#BTCMarketAnalysis

Current Price Snapshot

Bitcoin’s price is currently trading around $91,000–$95,000 (recent trading range).

The market recently failed to sustain gains above ~$92,000–$95,000 resistance, seeing pullbacks due to macro news and profit-taking.

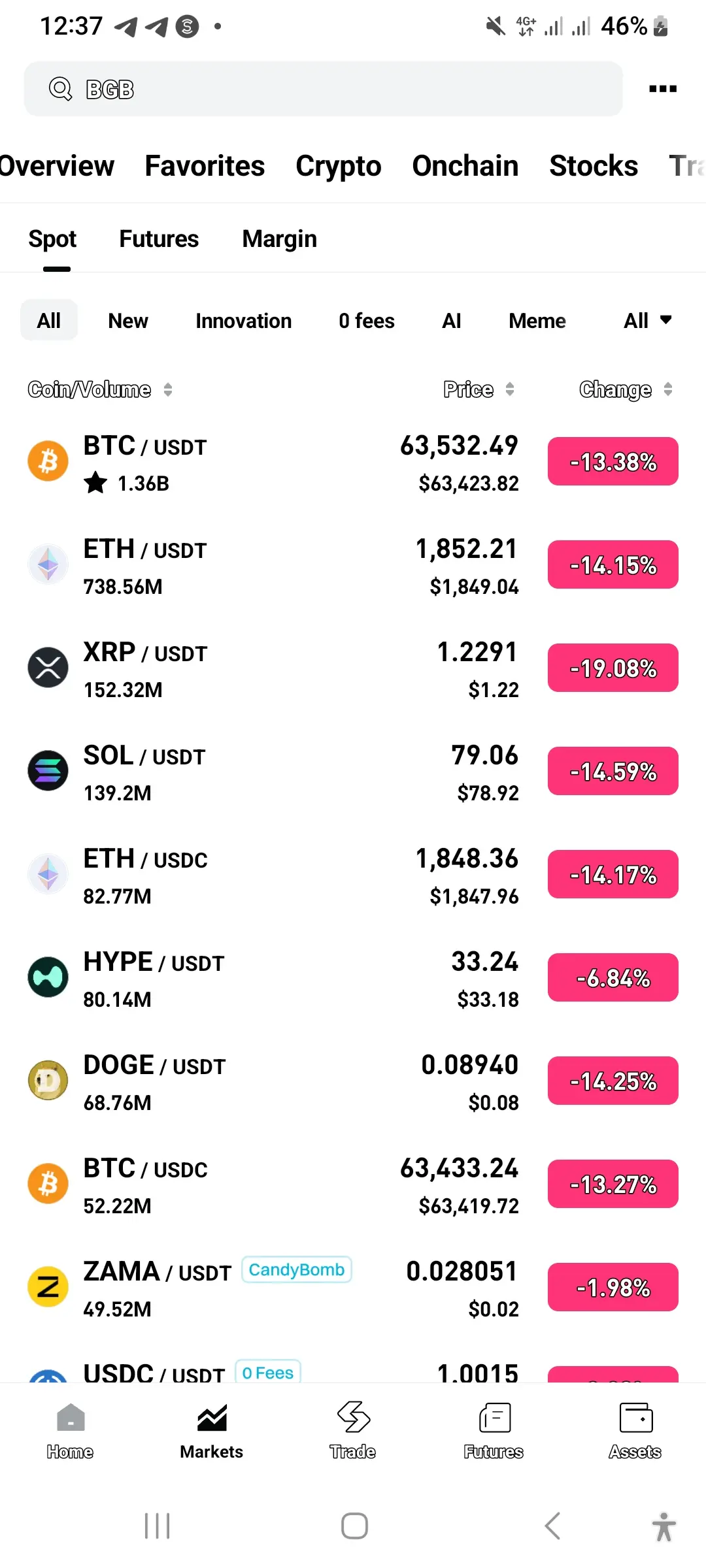

📊 2️⃣ Recent Price Movement & % Change

2 Days Ago (Jan 12, 2026): ~$91,000

Today: ~$91K–$95K (depending on source)

That’s roughly a +4–5% move higher in short term with volatility squeezing around resistance.

This shows a modest recovery, not an explosive breakout — meaning the market is cautious and traders are evaluating macro inputs before committing.

⚙️ 3️⃣ Technical Analysis — Levels That Matter

Key Support Zones

🟥 $90,000 psychological support — strong short‑term pivot zone.

🟧 $88,000 range — deeper technical support seen in consolidation.

🟨 Below $85,000 — risk zone where sellers could accelerate pressure.

