MarketMaestro

現在、コンテンツはありません

$CAMT

買いコール! 👇💯💰 $95

原文表示買いコール! 👇💯💰 $95

- 報酬

- いいね

- コメント

- リポスト

- 共有

$SRVR

$EQIX、$DLR、および$AMT は高いウェイトで関与しています。抵抗帯を突破し、月末の終値がこのまま維持されれば、トレンドは確認されるでしょう。.. SRVRはREITファンドです。中に含まれる企業は技術を生産しておらず、テック企業にスペースを賃貸しています。賃料から定期的な配当を支払っており、(約2%–3%)の範囲です。FRBの金利が下がれば、EquinixやAmerican TowerなどSRVR内の銘柄の借入コストが下がり、収益性が向上します。ターゲットに向かって進むと予想しています。 ...

原文表示$EQIX、$DLR、および$AMT は高いウェイトで関与しています。抵抗帯を突破し、月末の終値がこのまま維持されれば、トレンドは確認されるでしょう。.. SRVRはREITファンドです。中に含まれる企業は技術を生産しておらず、テック企業にスペースを賃貸しています。賃料から定期的な配当を支払っており、(約2%–3%)の範囲です。FRBの金利が下がれば、EquinixやAmerican TowerなどSRVR内の銘柄の借入コストが下がり、収益性が向上します。ターゲットに向かって進むと予想しています。 ...

- 報酬

- いいね

- コメント

- リポスト

- 共有

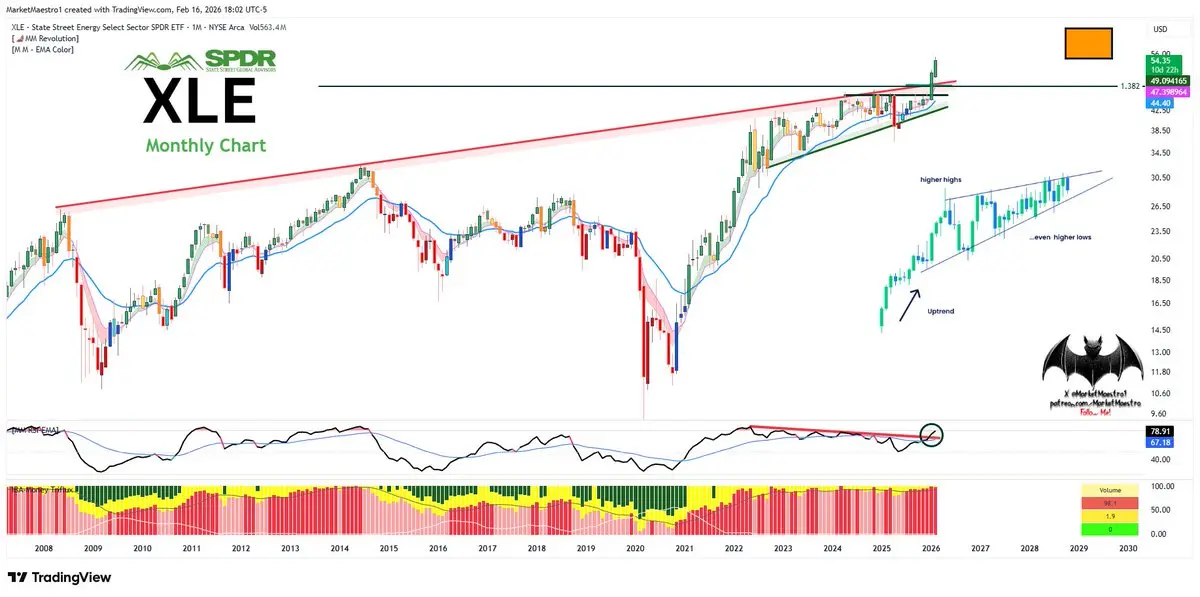

$XLE

現時点では、設定はかなり強気です。ブレイクアウトし、勢いを失わずに進み続けています。

背景には米国とロシアの包括的な取引に関する噂があり、これが制裁緩和につながる場合、XLEは短期的に売り圧力に直面する可能性があります。

現在、エネルギー市場は2026年の供給過剰を見込んでいます。取引が成立し、ロシアの石油・ガスに対する制裁が解除されれば、ロシアは世界市場、特に西側市場に対して(より容易に)より多くの供給を行うことができます。すでに十分な供給が見込まれている市場に追加のロシア供給が流入すると、ブレント原油やWTIの価格が急落する可能性があります。XLEは原油価格と高い相関性を持つため、原油価格の下落はXLE株(エクソン、シェブロンなど)に悪影響を与える可能性があります。

