Ethereum (ETH) News Today

Latest crypto news and price forecasts for ETH: Gate News brings together the latest updates, market analysis, and in-depth insights.

Ethereum Prediction for Dec 15: ETH is Back Above 20-Day SMA, Where Next?

Ethereum shows improving short-term momentum, trading above its 20-day average at $3,144.21 amid mixed signals. Key supports and resistances suggest potential volatility, with bullish prospects contingent on maintaining key support levels.

ETH2.3%

TheCryptoBasic·30m ago

Price prediction for the top 3 cryptocurrencies: BTC, ETH, and XRP enter a sensitive phase at key technical levels

Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP) are hovering around key technical levels in Monday's trading session, after a slight correction last week. The three largest market cap cryptocurrencies are facing the risk of deeper downward pressure, as signals indicate market movement.

TapChiBitcoin·1h ago

Small-cap tokens fall to a four-year low, is the "Shanzhai Bull" completely hopeless?

Despite a correlation of up to 0.9 with major Crypto market tokens, small-cap tokens have failed to provide any diversification value. In the first quarter of 2025, they plummeted by 46.4%, with an annual decline of approximately 38%, while the major US stock market index achieved double-digit growth with controlled pullbacks. This article is based on an article by Gino Matos, organized, translated, and written by ForesightNews.

(Background: Current situation of the altcoin ETF market: XRP as the biggest winner, LTC and DOGE abandoned by the market)

(Additional context: We earned $50 million in one year by targeting altcoins on DEX)

Table of Contents

Choose a reliable altcoin index

Sharpe Ratio and Drawdown

Bitcoin Investors and Crypto Liquidity

What does this mean for liquidity in the next market cycle

動區BlockTempo·2h ago

Algorithm Transparency: Ethereum Foundation's Perspective on Free Speech and Censorship Resistance

Davide Crapis and Vitalik Buterin from the Ethereum Foundation emphasize the importance of transparency in algorithms that protect freedom of speech, proposing the use of zero-knowledge proofs to ensure integrity without revealing sensitive information.

ETH2.3%

TapChiBitcoin·4h ago

Solana transfers 16 times more to Ethereum! 70% of clients are concentrated, scaring away 12 billion in funds

After three years of development, Firedancer launched on the Solana mainnet in December 2024, marking the network's first attempt to eliminate architectural bottlenecks that cause the most severe failures: nearly complete reliance on a single validator client. Over the past five years, Solana has experienced seven outages, five of which were caused by client errors.

MarketWhisper·4h ago

Fidelity survey shocks! 24% of Taiwanese hold digital assets, 51% are interested in increasing their holdings

Fidelity's latest investor survey shows that although Taiwanese regulators currently only allow institutional investors and professional investors to participate, 24% of individual investors in Taiwan have already held digital assets, and 51% express willingness to increase their holdings. In the Asia-Pacific region overall, 23% of investors hold digital assets, and more than half plan to increase their allocation within a year. Fidelity states that digital assets will reach a critical turning point in 2025, as regulatory frameworks become clearer and investment channels improve, leading to a significant increase in institutional participation.

