Mr_Desoza

No content yet

Mr_Desoza

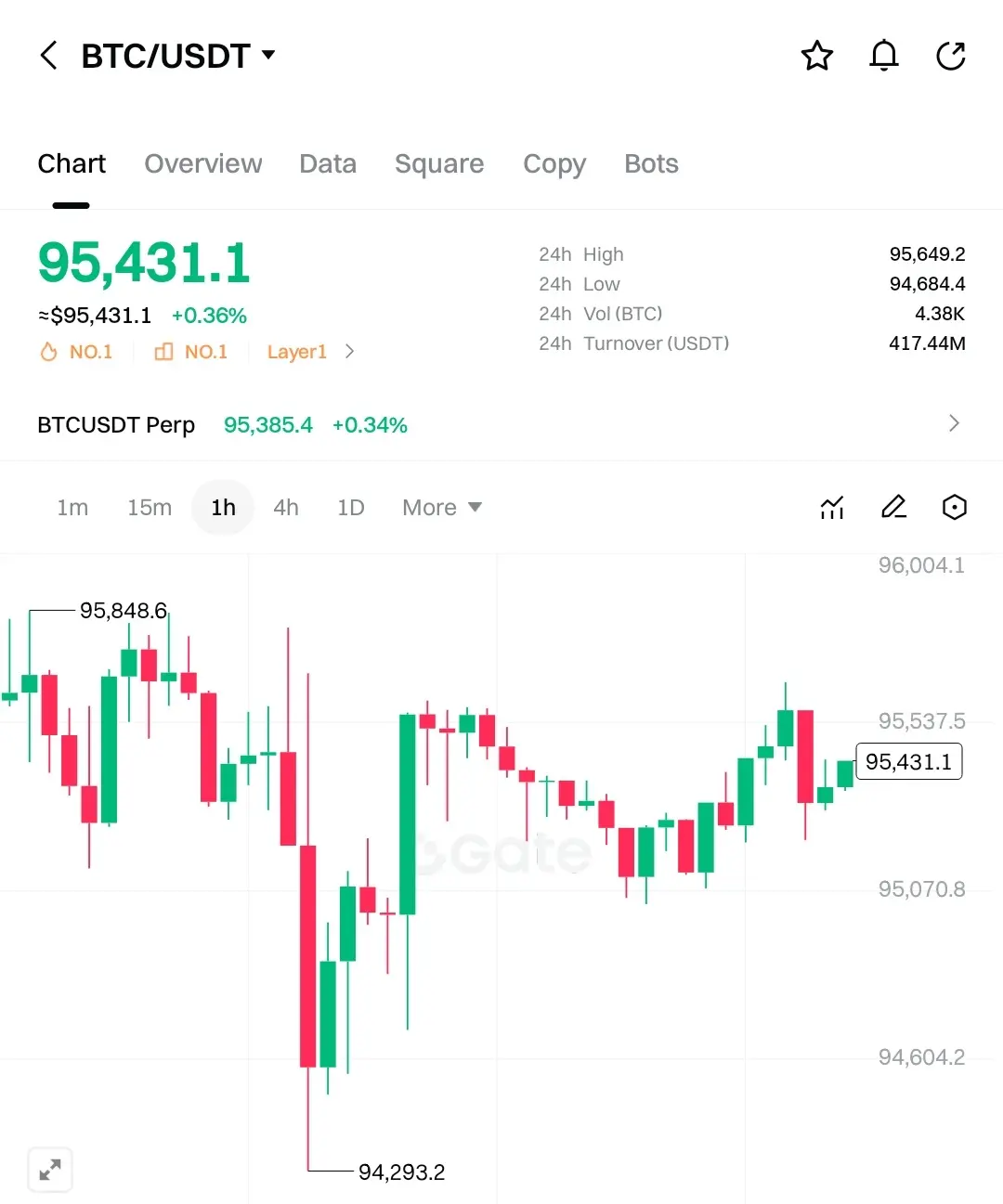

$BTC

Bitcoin continues to trade in a high-value consolidation range, maintaining strength above the critical support at 94,300–94,600, which acted as a strong rebound zone after the recent sell-off. The ability to reclaim and hold above 95,000 signals that buyers remain in control despite short-term volatility. Immediate resistance is positioned near 95,800–96,000, a psychological and technical barrier. A clean breakout above this zone would confirm bullish continuation and open the next target at 97,500, followed by 99,000 if momentum accelerates. On the downside, any pullback toward 94,600 i

