Mọi ETF Crypto của Mỹ mà bạn cần biết vào năm 2025

Tại sao ETF Tiền điện tử đang trở nên phổ biến

Với một chính quyền Mỹ thân thiện với tiền điện tử hơn và sự rời bỏ của Chủ tịch SEC Gary Gensler, các quỹ tài sản hiện đang đẩy mạnh cho một loạt rộng hơn các ETF - bao gồm cả altcoins, memecoins và thậm chí là NFTs.

Những điểm chính

- ETFs vị thế BTC và ETH mang về hàng tỷ đô la trong dòng vốn tự doanh, làm cho tiền điện tử hợp pháp trong TradFi.

- Các quỹ tài sản đang tích cực nộp đơn xin ETF bao gồm Solana, XRP, Litecoin, Cardano và nhiều hơn nữa.

- ETF cho các đồng tiền memecoins như DOGE, TRUMP, BONK và PENGU cũng đã được đệ trình.

- Bloomberg và Polymarket ước lượng khả năng được phê duyệt dao động từ 75–90% cho các tài sản như SOL, XRP và LTC, đến rất thấp cho SUI, APT và quỹ dựa trên meme.

Tiền điện tử bị chia cắt. Mọi thứ đều bị phân mảnh, từ tính thanh khoản đến ý kiến về sự ưu việt của Layer 1, và mọi người có những ý kiến khác nhau. Nhưng nếu có một điều gì đó kết nối tất cả những người sống trong thế giới tiền điện tử, đó là mong muốn được chấp nhận rộng rãi.

Vào năm 2024-2025, ước mơ được chấp nhận rộng rãi đã tiến một bước ngoặt lớn với sự chấp thuận và mở rộng nhanh chóng của ETF Tiền điện tử.

Lần đầu tiên, nhà đầu tư có thể trực tiếp tiếp cận một loạt tài sản kỹ thuật số thông qua các tài khoản môi giới truyền thống mà không cần điều hướng qua các ví tiền điện tử phức tạp hoặc sàn giao dịch.

Các nhà đầu tư tổ chức, trước đây do lo ngại về không chắc chắn về quy định, đã đổ hàng tỷ đô la vào BitcoinvàEthereumETFs chỉ trong vài tuần sau khi ra mắt. Tác động đã rõ rệt. Giá Bitcoin đã tăng vọt vượt qua mức cao mới nhất, và ETF Ethereum sớm nhận được sự chấp thuận. Những ETF này cung cấp một phương tiện đầu tư dễ tiếp cận hơn và tính thanh khoản thị trường sâu hơn cho các nhà tham gia TradFi. Điều này cũng tạo tiền lệ về quy định cho các ETF tiền điện tử.

Bây giờ, với Gary Gensler rời khỏi vị trí Chủ tịch SEC và Mỹ đang được điều hành bởi một chính quyền thân thiện với tiền điện tử hơn, các quản lý tài sản đang tận dụng cơ hội này để đệ đơn cho nhiều quỹ ETF altcoin hơn như SolanavàRipple, và thậm chí cả tiền điện tử như Dogecoin, BONK, và Trump Memecoin.

Bài viết này cung cấp một cái nhìn toàn diện về tình hình hiện tại của cơn sốt ETF tiền điện tử liên quan đến Hoa Kỳ.

ETF Bitcoin đã đặt nền móng

Bitcoin đã lâu trở thành biểu tượng của tiền điện tử, và vào năm 2024, nó chính thức nhập vào hệ thống tài chính chính thống với sự chấp thuận của sản phẩm đầu tư tiền điện tử ETF thế hệ đầu tiên tại Mỹ. Trong khi ETF hợp đồng tương lai Bitcoin đã tồn tại từ năm 2021, việc ra mắt ETF tiền điện tử thực sự là một cột mốc quan trọng khi nhà đầu tư có thể tiếp cận với việc sở hữu BTC thực sự, chứ không phải là hợp đồng tương lai.

Trong vài ngày giao dịch, ETF Bitcoin trên sàn attracted tỷ đô la trong luồng tiền vào. Dòng vốn này đã tăng đáng kể thanh khoản của Bitcoin và củng cố vị thế của nó như một lớp tài sản hợp pháp bên cạnh các loại hàng hóa truyền thống như vàng.

