Search results for "FLOW"

Gate 研究院:RENDER 涨逾 66%,Polymarket Builders 交易量新高|Gate VIP 周报

Last week's market overview shows that BTC and ETH are gradually recovering, with a clear influx of funds. Tokens such as RENDER, PEPE, and BONK have experienced significant gains. On-chain capital flows are diverging, with steady capital allocation centered around Ethereum continuing to flow back, and Polymarket Builders trading volume reaching new highs. The report will provide an in-depth analysis of market dynamics and technical trends.

GateResearch·4h ago

Ethereum spot ETF net inflow of $168.13 million... cumulative total has increased to $12.67 billion

The US Ethereum spot ETF market continues its net inflow trend.

According to SoSoValue data, on January 5 local time, the US Ethereum spot ETF market achieved a single-day net inflow of $168.13 million.

Following the previous trading day (January 2, net inflow of $174.43 million), funds have maintained inflows for two consecutive days, with the total net inflow expanding to $12.67 billion.

On that day, capital inflows were concentrated in large products. ▲BlackRock ETHA ($102.9 million) ▲Grayscale Mini ETH ($22.34 million) ▲Fidelity FETH ($21.83 million) ▲Bitwise ETHW ($19.73 million) ▲Grayscale ETHE ($1.32 million), a total of 5 ETFs confirmed net inflows, while the other 4 products saw no change in fund flow.

The total transaction volume recorded $2.24 billion, similar to the level of the previous trading day ($2.28 billion).

TechubNews·7h ago

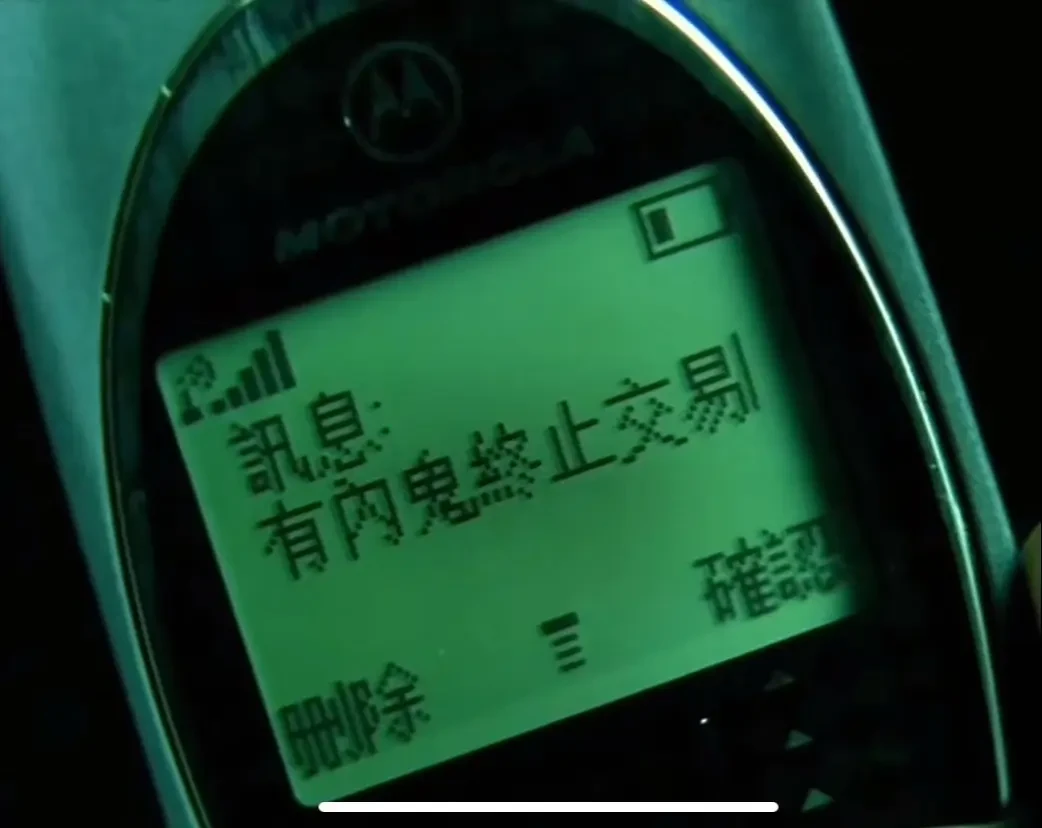

Mingxiang Garden and Dongyin Quick Knife Shop Owner Involved in Money Laundering Profits of 300 Million: Full Analysis of Restaurant, Gambling, and Money Laundering Processes

Well-known tea restaurant owner Luo Yixiang is suspected of operating money laundering and gambling websites under the restaurant's name, involving a cash flow of 30.6 billion yuan, with personal profits exceeding 300 million yuan. Prosecutors have indicted him and 35 co-conspirators and are requesting heavy sentences. A large amount of cash, virtual currency, and real estate have been seized.