一方、米国がイランを攻撃し、事態が混乱した場合、ホルムズ海峡の懸念が広がり、恐れられる事態が起こるかもしれません。世界の石油供給の約20%〜30%がその海峡を通過しているため、供給ショックへの恐怖からパニックが生じ、XLEは非常に急激な上昇を見せる可能性があります。

原文表示現時点では、設定はかなり強気です。ブレイクアウトし、勢いを失わずに進み続けています。

背景には米国とロシアの包括的な取引に関する噂があり、これが制裁緩和につながる場合、XLEは短期的に売り圧力に直面する可能性があります。

現在、エネルギー市場は2026年の供給過剰を見込んでいます。取引が成立し、ロシアの石油・ガスに対する制裁が解除されれば、ロシアは世界市場、特に西側市場に対して(より容易に)より多くの供給を行うことができます。すでに十分な供給が見込まれている市場に追加のロシア供給が流入すると、ブレント原油やWTIの価格が急落する可能性があります。XLEは原油価格と高い相関性を持つため、原油価格の下落はXLE株(エクソン、シェブロンなど)に悪影響を与える可能性があります。

一方、米国がイランを攻撃し、事態が混乱した場合、ホルムズ海峡の懸念が広がり、恐れられる事態が起こるかもしれません。世界の石油供給の約20%〜30%がその海峡を通過しているため、供給ショックへの恐怖からパニックが生じ、XLEは非常に急激な上昇を見せる可能性があります。

