Rickawsb

No content yet

rickawsb

In the AI era, I prefer reading short texts, preferably a compressed idea in one sentence.

Because reading others' lengthy essays is less effective than asking AI.

View OriginalBecause reading others' lengthy essays is less effective than asking AI.

- Reward

- like

- Comment

- Repost

- Share

If AI leads to widespread unemployment, will consumption collapse as a result?

If consumption crashes, who will use the products created by AI?

If no one uses them, will technological progress come to a halt?

Most importantly, will the US stock market continue to rise?

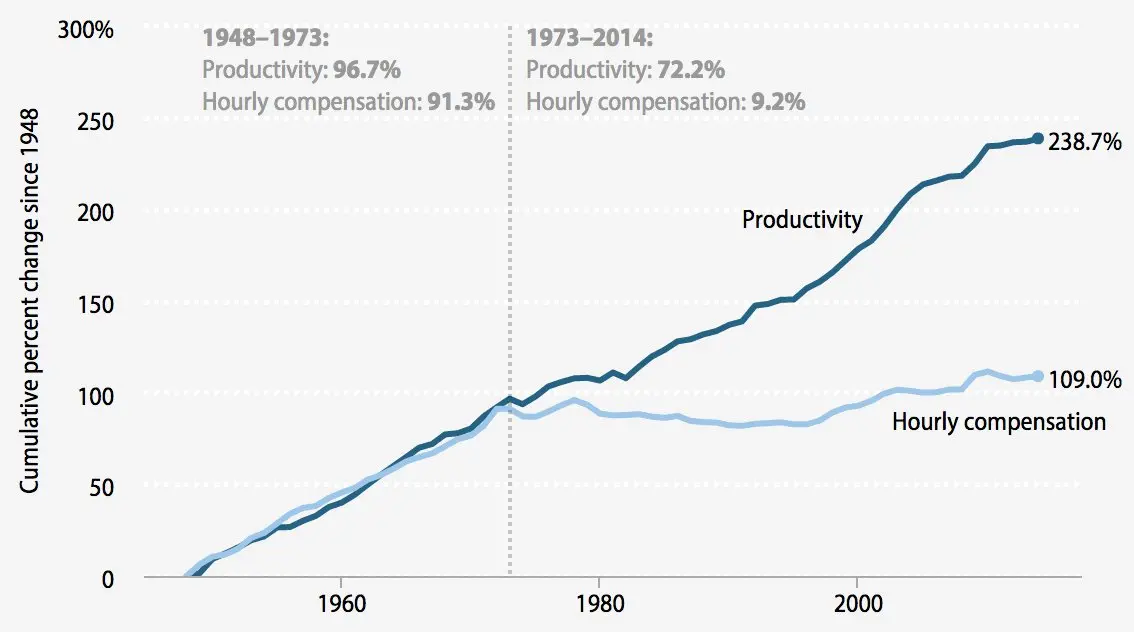

These questions seem simple on the surface but fundamentally touch on the core of technological and economic development: does economic growth come from the supply side or the demand side?

In the short term, it is almost inevitable that consumption will be impacted.

In modern economies, consumption mainly depends on

View OriginalIf consumption crashes, who will use the products created by AI?

If no one uses them, will technological progress come to a halt?

Most importantly, will the US stock market continue to rise?

These questions seem simple on the surface but fundamentally touch on the core of technological and economic development: does economic growth come from the supply side or the demand side?

In the short term, it is almost inevitable that consumption will be impacted.

In modern economies, consumption mainly depends on

- Reward

- like

- Comment

- Repost

- Share

The era of massive unemployment brought by AI is imminent, and flooding the market with liquidity is the only choice for all governments.

For everyone, the real risk is not choosing the wrong asset, but placing all their sense of security on a single form of currency that must be repeatedly used to stabilize society.

View OriginalFor everyone, the real risk is not choosing the wrong asset, but placing all their sense of security on a single form of currency that must be repeatedly used to stabilize society.

- Reward

- like

- Comment

- Repost

- Share

The Mac mini is out of stock at Best Buy.

