Post content & earn content mining yield

placeholder

KingOfCrypto

My logo for my YouTube channel that will be coming. What are your guys thoughts, do you like the logo? If anyone can generate a better logo than this then I will give you a .5 SOL I am open to all options! Let me know!

SOL-6.17%

- Reward

- like

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VQVGV1WNUW

View Original

- Reward

- like

- Comment

- Repost

- Share

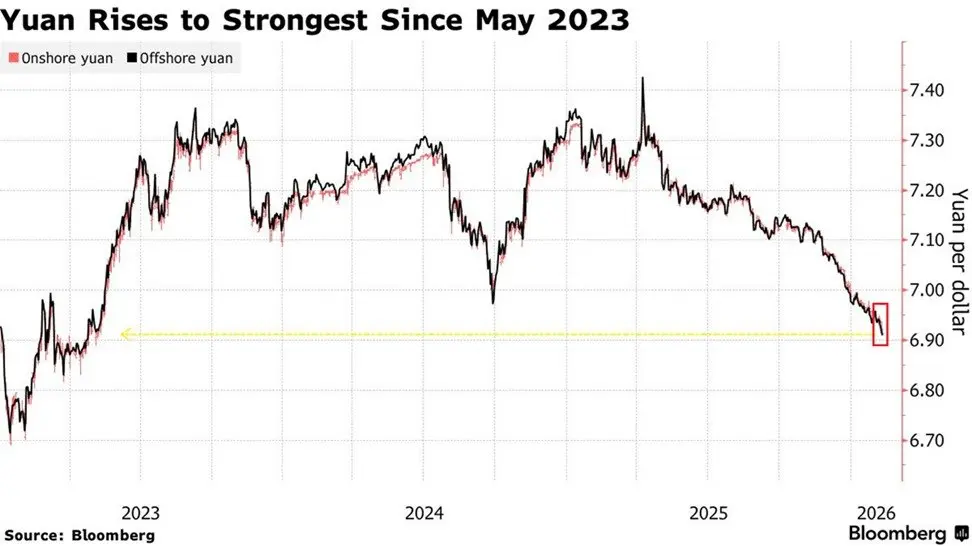

The Chinese Yuan has strengthened to 6.91 against the US Dollar, the strongest since May 2023.

The Yuan is now on track for its 7th consecutive monthly gain, the longest streak since 2020-2021, up+5% since 2025.

It has also been the 3rd-best-performing currency in Asia since September.

The most recent move comes after Chinese regulators advised banks to limit purchases of US Treasuries and instructed those with high exposure to pare down positions.

China is benefiting from the US Dollar's weakness.

The Yuan is now on track for its 7th consecutive monthly gain, the longest streak since 2020-2021, up+5% since 2025.

It has also been the 3rd-best-performing currency in Asia since September.

The most recent move comes after Chinese regulators advised banks to limit purchases of US Treasuries and instructed those with high exposure to pare down positions.

China is benefiting from the US Dollar's weakness.

- Reward

- like

- Comment

- Repost

- Share

孔子

孔子

Created By@PiggyFromTheOcean

Listing Progress

100.00%

MC:

$71.09K

More Tokens

#我在Gate广场过新年 I rarely intentionally criticize a coin, but this ZAMA makes me uncomfortable if I don't. It dropped from pre-market all the way down to worthless, then got listed on major exchanges. I thought it could rally, but it blindly dumped, and on social media, it openly attacked investors! How can a coin like this have a future? I've been burned by it again and again! It’s fallen 20 times since launch! Truly outrageous!$GT $ETH

View Original

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 2

- 2

- Repost

- Share

ProfessionalBrotherOnlyEmpty :

:

2026 Go Go Go 👊View More

Hyperliquid does 10% of Coinbase Spot Volume while only having 14 employees and no marketing department.

- Reward

- like

- Comment

- Repost

- Share

#BuyTheDipOrWaitNow?

#BuyTheDipOrWaitNow?

The crypto market is once again testing investor patience. Prices are under pressure volatility is elevated and sentiment is swinging rapidly between fear and cautious optimism. In moments like these one question dominates every traders mind. Buy the dip or wait for confirmation. This decision is not emotional it is strategic and it depends on understanding market structure liquidity behavior and macro conditions.

