Cipher_X

No content yet

Cipher_X

- Reward

- like

- Comment

- Repost

- Share

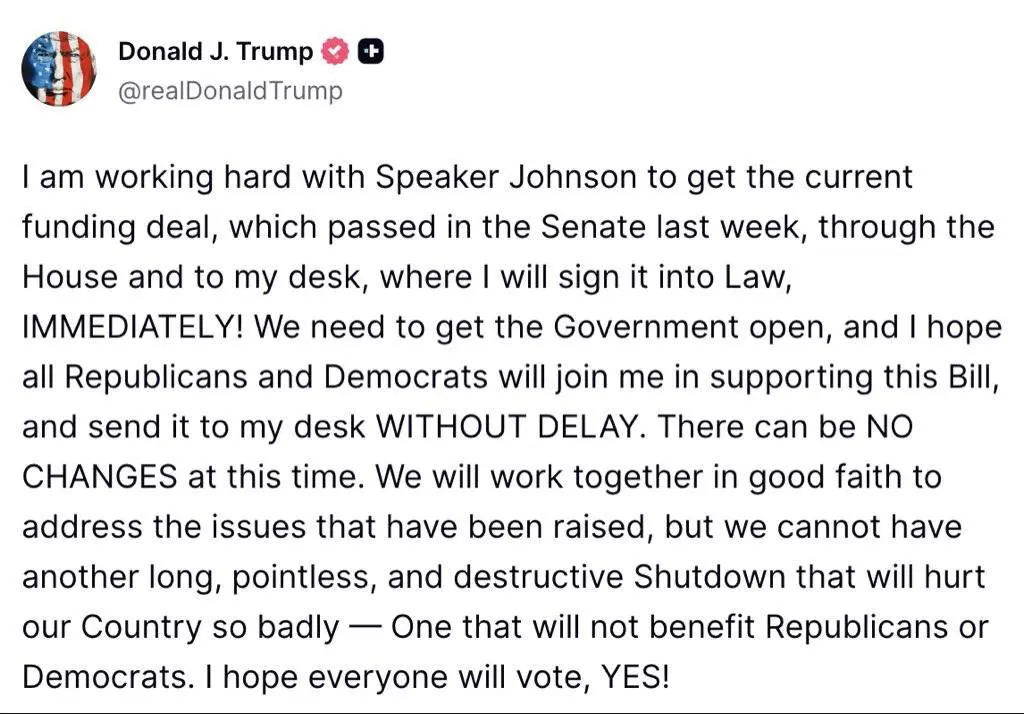

Trump just fired a very loud signal 🚨“Government must open IMMEDIATELY” isn’t political noise it’s a liquidity message.What this really implies: - Forced shutdown risk gets pulled off the table - Emergency repricing scenarios are avoided - Volatility pressure on risk assets easesMarkets hate uncertainty more than bad newsRemoving the shutdown tail risk is a green light.

- Reward

- like

- Comment

- Repost

- Share

Every major market is pulling back at the same time 🚨Metals, equities, crypto all redFear is loudConfidence is disappearingThis is the phase where people swear they’re “done” and rush for the exit.I’m not rushing anywhereNo excitement. No panic.Just waiting for prices to come to me.Big gains are built in silence not during euphoria.

- Reward

- like

- Comment

- Repost

- Share

Dollar is downGold is downSilver is downBitcoin is downETH is downBNB is downEverything is bleeding at the same time. You know what that usually means, right?Liquidity is being pulledRisk is being resetAnd the market is shaking out weak hands before the next real move. 🤝

- Reward

- like

- Comment

- Repost

- Share

🚨 FED DECISION DAY 2:30 PM ETSmall cut <25 bps → Risk assets ignite, Bitcoin leads the chargeLarger cut ~50 bps → Liquidity spills into alts, rotation beginsNo cut → Expect the printer: ~$1.5T liquidity injection incomingEither way, liquidity is comingThe Fed speaksMarkets reactCrypto doesn’t stay quiet.

BTC-3,81%

- Reward

- like

- Comment

- Repost

- Share

This is a big deal 🚨The U.S. Dollar Index has broken below a 14-year support levelThat’s not a normal pullback that’s a structural shift.When a currency loses a level it’s respected for over a decade, confidence cracksHistorically, this kind of breakdown fuels hard assets and risk assets.Weak dollar → stronger gold, commodities, and eventually BitcoinThe market is quietly telling you something changed.

