Gate Ventures Weekly Crypto Recap (September 01, 2025)

TL;DR

- Trump tried to dismiss Fed Governor Lisa Cook, further challenging the Fed’s independence and influencing the Fed’s decision making process.

- This week’s economic data includes the US labour market report, ISM PMI and trade data.

- ETH/BTC ratio remains resilient despite recent market pullbacks in both ETH and BTC.

- Top Performer: CRO rallied strongly on DAT synergies, outperforming other top 30 tokens.

- New Listing: WLFI enters the market, attracting attention for its ecosystem and political ties.

- Google Cloud builds universal ledger blockchain for payment and financial institutions.

- Numerai secures up to $500M from JPMorgan Asset Management to scale AI Hedge Fund.

- Aave Labs unveils Horizon to enable stablecoin borrowing against tokenized RWAs.

- Most funded is the Infra sector.

Macro Overview

Trump tried to dismiss Fed Governor Lisa Cook, further challenging the Fed’s independence and influencing the Fed’s decision making process.

Since August, the US government’s interference with the Fed has increasingly extended to specific personnel appointments and removals. In early August, Fed Governor Adriana Kugler abruptly resigned, and Trump nominated his economic advisor Stephen Miran to temporarily fill the vacancy, more recently, Trump has attempted to dismiss Governor Lisa Cook, posing an unprecedented challenge to the Fed’s independence. If Trump succeeds in these two key personnel moves, together with Governors Bowman and Waller he nominated in his first term, the White House would control 4 of the 7 the Fed’s Board seats. This could influence the appointment and removal of regional Fed presidents.

The US is entering a phase of fiscal dominance with monetary accommodation, and the recent Fed personnel shifts proves this trend. Under fiscal dominance, US dollar liquidity may trend toward abundance, benefiting global risk assets. Debt monetization, financial repression, and a renewed uptrend in inflation could enhance the effectiveness of fiscal deficits, buy time to address structural problems, and the U.S. nominal economic cycle is likely to recover from the bottom.

This week’s upcoming data includes August US labour market report, the PMI data from the Institute for Supply Management (ISM) and trade data including factory orders, trade figures, etc. The labour market report will be the key highlight this week, which will be released this Friday. Last week’s PCE data came as expected, with PCE rose 0.2% and core PCE rose 0.27% in July. Also, the US GDP rose 3.3% in 2025Q2 despite subdued trade, showing a stronger than previous rebound following the decrease in the first quartner.

DXY

The market synergy from PCE Index, GDP revision and expectation for rate cut contributed to the dollar index’s further downward trend, touching the one month low point again.

US 10-Year Bond Yield

The US Treasury 10-Year Bond yield had some further drop last week, as investors are keen on injecting more liquid capital into the risky asset classes.

Gold

Gold prices surged significantly last week thanks to dovish data and Fed rate cut expectations. The favorable PCE data and GDP revision helped boost gold buying.

Crypto Markets Overview

1. Main Assets

BTC Price

ETH Price

ETH/BTC Ratio

SOL/ETH Ratio

After weeks of rallies the price of Ethereum is entering into a periodical adjustment, dropping below $4,400 level and waiting for further gaining buying power to readjust. For Bitcoin, it has seen a consecutive third week of loss, currently below the $110k level.

As more DAT companies are entering the market, the investors are facing a broader range of crypto assets wrapped in the way of traditional stocks or other financial instruments, and this could further benefit the acceptance of crypto assets to major large cap investors. The leverage used in crypto asset acquisition could be beneficial to scale up the price impact on the underlying token assets.

As Ethereum still performs more appealing compared to Bitcoin and Solana in the past two weeks, the ETH/BTC ratio and the SOL/ETH ratio both moved in a direction showing stronger preference on the ETH side.

