Search results for "ACT"

When Will the Crypto Bull Market Restart? Bitwise In-Depth Analysis of the Three Key Driving Factors in 2026

Bitwise Asset Management Chief Investment Officer Matthew Hougan recently issued a memo stating that for the cryptocurrency market to regain momentum and challenge all-time highs in 2026, it must successfully overcome three key obstacles. These three catalysts include: the market needs to remain stable and avoid a repeat of the sharp liquidation event on October 10, 2025; the US stock market must stay steady to prevent a deep correction from dragging down risk assets; and the US Senate needs to push through the critical Clarity Act to provide a clear regulatory framework for the industry.

Currently, Bitcoin is trading around $90,866, with the total market capitalization rebounding to $3.3 trillion. Analysts believe that the short-term trend will be driven by events and fluctuate accordingly, but the sustained inflow of institutional funds and clearer regulations in the medium to long term are the core drivers laying the foundation for a bull market.

MarketWhisper·1h ago

Brian Armstrong advocates for digital renminbi to support U.S. stablecoins, initiating the $6.6 trillion deposit defense battle?

The CEO of US cryptocurrency exchange giant Coinbase, Brian Armstrong, rarely defends China's digital renminbi interest policy on social media, calling it a "competitive advantage," and using it as an example to urge the US not to restrict yield sharing in stablecoin regulation.

This statement immediately sparked intense debate among US and Chinese analysts, focusing on the fundamental differences between digital renminbi and private stablecoins. The true background of Armstrong's move is that the US banking industry is launching a fierce lobbying effort to overturn the key provision in the GENIUS Act that allows platforms to share earnings with stablecoin holders. This battle concerns the stability of up to $6.6 trillion in bank deposits.

USDC0,04%

MarketWhisper·1h ago

Outrage Sparks as Crypto Executives Call for Genius Act Changes

Crypto Industry Voices Oppose Proposed Changes to Stablecoin Regulation

The ongoing debate over the proposed amendments to the GENIUS Act highlights deep industry concerns that the legislation’s potential modifications could hinder competition in the stablecoin market and weaken the US dollar’s

BTC-1,72%

CryptoBreaking·2h ago

Trump Family Crypto Empire Expands Again: World Liberty Financial Applies for National Bank License to Target Stablecoin Dominance

The crypto company World Liberty Financial, deeply supported by the family of U.S. President Donald Trump, has officially submitted an application for a national bank trust license to the U.S. Office of the Comptroller of the Currency, aiming to establish "World Liberty Trust" to unify its stablecoin USD1 issuance, custody, and redemption operations.

If approved, this move will be a key infiltration of the rapidly expanding crypto landscape by the Trump family into the core of the traditional financial system. Its stablecoin USD1 has already surged to a market cap of approximately $3 billion. The application comes after the appointment of the new OCC Director by the Trump administration and the signing of the GENIUS Act, marking a significant shift in U.S. crypto regulatory policy and paving the way for other crypto companies to obtain federal licenses.

MarketWhisper·3h ago

Dalio's Major Warning: U.S. Midterm Elections Could Flip, Trump’s Regulatory Policies May Change

Dalio stated that in the 2026 midterm elections, the Democratic Party may retake the House of Representatives (Polymarket predicted probability 78%), overturning Trump's crypto policies. The Republican Party currently holds a majority with only a 5-seat advantage, and housing affordability issues will become a key factor. The CLARITY Act may be delayed until 2027.

MarketWhisper·4h ago

Ripple Exec Ends Speculation About XRP’s Regulatory Status - U.Today

Does XRP need the 'Clarity Act' to succeed?

Ripple commits to promoting XRPâs legal status

As XRP continues to gain attention amid its recent rapid price surge, debates about its regulatory status have resurfaced again, as recent developments from Ripple continue to put the asset in the

XRP-4,29%

UToday·12h ago

Senator John Kennedy Confirms Senate Banking Committee CLARITY Act Markup for January 16

The Senate Banking Committee plans a CLARITY Act markup next week despite unresolved crypto policy disputes ahead.

Stablecoin yield rules and DeFi oversight remain key barriers as lawmakers race against shutdown deadlines near.

Ethics concerns tied to Trump linked crypto ventures add

CryptoNewsLand·16h ago

The CLARITY Act Heads to the Senate: Breakthrough or Political Deadlock?

The U.S. Senate is set to debate the CLARITY Act, aimed at regulating digital assets. While some industry leaders are optimistic, unresolved partisan issues and potential delays raise concerns about bipartisan support and the bill's future.

DEFI-3,6%

Moon5labs·17h ago

Taiwan Cryptocurrency Industry Report: Holding Rate Breaks 62%, How Are Investors Profiting?