ChainNewsAbmedia·9h ago

[Spot ETF] XRP inflow of $46.1 million · SOL inflow of $16.24 million

In the US major altcoin spot ETF market, capital inflows centered around XRP and Solana continue, with the temperature difference between assets becoming increasingly apparent.

According to SosoValue statistics, as of January 5 (local time), the US XRP spot ETF market experienced a total of $46.1 million in single-day net inflows.

Since January 29, it has maintained inflows for five consecutive trading days, with the total net inflow expanding to $1.23 billion.

▲Bitwise XRP ($16.61 million) ▲Franklin XRPZ ($12.59 million) ▲Grayscale XRP ($9.89 million) ▲21Shares XRP ($7.01 million) — these four products confirmed net inflows, while the remaining one showed no capital flow changes.

The total trading volume is $72.15 million, and the total net asset value of XRP spot ETFs is 16

TechubNews·9h ago

Tether does not promote USDT, instead invests in SQRIL! Cross-border QR payment infrastructure layout exposed

Stablecoin giant Tether invests in Southeast Asia cross-border payment startup SQRIL, but without any wallet products or USDT flow-through. SQRIL focuses on creating an API-based payment exchange layer that allows banking apps in different countries to directly scan and pay for other countries' QR codes. Users pay in their local currency, and merchants receive the local currency instantly. Currently, it supports the Philippines, Vietnam, and Indonesia, and the entire process does not involve cryptocurrencies.

MarketWhisper·11h ago

The veteran blockchain summit "NFT Paris" announces its cancellation, and the community complains that sponsors are unable to get refunds.

On January 5th, Paris time, the NFT Paris event, originally scheduled to be held at the Villette Hall and having built a four-time reputation, announced its cancellation. The 20,000 tickets along with hundreds of sponsor booths suddenly became worthless. The organizers attributed the decision to a "market crash," undoubtedly putting the NFT sector on pause and writing a calm New Year’s memo for the Web3 ecosystem in 2026.

(Background: Bear market NFT comeback! Fat penguin on the Las Vegas sphere: What phenomena are we seeing?)

(Additional background: Flow has shifted to DeFi, the former top-tier NFT momentum and dilemma)

Table of Contents

The refund dilemma highlights liquidity limits

Bitcoin rises, NFTs fall: decoupling intensifies

After the bubble bursts, where does Web3 go from here?

FLOW10,71%

動區BlockTempo·12h ago

2026 Year-start Capital Reflow: Strong Buying Momentum for Bitcoin and Ethereum ETFs

Bloomberg analyst James Seyffart analyzed the fund flow trends of Bitcoin and Ethereum ETFs over the past year. Despite experiencing a challenging period for crypto ETFs at the end of 2025, they still demonstrated relative resilience and saw significant capital replenishment at the start of 2026.

Bitcoin ETF Shows Strong Resilience with Significant Capital Replenishment on the First Day of the New Year

Although from November to December 2025, the U.S. Bitcoin spot ETF experienced net outflows exceeding $6 billion, drawing market attention. However, according to data from Bloomberg analyst James Seyffart, this outflow accounted for less than 10% of the peak inflows of $62 billion in October of the same year. This indicates that most investors still prefer long-term holding, and the year-end outflows are more likely due to tax planning rather than trend reversals.

ETH4,21%

ChainNewsAbmedia·12h ago

The only neutral country in Central Asia: Turkmenistan announces that cryptocurrency mining and trading are legal. What does this imply?

Turkmenistan legalizes crypto mining and trading on New Year's Day, adopting a licensing system approved by the central bank, without recognizing its payment status. The policy shift aims to attract foreign investment through energy advantages and to control financial risks.

Turkmenistan is the only neutral country in Central Asia. On New Year's Day, it officially legalized cryptocurrency mining and trading activities, establishing a licensing system regulated by the central bank. This policy signifies a major change in Turkmenistan's national economic strategy. According to recent reports, the law incorporates virtual assets into civil law, allowing registered and approved enterprises and individuals to participate in cryptocurrency mining and trading. However, it still does not recognize cryptocurrencies as a means of payment, legal tender, or securities. Domestic internet and information flow remain under strict government control. Why is Turkmenistan gradually opening up to cryptocurrency mining and trading? The following is an analytical report.

Turkmenistan's Energy Resources and Mining Costs Connection

--------------

CryptoCity·13h ago

Why do institutions favor stablecoins becoming part of FinTech 4.0?

Financial technology has changed the way financial products are accessed over the past 20 years but has not altered the flow of capital. Stablecoins are breaking this pattern by enabling fintech companies to shift from "leasing bank APIs" to "owning financial infrastructure" through permissionless open networks, significantly reducing costs and enabling specialized services. This article is based on a piece by Spencer Applebaum, organized, compiled, and written by Techflow.

