Bit_Bull

No content yet

Bit_Bull

Coinbase Bitcoin premium has been negative for 2+ months now.

There has been 1-2 days where premium turned positive, but each time, it marked the local top.

Since 2023, this hasn't happened yet which is a clear sign that large players are still exiting.

Once this stabilizes during price downtrend, it'll be a sign of bottom formation.

There has been 1-2 days where premium turned positive, but each time, it marked the local top.

Since 2023, this hasn't happened yet which is a clear sign that large players are still exiting.

Once this stabilizes during price downtrend, it'll be a sign of bottom formation.

BTC0,64%

- Reward

- like

- Comment

- Repost

- Share

BREAKING: Harvard sold part of its Bitcoin exposure and rotated capital into Ethereum.

Harvard Management cut its Bitcoin ETF position by 21% in Q4 while opening a new $87M stake in an Ethereum ETF.

This marks Harvard’s first disclosed ETH allocation through regulated markets.

Even after the trim, Bitcoin remains its largest crypto holding at $260M+.

Total crypto ETF exposure now stands near $350M.

Institutions are no longer holding BTC alone, capital is starting to spread across major crypto assets.

Harvard Management cut its Bitcoin ETF position by 21% in Q4 while opening a new $87M stake in an Ethereum ETF.

This marks Harvard’s first disclosed ETH allocation through regulated markets.

Even after the trim, Bitcoin remains its largest crypto holding at $260M+.

Total crypto ETF exposure now stands near $350M.

Institutions are no longer holding BTC alone, capital is starting to spread across major crypto assets.

- Reward

- like

- Comment

- Repost

- Share

US national debt is projected to hit $64 TRILLION within the next decade, according to the CBO.

That surge is being driven by widening deficits and the impact of extended tax cuts.

Higher debt means higher Treasury issuance, rising interest costs, and more pressure on the Fed over time.

Historically, this kind of fiscal expansion has been bearish for the dollar but bullish for hard assets like gold and Bitcoin.

Liquidity rises... but so do long-term stability risks.

That surge is being driven by widening deficits and the impact of extended tax cuts.

Higher debt means higher Treasury issuance, rising interest costs, and more pressure on the Fed over time.

Historically, this kind of fiscal expansion has been bearish for the dollar but bullish for hard assets like gold and Bitcoin.

Liquidity rises... but so do long-term stability risks.

