Report: Gold ETFs Remain Strong Despite Price Declines

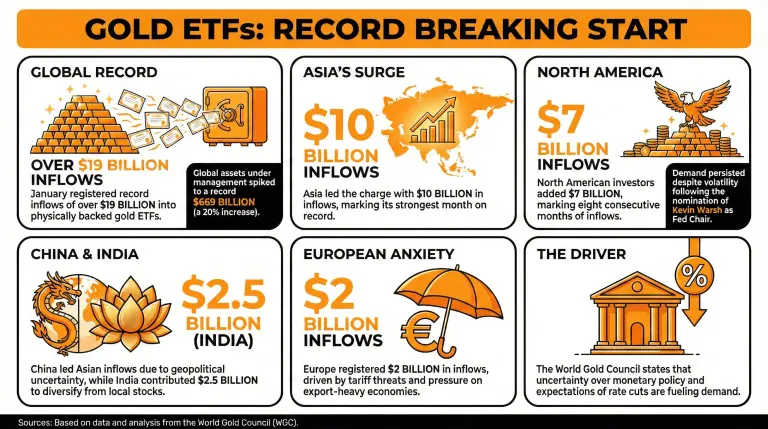

The World Gold Council (WGC) reported that physically backed gold ETFs registered record inflows in January, with investors pouring more than $19 billion into these funds. North American and Asian markets led the charge with strong demand despite recent price declines.

Paper Gold Markets Keep Growing as ETF’s Reach Record Inflows in January

Paper gold markets remain strong even amidst the current climate of volatility and the call to rely on physical investments.

According to the World Gold Council (WGC), January registered record inflows into physically backed gold exchange-traded funds (ETFs), with over $19 billion entering the precious metal market through these.

As a consequence, global gold ETF assets under management also spiked, reaching a record of $669 billion, a 20% month-on-month increase. All markets recorded inflows, with Asia leading the charge and North America following behind.

North American investors, particularly, have reported eight consecutive months of inflows, even after the sharp pullback gold experienced after the Trump Administration announced the nomination of Kevin Warsh as future Chairman of the Federal Reserve. These markets added $7 billion.

The WGC declared:

“This overhang on the future path of monetary policy, combined with investor expectations of eventual rate cuts, continues to support gold ETF demand.”

Asian funds reported record inflows in January, accounting for their strongest month on record after adding $10 billion. China led the region’s inflows as “robust gold prices, lingering geopolitical uncertainty, and strong institutional demand all underpinned the country’s continued appetite for gold ETFs.” India also contributed $2.5 billion in inflows as investors try to diversify from the underperforming local stock market.

European ETFs registered $2 billion in inflows, underpinned by current geoeconomic issues, including the tariff threat that puts pressure on export-heavy economies, increasing demand for safe-haven assets such as gold.

These numbers highlight the recovering relevance of gold across world markets, as regional markets experience a resurgence of the demand for the precious metal due to different local realities.

Read more: From Safe Haven to Stress Test: Gold and Silver Prices Feel the Heat

FAQ

- What recent trends have been observed in paper gold markets?

Despite market volatility, paper gold markets are strong, with record inflows into physically backed gold ETFs totaling over $19 billion in January.

- How have global gold ETF assets changed in recent months?

Global gold ETF assets under management reached a record $669 billion, reflecting a 20% increase month-on-month.

- Which regions are leading the inflows into gold ETFs?

Asia and North America are leading in inflows, with North American investors reporting eight consecutive months of growth.

- What factors are driving the demand for gold ETFs?

Investor concerns over monetary policy, expectations for rate cuts, and geopolitical uncertainties are fueling demand for gold as a safe-haven asset.

Related Articles

BlackRock & Mastercard Test The Waters On XRP Ledger Tie-Up

Chainlink Expands Adoption With Integrations on Ethereum, Solana, and BNB Chain

Pi Network Announces Critical Protocol Upgrade Path for 2026

Ethereum's RWA tokenization market has grown over 300% year-over-year, with a value exceeding $17 billion

10X Research: Bitcoin ETF size modestly decreases, still dominated by neutral and hedging positions

Crypto VC Boom Bursts as 85 % of 2025 Tokens Trade Below Their Launch Prices