gaspieldsd

用户暂无简介

gaspieldsd

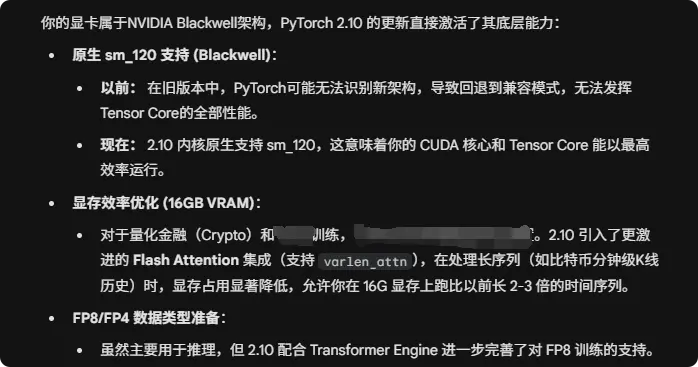

Pytorch 2.10发布之前有杠精说“开发量化模型”要几百万;没想到吧,全地球都在用开源框架还是免费滴。😂😂😂工具都是现成的,会用才是本事。

- 赞赏

- 点赞

- 评论

- 转发

- 分享

今年上半年有两个确定性机会1. #黄金 暴力反弹2. #BTC 的超绝轧空行情不过什么时候来,需要数据近一步估算逼近。

BTC-4.24%

- 赞赏

- 点赞

- 评论

- 转发

- 分享

- 赞赏

- 点赞

- 评论

- 转发

- 分享

以前觉得进场就盈利是件难事,但其实也没有太难。只是择时要更有质量。

- 赞赏

- 点赞

- 评论

- 转发

- 分享

这何尝不是一种牛市呢?真懂交易,其实只需要会一种:交易趋势。在任何一个节点上车,其实都无所谓,在红线随机入场,都是对的。看着很简单,难点在“我不确定这是一个趋势”。这个判断是隐式的,名为“市场状态”,需要计算逼近。只要状态对了,交易趋势方向,择时波动率什么时候来,简单但抽象

- 赞赏

- 点赞

- 评论

- 转发

- 分享

善战者无赫赫之功,真会下棋的,从来不会有“妙手”,真懂交易的也从不会“有高光”。这就是真交易员和假交易员的区别,交易员可以在短期内赚到暴利,然后在一次危机之中清算,真交易员很少有高光时刻,而是一步步利用危机就是商机,无论是暴涨暴跌,都可以通过正确的判断赚取稳定利润。

- 赞赏

- 点赞

- 评论

- 转发

- 分享

AI时代最重要的已经不是显式能力,显式知识都可以被编码,而隐性知识/隐式框架则无法编码。在交易中,显式分析可以被编码后自动化执行,而隐性的分析能力培养是很难的。

- 赞赏

- 点赞

- 评论

- 转发

- 分享

如果让哥锐评币圈神人分析贵金属:每个低端场总有几个老鼠人不愿意老实呆在山洞,以为自己那点亏钱鼠洞科学家的经验,能推而广之,能迁移到传统市场。#BTC #GC

BTC-4.24%

- 赞赏

- 点赞

- 评论

- 转发

- 分享

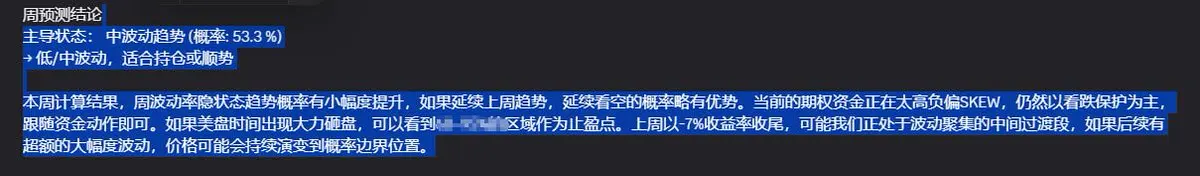

本周深度数据报告如预期,每周发布一次。计算周级别“市场状态”。低级交易者交易“明面上的数据”,高级交易者交易“市场波动状态”。如果状态是对空头有利的,那么无论如何结算概率终将偏向有利的一方,这就是控局者的交易思路。而非“随波逐流”。

- 赞赏

- 点赞

- 评论

- 转发

- 分享

币圈病危通知书患者名:缺块链 症状:流动性贫血,外部冲击免疫力差,自身虚弱,价值空虚治疗建议:系统性癌变,无治疗方案诊断建议:建议韭菜家属多陪陪

- 赞赏

- 点赞

- 评论

- 转发

- 分享

程序员猝死,每逢看到这样的悲剧,不禁让人心寒。\n这里有很大一部分原因是,东亚文化的集体潜意识祸害:\n\n认为资源永远匮乏,永远与人“卷”的文化才是真正的伤害。\n\n东亚人只要不与这种潜意识抗争,就很难摆脱这种以命和高昂的换取空无的悲剧。