2. Total Market Cap

Crypto Total Marketcap

Crypto Total Marketcap Excluding BTC and ETH

The crypto total market cap dropped below 3.7 trillion last week, and the total market cap excluding Bitcoin and Ethereum is 1.02 trillion. Compared to dominating Bitcoin and Ethereum, the altcoin market is still relatively weak in terms of market acceptance and real user penetration, but the integration between stock and crypto could to some extent slow down the above mentioned trend.

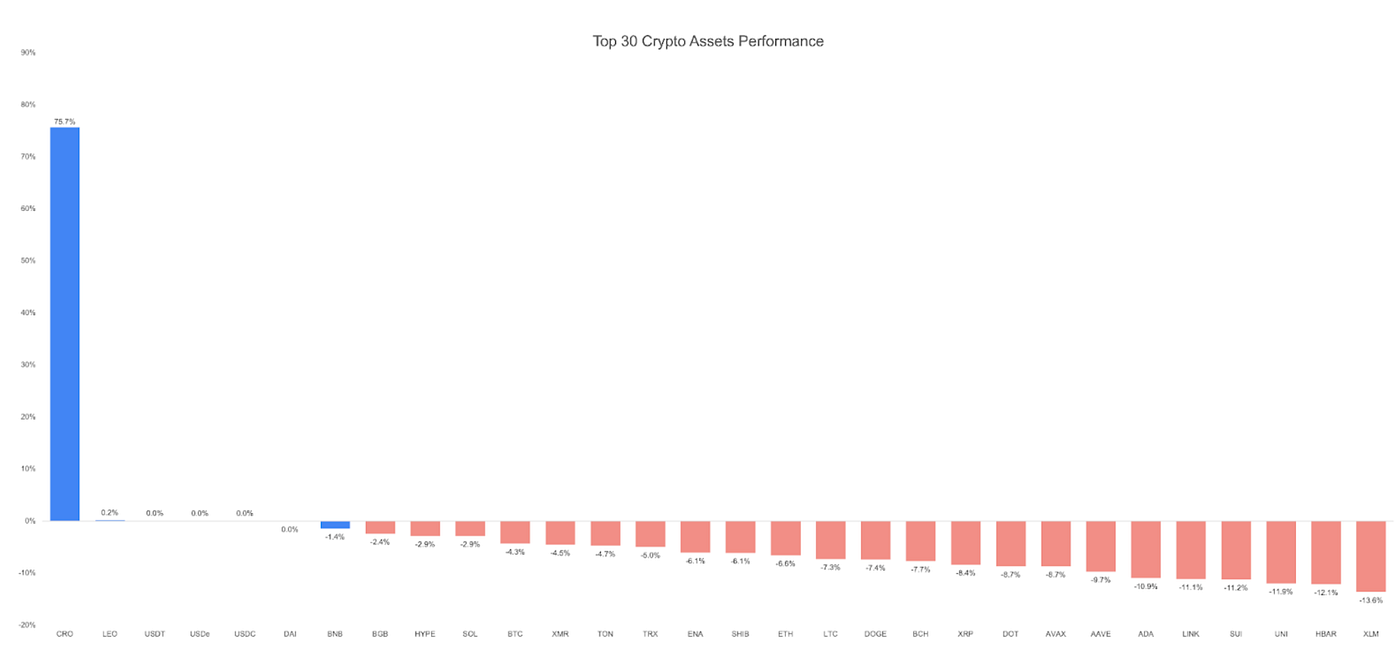

3. Top 30 Crypto Assets Performance

Source: Coingecko and Gate Ventures, as of Sept 1st 2025

Last week has been bloody for most of the top30 tokens, as significant price readjustment has been spanned across those multiple assets, as an afterwave of investors’ profit taking actions. The only asset that showed exceptionally strong gain is CRO, which benefits from the announcement that Trump Media, Crypto.com and the blank check firm Yorkville Acquisition will soon go into a de-SPAC deal for a CRO strategy DAT firm.

