EricaHazel

No content yet

- Reward

- like

- Comment

- Repost

- Share

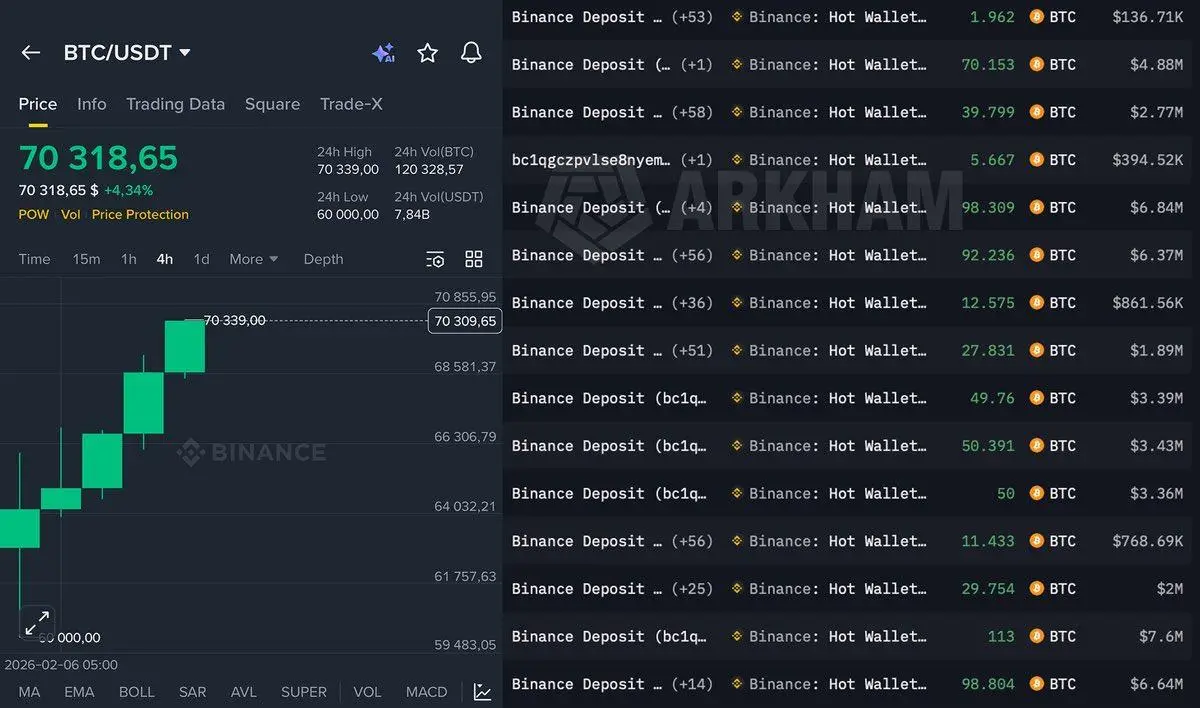

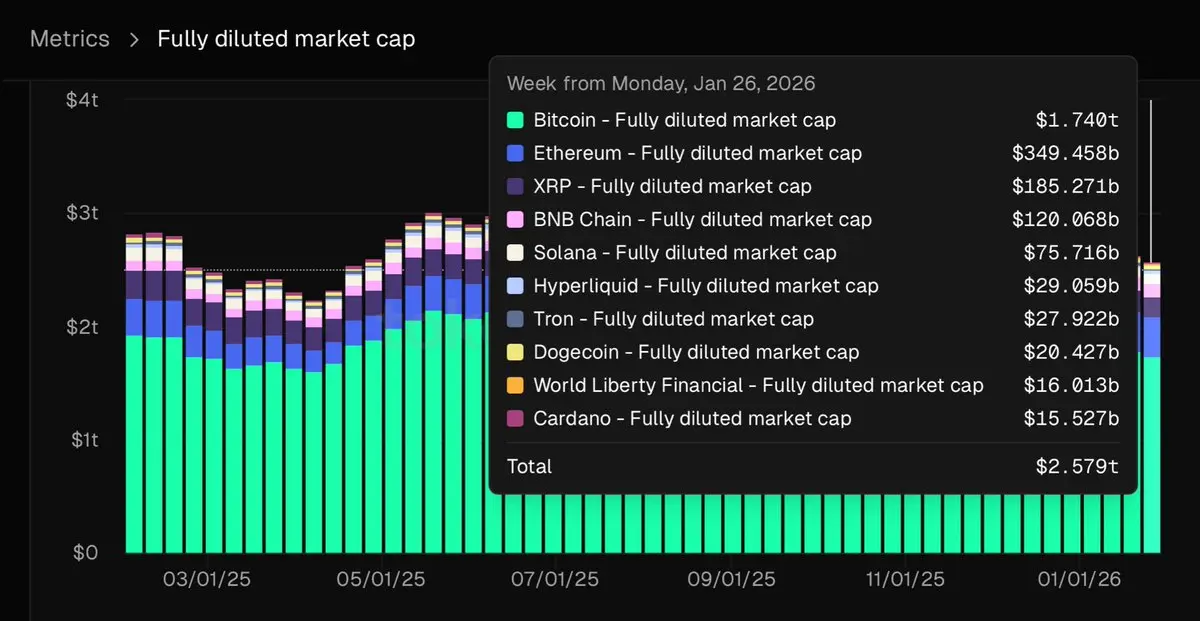

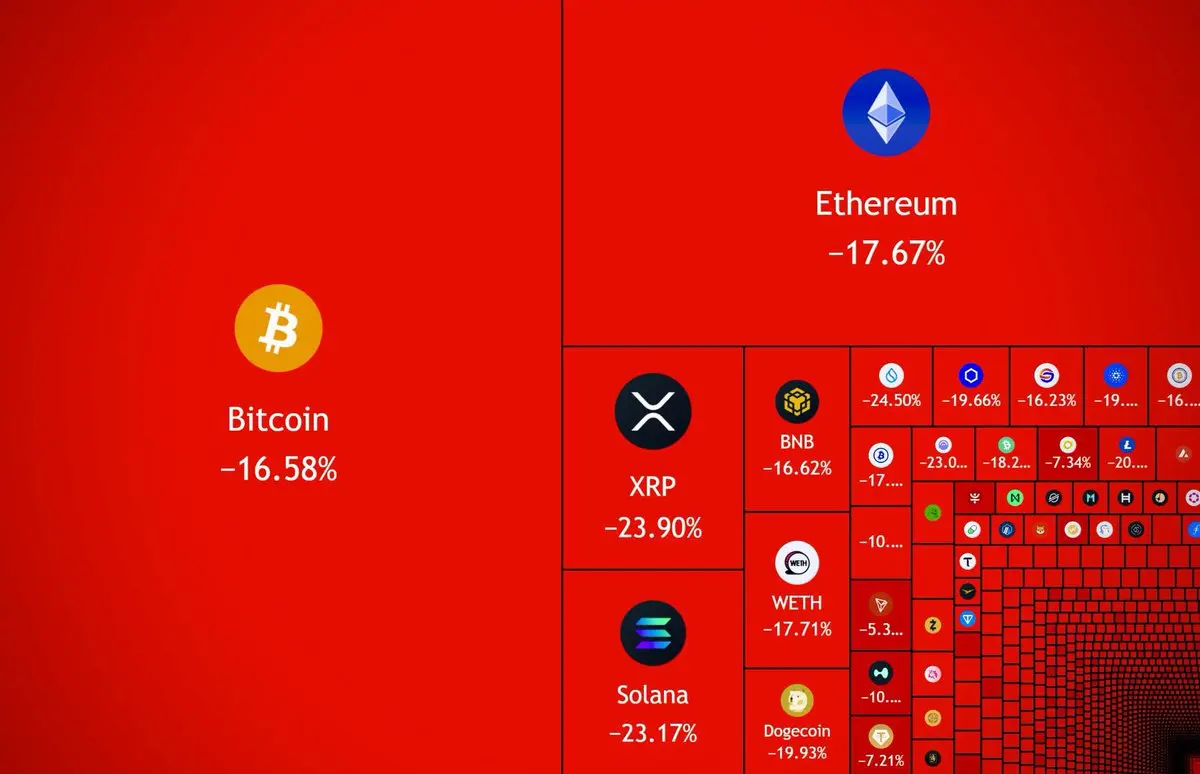

Another $350B vanished from the market today.

- Reward

- 1

- 1

- Repost

- Share

ybaser :

:

Happy New Year! 🤑125k $BTC: best buy ever115k $BTC: perfect dip105k $BTC: final shakeout95k $BTC: strong support85k $BTC: healthy pullback75k $BTC: risk management matters, hope profits were taken

BTC-2,11%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- 1

- Repost

- Share

SilencerYz :

:

https://www.gate.com/campaigns/3937?ref=BVFDV1BZ&ref_type=132U.S. Fed rate cut decision drops Wednesday at 2:00 PM ET.Expect volatility.