Bitcoin continues to trade in a high-value consolidation range, maintaining strength above the critical support at 94,300–94,600, which acted as a strong rebound zone after the recent sell-off. The ability to reclaim and hold above 95,000 signals that buyers remain in control despite short-term volatility. Immediate resistance is positioned near 95,800–96,000, a psychological and technical barrier. A clean breakout above this zone would confirm bullish continuation and open the next target at 97,500, followed by 99,000 if momentum accelerates. On the downside, any pullback toward 94,600 i

BTC-0,16%

- Reward

- 1

- 1

- Repost

- Share

Stuart_Crown :

:

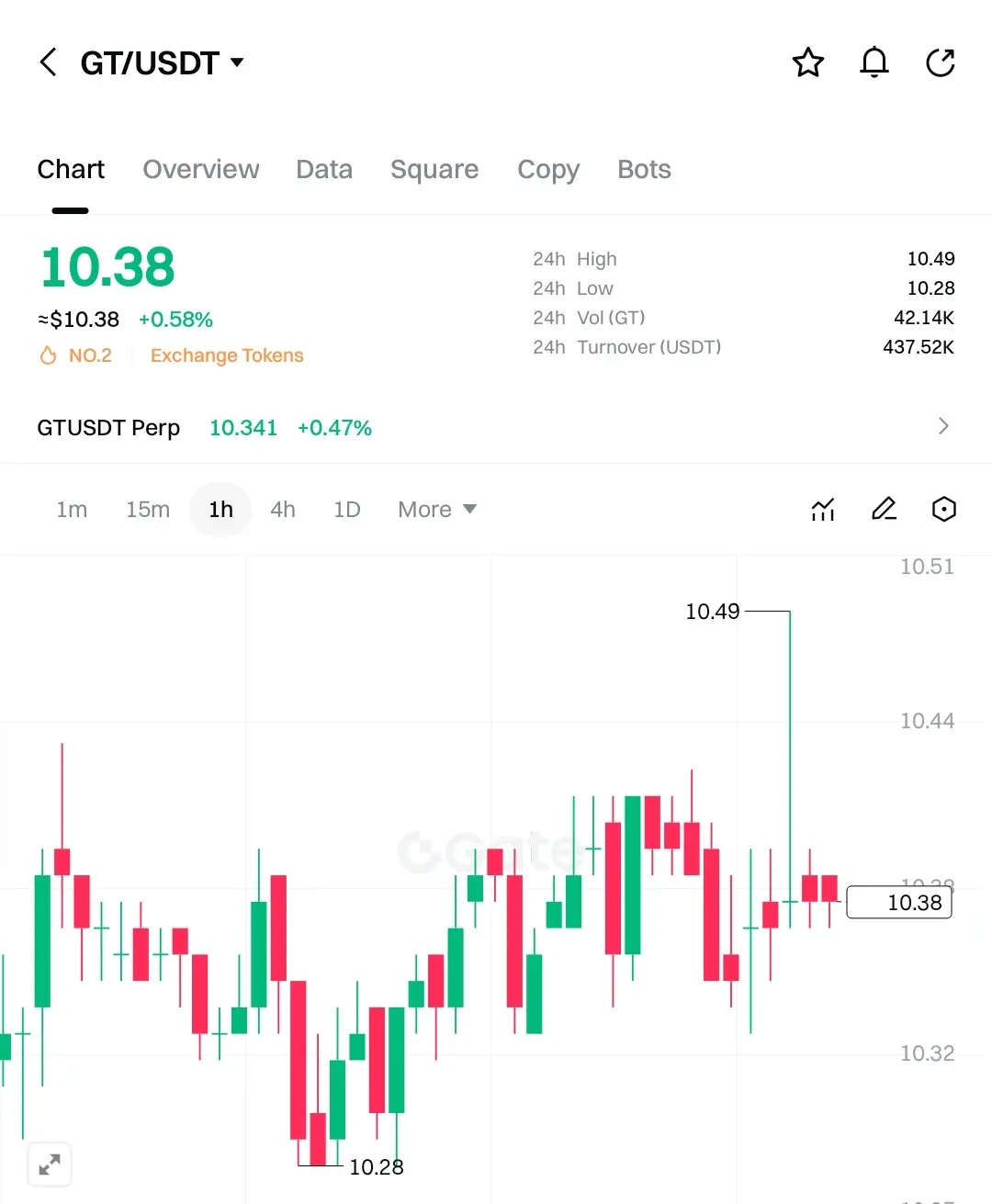

Send it higher 🚀$GT is trading in a tight consolidation range, signaling balance between buyers and sellers after recent volatility. The price is holding above a strong support zone at 10.28–10.30, which has repeatedly attracted buyers, confirming it as a reliable demand area. As long as this level holds, downside risk remains limited. Immediate resistance is located at 10.50, a level where price previously faced rejection and supply pressure. A decisive breakout above 10.50 can shift momentum bullish and push GT toward the next target at 10.80, followed by 11.20 in an extended move. The current sideways acti

