Gate Ventures Weekly Crypto Recap (October 6, 2025)

TL;DR

- US government shutdown on Oct 1st, and the market is concerned that the shutdown may last longer than expected.

- This week’s incoming data includes the US trade data, September FOMC meeting minutes, wholesale inventories and Fed Chairman Powell’s speech.

- Crypto markets kicked off “Uptober” with strong momentum — BTC +10.1% and ETH +8.9%, driven by record ETF inflows of $3.24B for BTC and $1.3B for ETH.

- The Fear & Greed Index jumped to 71 (Greed), while the ETH/BTC ratio edged lower to 0.366, reflecting BTC’s dominance.

- New listings also drew attention — DoubleZero ($2Z) surged from $0.74 to $1.53 post-TGE before stabilizing at $0.48, while OpenEden ($EDEN), backed by tokenized U.S. Treasuries, hit an ATH of $1.58 and now trades near $0.35–$0.36.

- Sui introduced suiUSDe and USDi to support the next generation of stable assets.

- Samsung has integrated Coinbase Pay into the Galaxy Wallet, giving 75 million U.S. users direct access to crypto services.

- Polygon hosted AlloyX’s tokenized MMF in partnership with Standard Chartered, bringing money market fund exposure on-chain.

Macro Overview

US government shutdown on Oct 1st, and the market is concerned that the shutdown may last longer than expected.