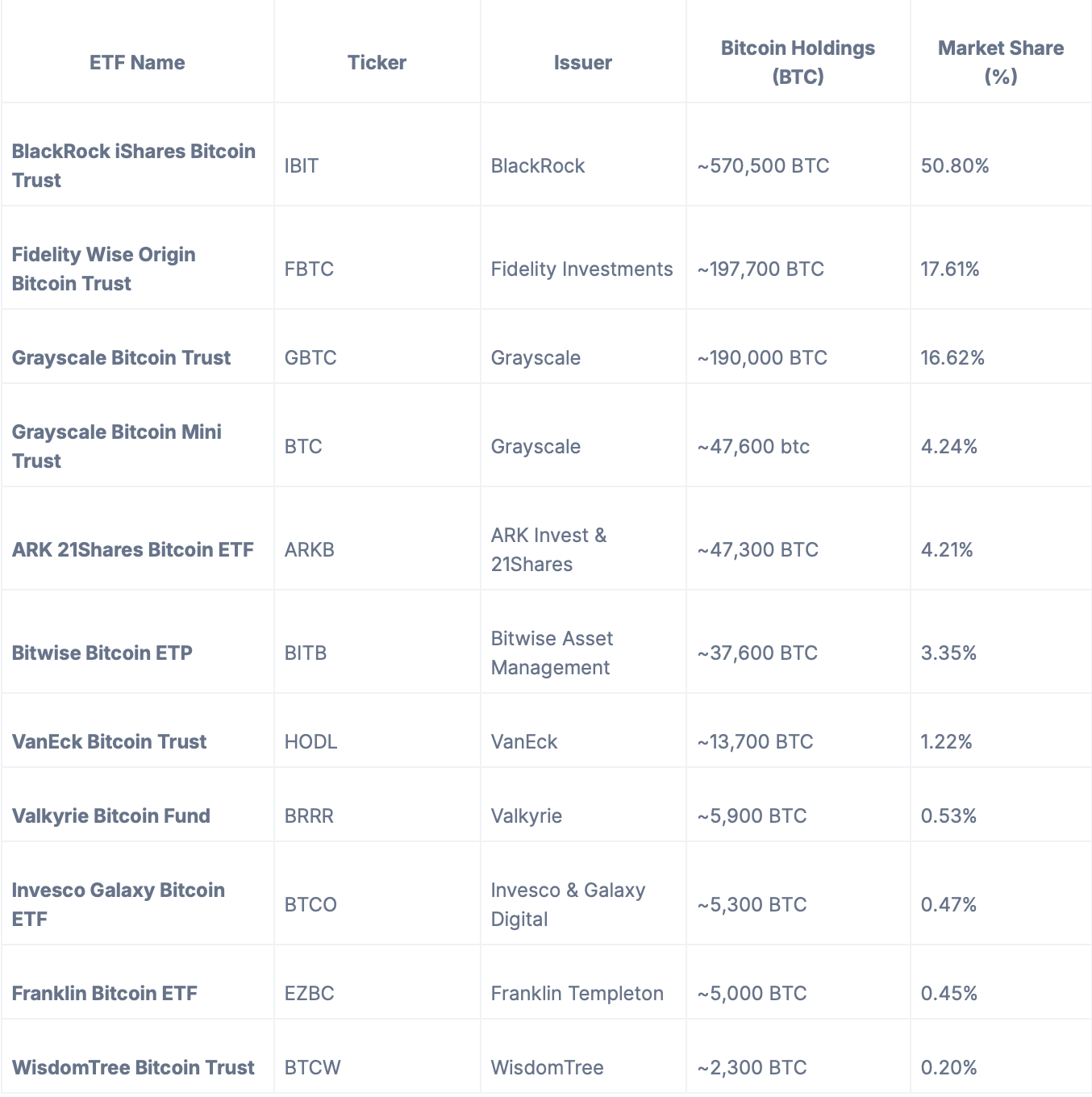

Với nhiều quỹ quản lý tài sản ra mắt các quỹ ETF Bitcoin cạnh tranh, thị trường nhanh chóng trở thành một chiến trường thu hút sự chú ý của nhà đầu tư. Trong khi Quỹ Bitcoin iShares của BlackRock chiếm ưu thế trong lưu lượng tiền rót ban đầu, các công ty như Fidelity, ARK Invest và VanEck cũng nhận thấy sự tham gia đáng kể.

Đến năm 2025, một số quỹ quản lý tài sản lớn đã ra mắt ETF Bitcoin theo giá hiện tại. Dưới đây là phân tích chi tiết về các quỹ hàng đầu và số lượng Bitcoin họ nắm giữ (tính đến thời điểm viết bài).

Nguồn: Bảng theo dõi ETF Bitcoin của Blockworks

Sự khác biệt chính giữa ETF Bitcoin dựa trên tương lai và ETF Bitcoin dựa trên thị trường hiện tại:

- ETFs về tương lai (ví dụ: BITO): Giữ hợp đồng tương lai Bitcoin của CME thay vì BTC thực tế. Dễ mắc lỗi theo dõi do việc chuyển hợp đồng.

- ETF Spot (ví dụ, IBIT): Trực tiếp nắm giữ Bitcoin, cho phép theo dõi chính xác giá thị trường của BTC.

Ethereum ETF là bước hợp lý tiếp theo

Sau thành công của các quỹ ETF Bitcoin, cột mốc lớn tiếp theo trong cảnh quan ETF tiền điện tử là Ethereum. Trong khi Bitcoin thường được coi là “vàng kỹ thuật số,” Ethereum phục vụ như cột sống của DeFivà hệ sinh thái hợp đồng thông minh.

Sự do dự của cơ quan quản lý về ETF Ethereum ban đầu rất cao. Khi SEC chấp thuận ETF Bitcoin thời điểm đầu năm 2024, con đường cho Ethereum trở nên rõ ràng hơn đáng kể.