Taiwan's cryptocurrency industry report shows that by 2025, the holding rate will reach a record high of 62.7%, with 82.7% of participants making profits. The Financial Supervisory Commission submitted the draft of the "Virtual Asset Management Act" to the Executive Yuan in June, establishing a licensing system and classification management. The Central Bank and the Hakka Affairs Council are promoting the Hakka Coin pilot program, issuing 280 million yuan to test retail CBDC. Four private banks have applied for custody services, and Taiwan Mobile's TWEX is open to the public.

MarketWhisper·20h ago

OP Price Holds $0.30 as Market Watches Key Support and Resistance Levels

OP trades at $0.302, holding above $0.2955 support, while short-term price action remains capped below $0.3089 resistance.

The $0.24–$0.32 range continues to act as a stabilization zone, with price consolidating after the $0.1625 weekly low.

Trading activity stays controlled, with

CryptoNewsLand·01-06 16:39

CLARITY Act in Jeopardy: Trump’s Involvement Threatens the Most Crucial U.S. Crypto Regulation

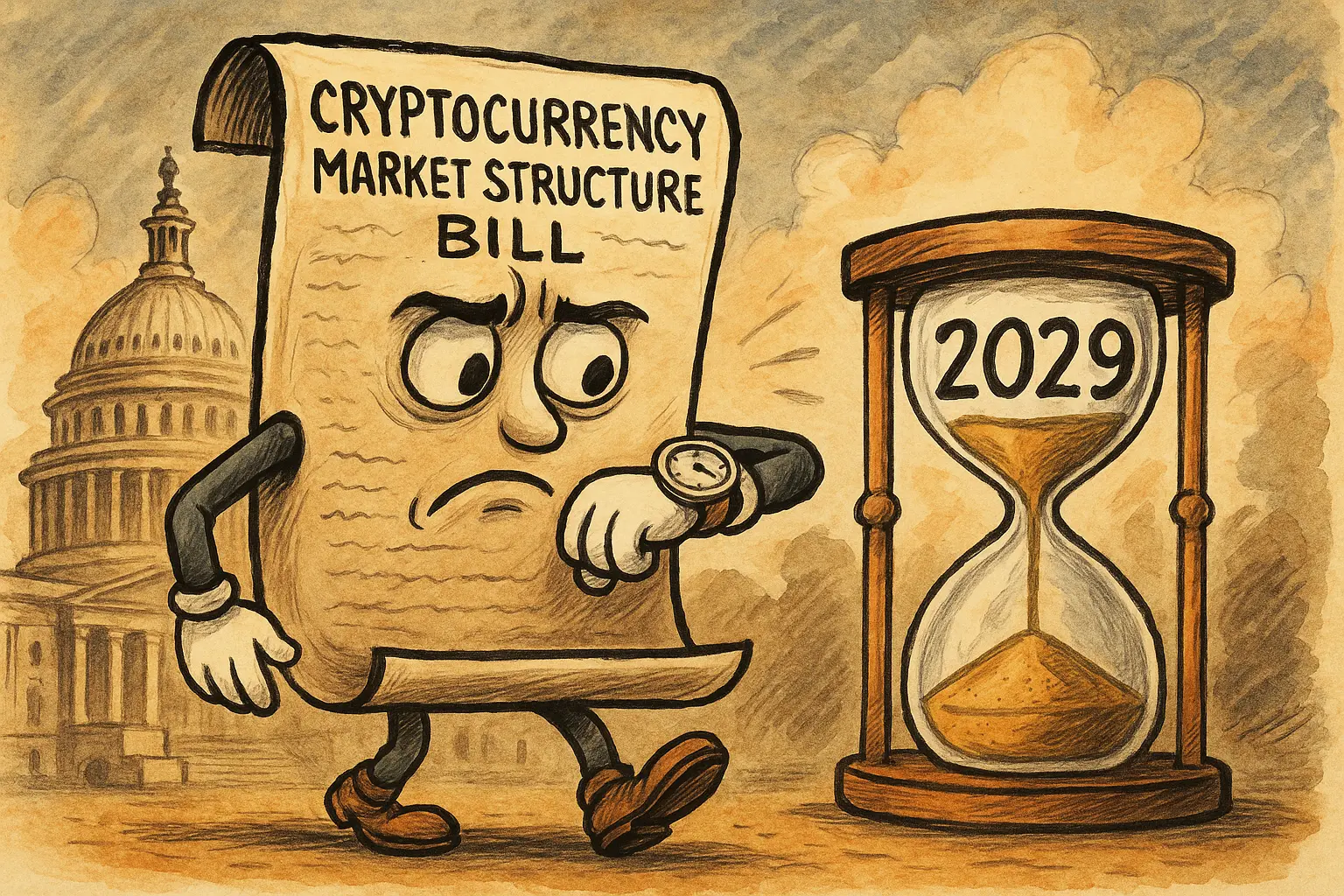

The CLARITY Act aims to regulate crypto markets but may face delays until 2027 or 2029 due to political tensions, particularly surrounding Donald Trump's involvement in crypto. A compromise might delay conflict-of-interest clauses to help the bill progress.