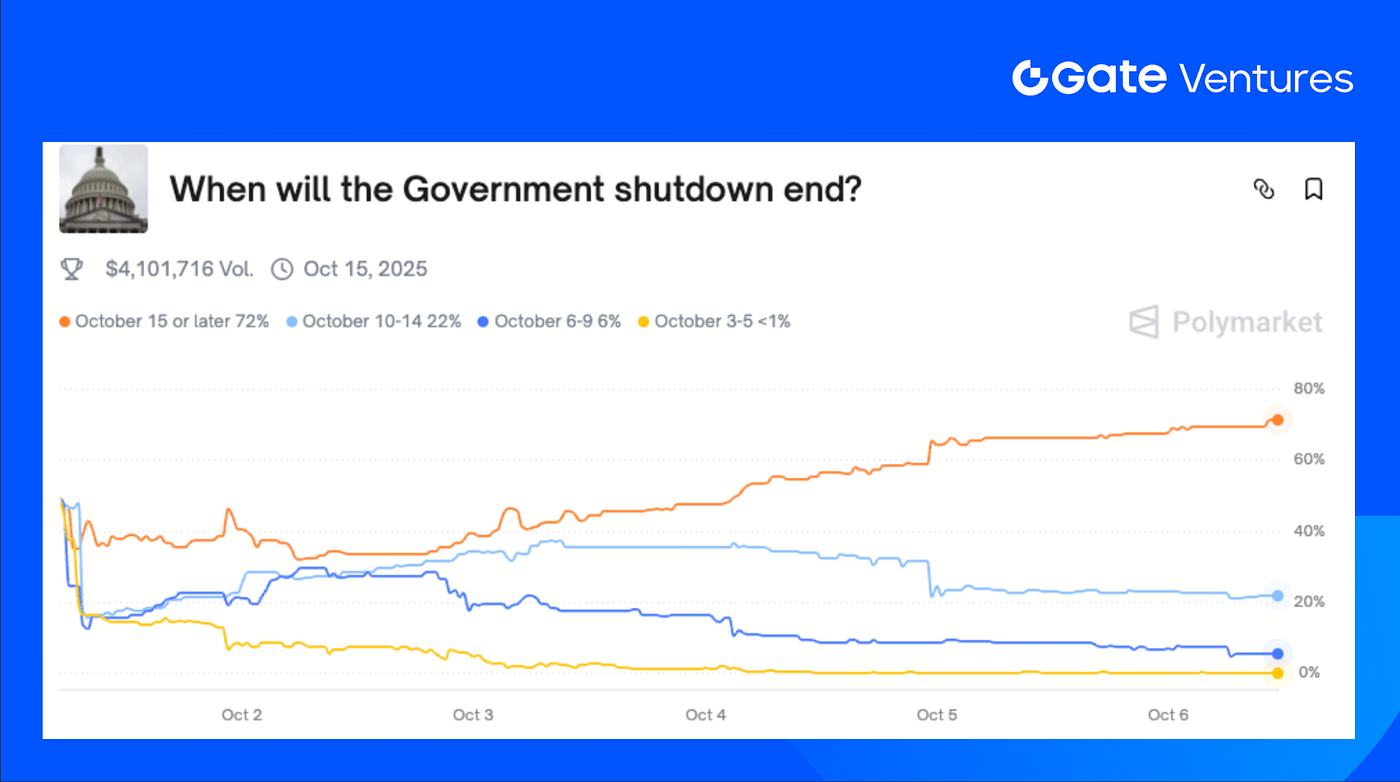

On October 1, the two parties failed to reach a compromise, and the US federal government temporarily shut down in line with market expectations. The focal point of the appropriations battle is cuts to healthcare subsidies, especially the Enhanced Premium Tax Credits (ePTC), which were originally set to expire at the end of 2025. Democrats may seek to leverage the shutdown to push Republicans to extend the ePTC. Republicans tend to believe the public will blame Democrats for the shutdown and see it as an opportunity to reduce the size of government. Betting markets like Polymarket currently price roughly a 30% probability that the shutdown ends within two weeks, with growing concern that it could last longer.

Taking 2013 as an example, the shutdown lasted 16 days: at that time, the September nonfarm payrolls, CPI/PPI, retail sales, the advance estimate of Q3 GDP, PCE, and other releases scheduled for October were all delayed by about 1–3 weeks, and the October data scheduled for November were also delayed by about 1–2 weeks. Therefore, if the current shutdown lasts more than two weeks, the nonfarm payrolls initially slated for release on October 3 might not be published until after October 20. Private-sector data such as ADP employment and ISM PMIs can be used to gauge changes, and such releases may carry greater short-term market impact. Trump has threatened to further cut federal employees during the shutdown, if implemented, this would amplify the negative impact.

This week’s incoming data includes the US trade data, September FOMC meeting minutes, wholesale inventories and Fed Chairman Powell’s speech. The policymakers’ views on the US economy and inflation outlook will continue to draw market attention, as this week not only the September FOMC meeting minutes will be released, Fed Chairman Powell will also give a speech. The Fed is assessing the management of maintaining a healthy job market against the possibility of sticky tariff-related inflation. (1, 2)

Polymarket: WHen will the Government shutdown end?

DXY

The US dollar has seen a weakening trend last week, as the uncertainty on US government shutdown and delayed key federal data released affected the economic outlook. (3)