BTC0,64%

- Reward

- like

- Comment

- Repost

- Share

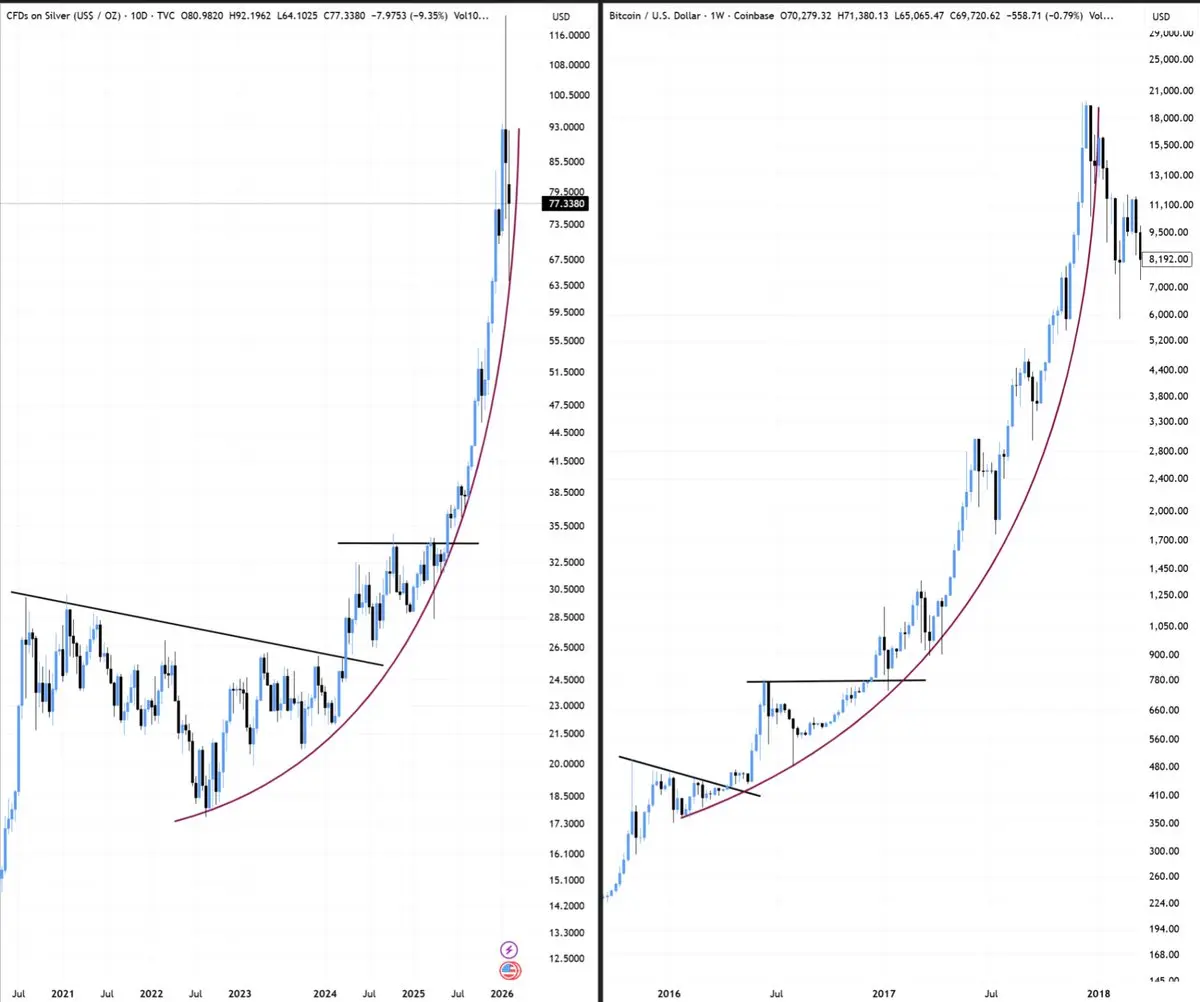

A lot of people think we are due for a V-shape recovery.

Just take a look at the 2018 and 2022 cycle, and you'll understand that the bottom isn't in yet.

Just take a look at the 2018 and 2022 cycle, and you'll understand that the bottom isn't in yet.

- Reward

- like

- Comment

- Repost

- Share

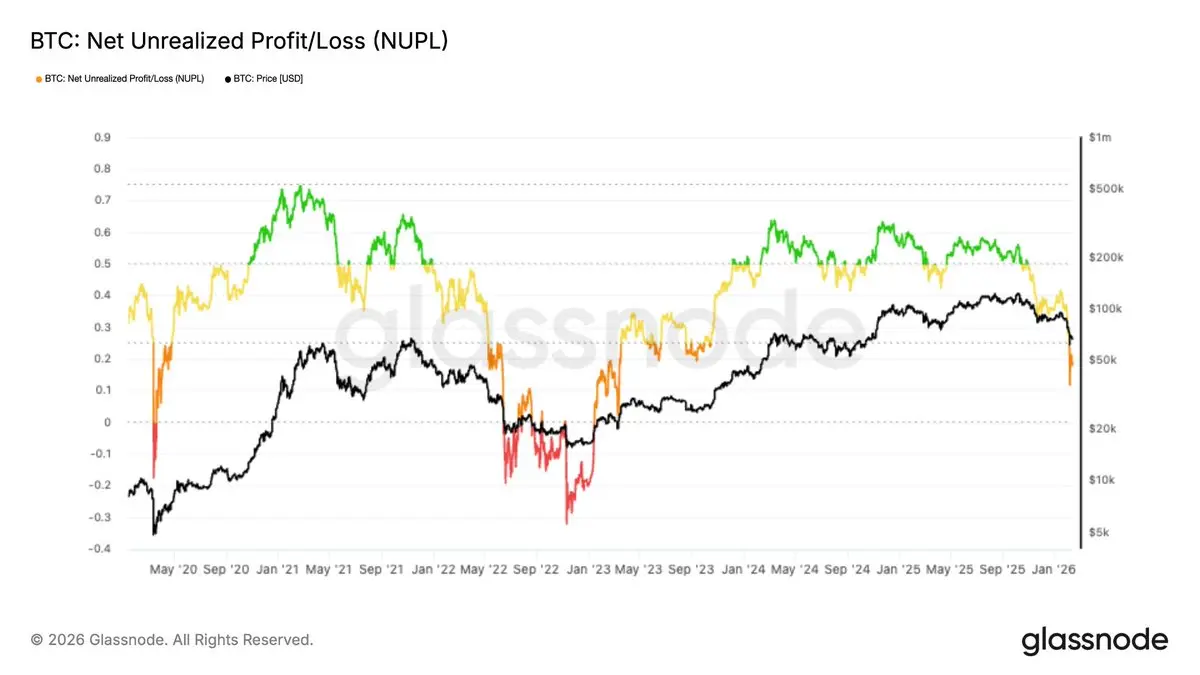

Bitcoin is now much closer to its bottom than a top.

