What are Meme Coins? — From Cultural Symbols to Market Phenomena

From Dogecoin to Gate Fun, a systematic analysis of the cultural origins, market logic, and investment essence of meme coins, helping you understand the mechanisms behind the journey from jokes to wealth.

Introduction: A Financial Revolution That Started as a Joke

If Bitcoin represents the rationality and technological revolution of “decentralized finance,” then meme coins represent the emotional and cultural revolution of the crypto market.

A meme was originally a “consensus symbol” in internet culture—people used images, videos, or emojis to express humor, attitudes, and identity. When this form of cultural expression combined with cryptocurrencies, a new species was born: Meme Coins.

The first meme coin was Dogecoin. It wasn’t initially created for commercial purposes, but as an internet joke—two engineers created this “joke version of Bitcoin” based on Bitcoin’s code in 2013. However, as the community grew and with the celebrity effect (especially Elon Musk’s multiple mentions), Dogecoin transformed from a joke into an asset worth billions of dollars. This event marked the first “consensus miracle” of meme coins: Emotion + Community > Technology + Whitepaper.

The Core Essence of Meme Coins: Amplifiers of Narrative Consensus

While traditional cryptocurrencies often derive value from “functionality”—such as Ethereum’s ability to support smart contracts or Uniswap providing decentralized trading—meme coins derive value from “narrative.”

We can divide the value structure of meme coins into three layers:

- Culture Layer: Meme coins often represent certain internet cultures or social psychologies, such as anti-elitism, anti-institutionalism, community autonomy, humor, or mockery of authority. It’s a digitalized form of cultural expression.

- Consensus Layer: When enough people identify with a meme and are willing to join the community, spread content, or buy tokens based on it, the consensus of the meme is formed. For example, “PEPE” is not just a frog image; it represents a rebellious spirit of internet subculture.

- Capital Layer: Capital inflow transforms meme coins from cultural phenomena to market events. Liquidity, exchange listings, Launchpad promotions, and KOL promotions are all important forces driving the market cap surge of meme coins.

In short, the underlying logic of meme coins is: “Emotional resonance creates value carriers.” This is also the biggest difference between them and traditional tokens.

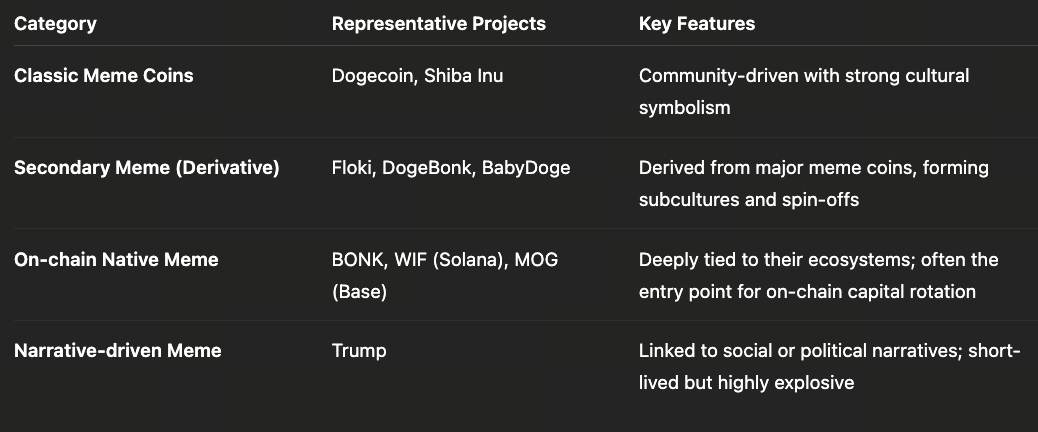

Classification and Representative Projects of Meme Coins

As the market matures, meme coins are no longer just “joke coins,” but have formed diverse types:

It’s clear that meme coins have evolved from single cultural symbols to a kind of investment narrative and community-driven financial experiment. This also explains why the meme sector always tends to start first and attract funds and users in every bull market.

Market Driving Factors of Meme Coins

To understand the price fluctuations of meme coins, one must recognize the three major driving forces behind them: emotion, liquidity, and propagation.

- Emotion: Meme coins are essentially “emotional assets.” The more optimistic the market, the easier it is for meme coins to explode. This has little to do with fundamentals or revenue models, but is highly correlated with market sentiment and propagation speed. This is why the meme sector always becomes the “testing ground” for funds in the early stages of a bull market—because it best reflects investors’ optimistic sentiment.

- Liquidity: The rise of meme coins is inseparable from trading depth and listing channels. On-chain fund activity (such as the popularity of Solana and Base chains) directly affects the explosion of new meme projects. Listings on centralized exchanges (CEX) are key to liquidity surges. Many projects often experience a “second wave” after being listed on mainstream platforms.

- Propagation: Meme coins are products of internet propagation. Content explosions on platforms like Twitter, Telegram, Reddit, and X Spaces often drive prices more than technological advancements. A good meme design (image, slogan, symbol) is often more spreadable than a ten-page whitepaper.

Investment Logic of Meme Coins: Understanding the “Wealth Code in Jokes”

Although meme coins seem absurd, there is still analyzable logic. Investors need to examine from three perspectives:

- Early Consensus Stage: Capturing the source of narratives. When a new meme starts appearing frequently on social media, community interaction becomes active, and on-chain transaction volume grows, it often means the “consensus formation period” is about to arrive. This is the stage with the most potential, but also the highest risk.

- Mainstream Diffusion Stage: Liquidity influx. When KOLs start promoting, exchanges list, or Launchpads launch, this is a signal that funds are starting to concentrate. Platforms like Pump Fun play a key role at this stage, combining meme coin issuance with community participation through the Launchpad model, providing both initial liquidity and increasing project exposure.

- Bubble Stage: Emotional peak and risk control. When media coverage becomes widespread, short-term gains are too rapid, and speculators flood in, it indicates the meme trend may be nearing its end. Smart investors should start reducing positions or exiting at this time to avoid becoming the “last bag holder.”

Case Studies: Evolution from Dogecoin to WIF

- Dogecoin (DOGE): From an internet joke to a mainstream asset, with market cap once exceeding $80 billion. It verified that “emotional consensus can create real value.”

- Shiba Inu (SHIB): Achieved transformation from meme to utility by building an ecosystem (DEX, NFT, metaverse), demonstrating the path of “narrative upgrade.”

- WIF (dogwifhat): One of the most successful meme coins on Solana. It became popular due to an emoji at the end of 2024, triggering an influx of funds into the Solana ecosystem, becoming a symbol of on-chain recovery.

These cases show that meme coins are not purely “joke assets”; they reflect market participants’ resonance with emotions, culture, and wealth.

Risk Warning and Rational Participation

The biggest risks in meme investment are: high volatility, low transparency, and strong emotional drive. Compared to traditional crypto assets, meme projects often lack clear business models or development roadmaps, therefore:

- It’s not recommended to heavily invest in a single meme project.

- It’s advised to combine on-chain data (such as DEX trading volume, token distribution, community activity) to judge trends.

- Pay attention to new projects on Launchpad platforms like Gate Fun, obtain early information through official channels to reduce participation risks.

The core of meme coins is “cultural resonance,” not “technological innovation.” The key to profiting from these assets lies in understanding emotional cycles and propagation mechanisms, rather than seeking “value support.”

Summary: Meme Coins are Culture, Not Scams

Meme coins are the “emotional magnifying glass” of the crypto world, revealing the most human aspects of investment behavior—greed, herd mentality, and hope. Understanding the significance of meme coins is not just about learning how to trade, but more about learning how to read market emotions and stories.