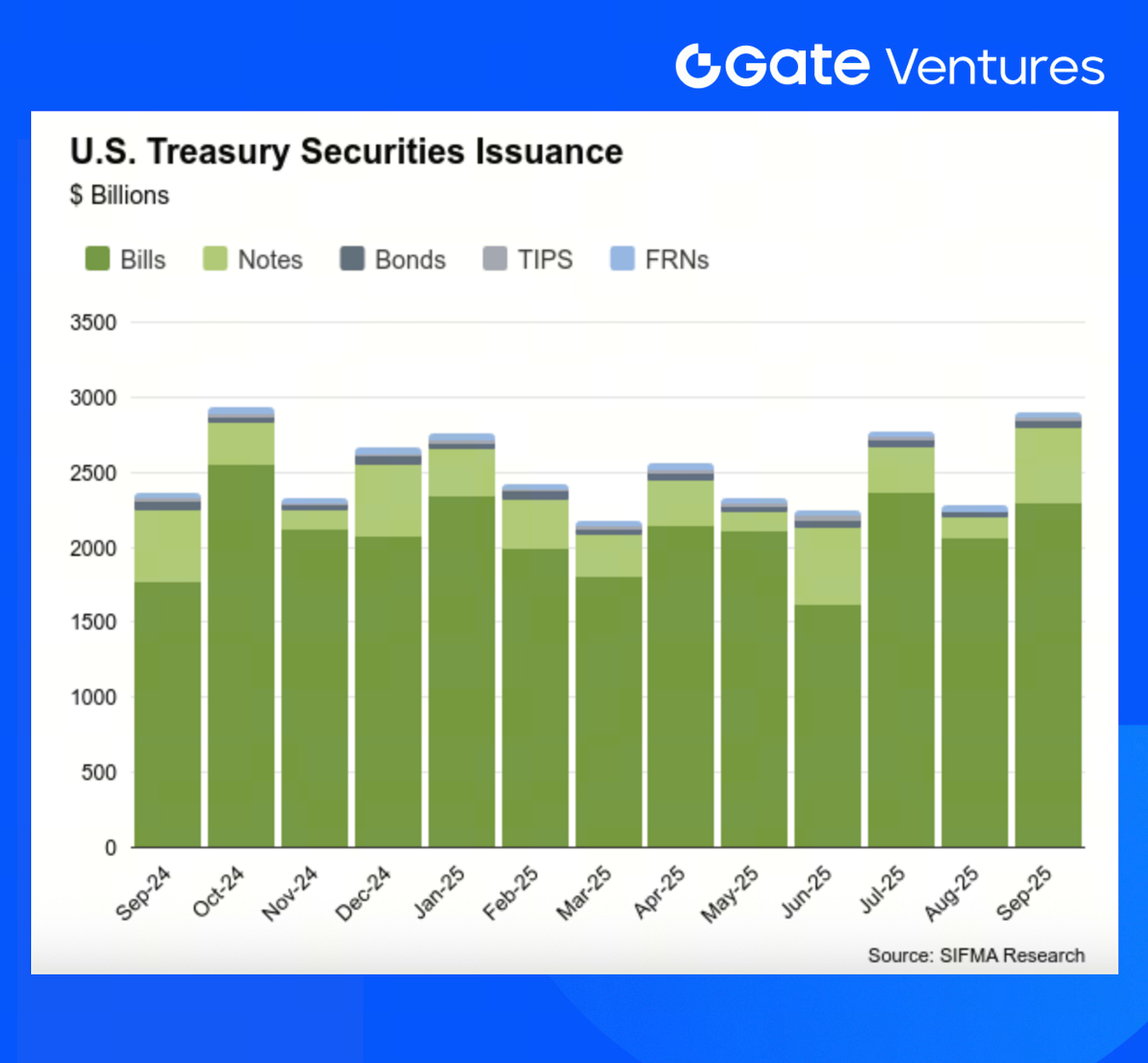

US Treasury Security Issuanc

The US treasury security issuance has seen a remarkable surge in Sept 2025, as the US government aims to finance its recently enacted fiscal package of tax cuts and new spending changes. (4)

Gold

Gold prices surged past $3,900 last week as the US government shutdown fueled the market uncertainty, and the delay of key federal data releases left investors reliant on private surveys. (5)

Crypto Markets Overview

1. Main Assets

BTC Price

ETH Price

ETH/BTC Ratio

BTC rose 10.09% this week, while ETH gained 8.94%. The BTC rally was primarily driven by strong inflows into U.S. Bitcoin ETFs, which recorded $3.24 billion in net inflows — the second-largest weekly inflow in ETF history. Meanwhile, U.S. Ethereum ETFs also attracted $1.3 billion in inflows. (6)

The Bitcoin Fear & Greed Index climbed from 50 (Neutral) last week to 71 (Greed), signaling a notable improvement in market sentiment. The ETH/BTC ratio edged slightly lower to 0.366, indicating BTC’s continued relative strength. (7)

2. Total Market Cap

Crypto Total Marketcap

Crypto Total Marketcap Excluding BTC and ETH

Crypto Total Marketcap Excluding Top 10 Dominance

The overall crypto market cap increased 8.65% this week, while the market cap excluding BTC and ETH rose only 5.55%, highlighting the stronger performance of BTC and ETH driven by robust ETF inflows. Moreover, the market cap excluding the top 10 tokens climbed just 3.49%, further underscoring that this week’s rally was largely led by blue-chips assets.

