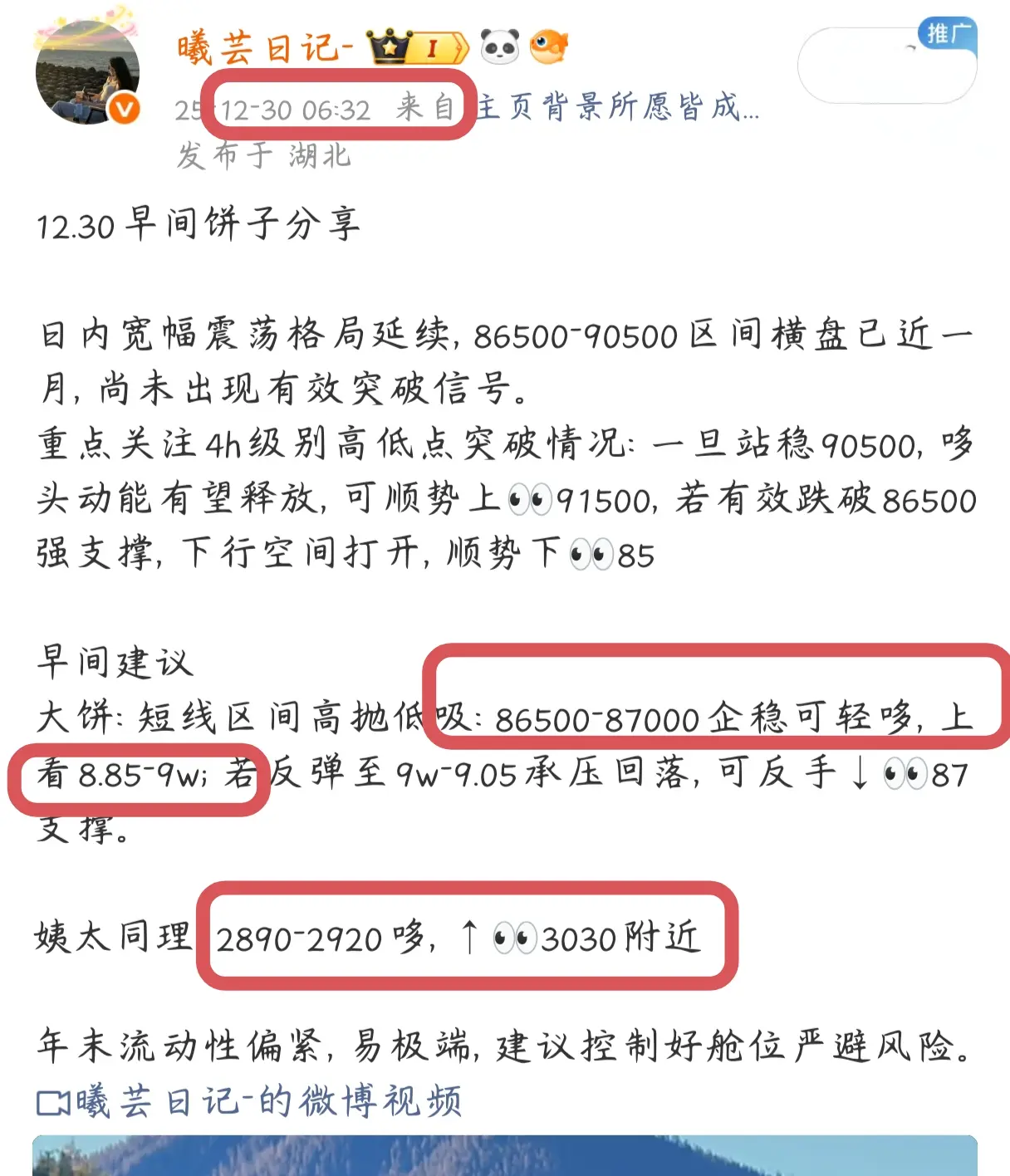

1.4 Morning Share:

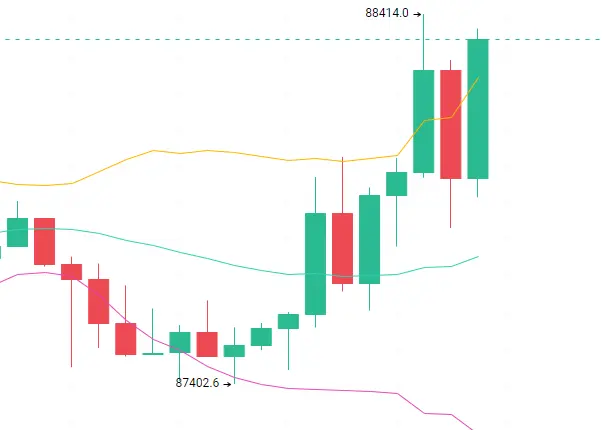

Weekend liquidity has declined, and bulls and bears are stuck in a tug-of-war, with volatility continuously narrowing, testing patience! Reviewing last night's market, Bitcoin found support around 89200 and stabilized, rebounding to a high near 90500 resistance; altcoins moved in sync, with the lowest dip to the 3060 support level, and a rebound to around 3120 encountered resistance and pulled back, maintaining a narrow range of consolidation overall.

After a mild rebound following a bearish candle on the 4-hour chart, a stair-step recovery structure has formed, with bulls a

View OriginalWeekend liquidity has declined, and bulls and bears are stuck in a tug-of-war, with volatility continuously narrowing, testing patience! Reviewing last night's market, Bitcoin found support around 89200 and stabilized, rebounding to a high near 90500 resistance; altcoins moved in sync, with the lowest dip to the 3060 support level, and a rebound to around 3120 encountered resistance and pulled back, maintaining a narrow range of consolidation overall.

After a mild rebound following a bearish candle on the 4-hour chart, a stair-step recovery structure has formed, with bulls a