- 報酬

- いいね

- コメント

- リポスト

- 共有

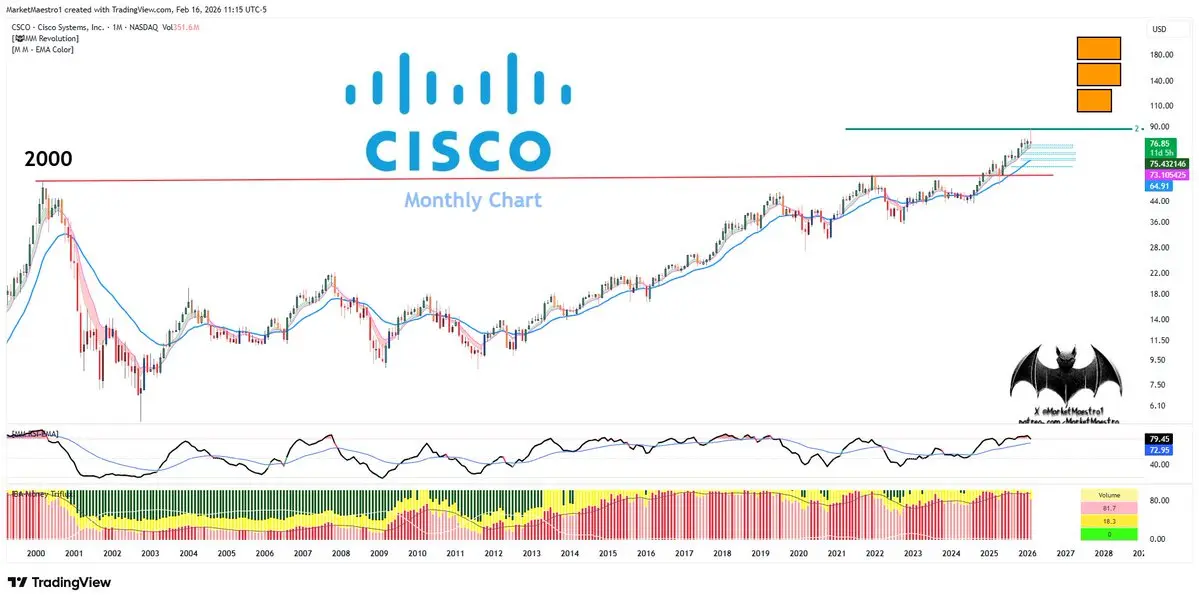

$CSCO

CSCOは第2四半期にEPSと売上高の両面で予想を上回り、2026年度のガイダンスを引き上げました。2026年度の売上高ガイダンスは612億ドルから617億ドルの範囲に引き上げられ、ストリートの予想607億7000万ドルを上回っています。私の見解では、これらは良い数字です。第2四半期には、ハイパースケーラー主導のAI注文が21億ドルに達したことを強調し、ハイパースケーラーのAI注文は50億ドルを超えると述べました。また、2026年度のハイパースケーラーAIインフラの売上高は30億ドル超になるとし、ネオクラウド/主権/エンタープライズ側では第2四半期にAI注文の$350M と25億ドル超のパイプラインがあると述べました。注文面では、製品注文は前年比18%増加し、サービスプロバイダー&クラウドセグメントの注文は65%増加しており、需要が再加速していることを示しています。定期収益基盤も拡大しています:RPOは434億ドル(+5%前年比)、ARRは$31B (+3%前年比)です。ネットワーキングは売上の54%を占め、サービス+セキュリティは37.3%に達しました。配当を引き上げ、積極的な株式買い戻しも行っています。ハードウェア販売の増加に伴い、メンテナンス/サービスやセキュリティサブスクリプションを通じて定期収益基盤が拡大しています。また、Splunkの買収が可観測性/セキュリ

原文表示CSCOは第2四半期にEPSと売上高の両面で予想を上回り、2026年度のガイダンスを引き上げました。2026年度の売上高ガイダンスは612億ドルから617億ドルの範囲に引き上げられ、ストリートの予想607億7000万ドルを上回っています。私の見解では、これらは良い数字です。第2四半期には、ハイパースケーラー主導のAI注文が21億ドルに達したことを強調し、ハイパースケーラーのAI注文は50億ドルを超えると述べました。また、2026年度のハイパースケーラーAIインフラの売上高は30億ドル超になるとし、ネオクラウド/主権/エンタープライズ側では第2四半期にAI注文の$350M と25億ドル超のパイプラインがあると述べました。注文面では、製品注文は前年比18%増加し、サービスプロバイダー&クラウドセグメントの注文は65%増加しており、需要が再加速していることを示しています。定期収益基盤も拡大しています:RPOは434億ドル(+5%前年比)、ARRは$31B (+3%前年比)です。ネットワーキングは売上の54%を占め、サービス+セキュリティは37.3%に達しました。配当を引き上げ、積極的な株式買い戻しも行っています。ハードウェア販売の増加に伴い、メンテナンス/サービスやセキュリティサブスクリプションを通じて定期収益基盤が拡大しています。また、Splunkの買収が可観測性/セキュリ