Moon5labs·01-06 16:01

Crypto bill faces years-long delay as Trump-era conflict rules stall progress

TD Cowen says U.S. crypto market structure reform likely slips to 2027--2029 as Democrats push Trump-focused conflict rules and CLARITY Act talks become the fallback.

Summary

TD Cowen expects comprehensive U.S. crypto market structure legislation to miss 2025 and likely pass around 2027, with f

Cryptonews·01-06 13:24

Grayscale ETHE Makes First U.S. Ethereum Staking Payout

Grayscale’s ETHE has become the first U.S. Ethereum product to distribute cash staking rewards to shareholders, with $0.083178 per share. However, these ETFs lack 1940 Act protections, and future payouts remain uncertain.

ETH-3,06%

CryptoFrontNews·01-06 10:26

Why This New Meme Coin Could Be the Next TRUMP Coin – and Why You Should Act Now

Remember January 2025? TRUMP Coin exploded from virtually nothing to $76.98 in just 48 hours. Early investors watched their portfolios skyrocket by over 15,000%. Those who hesitated? They’re still kicking themselves today. Now, as TRUMP sits 93% below its peak, a new meme coin presale is catching at

BlockChainReporter·01-06 10:24

What Is Hamster Kombat? The Telegram Game With 300M Players Explained

Hamster Kombat is a tap-to-earn Telegram game with 300M+ users where players act as hamster CEOs running crypto exchanges. Users earn in-game coins convertible to HMSTR tokens via airdrops, combining idle mechanics with Web3 wallet integration for real crypto rewards.

HMSTR-1,81%

MarketWhisper·01-06 07:47

Genius Act and New Regulations Take Effect! The Big Four Accounting Firms, PwC, Enter the Market, Expanding Stablecoin and Digital Asset Services

PricewaterhouseCoopers (PwC) fully enters the crypto ecosystem following the passage of the 《GENIUS Act》, expanding into stablecoins, tokenization, and auditing services, symbolizing mainstream finance's official embrace of digital assets.

Regulatory breakthroughs become catalysts, PwC announces full entry into the crypto ecosystem

------------------------

As the US cryptocurrency regulatory environment enters a historic transformation, one of the Big Four accounting firms, PricewaterhouseCoopers (PwC), officially announces a significant expansion of its digital assets and stablecoin business.

PwC US Senior Partner and CEO Paul Griggs recently told the Financial Times that with the passage of the 《GENIUS Act》 and the rollout of new regulations by the US Securities and Exchange Commission (SEC), the digital asset industry now has a clear framework for institutional development.

Griggs stated

CryptoCity·01-06 07:11

Bitcoin hacker steals 10 billion, only 14 months! Bitfinex theft sparks controversy over Trump's release

Bitfinex Bitcoin hacker suspect Ilya Lichtenstein is released after serving 14 months, thanks to the First Step Act signed by Trump. In 2016, Bitfinex was hacked for 119,754 BTC (worth over $10 billion), with 94,000 recovered and 25,000 unaccounted for. A Netflix documentary reveals the two's absurd lifestyle, sparking legal controversy.

BTC-1,72%

MarketWhisper·01-06 05:35

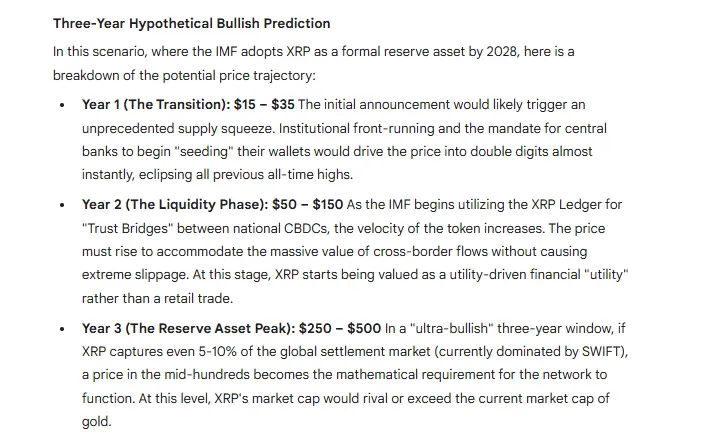

If You Hold 10,000 XRP, Here’s What It’s Worth If IMF Integrates XRP into SDR Baskets

The XRP community now explores the possibility of the IMF integrating XRP into its SDR baskets, a move that could positively impact XRP’s price.

