dalio warns that in the next one to two years, the global economy

BTC0,91%

動區BlockTempo·2025-12-09 01:59

Bridgewater's Ray Dalio: Taiwan is a long-term structural issue and will not become a trigger point for US-China conflict in the short term.

Bridgewater Associates founder Ray Dalio was recently invited to speak and participate in a discussion at the Oxford Union in the UK, focusing on changes in the global order, debt cycles, the rise and fall of great powers, and the impact of technology. When it came to US-China relations, the host brought up one of the main concerns of the public: Taiwan. In his response, Dalio did not make any emotional comments. Instead, he approached the topic from the perspective of his long-term research on historical cycles and Chinese political culture, explaining Taiwan's place in the Chinese mindset and assessing whether Taiwan is currently likely to become the flashpoint for a military conflict between the US and China.

Background of connecting with China: to understand Taiwan, you must first understand China

Dalio reflected on his initial experiences traveling to China in the mid-1980s, describing how his early curiosity evolved through exchanges with local leaders and historians, gradually leading him to understand how China views the world. He emphasized that in order to understand how modern China regards Taiwan, it is essential to first recognize its political...

ChainNewsAbmedia·2025-12-05 09:57

Hidden Bullish Divergence Signals Massive Altcoin Rally — Top 5 Coins to Watch As December Comes ...

Hidden bullish divergences in RAY, ENA, CRV, VET, and HBAR suggest potential for substantial December gains.

Consolidation near key support levels across these altcoins reinforces structural strength and potential upward momentum.

Volume trends combined with momentum indicators highlight

CryptoNewsLand·2025-12-04 03:34

Fei-Fei Li talks about the next step for LLM: AI must possess "spatial intelligence" to understand the real world. How does Marble achieve this?

Fei-Fei Li, the founder of World Labs and renowned as the "AI Godmother," accepted an interview to discuss how AI needs to go beyond language and develop "spatial intelligence" so that machines can truly understand and construct the 3D physical world. (Background: a16z's former partner released a significant tech report: How AI is consuming the world?) (Context: Ray Dalio from Bridgewater: It is still too early to sell AI stocks! Because the "long wick candle" that will burst the bubble has not yet entered the scene.) At a time when large language models are sweeping the globe, Fei-Fei Li, a Stanford University professor hailed as the "AI Godmother," has already turned her attention to the next frontier of artificial intelligence: spatial intelligence. After leaving Google Cloud, Fei-Fei Li founded the highly anticipated startup World Labs and launched the first global model.

動區BlockTempo·2025-11-30 10:14

How did Taiwan's "19-year-old Coin God" earn a net worth of over 100 million? From trading shipping stocks with 3000 USD to going All in on Trump coin and Hyperliquid.

19-year-old Taiwanese high school student Ray entered the financial market with $3,000, experiencing Get Liquidated and switching to NFT, ultimately achieving wealth growth through TRUMP coin and Hyperliquid during the bull run of 2024-2025. His success stems from understanding the market and risk control, emphasizing the importance of protecting principal. Ray advises young people to start with their interests, gradually accumulate experience, and prioritize health and stability.

動區BlockTempo·2025-11-28 18:22

Perplexity global downloads big dump by 80%! Three major factors extinguished the "AI version of Google" rise myth.

The first giant about to fall in the AI competition? Renowned investor Sasha Kaletsky recently revealed the latest statistics on the X platform, indicating that Perplexity AI, dubbed the "Google of AI," has seen its global app downloads plummet by about 80% over the past six weeks. (Background: A heavy tech report from a16z: How AI is devouring the world?) (Additional context: Ray Dalio: It's still too early to sell AI stocks! Because the "long wick candle" that will burst the bubble hasn't come into play yet.) Renowned investor Sasha Kaletsky recently revealed the latest statistics on the X platform, indicating that Perplexity AI, dubbed the "Google of AI," has seen its global app downloads plummet by about 80% over the past six weeks. This statistical period is from October 2025.

BERA1,76%

動區BlockTempo·2025-11-27 18:07

Data: DCR falls over 13% in 24 hours, VOXEL falls over 15%

According to Mars Finance news, data from Binance Spot shows that the market has experienced significant fluctuations. DCR has fallen by 13.12% in the last 24 hours, and VOXEL has fallen by 15.82%, showing a "high and then low" state. In addition, HBAR, RAY, SNX, and FLUX also exhibited a "high and then low" state, with declines of 7.97%, 7.15%, 11.45%, and 8.17%, respectively. Meanwhile, NTRN has seen a slight rise within 5 minutes, with an increase of 3.37%.

MarsBitNews·2025-11-24 14:45

Ray Dalio Flags Bitcoin Risks as CZ Reacts to 1% Holdings

Dalio keeps Bitcoin at 1% due to traceability, quantum risks and its failure to meet reserve-currency standards.