GT-0,86%

- Reward

- like

- Comment

- Repost

- Share

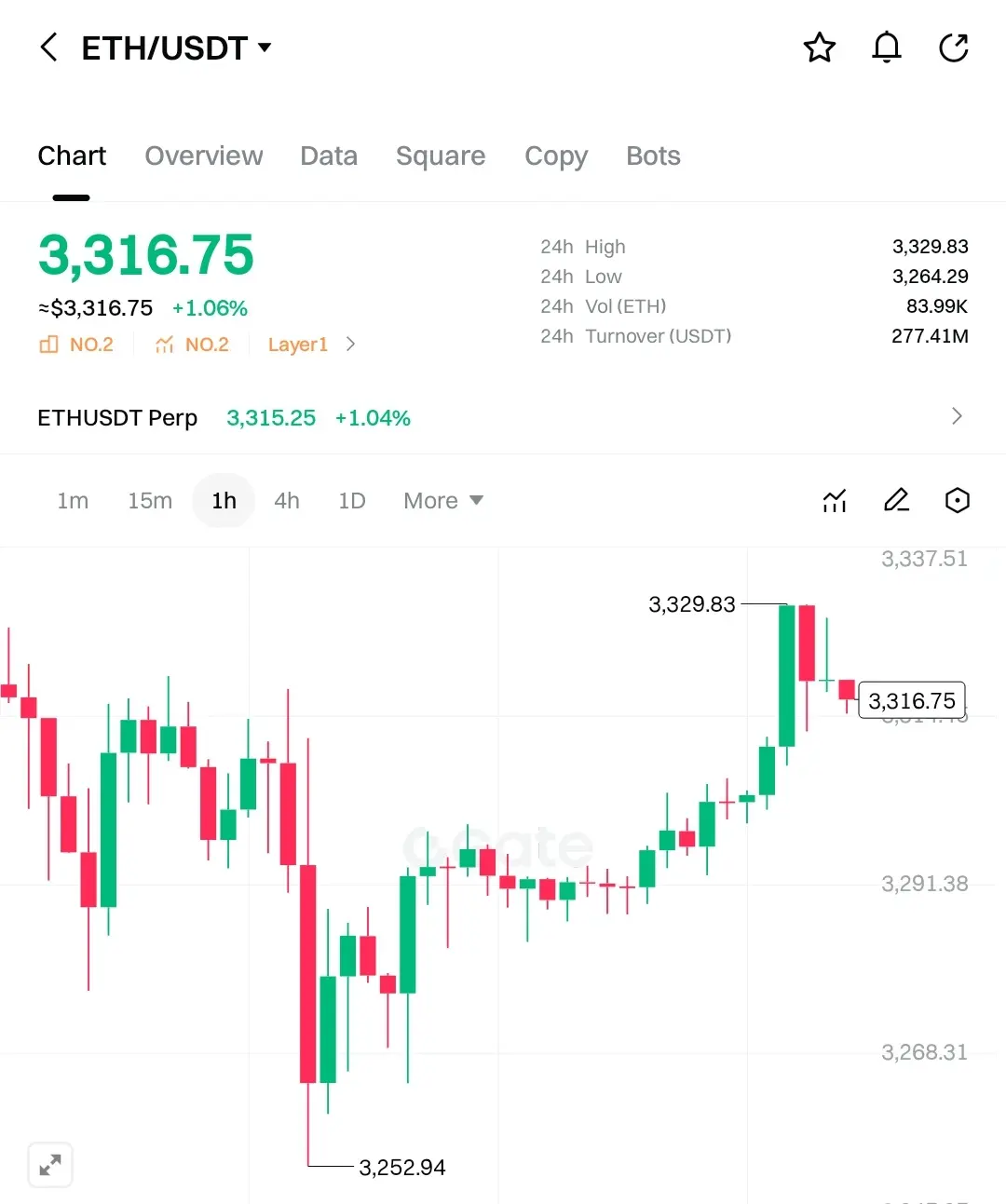

$ETH

Ethereum is displaying a clear bullish reversal on the intraday structure after defending the strong support zone at 3,250–3,270, where buyers absorbed selling pressure effectively. The price has since formed higher lows, signaling strengthening demand and renewed confidence. Currently, ETH is consolidating below a major resistance at 3,330–3,340, which is a critical breakout level. A confirmed push above this zone with volume can accelerate price toward the next target at 3,400, followed by 3,480 if momentum sustains. As long as ETH holds above 3,290, the bullish structure remains intact

Ethereum is displaying a clear bullish reversal on the intraday structure after defending the strong support zone at 3,250–3,270, where buyers absorbed selling pressure effectively. The price has since formed higher lows, signaling strengthening demand and renewed confidence. Currently, ETH is consolidating below a major resistance at 3,330–3,340, which is a critical breakout level. A confirmed push above this zone with volume can accelerate price toward the next target at 3,400, followed by 3,480 if momentum sustains. As long as ETH holds above 3,290, the bullish structure remains intact

ETH0,5%

- Reward

- 1

- Comment

- Repost

- Share

$SOL

Solana is holding a constructive bullish structure after bouncing strongly from the support zone around 140.20–141.00, where aggressive buying reversed the prior decline. Price is now stabilizing above 144.00, signaling strength and acceptance at higher levels. Immediate resistance is seen at 145.50, which previously capped the upside. A successful breakout above this level can fuel momentum toward the next target at 148.00, followed by 152.00 if bullish pressure sustains. As long as SOL remains above 142.80, the structure stays bullish and pullbacks are likely to attract buyers. A loss o

Solana is holding a constructive bullish structure after bouncing strongly from the support zone around 140.20–141.00, where aggressive buying reversed the prior decline. Price is now stabilizing above 144.00, signaling strength and acceptance at higher levels. Immediate resistance is seen at 145.50, which previously capped the upside. A successful breakout above this level can fuel momentum toward the next target at 148.00, followed by 152.00 if bullish pressure sustains. As long as SOL remains above 142.80, the structure stays bullish and pullbacks are likely to attract buyers. A loss o

SOL-1,2%

- Reward

- like

- Comment

- Repost

- Share

$XRP is currently showing a strong short-term recovery structure on the 1H timeframe, holding firmly above the key demand zone after a sharp bounce from the recent low near 2.02. This area is acting as a solid support, where buyers stepped in aggressively, indicating accumulation rather than panic selling. As long as price sustains above 2.05–2.06, bullish continuation remains favored. Immediate resistance is seen around 2.09–2.10, which aligns with the recent rejection zone and short-term supply. A clean breakout and hold above this level can open the door for the next upside target at 2.15,

XRP-0,48%

- Reward

- like

- Comment

- Repost

- Share

$ZEC is maintaining strength above its structural base, with price respecting higher lows despite broader market noise. The setup favors continuation if resistance is cleared.