Historically, when Bitcoin "supply in profit/loss" has converged, a cycle bottom has happened.

During the dump to $60K, this was very close to happening but didn't happen.

If you compare this with last cycle, something similar happened when BTC dropped below $20K in June 2022.

The actual bottom happened 20% lower, which could happen this time too.

For now, Bitcoin and alts are having a relief rally, but this isn't the start of a new bull run.

BTC could have one more flush below $50K (August 2024 bottom), especially due to major US stocks sho

Historically, when Bitcoin "supply in profit/loss" has converged, a cycle bottom has happened.

During the dump to $60K, this was very close to happening but didn't happen.

If you compare this with last cycle, something similar happened when BTC dropped below $20K in June 2022.

The actual bottom happened 20% lower, which could happen this time too.

For now, Bitcoin and alts are having a relief rally, but this isn't the start of a new bull run.

BTC could have one more flush below $50K (August 2024 bottom), especially due to major US stocks sho

BTC0,64%

- Reward

- like

- Comment

- Repost

- Share

A lot of people are already calling for a cycle bottom.

And they will be trapped again.

A relief rally towards $78K-$80K is possible, but there'll be another violent dump.

Bitcoin MVRV has still not dropped below 1, which means the capitulation hasn't happened.

IMO, Bitcoin could drop another 30%-35% from the current level before a macro bottom.

And they will be trapped again.

A relief rally towards $78K-$80K is possible, but there'll be another violent dump.

Bitcoin MVRV has still not dropped below 1, which means the capitulation hasn't happened.

IMO, Bitcoin could drop another 30%-35% from the current level before a macro bottom.

BTC0,64%

- Reward

- 2

- Comment

- Repost

- Share

🚨 BITCOIN IS BACK IN THE FEAR ZONE.

$BTC NUPL has dropped back into the Hope/Fear range (0.18) meaning unrealized profits across the network are getting thin again.

When profit cushions shrink, conviction weakens.

Rallies usually face heavy sell pressure as holders look to exit breakeven.

And if price dips, downside can extend faster because there’s less profit support below.

This is typically a reactive, fragile phase for the market.

$BTC NUPL has dropped back into the Hope/Fear range (0.18) meaning unrealized profits across the network are getting thin again.

When profit cushions shrink, conviction weakens.

Rallies usually face heavy sell pressure as holders look to exit breakeven.

And if price dips, downside can extend faster because there’s less profit support below.

This is typically a reactive, fragile phase for the market.

- Reward

- 1

- Comment

- Repost

- Share

🚨 TRILLIONS INSTITUTIONAL CAPITAL IS WAITING ON CRYPTO REGULATION.

Trump’s White House digital asset advisor Patrick Witt is now openly pushing the narrative that crypto is already a multi trillion dollar industry and that clear U.S. market structure laws could unlock trillions more from traditional finance.

Pension funds. Sovereign wealth. Asset managers.

Capital isn’t blocked by interest, it’s blocked by rules.

Washington isn’t debating crypto anymore...

They’re positioning to absorb the biggest capital inflow the industry has ever seen.

Trump’s White House digital asset advisor Patrick Witt is now openly pushing the narrative that crypto is already a multi trillion dollar industry and that clear U.S. market structure laws could unlock trillions more from traditional finance.

Pension funds. Sovereign wealth. Asset managers.

Capital isn’t blocked by interest, it’s blocked by rules.

Washington isn’t debating crypto anymore...

They’re positioning to absorb the biggest capital inflow the industry has ever seen.