4. New Token Launched

WLFI will soon start trading on multiple crypto exchanges from Sept 1st. The trading prices has seen multiple times exceeding the price that early investors got in, and it is expected to further expand its business across multiple narratives and niche sectors including stablecoin. Also it entered into a strategic collaboration with NASDAQ listed firm ALT5 Sigma, which has raised $1.5 billion for WLFI treasury and has welcomed Eric Trump on its board of directors.

The Key Crypto Highlights

1. Google Cloud builds universal ledger blockchain for payment and financial institutions

Google Cloud is developing its own blockchain network, the Google Cloud Universal Ledger (GCUL), aimed at powering payments and digital financial products. GCUL is currently running in private testnet and will be unveiled in greater detail later this year. GCUL is designed as a “performant, credibly neutral” infrastructure layer for financial institutions, supporting Python-based smart contracts and offering access via a single API. Google Cloud emphasized that the system is permissioned and compliance-focused, enabling payment automation and digital asset management within regulated frameworks.

Despite being described as a Layer 1 network, the blockchain’s private and permissioned model has sparked skepticism within the crypto community, with some arguing it does not reflect decentralization. The initiative was first disclosed in March 2025, when Google Cloud revealed a pilot with the CME Group, testing GCUL for wholesale payments and asset tokenization. If successful, GCUL could become a core enterprise-grade ledger service, extending Google Cloud’s reach into the intersection of fintech and blockchain infrastructure.

2. Numerai secures up to $500M from JPMorgan Asset Management to scale AI Hedge Fund

Numerai ($NMR) based AI-driven hedge fund, announced it has secured up to $500M from JPMorgan Asset Management, marking its largest funding milestone to date. Over the past three years, Numerai has scaled from managing $60M to $450M in assets, supported by its network of data scientists.

Numerai highlighted JPMorgan’s reputation as one of the world’s largest allocators to quantitative and machine learning–driven strategies, making the partnership a validation of its AI-focused approach. Last year, the firm’s global equity hedge fund returned 25% net, strengthening its track record ahead of the deal. The firm is now expanding its team, recently hiring an AI researcher from Meta and a trading engineer from Voleon, alongside other specialists to build out its quantitative and infrastructure capabilities. Numerai described the raise as a turning point, signaling its ability to compete at scale within the hedge fund industry while deepening ties with traditional finance.

3. Aave Labs unveils Horizon to enable stablecoin borrowing against tokenized RWAs

Aave Labs has launched Horizon, a new institutional platform allowing stablecoin borrowing against tokenized real-world assets (RWAs) such as U.S. Treasurys and collateralized loan obligations. Built on a permissioned instance of Aave V3, Horizon provides capital-efficient, compliant, and 24/7 lending infrastructure tailored to institutional needs. Through Horizon, qualified institutions can post tokenized securities as collateral and borrow stablecoins like USDC, RLUSD, and GHO. Compliance is enforced at the token level via issuer permissioning, while the stablecoin markets remain permissionless to preserve DeFi composability.

Launch partners include Circle, VanEck, WisdomTree, Chainlink, Centrifuge, Superstate, OpenEden, Hamilton Lane, Securitize, Ethena, and Ant Digital Technologies. Supported assets at launch span major tokenized funds, such as Superstate USTB and USCC, Circle’s USYC, Centrifuge’s JAAA and JTRSY, and VanEck’s VBILL. Together, these tap into an onchain RWA market now exceeding $25 billion. Chainlink’s SmartData underpins Horizon’s architecture, starting with Onchain NAV to deliver real-time fund valuations directly onchain, enabling automated overcollateralized lending for DeFi’s institutional growth.

Key Ventures Deals

1. Maven 11, Lightspeed Faction lead $4.5M Seed round for Credit Coop’s Onchain Credit Network

Credit Coop has closed a $4.5M Seed round led by Maven 11 Capital and Lightspeed Faction, with participation from Coinbase Ventures, Signature Ventures, Veris Ventures, TRGC, and dlab. The raise will fund expansion of its programmable credit platform for the stablecoin economy. Credit Coop addresses a $25 trillion payments opportunity, targeting the inefficiencies of traditional settlement rails that delay payouts for businesses. Its core product, a Secured Line of Credit powered by Spigot technology, converts future receivables (e.g., Visa or Mastercard settlements) into instant working capital. Repayments occur programmatically at the source, removing counterparty risk while remaining fully on-chain, transparent, and UCC Article 12-compliant.