Key Resistance Levels

🟩 $92,300–$95,000 cluster — immediate resistance area traders watch.

🟦 $96,000–$98,500 — next hurdle to confirm bullish momentum.

🟪 $100,000 barrier — psychological major target if bull resumes.

Technical signals:

Neutral momentum indicators (RSI neither extreme bullish nor bearish).

Price below some major moving averages, meaning bulls haven’t fully regained technical control.

Consolidation pattern suggests range‑bound movement until clear breakout or breakdown.

🌍 4️⃣ Macro & Fundamental Market Drivers

Bullish Structural Factors

✔ Ongoing regulatory progress — U.S. Senate working on digital asset clarity legislation, which boosts institutional confidence.

✔ Institutional and ETF participation is still growing, seen as long-term support for BTC demand.

✔ Long-term adoption narratives (store of value, institutional balance‑sheet allocation).

Bearish / Caution Factors

⚠ Geopolitical and macro volatility (tariff announcements and risk asset pressure) have weighed on BTC upside.

⚠ Some pundits favor other assets (e.g., gold) over BTC in periods of major macro stress.

⚠ Drawdowns still significant from last cycle peaks; recovery remains incomplete.

Overall macro picture: A tug‑of‑war between long-term structural optimism and near‑term macro uncertainty.

💡 5️⃣ Market Sentiment — What Traders Are Thinking

Bullish Trader Views

💭 Traders expecting a breakout above resistance believe BTC is building a base before a strong uptrend.

💭 Many see the current price range as a “coil” before a larger impulse wave resumes.

💭 Institutional interest and regulatory clarity are seen as catalysts for renewed inflows.

Cautious / Neutral Views

💭 Some traders believe the market is in a temporary range, waiting for either confirmation of a breakout or a deeper correction to buy.

💭 Fear & Greed Index and sentiment metrics recently show neutral to cautious territory, indicating marginal conviction among retail traders.

Bearish Perspectives

💭 A break below key support could accelerate downside risk toward lower technical supports.

💭 Macro news spikes can trigger sharp volatility drops, especially if risk appetite weakens.

Overall sentiment = neutral‑cautious with selective bullish undertones.

🔎 6️⃣ Forecast Scenarios — What’s Next?

Bullish Scenario

🚀 Break and hold above $96K–$98.5K → trigger momentum players

🚀 Next targets: $100K → $110K → $143K+ in mid‑long term.

Some institutional forecasts even see BTC moving above $140K in 2026.

Neutral / Range Bound Scenario

➡ BTC trades $88K–$96K for weeks → consolidates

➡ Ideal for swing traders capturing ups and downs in range.

Bearish Scenario

📉 Break below $88K → potential retest of $85K / $80K zone

📉 Weak macro data and risk‑off sentiment could trigger deeper selloffs.

🛠 7️⃣ Trading Strategy & Plan

Strategy A — Range Play

✔ Buy near support ($88K–$90K)

✔ Take partial profit near resistance ($92K–$95K)

✔ Tight stop‑loss below major support

➡ Best for short‑term traders in current range market.

Strategy B — Breakout Play

✔ Wait for clear breakout above $96K–$98K

✔ Enter on pullback retest of breakout level

✔ Set targets toward psychological $100K+ zones

Strategy C — Long‑Term Accumulation

✔ DCA (Dollar‑Cost Average) over macro dips

✔ Focus on long ranges and ETF flows

✔ Hold strong support levels for longer cycles

Risk Management

⚠ Always use stop losses

⚠ Adjust position sizing to volatility

⚠ Monitor macro catalysts closely

📍 8️⃣ Summary — Professional Recap

Bitcoin is currently in a consolidation phase with modest short‑term gains (around +4–5%) over the past 48 hrs. The market lacks full breakout conviction, oscillating between $88K–$96K resistance and support.

Macro catalysts like regulatory clarity and institutional ETF flows give the market structural bullish underpinnings, but geopolitical, macroeconomic risk signals cap upside near resistance.

Traders remain neutral‑to‑slightly optimistic, favoring range trades and breakout strategies with disciplined risk management. Future direction hinges on BTC’s ability to break above $96K with volume or fail support and re‑test lower bands.

$BTC

Current Price Snapshot

Bitcoin’s price is currently trading around $91,000–$95,000 (recent trading range).

The market recently failed to sustain gains above ~$92,000–$95,000 resistance, seeing pullbacks due to macro news and profit-taking.

📊 2️⃣ Recent Price Movement & % Change

2 Days Ago (Jan 12, 2026): ~$91,000

Today: ~$91K–$95K (depending on source)

That’s roughly a +4–5% move higher in short term with volatility squeezing around resistance.