- Reward

- like

- Comment

- Repost

- Share

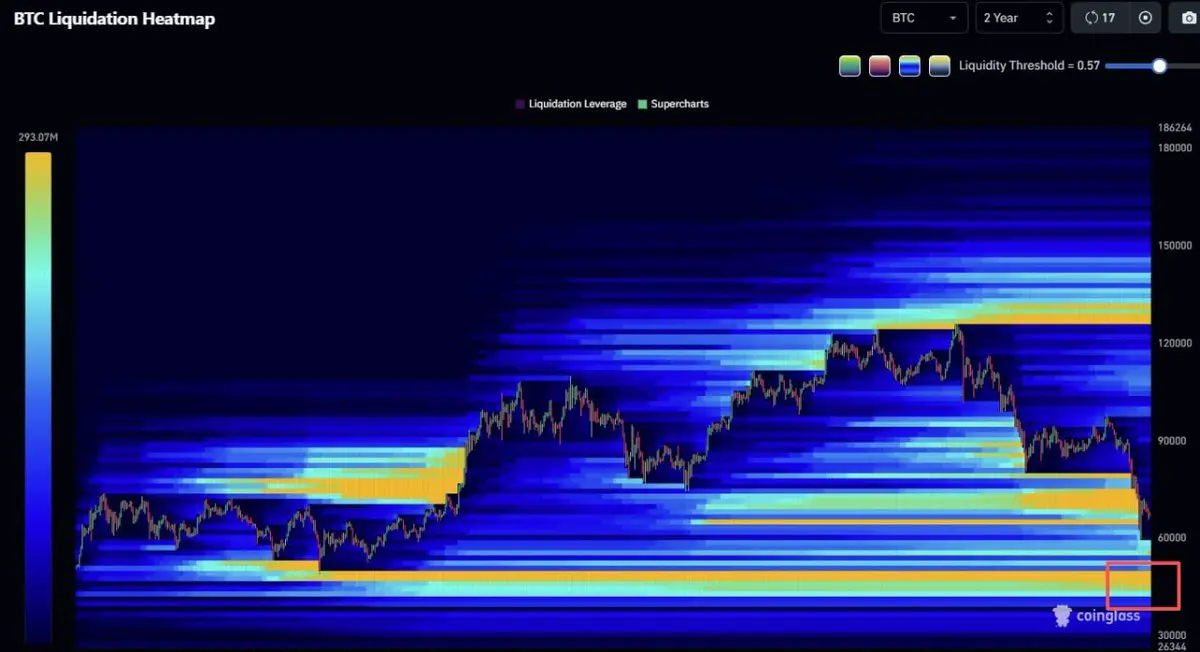

$BTC 2-year liquidation heatmap is telling where this cycle bottom could happen.

There's a big liquidity cluster sitting around $45K-$50K right now, and this zone could be the bottom.

A few other things also support this bottom thesis:

- In Q2 and Q3 2024, BTC traded around $50K zone for a long time, which could act as a support

- ETFs approval happened around $42K, and it hasn't been retested properly

- Long-term holders realized price is also around this zone, which has historically acted as a bottom line.

It's possible that we could a few wicks below this, but $45K-$50K looks like the botto

There's a big liquidity cluster sitting around $45K-$50K right now, and this zone could be the bottom.

A few other things also support this bottom thesis:

- In Q2 and Q3 2024, BTC traded around $50K zone for a long time, which could act as a support

- ETFs approval happened around $42K, and it hasn't been retested properly

- Long-term holders realized price is also around this zone, which has historically acted as a bottom line.

It's possible that we could a few wicks below this, but $45K-$50K looks like the botto

BTC0,64%

- Reward

- like

- Comment

- Repost

- Share

$60K was not the cycle bottom for Bitcoin.

First of all, BTC is following the 4-year cycle and the bottom never happens only 4 months after the top.

I know a lot of people think we will front run the bottom, but it'll happen by 1-2 months and not 6-8 months.

Bitcoin will bottom in Q3/Q4 and the price will be $40K-$45K.

First of all, BTC is following the 4-year cycle and the bottom never happens only 4 months after the top.

I know a lot of people think we will front run the bottom, but it'll happen by 1-2 months and not 6-8 months.

Bitcoin will bottom in Q3/Q4 and the price will be $40K-$45K.