Đến tháng 5 năm 2024, nhiều quỹ ETF tương lai Ethereum đã nhận được sự chấp thuận của cơ quan quản lý, đánh dấu một cột mốc quan trọng khác cho việc áp dụng tiền điện tử, với việc quỹ ETF Ethereum hiện tại được phê duyệt vào tháng 7 năm 2024. Như một kết quả, giá của Ethereum đã chọc phá mốc 4.000 đô la trong những tháng trước khi nhận được sự chấp thuận, giống như cuộc tăng giá của Bitcoin vào đầu năm.

Đến năm 2025, các quỹ ETF Ethereum trực tiếp cùng nhau nắm giữ một lượng lớn ETH, biến chúng trở thành một trong những phương tiện đầu tư cơ sở lớn nhất cho tài sản đó.

Nguồn: Bảng theo dõi ETF Ethereum của Blockworks

Với gần 3 triệu ETH được nắm giữ bởi các quỹ ETF (tính đến thời điểm viết bài), sự tham gia của các tổ chức trong Ethereum hiện đang mạnh mẽ hơn bao giờ hết.

Mùa ETF Altcoin là lần tiếp theo

Với ETF Bitcoin và Ethereum theo giá hiện tại đã chắc chắn có sẵn, các quản lý tài sản đã đặt mục tiêu của họ vào hệ sinh thái tiền điện tử rộng lớn.

Được khuyến khích bởi sự mở cửa ngày càng tăng của SEC đối với tiền điện tử và trang bị cấu trúc giám sát thị trường cải thiện, các quản lý tài sản đã nộp đơn cho một làn sóng các quỹ ETF altcoin. Những đề xuất này nhằm mục tiêu mang lại cơ hội đầu tư cho các token có nhu cầu cao như Litecoin, XRP, Solana, Dogecoin, Cardano, và hơn nữa.

Trong khi chưa có ETF altcoin nào được phê duyệt tại Mỹ, có một số đang được xem xét tích cực và tinh thần quản lý đang thay đổi. Các nhà phân tích và người nội bộ tin rằng khi ETF đầu tiên được phê duyệt, các ETF khác sẽ tiếp tục theo sau liên tiếp. Điều này sẽ rất giống với hiệu ứng domino đã thấy với Bitcoin và Ethereum.

Tiền điện tử Solana (SOL) ETFs

Sự phổ biến của Solana đã tăng mạnh trong năm qua, khiến nó trở thành một trong những ứng cử viên ETF altcoin được yêu cầu nhiều nhất. Với một hệ sinh thái DeFi mạnh mẽ, Solana được xem là đối thủ gần nhất của Ethereum trong lĩnh vực hợp đồng thông minh.

Tuy nhiên, một rào cản quản lý chính là: liệu Solana có được coi là một loại chứng khoán hay không. Các vụ kiện và tranh luận phân loại tiếp tục diễn ra có thể làm trì hoãn quyết định của SEC. Mặc dù vậy, cơ sở hạ tầng đã hình thànhHai quỹ ETF tương lai Solana (SOLZ, SOLT) được liệt kê bởi DTCC, và CME đang chuẩn bị hợp đồng tương lai SOL để ra mắt vào năm 2025.

Tín dụng VanEck Solana

- Filed: Tháng Sáu 2024

- Chi tiết: VanEck đã nộp đơn đăng ký S-1 với SEC để ra mắt một quỹ ETF Solana trực tiếp, nhằm theo dõi giá SOL trực tiếp. Điều này là lần đầu tiên tại Mỹ có đơn đăng ký quỹ ETF Solana trực tiếp.

ETF Solana Core của 21Shares

- Filed: Tháng 6 năm 2024

- Chi tiết: 21Shares đã nộp một bản đăng ký S-1 với SEC cho một ETF Solana ngay lập tức theo sau sáng kiến của VanEck, để được niêm yết trên sàn giao dịch Cboe BZX.

ETF Solana Bitwise

- Filed: Tháng 11 năm 2024

- Chi tiết: Ban đầu, Bitwise đã nộp đơn thành lập một quỹ tín thác theo luật tại Delaware cho một ETF Solana, sau đó rút lại để nộp lại một S-1 với SEC.

Chuyển đổi ETF Grayscale Solana (Chuyển đổi ETF Spot)

- Đã nộp: Tháng 1 năm 2025

- Chi tiết: Grayscale đã nộp đơn với SEC để chuyển đổi Quỹ Solana hiện tại của mình (GSOL) thành một ETF trực tiếp để được niêm yết trên NYSE Arca. Đơn này được xây dựng dựa trên quỹ AUM 134 triệu đô la của nó.

ETF Canary Solana

- Đệ trình: Cuối năm 2024 đến đầu năm 2025

- Chi tiết: Canary Capital đã nộp đơn S-1 với SEC để thành lập một quỹ ETF Solana, tham gia cuộc đua trong bối cảnh sự quan tâm tăng vọt đến quỹ ETF altcoin sau khi Trump giành chiến thắng trong cuộc bầu cử.