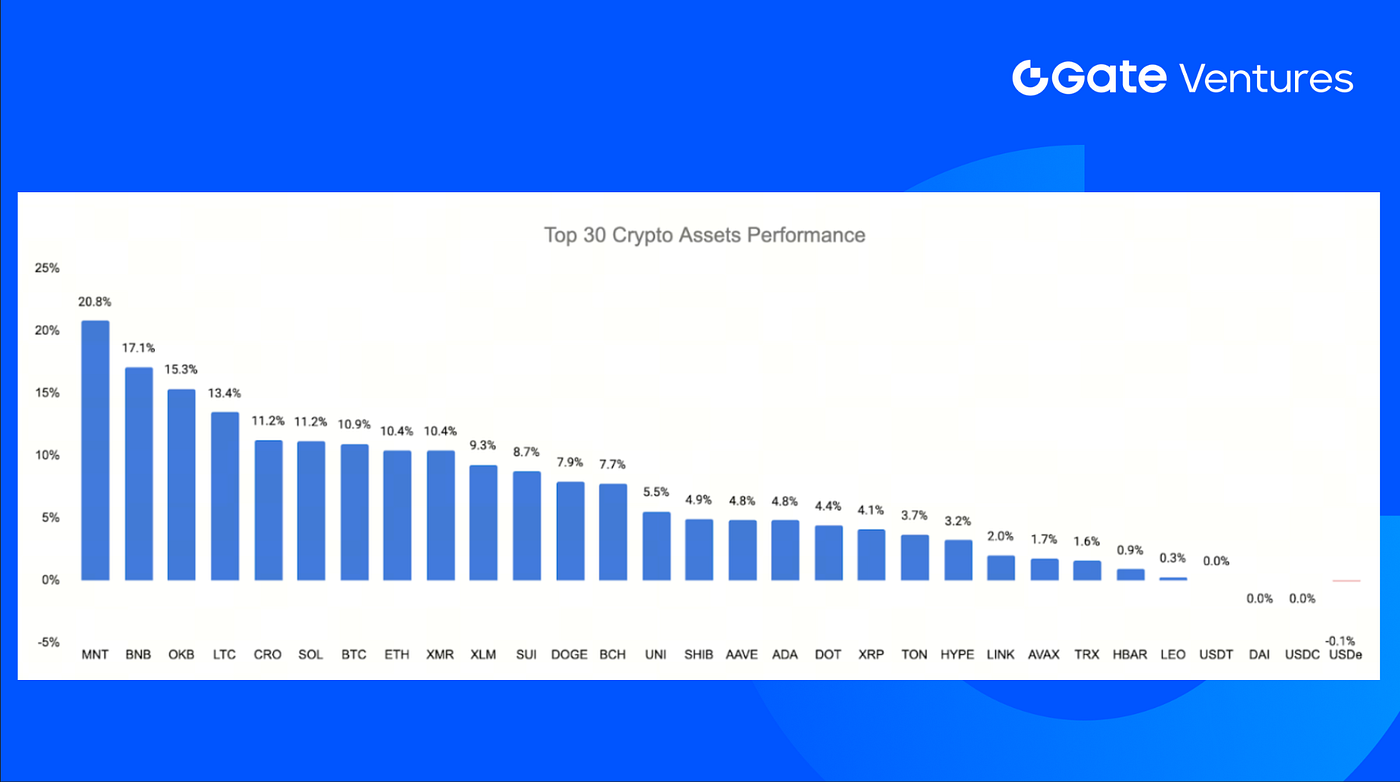

3. Top 30 Crypto Assets Performance

Source: Coinmarketcap and Gate Ventures, as of Sept 29th 2025

As “Uptober” begins, the crypto market kicks off strongly, led by CEX ecosystem tokens. MNT, BNB, and OKB each gained over 15% this week. MNT maintained its bullish momentum, reaching a new all-time high with a 20.8% rally.

BNB followed with a 17.1% surge, fueled by the continuously growing enthusiasm around the BNB Chain ecosystem and its Catalyst campaign, where memecoins like $4, $1, and $GIGGLE have reignited on-chain trading activity.

