Jamesvanst

No content yet

Jamesvanst

MSTR has already acquired 65k BTC since December.

The company managed just 10k BTC in the entirety of 2022.

The company managed just 10k BTC in the entirety of 2022.

BTC-1,14%

- Reward

- like

- Comment

- Repost

- Share

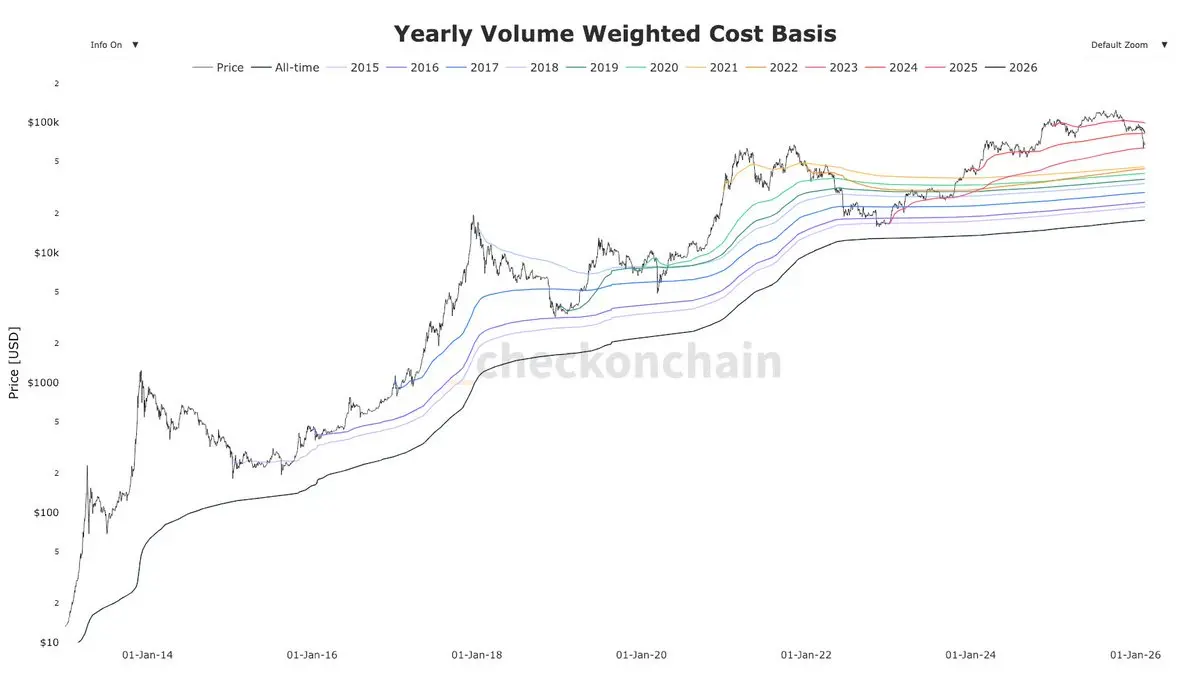

Last week's drop to $60k not only saw the largest one-day realized loss in Bitcoin history, but also bounced straight off the 2023 realized price.

Very similar to December 2018 using the 2016 realized price as support.

Very similar to December 2018 using the 2016 realized price as support.

BTC-1,14%

- Reward

- 1

- 1

- Repost

- Share

Unoshi :

:

Thanks for informationMSTR has now survived a full cycle, so it is prudent to include it in all analysis when looking at Bitcoin.

If we are in May 2022, why does the MSTR/BTC ratio look nothing like May 2022?

The MSTR/BTC ratio is up 10% YTD.

If we are in May 2022, why does the MSTR/BTC ratio look nothing like May 2022?

The MSTR/BTC ratio is up 10% YTD.

BTC-1,14%

- Reward

- like

- 1

- Repost

- Share

Shahid1995 :

:

so niceThe two largest Bitcoin treasury companies, MSTR and Metaplanet, both have a positive mNAV of 1.19 and 1.17.

This follows a +50% correction in Bitcoin's price.

mNAV is a forward-looking metric.

It captures market expectations of future BTC scaling.

The premium exists because of anticipated growth in BTC holdings beyond current levels, not just today's snapshot.

When mNAV compresses toward or below 1x, it signals fading confidence in that future accretion story.

This follows a +50% correction in Bitcoin's price.

mNAV is a forward-looking metric.

It captures market expectations of future BTC scaling.

The premium exists because of anticipated growth in BTC holdings beyond current levels, not just today's snapshot.

When mNAV compresses toward or below 1x, it signals fading confidence in that future accretion story.

BTC-1,14%

- Reward

- like

- Comment

- Repost

- Share

One of my mates had a loan with Ledn and got liquidated in the downturn. Substantial amount.

Back to my theory of time based capitulation.

Back to my theory of time based capitulation.

- Reward

- like

- Comment

- Repost

- Share

Bitcoin did not enter backwardation last week.

This may not occur this time around due to low industry vol and leverage, which is a major difference compared to 2022.

This may not occur this time around due to low industry vol and leverage, which is a major difference compared to 2022.

BTC-1,14%

- Reward

- like

- Comment

- Repost

- Share

Bottoms take months to form and, by design, are the choppiest period.