(Previous context: South Korea temporarily halts "Won stablecoin," missing the Asian first launch; banks and the Financial Services Commission are at odds)

(Additional background: People's Bank of China Governor Pan Gongsheng: Insist on cracking down on cryptocurrencies! Stablecoins are still in the early stages of development, with a strong push for digital RMB development)

Table of Contents

Fintech 1.0: Digital Distribution (2000-2010)

Fintech 2.0: The New Banking Era

動區BlockTempo·01-05 08:40

Why do institutions favor stablecoins becoming part of FinTech 4.0?

Financial technology has changed the way financial products are accessed over the past 20 years but has not altered the flow of capital. Stablecoins are breaking this pattern by enabling fintech companies to shift from "leasing bank APIs" to "owning financial infrastructure" through permissionless open networks, significantly reducing costs and enabling specialized services. This article is based on a piece by Spencer Applebaum, organized, compiled, and written by Techflow.

(Previous context: South Korea temporarily halts "Won stablecoin," missing the Asian first launch; banks and the Financial Services Commission are at odds)

(Additional background: People's Bank of China Governor Pan Gongsheng: Insist on cracking down on cryptocurrencies! Stablecoins are still in the early stages of development, with a strong push for digital RMB development)

Table of Contents

Fintech 1.0: Digital Distribution (2000-2010)

Fintech 2.0: The New Banking Era

動區BlockTempo·01-05 08:34

Crypto VC Outlook 2026: A Shift in the Winds! Funds Will Flow Into These Three "Certain" Tracks

After experiencing the rollercoaster of 2025, the crypto venture capital market is standing at a critical crossroads. Although the total traditional VC investment has rebounded to $18.9 billion, the number of deals has plummeted by approximately 60% year-over-year, with funds highly concentrated in later-stage projects and DAT companies. Looking ahead to 2026, top investors generally expect the market to continue its rationality and discipline, with early-stage investments only experiencing a mild recovery, and token sales serving as a supplementary fundraising method. This article will delve into the underlying logic behind capital flows and reveal the certainty tracks and potential risks that institutions see in the coming year.

MarketWhisper·01-05 05:21

Elon Musk supports increasing X creators' revenue share! Aiming to surpass YouTube and compete for content creators

Elon Musk publicly supports increasing X creator revenue share, combined with X Money and payment flow layout, indicating that the platform is shifting towards using revenue sharing incentives to attract high-quality content, directly challenging YouTube.

Elon Musk publicly states support for increasing creator revenue share

-------------------

Recently, the social platform X has been rumored to significantly adjust its creator revenue sharing policy, attracting high industry attention. The cause was a suggestion from a user on the platform, proposing that if X wants to attract more original content, it should pay creators a higher revenue share than YouTube.

In response, X CEO Elon Musk (Elon Musk) rarely personally commented, clearly expressing support for the direction of "increasing revenue share," while emphasizing that the revenue sharing system must be based on the premise of "fairness and enforceability." This statement was interpreted by the outside world as a possible shift in X's content strategy.

CryptoCity·01-05 02:35

Why will 90% of prediction markets not survive until the end of 2026?

Author: Azuma, Odaily Planet Daily

In the past two days, there has been a lot of discussion on X about the formula Yes + No = 1 in prediction markets. The origin can be traced back to a detailed analysis of Polymarket's shared order book mechanism written by the influential DFarm (@DFarm\_club), which resonated emotionally with the community about the power of mathematics — the original article titled "A Comprehensive Explanation of Polymarket: Why Must YES + NO Equal 1?" is highly recommended.

In subsequent discussions, several influential figures, including Blue Fox (@lanhubiji), mentioned that Yes + No = 1 is another minimalist yet powerful formula innovation following x \ y = k, with the potential to unlock a trillion-dollar-scale information flow trading market. I fully agree with this, but

PANews·01-04 13:36

Why hasn't the $1 billion USD ETF XRP yet made a breakthrough for the market?

The XRP spot ETF funds have surpassed the $1 billion USD assets under management (AUM), with a total of approximately $1.14 billion USD allocated across 5 issuing organizations. The total net capital flow since November 14th is currently around $423.27 million USD.

On the same CoinGlass data table, XRP is trading around $1.88 USD, with a market capitalization reaching a...

TapChiBitcoin·01-04 03:07

Coin issuance funds flow in but hide a deadly signal! $0.214 becomes the critical threshold between bulls and bears

The recent trend of Pi Coin shows contradictions: the Crypto Money Flow Index (CMF) has risen above the zero line indicating continuous capital inflow, but from December 19 to January 3, the price made a lower high while the RSI made a higher high, forming a hidden bearish divergence. Pi Coin is currently facing strong resistance at $0.214, and a breakout could challenge $0.226. Falling below $0.207 would test the key support at $0.199.