ETF Franklin Templeton Solana

- Filed: Tháng Ba 2025

- Chi tiết: Franklin Templeton, quản lý hơn 1,5 nghìn tỷ USD tài sản, đã nộp các biểu mẫu S-1 và 19b-4 với SEC để phát hành một ETF Solana trên thị trường giao dịch Cboe BZX, khiến nó trở thành ứng viên ETF SOL thứ sáu lớn tại Mỹ.

ETF SOL sẽ được phê duyệt không? TheoCác nhà phân tích tại Bloomberg Intelligence, ETFs của Solana có khả năng cao được phê duyệt (75% khả năng).

Tiềm năng ảnh hưởng: Nhà phân tích dự kiến$3-6 tỷ đô la trong trường hợp các ETF được chấp thuận.

ETFs XRP (Ripple)

XRP đặt ra một thách thức độc đáo: tình trạng pháp lý của nó. Trong khi Ripple đã đảm bảo một chiến thắng pháp lý một phần vào năm 2023, quan điểm cuối cùng của SEC về việc XRP có phải là một chứng khoán vẫn là một khu vực mơ hồ. Tuy nhiên, sự tràn ngập các đơn kiện vào đầu năm 2025 cho thấy sự lạc quan rằng sự rõ ràng về mặt pháp lý sắp tới hoặc đủ để được phê duyệt ETF.

ETF Bitwise XRP

- Filed: Tháng 10 năm 2024

- Chi tiết: Quản lý tài sản Bitwise đã nộp đơn đăng ký S-1 với SEC, đánh dấu đề xuất ETF XRP chính thức đầu tiên của Mỹ.

ETF Canary Capital XRP

- Đã nộp: Tháng 10 năm 2024

- Chi tiết: Canary Capital, do cựu đồng sáng lập Valkyrie Funds Steven McClurg sáng lập, đã nộp đơn S-1 với SEC để thành lập một ETF XRP.

ETF XRP cốt lõi của 21Shares

- Đã nộp: Tháng 11 năm 2024

- Chi tiết: 21Shares, một công ty đầu tư tiền điện tử có trụ sở tại Thụy Sĩ, đã nộp đơn S-1 với SEC để ra mắt một ETF XRP trên thị trường.

ETF WisdomTree XRP

- Filed: Tháng Mười Hai 2024

- Chi tiết: WisdomTree, một quỹ quản lý tài sản toàn cầu, đã nộp đơn S-1 với SEC để đưa một ETF XRP trực tiếp được niêm yết trên Sàn giao dịch Cboe BZX.

Chuyển đổi ETF XRP Grayscale (Chuyển đổi ETF Spot)

- Đã nộp: Tháng 1 năm 2025

- Chi tiết: Grayscale Investments đã nộp hồ sơ với SEC để chuyển đổi XRP Trust hiện tại của mình (quản lý 16,1 triệu đô la tính đến tháng 1 năm 2025) thành một ETF trực tiếp để được niêm yết trên NYSE Arca.

ETF CoinShares XRP

- Filed: Tháng 1 năm 2025

- Chi tiết: Công ty đầu tư tiền điện tử Châu Âu CoinShares đã nộp đơn S-1 với SEC cho một ETF XRP spot.

ETF ProShares XRP

- Filed: January 17, 2025

- Chi tiết: ProShares đã nộp S-1 với SEC cho một ETF XRP theo giá hiện tại cùng ba sản phẩm đầu tư liên quan đến XRP khác (chi tiết chưa được chỉ định).

ETF Teucrium XRP

- Đã nộp: 21 tháng 1, 2025

- Chi tiết: Teucrium đã nộp đơn S-1 với SEC cho một ETF XRP theo giá hiện tại, thêm vào danh sách ngày càng tăng của các ứng viên.

MEMX XRP ETF

- Đã nộp: Tháng 2 năm 2025 (ngày chính xác không xác định)

- Chi tiết: MEMX, một sàn giao dịch chứng khoán có trụ sở tại Hoa Kỳ, đã nộp đơn với SEC để phát hành một ETF XRP dưới danh mục Trust dựa trên hàng hóa.

ETF Tiền điện tử Volatility Shares XRP

- Đã nộp: 10 tháng 3, 2025

- Chi tiết: Volatility Shares đã nộp một S-1 với SEC cho một ETF XRP trực tiếp, được thiết kế để theo dõi giá XRP trực tiếp.

Franklin Templeton XRP ETF

- Đã nộp: 11 tháng 3 năm 2025

- Chi tiết: Franklin Templeton, quản lý hơn $1.5 nghìn tỷ, đã nộp các biểu mẫu S-1 và 19b-4 với SEC cho một quỹ ETF XRP, với Coinbase Custody làm người giám hộ.

Liệu ETF XRP sẽ được phê duyệt? Mức độ tích cực vừa phải (65% cơ hội, theonhà phân tích của Bloomberg). Theo thông tin từ Gate.comPolymarket, tuy nhiên, cơ hội cao hơn ở mức 81%.