Support: 378 – 365

Resistance: 405 – 425

Entry Point (EP): 382 – 392

Targets:

TP1: 405

TP2: 425

TP3: 460

Stop Loss (SL): 358

Outlook:

$ZEC remains bullish while holding above 378. A decisive move through 405 would likely invite follow-through toward higher liquidity zones.$ZEC

Support: 378 – 365

Resistance: 405 – 425

Entry Point (EP): 382 – 392

Targets:

TP1: 405

TP2: 425

TP3: 460

Stop Loss (SL): 358

Outlook:

$ZEC remains bullish while holding above 378. A decisive move through 405 would likely invite follow-through toward higher liquidity zones.$ZEC

ZEC-2,1%

- Reward

- like

- Comment

- Repost

- Share

$MNT is under corrective pressure after failing to hold prior range support. Selling momentum is elevated, but price is approaching a historically responsive demand zone where reactions are likely. This is a high-risk, mean-reversion setup rather than a trend trade.

Support: 1.16 – 1.12

Resistance: 1.26 – 1.34

Entry Point (EP): 1.17 – 1.20

Only valid if price stabilizes and prints higher lows.

Targets:

TP1: 1.26 – range reclaim

TP2: 1.34 – breakdown retest

TP3: 1.48 – extension on strength

Stop Loss (SL): 1.09

Outlook:

$MNT requires confirmation. A reclaim of 1.26 would signal buyer control re

Support: 1.16 – 1.12

Resistance: 1.26 – 1.34

Entry Point (EP): 1.17 – 1.20

Only valid if price stabilizes and prints higher lows.

Targets:

TP1: 1.26 – range reclaim

TP2: 1.34 – breakdown retest

TP3: 1.48 – extension on strength

Stop Loss (SL): 1.09

Outlook:

$MNT requires confirmation. A reclaim of 1.26 would signal buyer control re

MNT0,71%

- Reward

- 2

- Comment

- Repost

- Share

$MON remains in a sharp drawdown phase with heavy selling pressure. However, price is now deeply extended and nearing a potential exhaustion zone. Volatility expansion to the downside often precedes short-term relief rallies.

Support: 0.0172 – 0.0164

Resistance: 0.0205 – 0.0230

Entry Point (EP): 0.0175 – 0.0182

Targets:

TP1: 0.0205

TP2: 0.0230

TP3: 0.0275

Stop Loss (SL): 0.0159

Outlook:

$MON is speculative. While downside momentum is strong, any stabilization above 0.0172 could trigger a sharp reactive bounce.

$MON

Support: 0.0172 – 0.0164

Resistance: 0.0205 – 0.0230

Entry Point (EP): 0.0175 – 0.0182

Targets:

TP1: 0.0205

TP2: 0.0230

TP3: 0.0275

Stop Loss (SL): 0.0159

Outlook:

$MON is speculative. While downside momentum is strong, any stabilization above 0.0172 could trigger a sharp reactive bounce.

$MON

MON-1,88%

- Reward

- like

- Comment

- Repost

- Share

$JELLYJELLY is attempting to base after a steep pullback. Selling pressure has slowed, and price is compressing near support, indicating balance returning between buyers and sellers.

Support: 0.0860 – 0.0835

Resistance: 0.0955 – 0.1020

Entry Point (EP): 0.0870 – 0.0890

Targets:

TP1: 0.0955

TP2: 0.1020

TP3: 0.1150

Stop Loss (SL): 0.0819

Outlook:

Holding above 0.086 keeps $JELLYJELLY positioned for recovery. A break above 0.0955 would confirm momentum shift.$JELLYJELLY

Support: 0.0860 – 0.0835

Resistance: 0.0955 – 0.1020

Entry Point (EP): 0.0870 – 0.0890

Targets:

TP1: 0.0955

TP2: 0.1020

TP3: 0.1150

Stop Loss (SL): 0.0819

Outlook:

Holding above 0.086 keeps $JELLYJELLY positioned for recovery. A break above 0.0955 would confirm momentum shift.$JELLYJELLY

JELLYJELLY-1,22%

- Reward

- 1

- Comment

- Repost

- Share

$HYPE is under sustained distribution pressure, with sellers firmly in control. However, price is approaching a major support shelf where reactions have historically occurred.