OKB climbed 15.3%, driven by OKX’s roadmap announcement at Token2049, which outlined the upcoming launch of its native stablecoin USDG, X Layer integrations with Aave, Uniswap, Balancer, and Chainlink, and a $100 million Vision Fund to support top developers and ecosystem growth.(8)

4. New Token Launched

DoubleZero is a decentralized network infrastructure protocol optimized for high-performance connectivity across blockchains and distributed systems. It offers a two-ring architecture combining edge traffic filtering and dedicated fiber mesh routing, designed to reduce latency, jitter, and congestion in blockchain node communication.

The 2Z token launched at approximately $0.74, and following strong initial momentum and liquidity support it surged to an ATH of ~$1.53, before stabilizing in the $0.48 range. Right after TGE, it secured listings on major exchanges such as Binance, Upbit, Gate.io, and Bybit, enhancing its visibility and tradability.

OpenEden is a regulated RWA tokenization platform that brings real-world assets, primarily U.S. Treasury securities on-chain, enabling users to mint, trade, and redeem yield-bearing tokens with institutional robustness and DeFi composability.

Its flagship product, TBILL Vault, allows users to mint TBILL tokens backed 1:1 by short-dated U.S. Treasury Bills (plus small USD buffers). The underlying fund is a BVI-registered professional fund with assets managed by BNY Mellon and held in regulated custody.

According to market data, EDEN reached an ATH of ~$1.58 before retracing. Its current trading price rests around $0.35–$0.36. It secured listings on major exchanges such as Binance and Gate.io.

The Key Crypto Highlights

1. Sui unveils suiUSDe and USDi to power the next generation of stable assets

SUI Group Holdings partners with Ethena and SUI Foundation to launch suiUSDe, a Sui-native synthetic dollar and USDi (backed by BlackRock’s BUIDL) is also slated to arrive on Sui later this year. Net income from suiUSDe will be used by the Sui Foundation and SUIG to purchase SUI on the open market, reinforcing ecosystem demand. As the first income-generating stable asset on a non-EVM chain, the launch aligns stablecoin revenues with native-token accrual and network growth. (9)

2. Samsung integrates Coinbase Pay into Galaxy Wallet for 75M U.S. users

Samsung expanded its U.S. partnership with Coinbase, enabling Galaxy smartphone users to fund accounts via Samsung Pay and access a limited-time Coinbase One promotion through Samsung Wallet. The integration, which potentially reaches over 75 million Galaxy users, positions Coinbase to strengthen retail onboarding amid intensifying competition from Kraken and Robinhood. Samsung framed the move as part of its effort to enhance Galaxy Wallet functionality and expand its financial ecosystem across upcoming international markets.(10)

3. Polygon hosts AlloyX tokenized MMF with Standard Chartered, bringing exposure on-chain

Polygon is the launch venue for AlloyX’s tokenized money market fund, with Standard Chartered as custodian and registrar. The AlloyX Real Yield Token (RYT) offers exposure to the China AMC Select USD MMF; tokens transact on Polygon while assets remain off-chain with Standard Chartered. AlloyX integrated Chainlink Proof of Reserve and NAVLink for transparency. After AlloyX’s $350M acquisition by Solowin, the rollout targets institutions bridging regulated MMFs and DeFi. The move pairs bank-grade custody with low-cost settlement for RWA tokenization.(11)

Key Ventures Deals

1. Flying Tulip closes $200M token round with “onchain redemption rights” for downside protection

Flying Tulip, founded by Andre Cronje, raised $200M at a $1B FDV from Brevan Howard Digital, CoinFund, DWF Labs, Lemniscap, Nascent, Republic Digital, Selini, Susquehanna Crypto, and other investors. The round introduces “onchain redemption rights” that let investors redeem up to original principal at any time, pairing downside protection with yield-funded upside. Proceeds support a full-stack onchain exchange integrating spot, derivatives, lending, a native stablecoin, and insurance under one cross-margin system. The design targets institutional-grade depth across chains.(12)