- 赞赏

- 点赞

- 评论

- 转发

- 分享

币圈的认知:好像长线我们能赢

结果:2025大饼以太年化负收益率

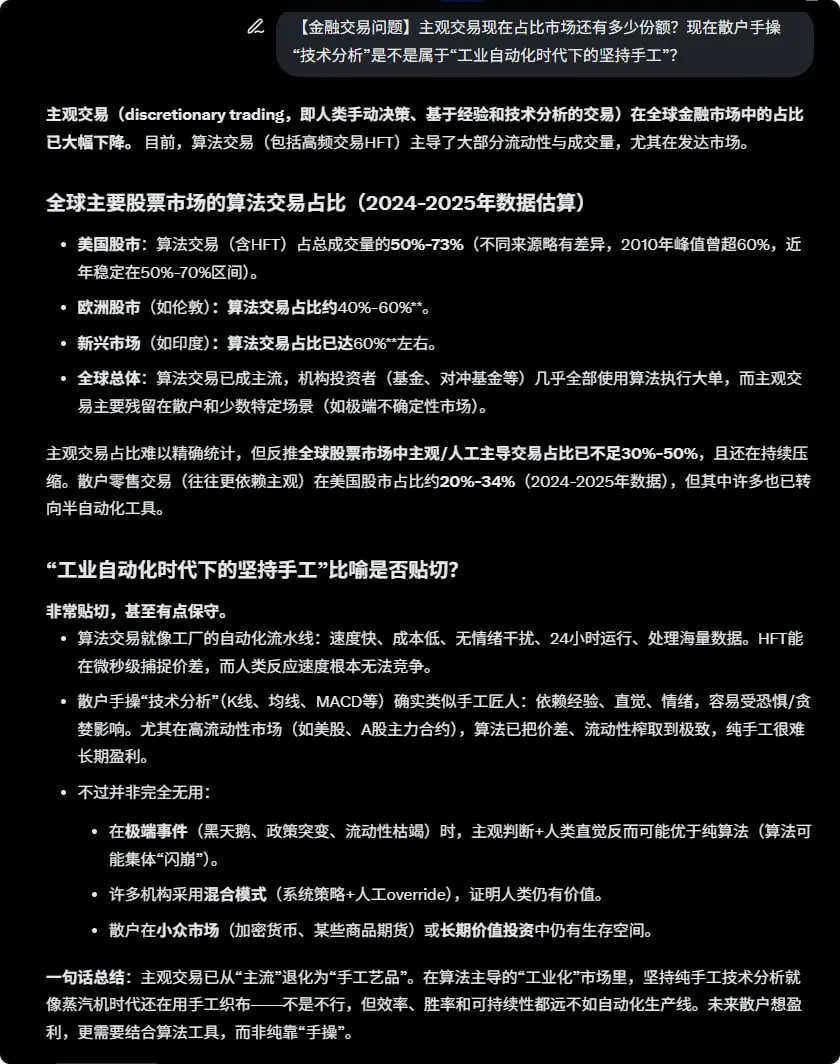

只有把自己的竞争力提高到和用AI的人同级才配在牌桌。

而不是“换时间周期”,换“标的”;全世界所有金融资产都有AI算法的模型在交易,你换什么打?

结果:2025大饼以太年化负收益率

只有把自己的竞争力提高到和用AI的人同级才配在牌桌。

而不是“换时间周期”,换“标的”;全世界所有金融资产都有AI算法的模型在交易,你换什么打?

ETH-5.44%

- 赞赏

- 点赞

- 评论

- 转发

- 分享

有时候我讨论币圈的“原始人”交易,其实这并不是玩笑

人类璀璨现代文明,是发端于三百多年前,纺织机,汽车到AI,人类的大脑其实还没真正适应现代范式。

相反,如未经特殊锻炼,就在市场交易,大概率调用的几万年进化而来的“默认神经反应”。(原始人模式)

而现代范式是:高度理性复杂性、系统化

人类璀璨现代文明,是发端于三百多年前,纺织机,汽车到AI,人类的大脑其实还没真正适应现代范式。

相反,如未经特殊锻炼,就在市场交易,大概率调用的几万年进化而来的“默认神经反应”。(原始人模式)

而现代范式是:高度理性复杂性、系统化

- 赞赏

- 点赞

- 评论

- 转发

- 分享

25年终总结:

回看24年的自己,25年变得更强,更稳

今年的许多操作可以说是沉淀多年的认知变现,

1~4月 :装修别墅没时间做交易,被动躲过市场打劫

5~8月:回归,踩中多头趋势,ETH波段到四千五离场反转做空,操作高光

9~11月:通过风险模型,提前1011几日清场,吃进了空头波段

保持优势,马到成功

回看24年的自己,25年变得更强,更稳

今年的许多操作可以说是沉淀多年的认知变现,

1~4月 :装修别墅没时间做交易,被动躲过市场打劫

5~8月:回归,踩中多头趋势,ETH波段到四千五离场反转做空,操作高光

9~11月:通过风险模型,提前1011几日清场,吃进了空头波段

保持优势,马到成功

ETH-5.44%

- 赞赏

- 点赞

- 评论

- 转发

- 分享

#BTC 为什么总能抢跑到呢?

分析再多,废话再多,

有一个AI可直接计算发“高维度输出信号”强吗🤣🤣

分析再多,废话再多,

有一个AI可直接计算发“高维度输出信号”强吗🤣🤣

BTC-4.24%

- 赞赏

- 点赞

- 评论

- 转发

- 分享

GPT年度报告,描述过于精确😂😂

- 赞赏

- 点赞

- 评论

- 转发

- 分享

从AI的语词向量空间看,信息茧房其实是由一组邻近的语词簇和情感簇构成的,这些簇通过不断强化特定观点和情感,逐渐塑造了我们的认知。

很多人并非没有意识到信息茧房的存在,而是被巨大的语词簇包围后,挣脱的阻力太大,甚至会因为逆向思考而感到孤立和不安。

很多人并非没有意识到信息茧房的存在,而是被巨大的语词簇包围后,挣脱的阻力太大,甚至会因为逆向思考而感到孤立和不安。

- 赞赏

- 点赞

- 评论

- 转发

- 分享

做KOL在币圈是一种比梭哈山寨还要差劲的投资。

同等的时间精力,拿来提升自己的回报是做KOL的N倍。🤡

同等的时间精力,拿来提升自己的回报是做KOL的N倍。🤡

- 赞赏

- 点赞

- 评论

- 转发

- 分享

美国散户已经半自动,中国散户还在研究波浪肠论半桶水。

- 赞赏

- 点赞

- 评论

- 转发

- 分享

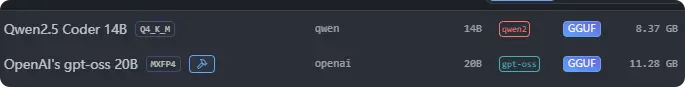

Open AI 20B开源模型不仅体积小,还特别好使,对于本地处理金融敏感数据、review审核代码、编写整理文档简直不要太香。

- 赞赏

- 点赞

- 评论

- 转发

- 分享

热门 Gate Fun

查看更多- 市值:$0.1持有人数:10.00%

- 市值:$0.1持有人数:10.00%

- 市值:$0.1持有人数:00.00%

- 市值:$2658.62持有人数:10.00%

- 市值:$0.1持有人数:10.00%

置顶

#交易员说Gate广场

跟单交易员访谈来袭!我们将采访数位收益胜率优秀的交易员,分享他们在广场记录交易的体验。

今天我们请到的是,在广场分享操盘RIVER 取得10000USDT收益的 TX缠论量化实盘全自动。听听他使用Gate广场记录交易的心得吧!

更多关于明星交易员

https://www.gate.com/zh/announcements/article/49427Gate 广场内容挖矿焕新公测进行中!

发帖互动带交易,最高享 60% 手续费返佣!

参与教程

1️⃣ 报名公测:https://www.gate.com/questionnaire/7358

2️⃣ 用代币组件 / 跟单卡片发帖,分享行情观点

3️⃣ 与粉丝互动,促成真实交易

🎁 奖励机制

• 基础返佣:粉丝交易即得 10%

• 发帖 / 互动达标:每周再加 10%

• 排名加码:周榜前 100 再享 10%

• 新 / 回归创作者:返佣翻倍

活动详情:https://www.gate.com/announcements/article/49475

加入 Gate 广场,变身内容矿工,让内容真正变成长期收益Gate 广场“新星计划”正式上线!

开启加密创作之旅,瓜分月度 $10,000 奖励!

参与资格:从未在 Gate 广场发帖,或连续 7 天未发帖的创作者

立即报名:https://www.gate.com/questionnaire/7396

您将获得:

💰 1,000 USDT 月度创作奖池 + 首帖 $50 仓位体验券

🔥 半月度「爆款王」:Gate 50U 精美周边

⭐ 月度前 10「新星英雄榜」+ 粉丝达标榜单 + 精选帖曝光扶持

加入 Gate 广场,赢奖励 ,拿流量,建立个人影响力!

详情:https://www.gate.com/announcements/article/49672