Tác động tiềm năng: Nhà phân tích tại JPMorgandự án $4-8 tỷ USD trong luồng tiền vào ETF nếu các quỹ ETF XRP được phê duyệt, đẩy mạnh vốn hóa thị trường và uy tín của XRP.

ETFs Litecoin (LTC)

Nếu Bitcoin được coi là “vàng số,” Litecoin được coi là “bạc số.”

LTC đã liên tục giữ vị trí là một trong những loại tiền điện tử có tuổi đời lâu nhất và được giao dịch tích cực nhất trên thị trường. Được ra mắt vào năm 2011 bởi Charlie Lee, Litecoin được thiết kế để cung cấp thời gian giao dịch nhanh hơn và phí thấp hơn so với Bitcoin, làm cho nó lý tưởng cho giao dịch hàng ngày.

Với hơn một thập kỷ lịch sử hoạt động, việc Litecoin được bao gồm trong nhiều đề xuất ETF có vẻ là một bước đi hợp lý sau ETF BTC và ETH.

ETF Tiền điện tử Canary Capital Litecoin

- Filed: Tháng Mười 2024

- Chi tiết: Đã nộp đơn đăng ký S-1 với SEC, đánh dấu đề xuất ETF Litecoin lần đầu tiên tại Mỹ.

ETF Litecoin Canary hiện được xem là ETF altcoin có khả năng được phê duyệt nhất. Với lịch sử dài từ năm 2011, LTC đáp ứng nhiều tiêu chí của SEC về thanh khoản, lịch sử và sự chín chắn của thị trường.

Grayscale Litecoin Trust (Chuyển đổi ETF)

- Đã nộp: Tháng 1 năm 2025

- Chi tiết: Grayscale Investments đã nộp đơn với SEC để chuyển đổi Quỹ Litecoin của Grayscale hiện có (LTCN), quản lý 127,4 triệu đô la tài sản, thành một ETF trên chỗ. Nó sẽ được niêm yết trên NYSE Arca.

Bước đi của Grayscale chuyển đổi Quỹ Litecoin hiện tại thành ETF củng cố kỳ vọng rằng LTC sẽ là một trong những loại tiền điện tử phụ đề xuất nhận được sự chấp thuận ETF đầu tiên.

ETF CoinShares Litecoin

- Filed: Tháng 1 năm 2025

- Chi tiết: CoinShares, một quản lý tài sản kỹ thuật số châu Âu, đã nộp đơn S-1 với SEC cho một ETF Litecoin spot để cung cấp exposure mà không cần bảo quản trực tiếp. Cổ phiếu sẽ được phát hành theo 'Baskets' của 5.000 và được giao dịch trên Nasdaq.

ETF LTC sẽ được phê duyệt không? Cao ( Nhà phân tích ước tínha 90% chance in 2025)

Tiềm năng tác động: Tăng cường khả năng nhìn thấy, tính thanh khoản và giá của LTC khi các kênh ETF mở ra.

ETFs Cardano (ADA)

Cardano nằm trong top 10 tiền điện tử theo vốn hóa thị trường và có một cộng đồng lớn, trung thành. Sự tập trung vào phát triển được đánh giá bởi người đồng nghiệp và bền vững về môi trường khiến nó hấp dẫn đối với các nhà đầu tư quan tâm đến ESG. Tuy nhiên, nó thiếu một thị trường tương lai ở Mỹ, điều này có thể làm chậm quá trình phê duyệt của SEC.

Grayscale Cardano Trust (Chuyển đổi ETF)

- Đã nộp: Tháng Hai 2025

- Chi tiết: NYSE Arca đã nộp mẫu 19b-4 với SEC thay mặt cho Grayscale Investments để niêm yết và giao dịch cổ phần của Grayscale Cardano Trust dưới mã chứng khoán GADA.

ETF ADA sẽ được phê duyệt không? TheoPolymarket, ETFs Cardano có vẻ hứa hẹn với khả năng được phê duyệt ở mức 65%.

Tiềm năng tác động: Tăng sự tham gia đặt cược, sự phát triển của người xác minh, và sự ổn định giá lâu dài.

ETF Avalanche (AVAX)

Avalanchelà một blockchain Layer 1 khác cạnh tranh với Ethereum. Cài đặt tin cậy của VanEck cho thấy ý định, nhưng việc thiếu một đơn đăng ký chính thức từ SEC có nghĩa là nó vẫn ở giai đoạn đầu.

ETF VanEck Avalanche

- Đã nộp: Tháng Ba 2024

- Chi tiết: VanEck, một quỹ quản lý đầu tư toàn cầu, đã nộp đơn đăng ký S-1 với SEC để ra mắt một quỹ ETF Avalanche spot.

Avalanche là một blockchain Layer 1 khác cạnh tranh với Ethereum. Cách thiết lập tin cậy của VanEck cho thấy ý định, nhưng việc thiếu một đơn đăng ký chính thức tại SEC có nghĩa là nó vẫn đang ở giai đoạn đầu.