MarketWhisper·01-04 02:48

Bitcoin whale hoarding is a false illusion! Internal exchange maintenance was misinterpreted; December was actually a net sell-off.

CryptoQuant Research Director Julio Moreno revealed on January 2nd that recent on-chain signals interpreted as "Bitcoin whale" buying are actually internal maintenance related to exchange asset integration. Excluding technical transfers, whales were net sellers in December, reducing their holdings from 3.2 million to 2.9 million. Glassnode confirmed that net fund flow has turned negative, ending two years of positive inflows.

BTC1,46%

MarketWhisper·01-04 02:01

Ethereum 2026 Declaration: Vitalik Buterin Calls for Combating Tech "Hegemons" and Rebuilding a Decentralized Internet

Ethereum co-founder Vitalik Buterin, at the start of the new year, set the development direction for Ethereum in 2026. The core is not a specific technical roadmap, but a "rebellion declaration" against centralization. Buterin warns that current internet power and wealth are increasingly concentrated in the hands of a few "centralized giants" like Apple and Microsoft, and Ethereum's mission is to become an uncensorable, permissionless "civilization infrastructure."

This declaration was published during a market downturn when Ethereum's price had fallen nearly 40% from its all-time high, and ETF funds continued to flow out. However, Buterin emphasizes that true success lies in building durable applications that can pass the "exit test," while achieving global usability and genuine decentralization. This marks a strategic shift for Ethereum from chasing market narratives to solidifying its long-term value as the foundation of the next-generation internet.

MarketWhisper·01-04 01:55

Aave Labs Addresses DAO Rift With Revenue Sharing Plan

Aave Labs will propose sharing revenue earned outside the core protocol with AAVE holders, addressing concerns over fee alignment.

Governance disputes over frontend fees, branding, and IP control pushed Aave Labs to clarify value flow beyond the DAO.

Aave’s strategy targets expansion

AAVE6,64%

CryptoFrontNews·01-03 20:46

Domestic stock funds, last year's return was 81%... Outperformed overseas funds

In 2025, domestic stock funds achieved a return of 81.53%, significantly higher than the 17.04% of overseas funds. The KOSPI index increased by 75.63%, boosting market vitality, but fund flow data shows that investors still prefer overseas assets. In the future, global economic conditions and market volatility will influence investment strategy choices.

TechubNews·01-02 23:31

Crypto Market Starts 2026 Strong: Truflation Signals Sharp Disinflation

Truflation data reveals a significant drop in inflation to 1.955%, raising expectations for interest rate cuts by the Fed. Markets anticipate "Trump-flation" benefits, linking disinflation to proposed economic policies. Historical trends suggest liquidity will flow back into risk assets like stocks and crypto, emphasizing a favorable environment for investment.

Coinfomania·01-02 13:36

Pundit Explains How to Turn $1 Million in XRP into Real Cash Flow

A market commentator has explained how XRP investors could turn $1 million in XRP into real cash flow for possible retirement.

Notably, speculation about XRP reaching $100 has led many investors to believe that such a price could lead to early retirement. Some believe holding around 20,000 XRP

TheCryptoBasic·01-02 12:42

XRP Liquidity Is Tightening Fast as a New Buyer Steps In

XRP shows strong ETF demand with consistent inflows despite declining prices. Spot ETFs have absorbed over $1B, indicating robust support, but caution is advised as flow pace may fluctuate in a shifting market.

XRP12,5%

CaptainAltcoin·01-02 07:35

Flow outlines Phase 2 progress, targets full EVM functionality within 24 hours

According to a recent update, the Flow Foundation has made "significant progress" in its remediation plan to address the damages dealt during the $3.9 million exploit of the blockchain last week.

Summary

Flow developers are restoring EVM functionality ahead of schedule, allowing parallel

FLOW10,71%

Cryptonews·01-02 06:48

Mingxiangyuan boss involved in money laundering of 25.9 billion! Created cash flow disruptions using Tether, and his Porsche was auctioned by the police.

Mingxiangyuan and Dongyin Kuai Dao Shou Responsible Persons Suspected of Money Laundering 25.9 Billion Yuan, Using Tether to Create Cash Flow Breakpoints. Police Seize Over 100 Million Assets, and His Porsche Sports Car Has Been Auctioned for 8.65 Million Yuan.

Mingxiangyuan and Dongyin Responsible Persons Involved in Money Laundering of 25.9 Billion Yuan

----------------

The Criminal Investigation Bureau recently uncovered a large-scale third-party payment money laundering case, with the main suspects being Luo Yixiang, the owner of the well-known Taipei Hong Kong-style restaurant "Mingxiangyuan Bing Shi," and Huang Xiurong, the owner of the popular noodle shop "Dongyin Kuai Dao Shou."

