The Life Cycle and Investment Rhythm of Meme Coins

From going viral to hitting zero, the fate of meme coins often follows a recognizable rhythm. This section will systematically explain the life cycle, price stages, and emotional cycles of meme coins, helping investors identify key points of high risk and high potential.

Introduction: Why Understanding the Life Cycle is Crucial

Meme coins experience volatile price fluctuations and short life cycles, making the grasp of investment timing particularly crucial. Unlike assets such as Bitcoin or Ethereum, which have long-term technological and ecosystem support, meme coins often rely on the strength of narrative, propagation, and emotions. Therefore, understanding the complete cycle of meme coins from birth to decline not only helps investors discover opportunities but also avoids being “consumed by emotions” at high points.

Five Stages of the Meme Coin Life Cycle

Looking at hundreds of past meme projects, a relatively common life cycle model can be summarized, similar to the “narrative cycle curve”:

1. Starting Point: Community Germination and Narrative Establishment

- Characteristics: Project just launched, small community size, large price fluctuations.

- Main participants: Core developers, early community members, on-chain players.

- Key actions: Creating memes, spreading slogans, establishing Telegram groups, attracting initial liquidity.

This stage is often the most “decentralized” phase, where the project’s ability to quickly form topics on social media determines whether it can enter the next round of diffusion. For example, WIF (dogwifhat) gained early attention through its unique avatar image and Twitter self-propagation.

2. Diffusion Period: Emotion Amplification and Liquidity Inflow

- Characteristics: Increased trading volume, KOLs begin to mention, short-term price surge.

Key indicators:

Listing on decentralized exchanges (DEX)

- Appearance of numerous meme propagations (images, videos, derivatives)

- Price skyrockets 5-10 times

- Core driving force: Narrative and social propagation.

In this stage, investors are attracted by “social proof”. If the project team can collaborate with Launchpads (such as Gate Fun and other platforms), they can further introduce mainstream liquidity through public sales. This is also the key stage for most meme coins to achieve “breaking out”.

3. Mainstream Period: FOMO Spread and Valuation Frenzy

Characteristics:

Exchange listings (CEX)

- Large-scale promotion by celebrities or KOLs

- Explosive entry of new users

- Market performance: Price increases tens of times in a short period.

Risk signals:

High turnover rate

- Prevalence of “To the moon” slogans

- Excessive market optimism

This is the peak of emotions. Historically, PEPE reached its peak after making headlines in mainstream media in May 2023, followed by an 80% price drop. For investors, this is the stage to “realize profits” rather than “increase positions at high prices”.

4. Recession Period: Heat Dissipation and Fund Withdrawal

- Characteristics: Decreased trading volume, reduced community discussions, KOLs shifting to new narratives.

Typical phenomena:

Chart enters long-term horizontal trend

- More “reviewers” than “propagators”

- Gradual depletion of liquidity

At this stage, prices typically halve or lower, but for projects with potential revival narratives (such as Shiba Inu’s resurgence through ecosystem expansion), there’s still a chance for a “second life”.

5. Rebirth Period (or Zero Period): Differentiation and Re-Narration

Some meme coins regain attention after market recession through new narratives or product features, for example:

- Shiba Inu through the launch of the Shibarium Layer 2 network.

- Floki by venturing into education and gaming ecosystems to strengthen its brand.

More projects disappear forever after the recession. Investors need to distinguish between these two types of assets: whether they can build sustainable communities and ongoing narratives determines if the project can revive in the next cycle.