- Reward

- like

- Comment

- Repost

- Share

Officially partnered with @Freedx and secured a $10 USDT bonus for new users. Withdrawable.\n\nHow to get it:\n\n• Sign up with my link\n• Complete KYC\n• Deposit $80+\n• Make 5 trades\n• Hit $1K spot or $10K futures volume\n\nBonus is credited directly.\n\n

- Reward

- 1

- Comment

- Repost

- Share

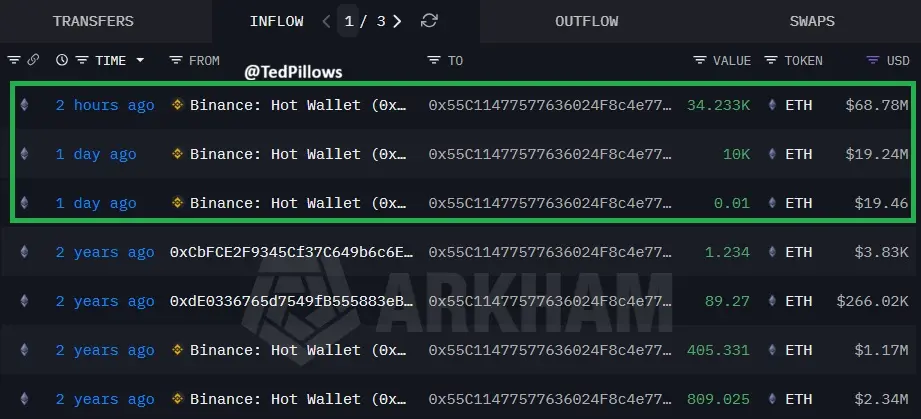

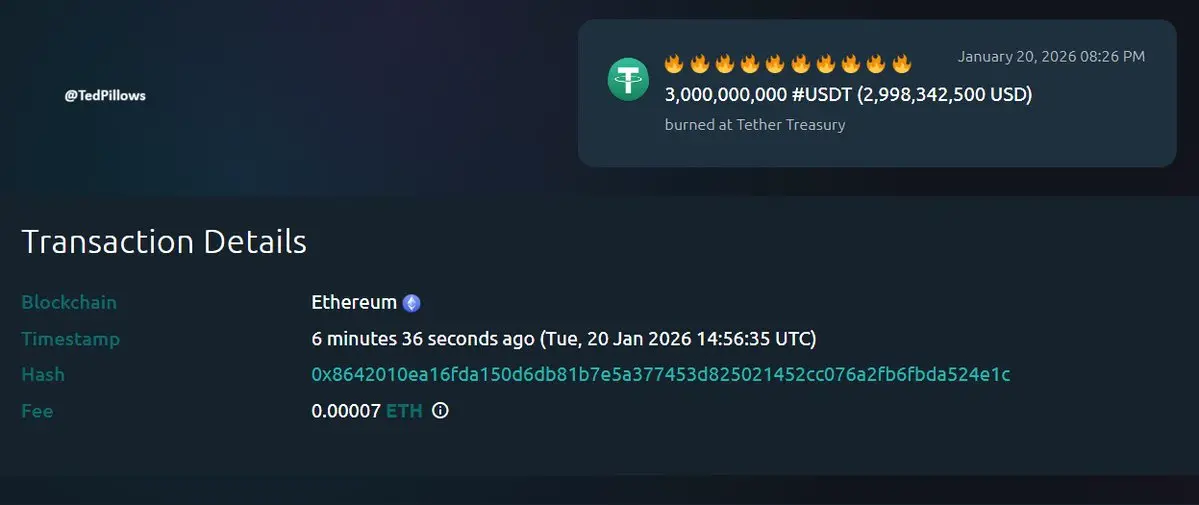

$3,000,000,000 $USDT has been burnt now.

Someone big just completely exited the market.

Someone big just completely exited the market.

