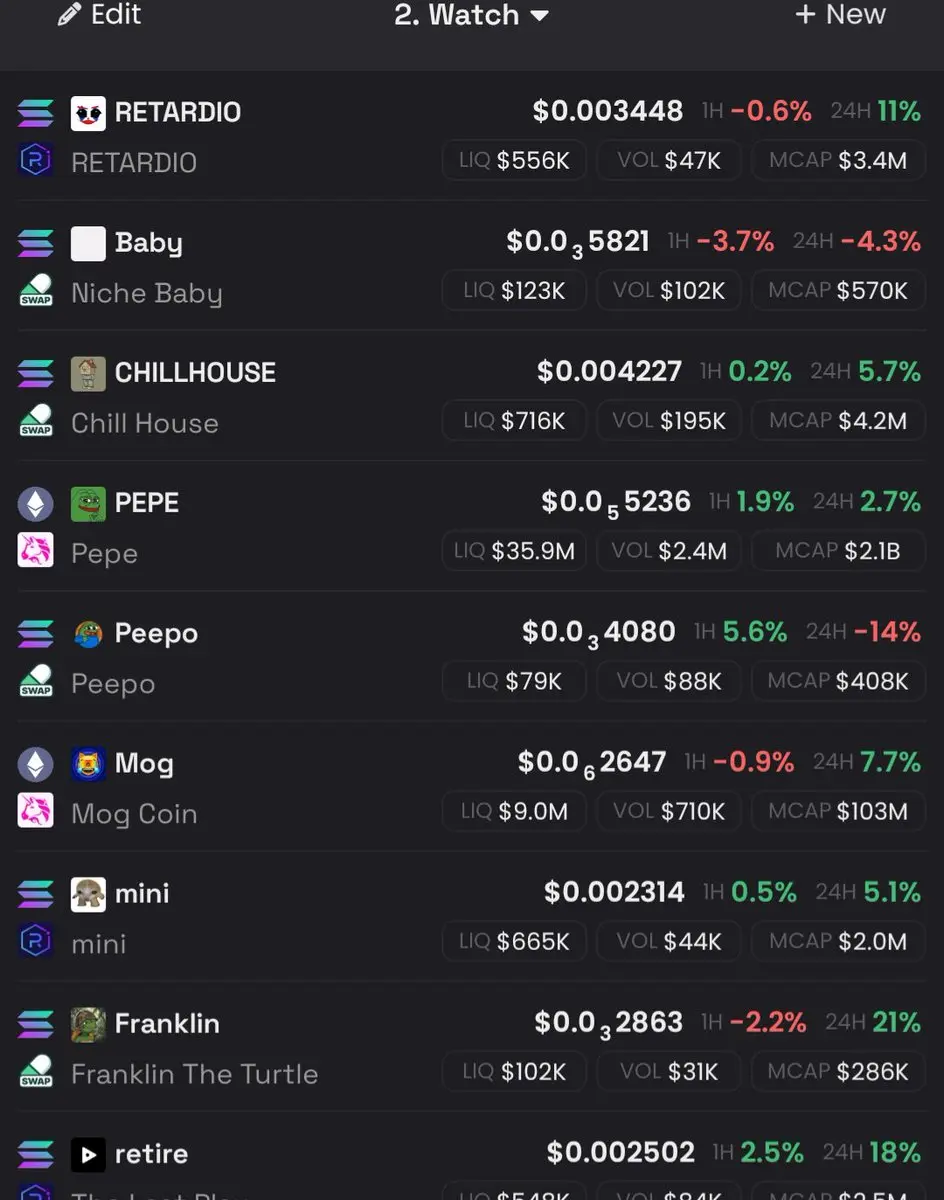

- Bitcoin, Ethereum, and XRP prices declined as outflows from exchange-traded funds (ETFs) continued:

The (ETFs) for spot Bitcoin continued to experience withdrawals for the second consecutive day, with $483 million pulled on Tuesday. The total cumulative inflows amount to approximately $57.3 billion, while the net asset value stands at $116.7 billion.

The resumption of investment flows last week led to an increase in total inflows by $1.42 billion, the highest since October. These flows contributed to pushing Bitcoin's price toward $98,000 on January 14, confirming the impact of ETFs on prices.

Bitcoin ETF Statistics | Source: SoSoValue

Spot Ethereum ETFs also experienced outflows on Tuesday, with investors withdrawing nearly $230 million. This outflow followed a five-day streak of inflows last week.

According to data from SoSoValue, the total cumulative inflows amount to approximately $12.7 billion, while the net assets are $18.4 billion.

Ethereum ETF Statistics | Source: SoSoValue

Meanwhile, XRP spot ETFs recorded their second outflow since launch in November. These US-listed funds experienced outflows of about $53 million on Tuesday, bringing the total cumulative inflows to $1.2 billion, and net assets to $1.3 billion.

XRP ETF Statistics | Source: SoSoValue

The (ETFs) for spot Bitcoin continued to experience withdrawals for the second consecutive day, with $483 million pulled on Tuesday. The total cumulative inflows amount to approximately $57.3 billion, while the net asset value stands at $116.7 billion.

The resumption of investment flows last week led to an increase in total inflows by $1.42 billion, the highest since October. These flows contributed to pushing Bitcoin's price toward $98,000 on January 14, confirming the impact of ETFs on prices.

Bitcoin ETF Statistics | Source: SoSoValue

Spot Ethereum ETFs also experienced outflows on Tuesday, with investors withdrawing nearly $230 million. This outflow followed a five-day streak of inflows last week.

According to data from SoSoValue, the total cumulative inflows amount to approximately $12.7 billion, while the net assets are $18.4 billion.

Ethereum ETF Statistics | Source: SoSoValue

Meanwhile, XRP spot ETFs recorded their second outflow since launch in November. These US-listed funds experienced outflows of about $53 million on Tuesday, bringing the total cumulative inflows to $1.2 billion, and net assets to $1.3 billion.

XRP ETF Statistics | Source: SoSoValue