MarketWhisper·4h ago

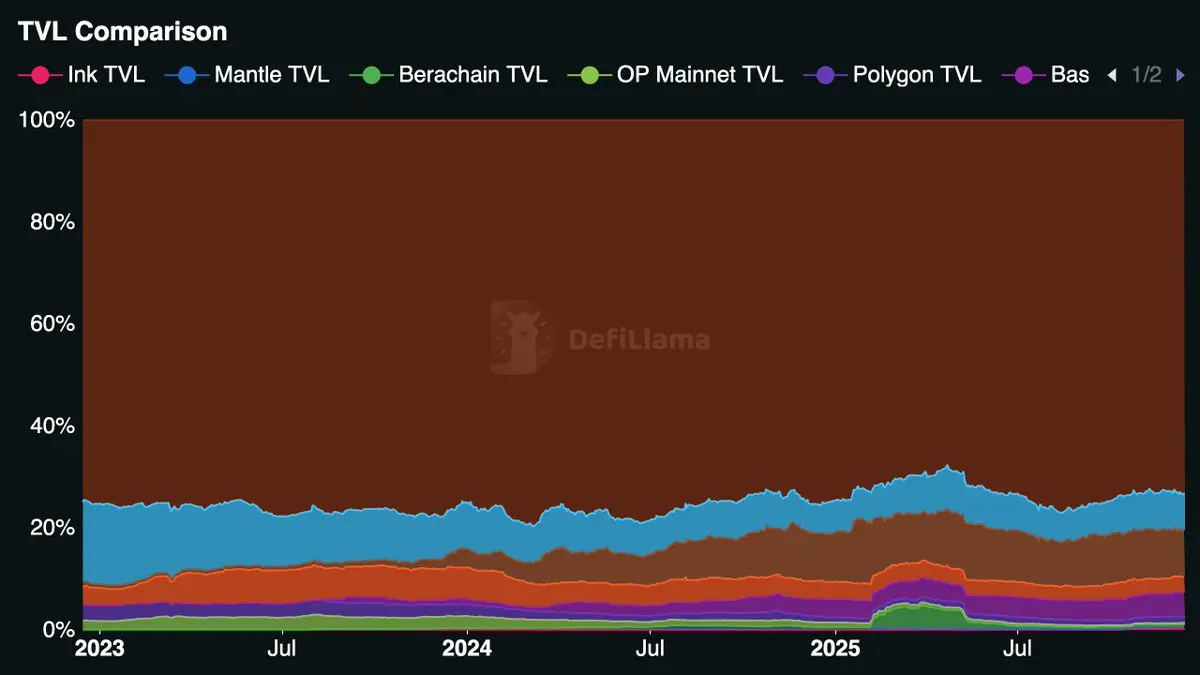

What Is the Most Used Blockchain? Data Shows Solana Leading Over Ethereum in 2025

In the competitive landscape of blockchain networks, determining the "most used" chain involves analyzing key metrics like Total Value Locked (TVL), transaction volumes, user counts, fee revenues, and value transfers—areas where Solana has shown remarkable growth compared to Ethereum and its Layer-2 solutions.

CryptopulseElite·5h ago

Crazy accumulation of 3.86 million ETH, what is the investment logic of the "brainless bull" Tom Lee?

From multiple interviews with Tom Lee, we can roughly see his long-term optimistic core logic about Ethereum:

1. Ethereum is the core settlement layer for future financial infrastructure.

ETH is not only a digital currency but also the infrastructure for building and operating DeFi, stablecoins, NFTs, on-chain markets, RWA, and more. Especially in terms of RWA, this will be the biggest narrative in the future. Wall Street is bringing trillions of assets (bonds/stocks, etc.) on-chain to Ethereum. As the dominant settlement layer, Ethereum will generate a large demand and drive the increase in ETH value. Tokenization is not short-term speculation but a structural transformation that will drive ETH into a bull market independent of BTC.

2. Institutional adoption and ecosystem maturity.

Currently, approximately 4 million BTC wallets worldwide hold over $10,000 in assets, while the global holdings of stocks/pension accounts with similar amounts are about 900 million, a gap of over 200 times.