Liệu ETF AVAX sẽ được phê duyệt? Trong khi khả năng cho một ETF AVAX trực tiếp thấp hơn, khả năng có thể tăng cao sau này trong năm, theoNhà phân tích ETF của Bloomberg James Seyffart.

Tiềm năng ảnh hưởng: Sẽ phụ thuộc nặng nề vào môi trường phê duyệt cho Solana và Cardano.

ETF Aptos (APT)

Aptos là một Layer 1 được xây dựng bởi các kỹ sư trước đây của Meta. Việc nộp đơn ETF được xem là một bước đi táo bạo của Bitwise, nhằm tận dụng cơ hội từ làn sóng tăng trưởng tiền điện tử tiếp theo.

ETF Bitwise Aptos

- Đã nộp: Tháng Ba 2025

- Chi tiết: Quản lý tài sản Bitwise đã nộp một bản tuyên bố đăng ký S-1 với SEC. Bản khai báo này đã theo sau việc đăng ký trước đó của một thực thể tin cậy “Bitwise Aptos ETF” tại Delaware vào ngày 25 tháng 2 năm 2025, đó là một bước hành chính ban đầu. Bản khai báo S-1 vào ngày 5 tháng 3 chính thức hóa đề xuất ETF, với Coinbase Custody được liệt kê là người giám định đề xuất.

Liệu ETF APT sẽ được phê duyệt? Thấp đến vừa (có khả năng cao hơn sau khi SOL, XRP và ADA được phê duyệt).

Tiềm năng tác động: Nếu được phê duyệt sau các ETF altcoin khác, kết quả có thể mang lại tác động ngắn hạn nhỏ nhưng đồng thời là một chiến thắng tượng trưng cho các blockchain mới hơn.

Sui (SUI) ETF

Sui, giống như Aptos, là một Layer 1 đang nổi lên với một hệ sinh thái đang phát triển. Việc đệ trình ETF chủ yếu là một sự suy đoán ở giai đoạn này, cho thấy sự tự tin dài hạn thay vì việc phê duyệt sắp tới.

ETF Canary Sui

- Đã nộp: Tháng Ba 2025

- Chi tiết: Canary Capital đã nộp đơn đăng ký S-1 với SEC. Trong đơn không chỉ định sàn giao dịch hoặc ký hiệu cho ETF. Trước đó, vào ngày 6 tháng 3 năm 2025, Canary Capital đã đăng ký một thực thể tin cậy cho ETF Sui tại Delaware, một bước sơ bộ thường được tiếp theo sau khi nộp S-1.

ETF SUI có được phê duyệt không? Rất thấp (không được mong đợi trước năm 2026)

Tiềm năng tác động: Giá của SUI tăng hơn 10%ngay sau khi tin tức về việc đệ trình ETF của nó được tiết lộ. Nếu sự hăng hái tiếp tục, tác động tiềm năng lên giá của Sui có thể vượt qua mức cao nhất trước đó.

ETF Tiền điện tử Move (MOVE)

ETF MOVE nhằm theo dõi giá của MOVE, token bản địa của Mạng lưới Movement, một giao thức Ethereum Layer 2 được xây dựng bằng cách sử dụng MoveVM (ban đầu được phát triển bởi nhóm Diem của Facebook). Movement tập trung vào hợp đồng thông minh nhanh hơn và tiết kiệm gas - đặt mình là một lớp cơ sở hạ tầng blockchain thế hệ tiếp theo.

ETF MOVE tuân theo cách thức được sử dụng cho việc nộp đơn ETF Layer 1 trước đây (như Aptos và Sui) nhưng với một sự hấp dẫn kỹ thuật và phát triển viên trung tâm hơn.

Rex-Osprey MOVE ETF

- Nhà phát hành: Rex Shares & Osprey Funds

- Chi tiết: Cổ phiếu REX, phối hợp với Quỹ Osprey, đã nộp đơn đăng ký S-1 với SEC vào ngày 10 tháng 3 năm 2025, cho “ETF REX-Osprey MOVE.” ETF đang chờ xác nhận từ SEC về biểu mẫu 19b-4 để bước vào quá trình xem xét chính thức.

ETF MOVE sẽ được phê duyệt không? MOVE vẫn là tài sản khá trẻ, và thiếu thanh khoản cơ sở hoặc thị trường tương lai sâu. Do đó, cơ hội không trông có vẻ quá tươi sáng.

Tiềm năng tác động: Nếu được phê duyệt, điều này có thể phục vụ như một mẫu cho các quỹ ETF dựa trên token cơ sở hạ tầng (ví dụ, Lạc quan, StarkNet).

ETF Tiền điện tử dường như là một trò đùa đã đi quá xa

Trong khi memecoins là những lá bài hoang dã của tiền điện tử thường bị coi thường như những trò đùa trên internet không có giá trị cốt lõi (đúng vậy), sức mạnh tồn tại và giá trị văn hóa của chúng là không thể phủ nhận.