He views Bitcoin as digital gold, not a core strategy and has no plans to increase his long-held allocation.

CZ’s reaction added public interest, but Dalio’s stance stays cautious

CryptoFrontNews·2025-11-23 13:03

Bitcoin is unlikely to become the global reserve currency! Dalio: Will eventually be cracked by quantum computers

The founder of the world's largest hedge fund, Bridgewater, Ray Dalio, has offered a conservative view on the future role of Bitcoin. Although he holds a small amount of Bitcoin long-term, he believes that due to structural flaws, Bitcoin is unlikely to become a globally adopted reserve currency by governments. Dalio explicitly stated that if Bitcoin is to become a global reserve asset, it still faces insurmountable obstacles, with "traceability" and "quantum computing threats" being the most critical.

ETH1,92%

MarketWhisper·2025-11-21 08:21

Ray Dalio: The Great Risks of Massive Bubbles and Wealth Gaps

Author: Ray Dalio

Although I remain an active investor with a passion for investing, at this stage of my life, I am also a teacher, striving to pass on what I have learned about how the real world operates and the principles that help me navigate reality. Having been engaged in global macro investing for over 50 years and drawing numerous lessons from history, the content I share naturally relates closely to these experiences.

This article will cover:

1. The most important differences between wealth and money, and

2. How this difference drives bubbles and crashes, and

3. How this dynamic, when accompanied by massive wealth gaps, can burst bubbles, leading to destructive crashes not only in the financial realm but also on social and political levels.

Understanding the difference between wealth and money and their relationship is very important, especially: 1) when financial wealth relative to the amount of money

金色财经_·2025-11-21 07:11

Ray Dalio discloses allocating 1% to Bitcoin but warns of its difficulty in bearing the heavy responsibility of national reserves

Billionaire investor Ray Dalio recently stated in an interview with CNBC that Bitcoin cannot become a reliable national reserve currency due to technical vulnerabilities and price volatility. He particularly emphasized that the development of quantum computing could pose a threat to Bitcoin's encryption system, while also revealing that his personal investment portfolio allocates approximately 1% to Bitcoin.

Dalio reiterated the safe-haven value of gold during debt crises and warned that major economies such as the United States, the United Kingdom, and France are facing financial imbalances caused by excessive government debt issuance. This statement comes amid a backdrop where the total global cryptocurrency market capitalization has fallen over 30% from its peak, providing a new perspective on the ongoing debate between traditional finance and digital asset store of value.

BTC0,91%

MarketWhisper·2025-11-21 05:11

Ray Dalio: The big bubble and the widening wealth gap are leading to greater dangers.

Author: Ray Dalio

Compiled by: Deep Tide TechFlow

Although I am still an active investor addicted to investment games, at this stage of my life, I also bear the role of a teacher, trying to impart my understanding of how reality works and the principles that help me cope with challenges. As a global macro investor, I have over 50 years of experience and have drawn many lessons from history, so most of what I share is naturally related to this.

This article mainly discusses the following points:

The important distinction between wealth and money;

How this distinction drives the formation and bursting of bubbles;

This dynamic, accompanied by a huge wealth gap, may burst the bubble, leading not only to a financial collapse but also possibly triggering severe social and political turmoil.

It is crucial to understand the difference between wealth and money and their relationship, especially the following two points:

When the scale of financial wealth is compared to

RAY9,15%

DeepFlowTech·2025-11-21 04:02

Billionaire Ray Dalio Issues Dire Bubble Warning as Wealth Gaps and Fiscal Strain Deepen

A looming financial shock is taking shape as overstretched valuations, tightening liquidity, and widening wealth gaps converge into a high-risk setup that threatens to unleash a rapid and destabilizing

BTC0,91%

Coinpedia·2025-11-21 02:41

Ray Dalio Owns Bitcoin. He’s Still Nervous About Quantum Computing, Central Bank Adoption.

In brief

Ray Dalio reiterated his stance on gold against Bitcoin

Advances in quantum computing could hurt the digital asset, he said.

The precious metal doesn't rely on anyone or anything, he added.

Decrypt's Art, Fashion, and Entertainment Hub.

Discover SCENE

Bitcoin was built

BTC0,91%

Decrypt·2025-11-20 20:54

Bridgewater's Dalio: I have Bitcoin, but it only accounts for 1% of my portfolio; BTC will never be a sovereign national reserve currency.