The company plans to expand beyond payments into marketplace payouts, SaaS revenues, and subscriptions, enabling any digital cash flow to be instantly financed. Early adopters include Rain, Coinflow, Tulipa Capital, Re7 Capital, and Valinor, with traction with $180M processed, $8.7M active loans, and zero defaults over $130M in additional borrower demand already queued. The new funding will accelerate product development, network expansion, and lender-borrower integrations, positioning Credit Coop as a foundational layer for instant, programmable credit in the stablecoin era.

2. M0 raises $40M Series B to build stablecoin network infrastructure

M0, a stablecoin infrastructure startup, has raised $40M in a Series B round led by Polychain Capital and Ribbit Capital, with participation from Endeavor Catalyst, Pantera Capital, and Bain Capital Crypto. The round included equity and locked tokens, bringing M0’s total funding to nearly $100M.

M0 launched in 2023 to create a “layer zero of money” — a base network enabling stablecoin issuers to interoperate seamlessly. M0 provides infrastructure for liquidity and interoperability across stablecoins, removing the complexity of transferring assets across blockchains like Ethereum or Solana. M0 has already partnered with MetaMask to launch its own stablecoin and aims to onboard issuers at scale before prioritizing profitability

The funding comes amid surging stablecoin adoption, highlighted by Circle’s $30B IPO valuation and the passage of the Genius Act, which set a federal regulatory framework for the sector. Big Tech firms like Meta and Airbnb, along with banks such as JPMorgan and Bank of America, are also exploring stablecoin integration whether M0 is positioning itself as a foundational player in that transformation.

3. Visa-Integrated stablecoin platform Rain secures $58M SeriesB to expand enterprise payment infrastructure

Rain, a leading enterprise-grade stablecoin payments platform, has raised $58M in Series B funding led by Sapphire Ventures, with participation from Dragonfly, Galaxy Ventures, Endeavor Catalyst, Samsung Next, Lightspeed, and Norwest. The round brings Rain’s total funding to $88.5M, following its Series A just 5 months earlier. Rain enables fintechs, banks, and marketplaces to embed stablecoins into cards, wallets, and payments via a single API. Its infrastructure covers money-in, storage, spending, and money-out, serving more than 1.5 billion people through global partners. Expansion is underway into Europe, the Middle East, Africa, and Asia-Pacific, driven by regulatory clarity from the GENIUS Act in the U.S. and MiCA in Europe.

The company has pioneered Visa-integrated stablecoin cards, processingMs of transactions across 150+ countries, with 10x transaction growth in 2025. Portfolio partners including Nuvei, Avalanche, Dakota, and Nomad use Rain for payouts, consumer purchases, B2B spend, and cross-border payroll. Rain is also a Visa Principal Member, uniquely settling 100% of card volume directly in stablecoins. With the new funding, Rain will expand engineering, compliance, and commercial teams, support scaling for existing partners, and enter new markets. By building natively for stablecoins and meeting enterprise compliance standards.

