# BuyTheDipOrWaitNow?

274.07K

Berserker_09

XRP price eyes $2.00 as failed auction confirms bullish shift

XRP price has formed a potential failed auction at $1.58, signaling demand at range lows and increasing the probability of a recovery move toward $2.00 upside.

Summary

$XRP failed to gain acceptance below the $1.58 range low, highlighting buyer demand

Holding above $1.58 preserves the broader range structure

A rotation toward the $2.00 value area low becomes more likely if support holds

XRP (XRP) price action has begun to stabilize after a sharp corrective move, with recent trading behavior offering important insight into market pos

XRP price has formed a potential failed auction at $1.58, signaling demand at range lows and increasing the probability of a recovery move toward $2.00 upside.

Summary

$XRP failed to gain acceptance below the $1.58 range low, highlighting buyer demand

Holding above $1.58 preserves the broader range structure

A rotation toward the $2.00 value area low becomes more likely if support holds

XRP (XRP) price action has begun to stabilize after a sharp corrective move, with recent trading behavior offering important insight into market pos

XRP1,78%

- Reward

- 1

- 1

- Repost

- Share

GateUser-850a7985 :

:

Happy New Year 🧨#BuyTheDipOrWaitNow? 📉📈

The question every investor quietly asks when the market turns red is this the opportunity of a lifetime, or the trap before another drop? In crypto, timing feels like everything. One moment, fear dominates timelines. The next, prices bounce and regret sets in. “I should have bought.” Or worse: “Why didn’t I wait?”

This dilemma isn’t new, but in today’s market environment, it feels sharper than ever. With macro uncertainty, shifting liquidity, ETF narratives, and evolving on-chain behavior, deciding whether to buy the dip or wait is no longer just about gut feeling

The question every investor quietly asks when the market turns red is this the opportunity of a lifetime, or the trap before another drop? In crypto, timing feels like everything. One moment, fear dominates timelines. The next, prices bounce and regret sets in. “I should have bought.” Or worse: “Why didn’t I wait?”

This dilemma isn’t new, but in today’s market environment, it feels sharper than ever. With macro uncertainty, shifting liquidity, ETF narratives, and evolving on-chain behavior, deciding whether to buy the dip or wait is no longer just about gut feeling

- Reward

- 1

- 2

- Repost

- Share

ybaser :

:

To The Moon 🌕View More

Bitcoin Weekly Analysis

On the weekly chart, the 20W MA has dropped below the 50W MA. This same crossover occurred in 2022, right before Bitcoin entered a deeper correction phase.

After that signal in the last cycle, BTC printed 9 straight red weekly candles.

In this cycle so far, Bitcoin has never printed more than 4 in a row, making this moment critical.

If this week also closes red, it would confirm continued structural weakness. Price has already lost the $75K weekly support, opening the door to the $60K zone near long-term support.

From here the structure remains clear:

• Reclaim $75K me

On the weekly chart, the 20W MA has dropped below the 50W MA. This same crossover occurred in 2022, right before Bitcoin entered a deeper correction phase.

After that signal in the last cycle, BTC printed 9 straight red weekly candles.

In this cycle so far, Bitcoin has never printed more than 4 in a row, making this moment critical.

If this week also closes red, it would confirm continued structural weakness. Price has already lost the $75K weekly support, opening the door to the $60K zone near long-term support.

From here the structure remains clear:

• Reclaim $75K me

BTC-0,29%

- Reward

- 1

- 1

- Repost

- Share

Discovery :

:

To The Moon 🌕Back to Bear Market Territory?