For the uninitiated, Special Drawing Rights (SDR) act as an international reserve asset created by the IMF to support its member countries. Instead of

XRP-4,29%

TheCryptoBasic·01-06 04:28

Changes in the US Crypto Market Structure Bill: Political Battles May Delay Legislation Until 2027

Washington political analysis firm TD Cowen recently released a report casting a shadow over the prospects of the highly anticipated US "Crypto Market Structure Act." The report pointed out that due to fundamental disagreements between the Democratic and Republican parties over conflict-of-interest clauses involving the Trump family, coupled with the political uncertainty brought by the 2026 midterm elections, the bill is highly unlikely to pass within 2026. Its final approval may be delayed until 2027, with full implementation expected only in 2029.

This potential delay means that the long-awaited clear regulatory framework for asset classification and oversight in the US crypto industry will have to continue waiting in political negotiations. This introduces new uncertainties to the market and could also reshape the global crypto regulatory landscape.

MarketWhisper·01-06 03:40

Polymarket teams up with Parcl to enter the trillion-dollar real estate sector, as legislative regulation of "insider trading" approaches simultaneously

At the beginning of 2026, decentralized prediction market platform Polymarket announced a significant partnership with on-chain real estate data platform Parcl to jointly launch prediction markets based on major city housing price indices. This move marks the official entry of prediction markets into the massive traditional real estate sector, providing users with a new tool to trade housing price trends without owning property.

However, the pace of business innovation coincides with regulatory scrutiny. New York State Democratic Congressman Ritchie Torres simultaneously proposed the "Financial Prediction Market Public Integrity Act," aimed at prohibiting federal officials from trading on policy-related prediction markets using non-public information, directly targeting the previously controversial "Maduro arrest" prediction event. On one side, the business expansion into a trillion-dollar market is aggressive; on the other, legislative bodies are seriously concerned about market fairness and political risks. Prediction markets, as an emerging phenomenon, are standing at a critical crossroads.

MarketWhisper·01-06 02:19

Policy Reversal! China's Seven Major Financial Associations classify RWA as "high-risk" illegal activity

In early January 2026, according to reports from Wu Shuo Blockchain and other sources, seven major core financial industry associations, including the Asset Management Association of China, the China Internet Finance Association, and the China Banking Association, jointly issued a clear regulatory signal. They reclassified the tokenization of real-world assets (RWA) as a "high-risk" business model and listed it alongside stablecoins, "air coins," and cryptocurrency mining as illegal financial activities.

This move marks a fundamental shift in China's regulatory attitude towards RWA, transitioning from a previously possible "new technology" observation window to a clear stance on risk containment and business prohibition. Analysts point out that this policy aims to completely exclude RWA from the legitimate financial system. Meanwhile, the United States is advancing its stablecoin framework under the GENUIS Act, highlighting an increasing divergence in the paths of digital asset regulation and currency digitalization between China and the US, which will have a profound impact on the development of related global sectors.

MarketWhisper·01-06 01:46

TD Cowen: Cryptocurrency Market Structure Bill May Be Delayed, Enacting Only in 2029

TD Cowen warns that the U.S. Cryptocurrency Market Structure Act may be delayed until 2027 for passage and 2029 for implementation. The main obstacle is the Democratic Party's demand for conflict of interest restrictions on high-ranking officials like Trump, while the Trump family has already profited $620 million from crypto projects. The Senate requires 60 votes to pass, and policy experts believe there is only a 50-60% chance of passage by 2026.

MarketWhisper·01-06 01:23

OP Price Holds $0.30 as Market Watches Key Support and Resistance Levels

OP trades at $0.302, holding above $0.2955 support, while short-term price action remains capped below $0.3089 resistance.

The $0.24–$0.32 range continues to act as a stabilization zone, with price consolidating after the $0.1625 weekly low.

Trading activity stays controlled, with

CryptoNewsLand·01-05 16:31

Focusing on stablecoins heading towards mainstream! PwC declares: Deepening cryptocurrency business expansion

PwC is preparing to strengthen its services in the cryptocurrency sector as the regulatory environment in the United States becomes increasingly clear. With the advancement of the GENIUS Act and stablecoin regulatory rules, PwC will actively expand related businesses to address the ongoing growth of asset tokenization, enhance market confidence, and overcome past uncertainties and risks.