Ventures Market Metrics

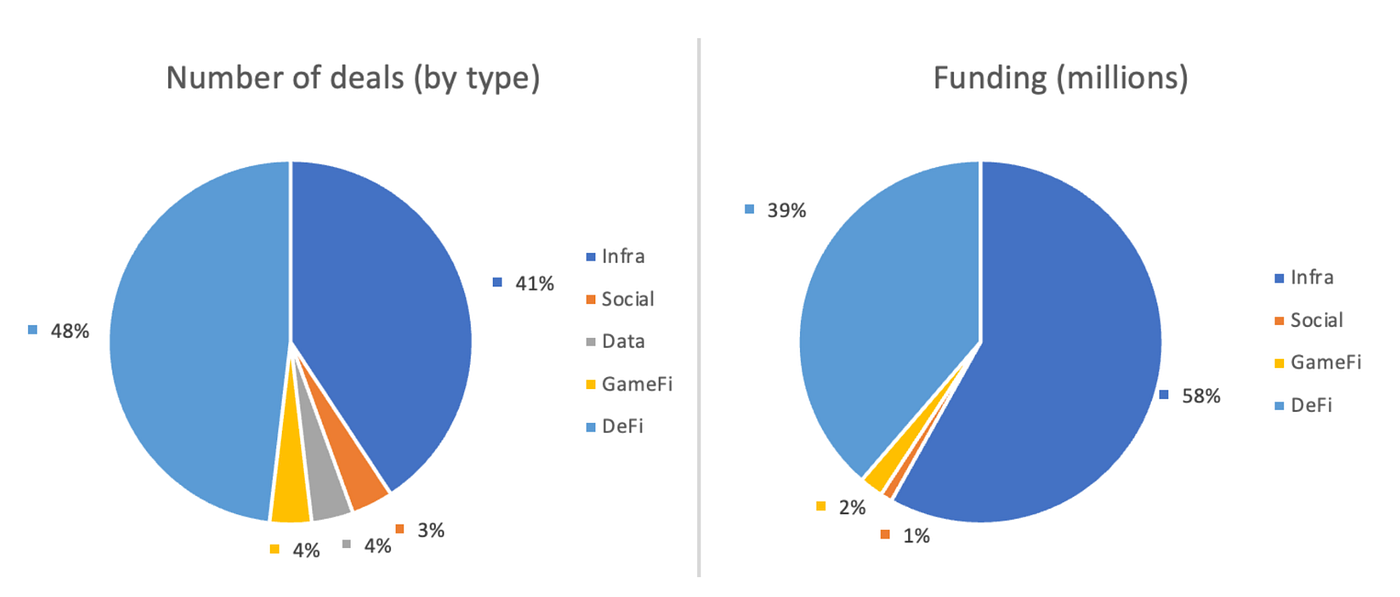

The number of deals closed in the previous week was 27, with Infra having 11 deals, representing 41% for each sector of the total number of deals. Meanwhile, Social had 1 (4%), Data had 1 (4%), Gamefi had (4%) and DeFi had 13 (48%) deals

Weekly Venture Deal Summary, Source: Cryptorank and Gate Ventures, as of 1st Sep 2025

The total amount of disclosed funding raised in the previous week was $237M, 33% deals (9/27) in previous week didn’t public the raised amount. The top funding came from Infra sector with $137M. Most funded deals: Rain $58M, M0 $40M

Weekly Venture Deal Summary, Source: Cryptorank and Gate Ventures, as of 01st Sep 2025