According to United News Network, Luo Yixiang and Huang Xiurong appear to operate highly popular dining establishments on the surface, but secretly use their self-created "Hero Pay" payment platform to launder money for Southeast Asian gambling groups. Police investigations indicate that the group handled a total of 25.9 billion yuan in money laundering over just a few years, earning illegal profits of over 500 million yuan.

41-year-old Luo Yixiang

CryptoCity·01-02 06:31

What is the significance behind Turkmenistan, the only neutral country in Central Asia, legalizing cryptocurrency mining and trading?

Turkmenistan is the only neutral country in Central Asia. On New Year's Day, the country officially legalized cryptocurrency mining and trading activities, establishing a licensing system regulated by the central bank. This policy signifies a major shift in Turkmenistan's national economic policy. According to recent reports, the bill classifies virtual assets under civil law, allowing registered and approved enterprises and individuals to participate in cryptocurrency mining and trading. However, it still does not recognize cryptocurrencies as a means of payment, legal tender, or securities. Domestic internet and information flow remain under strict government control. Why is Turkmenistan gradually opening up to cryptocurrency mining and trading? Below is an analytical report.

Turkmenistan's Energy Resources and Mining Costs

Turkmenistan has abundant natural gas resources, and its electricity production capacity often exceeds domestic consumption. Cryptocurrency mining is an energy-intensive activity. With proper planning, excess energy can be utilized to make mining economically viable.

ChainNewsAbmedia·01-02 04:06

2026 is expected to see only one rate cut! Federal Reserve: Interest rates are no longer the focus, officials are concerned about short-term financing pressures

The Federal Reserve meeting minutes show a shift in focus toward short-term financing pressures, predicting only one rate cut in 2026, and will purchase Treasury securities to maintain market liquidity stability.

Federal Reserve Focus Shifts to Cash Flow, Short-term Financing Pressure Becomes a Hidden Concern

--------------------

The U.S. Federal Reserve (Fed) released the minutes of its December monetary policy meeting on December 30, revealing a change in the focus of officials.

According to CoinDesk, Fed officials are increasingly concerned about whether the financial system has enough cash to operate smoothly, and their attention to interest rate changes has relatively decreased.

The minutes reveal a rarely noticed risk in the market: that pressure in the short-term financing market could quietly emerge and trigger market volatility in an instant.

Although officials described the reserve levels of the banking system as ample,

CryptoCity·01-02 02:40

Solana in early 2026 attracts capital flow: whales and institutions join the race

In early 2026, Solana stands out in the crypto market with significant buying activity from "whales" and institutional investments. A recent report shows a $7.5 million increase in Solana-related investment products, with a total inflow exceeding $1.3 billion since its ETF listing in October.

SOL6,7%

TapChiBitcoin·01-02 00:23

What are the "cryptocurrency whales" buying and selling on New Year's Day 2026?

If you are reading this article on New Year's Day 2026, it is very likely that the "whales" in the cryptocurrency market have already gotten ahead of you. While most traders are just starting their day, large wallets have already begun buying and selling, revealing the early-year cash flow trend.

Some whales are preparing to

TapChiBitcoin·01-01 14:34

Larry Fink Explains How Tokenization Expands Market Access

Fink says tokenizing assets can remove intermediaries, shorten settlement cycles and lower transaction costs.

$4.1T is in digital wallets, but fees and delays block entry into markets; tokenization keeps capital in one flow.

A single digital account could hold cash, stocks and bonds,

CryptoFrontNews·01-01 08:51

Flow freezes NFT loan repayment after hack incident

The NFT loan repayments on the Flow blockchain have been halted due to a previous exploitation incident. This has led to defaults and the inability to settle loans, with Flowty freezing loan activities to prevent forced defaults. Although the blockchain is now operational, key functionalities remain interrupted, impacting borrowers' ability to repay and causing a significant drop in FLOW token value.

FLOW10,71%

TapChiBitcoin·01-01 00:07

A review of 10 KOLs' outlook on the crypto industry in 2026

In 2026, the crypto world will usher in new trends, with a focus on prediction markets, compliant stablecoins, and AI technology. Experts believe that institutional funds will flow into these areas, while execution capability and value creation will become key evaluation criteria. Black swan events should still be approached with caution.

Biteye·2025-12-31 15:01

[Chain Flow] Ethereum bridge fund net inflow of $46.47 million within 7 days… Arbitrum now has the largest net outflow

In the past seven days, Ethereum has performed prominently in bridge asset flows, with a net inflow of $46.47 million, while Arbitrum experienced a net outflow of $75.73 million, indicating a clear trend of fund transfer. Other chains such as Hyperliquid and Polygon PoS also showed additional inflow and outflow activities.