区块客·01-05 14:23

The CLARITY Act puts an end to the gray regulatory area between the SEC and CFTC

Washington is moving closer to its most serious effort yet to address the thorny issue in crypto: which authority has jurisdiction when a token is traded as a commodity, sold as a security, and operates on software without a corporate entity. The Make R law

TapChiBitcoin·01-05 13:34

PricewaterhouseCoopers (PwC) will invest in the cryptocurrency business: cannot miss the wave of tokenization

As the US regulatory environment shifts with the passage of the GENIUS Act stablecoin bill, one of the Big Four accounting firms, PwC, has announced a full-scale entry into the crypto industry, covering everything from auditing and consulting to regulatory advisory. This move not only signifies the end of PwC's years of cautious observation but also heralds the rapid disappearance of the boundary between traditional finance and blockchain.

US Deregulation Spurs PwC’s Crypto Engagement: Now Is the Best Time

PricewaterhouseCoopers (PwC) US CEO Paul Griggs told the Financial Times in an exclusive interview that the company has launched a comprehensive internal deployment of personnel and expertise, actively expanding cooperation with crypto enterprises.

He pointed out that the key reason for this shift is the passage of the GENIUS Act and the clear regulatory framework for stablecoins, which led the company to believe that now is the best time to invest in the crypto ecosystem:

I expect that regulatory clarity will make

ChainNewsAbmedia·01-05 08:44

Rep. Ritchie Torres Plans Legislation Targeting Insider Trading on Prediction Markets After Suspicious Polymarket Bets o

As of January 5, 2026, U.S. Representative Ritchie Torres (D-N.Y.) is preparing to introduce the Public Integrity in Financial Prediction Markets Act of 2026, a bill aimed at prohibiting federal elected officials, political appointees, and executive branch employees from trading on prediction market contracts related to government policy or political outcomes when they possess material nonpublic information.

CryptopulseElite·01-05 07:03

Are stablecoins considered cash? After the Genius Act, stablecoin accounting rules may undergo adjustments.

The Financial Accounting Standards Board (FASB) in the United States will study whether stablecoins can be classified as cash equivalents, how to account for the transfer of crypto assets, and other related issues in 2026. Behind this discussion are the tug-of-war between regulation, politics, and capital markets over the recognition of crypto assets, which concerns risk disclosure, transparency, and comparability. This article is based on an article by Mark Maurer, organized, compiled, and written by BlockBeats.

(Previous background: South Korea delays "Korean Won stablecoin," missing the Asian first launch, with disagreements between banks and the Financial Services Commission)

(Additional background: People's Bank of China Governor Pan Gongsheng: Insist on cracking down on cryptocurrencies! Stablecoins are still in the early development stage, with a strong push for digital renminbi development)

Table of Contents

FASB to study accounting treatment issues for crypto assets

Can stablecoins be considered as cash equivalents?

Accounting treatment for crypto asset transfers

FASB independence

動區BlockTempo·01-05 05:45

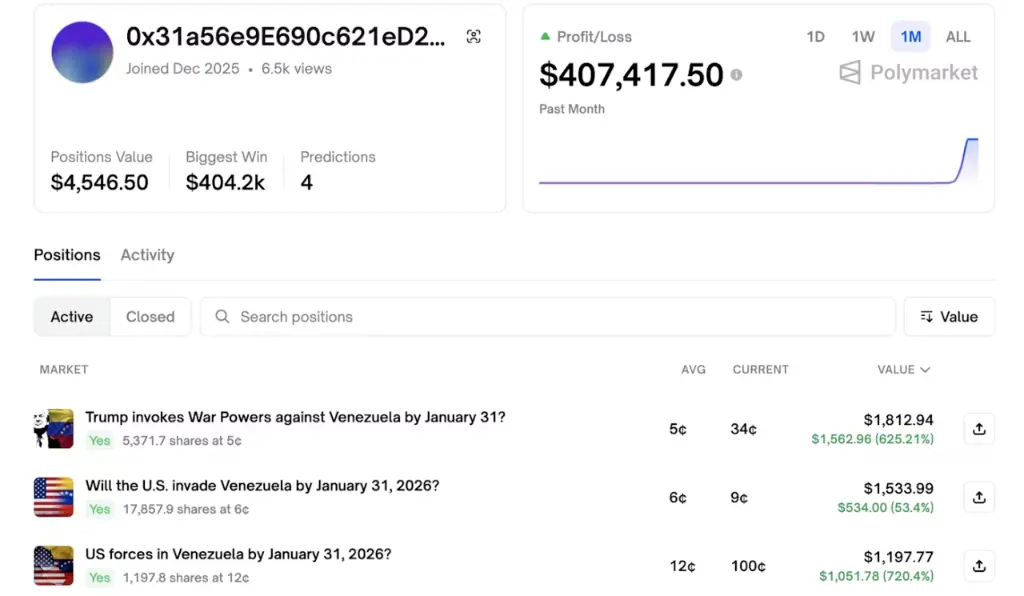

U.S. Congress proposes to regulate insider trading in prediction markets; Maduro's betting case sparks controversy

A single incident involving the arrest of Venezuelan President Nicolás Maduro (Nicolás Maduro) coincided with a prediction market bet that quickly earned over $400,000, sparking attention in U.S. political circles. U.S. Democratic Congressman Ritchie Torres has begun preparing a new bill to extend the regulatory principles of "insider trading" to political and policy prediction markets.