Bây giờ, các quản lý tài sản đang bắt đầu thử nghiệm ranh giới của sự cho phép theo quy định bằng cách nộp đề xuất ETF cho một số đồng tiền kỹ lưỡng nhất, bao gồm Dogecoin, TRUMP và BONK.

Liệu một tài sản dựa trên meme có thể được cung cấp trong một bọc hộp tài chính được điều tiết không? Nếu có, các cơ quan quản lý sẽ đặt ranh giới ở đâu giữa châm biếm và an ninh?

ETFs Dogecoin (DOGE)

Rất ít memecoin vượt qua trạng thái "meme" của họ và trở thành một token có tác động trong thế giới thực. Dogecoin là một trong số đó.

Với vốn hóa thị trường luôn đứng trong số các loại tiền điện tử hàng đầu, DOGE đã thể hiện sức mạnh ổn định đáng kinh ngạc qua nhiều chu kỳ thị trường. Sự thanh khoản mạnh mẽ, sự hỗ trợ trao đổi rộng lớn và cơ sở người dùng tích cực khiến nó trở thành một tài sản hấp dẫn ngày càng đối với các sản phẩm tổ chức.

Rex Shares Osprey Dogecoin ETF

- Đã nộp: Tháng 1 năm 2025

- Chi tiết: Điều này là một phần của một làn sóng rộng lớn các đơn đăng ký nhắm vào memecoins và các loại tiền điện tử khác.

Grayscale Dogecoin Trust (ETF Conversion)

- Đã nộp: Tháng 1 năm 2025

- Chi tiết: Grayscale Investments đã nộp hồ sơ với SEC vào ngày 31 tháng 1 năm 2025, để chuyển đổi Quỹ Dogecoin riêng hiện tại của mình thành một ETF trực tiếp để được niêm yết trên NYSE Arca theo Quy tắc 8.201-E (Cổ phiếu Quỹ Dựa trên Hàng hóa).

ETF Dogecoin của Bitwise

- Đã nộp: Thực thể đã đăng ký, toàn bộ hồ sơ sẽ được xác định sau

- Chi tiết: Quản lý Tài sản Bitwise đã đăng ký một tổ chức tin cậy "Bitwise Dogecoin ETF" tại Delaware vào ngày 23 tháng 1 năm 2025, như một bước chuẩn bị. Họ tiếp tục với bản tuyên bố đăng ký S-1 được nộp cho SEC vào ngày 28 tháng 1 năm 2025, để ra mắt một DOGE spot ETF. NYSE Arca nộp một biểu mẫu 19b-4 cho SEC vào ngày 3 tháng 3 năm 2025, để niêm yết và giao dịch ETF, đẩy nhanh quy trình phê duyệt.

ETF Tiền điện tử DOGE sẽ được phê duyệt không? Nhà phân tích ETF của Bloomberg, Eric Balchunas, cho rằng có 75% cơ hội duyệt ETF Dogecoin.

Tiềm năng tác động: Việc phê duyệt ETF Dogecoin có thể là một tác nhân thúc đẩy cho việc chính thức hóa tiền điện tử trong xã hội.memecoins.

TRUMP Memecoin ETF

Token TRUMP bùng nổ về mức độ phổ biến vào cuối năm 2024 khi diễn đàn chính trị và văn hóa meme va chạm.

ETF của Rex Shares TRUMP

- Ngày nộp: 21 tháng 1 năm 2025

Trong tất cả các hồ sơ ETF năm 2025, có lẽ đây là một trong những hồ sơ gây tranh cãi nhất vì đó là nỗ lực nghiêm túc đầu tiên để bọc một loại tiền điện tử meme với nhãn hiệu chính trị rõ ràng vào một ETF.

Đề xuất ETF của nó lời hứađể đầu tư 80% hoặc hơn tài sản của nó vào token hoặc các sản phẩm phái sinh liên quan đến nó.

Liệu ETF TRUMP có được phê duyệt không? Do tính chất chính trị của tài sản cơ bản, tức là đồng tiền memecoin TRUMP, có khả năng cao rằng ETF này sẽ bị từ chối. Ngay cả các chuyên gia ETF như Eric Balchunas từ Bloomberg cũng gọi đơn đăng ký này là "bất thực." Hầu hết các nhà phân tích cho rằng đây là một trường hợp thử nghiệm hoặc một chiến lược quảng cáo hơn là một con đường hợp lệ đến việc phê duyệt.

Tiềm năng tác động: Nếu ETF này được phê duyệt, đây là một rủi ro uy tín cao đối với SEC.

BONK ETF

Đơn đăng ký cho một quỹ ETF BONK đến cùng với ETF TRUMP như một phần của chiến lược của Rex Shares để đẩy ranh giới của tiền điện tử meme.

Kể từ khi BONK đã thu hút sự chú ý đáng kể trên Solana, nó trở thành ứng cử viên cho một ETF memecoin “nghiêm túc” hơn do sự tham gia mạnh mẽ từ phía người tiêu dùng bán lẻ.