First it is important to understand what kind of dip the market is experiencing. Not every dip is an opportunity. Some dips are corrections

#BuyTheDipOrWaitNow?

The crypto market is once again testing investor patience. Prices are under pressure volatility is elevated and sentiment is swinging rapidly between fear and cautious optimism. In moments like these one question dominates every traders mind. Buy the dip or wait for confirmation. This decision is not emotional it is strategic and it depends on understanding market structure liquidity behavior and macro conditions.

First it is important to understand what kind of dip the market is experiencing. Not every dip is an opportunity. Some dips are corrections

BTC-3.26%

- Reward

- 1

- Comment

- Repost

- Share

>>> 1M next >>>> 10>>>> 20>>>>> 69

And there is nothing that can be done to stop it.

Do you understand?

$GROKPEPE

And there is nothing that can be done to stop it.

Do you understand?

$GROKPEPE

- Reward

- like

- Comment

- Repost

- Share

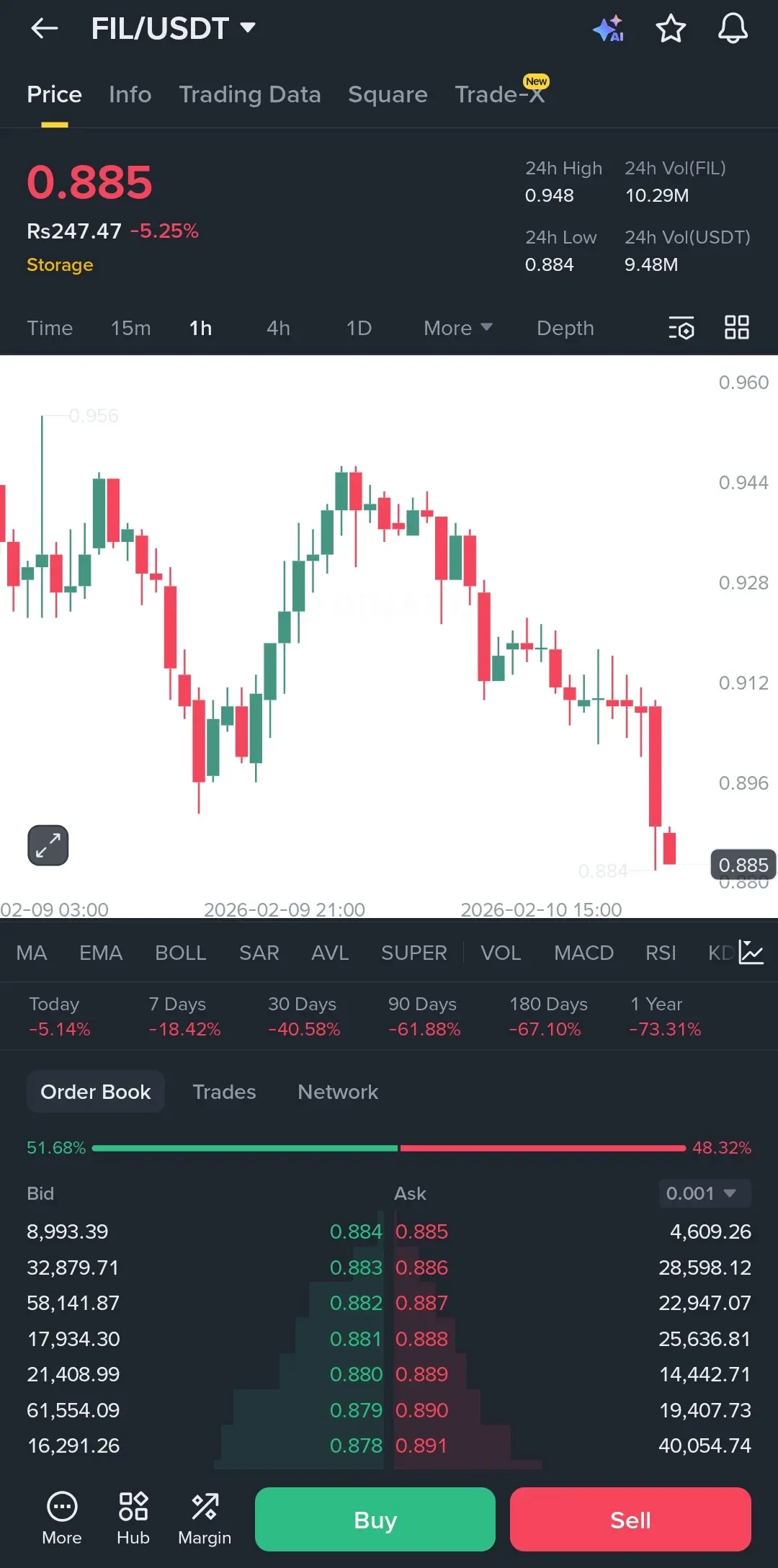

Is it just me, or is $FIL trying to catch a falling knife right now?

We just hit a fresh 24h low at 0.884 and the chart looks pretty heavy. That last hour candle was a straight flush down, and we haven't seen any real "get me in" volume from the buyers yet.

Price is currently at 0.885. If you look at the previous peaks around 0.944, we’ve just been making lower highs all day. It’s a classic downtrend. The only silver lining is that the order book is roughly 51% green, so some people are at least trying to build a wall here.

If this 0.88 support doesn't hold, we’re likely looking for a much

We just hit a fresh 24h low at 0.884 and the chart looks pretty heavy. That last hour candle was a straight flush down, and we haven't seen any real "get me in" volume from the buyers yet.