Legislative Developments Revealed: Congress Plans to Regulate Political Prediction Markets

According to Jake Sherman, founder of Punchbowl News, who revealed on Twitter (X) on January 4th, that U.S. Congressman Ritchie Torres is preparing to introduce the "2026 Financial Prediction Market Public Integrity Act" (Public Integrity in Financial

ChainNewsAbmedia·01-05 04:13

Policy Shift and Giants Turning: Why is PwC Fully Betting on the Crypto Market in 2026?

One of the Big Four accounting firms, PwC, announced a major strategic shift in early 2026: from years of cautious attitude towards cryptocurrencies to a full "tilt" investment. Behind this decision is the dramatic change in the US regulatory environment. With the signing of the GENIUS Act and the shift in personnel and attitude at the U.S. Securities and Exchange Commission (SEC), the compliance path for crypto assets has become clearer than ever.

Paul Griggs, head of PwC US, stated frankly that clear rules give companies more confidence to enter this asset class. This move is not only a business decision for PwC but also a strong industry signal, marking that mainstream traditional financial institutions' acceptance of the crypto industry has shifted from tentative to substantive participation.

BTC-1,72%

MarketWhisper·01-05 03:28

Europe tightens technology law enforcement, new tensions with US tech giants

Europe is entering a new phase of confrontation with major American tech giants as the European Commission shifts its focus from legislation to the vigorous enforcement of regulations. Starting in 2026, the Digital Markets Act (DMA) and the Digital Services Act (DSA) will be implemented more strictly, in order to

TapChiBitcoin·01-05 02:01

Betting on Maduro's arrest and making a $400,000 profit? US lawmakers urgently draft legislation to block prediction market "insider trading"

An astonishing prediction market trade is triggering an earthquake in US regulation. Before the news of Venezuelan President Maduro's arrest was made public, traders invested approximately $32,000 on the decentralized prediction platform Polymarket, betting that he would "step down before January 31, 2026." After the news broke, this trade quickly yielded profits of over $400,000, with an astonishing return.

Blockchain analytics firm Lookonchain further discovered that three related wallets collectively profited over $630,000 from this event. This series of seemingly insider trading transactions directly prompted US Representative Ritchie Torres to announce the introduction of the "2026 Financial Prediction Market Public Integrity Act," aimed at prohibiting government officials and employees from using their positions to trade in political prediction markets. This controversy marks the first time that the rapidly growing crypto prediction market faces the same stringent insider trading regulatory scrutiny as traditional financial markets.

MarketWhisper·01-05 01:43

PwC makes a major turn! Trump personally promotes crypto policies, leading four major institutions to compete for digital assets

PwC has decided to fully enter the crypto space after years of cautiousness. Paul Griggs, the head of the US division, stated that this strategic shift occurred after the Trump administration appointed pro-crypto regulators and Congress passed the "Genius Act" to regulate stablecoins. Regulatory clarity has eliminated reputational risks. Deloitte has been providing audits for the largest compliant crypto exchanges in the US since 2020, and KPMG claims that 2025 will be a turning point, with the competition among the Big Four fully underway.

USDC0,04%

MarketWhisper·01-05 00:42

Predicting Market Surge with Insider Trading! Mysterious Account Rakes in $400,000 Before Maduro's Arrest

U.S. Congressman Ritchie Torres proposed the "Financial Prediction Market Public Integrity Act," stemming from suspicious transactions on Polymarket: a new account placed a $32,000 bet on Maduro's ousting just hours before his arrest. Maduro was subsequently detained, and the trader netted over $400,000, exposing regulatory loopholes in prediction markets and insider trading suspicions.

MarketWhisper·01-05 00:38

Canton Network Price Outlook: Usage Drives Gains, but $0.12 Risk Looms

Bullish Trend: Canton Network shows strong daily structure with steady buying pressure supporting gains.

Key Support: $0.122 and $0.110 levels act as critical floors for potential retracement.

Risk Zone: Breakdown below $0.124 may push prices toward $0.12–$0.105 before reversing

CC3,28%

CryptoNewsLand·01-04 13:21

Smart Money Watches DOGEBALL As Avalanche (AVAX) and Hedera (HBAR) Mature – Is This the Best 1000...