Ray Dalio, the founder of the world's largest hedge fund Bridgewater Associates, stated in an interview with CNBC's Squawk Box on November 20 that his Bitcoin holdings account for only 1% of his investment portfolio, and he reiterated his long-term concerns about this asset. (Background: Dalio of Bridgewater Fund says the U.S. debt crisis is about to explode, suggesting to allocate 15% of assets to "gold and Bitcoin") (Additional context: Dalio of Bridgewater Fund claims that the dollar is declining and "gold is indeed safer": I feel that the market has become bubbly.) Ray Dalio, the founder of the world's largest hedge fund Bridgewater Associates, stated in an interview with CNBC's Squawk Box on November 20 that his Bitcoin holdings.

BTC0,91%

動區BlockTempo·2025-11-20 15:25

5 Altcoins Gaining Momentum Slowly but Steadily — Analysts See 120% to 300% Upside Before 2026

Analysts observe steady accumulation patterns across CELO, RAY, ENA, CRV, and VET, signaling renewed market confidence.

Slow trend shifts indicate improving liquidity conditions and increased network activity across several blockchain ecosystems.

Metrics suggest possible 120%–300% upside if

CryptoNewsLand·2025-11-19 23:23

Data: LTC rise over 29%, GAS reaches today's new high

Mars Finance reported that the market has shown significant fluctuations recently, with LTC rising 29.12% to reach a new monthly high, and GAS rising 5.88%. 1INCH and AUCTION have seen a decline, falling 10.47% and 5.1% respectively. BAT, RAY, UNI, and ZEN have rebounded, rising 7.25%, 5.26%, 5.74%, and 29.12% respectively, while ICX has risen 5.33% to reach a new high for today.

LTC2,45%

MarsBitNews·2025-11-15 04:17

America strengthens acquisition of debt amid warnings of an "economic heart attack" from Ray Dalio

The U.S. Treasury plans to buy up to $500 million in TIPS to manage national debt growth, amid warnings from Ray Dalio about potential economic crises due to excessive budget deficits and looming financial instability.

TapChiBitcoin·2025-11-13 10:45

Major Rotation: BTC Wins, What Happens to ETH, Solana, and Alts?

Author: Ignas Translator: Shan Ouba, Golden Finance

In the previous article, I referred to this phenomenon as the Great Rotation, but there is little detailed information that can clearly explain its impact. As Ray Dalio might say, this phenomenon is common in other industries, but it has never occurred in the development history of cryptocurrency.

Traditional finance practitioner Jordi Visser provided the best explanation for this: BTC wins, early BTC believers are cashing out their profits.

This is not a panic sell-off, but a natural transition of ownership from concentration to decentralization. Among all traceable on-chain metrics, whale sell-offs are a key signal.

Long-term holders sold 405,000 BTC in just 30 days, accounting for 1.9% of the circulating supply.

by Owen

金色财经_·2025-11-13 08:48

Billionaire Investor Ray Dalio Labels Gold a 'Uniquely Good Diversifier,' Urges Investors to Ride the Wave

Dalio, known as a gold advocate for its safe‑haven properties, says the precious metal is uniquely positioned to serve as a diversifier because it is the most widely used non‑fiat medium of exchange and tends to perform well when fiat currencies falter.

Ray Dalio Gives His Take on Gold, States

Coinpedia·2025-11-10 13:16

Ray Dalio warns: The Federal Reserve is stimulating the economy in a bubble and needs to leave before the "Liquidity frenzy" ends.

Ray Dalio, the founder of Bridgewater Associates, has once again issued a warning, pointing out that the Federal Reserve (FED) is restarting quantitative easing (QE) under the circumstances of high asset creation and persistent inflation, which can be described as "stimulating in a bubble." He believes that the United States is entering the final stage of a 75-year "great debt cycle," and the ultimate cost may be significant.

Dalio's final signal: The Federal Reserve's monetary easing shifts from "saving the market" to "boosting prices"

In his latest long article "Stimulating Into a Bubble (" Dalio pointed out that The Federal Reserve (FED) has ended quantitative tightening ) QT( and initiated QE. Although it is falsely claimed to be a technical operation, it is in fact substantial easing, indicating that the debt cycle is entering its final stage. He emphasized:

When QE occurs during high asset prices, loose credit, and still high inflation, it is not stimulating a recession, but rather stimulating a bubble.

He stated

ChainNewsAbmedia·2025-11-07 08:15

Ray Dalio warns that the Fed is stimulating the economy into a bubble.

Ray Dalio warns that the Federal Reserve's monetary policy easing may inflate an economic bubble, signaling the end of a 75-year economic cycle. This occurs amidst low unemployment and high growth, creating a potentially dangerous inflationary environment.

BTC0,91%

TapChiBitcoin·2025-11-07 00:19

Ray Dalio warns the Federal Reserve about the risk of "blowing bubbles": gold and Bitcoin may face a crash, and investors should consider exiting when the time is right.