Support: 22.40 – 21.60

Resistance: 25.20 – 27.80

Entry Point (EP): 22.60 – 23.20

Targets:

TP1: 25.20

TP2: 27.80

TP3: 31.50

Stop Loss (SL): 20.90

Outlook:

$HYPE remains risky until support proves itself. A strong defense of 22.40 would be the first signal of potential reversal.$HYPE

Support: 22.40 – 21.60

Resistance: 25.20 – 27.80

Entry Point (EP): 22.60 – 23.20

Targets:

TP1: 25.20

TP2: 27.80

TP3: 31.50

Stop Loss (SL): 20.90

Outlook:

$HYPE remains risky until support proves itself. A strong defense of 22.40 would be the first signal of potential reversal.$HYPE

HYPE2,65%

- Reward

- like

- Comment

- Repost

- Share

$PIPPIN is in a corrective phase after a recent downside sweep, with price stabilizing near a developing demand pocket. Selling momentum has slowed, suggesting exhaustion rather than aggressive continuation. Structure favors a tactical rebound if support continues to hold.

Support: 0.452 – 0.438

Resistance: 0.492 – 0.525

Entry Point (EP): 0.455 – 0.468

Best entries come from basing behavior, not impulse candles.

Targets:

TP1: 0.492 – first reaction level

TP2: 0.525 – range high

TP3: 0.575 – extension on momentum

Stop Loss (SL): 0.424

Outlook:

As long as $PIPPIN holds above 0.45, downside looks

Support: 0.452 – 0.438

Resistance: 0.492 – 0.525

Entry Point (EP): 0.455 – 0.468

Best entries come from basing behavior, not impulse candles.

Targets:

TP1: 0.492 – first reaction level

TP2: 0.525 – range high

TP3: 0.575 – extension on momentum

Stop Loss (SL): 0.424

Outlook:

As long as $PIPPIN holds above 0.45, downside looks

PIPPIN2,59%

- Reward

- like

- Comment

- Repost

- Share

$FDUSD remains tightly anchored to its peg, showing stable liquidity and minimal deviation. Market behavior is consistent with normal conditions, with no signs of stress or imbalance.

Support: 0.9978

Resistance: 1.0015

Entry Point (EP): 0.9990 – 1.0002

Targets:

TP1: 1.0006

TP2: 1.0012

TP3: 1.0020

Stop Loss (SL): 0.9968

Outlook:

$FDUSD continues to perform as intended. Any sustained deviation outside the range would be notable, but current structure confirms stability.$FDUSD

Support: 0.9978

Resistance: 1.0015

Entry Point (EP): 0.9990 – 1.0002

Targets:

TP1: 1.0006

TP2: 1.0012

TP3: 1.0020

Stop Loss (SL): 0.9968

Outlook:

$FDUSD continues to perform as intended. Any sustained deviation outside the range would be notable, but current structure confirms stability.$FDUSD

FDUSD-0,02%

- Reward

- like

- Comment

- Repost

- Share

$NIGHT is consolidating after a slow grind lower, with price now attempting to form a base. Volatility compression suggests a directional move is approaching, with support being the key decision level.