Rex Shares BONK ETF

- Đã nộp: 21 tháng 1, 2025

- Nhà phát hành: Rex Shares / Osprey

- Tài sản: BONK - một đồng tiền điện tử chủ đề Shiba Inu trên Solana

Liệu ETF BONK sẽ được phê duyệt? Với việc tính đến các altcoin khác có tính ứng dụng và uy tín hơn so với memecoin, cơ hội phê duyệt cho ETF BONK là rất nhỏ trong dài hạn ngắn.

Tiềm năng tác động: Nếu ETF BONK được phê duyệt, nó có thể mở ra một hộp Pandora và để cho các ETF memecoin khác, như PEPEvà FWOG, vào thị trường.

ETF PENGU

PENGU is the official token of the Bộ sưu tập NFT của những chú chim cánh cụt béo.

ETF Canary Capital PENGU

- Đã nộp: Tháng 3 năm 2025

- Chi tiết: Đơn đăng ký ETF Canary PENGU đang ở giai đoạn sớm nhất, chỉ có S-1 được nộp. Bước tiếp theo sẽ là việc nộp và SEC công nhận một biểu mẫu 19b-4 bởi một sàn giao dịch (ví dụ, Nasdaq hoặc Cboe).

Không giống như các quỹ ETF tiền điện tử khác chỉ tập trung vào các token có thể thay thế, quỹ này đề xuất giữ cả tiền điện tử và các token không thể thay thế (NFT). Cụ thể, quỹ sẽ phân bổ:

- 80–95% của tài sản được đầu tư vào PENGU, token bản địa của hệ sinh thái Pudgy Penguins.

- 5–15% đối với Pudgy Penguins NFTs.

- Phần còn lại để phân bổ cho ETH và SOL cho thanh khoản.

Nếu được phê duyệt, đó sẽ là ETF đầu tiên tại Hoa Kỳ nắm giữ NFT trực tiếp.

Tại sao điều đó quan trọng:

- Đưa NFT vào một phương tiện đầu tư được quy định lần đầu tiên.

- Mở cánh cửa cho các bộ sưu tập NFT khác (ví dụ, Vượn buồn chán, Azuki) để theo dõi.

- Cung cấp cho nhà đầu tư đặt cược và văn hóa một con đường mới để tiếp cận.

Liệu PENGU ETF sẽ được phê duyệt không? Thấp đến mức độ đầu cơ. SEC chưa bao giờ phê duyệt một ETF nắm giữ tài sản không thể đổi được, và vẫn còn câu hỏi về cách mà các NFT như vậy sẽ được định giá, lưu trữ và thanh lý.

Tiềm năng ảnh hưởng: Đưa NFT vào một phương tiện đầu tư được quy định lần đầu tiên, có khả năng tăng sự quan tâm vào PENGU và Pudgy Penguins, và giá sàn có thể tăng vọt lên.

Kết luận

2024–2025 đã là một giai đoạn quan trọng đối với ETFs.

Tiền điện tử Bitcoin và Ether hiện là một phần của cảnh quan tài chính, và một làn sóng thứ hai của tài sản tiền điện tử đang được chuẩn bị cho quyết định của SEC. Trong năm nay và năm sau có thể sẽ có quỹ cho Litecoin, XRP, Solana, Dogecoin và nhiều tài sản khác, điều này sẽ mở rộng đáng kể phạm vi của tiền điện tử trong thị trường truyền thống.

Khả năng phê duyệt của mỗi quỹ ETF đang chờ sự chấp thuận phụ thuộc vào sự thoải mái của quy định và sự chín chắn của thị trường. Nếu hầu hết chúng được phê duyệt, đến năm 2026, chúng ta có thể chứng kiến một sự phát triển có thể kết nối ngành công nghiệp tiền điện tử chặt chẽ hơn vào cơ cấu tài chính chính thống.

Bài viết này chỉ mang tính chất thông tin và không nên coi là tư vấn tài chính hoặc đầu tư. Luôn tự tìm hiểu kỹ trước khi đầu tư vào bất kỳ loại tiền điện tử hoặc sản phẩm tài chính nào.

Tuyên bố từ chối trách nhiệm:

Bài viết này được sao chép từ [ Coingecko]. Tất cả bản quyền thuộc về tác giả gốc [Sankrit K]. Nếu có ý kiến phản đối về việc tái in này, vui lòng liên hệ với Học cửađội ngũ, và họ sẽ xử lý nhanh chóng.

Miễn trừ trách nhiệm về trách nhiệm: Các quan điểm và ý kiến được thể hiện trong bài viết này chỉ thuộc về tác giả và không cấu thành bất kỳ lời khuyên đầu tư nào.

Các bản dịch của bài viết sang các ngôn ngữ khác được thực hiện bởi đội ngũ Gate Learn. Trừ khi được nêu ra, việc sao chép, phân phối hoặc đạo văn các bài viết dịch là không được phép.

Bài viết liên quan

Tronscan là gì và Bạn có thể sử dụng nó như thế nào vào năm 2025?

Coti là gì? Tất cả những gì bạn cần biết về COTI

Stablecoin là gì?

Mọi thứ bạn cần biết về Blockchain

HODL là gì