- 報酬

- いいね

- コメント

- リポスト

- 共有

- 報酬

- いいね

- コメント

- リポスト

- 共有

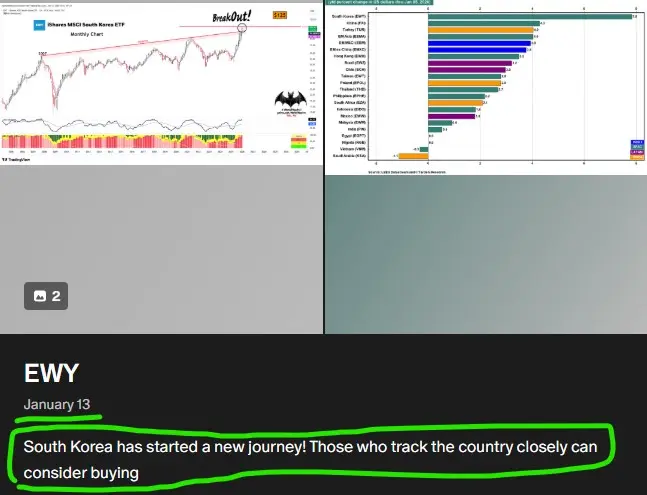

$EWY

買いコール! 💯👇💰

原文表示買いコール! 💯👇💰

- 報酬

- いいね

- コメント

- リポスト

- 共有

$ZS

コレクションバンドと衝突した後、ダブルトップを形成しました。その後、(AI破壊的)のセクターで現れた弱さとともに、壊したカップ+ハンドルの形成を再テストしました。また、サポートバンドを維持しようとしています。しかし、赤い斜め抵抗線を失ってはいけません。さもなければ、ブレイクアウト失敗となり終わりです

原文表示コレクションバンドと衝突した後、ダブルトップを形成しました。その後、(AI破壊的)のセクターで現れた弱さとともに、壊したカップ+ハンドルの形成を再テストしました。また、サポートバンドを維持しようとしています。しかし、赤い斜め抵抗線を失ってはいけません。さもなければ、ブレイクアウト失敗となり終わりです

- 報酬

- いいね

- コメント

- リポスト

- 共有

- 報酬

- いいね

- コメント

- リポスト

- 共有

$SOFI

AI主導の売り優先、質問後の波の中で、金融ETFの大規模な売却はSoFiにとって二つの異なるチャネルを通じて重要です:

ご存知の通り、金融セクター (XLF) はAIの影響で売られています。XLFは通常、JPMorganやBank of Americaなどの伝統的な銀行が支配しています。市場がAIによって古い銀行業が淘汰されるという見解でこのセクターを売っている場合、SOFIはその見解の犠牲者ではなく、むしろ勝者になる可能性があります。なぜなら、SoFiはフィンテックのアイデンティティを持ち、この分断の中央に位置するハイブリッド構造だからです。

もしSOFIがAIを活用したテクノロジー重視の破壊者として見られる場合 (Galileo、Technisys)、伝統的な銀行からの資金の一部は最終的にここに預けられるかもしれません。

一方、アルゴリズムに基づくファンドの資金流はしばしばセクター売りのロジックで動きます。したがってETFからの資金流出時には、良い銘柄も悪い銘柄とともに罰せられ、SOFIは金融の倍率でペナルティを受ける一方、そのテクノロジーの強さは無視されることがあります。

市場がOld Economy (銀行) を売り、新しい経済 (AI) を買っている場合、理論上、SOFIは新しい経済側に留まるべきです。ETFの売却によって不当に叩かれている場合、それはコストベ

原文表示AI主導の売り優先、質問後の波の中で、金融ETFの大規模な売却はSoFiにとって二つの異なるチャネルを通じて重要です:

ご存知の通り、金融セクター (XLF) はAIの影響で売られています。XLFは通常、JPMorganやBank of Americaなどの伝統的な銀行が支配しています。市場がAIによって古い銀行業が淘汰されるという見解でこのセクターを売っている場合、SOFIはその見解の犠牲者ではなく、むしろ勝者になる可能性があります。なぜなら、SoFiはフィンテックのアイデンティティを持ち、この分断の中央に位置するハイブリッド構造だからです。

もしSOFIがAIを活用したテクノロジー重視の破壊者として見られる場合 (Galileo、Technisys)、伝統的な銀行からの資金の一部は最終的にここに預けられるかもしれません。

一方、アルゴリズムに基づくファンドの資金流はしばしばセクター売りのロジックで動きます。したがってETFからの資金流出時には、良い銘柄も悪い銘柄とともに罰せられ、SOFIは金融の倍率でペナルティを受ける一方、そのテクノロジーの強さは無視されることがあります。

市場がOld Economy (銀行) を売り、新しい経済 (AI) を買っている場合、理論上、SOFIは新しい経済側に留まるべきです。ETFの売却によって不当に叩かれている場合、それはコストベ

- 報酬

- いいね

- 1

- リポスト

- 共有

Lions_Lionish :

:

GATE SQUAREの最新コイン&マーケットアップデートを独占配信 ✅ 今すぐフォロー 🔥💰💵$CCJ

この株はこれまでの荒波の時期を乗り越えてきました。似たようなRSIの形が何度も形成されているにもかかわらずです。再び小さなダブルトップとネガティブダイバージェンスの兆候がありますが、より横ばいのネガティブで少し深くなっており、この過程も乗り越えられると考えています。月次ベースで見る必要があり、下のサポートバンドは押し目で再び保護的な役割を果たす可能性があります。

原文表示この株はこれまでの荒波の時期を乗り越えてきました。似たようなRSIの形が何度も形成されているにもかかわらずです。再び小さなダブルトップとネガティブダイバージェンスの兆候がありますが、より横ばいのネガティブで少し深くなっており、この過程も乗り越えられると考えています。月次ベースで見る必要があり、下のサポートバンドは押し目で再び保護的な役割を果たす可能性があります。

- 報酬

- 1

- コメント

- リポスト

- 共有

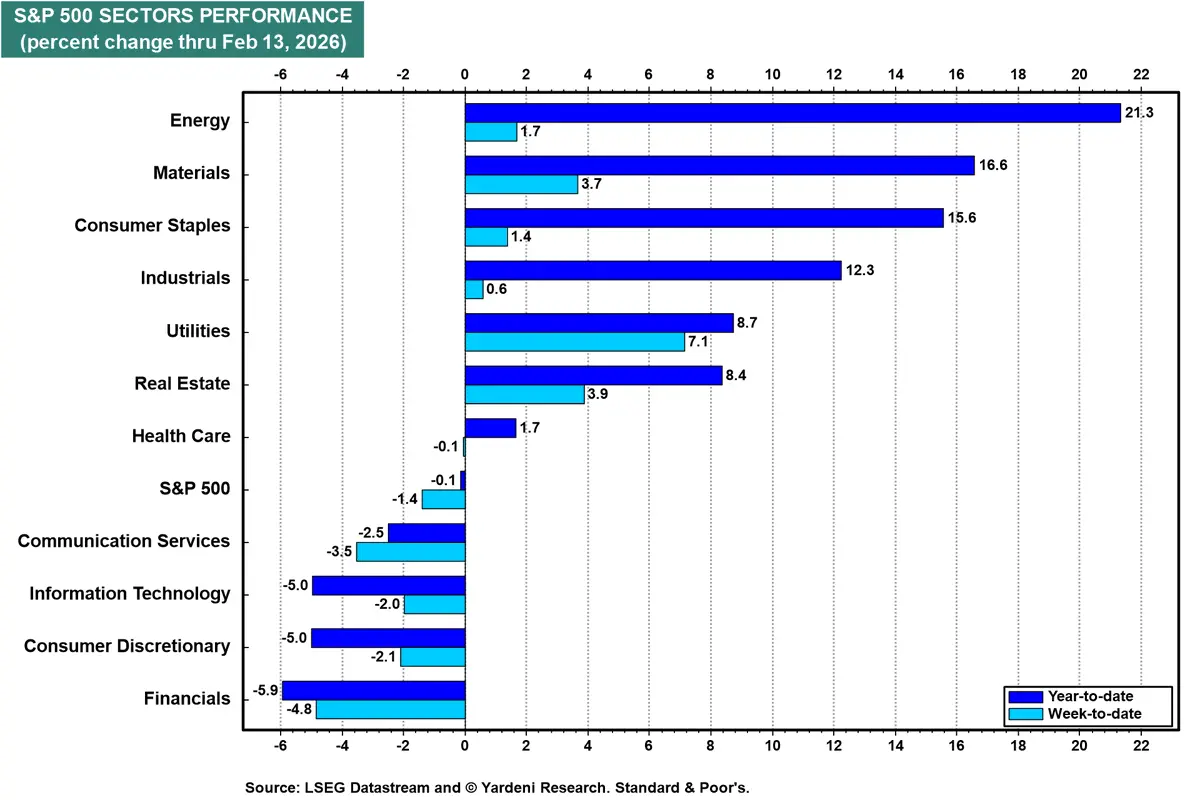

$SPY $Q

私たちが進行中のプロセスを最もよく要約しているのは:回転!