PANews·5h ago

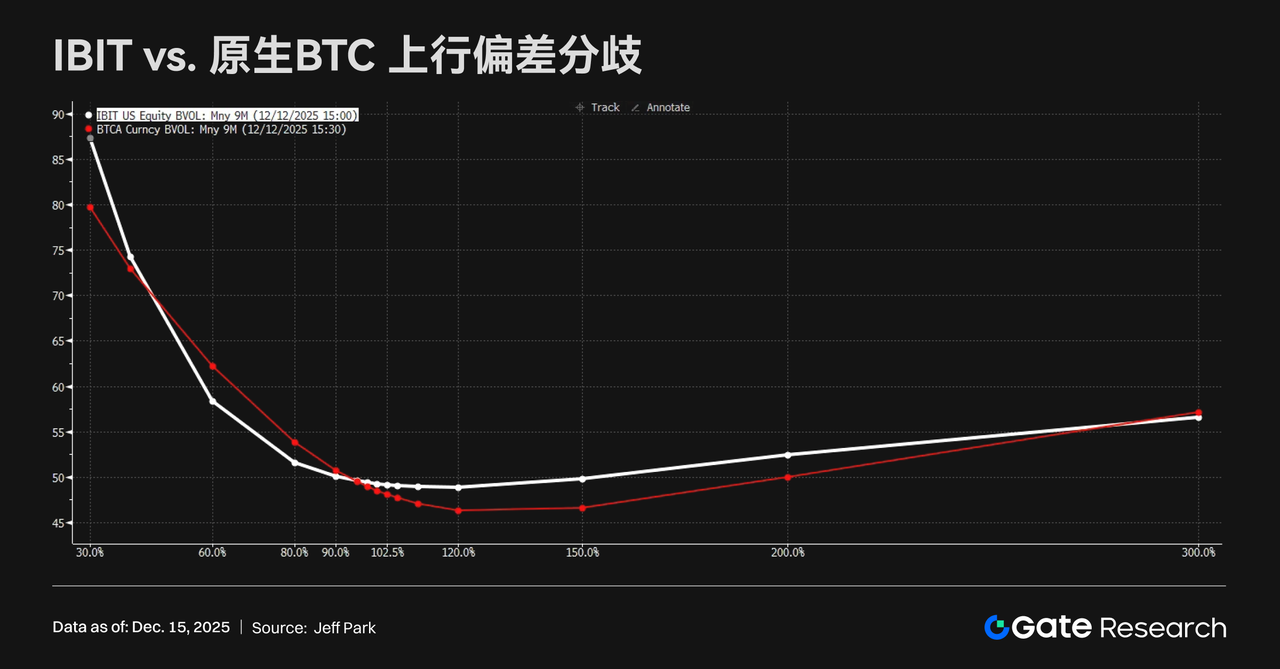

Gate Research Institute: Market Under Pressure and Consolidation | BTC Upward Momentum Restricted by Options Structure

Gate Research Institute Daily Report: December 15 — The overall crypto market continues to face pressure, with BTC and ETH maintaining low-level consolidation, while GT shows relative resilience. Under the weak performance of mainstream coins, tokens such as FHE, ICE, and BAS have reversed trends and strengthened amid catalysts like privacy computing collaborations with Chainlink, token migrations and mainnet transitions, as well as ERC-8004 protocol upgrades, reflecting a concentrated battle for structural opportunities among funds. The structural selling pressure in the options market still suppresses BTC upside momentum. The divergence between ETF bullish demand and OG holders selling volatility suggests that BTC is more likely to remain in short-term consolidation rather than make rapid breakthroughs; Ant International is reconstructing corporate treasury management systems through blockchain, AI, and tokenized deposits; after the mainnet launch of Stable, on-chain activity has been below expectations, highlighting ongoing challenges for the differentiated implementation of stablecoin public chains.

GateResearch·5h ago

Institutional Demand Stays Strong as Bitcoin, Ethereum, Solana, ETFs Add $530M

Institutional demand for crypto stayed strong last week. From December 8 to December 12, spot ETFs tracking Bitcoin, Ethereum, and Solana pulled in a combined $530 million. The steady inflows came despite choppy prices and cautious market sentiment

Bitcoin led the pack. U.S. spot Bitcoin ETFs

Coinfomania·6h ago

Cathie Wood Ranks Her Top Crypto Winners for the Next 3–5 Years: BTC, ETH, SOL

Bitcoin leads due to liquidity, institutional adoption, and declining volatility.

Ethereum attracts institutions building scalable, structured blockchain infrastructure.

Solana targets consumers with speed, simplicity, and direct real-world usage.

Cathie Wood has never shied away from bold

CryptoNewsLand·6h ago

Month-old Ethereum client bug blamed for Prysm outage

A bug in Prysm, introduced on a testnet before Ethereum's Fusaka upgrade, caused node validation issues, impacting performance and leading to missed rewards for validators. The incident raises concerns over client diversity in the Ethereum network.

Cointelegraph·6h ago

Cardano accelerates DeFi, targeting Ethereum and Solana's capital flow through Pyth

Cardano has taken an important step this week by fundamentally changing the network's approach to market infrastructure.

Within the framework of Pentad and Intersect governance, which have just officially gone live, the coordinating committee approved the deployment of the low-latency oracle suite of

TapChiBitcoin·8h ago

What is Tempo? Stripe enters the blockchain aiming at the 2 trillion stablecoin market

What is Tempo? It is a Layer 1 blockchain jointly developed by the $90 billion fintech giant Stripe and top crypto venture Paradigm, designed specifically for stablecoin payments and traditional financial institutions. Its core innovations include dedicated payment channels ensuring each transaction costs only one-tenth of a cent, the ability to pay Gas directly with any USD stablecoin without native tokens, and built-in stablecoin DEX for automatic conversions.