View Original- Reward

- like

- Comment

- Repost

- Share

Moltbot/clawdbot will soon let everyone realize how important computation and storage on the client side and user side are. Everyone's personal ability depends on the capability of their AI assistant, which in turn depends on the computing power and storage they have. Memory sticks are more valuable than gold bars, and it's not just a slogan.

View Original- Reward

- like

- Comment

- Repost

- Share

Perhaps everyone hasn't realized yet that the Moltbook platform, which has over 100,000 registered users (agents) within 48 hours of launch and is rapidly growing every hour, is currently the world's largest decentralized computing power cluster.

View Original- Reward

- like

- Comment

- Repost

- Share

Now, looking at Moltbook, it feels like the App Store of 10 years ago, filled with silly apps like drinking beer and farting, but everyone knows in their hearts that a new era has begun.

View Original- Reward

- like

- Comment

- Repost

- Share

If I had to choose one keyword to describe AI over the past 26 years, I would say it is recursive self-iteration. For C-end users, Clawdbot's self-improvement is the most vivid understanding of this term.

View Original- Reward

- like

- Comment

- Repost

- Share

ClawdBot may be a direction for future (at least in the next two years) consumer (of course also including enterprise) AI application deployment — the ultimate agentification, which is also very likely to change personal computing (edge computing). Applications like ClawdBot are essentially long-term resident intelligent agents. The model is responsible for "thinking," but the local system handles "doing": listening to events, maintaining state, scheduling tools, executing commands, managing permissions. This directly shifts the focus of hardware. Local GPUs do not need to be the core computin

View Original- Reward

- like

- Comment

- Repost

- Share

It must be said that saving the crypto industry still depends on AI. Clawdbot is a perfect decentralized product form, or rather, a product ecosystem.

View Original- Reward

- like

- Comment

- Repost

- Share

Recently, there has been a lot of discussion on social media about Europe selling off U.S. Treasuries to counter the United States. It must be said that such views lack basic financial and geopolitical common sense. Europe's holdings of U.S. Treasuries can be roughly divided into two categories: one is official sectors (central banks, finance ministries, sovereign institutions), totaling about $2.5–3 trillion. These funds are highly cautious, with a slow adjustment pace, mainly serving as reserves and risk management tools rather than political weapons. If used as political weapons, the U.S. h

View Original

- Reward

- 1

- 1

- Repost

- Share

The upward movement of long-term Japanese government bond yields means there's basically no need to worry about carry trades or similar strategies, as the market has already become desensitized through repeated friction.

What’s more important here is the AI-driven industry restructuring, which is systematically increasing the long-term capital demand and the median of risk-free interest rates in the US and allied countries. Japan is just one of the earliest economies to face this.

The US will inevitably face it sooner or later.

But this is not a problem; it’s just the growing pains of the earl

View OriginalWhat’s more important here is the AI-driven industry restructuring, which is systematically increasing the long-term capital demand and the median of risk-free interest rates in the US and allied countries. Japan is just one of the earliest economies to face this.

The US will inevitably face it sooner or later.

But this is not a problem; it’s just the growing pains of the earl

- Reward

- 1

- 1

- Repost

- Share

Today there is news that Meta might not buy Google's TPU and instead choose AMD's GPU.

The reason behind this is firstly that Meta pursues control and does not want to be overly influenced or controlled by Google.

Another point is that Meta has not given up its ambition in the large model arms race.

Therefore, a more powerful TPU for inference is obviously not the optimal choice.

View OriginalThe reason behind this is firstly that Meta pursues control and does not want to be overly influenced or controlled by Google.

Another point is that Meta has not given up its ambition in the large model arms race.

Therefore, a more powerful TPU for inference is obviously not the optimal choice.

- Reward

- like

- Comment

- Repost

- Share

A little tip for trading US stocks by sector: buy the sectors with fewer Chinese competitors directly.

I call these sectors "Low Competition Rate" sectors.

