Investment and Risk: How to Safely Participate in the Meme Market

This chapter will systematically guide you through the key safety points and strategy building in Meme coin investment, from wallet setup and risk identification to fund allocation and emotional management, helping you find a balanced approach to rational operations in the highly volatile Meme market.

Starting with Wallets: Safety is the First Step in Investment

Before any on-chain investment activity, wallet setup and usage security are the first line of defense. Whether you choose {Pump.fun}, {Gate Fun}, or other Meme Launchpads, you must have an independent, protected wallet environment.

1. Wallet Choice and Setup

- {MetaMask} (Ethereum ecosystem): The most commonly used EVM wallet, supporting Ethereum, Base, BNB Chain, and other ecosystems.

- {Phantom} (Solana ecosystem): Preferred by Solana chain users, compatible with {Pump.fun} and tokens like BONK, WIF.

- {Gate Wallet}: Suitable for {Gate Layer} and {Gate Fun} users, allowing direct on-chain interactions within the Gate App.

It’s recommended to establish separate wallets for different purposes (trading, testing, airdrop participation) and store recovery phrases offline, avoiding screenshots or cloud storage.

2. Common DEX Tools and Applications

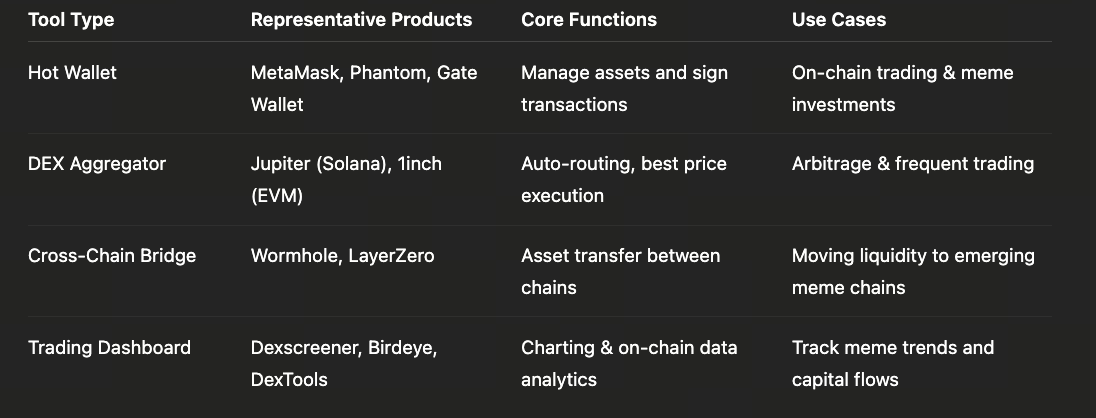

Meme coins are mainly active in on-chain DEXs (Decentralized Exchanges). Here are commonly used tools:

- {Jupiter} (Solana): Quickly search popular tokens, automatically route the best trading path;

- {Uniswap} (Ethereum / Base): Established DEX, suitable for trading mainstream Memes;

- {Gate Swap} ({Gate Layer}): Designed specifically for {Gate Fun} issued tokens, automatically locks liquidity after migration.

These tools help you execute trades quickly, but be mindful of slippage settings and the risk of fake tokens.

Identifying Common Traps: Rug Pulls and High Slippage Scams

In the Meme market, scams often coexist with innovation. Understanding common risks is key to avoiding losses.

1. Rug Pull

Refers to project teams suddenly withdrawing liquidity after the token’s popularity rises, causing the token value to plummet to zero.

Common characteristics include:

- Unlocked contract liquidity (funds can be withdrawn at any time);

- No team disclosure or newly created social accounts;

- Large number of buy orders in a short period with almost no one selling;

- Contract functions include “blacklist” or “tax rate modification” permissions.

Judgment techniques:

On {Pump.fun}, check if the token has “graduated” to the Raydium liquidity pool;

On {Gate Fun}, confirm if the project has completed 100% progress and migrated to {Gate Swap} (liquidity is automatically locked after migration).

2. High Slippage Traps

Some projects deceive traders through high slippage settings (e.g., 20%-50%) to collect excessive fees.

Prevention methods:

- Check the “Price Impact” indicator on DEX before trading;

- If slippage is too high, review the token’s transfer tax rate in the contract explorer;

- Use small test orders to confirm safety before investing main funds.

Meme Investment Strategies: From Position Allocation to Profit-Taking Rules

The core of Meme investment is not “betting on one 100x coin” but finding probabilistic advantages in high-risk environments through structured strategies.

1. Fund Allocation

Consider using the “6-3-1” principle:

- 60% invested in mainstream Memes (DOGE, SHIB, WIF, MOG, etc.), relatively controllable volatility;

- 30% participating in popular Launchpad projects ({Pump.fun}, {Gate Fun}, etc.), seeking short to medium-term gains;

- 10% reserved as experimental funds for high-risk attempts or new on-chain narrative projects.

2. Profit-Taking and Stop-Loss Strategies

- Profit-taking: Recommend staged profit-taking (30%+30%+40%), securing profits while retaining upside potential;

- Stop-loss: Set a maximum loss percentage (e.g., 20%), exit when reached, don’t “fight” the market;

- Trailing Stop: Set dynamic profit-taking on-chain or on CEX to protect against sudden rises and falls.

3. Review and Data Tracking

Use tools (like Dextools, Birdeye, Dexscreener) to monitor token trading volume, liquidity, and holder concentration, and analyze whale behavior through wallet analysis (e.g., Solscan or BaseScan).

Social Hype vs. Actual Liquidity: Don’t Be Misled by Emotions

Meme coin explosions often originate from social media hype. But hype ≠ value; liquidity is the real signal.

Judgment techniques:

- Focus on real trading depth (24h trading volume to holder number ratio);

- Observe the sustainability of community enthusiasm, not just instant bursts;

- Analyze whether there’s genuine user interaction in Twitter, Telegram, Discord channels, rather than bot spamming.

A truly potential Meme project often maintains stable trading and capital inflow even after the hype subsides.

Psychological Aspect: Balancing FOMO and Patience

The hardest part of Meme investing is not project selection, but emotional control.

- FOMO (Fear Of Missing Out): Easy to impulsively chase when seeing a coin surge 1000%;

- Overconfidence: Increasing position size after consecutive profits, ultimately losing gains to corrections;

- Impatience: Selling potential coins too early, missing long-term trends.

Suggest establishing a fixed operational rhythm:

- Set profit and loss boundaries before investing;

- Avoid excessive price watching after investing, stay calm;

- Regularly summarize decision-making logic, optimize judgment models.

Winners in the Meme market are often not the “smartest” people, but those who can maintain stable execution between greed and fear.

Summary

The world of Meme coins is a game of speed, emotion, and risk management. Wallet security is the foundation, risk identification is the defense line, strategy allocation is the underlying logic, and emotional control is the key to staying in the game long-term. Short-term wealth stories belong to the few, while long-term profit patterns belong to those who understand risk, respect cycles, and know when to exit.