This shows a modest recovery, not an explosive breakout — meaning the market is cautious and traders are evaluating macro inputs before committing.

⚙️ 3️⃣ Technical Analysis — Levels That Matter

Key Support Zones

🟥 $90,000 psychological support — strong short‑term pivot zone.

🟧 $88,000 range — deeper technical support seen in consolidation.

🟨 Below $85,000 — risk zone where sellers could accelerate pressure.

Key Resistance Levels

🟩 $92,300–$95,000 cluster — immediate resistance area traders watch.

🟦 $96,000–$98,500 — next hurdle to confirm bullish momentum.

🟪 $100,000 barrier — psychological major target if bull resumes.

Technical signals:

Neutral momentum indicators (RSI neither extreme bullish nor bearish).

Price below some major moving averages, meaning bulls haven’t fully regained technical control.

Consolidation pattern suggests range‑bound movement until clear breakout or breakdown.

🌍 4️⃣ Macro & Fundamental Market Drivers

Bullish Structural Factors

✔ Ongoing regulatory progress — U.S. Senate working on digital asset clarity legislation, which boosts institutional confidence.

✔ Institutional and ETF participation is still growing, seen as long-term support for BTC demand.

✔ Long-term adoption narratives (store of value, institutional balance‑sheet allocation).

Bearish / Caution Factors

⚠ Geopolitical and macro volatility (tariff announcements and risk asset pressure) have weighed on BTC upside.

⚠ Some pundits favor other assets (e.g., gold) over BTC in periods of major macro stress.

⚠ Drawdowns still significant from last cycle peaks; recovery remains incomplete.

Overall macro picture: A tug‑of‑war between long-term structural optimism and near‑term macro uncertainty.

💡 5️⃣ Market Sentiment — What Traders Are Thinking

Bullish Trader Views

💭 Traders expecting a breakout above resistance believe BTC is building a base before a strong uptrend.

💭 Many see the current price range as a “coil” before a larger impulse wave resumes.

💭 Institutional interest and regulatory clarity are seen as catalysts for renewed inflows.

Cautious / Neutral Views

💭 Some traders believe the market is in a temporary range, waiting for either confirmation of a breakout or a deeper correction to buy.

💭 Fear & Greed Index and sentiment metrics recently show neutral to cautious territory, indicating marginal conviction among retail traders.

Bearish Perspectives

💭 A break below key support could accelerate downside risk toward lower technical supports.

💭 Macro news spikes can trigger sharp volatility drops, especially if risk appetite weakens.

Overall sentiment = neutral‑cautious with selective bullish undertones.

🔎 6️⃣ Forecast Scenarios — What’s Next?

Bullish Scenario

🚀 Break and hold above $96K–$98.5K → trigger momentum players

🚀 Next targets: $100K → $110K → $143K+ in mid‑long term.

Some institutional forecasts even see BTC moving above $140K in 2026.

Neutral / Range Bound Scenario

➡ BTC trades $88K–$96K for weeks → consolidates

➡ Ideal for swing traders capturing ups and downs in range.

Bearish Scenario

📉 Break below $88K → potential retest of $85K / $80K zone

📉 Weak macro data and risk‑off sentiment could trigger deeper selloffs.

🛠 7️⃣ Trading Strategy & Plan

Strategy A — Range Play

✔ Buy near support ($88K–$90K)

✔ Take partial profit near resistance ($92K–$95K)

✔ Tight stop‑loss below major support

➡ Best for short‑term traders in current range market.

Strategy B — Breakout Play

✔ Wait for clear breakout above $96K–$98K

✔ Enter on pullback retest of breakout level

✔ Set targets toward psychological $100K+ zones

Strategy C — Long‑Term Accumulation

✔ DCA (Dollar‑Cost Average) over macro dips

✔ Focus on long ranges and ETF flows

✔ Hold strong support levels for longer cycles

Risk Management

⚠ Always use stop losses

⚠ Adjust position sizing to volatility

⚠ Monitor macro catalysts closely

📍 8️⃣ Summary — Professional Recap

Bitcoin is currently in a consolidation phase with modest short‑term gains (around +4–5%) over the past 48 hrs. The market lacks full breakout conviction, oscillating between $88K–$96K resistance and support.

Macro catalysts like regulatory clarity and institutional ETF flows give the market structural bullish underpinnings, but geopolitical, macroeconomic risk signals cap upside near resistance.

Traders remain neutral‑to‑slightly optimistic, favoring range trades and breakout strategies with disciplined risk management. Future direction hinges on BTC’s ability to break above $96K with volume or fail support and re‑test lower bands.

$BTC