BTC0,64%

- Reward

- like

- Comment

- Repost

- Share

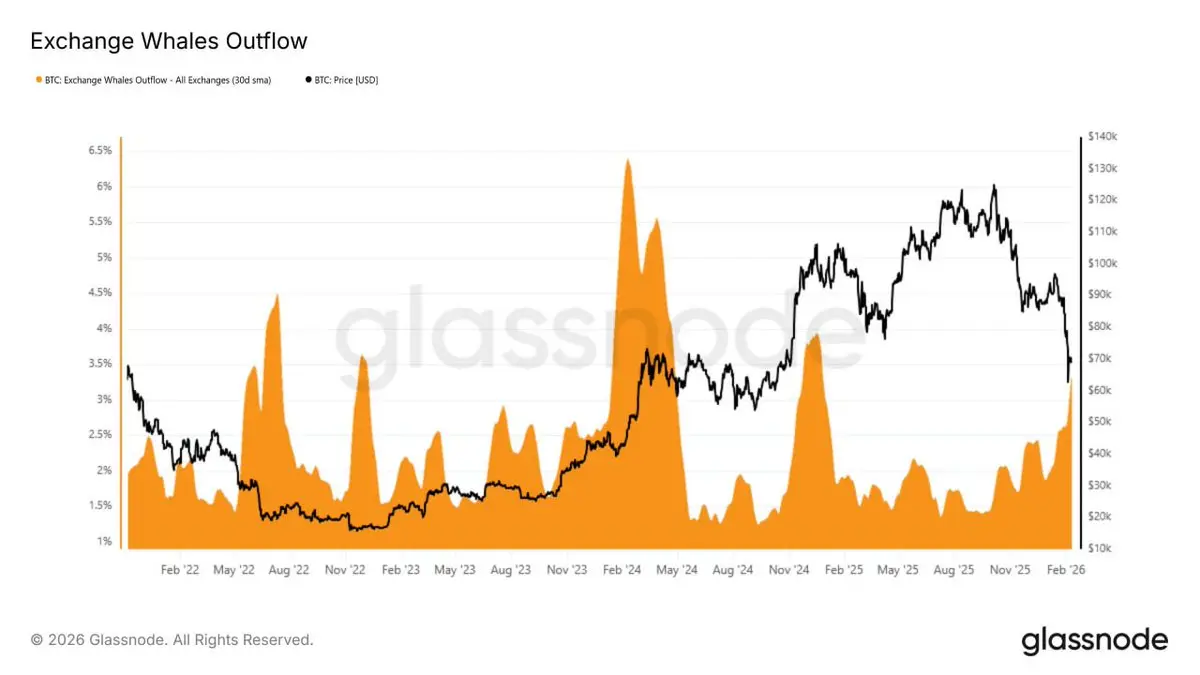

Whales have started to buy the dip.

After the recent dump, the percentage of exchange balances flowing out to large entities has spiked to 3.2%, its highest level since November 2024.

If comparing this with the 2022 bear market, something similar happened after the Q2 crash and even after the FTX crash.

Smart money never buys the absolute bottom, but they have now started to add aggressively.

This doesn't mean BTC can't go down more, but it's a sign that whales now find BTC attractive after offloading for months.

After the recent dump, the percentage of exchange balances flowing out to large entities has spiked to 3.2%, its highest level since November 2024.

If comparing this with the 2022 bear market, something similar happened after the Q2 crash and even after the FTX crash.

Smart money never buys the absolute bottom, but they have now started to add aggressively.

This doesn't mean BTC can't go down more, but it's a sign that whales now find BTC attractive after offloading for months.

BTC0,64%

- Reward

- like

- Comment

- Repost

- Share

This is probably the most bearish chart out here.

$DXY, which looks like it's getting ready for another dump.

Good for those who are holding hard assets.

$DXY, which looks like it's getting ready for another dump.

Good for those who are holding hard assets.

- Reward

- 1

- Comment

- Repost

- Share

Ethereum ETF holders are now feeling the pressure.

$ETH is roughly down 50% from the US ETH ETF average cost basis, compared to 20% for Bitcoin ETFs.

This is definitely not happening for the first time, as during April 2025, ETH was down almost 60% from its ETF cost basis.

But back then, there were 2 things.

- The crypto market was still in the 4-year bull cycle.

- DATs buying wasn't there for ETH

This is why ETH had a V-shaped recovery, which is less likely to happen now.

And I think this is what will cause the final capitulation.

I'm not saying that large money will completely exit, but some

$ETH is roughly down 50% from the US ETH ETF average cost basis, compared to 20% for Bitcoin ETFs.

This is definitely not happening for the first time, as during April 2025, ETH was down almost 60% from its ETF cost basis.

But back then, there were 2 things.

- The crypto market was still in the 4-year bull cycle.

- DATs buying wasn't there for ETH

This is why ETH had a V-shaped recovery, which is less likely to happen now.

And I think this is what will cause the final capitulation.

I'm not saying that large money will completely exit, but some

- Reward

- like

- Comment

- Repost

- Share