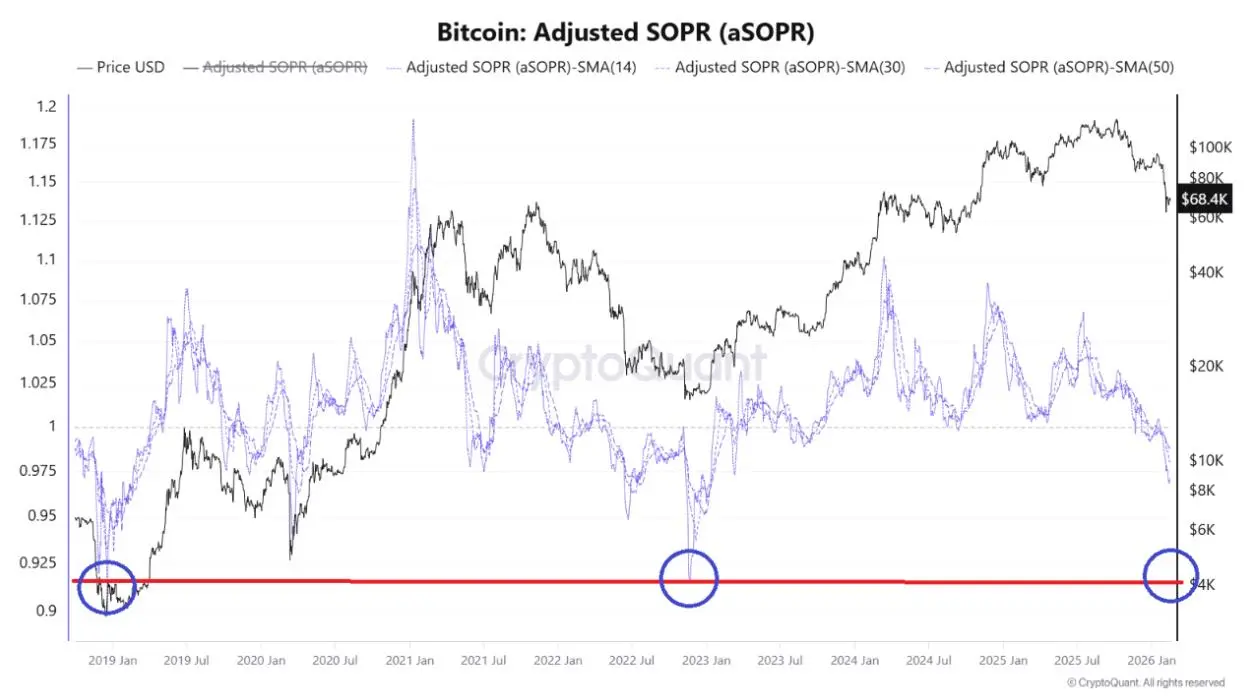

Bitcoin Adjusted SOPR (aSOPR) just slid back into the 0.92–0.94 zone — a range that historically aligns with peak bear market stress.

When aSOPR stays below 1.0, it signals that coins are being spent at a loss. That’s not strength — that’s pressure.

This is the phase where weak hands capitulate and strong hands quietly accumulate.

Stress is high. Sentiment is fragile.

But historically, this zone has marked late-stage pain — not early-stage euphoria.

Watch the reaction carefully.

#BuyTheDipOrWaitNow? #Market

Bitcoin Adjusted SOPR (aSOPR) just slid back into the 0.92–0.94 zone — a range that historically aligns with peak bear market stress.

When aSOPR stays below 1.0, it signals that coins are being spent at a loss. That’s not strength — that’s pressure.

This is the phase where weak hands capitulate and strong hands quietly accumulate.

Stress is high. Sentiment is fragile.

But historically, this zone has marked late-stage pain — not early-stage euphoria.

Watch the reaction carefully.

#BuyTheDipOrWaitNow? #Market

BTC-0,29%

- Reward

- 5

- Comment

- Repost

- Share

#BuyTheDipOrWaitNow?

This is the question every trader and investor is asking right now:

Is this a golden opportunity to buy the dip — or is it smarter to wait for more confirmation?

Before making any decision, it’s important to step back and analyze the situation from multiple angles instead of reacting emotionally.