TechubNews·2025-12-31 08:18

Shiba Inu Enters Price Compression Zone at $0.0571 — Breakout or Breakdown Ahead?

Shiba Inu traded within a tight range, with support and resistance containing short-term volatility.

Price compression reflected balanced order flow and cautious positioning from short-term traders.

Relative strength against Bitcoin and Ethereum signaled rotation rather than broad

CryptoNewsLand·2025-12-31 06:36

Surpassing MicroStrategy: Metaplanet Opens New Possibilities for $3 Billion Holdings with "Bitcoin Yield" Model

Tokyo-listed company Metaplanet once again shocks the market with its aggressive Bitcoin strategy. The company disclosed on December 30th that it increased its holdings by 4,279 Bitcoins at a total cost of approximately $451 million, bringing its total holdings to 35,102 BTC. Based on current market prices, its Bitcoin reserves have surpassed the $3 billion mark, maintaining a leading position among publicly traded companies worldwide.

What’s even more remarkable is that its “Bitcoin revenue-generating business,” focused on options strategies, has performed far beyond expectations. Operating revenue for fiscal year 2025 is projected to reach 85.8 billion yen (about $540 million), a 186% increase from initial guidance. This Japanese company is successfully demonstrating an innovative “dual-wheel drive” model: on one hand, holding Bitcoin as a long-term core treasury asset indefinitely; on the other hand, utilizing derivatives strategies to “activate” part of its holdings and generate continuous cash flow. This strategy not only makes it the most powerful Asian mirror of MicroStrategy but also potentially opens a new path for global corporate treasury management that balances value storage and asset income.

BTC1,46%

MarketWhisper·2025-12-31 03:56

Top 10 Key Developments in the Mining Industry: Miner Transformation to AI, Bitcoin Hashrate Surpassing 1 ZH/s, and Sovereign Nations Entering the Market

The mining industry is entering a stage of structural reshaping

In recent years, the core logic of the mining industry has been changing. Early mining relied on cheap electricity and hardware dividends, but now the scale of computing power continues to expand, and industry competition has entered a new stage of “high capital, high energy consumption, high compliance.” The business model relying solely on block rewards is being replaced by diversified computing power services.

Why are mining companies collectively turning to AI and high-performance computing

The transformation of mining companies to AI is no coincidence. AI model training and inference demand huge amounts of GPUs and data center resources, while traditional mining farms have natural advantages in electricity, cooling, and infrastructure. Compared to the more volatile returns of Bitcoin mining, AI computing power leasing usually involves long-term contracts, resulting in more stable cash flow.

More and more mining companies are positioning themselves from “miners” to “computing infrastructure providers,” which also changes the market’s valuation approach to mining companies.

Bit

BTC1,46%

GateLearn·2025-12-31 03:34

Grayscale 2026 Crypto Outlook: BTC Expected to Reach New High in the First Half of the Year, Regulation and Hedging Demand as Key Supports

Grayscale (Grayscale) Research Director Zach Pandl stated in a recent interview that the crypto market will undergo significant structural changes by 2026. The core drivers come from two main factors: firstly, the ongoing increase in demand from investors for hedging and alternative store-of-value assets in the global macro environment; secondly, the gradual clarification of crypto regulatory frameworks in major markets. He pointed out that with increased regulatory clarity and continuous institutional investment, digital assets are accelerating toward a more institutionalized and mainstream development stage.

Unresolved macroimbalances, Bitcoin remains the core store-of-value asset

Pandl noted that the crypto market encompasses diverse technologies and applications, but in terms of overall capital flow, Bitcoin remains the most core asset, primarily driven by global demand for alternative store-of-value tools.

He stated that the expansion of global debt and fiscal deficits, along with rising risks of fiat currency devaluation, continue to prompt investors to adjust their allocations.

ChainNewsAbmedia·2025-12-31 02:43

2026 Crypto World Roadmap: From Hong Kong to Dubai, Insights into the Strategic Significance of Nine Must-Attend Events

The article discusses the global events schedule for the cryptocurrency industry in 2026, highlighting how nine core activities from Hong Kong to Singapore reflect the flow of capital, talent, and innovation. Each event mirrors different regional political and industry trends, helping participants prioritize resources and develop strategic plans for future growth.

TechubNews·2025-12-31 02:40

Flow Scraps Rollback Plan Amid Decentralization and Security Concerns

Flow Foundation Abandons Chain Rollback Proposal Amid Community Backlash

The Flow Foundation, the organization responsible for managing the blockchain, has rejected a controversial proposal to roll back the network’s layer-1 chain following a $3.9 million exploit. The decision comes after

CryptoBreaking·2025-12-31 00:20

Higher Volatility Ahead: 5 Cryptos Worth Holding as ETF Flows Shift and Downside Risk Rises 25%–40%

ETF flow shifts are increasing volatility across both large-cap and mid-cap cryptocurrencies.

