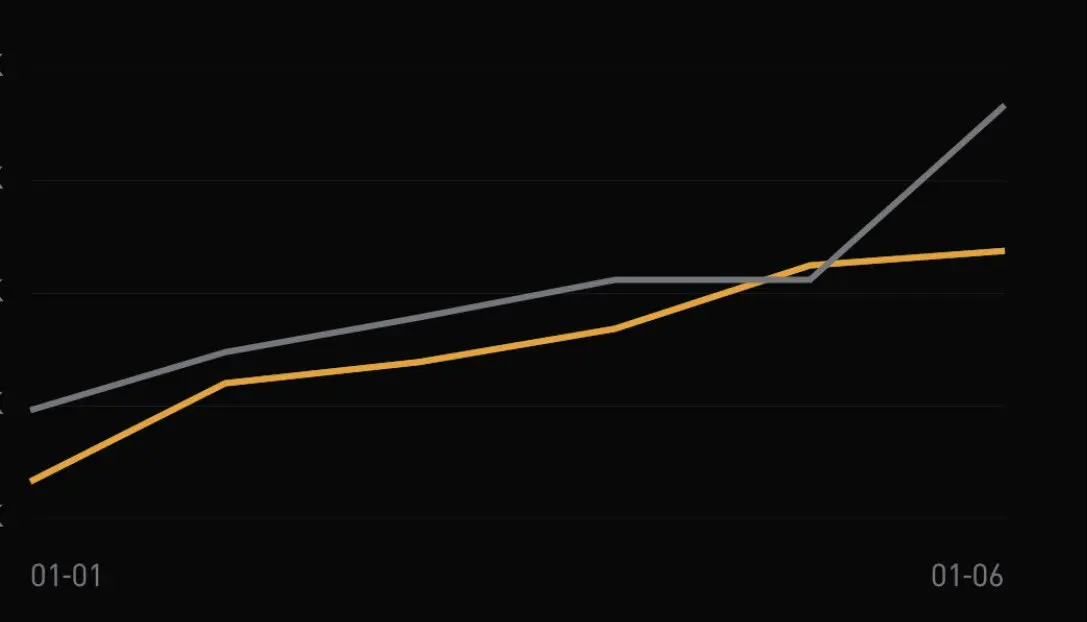

Screenshotting uPnL isn’t taking profits.

It’s usually euphoria.

Emotionally, the “I could have, I would have, I had” feeling afterward, when an asset drops or rolls into a downtrend, is always far worse than taking partial profits on the way up and watching price continue higher. Yes, it’s frustrating to scale out and see price keep running. You think you could have made more. But that mindset is the wrong approach. The correct mindset of a consistently profitable trader is to always take partial profits to keep risk as low as possible.

Profitable traders understand that there will be new se

It’s usually euphoria.

Emotionally, the “I could have, I would have, I had” feeling afterward, when an asset drops or rolls into a downtrend, is always far worse than taking partial profits on the way up and watching price continue higher. Yes, it’s frustrating to scale out and see price keep running. You think you could have made more. But that mindset is the wrong approach. The correct mindset of a consistently profitable trader is to always take partial profits to keep risk as low as possible.

Profitable traders understand that there will be new se