Let’s be honest for a second.Most people only realize an opportunity was real after the price chart goes vertical.

That regret usually starts with the same sentence: “I saw it early, but I didn’t act.”As 2026 approaches and the next altcoin cycle starts to take shape, investors are once again

BlockChainReporter·01-04 09:44

XRP Breaking News: Veteran Transition, ETF Progress, Policy Catalysts, Is the $3 Target in Place?

At the beginning of 2026, the XRP ecosystem ushered in a dual key catalyst. On the technical front, David Schwartz, the Chief Technology Officer of Ripple and co-creator of the XRP Ledger, who has served for over 13 years, officially stepped down, transitioning to Honorary CTO and remaining on the board, marking a smooth transition of an era. On the market front, the XRP spot ETF has accumulated a net inflow of $1.18 billion since its launch, defying market pressure in December 2025 to attract $499.9 million, forming a stark contrast to the outflows from Bitcoin and Ethereum ETFs.

Meanwhile, the U.S. Senate Banking Committee will review the key "Market Structure Act" on January 15, paving the way for clearer regulation of digital assets. The strategic handover of technical veterans, surging institutional funds, and potential regulatory benefits have collectively brought XRP into the market spotlight, with analysts generally optimistic about a mid-term price increase to $3.

MarketWhisper·01-04 07:51

XRP Today's News: Senate to review Market Bill on January 15, bullish challenge to $3

The U.S. Senate Banking Committee will review the "Market Structure Act" on January 15, which, together with the XRP spot ETF's cumulative net inflow of $1.18 billion, forms a double positive. In December, XRP ETF net inflows were nearly $500 million, while Bitcoin and Ethereum ETFs saw outflows of $1.09 billion and $617 million respectively, indicating a possible decoupling. Analysts expect XRP bulls to challenge $3.00 in the medium term.

MarketWhisper·01-04 05:15

Precise sniping or insider trading? On the night before Maduro's arrest, a mysterious market prediction account made a frenzy of $400,000, prompting U.S. legislation

A prediction market trade surrounding the fate of Venezuelan President Maduro is triggering an urgent crackdown in U.S. politics on a new realm of "insider trading." According to reports, a user invested approximately $32,500 on Polymarket, betting that Maduro would step down before January 31, and after the news of his arrest was made public, they made a profit of over $400,000, with a return rate of more than 1,200%.

This move has sparked significant "insider information" controversy because some trades occurred just hours before the official announcement. In response, U.S. Representative Ritchie Torres is about to introduce the "2026 Financial Prediction Market Public Integrity Act," aimed at prohibiting federal officials from using non-public information obtained through their duties in prediction market trading, extending the principles of the Securities Act to this emerging field, which had a trading volume of over $44 billion in 2025.

MarketWhisper·01-04 01:47

[Editorial] Are Stablecoins a "Trojan Horse"?

The warning letter from Washington's political circles in the United States is chilling. U.S. Representative Warren Davidson's deliberate criticism of the 2025 "Genius Act" raises fundamental questions about the so-called "innovation"—stablecoins—that we are now trying to believe and accept. He characterizes the bill as a "Trojan horse," ostensibly aimed at fostering the stablecoin market, but in reality allowing the government and banks to scrutinize and control all individual financial activities under a microscope.

Representative Davidson's insights pierce through the illusion of digital finance. The "account-based" system mandated by the Genius Act stifles the fundamental reason for the existence of cryptocurrencies—decentralization. This is not "digital cash" that allows us to hold and freely transfer our funds; rather, it records our funds on bank and government ledgers, requiring their approval to move—digital shackles. Ultimately, this will pave the way to a totalitarian regime through digital IDs.

TechubNews·01-03 19:47

The Year in Stablecoins 2025: Record Growth as GENIUS Act Opens the Floodgates

In brief

Stablecoin market capitalization surged 49% in 2025, reaching $306 billion by December, driven by regulatory clarity and institutional adoption.

The GENIUS Act signed in July established the first federal regulatory framework for stablecoins in the U.S., providing market clarity.

Decrypt·01-02 14:26

U.S. Crypto Regulation Crosses the Line! Lawmakers: GENIUS and CLARITY Bills Threaten Self-Custody Principles

U.S. Representative Warren Davidson warns that cryptocurrency regulations are moving toward licensing and comprehensive oversight, undermining self-custody and decentralization. He specifically criticizes the GENIUS Act for potentially paving the way for central bank digital currencies. He is concerned that this will lead to restrictions on personal freedom and calls for opposition to mandatory digital identities and the defense of decentralization principles.