- Reward

- like

- Comment

- Repost

- Share

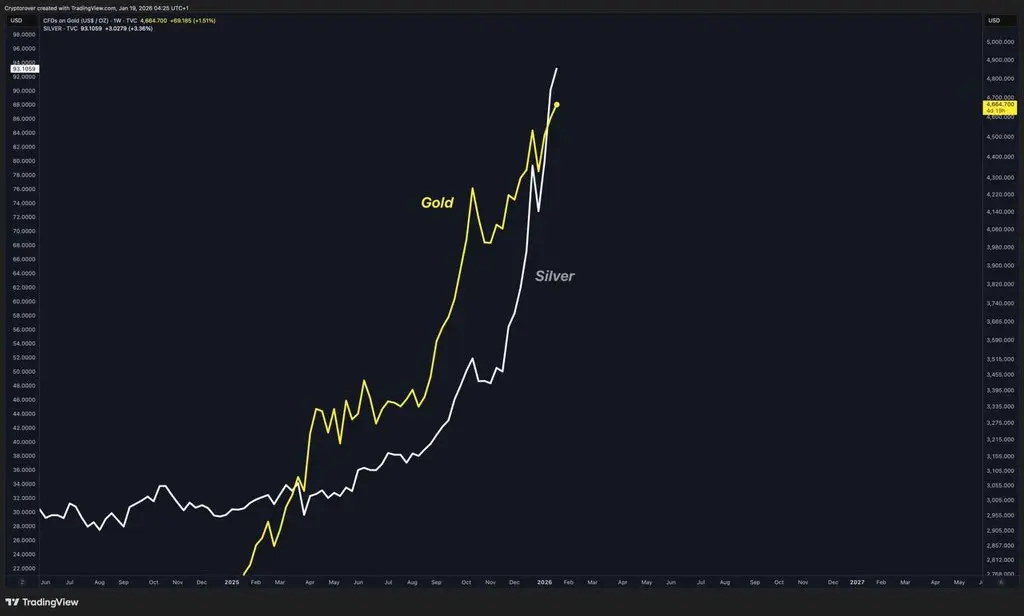

Gold sets the direction. Silver accelerates the move.

When silver starts closing the gap this aggressively, it signals strength already flowing through the metals complex.

These rotations tend to move fast once confirmed.

Chasing late usually ends the same way.

When silver starts closing the gap this aggressively, it signals strength already flowing through the metals complex.

These rotations tend to move fast once confirmed.

Chasing late usually ends the same way.

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

Gm 🦋

Have a great weekend 💖

Have a great weekend 💖

- Reward

- like

- Comment

- Repost

- Share

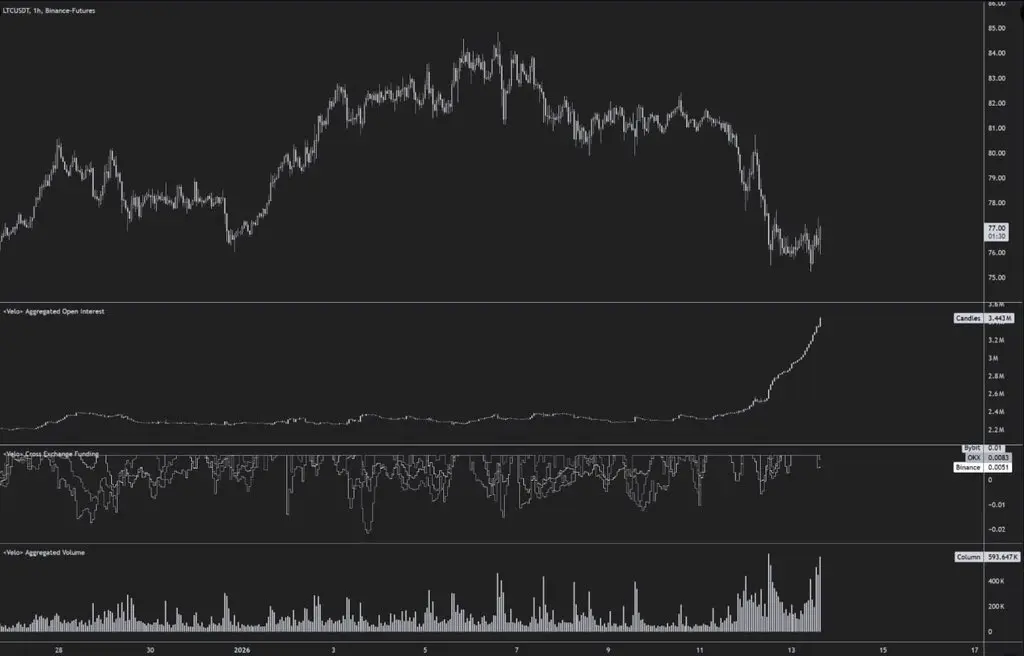

$LTC:

Nothing broken. Large players are positioning.

• Open interest +40%

• Price flat

• Funding neutral

• Volume rising

Clear accumulation. Breakout will set direction.

Nothing broken. Large players are positioning.

• Open interest +40%

• Price flat

• Funding neutral

• Volume rising

Clear accumulation. Breakout will set direction.

LTC-2,82%

- Reward

- 2

- 1

- Repost

- Share

GarikBY :

:

He is going to finish the tail.ALERT

A trader on HTX just got wiped out as a $35M short was liquidated in one single order.

This is the reminder the market gives every cycle.

Leverage feels effortless when price moves your way, but it shows no mercy when it turns.

Risk management is not optional.

A trader on HTX just got wiped out as a $35M short was liquidated in one single order.

This is the reminder the market gives every cycle.

Leverage feels effortless when price moves your way, but it shows no mercy when it turns.

Risk management is not optional.

HTX-0,37%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More136.94K Popularity

25.64K Popularity

22.52K Popularity

67.4K Popularity

10.4K Popularity

Pin