CryptoPhineas

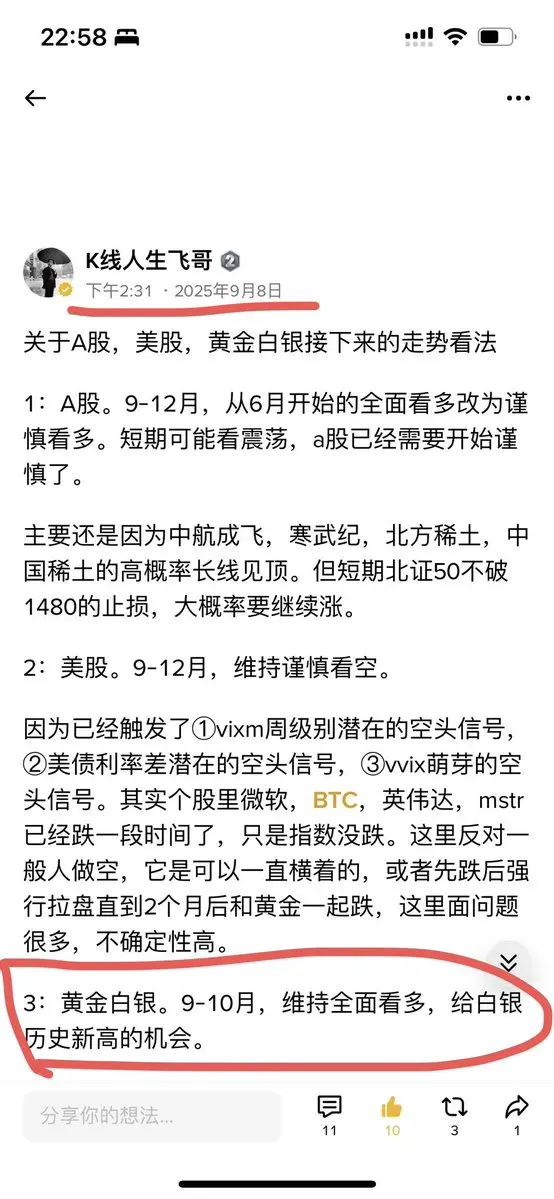

The current total market value of gold is approximately $30 trillion.

The size of US debt is $37.5 trillion.

If global central banks buy gold to hedge against the risk of US debt default,

then the total market value of gold in this round should be comparable to the size of US debt.

To reach a market value of $37.5 trillion, gold needs to increase by another 25%.

Converted to price, that is $5,375 per ounce.

This price should be the cyclical top of this phase.

View OriginalThe size of US debt is $37.5 trillion.

If global central banks buy gold to hedge against the risk of US debt default,

then the total market value of gold in this round should be comparable to the size of US debt.

To reach a market value of $37.5 trillion, gold needs to increase by another 25%.

Converted to price, that is $5,375 per ounce.

This price should be the cyclical top of this phase.