原文表示私たちが進行中のプロセスを最もよく要約しているのは:回転!

- 報酬

- いいね

- コメント

- リポスト

- 共有

$DNN

月次で注目すべき重要価格:..は失ってはならないサポートラインであり、..は上昇トレンドのために突破すべきレジスタンスラインです。

週次で注目すべき重要価格:..は失ってはならないサポートラインであり、..はクリアすべきレジスタンスラインです。

これらのレベルと終値に基づいて方向性が明確になります。…矢印で示したように振る舞うことがあります。

原文表示月次で注目すべき重要価格:..は失ってはならないサポートラインであり、..は上昇トレンドのために突破すべきレジスタンスラインです。

週次で注目すべき重要価格:..は失ってはならないサポートラインであり、..はクリアすべきレジスタンスラインです。

これらのレベルと終値に基づいて方向性が明確になります。…矢印で示したように振る舞うことがあります。

- 報酬

- 1

- コメント

- リポスト

- 共有

$NLST

それは矢印で示した道に沿って進みたいかもしれません。月末のクローズに基づいて決定します。もちろん、道は変わる可能性があり、確定ではありません

原文表示それは矢印で示した道に沿って進みたいかもしれません。月末のクローズに基づいて決定します。もちろん、道は変わる可能性があり、確定ではありません

- 報酬

- 1

- コメント

- リポスト

- 共有

サムスンはこの分野に新しいわけではありませんが、新世代のAIに焦点を当てたメモリ市場でリーダーシップを取り戻すための大規模な攻勢を開始しました。2026年2月12日、サムスンは世界初のHBM4 16世代ハイバンド幅メモリを大量生産開始し、顧客に出荷したと発表しました。昨年はSKハイニックスやマイクロンにやや遅れをとっていましたが、この動きはAIチップ、特にNvidiaの次世代GPU向けのリーダーシップを取り戻す努力と見なされています。サムスンが実際に新たに参入したり、収益性を向上させようとしているのは、非メモリ半導体ファウンドリー事業です。テスラとの契約:サムスンはテスラ向けの次世代自動運転チップの製造に数十億ドル規模の契約を締結しました。アナリストは、長年赤字だったサムスンの非メモリチップ部門が、2026年に初めて営業利益を出すと予測しています。ゴールドマン・サックスやUBSなどの大手は、サムスンに深刻な供給不足が生じると予測しています。これにより、サムスンの利益率が大きく拡大する可能性があります。2026年の営業利益は180兆ウォンを超える可能性があり、メモリ価格の上昇とともにほぼ4倍に増加する見込みです。しかし、株価はひどい状態です。この底値から抜け出すのは容易ではありません。また、OTC市場で取引されているため、注意が必要です。

原文表示

- 報酬

- 1

- コメント

- リポスト

- 共有

$DPRO

緑のサポートラインは、道に沿った行動を支える最も重要なサポートです。失ってはいけません

原文表示緑のサポートラインは、道に沿った行動を支える最も重要なサポートです。失ってはいけません

- 報酬

- いいね

- コメント

- リポスト

- 共有

$BSFY 🇩🇪

最近、ワシントンとモスクワの間で取引の可能性に関するニュースがあります。投資家として、私たちが本当に尋ねるべき質問は:平和が訪れた場合、方程式はどう変わるのか?誰がプラスまたはマイナスの影響を受けると思いますか?私から始めましょう:BSFYはプラスの恩恵を受ける可能性があります。修正バンドのブレイクアウトとともに、上昇トレンドを開始できるでしょう。

原文表示最近、ワシントンとモスクワの間で取引の可能性に関するニュースがあります。投資家として、私たちが本当に尋ねるべき質問は:平和が訪れた場合、方程式はどう変わるのか?誰がプラスまたはマイナスの影響を受けると思いますか?私から始めましょう:BSFYはプラスの恩恵を受ける可能性があります。修正バンドのブレイクアウトとともに、上昇トレンドを開始できるでしょう。

- 報酬

- いいね

- コメント

- リポスト

- 共有

先物はグリーンです

原文表示

- 報酬

- いいね

- コメント

- リポスト

- 共有