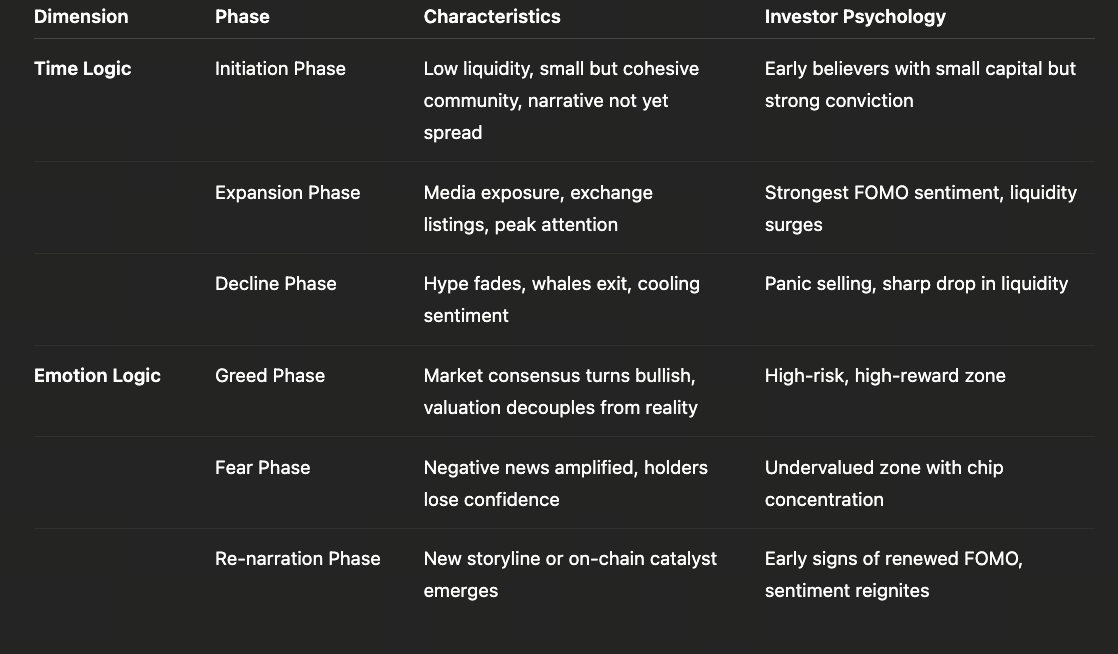

“Time Logic” and “Emotion Logic” of Meme Investment

The core of meme investment is understanding the combination of time windows and emotional rhythms.

Rule of thumb: When participating in meme coins, don’t ask “how much more can it rise”, but “how many more people can know about it”. When social propagation slows down, it means the limit of emotional diffusion is near.

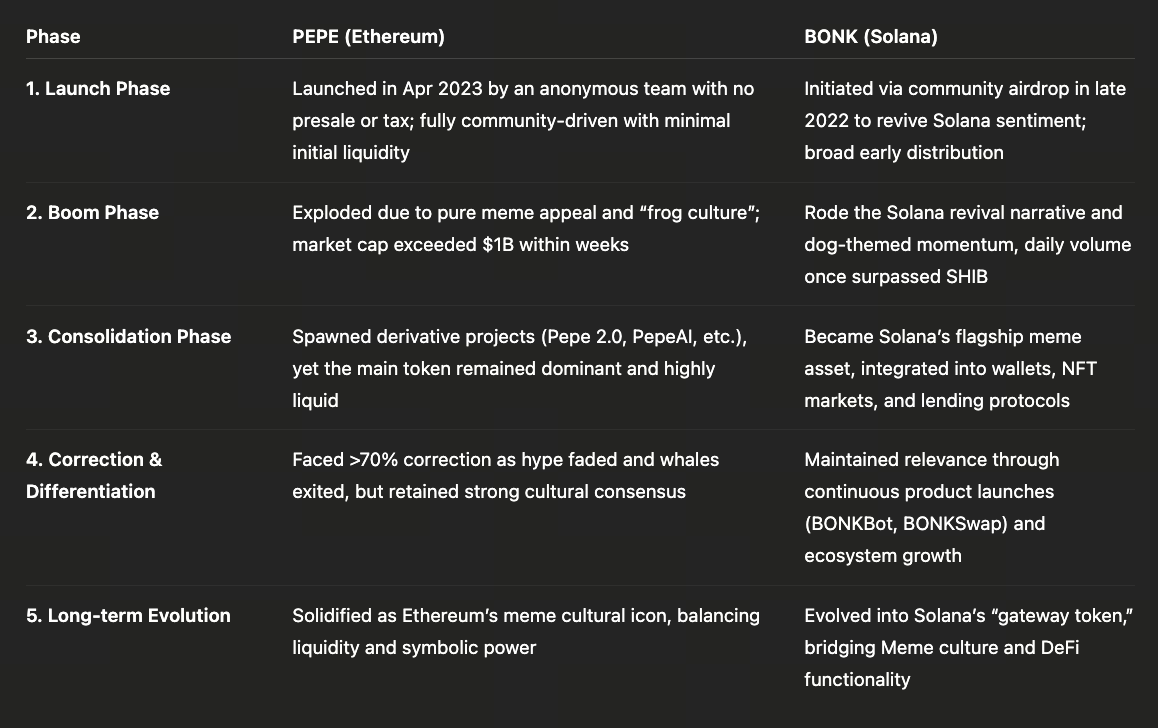

Case Analysis: Comparison of PEPE and BONK Life Cycles

The two demonstrate different meme evolution paths in different ecosystems:

- Ethereum chain focuses on “social propagation and KOL narratives”;

- Solana chain emphasizes “on-chain liquidity and ecosystem participation”.

This reminds us: different public chain ecosystems have different rhythms, investors should judge timing by combining on-chain data and community activity.

How Investors Should Grasp the Rhythm

Meme investment is not purely luck-based, but can be optimized through cycle identification and position strategies.

Position Management

- Early participation: Invest 5-10% of total funds, set stop-loss.

- Diffusion period: Increase positions based on trends, but not exceeding 30% of total position.

- Peak period: Gradually reduce positions to lock in profits.

Emotion Monitoring

- Use X (Twitter) keyword trends, Google Trends, DEX Screener popularity as references.

- When the popularity of meme keywords exceeds the frequency of substantial project updates, it indicates the market is entering an overheated stage.

Review and Re-entry

The meme market is volatile, but “narratives often recur”. Excellent investors will prepare for the next cycle in advance by recording, reviewing, and paying attention to new on-chain projects (such as new launch activities on Gate Fun).

Summary: The Key to Meme Investment is “Rhythm Sense”

Understanding the life cycle of meme coins is key to moving from “speculation” to “strategic participation”. In the waves of emotion, you don’t need to predict the market, but learn to recognize the rhythm.