Assets with established networks appear more resilient, though downside risk remains elevated.

Market focus is shifting from growth narratives toward liquidity and structural

CryptoNewsLand·2025-12-30 23:16

Schiff: Bitcoin Has No Earnings - U.Today

The 'zero-yield' critique

Another attack on Strategy

Peter Schiff, the Euro Pacific Capital chief economist who has built a career on predicting the collapse of the fiat monetary system, turned his sights once again to the "cash flow" argument on Tuesday

The gold bug contrasted the projected re

BTC1,46%

UToday·2025-12-30 16:08

Lighter Launches LIT Token with Full Revenue Flow to Holders – A U.S.-Based DeFi Model

Lighter, a decentralized perpetuals exchange (Perp DEX) on Ethereum Layer 2, has officially launched its native token LIT.

CryptopulseElite·2025-12-30 09:59

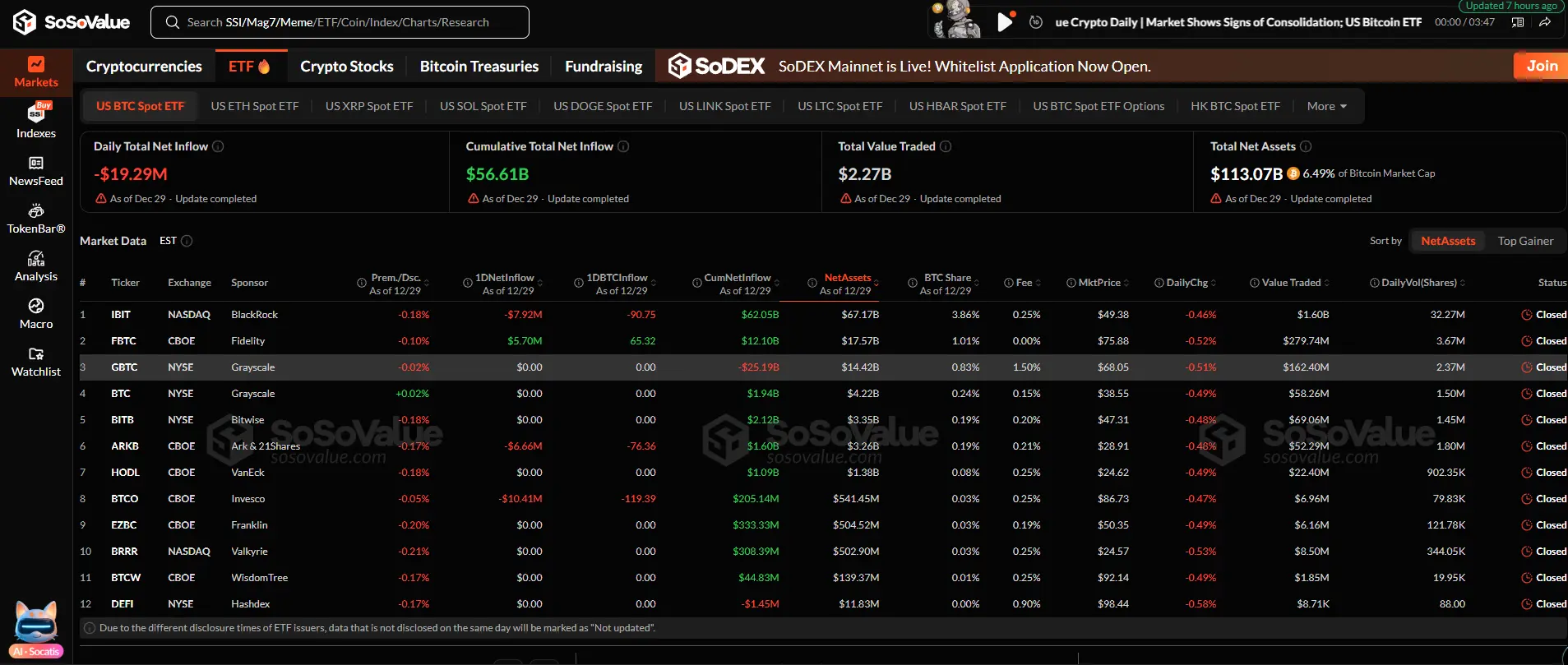

Cryptocurrency ETF capital flow on 12/29: Bitcoin and Ethereum experience outflows, Solana and XRP attract funds back

According to data from SoSoValue, on December 29th, US-based spot Bitcoin ETFs recorded a total net outflow of $19.29 million, reflecting investors' cautious sentiment as the market enters the end-of-year period. Notably, the Fidelity Bitcoin ETF (FBTC) still led in inflows for the day, with

TapChiBitcoin·2025-12-30 07:11

Grant Cardone to Fund Bitcoin Buys with Real Estate Cash Flow

Grant Cardone Plans to Use Real Estate Cash Flow to Buy Bitcoin – Aiming for the "Next Michael Saylor".