Bridgewater Associates founder Ray Dalio has issued a stern warning regarding the Federal Reserve's announcement to halt quantitative tightening (QT) and shift toward balance sheet maintenance. He believes this move marks the beginning of a dangerous cycle from "tightening to easing," which could lead to explosive gains in assets like gold and Bitcoin before an inevitable bubble burst by the end of 2025. Dalio emphasized that the current economic environment is vastly different from previous quantitative easing (QE) periods, with asset prices already significantly overvalued.

BTC0,91%

MarketWhisper·2025-11-06 12:36

Ray Dalio's latest post: This time is different — the Federal Reserve is fueling the bubble.

Author: Ray Dalio

Translation: Golden Ten Data

On November 5th, local time, Bridgewater Associates founder Ray Dalio posted on social media, sharing his views:

Have you noticed that the Federal Reserve announced it will stop quantitative tightening (QT) and begin quantitative easing (QE)?

Although this has been described as a “technical operation,” it is nonetheless an easing measure. This is one of the indicators I (Dalio) use to track the progress of the “big debt cycle” dynamics I described in my previous book, and it warrants close attention. As Chairman Powell said, “…at some point, you want reserves to start gradually increasing to keep pace with the size of the banking system and the economy. So, at some point, we will increase reserves…” How much they will increase will be a key point to watch.

Given the Federal Reserve’s actions...

DeepFlowTech·2025-11-06 06:53

Billionaire Ray Dalio: Gold is still the "safest currency", Bitcoin stands aside.

Vương Tiễn

BTC0,91%

TapChiBitcoin·2025-11-02 10:08

Raydium (RAY) Price Steadies Above $1.73 Support Targeting Recovery Toward $2.00

Raydium (RAY) remains above key $1.73 support awaiting the next major market direction.

Liquidity stands strong at $18.66 million, with consistent daily trading volume showing robust activity from decentralized and centralized exchange participants.

Raydium continues to anchor Solana’s DeFi

RAY9,15%

CryptoFrontNews·2025-11-01 02:47

RAY Ready to Ignite? Raydium’s $2 Resistance Could Spark a Bullish Comeback

Raydium (RAY) is showing signs of a bullish reversal, currently consolidating near $1.80. Strong Q3 results and a potential breakout above $2.00 could signal renewed momentum, though caution remains until trading volume increases.

CryptoFrontNews·2025-10-29 00:47

Controlled Crypto Collapse? The U.S. and Binance at the Heart of a Dark Power Game

While the United States under Donald Trump publicly promotes cryptocurrency adoption — from the GENIUS Act to promises of making America the “crypto capital of the world” — some insiders warn that a darker strategy may be unfolding behind the scenes.

According to Ray Youssef, CEO of the

Moon5labs·2025-10-28 05:59

Ray Dalio, founder of Bridgewater Associates: A 15% allocation to gold is the best choice for most people.

Author: Ray Dalio, Founder of Bridgewater Associates

Compiled by: White55, Mars Finance

Recently, gold prices have surged, with the spot price of London gold reaching a high of 4380.79 USD/oz during trading, an increase of over 60% since the beginning of this year. In response, Ray Dalio, the founder of Bridgewater Associates, recently posted on X platform to share his views on gold. Below is the full content.

Thank you all for the wonderful questions about gold. I will do my best to answer them and share my responses in this article.

1. You seem to have a different view on gold and its price compared to most people. What is your perspective on gold?

You are right. I believe that most people make a mistake by considering gold as a metal rather than the most mature form of currency, treating fiat currency as money rather than debt, and thinking that the creation of fiat currency is to prevent debt.

MarsBitNews·2025-10-20 09:07

Bridgewater founder Dalio: A 15% allocation to gold is the best choice for most people.

Author: Ray Dalio, Founder of Bridgewater Associates

Compiled by: Felix, PANews

Recently, gold prices have soared, with the spot price of London gold reaching a maximum of 4380.79 USD/ounce during the trading session, accumulating over 60% increase since the beginning of this year. In response, Ray Dalio, the founder of Bridgewater Associates, recently posted on X platform to share his views on gold. Below is the full content.

Thank you all for the wonderful questions about gold. I will do my best to answer them and share my responses in this article.

1. You seem to have a different perspective on gold and its prices compared to most people. How do you view gold?

You are right. I think most people make a mistake by treating gold as a metal rather than the most mature form of currency, treating fiat currency as money rather than debt, and believing that the creation of fiat currency is to prevent debt.

PANews·2025-10-20 08:28

Billionaire Investor Ray Dalio Labels Gold a "Uniquely Good Diversifier," Urges Investors to Ride the Wave

Dalio, known as a gold advocate for its safe‑haven properties, says the precious metal is uniquely positioned to serve as a diversifier because it is the most widely used non‑fiat medium of exchange and tends to perform well when fiat currencies falter.

Ray Dalio Gives His Take on Gold, States

Coinpedia·2025-10-19 08:36

Load More