- Reward

- like

- Comment

- Repost

- Share

I have never seen so much hate toward a stock that people don’t even own towards MSTR.

If you don’t own the stock, why do you care?

Or were in the depths of a bear market and this is normal behaviour

If you don’t own the stock, why do you care?

Or were in the depths of a bear market and this is normal behaviour

- Reward

- like

- Comment

- Repost

- Share

Bitcoin Back at $70k the Singularity

BTC-1,14%

- Reward

- like

- Comment

- Repost

- Share

Wonder what the market makers have in store for us this weekend.

- Reward

- like

- Comment

- Repost

- Share

Anyone who is solvent, has cash flow, and is not trading on margin with a liquidation level hanging over them is not panicking. The ones who are panicking can\'t manage risk, and any margin should have been removed after Oct. 10.

- Reward

- like

- Comment

- Repost

- Share

The market makers that are left have done a fantastic job.

- Reward

- like

- Comment

- Repost

- Share

The guy who got me into Bitcoin back in 2017, just called me. He was about to sell today. He’s never sold before……

BTC-1,14%

- Reward

- like

- Comment

- Repost

- Share

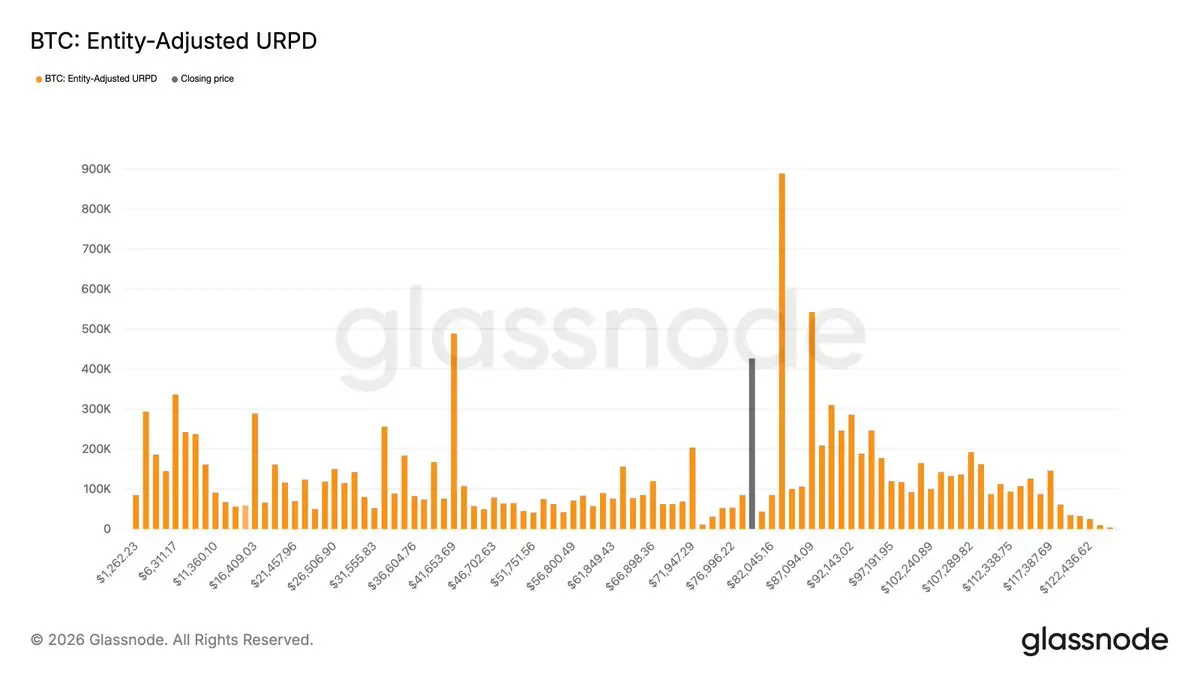

Just to put into context how little time Bitcoin has spent in the $70,000–$80,000 range.MSTR has purchased in this range only once.

BTC-1,14%

- Reward

- 1

- Comment

- Repost

- Share

"Power tends to corrupt, and absolute power corrupts absolutely."And that is the beauty of bitcoin

BTC-1,14%

- Reward

- 1

- Comment

- Repost

- Share

"Market madnes, BTC, gold and silver"

BTC-1,14%

- Reward

- like

- Comment

- Repost

- Share

Longest consecutive negative months in BTC history2011 Saw 5 consecutive negative months2014 Saw 4 consecutive negative months2018 Saw 6 consecutive negative months2026 Currently 4 consecutive negative months

BTC-1,14%

- Reward

- like

- Comment

- Repost

- Share

IBIT holders have to wait another 40 hours until they can capitulate

- Reward

- like

- Comment

- Repost

- Share

The biggest bubble in any asset globally is the US bond market. If you continue to suppress volatility and don’t let price discovery occur in yields, vol will eventually find itself popping up elsewhere ie metals. Metals lead and Bitcoin vol is massively underpriced

BTC-1,14%

- Reward

- like

- Comment

- Repost

- Share

Just to point out, no systematic collapse happened, no bank failures, no dead bodies rose to the surface.On this unprecedented metals run.One exec at Goldman Sachs left.What does that tell you?

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More32.79K Popularity

42.26K Popularity

15.05K Popularity

41.38K Popularity

250.59K Popularity

Pin