1️⃣ Understanding the Dip

Not every dip is the same. Some dips are:

Healthy pullbacks in an uptrend

Liquidity grabs before continuation

Market overreactions to news

Or the beginning of a deeper correction

The key is identifying the structure.

If the overall trend remains bullish

This is the question every trader and investor is asking right now:

Is this a golden opportunity to buy the dip — or is it smarter to wait for more confirmation?

Before making any decision, it’s important to step back and analyze the situation from multiple angles instead of reacting emotionally.

1️⃣ Understanding the Dip

Not every dip is the same. Some dips are:

Healthy pullbacks in an uptrend

Liquidity grabs before continuation

Market overreactions to news

Or the beginning of a deeper correction

The key is identifying the structure.

If the overall trend remains bullish

- Reward

- 4

- 5

- Repost

- Share

ybaser :

:

Good luck and prosperity 🧧View More

#BuyTheDipOrWaitNow?

Stop asking if this is “the dip.”

Ask a better question:

Who is trapped right now?

As of mid-February 2026, Bitcoin (BTC) is hovering around the psychological battlefield between $69K–$70K. After heavy liquidation events earlier this month, weak hands are gone — but positioning tells a deeper story.

Here’s what most traders are missing:

1️⃣ Liquidity > Emotion

The recent bounce wasn’t “confidence.”

It was short covering + passive spot absorption.

If this were true strength, we’d see:

Expanding spot CVD

Sustained ETF inflows

Rising OI with controlled funding

Instead? We’re

Stop asking if this is “the dip.”

Ask a better question:

Who is trapped right now?

As of mid-February 2026, Bitcoin (BTC) is hovering around the psychological battlefield between $69K–$70K. After heavy liquidation events earlier this month, weak hands are gone — but positioning tells a deeper story.

Here’s what most traders are missing:

1️⃣ Liquidity > Emotion

The recent bounce wasn’t “confidence.”

It was short covering + passive spot absorption.

If this were true strength, we’d see:

Expanding spot CVD

Sustained ETF inflows

Rising OI with controlled funding

Instead? We’re

BTC-0,29%

- Reward

- 4

- 5

- Repost

- Share

Discovery :

:

To The Moon 🌕View More

Based on a true story.

A close friend invested $130,000 into altcoins in 2023.

At the peak, it grew to $840,000.

He didn’t sell. He wanted to see $1 million.

After the recent crash, it’s now worth about $8,200.

He never cashed out a single dollar.

Crypto teaches patience.

And sometimes, taking profit.

EXCLUSIVE LATEST COIN & MARKET UPDATES on GATE SQUARE ✅ FOLLOW ME NOW 🔥💰💵

#BuyTheDipOrWaitNow?

Market red means green for buyers. 🟢 Catch the reversal before it lifts off. Invest Now, Big Opportunity. 📈 DYOR

$PENGUIN $SPACE $BTC

A close friend invested $130,000 into altcoins in 2023.

At the peak, it grew to $840,000.

He didn’t sell. He wanted to see $1 million.

After the recent crash, it’s now worth about $8,200.

He never cashed out a single dollar.

Crypto teaches patience.

And sometimes, taking profit.

EXCLUSIVE LATEST COIN & MARKET UPDATES on GATE SQUARE ✅ FOLLOW ME NOW 🔥💰💵

#BuyTheDipOrWaitNow?

Market red means green for buyers. 🟢 Catch the reversal before it lifts off. Invest Now, Big Opportunity. 📈 DYOR

$PENGUIN $SPACE $BTC

- Reward

- 1

- 1

- Repost

- Share

Bengs37 :

:

that's very painful 😖😣$HYPE sliced through $30 as the sell pressure spiked, but don't get shaken out just yet.

Whales are aggressively front-running the bounce—smart money smells a deviation.

Resistance: $30 (Needs to flip back to support)

Support: $28 (The line in the sand)

Send it.

#GateSquare$50KRedPacketGiveaway #BuyTheDipOrWaitNow?

