决定 Crypto 未来行情的除了美联储降息,还有另一个重要数据

文章指出,尽管关税问题导致了市场的短期波动,但市场的长期走势仍受到通胀和降息预期的主导。转发原文标题《决定Crypto未来行情的除了美联储降息,还有另一个重要数据丨BK Weekly#23》

TL;DR

在经历起伏的关税摩擦一周后,市场终于在周末有了一些喘息机会,但这种喘息能持续多久,尚不可断论,因为关税问题是一种事件性的突发情况,导致的是资金的避险和情绪的短暂坍塌,所以波动性也会非常大。

不过一旦市场确认了关税带来的基本面改变和避险情绪的释放,整个金融市场便能从中找到新的平衡,这也是为什么全球股市,尤其是美股在上周五以收涨结束了一周的波动,这点我们从标普500的波动率指数变化就可看出一二。

可以看到,上周VIX指数创下了近期新高,过去几年能与之“媲美”的除了去年日本央行加息的极端事件插针,再就是2020年疫情引起的金融动荡,这也是为什么市场在过去一周会出现如此大波动的原因,毕竟历史罕见。

那么,当这种巨大波动暂告段落后,影响Crypto市场走势的又要回到老生常谈的“通胀”和“降息”上来,因为只有降息才能迎来“水漫金山”,也才能为以BTC为首的风险资产带来增长的希望。