Price is currently at 0.885. If you look at the previous peaks around 0.944, we’ve just been making lower highs all day. It’s a classic downtrend. The only silver lining is that the order book is roughly 51% green, so some people are at least trying to build a wall here.

If this 0.88 support doesn't hold, we’re likely looking for a much

FIL-5.98%

- Reward

- like

- Comment

- Repost

- Share

🚀 $KITE /USDT – Bullish Momentum Incoming! 🟢

$KITE is surging at 0.1903 and showing steady buy-side strength! Buyers are stepping in with confidence 💪, and while volume is moderate, the uptrend looks slow but solid.

Key Levels:

🛡️ Support: 0.1870 – 0.1850

⚡ Resistance: 0.1930 – 0.1960

Targets (TP):

🎯 TP1: 0.1930

🎯 TP2: 0.1960

🎯 TP3: 0.1990

🛑 Stop Loss: 0.1845

💡 Trade Insight: Staying above 0.1870 keeps the bullish vibe alive. A breakout above 0.1930 could send $KITE flying 🚀🔥

#KITE #CryptoTrading #USDT #Altcoins

$KITE is surging at 0.1903 and showing steady buy-side strength! Buyers are stepping in with confidence 💪, and while volume is moderate, the uptrend looks slow but solid.

Key Levels:

🛡️ Support: 0.1870 – 0.1850

⚡ Resistance: 0.1930 – 0.1960

Targets (TP):

🎯 TP1: 0.1930

🎯 TP2: 0.1960

🎯 TP3: 0.1990

🛑 Stop Loss: 0.1845

💡 Trade Insight: Staying above 0.1870 keeps the bullish vibe alive. A breakout above 0.1930 could send $KITE flying 🚀🔥

#KITE #CryptoTrading #USDT #Altcoins

KITE-0.67%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

Join the horse racing predictions, complete tasks to earn horse racing tickets, enjoy daily million Gift Coins giveaways, and share a 100,000 USDT prize pool—all at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=BVVEVQ9c

- Reward

- 1

- 3

- Repost

- Share

Discovery :

:

Buy To Earn 💎View More

马勒戈币

马勒戈币

Created By@LittlePonyGogo

Listing Progress

100.00%

MC:

$64.9K

More Tokens

- Reward

- like

- Comment

- Repost

- Share

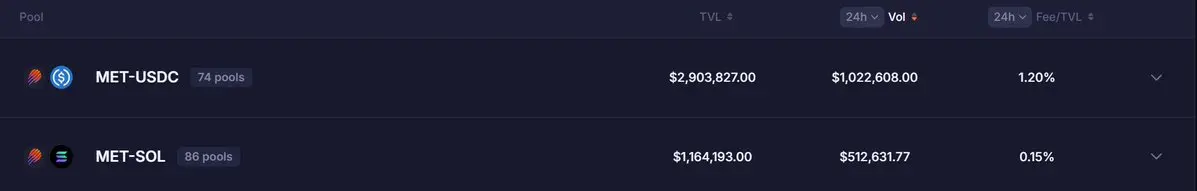

Honest question:

Would it make more sense to incentivize with farms $MET liquidity primarily through a stable pair (MET/USDC) rather than MET/SOL?

My concern lately has been SOL downside risk spilling over into Meteora LPs. Even if MET fundamentals stay unchanged, SOL volatility directly impacts LP performance and impermanent loss.

From a market-structure perspective, anchoring the main liquidity pool to USDC could:

• Reduce exposure to SOL-driven volatility

• Make MET pricing more predictable

• Improve capital efficiency for LPs who want MET exposure without directional SOL risk

Notably, the

Would it make more sense to incentivize with farms $MET liquidity primarily through a stable pair (MET/USDC) rather than MET/SOL?

My concern lately has been SOL downside risk spilling over into Meteora LPs. Even if MET fundamentals stay unchanged, SOL volatility directly impacts LP performance and impermanent loss.

From a market-structure perspective, anchoring the main liquidity pool to USDC could:

• Reduce exposure to SOL-driven volatility

• Make MET pricing more predictable

• Improve capital efficiency for LPs who want MET exposure without directional SOL risk

Notably, the

- Reward

- like

- Comment

- Repost

- Share

Viewing the Top Market Coins Spot Chart and comparing them

- Reward

- 8

- 5

- Repost

- Share

ybaser :

:

Happy New Year! 🤑View More

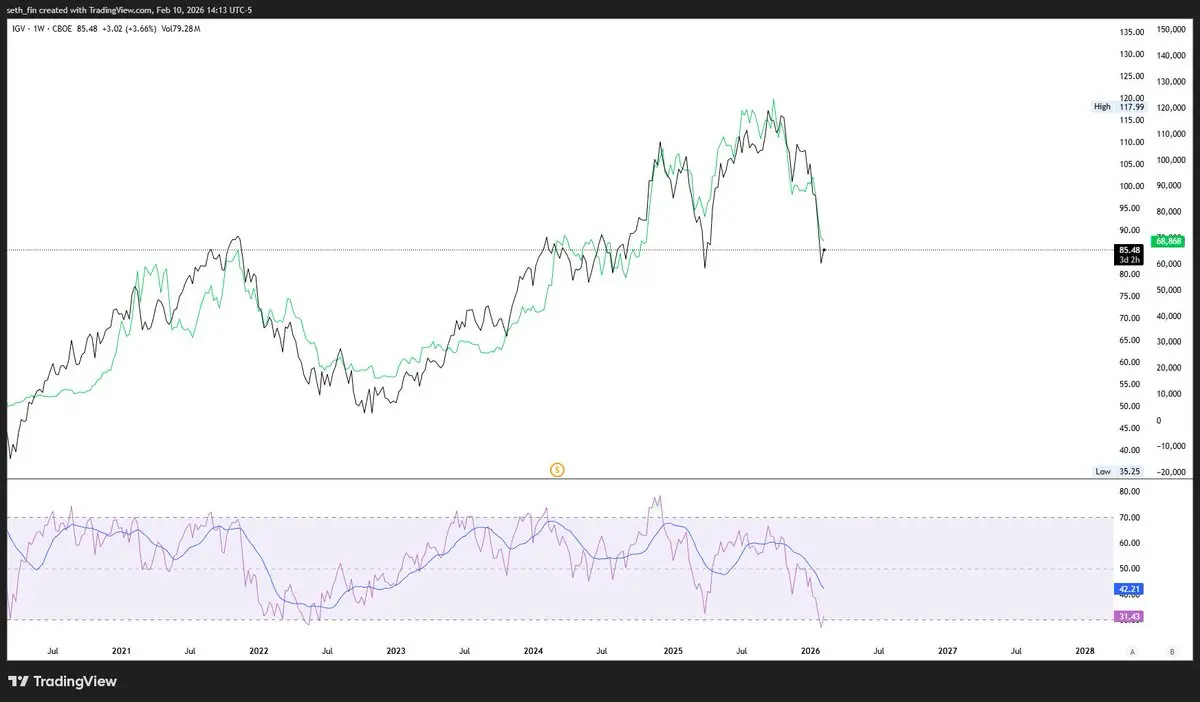

Blackrock iShares Expanded Tech-Software Sector ETF overlay $BTC. The correlation is significant for the period of 2021-2026.

The $IGV is more oversold now than at the 2022 bottom and Covid crash.

Once this pump and I believe it will, I wonder how Bitcoin will react. Interesting, don't you think?

The $IGV is more oversold now than at the 2022 bottom and Covid crash.

Once this pump and I believe it will, I wonder how Bitcoin will react. Interesting, don't you think?

BTC-3.26%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

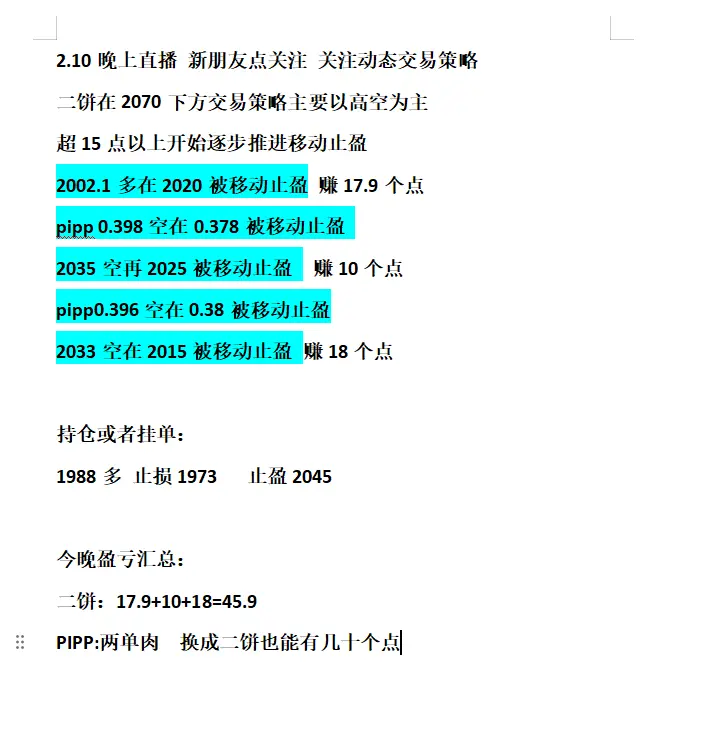

End sleep with 45 points and two meat pies

Several PIPP short positions in the market.

Reject post-mortem analysis, only do pre-mortem analysis

Consistently eating meat is the norm.

Continuous eating meat is the goal.

Did the bystander eat meat?

Broadcast around 10:30 PM tomorrow night

View OriginalSeveral PIPP short positions in the market.

Reject post-mortem analysis, only do pre-mortem analysis

Consistently eating meat is the norm.

Continuous eating meat is the goal.

Did the bystander eat meat?