Whales are aggressively front-running the bounce—smart money smells a deviation.

Resistance: $30 (Needs to flip back to support)

Support: $28 (The line in the sand)

Send it.

#GateSquare$50KRedPacketGiveaway #BuyTheDipOrWaitNow?

HYPE-2,17%

- Reward

- like

- Comment

- Repost

- Share

#BuyTheDipOrWaitNow? Bitcoin at $69,500–$70K | Mid-February 2026 Market Outlook 📊🚀

As of mid-February 2026, Bitcoin (BTC) is trading in the crucial $69,500–$70,000 range, bouncing back from an early-month drop below $65K triggered by over $8 billion in liquidations. The swift rebound of nearly 6% within 72 hours highlights improving macro sentiment, renewed institutional dip-buying, and the clearing of excessive leverage. Yet, with BTC still far below the October 2025 peak near $126K, the market remains in a post-bull correction and strategic reaccumulation phase.

🔻 February Dip Triggers

T

As of mid-February 2026, Bitcoin (BTC) is trading in the crucial $69,500–$70,000 range, bouncing back from an early-month drop below $65K triggered by over $8 billion in liquidations. The swift rebound of nearly 6% within 72 hours highlights improving macro sentiment, renewed institutional dip-buying, and the clearing of excessive leverage. Yet, with BTC still far below the October 2025 peak near $126K, the market remains in a post-bull correction and strategic reaccumulation phase.

🔻 February Dip Triggers

T

BTC-0,29%

- Reward

- 11

- 9

- Repost

- Share

ShainingMoon :

:

2026 GOGOGO 👊View More

#BuyTheDipOrWaitNow?

Bitcoin is hovering around $68,700–$68,900 USD, bouncing from yesterday’s mild red close. After the brutal early-Feb dip (~$60,062 on Feb 6), BTC has recovered roughly 15%,

Global crypto market has seen $2+ trillion wiped from total cap since late 2025, massive ETF outflows, $16B+ liquidations, and two major on-chain capitulation waves. Fear & Greed Index hit extreme lows (~5), retail participation faded, and leveraged positions unwound hard.

So the question: Buy the dip now? DCA in phases? Or wait for further pain? Let’s break it down in full.

1️⃣ Ultra-Current Market S

Bitcoin is hovering around $68,700–$68,900 USD, bouncing from yesterday’s mild red close. After the brutal early-Feb dip (~$60,062 on Feb 6), BTC has recovered roughly 15%,

Global crypto market has seen $2+ trillion wiped from total cap since late 2025, massive ETF outflows, $16B+ liquidations, and two major on-chain capitulation waves. Fear & Greed Index hit extreme lows (~5), retail participation faded, and leveraged positions unwound hard.

So the question: Buy the dip now? DCA in phases? Or wait for further pain? Let’s break it down in full.

1️⃣ Ultra-Current Market S

BTC-0,29%

- Reward

- 19

- 25

- Repost

- Share

CryptoChampion :

:

Thanks for the information ☺️View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

152.75K Popularity

30.03K Popularity

26.77K Popularity

72.13K Popularity

12.73K Popularity

274.07K Popularity

346.03K Popularity

25.45K Popularity

14.55K Popularity

13.18K Popularity

12.81K Popularity

12.31K Popularity

11.81K Popularity

39.99K Popularity

News

View MoreData: If BTC breaks through $71,463, the total liquidation strength of mainstream CEX short positions will reach $1.205 billion.

1 h

European Central Bank's Nagel: Euro stablecoins facilitate low-cost cross-border payments

1 h

Fed Governor Notes Fading Crypto Euphoria; Chinese Exchanges Tighten Rules; Senators Query UAE Stake in WLFI

1 h

Data: Over the past 24 hours, the entire network has been liquidated for $296 million, mainly long positions.

4 h

BTC short-term decline of -1.17%: Panic spreading and long-term holders selling dominate downward pressure

4 h

Pin