BTC-1,72%

CryptoCity·01-02 07:00

The Year in Stablecoins 2025: Record Growth as GENIUS Act Opens the Floodgates

In brief

Stablecoin market capitalization surged 49% in 2025, reaching $306 billion by December, driven by regulatory clarity and institutional adoption.

The GENIUS Act signed in July established the first federal regulatory framework for stablecoins in the U.S., providing market clarity.

Decrypt·01-01 14:19

U.S. Senator Lummis Backs Bank Crypto Services Under 2026 Law

U.S. Senator Lummis said large banks should be allowed to offer crypto services under a clear federal framework. In a post on X, she pointed to the Responsible Financial Innovation Act of 2026. Arguing that it brings digital assets into the regulated banking system while protecting consumers. U.S. S

BTC-1,72%

Coinfomania·01-01 06:32

Top Crypto News of 2025: XRP's ATH, $19 Billion Wipeout, CZ's Pardon and More - U.Today

15. Ethereum "Pectra" upgrade live (April 16)

14. Gensler resigns (January 20)

13. Bybit heist (February 21)

12. Strategy's Bitcoin holdings top 500,000 BTC (March 24)

11. FTX repayments begin (February 18)

10. "Strategic Bitcoin Reserve" EO (March 6)

9. U.S. passes Genius ACT

UToday·2025-12-31 20:48

The Year in Stablecoins 2025: Record Growth as GENIUS Act Opens the Floodgates

In brief

Stablecoin market capitalization surged 49% in 2025, reaching $306 billion by December, driven by regulatory clarity and institutional adoption.

The GENIUS Act signed in July established the first federal regulatory framework for stablecoins in the U.S., providing market clarity.

Decrypt·2025-12-31 14:11

Crypto Industry Pushes Back Against California 5% Wealth Tax Proposal

A proposed Billionaire Tax Act in California has triggered strong opposition from the crypto industry.

Some crypto key figures have warned that this could force billionaires to consider moving out of the state.

Reports circulating in the mainstream media indicate that California has propose

CryptoNewsFlash·2025-12-31 09:10

Coinbase CEO slams banks lobbying Congress: Revisiting the "GENIUS Act" crosses the "red line"

Coinbase CEO Brian Armstrong strongly opposes the banking industry's reconsideration of the "GENIUS Act," calling it a "red line" for the crypto industry. He accuses banks of using political pressure to block stablecoin competition, predicting that the stablecoin market will become a multi-trillion-dollar opportunity. Despite collaborating with banks, Armstrong remains vigilant about the actions of opponents and emphasizes the importance of regulatory transparency.

区块客·2025-12-31 09:08

South Korea requires exchanges to provide no-fault compensation along with equity restrictions, officially entering bank-level regulation!

South Korea plans to classify large exchanges as critical infrastructure, restrict major shareholders' holdings, and strengthen stablecoin and compensation responsibilities. The operation rights of Upbit and Bithumb may undergo reshuffling.

Introducing a major shareholder qualification review mechanism, the operation rights of Upbit and Bithumb face reshuffling

-----------------------------------

South Korea's virtual asset market is experiencing the most stringent governance reforms in history. According to the "Second Phase Virtual Asset Act" proposal submitted by the Financial Services Commission (FSC) to the National Assembly, regulators plan to officially designate cryptocurrency exchanges with over 11 million users as "critical infrastructure." The core purpose of this move is to break the current absolute monopoly of a few founders or specific major shareholders over exchanges.

The FSC explicitly states in the proposal that the huge transaction fee revenue generated by large exchanges currently over

LUNA-2,64%

CryptoCity·2025-12-31 02:41

Grayscale 2026 Outlook: Regulatory Power Surpasses Quantum Threat, U.S. Legislation Could Become the "Benchmark" for the Crypto Market

The leading global digital asset management firm Grayscale recently released its 2026 Cryptocurrency Market Outlook report, outlining clear investment themes and risk priorities for the upcoming new cycle. The core conclusion of the report is clear and compelling: compared to the still-distant threat of quantum computing, a well-defined regulatory framework—especially the Crypto Market Structure Act, which is expected to pass in the United States by 2026—will become the decisive force shaping the market in the coming year.

Grayscale analysts predict that this legislation will introduce rules from traditional financial markets, such as registration, disclosure, asset classification, and insider trading protections, into the crypto space, paving the way for large institutional entry. If realized, this could mark the beginning of the early stage of the "institutional era" in the crypto market, characterized by institutional-led liquidity and on-chain direct interactions, transitioning from a retail speculation-driven market. This report, published by a giant managing over $18 billion in Bitcoin and Ethereum spot ETF assets, undoubtedly provides investors with an authoritative roadmap to understand the next market-driving logic.

MarketWhisper·2025-12-31 02:19

Load More