Advanced semiconductor processes, AIDC, space, precision manufacturing, military industry, energy, electricity, infrastructure, etc., all belong to these sectors.

View OriginalI call these sectors "Low Competition Rate" sectors.

Advanced semiconductor processes, AIDC, space, precision manufacturing, military industry, energy, electricity, infrastructure, etc., all belong to these sectors.

- Reward

- like

- Comment

- Repost

- Share

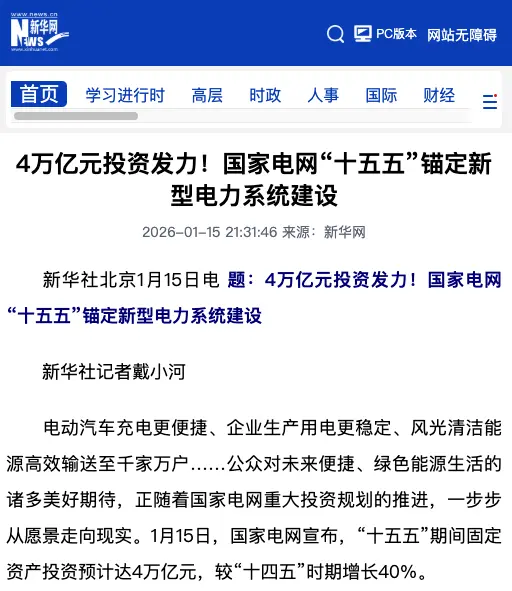

After more than 20 years, a reversal: the United States' future 5-year electricity infrastructure investment may surpass China

In the next five years, the total US investment in electricity infrastructure will exceed $2.1 trillion, while China's new 5-year plan allocates 4 trillion RMB.

This is the first time in nearly 20 years that US electricity infrastructure investment has overtaken China.

Wealthy AI giants are leveraging market power to fully modernize and privatize the US power supply infrastructure.

Among them, a company's backlog orders for generators, GEV, exceed $135 billion, nearly

View OriginalIn the next five years, the total US investment in electricity infrastructure will exceed $2.1 trillion, while China's new 5-year plan allocates 4 trillion RMB.

This is the first time in nearly 20 years that US electricity infrastructure investment has overtaken China.

Wealthy AI giants are leveraging market power to fully modernize and privatize the US power supply infrastructure.

Among them, a company's backlog orders for generators, GEV, exceed $135 billion, nearly

- Reward

- like

- Comment

- Repost

- Share

Recently, there has been heated discussion about China's new birth rate dropping below 8 million in 2025, as if aging will become the final straw.

This is a complete misjudgment due to a lack of understanding of the AI revolution.

The robot revolution will soon solve the labor shortage, and the life sciences revolution brought about by AI will greatly alleviate aging within ten years at most.

In the future, 65 will be the prime age.

The major unemployment caused by AI is what China (and the United States) should fear the most.

There will no longer be any demographic dividend or engineer divide

View OriginalThis is a complete misjudgment due to a lack of understanding of the AI revolution.

The robot revolution will soon solve the labor shortage, and the life sciences revolution brought about by AI will greatly alleviate aging within ten years at most.

In the future, 65 will be the prime age.

The major unemployment caused by AI is what China (and the United States) should fear the most.

There will no longer be any demographic dividend or engineer divide

- Reward

- like

- Comment

- Repost

- Share

US stock discussion group, limited time deletion

View Original- Reward

- like

- Comment

- Repost

- Share

Investing in US stocks is actually very simple: buy high-growth or undervalued stocks; ideally, both.

But this simple thing is not easy.

Behind it are countless sweat and tokens.

View OriginalBut this simple thing is not easy.

Behind it are countless sweat and tokens.

- Reward

- like

- Comment

- Repost

- Share

The likelihood of Khamenei stepping down this year has already reached 59% on Polymarket.

It seems another old friend of a certain country is gone.

View OriginalIt seems another old friend of a certain country is gone.

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More82.19K Popularity

6.76K Popularity

6.66K Popularity

53.3K Popularity

3.76K Popularity

Pin