2. xMoney secures $21.5M strategic round to scale MiCA-compliant global payments infrastructure

xMoney secured $21.5M led by Sui Foundation with MultiversX backing to expand its MiCA-compliant global payments infrastructure. A licensed Electronic Money Institution and Visa/Mastercard principal member, xMoney enables stablecoin payments for 5,000+ merchants, including institutional partners in Liechtenstein and Lugano. The funding supports scaling of compliant, user-friendly rails for the $7T stablecoin market. The funding round reinforces xMoney’s positioning at the intersection of blockchain performance, financial compliance, and real-world payment adoption.(13)

3. Lava secures $17.5M to scale BTC-collateral credit and unveils dollar yield product

Lava, a platform for bitcoin-backed loans, raised $17.5M in a Series A extension from Peter Jurdjevic (Qatar Investment Authority), Bijan Tehrani (Stake), Zach White (8VC), and other angel investors, and launched a dollar yield product offering up to 7.5% APY on BTC-collateralized loans. Its earlier $10M Series A (Dec 2024) was co-led by Founders Fund and Khosla Ventures. Focusing solely on bitcoin simplifies collateral risk and targets institutional demand for cleaner, risk-adjusted yield.(14)

Ventures Market Metrics

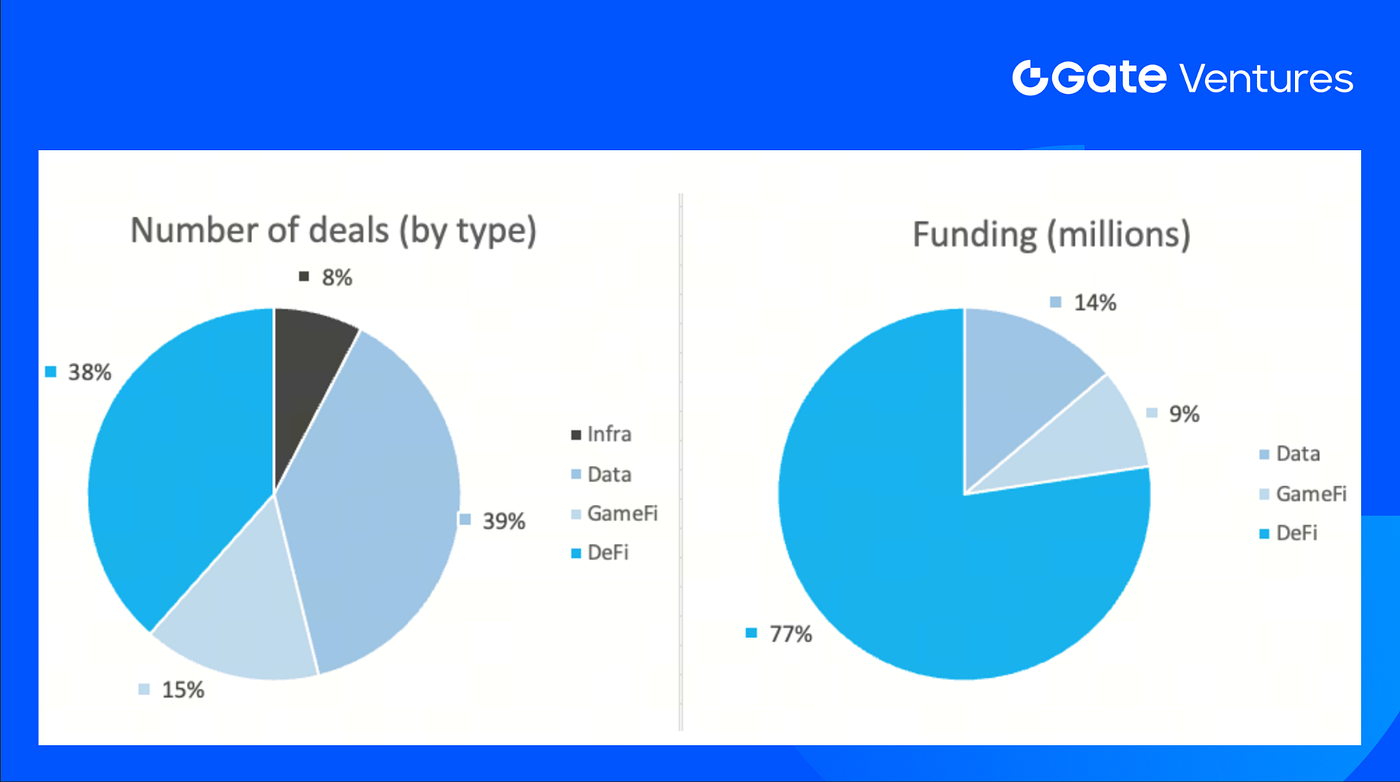

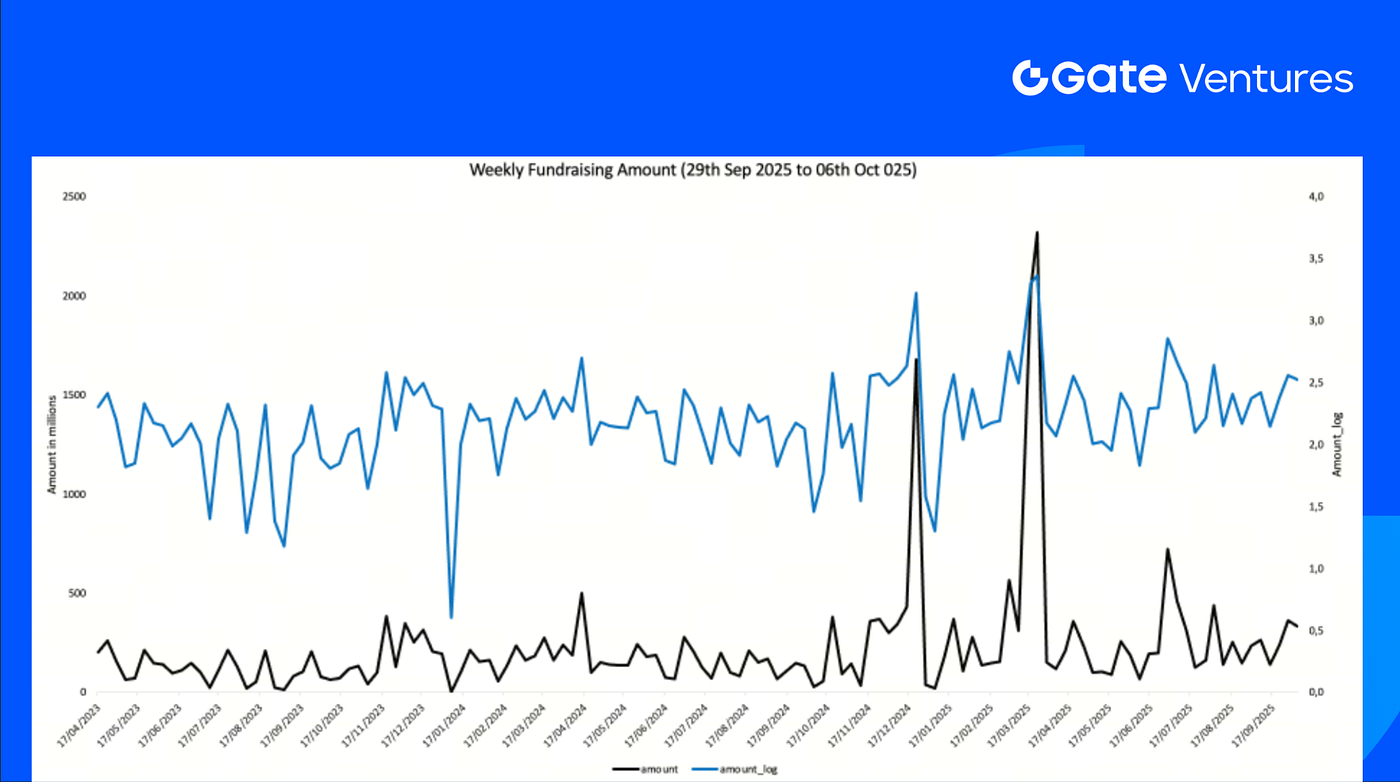

The number of deals closed in the previous week was 13, with Data having 5 deals, representing 38% for each sector of the total number of deals. Meanwhile, Infra had 1 (20%), Gamefi had 2 (15%) and DeFi had 5 (38%) deals.