Support: 0.0835 – 0.0818

Resistance: 0.0895 – 0.0940

Entry Point (EP): 0.0845 – 0.0860

Targets:

TP1: 0.0895

TP2: 0.0940

TP3: 0.1025

Stop Loss (SL): 0.0799

Outlook:

Holding above 0.0835 keeps $NIGHT positioned for a recovery push. A clean break above 0.0895 would signal momentum shift

$NIGHT

Support: 0.0835 – 0.0818

Resistance: 0.0895 – 0.0940

Entry Point (EP): 0.0845 – 0.0860

Targets:

TP1: 0.0895

TP2: 0.0940

TP3: 0.1025

Stop Loss (SL): 0.0799

Outlook:

Holding above 0.0835 keeps $NIGHT positioned for a recovery push. A clean break above 0.0895 would signal momentum shift

$NIGHT

NIGHT-2,16%

- Reward

- like

- Comment

- Repost

- Share

$VSN is trading within a controlled downtrend but showing early signs of stabilization near historical support. Seller momentum is weakening, increasing the probability of a relief bounce.

Support: 0.0755 – 0.0730

Resistance: 0.0825 – 0.0870

Entry Point (EP): 0.0760 – 0.0780

Targets:

TP1: 0.0825

TP2: 0.0870

TP3: 0.0955

Stop Loss (SL): 0.0719

Outlook:

$VSN remains risky but attractive for tactical trades while holding support. A reclaim of 0.0825 would confirm recovery intent.$VSN

Support: 0.0755 – 0.0730

Resistance: 0.0825 – 0.0870

Entry Point (EP): 0.0760 – 0.0780

Targets:

TP1: 0.0825

TP2: 0.0870

TP3: 0.0955

Stop Loss (SL): 0.0719

Outlook:

$VSN remains risky but attractive for tactical trades while holding support. A reclaim of 0.0825 would confirm recovery intent.$VSN

VSN-9,82%

- Reward

- like

- Comment

- Repost

- Share

$MBG continues to show constructive behavior after defending its higher low. Buyers are stepping in consistently on dips, suggesting accumulation rather than distribution.

Support: 0.488 – 0.472

Resistance: 0.525 – 0.565

Entry Point (EP): 0.492 – 0.505

Targets:

TP1: 0.525

TP2: 0.565

TP3: 0.620

Stop Loss (SL): 0.459

Outlook:

As long as $MBG holds above 0.488, trend continuation remains favored. A breakout above 0.525 could accelerate upside momentum.$MBG

Support: 0.488 – 0.472

Resistance: 0.525 – 0.565

Entry Point (EP): 0.492 – 0.505

Targets:

TP1: 0.525

TP2: 0.565

TP3: 0.620

Stop Loss (SL): 0.459

Outlook:

As long as $MBG holds above 0.488, trend continuation remains favored. A breakout above 0.525 could accelerate upside momentum.$MBG

MBG-0,89%

- Reward

- like

- Comment

- Repost

- Share

$SOL is holding firm above its medium-term support after absorbing recent volatility. Price action shows controlled pullbacks with no aggressive follow-through from sellers, indicating that downside liquidity is being absorbed. The structure remains constructive as long as price stays above the prior base.

Support: 121.5 – 118.8

Resistance: 127.8 – 132.0

Entry Point (EP): 122.5 – 124.0

Ideal on shallow dips into support.

Targets:

TP1: 127.8 – local resistance

TP2: 132.0 – breakout continuation

TP3: 138.5 – expansion if momentum strengthens

Stop Loss (SL): 116.9

Below structural support.

Outloo

Support: 121.5 – 118.8

Resistance: 127.8 – 132.0

Entry Point (EP): 122.5 – 124.0

Ideal on shallow dips into support.

Targets:

TP1: 127.8 – local resistance

TP2: 132.0 – breakout continuation

TP3: 138.5 – expansion if momentum strengthens

Stop Loss (SL): 116.9

Below structural support.

Outloo

SOL-1,2%

- Reward

- like

- Comment

- Repost

- Share

$BEAT is displaying strong relative momentum after a sharp upside expansion. Volume confirms participation, but price is now transitioning into a digestion phase. This is typically where continuation setups form if support holds.

Support: 2.00 – 1.90

Resistance: 2.35 – 2.60

Entry Point (EP): 2.05 – 2.12

Prefer entries on controlled pullbacks, not breakouts.