- Reward

- like

- Comment

- Repost

- Share

Next week 🚨▸ Fresh GDP data sets the macro tone▸ $8.3B in liquidity enters the system▸ Rate decision drops▸ U.S. balance sheet update▸ FOMC voices hit the marketThis is how inflection points formLiquidity, policy, and expectations collide and that’s usually where major trends are born.

- Reward

- like

- Comment

- Repost

- Share

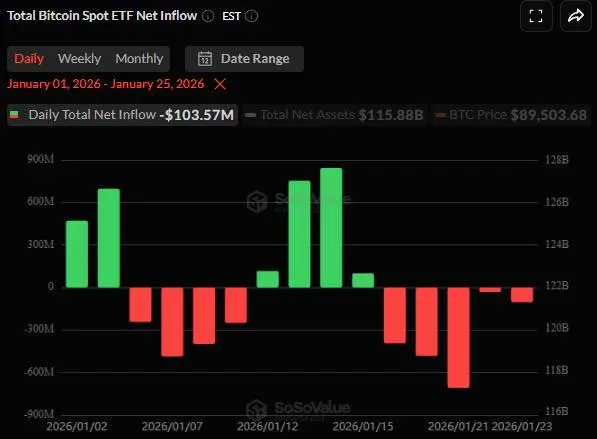

BITCOIN ETF FLOWS TURN NEGATIVE 🚨Bitcoin Spot ETFs have recorded consistent outflows, with investors pulling over $100M+ during the recent sessions ETF demand cooling while price holds steady shows cautious positioning, not panicRisk-off sentiment is creeping in as institutions rebalance exposure.

BTC-3,81%

- Reward

- like

- Comment

- Repost

- Share

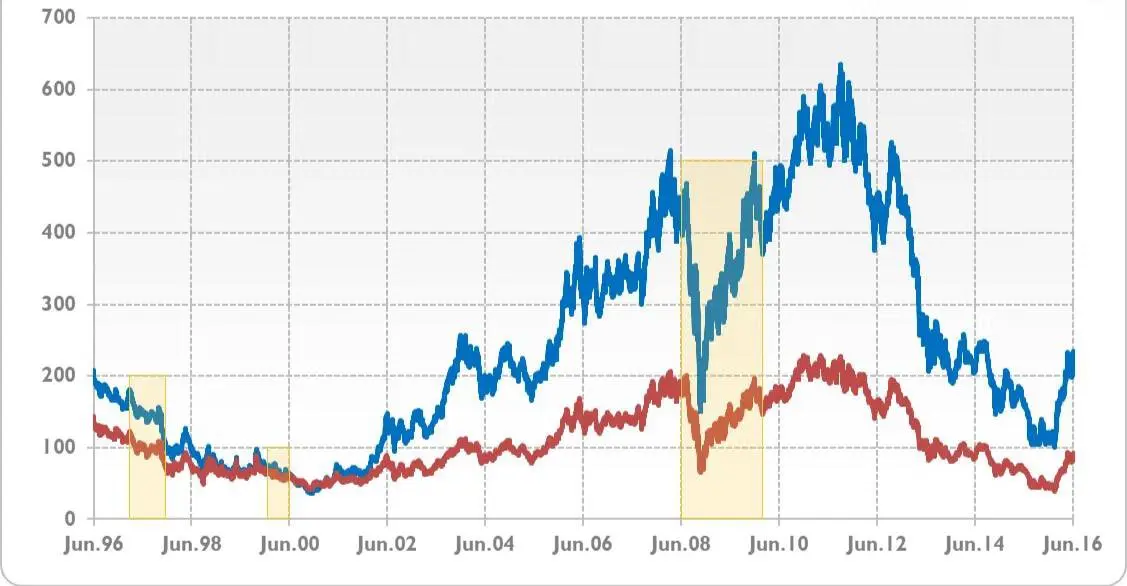

Gold mining stocks aren’t the hedge people think they are 👇\n\nHistory shows they drop hard during crises much harder than gold or silver and recover far slower. \n\nAfter Lehman → miners crashed deeper and many still sit below pre-crisis levels \n\nWhy? \n\nThey’re equities\n\nMargins, costs and economic cycles matter\n\nGold and silver have centuries of monetary history\n\nMining stocks don’t.

- Reward

- like

- Comment

- Repost

- Share

Markets are walking into danger again 🚨👇

The U.S. stock market is setting up for another tariffs-driven crash

Trade pressure is back on the table and risk sentiment is already fragile

I’m watching the U.S. market open today very closely

If stocks slip, fear spreads fast and liquidity disappears even faster

That scenario is really bad for Bitcoin

Stay Safe.