MarketWhisper·8h ago

Aave Governance Crisis! Laboratory Embezzles $10 Million in Fees, Igniting Community Outrage

Aave Decentralized Autonomous Organization (DAO) and Aave Labs have erupted into a heated conflict over fee distribution issues related to CoW Swap integration. DAO members revealed that the fees generated from using CoW Swap for crypto asset exchanges are flowing into private addresses controlled by Aave Labs, rather than the Aave DAO treasury. This has resulted in a weekly loss of approximately $200,000 worth of Ethereum, amounting to an annual loss of up to $10 million.

MarketWhisper·8h ago

Gate Daily (December 15): SEC releases crypto custody guidelines; UK plans to implement crypto regulation rules by 2027

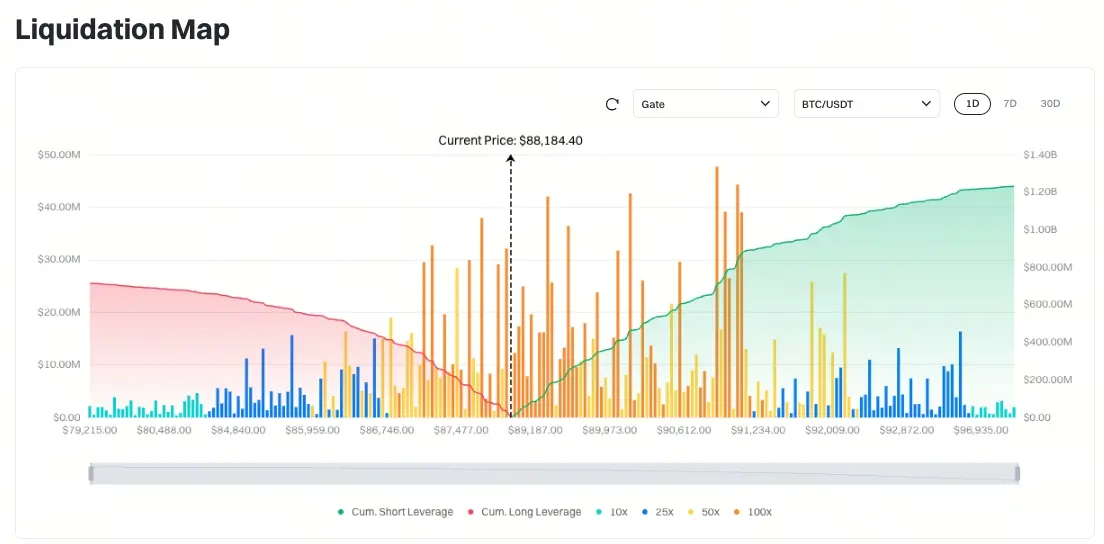

Bitcoin (BTC) opened this week with a sharp decline, currently around $88,460 as of December 15. The UK Treasury plans to establish crypto regulatory rules, to be implemented starting in 2027. The U.S. Securities and Exchange Commission (SEC) released crypto custody guidelines aimed at educating investors. Hong Kong Legislative Council member Wu Jiezhuang was successfully re-elected, promising to continue promoting Web3 development.

MarketWhisper·10h ago

Bankless: This crypto cycle has overlooked Ethereum

Author: David Hoffman, Source: Bankless, Translation: Shaw Golden Finance

About two years ago, Ryan and I had a phone call with Chris Burniske, shortly after we recorded a podcast episode with him.

In the cryptocurrency space, Chris has always been a mentor to Ryan and me, because both of us entered the crypto industry to try to understand, categorize, define, and model this inherently unknown industry.

During the call, he said something that Ryan and I both didn’t want to hear: “This cycle might skip Ethereum altogether.”

And indeed, that’s how things turned out. Setting aside debates about cycle dynamics and timing, most on-chain activity over the past few years has been unrelated to Ethereum, and the price of Ether reflects that.

I suppose this is probably how Bitcoin holders felt in 2021. Bitcoin

金色财经_·10h ago

The Bank of Japan may raise interest rates this week, causing Bitcoin to drop to 88K

Broadcom's sales outlook disappoints, causing an 11% plunge in stock price and sparking market concerns over artificial intelligence, leading to a pullback in the US stock market. The Bank of Japan may raise interest rates, putting pressure on the cryptocurrency market, with Bitcoin dropping to $88K and a 1.8% decline in total market capitalization. Investors are shifting towards diversified investments, and several investment banks are optimistic about next year's stock market performance.

