LacolaCrypto

No content yet

LacolaCrypto

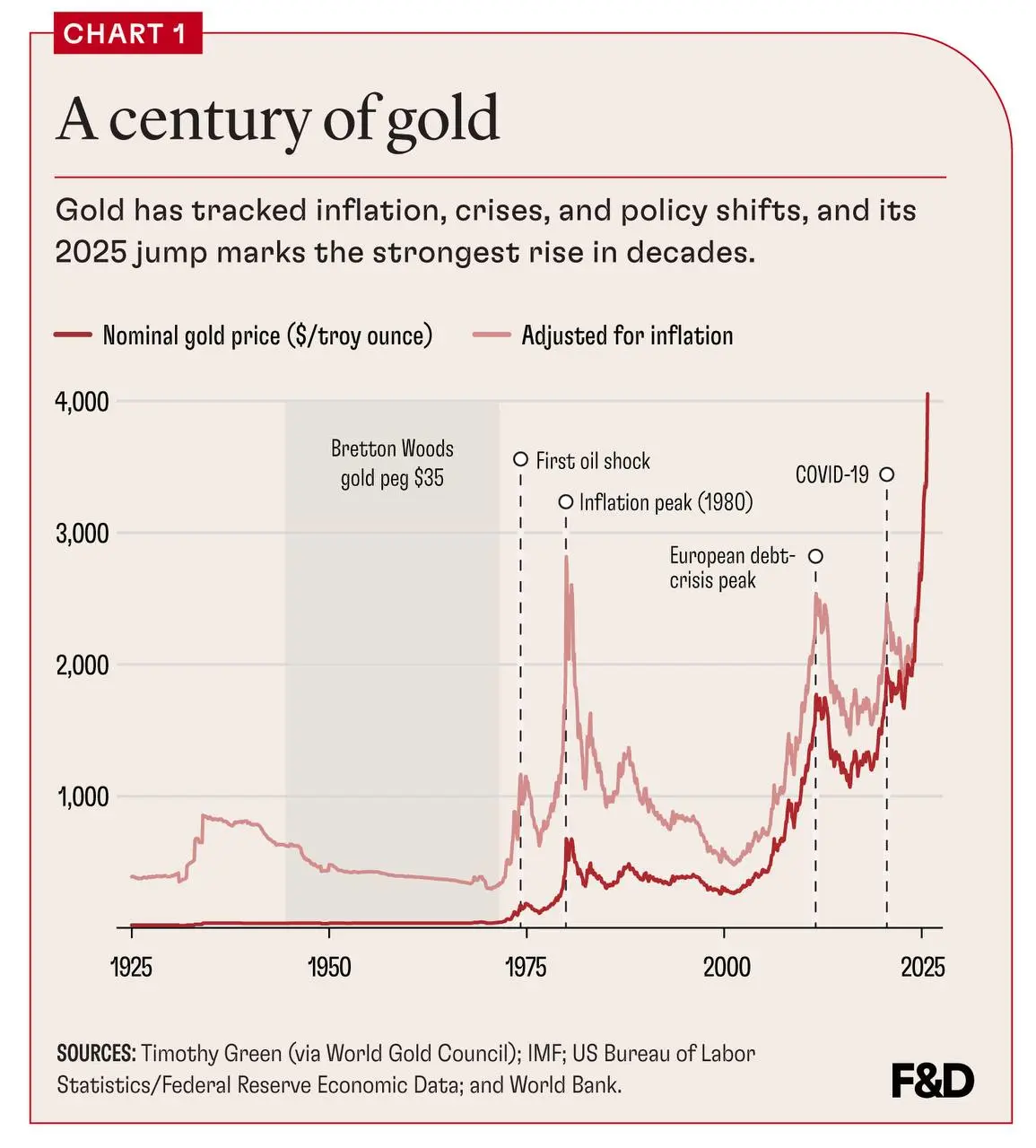

A historical analysis of gold's price growth reveals that it does not increase steadily but rather in bursts during periods of global financial instability.

Key periods include:

- 1970s: Oil shock and inflation led to a dramatic increase, with gold rising approximately 20 times.

- 1980: Peak inflation created a historic growth spike, followed by a prolonged correction.

- 2008-2011: The financial crisis and European debt issues pushed gold above $1,000 per ounce, reaching new highs.

- 2020: The COVID-19 pandemic saw gold prices approach $2,000 per once

- 2025-2026 (projected): A potential surge

Key periods include:

- 1970s: Oil shock and inflation led to a dramatic increase, with gold rising approximately 20 times.

- 1980: Peak inflation created a historic growth spike, followed by a prolonged correction.

- 2008-2011: The financial crisis and European debt issues pushed gold above $1,000 per ounce, reaching new highs.

- 2020: The COVID-19 pandemic saw gold prices approach $2,000 per once

- 2025-2026 (projected): A potential surge

- Reward

- like

- Comment

- Repost

- Share

Market Update - January 26

- Gold surpasses $5,000, Bitcoin drops to $87,000, and altcoins face significant losses amid geopolitical instability.

- The Netherlands plans to tax cryptocurrencies based on unrealized gains starting in 2028, prompting strong community backlash.

- Michael Saylor reveals plans to acquire more Bitcoin this week; his strategy currently holds 709,715 BTC, valued at approximately $62 billion.

- Foundry USA, the world's largest Bitcoin mining pool, reports a 60% decrease in hashrate to around 200 EH/s due to the ongoing mining winter in the U.S.

- Colombia's second-large

- Gold surpasses $5,000, Bitcoin drops to $87,000, and altcoins face significant losses amid geopolitical instability.

- The Netherlands plans to tax cryptocurrencies based on unrealized gains starting in 2028, prompting strong community backlash.

- Michael Saylor reveals plans to acquire more Bitcoin this week; his strategy currently holds 709,715 BTC, valued at approximately $62 billion.

- Foundry USA, the world's largest Bitcoin mining pool, reports a 60% decrease in hashrate to around 200 EH/s due to the ongoing mining winter in the U.S.

- Colombia's second-large

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More44.22K Popularity

6.3K Popularity

5.88K Popularity

3.27K Popularity

2.65K Popularity

Pin