The U.S. stock market is setting up for another tariffs-driven crash

Trade pressure is back on the table and risk sentiment is already fragile

I’m watching the U.S. market open today very closely

If stocks slip, fear spreads fast and liquidity disappears even faster

That scenario is really bad for Bitcoin

Stay Safe.

BTC-3,81%

- Reward

- like

- Comment

- Repost

- Share

BIG WEEK AHEAD 🚨👇

▸ U.S. Core PCE inflation the Fed’s most important inflation gauge

▸ Bank of Japan policy decision and press conference

▸ U.S. GDP data

▸ Global Flash PMIs for manufacturing & services

▸ U.K. CPI and Retail Sales

▸ Australian employment data

▸ President Trump speaking during WEF meetings

Stay Safe.

▸ U.S. Core PCE inflation the Fed’s most important inflation gauge

▸ Bank of Japan policy decision and press conference

▸ U.S. GDP data

▸ Global Flash PMIs for manufacturing & services

▸ U.K. CPI and Retail Sales

▸ Australian employment data

▸ President Trump speaking during WEF meetings

Stay Safe.

- Reward

- 1

- Comment

- Repost

- Share

Big money is about to reshape the markets 🚨👇

$4.7T is flowing into the US over the next year

- tax refunds

- corporate cash returning

- investment incentives

This isn’t hype.

This is pure liquidity.

Cash hits stocks first, fuels risk appetite, then moves into Bitcoin.

Corporate boards will do what they always do: buybacks, dividends, M&A, capital spending.

Markets feel it before anyone notices.

Trump’s push isn’t about “fixing” the economy it’s about moving liquidity fast.

This is why assets surge while wages lag and why inflation sneaks up afterward.

Pay attention to the flows.

Timing

$4.7T is flowing into the US over the next year

- tax refunds

- corporate cash returning

- investment incentives

This isn’t hype.

This is pure liquidity.

Cash hits stocks first, fuels risk appetite, then moves into Bitcoin.

Corporate boards will do what they always do: buybacks, dividends, M&A, capital spending.

Markets feel it before anyone notices.

Trump’s push isn’t about “fixing” the economy it’s about moving liquidity fast.

This is why assets surge while wages lag and why inflation sneaks up afterward.

Pay attention to the flows.

Timing

BTC-3,81%

- Reward

- like

- Comment

- Repost

- Share

Silver market cap added $3.9 trillion in just 12 months 👇

That single move is now nearly 2× Bitcoin’s entire current market cap

Let that sink in

Silver is a slow, traditional asset with limited global accessibility

Bitcoin is digital, borderless, liquid 24/7, and increasingly adopted by institutions.

If Bitcoin simply catches up to silver’s market cap $BTC would be trading around $270,000+

This isn’t a moonshot narrative.

It’s pure relative valuation.

Hard asset vs harder asset.

One already proved capital can flow at scale.

The other is still early.

That single move is now nearly 2× Bitcoin’s entire current market cap

Let that sink in

Silver is a slow, traditional asset with limited global accessibility

Bitcoin is digital, borderless, liquid 24/7, and increasingly adopted by institutions.

If Bitcoin simply catches up to silver’s market cap $BTC would be trading around $270,000+

This isn’t a moonshot narrative.

It’s pure relative valuation.

Hard asset vs harder asset.

One already proved capital can flow at scale.

The other is still early.

BTC-3,81%

- Reward

- like

- Comment

- Repost

- Share

Crypto fails because of hacks!

Before trillions come onchain, one thing has to be solved first: security.

Immunefi is already doing that work at scale. They’ve helped protect:

→ 650+ protocols

→ ~$180B in value

→ stopped ~$25B in hack damage

IMU is all about backing the system that makes crypto feel safe enough to grow.

If security becomes mandatory, platforms like Immunefi become unavoidable.

@immunefi

Before trillions come onchain, one thing has to be solved first: security.

Immunefi is already doing that work at scale. They’ve helped protect:

→ 650+ protocols

→ ~$180B in value

→ stopped ~$25B in hack damage

IMU is all about backing the system that makes crypto feel safe enough to grow.

If security becomes mandatory, platforms like Immunefi become unavoidable.

@immunefi

IMU-7,45%

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More13.5K Popularity

8.96K Popularity

7.97K Popularity

3.11K Popularity

5.11K Popularity

Pin