Broadcast around 10:30 PM tomorrow night

- Reward

- like

- Comment

- Repost

- Share

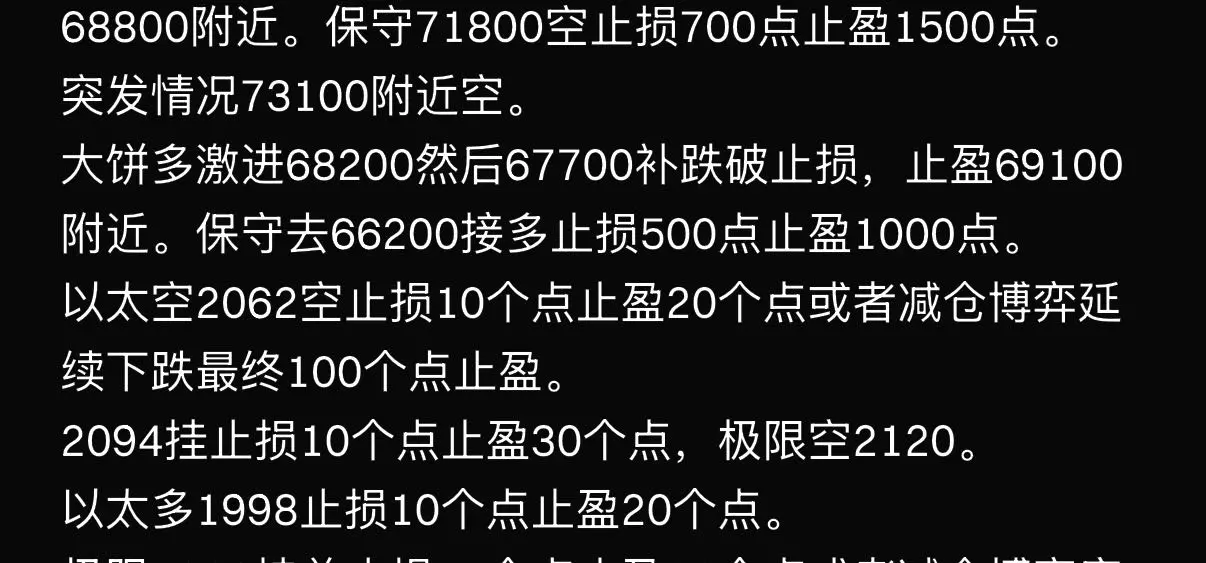

Bitcoin's fate will be decided this week. Holding above 68K means a raging bull market.

If Bitcoin can hold steady without breaking below the 200-week EMA, it will enter at least 6 months of疯狂上涨.

Historically, whenever Bitcoin breaks below the 200-week EMA, it usually drops another 30%~45%,

until it hits the true bottom. Based on this pattern, Bitcoin might fall to the 35K~38K range this time.

In a rate hike cycle, the decline lasts about half a year before rebounding.

In a rate cut cycle, the duration may be 7~10 days, then it quickly takes off.

#BTC #BTCUSD #BTCUSDT

If Bitcoin can hold steady without breaking below the 200-week EMA, it will enter at least 6 months of疯狂上涨.

Historically, whenever Bitcoin breaks below the 200-week EMA, it usually drops another 30%~45%,

until it hits the true bottom. Based on this pattern, Bitcoin might fall to the 35K~38K range this time.

In a rate hike cycle, the decline lasts about half a year before rebounding.

In a rate cut cycle, the duration may be 7~10 days, then it quickly takes off.

#BTC #BTCUSD #BTCUSDT

BTC-3.26%

- Reward

- like

- Comment

- Repost

- Share

Ethereum long positions with capital preservation, don't hold to the death. If it breaks below, re-enter from below.

ETH-6.22%

- Reward

- 2

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More211.76K Popularity

7.57K Popularity

10.15K Popularity

10.78K Popularity

5.08K Popularity

Hot Gate Fun

View More- MC:$0.1Holders:10.00%

- MC:$0.1Holders:10.00%

- MC:$0.1Holders:10.48%

- MC:$2.41KHolders:10.00%

- MC:$0.1Holders:10.00%

News

View MoreData: In the past 24 hours, the entire network has liquidated $227 million, with long positions liquidated at $156 million and short positions at $71.47 million.

16 m

Data: 2012.8 BTC transferred from an anonymous address, routed through a middle address, and then sent to another anonymous address

46 m

Data: If BTC breaks through $72,308, the total liquidation strength of mainstream CEX short positions will reach $1.117 billion.

1 h

Data: If ETH breaks through $2,103, the total liquidation strength of short positions on mainstream CEXs will reach $679 million.

1 h

Bitcoin Hashrate Drops 20% as Mining Profitability Collapses

1 h

Pin