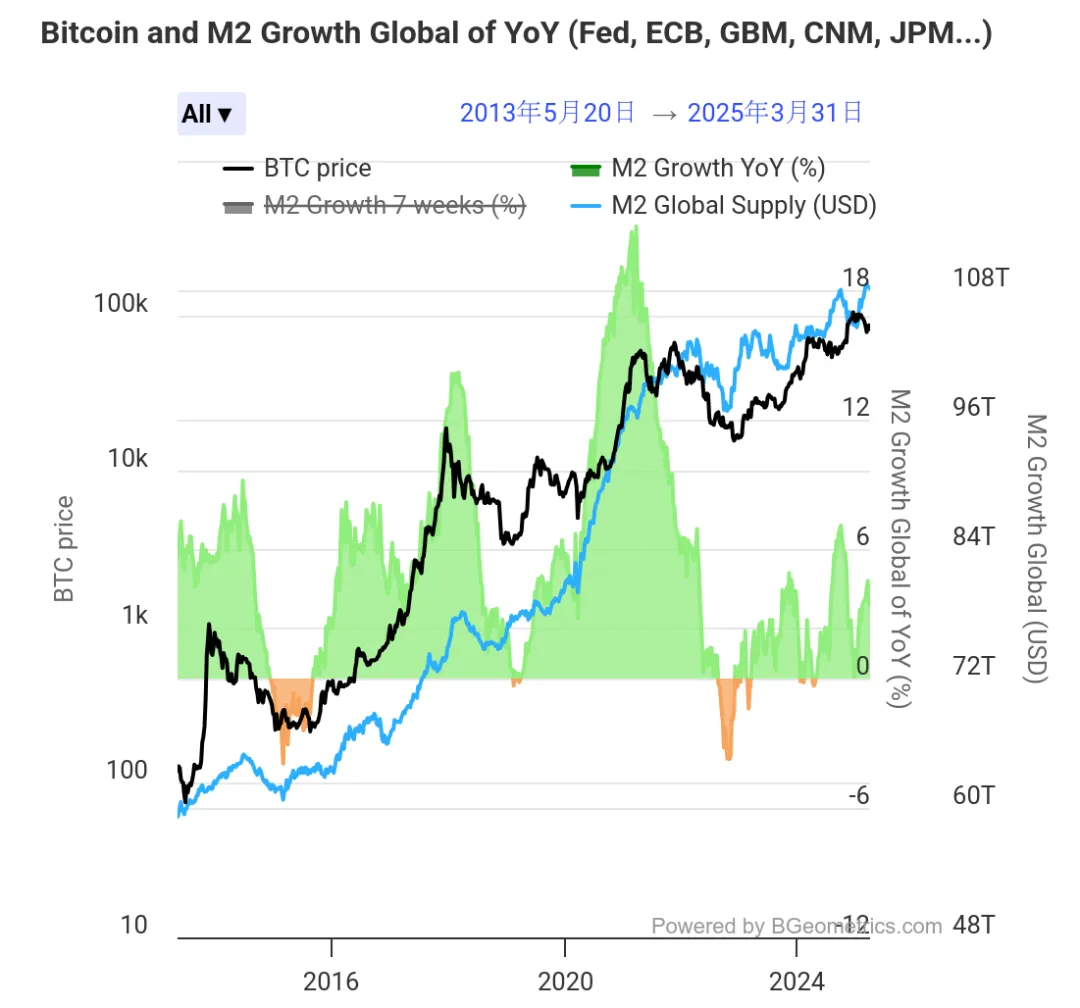

我们通过对比过去10年全球广义货币供应量(M2)与BTC的走势,就可以分析出这种相关性,下图可以直观看到,BTC过去10年的巨大涨幅正是建立在全球M2暴增基础上,且这种相关性走势远超其他金融数据。

这也是为什么每当老美要公布和通胀或降息相关数据时,BTC总会有所波动,因为它最终影响到的是能否有新的资金进入Crypto领域。

但目前Crypto市场似乎大部分人都只把目光集中到了美联储的降息路径上,而忽视了另一个值得关注的数据——PBOC资产规模,也就是央行资产规模,它反映的是当前我国货币的流动性情况。

当大家都在关注西海岸的金融市场时,恰恰忽视了我们自己的金融流动性,实际上它与BTC的涨跌幅同样息息相关,毕竟我们可是泱泱大国,数一数二。

下图是BTC过去3个周期涨幅与PBOC资产规模增长的变化图,可以看到这种相关性波动几乎贯穿了每一次BTC的大涨,也刚好和每4年一次的周期相对应。

PBOC的流动性在2020-2021年的Crypto牛市、2022年的熊市、2022年-2023年初从周期低点的复苏、2023年第四季度(BTC ETF获批之前)的飙升以及2024年的第二季度至第三季度的回调中都发挥了作用。

同样在2024年美国大选前几个月,PBOC的流动性再次转为正值,刚好带来了一波“选举牛”。

不过在下图我们又可以看到,POBC的规模在2024年9月后开始回落,并于2024年底触底回升,目前涨至了过去一年的高点。而从数据相关性看,PBOC流动性的变化通常先于BTC和Crypto市场大幅波动。

有趣的是,在2017年的BTC牛市中,美联储并不是“放水”的那一方,反而全年加息了3次,且存在量化紧缩,但以BTC为首的风险资产在2017年表现依然非常乐观,因为PBOC规模在那一年创下新高。

甚至从标普500的涨幅来说,也与PBOC的流动性存在一定相关性。从历史数据看,PBOC总资产规模与标普500的年度相关性系数约为0.32(基于2015-2024年数据)。

当然某种意义上,也是因为PBOC季度货币政策报告与美联储议息会议的时间窗口有重叠期,所以相关性会在短期被放大。

综上,我们可以发现,除了要密切关注老美的放水情况,同样需要留意国内的金融数据变化。而在一周前新闻已经放出来了:“降准、降息等货币政策工具已留有充分调整余地,随时可以出台”,我们要做的便是跟踪这一变化。

值得注意的是,从资产规模来看,截止2025年1月,我国存款总额为42.3万亿美元,而老美的存款总额约为17.93万亿美元,不得不说,从存款规模上看,我们存在更多的金融可能性,如果流动性改善,或许会迎来某种变化。

当然,另一个需要探讨的点在于,资金的流动性如果有了,是否能流入加密市场,毕竟还存在某些限制,但香港已经给出了答案,从政策松紧情况和便捷些看,已不同于几年前。

最后,借用雷布斯的一句话来结束本周评述,“风来了猪都会飞”,乘势而上好过逆水行舟,我们要做的除了等待,就是在风起时敢于拾级而上,迎风飞扬。

声明:

本文转载自 [区块链骑士],原文标题《决定Crypto未来行情的除了美联储降息,还有另一个重要数据丨BK Weekly#23》,著作权归属原作者 [区块链骑士],如对转载有异议,请联系 Gate Learn 团队,团队会根据相关流程尽速处理。

免责声明:本文所表达的观点和意见仅代表作者个人观点,不构成任何投资建议。

文章其他语言版本由 Gate Learn 团队翻译, 在未提及 Gate.com 的情况下不得复制、传播或抄袭经翻译文章。

相关文章

不可不知的比特币减半及其重要性

如何选择比特币钱包?

CKB:闪电网络促新局,落地场景需发力