Targets:

TP1: 2.35 – prior high

TP2: 2.60 – momentum continuation

TP3: 2.95 – extension zone

Stop Loss (SL): 1.82

Below base support.

Outlook:

As long as $BEAT stays above 2.00, upside continuation remains favored. Losing that level would s

Support: 2.00 – 1.90

Resistance: 2.35 – 2.60

Entry Point (EP): 2.05 – 2.12

Prefer entries on controlled pullbacks, not breakouts.

Targets:

TP1: 2.35 – prior high

TP2: 2.60 – momentum continuation

TP3: 2.95 – extension zone

Stop Loss (SL): 1.82

Below base support.

Outlook:

As long as $BEAT stays above 2.00, upside continuation remains favored. Losing that level would s

BEAT2,16%

- Reward

- like

- Comment

- Repost

- Share

$STABLE has shown a strong impulse move, followed by orderly consolidation. Buyers are clearly defending higher lows, signaling intent to continue the trend rather than distribute.

Support: 0.0126 – 0.0121

Resistance: 0.0144 – 0.0158

Entry Point (EP): 0.0129 – 0.0132

Targets:

TP1: 0.0144 – first resistance

TP2: 0.0158 – range expansion

TP3: 0.0180 – momentum extension

Stop Loss (SL): 0.0117

Outlook:

$STABLE remains technically strong while holding above 0.0126. A decisive break above 0.0144 would likely unlock further upside liquidity.$STABLE

Support: 0.0126 – 0.0121

Resistance: 0.0144 – 0.0158

Entry Point (EP): 0.0129 – 0.0132

Targets:

TP1: 0.0144 – first resistance

TP2: 0.0158 – range expansion

TP3: 0.0180 – momentum extension

Stop Loss (SL): 0.0117

Outlook:

$STABLE remains technically strong while holding above 0.0126. A decisive break above 0.0144 would likely unlock further upside liquidity.$STABLE

STABLE-2,89%

- Reward

- like

- Comment

- Repost

- Share

$USDC continues to trade tightly around its peg, reflecting stable market mechanics and low volatility. No directional bias is expected under normal conditions, but monitoring deviations is essential during broader market stress.

Support: 0.9995

Resistance: 1.0008

Entry Point (EP): 0.9998 – 1.0001

Targets:

TP1: 1.0005

TP2: 1.0010

TP3: 1.0020

Stop Loss (SL): 0.9988

Outlook:

$USDC remains stable. Any sustained deviation outside this range would be noteworthy, but current behavior confirms normal market function.$USDC

Support: 0.9995

Resistance: 1.0008

Entry Point (EP): 0.9998 – 1.0001

Targets:

TP1: 1.0005

TP2: 1.0010

TP3: 1.0020

Stop Loss (SL): 0.9988

Outlook:

$USDC remains stable. Any sustained deviation outside this range would be noteworthy, but current behavior confirms normal market function.$USDC

- Reward

- like

- Comment

- Repost

- Share

$DOGE is consolidating after a mild recovery, with price compressing near a key decision zone. Volatility has reduced, suggesting a larger move may be forming as liquidity builds on both sides.

Support: 0.1180 – 0.1145

Resistance: 0.1285 – 0.1350

Entry Point (EP): 0.1195 – 0.1215

Targets:

TP1: 0.1285

TP2: 0.1350

TP3: 0.1480

Stop Loss (SL): 0.1119

Outlook:

Holding above 0.118 keeps $DOGE constructive. A confirmed break above 0.1285 would favor upside continuation toward higher liquidity zones.$DOGE

Support: 0.1180 – 0.1145

Resistance: 0.1285 – 0.1350

Entry Point (EP): 0.1195 – 0.1215

Targets:

TP1: 0.1285

TP2: 0.1350

TP3: 0.1480

Stop Loss (SL): 0.1119

Outlook:

Holding above 0.118 keeps $DOGE constructive. A confirmed break above 0.1285 would favor upside continuation toward higher liquidity zones.$DOGE

DOGE-0,5%

- Reward

- like

- Comment

- Repost

- Share