BTC1,46%

CryptopulseElite·2025-12-30 06:32

[Wall Street Liquidity Radar] Coinbase Bitcoin net outflow widens again · Premium declines... indicating a lack of confidence among institutional buyers

Coinbase recovers from net outflows and weak premiums, while trading volume surges simultaneously, indicating that the supply and demand of Bitcoin originating from the United States have entered an adjustment phase.

According to CryptoQuant data, on December 30 (UTC standard, not yet finalized), Coinbase Bitcoin net fund flow recorded a net outflow of -957.74 BTC.

Especially after a sharp net outflow of over -7000 BTC on December 23, the scale of fund inflows and outflows significantly decreased. Although there were limited net inflows on December 24 and 29, the strength was not enough to trigger a trend reversal. On December 30, net outflows expanded again, confirming a conservative supply and demand trend in the short term. Overall, this is interpreted as a move towards reduced volatility and entering an "adjustment phase" after large-scale fund movements.

Bitcoin Exchange Net Flow (Netflow) - Coinbase Ad

BTC1,46%

TechubNews·2025-12-30 05:04

Real estate tycoon Grant Cardone announces building a Bitcoin real estate empire: continuous free cash flow to buy BTC

Real estate investor Grant Cardone plans to establish the world's largest Bitcoin real estate company by 2026, continuously using cash flows such as rent and depreciation to buy Bitcoin. His strategy is to use income from rent and other sources to support Bitcoin investments and aims to bring this business model to market.

動區BlockTempo·2025-12-30 04:25

Ethereum leads DeFi capital flow in 2025 as liquidity returns to layer 1

Ethereum emerged as the leading destination for net capital flow in 2025, solidifying its central role in high-value DeFi liquidity. Although DeFi activity expanded strongly across multiple Layer-2 networks, most of the liquidity ultimately returned to Ethereum's Layer-1. Throughout 2025, Ether

TapChiBitcoin·2025-12-30 03:35

Flow abandons blockchain rollback plan: sticking to the "decentralization bottom line" is more important than losing 4 million USD

Flow chain loses $3.9 million to hacking and abandons rollback in favor of isolated repair, preserving the immutability principle but severely damaging market confidence

(Background: Flow rollback blockchain "requires nodes not to initiate new transactions," community criticizes: decentralization is meaningless after a 40% price crash)

(Additional context: Flow flash crash update: Foundation confirms hacking of $3.9 million, network is being restarted)

On December 28, the blockchain Flow was targeted by hackers exploiting a runtime vulnerability, resulting in the illegal minting and cross-chain transfer of assets worth approximately $3.9 million. Within just 48 hours, the development team completely rolled back the plan to a previous state and ultimately chose to implement "isolated repair," subjecting on-chain governance and technical trust to an extreme stress test.

After the incident, the Flow Foundation proposed a "full rollback" by resetting the chain to a snapshot point before the attack. This move is equivalent to erasing the chain's history up to that point.

FLOW10,71%

動區BlockTempo·2025-12-30 03:30

Crypto Witnesses Net Capital Flow Below $4.5 Billion For The First Time In Two Years | Bitcoinist.com

Trusted Editorial content, reviewed by leading industry experts and seasoned editors. Ad Disclosure

For the first time in nearly two years, the cryptocurrency market has experienced a turn in net capital flows, dropping below the $4.5 billion mark. This downturn comes as Bitcoin (BTC) has led a tu

Bitcoinistcom·2025-12-30 03:08

Flow Validators Urged to Stop Operations Following Chain Rollback

Flow Blockchain Stalls After Controversial Rollback Following Security Breach

The Flow blockchain experienced a significant disruption after a contentious chain rollback intended to mitigate the effects of a recent security breach. This incident has sparked debate within the crypto community

FLOW10,71%

CryptoBreaking·2025-12-30 02:10

Grant Cardone launches real estate Bitcoin company! Rent to buy coins to create a new version of MicroStrategy

Cardone Capital CEO, billionaire Grant Cardone, announced that in 2026 he will launch the world's largest real estate Bitcoin company, aiming to create "the next Michael Saylor." He plans to leverage monthly rental cash flow and depreciation advantages from real estate to purchase BTC, accumulating 3,000 bitcoins by the end of 2026. The company plans to bundle and list ten real estate and Bitcoin hybrid funds.

BTC1,46%

MarketWhisper·2025-12-30 01:49

Load More