ChainNewsAbmedia·11h ago

What broke Ethereum’s Fusaka upgrade? Prysm post-mortem reveals the cause

On December 4, 2025, a Prysm bug reduced Ethereum validator participation to 75%, causing the network to miss 41 epochs and lose 382 ETH in rewards. Quick fixes and client diversity prevented finality loss, allowing normal operations to resume within 24 hours.

ETH2.3%

Cryptonews·17h ago

ETF’s Update: Bitcoin, Ethereum, XRP Prices React to Latest Institutional Activity

Bitcoin, Ethereum, and XRP spot ETFs revealed contrasting trends, with Bitcoin and Ethereum facing significant outflows, while XRP experienced sustained inflows. Market sentiment fluctuates ahead of the Federal Reserve's policy decision, impacting investor behaviors.

CryptoNewsLand·19h ago

Ethereum Shows Early Signs of Breakout as Momentum Shifts Above Key Support

Ethereum maintains support above $3,100 with RSI momentum breaking the downward trend for early breakout potential.

Price structure shows higher lows and controlled intraday ranges, reflecting cautious but persistent buyer activity.

Volume and liquidity remain robust, supporting orderly moves and

ETH2.3%

CryptoFrontNews·22h ago

Prysm Details Fusaka Mainnet Outage and 382 ETH Loss

Prysm nodes failed under heavy attestation load during Fusaka, causing ~18.5% missed slots, low participation and 382 ETH losses.

Out-of-sync attestations forced Prysm to replay old beacon states, triggering thousands of costly recomputations and resource exhaustion.

Prysm mitigated the issue

ETH2.3%

CryptoFrontNews·12-14 09:31

Ethereum is becoming the new global financial backend

Ethereum has restructured the traditional financial system by reducing the costs and complexities of financial services. It leverages programmable digital assets and shared ledgers to minimize intermediaries and friction, enhancing the efficiency of real-time transactions and automated execution mechanisms. As its technology matures, Ethereum is expanding into broader markets and becoming a potential foundation for financial infrastructure.

ETH2.3%

金色财经_·12-14 09:07

Cathie Wood Lists BTC, ETH, SOL Winners for Next Five Years

Bitcoin ranks first as the most liquid crypto and primary entry point for institutions, often leading market moves in stress events.

Ethereum places second, driven by institutional building and Layer 2 growth, though Wood questions long-term L2 commoditization.

Solana ranks third as a

CryptoFrontNews·12-14 08:31

a16z Long Article: What Risks Does Quantum Computing Pose to Crypto?

When will the "quantum computers that pose a real threat to cryptography" arrive? In what scenarios are HNDL attacks applicable? What are the unique challenges Bitcoin faces? a16z provides an in-depth analysis of the actual impact of quantum threats on blockchain and strategies to address them. This article is adapted from a16z’s original piece, compiled, translated, and written by Wu on Blockchain.

(Previous summary: In-depth analysis: Are we overestimating the cryptographic security threats brought by quantum computers?)

(Background supplement: a16z: 17 Major Potential Trends in the Crypto Field to Watch in 2026)

Table of Contents

Where are we currently in the timeline?

Which scenarios are HNDL attacks applicable to (and which are not)?

What does this mean for blockchain

Bitcoin's unique challenges: governance mechanisms + abandoned coins

The costs and risks of post-quantum signatures

Blockchain v

ETH2.3%

動區BlockTempo·12-14 07:55

Aggressive Buying Pushes Ethereum Above Major Liquidity Levels

Ethereum rebounded sharply after major liquidity bands absorbed selling pressure and stabilized prices between $3,300 and $3,350.

Aggressive buying by whales and traders overcame passive orders, pushing Ethereum through mid-intensity liquidity zones to establish a new equilibrium.

Monitoring key r

ETH2.3%

CryptoFrontNews·12-14 07:47

Why is HashKey able to become Hong Kong's "Number One Crypto Stock"?

Author | Guo Fangxin, Li Xiaobei

Introduction

On December 1, 2025, a major news story broke: According to the Hong Kong Stock Exchange (HKEX) disclosure, HashKey, as one of the first licensed virtual asset service providers (VATP) in Hong Kong, officially passed the HKEX listing hearing.

