Andy2024

No content yet

andy2024

I\'m gonna jump out of a plane before I leave Hawaii. Never done it and its gonna happen this time around.\n\nAbsolutely terrified of heights but I\'m 26 years old, gonna send it.

- Reward

- like

- Comment

- Repost

- Share

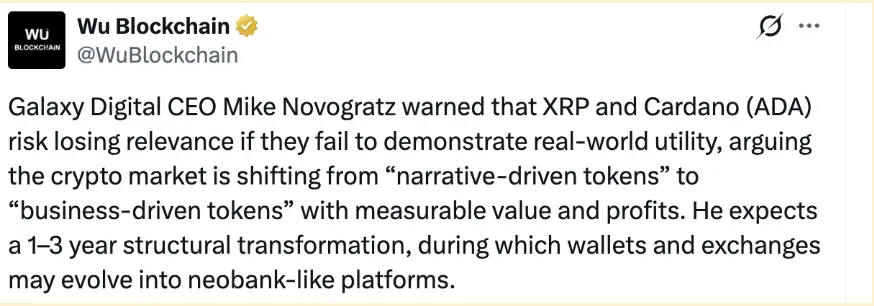

The biggest investors in our industry are all pointing to neo finance.\n\nIts simply impossible to ignore this shift. Its not sexy, its not a short-term game. There are winners that will outperform over the next 12-18 months. You need a longer term time horizon.\n\nThis isn\'t the trenches. It\'s not gamefi, infra, L1s, L2s, its none of that. Its real onchain businesses, producing real cash flows, at scale.\n\nInstitutional investors are itching to allocate here, meaning they will buy your tokens in size IF you hold the right ones.\n\nThere are alot of wrong ones, but there are a few right one

NEO-0,32%

- Reward

- like

- Comment

- Repost

- Share

Just signed a lease in NYC starting in March.\n\nSophomore year in the city begins, this time with a massive surprise that y\'all are going to absolutely love 😤

- Reward

- like

- Comment

- Repost

- Share

What neobank are you most bullish on?

- Reward

- like

- Comment

- Repost

- Share

This is what dreams are made of 🤙

- Reward

- like

- Comment

- Repost

- Share

Just signed a lease in NYC starting in March.

We are so back.

We are so back.

- Reward

- like

- Comment

- Repost

- Share

Everytime I use near intents I'm just reminded how much better the onchain UX has gotten since 2020.

Absolutely insane how easy it is now. Low slippage. Transfers in seconds across tons of chains that most don't support.

Intents was always the answer, wasn't it???

Absolutely insane how easy it is now. Low slippage. Transfers in seconds across tons of chains that most don't support.

Intents was always the answer, wasn't it???

- Reward

- like

- Comment

- Repost

- Share

Neo finance.

- Reward

- like

- Comment

- Repost

- Share

Long weekend in Hawaii be like

- Reward

- like

- Comment

- Repost

- Share

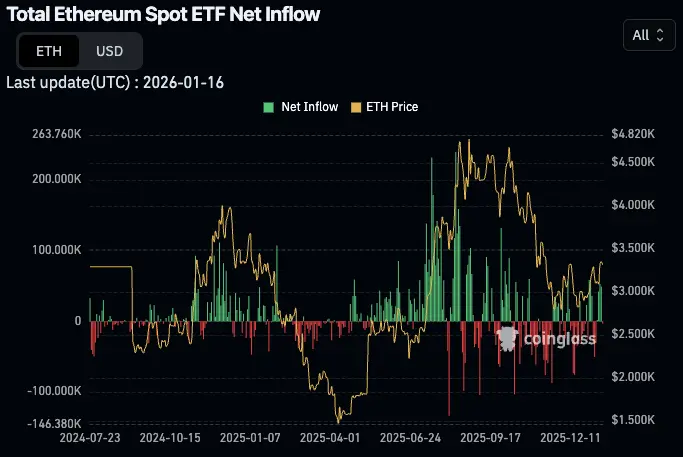

Be completely honest with me. Hold us accountable.

What did we get wrong here???

What did we get wrong here???

- Reward

- like

- Comment

- Repost

- Share

gm to everyone who's excited about reshaping the global financial stack with blockchain, stablecoins, and crypto rails underneath 🤙

- Reward

- like

- Comment

- Repost

- Share

Have a good weekend fam 🤙

- Reward

- like

- Comment

- Repost

- Share

The frame to think about this new category we discovered and now formally unveiled is this:

Neo finance vs. legacy finance & banks

Neo finance vs. valueless governance token & infra slop

It’s an out with the old, in with the new for the global financial stack.

Neo finance vs. legacy finance & banks

Neo finance vs. valueless governance token & infra slop

It’s an out with the old, in with the new for the global financial stack.

- Reward

- like

- Comment

- Repost

- Share