Weekly Venture Deal Summary, Source: Cryptorank and Gate Ventures, as of 6th Oct 2025

The total amount of disclosed funding raised in the previous week was $325M, 15% deals (2/13) in previous week didn’t public the raised amount. The top funding came from DeFi sector with $252M. Most funded deals: Flying Tulip $200M, Ethena $30M.

Weekly Venture Deal Summary, Source: Cryptorank and Gate Ventures, as of 6th Oct 2025

Total weekly fundraising fell to $325M for the 1st week of Oct-2025, a decrease of -8% compared to the week prior. Weekly fundraising in the previous week was up +91% year over year for the same period.

About Gate Ventures

Gate Ventures, the venture capital arm of Gate.com, is focused on investments in decentralized infrastructure, middleware, and applications that will reshape the world in the Web 3.0 age. Working with industry leaders across the globe, Gate Ventures helps promising teams and startups that possess the ideas and capabilities needed to redefine social and financial interactions.

Website | Twitter | @gate_ventures">Medium | LinkedIn

The content herein does not constitute any offer, solicitation, or recommendation. You should always seek independent professional advice before making any investment decisions. Please note that Gate Ventures may restrict or prohibit the use of all or a portion of the services from restricted locations. For more information, please read its applicable user agreement.

Reference:

- S&P Global Weekly Ahead Economic Data, https://www.spglobal.com/marketintelligence/en/mi/research-analysis/week-ahead-economic-preview-week-of-6-october-2025.html

- When will the Government shutdown end, Polymarket, https://polymarket.com/event/when-will-the-government-shutdown-end?tid=1759720959026

- TradingView on DXY Index, https://www.tradingview.com/chart/z1UD772v/?symbol=TVC%3ADXY

- US Treasury Security Issuance, https://www.sifma.org/resources/research/statistics/us-treasury-securities-statistics/

- TradingView on Gold, https://www.tradingview.com/chart/z1UD772v/?symbol=TVC%3AGOLD

- BTC & ETH ETF Inflow, https://sosovalue.com/tc/assets/etf/us-btc-spot

- BTC Greed and Fear Index, https://alternative.me/crypto/fear-and-greed-index/

- X Layer Roadmap, https://cryptorank.io/news/feed/6e09e-okx-unveils-three-phase-x-layer-roadmap-at-token2049-singapore

- Sui, SUIG, and Ethena to Launch Native suiUSDe, https://blog.sui.io/suig-ethena-suiusde-stablecoin/?utm_source=twitter&utm_medium=organic&utm_campaign=news

- Samsung integrates Coinbase Pay into Galaxy Wallet for 75M U.S. users,

https://www.theblock.co/post/373346/samsung-expands-coinbase-partnership-with-galaxy-wallet-integration-in-us - Polygon hosts AlloyX tokenized MMF with Standard Chartered, bringing exposure on-chain, https://blockworks.co/news/polygon-alloyx-standard-chartered

- Flying Tulip closes $200M token round with “onchain redemption rights” for downside protection, https://www.theblock.co/post/372787/andre-cronje-flying-tulip-funding-crypto-token-valuation?utm_source=twitter&utm_medium=social

- xMoney secures $21.5M strategic round to scale MiCA-compliant global payments infrastructure,

https://www.xmoney.com/blog/xmoney-strategic-funding-round - Lava secures $17.5M to scale BTC-collateral credit and unveils dollar yield product, https://www.theblock.co/post/373096/bitcoin-lending-platform-lava-funding-new-yield-product

Related Articles

Gate Ventures Weekly Crypto Recap (September 29, 2025)

Gate Ventures Research Insights: The Bittensor Revolution – The Rise of AI’s Bitcoin and the New Economic Landscape

Gate Ventures Weekly Crypto Recap (September 22, 2025)

Gate Ventures Weekly Crypto Recap (October 20, 2025)

How On-Chain TCGs Could Unlock the Next $2 Billion Market: Landscape Overview and Valuation Outlook