As early as one or two months ago, the market was buzzing with internal rumors that HashKey was preparing to go public. On December 1, HashKey passed the hearing and released the "Post-Hearing Document Set." Many mainland readers might wonder: At what stage is HashKey's listing?

From a legal perspective, the HKEX conducted comprehensive due diligence and review on HashKey’s basic information, including its underlying business structure, complex compliance systems, financial status, and corporate governance structure. This essentially recognizes HashKey's entry into the mainstream capital market, just one step away from listing.

HashKey released on HKEX Disclosure Platform

PANews·12-14 06:46

Prysm releases post-incident report on Ethereum Fusaka mainnet network outage on 12/4

Prysm's post-mortem report on the Fusaka mainnet disruption on December 4 highlights resource exhaustion caused by costly state recalculations for certain attestations. This led to consecutive missed epochs, reducing network participation to 75% and costing validators approximately 382 ETH in rewards. Temporary fixes were implemented, followed by long-term improvements in versions v7.0.1 and v7.1.0 to enhance attestation validation logic and Ethereum's consensus stability.

ETH2.3%

TapChiBitcoin·12-14 03:08

Ethereum staking rate has reached 27.93%. BNB breaks through $900.

Headlines

▌Data: Ethereum Staking Rate Reaches 27.93%, Lido Market Share Reaches 24.74%

According to Dune Analytics data, the total amount of ETH staked on the Ethereum Beacon Chain reaches 34,676,830 ETH, with staking ETH accounting for 27.93% of the total supply. Among them, the liquid staking protocol Lido accounts for 24.74%. Additionally, since the Shanghai upgrade, there has been a net inflow of 16,511,352 ETH.

▌BNB Breaks $900

Market data shows that BNB has broken through $900, currently trading at $900.17, with a 24-hour increase of 2.94%. Market fluctuations are significant, please manage risk accordingly.

---

Market

As of press time, market data shows:

BTC price is $90,329.00, with a 24-hour change of approximately +0.6%;

ETH price is

金色财经_·12-14 02:54

Ethereum (ETH) Dips to Retest Key Breakout – Will It Bounce Back?

Date: Sat, Dec 13, 2025 | 05:58 PM GMT

The broader altcoin market has remained volatile over the past few weeks, with sharp swings keeping traders on edge. Amid this uncertainty, Ethereum ($ETH) is flashing a technically important signal. While price action may appear hesitant on the surface, the la

ETH2.3%

CoinsProbe·12-13 18:05

XRP Sentiment Surges Amid Ethereum Caution

XRP shows strong trader optimism for a potential rally, targeting $2.10, while Ethereum sentiment is cautious, ranking only 23rd most bullish amid a 35% price drop. This reflects differing market psyches as XRP consolidates and Ethereum pulls back.

CryptoFrontNews·12-13 17:16

Ethereum price stalls at $3K as ETH ETFs record $19.4M in outflows

Ethereum spot ETFs recorded $19.41 million in net outflows on December 12 as ETH price stalled near the $3,000 level.

Summary

Ethereum ETFs posted $19.41M in net outflows on December 12 amid mixed fund activity.

BlackRock ETHA saw inflows, but Grayscale and Fidelity outflows dragged totals low

Cryptonews·12-13 14:36

XRP Defends $2 As Bulls Hold the Line, but Ethereum’s 35% Slide Changes the Mood

XRP price has reached one of those moments where the chart starts doing the talking. After months of sharp swings and fading excitement across crypto, Ripple is now sitting at a level that feels important. Price is no longer racing higher, yet it is not collapsing either. XRP has been hovering

CaptainAltcoin·12-13 14:03

ETF Bitcoin attracts $49.16 million, Ethereum experiences capital withdrawal, XRP records an inflow of $20.17 million

On December 12, Bitcoin spot ETFs saw a net inflow of $49.16 million, indicating strong institutional demand, mainly driven by BlackRock's IBIT. In contrast, Ethereum ETFs faced a net outflow of $19.41 million, while XRP ETFs noted a positive inflow of $20.17 million, reflecting selective investor preferences for liquidity and reputable brands.

TapChiBitcoin·12-13 13:06

XRP Bulls Maintain $2 Value While Ethereum Faces 35% Drop in 12 Weeks

XRP holds steady at $2 amid bullish sentiment, while Ethereum faces a 35% drop in 12 weeks, signaling shifting market dynamics.