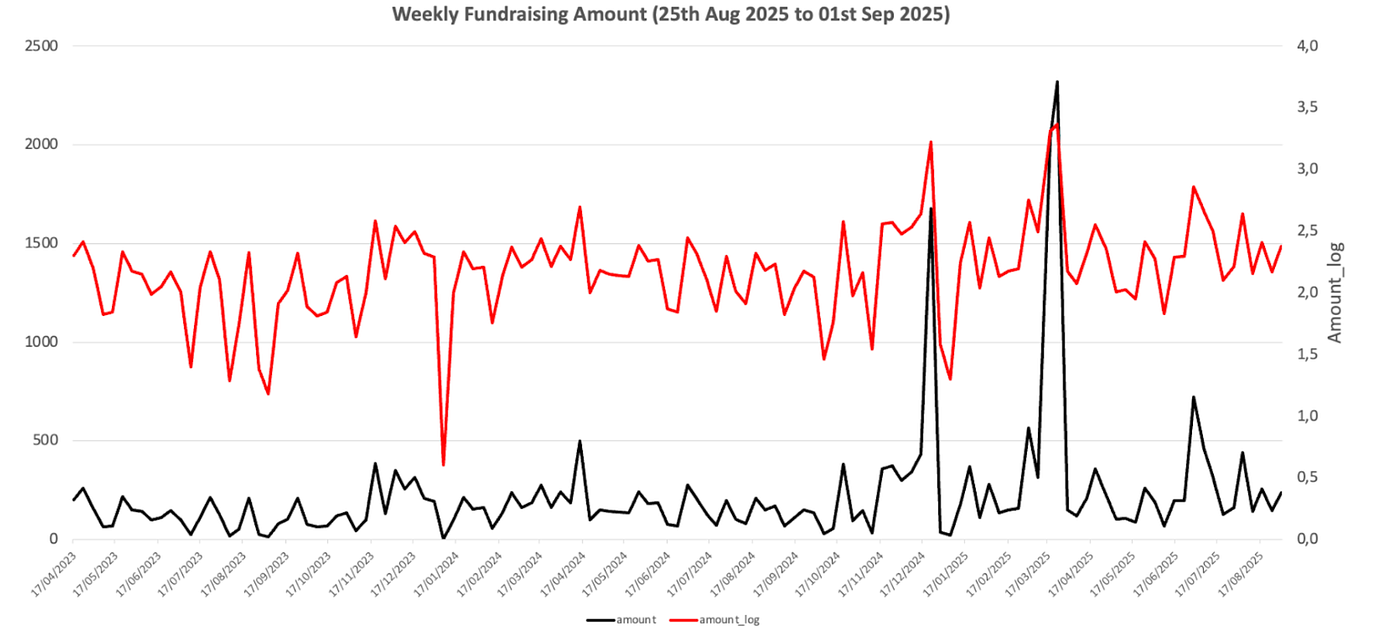

Total weekly fundraising rose to $237M for the 5th week of Aug-2025, an increase of +60% compared to the week prior. Weekly fundraising in the previous week was up 28% year over year for the same period.

About Gate Ventures

Gate Ventures, the venture capital arm of Gate, is focused on investments in decentralized infrastructure, middleware, and applications that will reshape the world in the Web 3.0 age. Working with industry leaders across the globe, Gate Ventures helps promising teams and startups that possess the ideas and capabilities needed to redefine social and financial interactions.

Website: https://ventures.gate.com/

Twitter: https://x.com/gate_ventures

Medium: https://medium.com/@ gate_ventures

LinkedIn: https://www.linkedin.com/company/gateventures-vc/

The content herein does not constitute any offer, solicitation, or recommendation. You should always seek independent professional advice before making any investment decisions. Please note that Gate Ventures may restrict or prohibit the use of all or a portion of the services from restricted locations. For more information, please read its applicable user agreement.

Sources

Macro: TradingView

Crypto Markets: TradingView, CoinGecko

New Token Launched: CoinDesk, Crypto Exchange Announcements, BWEnews

Google Cloud is developing its own blockchain for payments, currently in private testnet

Beyond stablecoins: The evolution of digital money

AI hedge fund Numerai secures up to $500 million from JPMorgan, token jumps 33%

JPMorgan backs hedge fund Numerai with $500M, fueling crypto-AI convergence

JPMorgan Secures $500m Capacity in Numerai Following Breakthrough Year

Aave Labs launches Horizon, offering institutional stablecoin borrowing against tokenized RWAs

Aave’s RWA Market Horizon Launches

Related Articles

Gate Ventures Weekly Crypto Recap (September 29, 2025)

Gate Ventures Weekly Crypto Recap (October 6, 2025)

Gate Ventures Weekly Crypto Recap (September 22, 2025)

Gate Ventures Weekly Crypto Recap (October 20, 2025)

How On-Chain TCGs Could Unlock the Next $2 Billion Market: Landscape Overview and Valuation Outlook