XRP has held its ground at the $2 mark despite market fluctuations, while Ethereum has seen a 35% drop over the last 12 weeks.

Despite the strong performance of XRP,

LiveBTCNews·12-13 12:35

ETH Makes Bullish Higher Low After Volatile Moves and Fakeout Trap

Ethereum has experienced significant volatility over the past year, marked by several false breakouts and price fluctuations.

However, recent price action suggests Ethereum is stabilizing and showing signs of potential recovery. After battling through uncertainty, ETH has established a bullish

ETH2.3%

LiveBTCNews·12-13 12:17

Bitmine Boosts Ethereum Holdings with $46M Acquisition

Bitmine's acquisition of 14,959 ETH for $46 million illustrates a strategic, long-term approach to Ethereum investment rather than speculative trading, amidst rising institutional interest and bullish technical indicators suggesting potential growth.

ETH2.3%

CryptoFrontNews·12-13 11:03

Ethereum Faces Bear Flag Pressure as $2,400 Downside Target Remains Active

Ethereum is currently trading within a rising channel, indicating a corrective price trend rather than strong bullish momentum. A potential breakdown could target the $2,400 demand zone, with reduced trading volume suggesting market indecision following recent price shifts.

ETH2.3%

CryptoFrontNews·12-13 10:17

Ether.fi Card launches the "10% ETH Spending Cashback" promotion, the ultimate U Card for Christmas shopping

Ether.fi Crypto U Card Launches Year-End Second Wave Event "10 Days of ETHmas." The event lasts ten days, inviting friends to join and spend, with both parties earning 10% wETH cashback. ( Please register using the Dynamic Zone link to enjoy the 10% wETH spending cashback.

(Previous update: Ether.fi Card offers 10% spending cashback! Recommend 10 people to compete for VIP membership.)

(Additional background: Ether.fi Card's triple rewards now available: 400,000 ETHFI airdrop, rewards for card spending and deposits.)

Table of Contents

Core benefits of the event

Event schedule (Taiwan time)

Details of Ether.fi ETHmas reward mechanism

Participation eligibility and notes

E

動區BlockTempo·12-13 09:40

Load More

Hot Tags

Hot Topics

MoreCrypto Calendar

MoreHayabusa Yükseltmesi

VeChain, Aralık ayında planlanan Hayabusa yükseltmesini duyurdu. Bu yükseltmenin, protokol performansını ve tokenomi'yi önemli ölçüde artırmayı hedeflediği belirtiliyor ve ekip, bu güncellemeyi bugüne kadarki en çok fayda odaklı VeChain sürümü olarak nitelendiriyor.

2025-12-27

Litewallet Gün Batımları

Litecoin Vakfı, Litewallet uygulamasının 31 Aralık'ta resmi olarak sona ereceğini duyurdu. Uygulama artık aktif olarak korunmamakta olup, bu tarihe kadar yalnızca kritik hata düzeltmeleri yapılacaktır. Destek sohbeti de bu tarihten sonra sona erecektir. Kullanıcıların Nexus Cüzdan'a geçiş yapmaları teşvik edilmektedir; Litewallet içinde geçiş araçları ve adım adım bir kılavuz sağlanmıştır.

2025-12-30

OM Token Göçü Sona Erdi

MANTRA Chain, kullanıcıları OM token'larını 15 Ocak'tan önce MANTRA Chain ana ağına taşımaları için bir hatırlatma yayınladı. Taşıma işlemi, $OM'nin yerel zincirine geçişi sırasında ekosistemdeki katılıma devam edilmesini sağlar.

2026-01-14

CSM Fiyat Değişikliği

Hedera, Ocak 2026'dan itibaren KonsensüsSubmitMessage hizmeti için sabit USD ücretinin $0.0001'den $0.0008'e yükseleceğini duyurdu.

2026-01-27

Vesting Kilidi Gecikti

Router Protocol, ROUTE tokeninin Hakediş kilidinin 6 aylık bir gecikme ile açılacağını duyurdu. Ekip, projenin Open Graph Architecture (OGA) ile stratejik uyum sağlamak ve uzun vadeli ivmeyi koruma hedefini gecikmenin başlıca nedenleri olarak belirtiyor. Bu süre zarfında yeni kilit açılımları gerçekleşmeyecek.

2026-01-28