2025 MICHI Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: Market Position and Investment Value of MICHI

MICHI (MICHI) emerges as a popular meme-based token on the Solana blockchain, backed by Michi, an internet-famous feline figure recognized as one of the most memeable cats online. Since its launch, MICHI has garnered significant community attention from cat enthusiasts and meme culture aficionados. As of December 25, 2025, MICHI's market capitalization stands at approximately $2.76 million USD, with a circulating supply of 555.77 million tokens and a current price hovering around $0.004959. This digital asset, celebrated for its vibrant community engagement and cultural resonance, continues to capture the imagination of the cryptocurrency community through its unique blend of feline charm and blockchain innovation.

This comprehensive analysis will examine MICHI's price trajectories and market dynamics through 2025 and beyond, synthesizing historical price patterns, market supply and demand fundamentals, ecosystem development, and broader macroeconomic conditions to deliver professional price forecasts and actionable investment guidance for market participants.

I. MICHI Price History Review and Current Market Status

MICHI Historical Price Evolution

-

November 2024: MICHI reached its all-time high of $0.5915 on November 13, 2024, marking the peak of market enthusiasm for this Solana-based meme token.

-

December 2024 - Present: Following the peak, MICHI experienced a significant decline. The token dropped to its all-time low of $0.00456 on December 24, 2025, representing a dramatic correction from the historical high.

MICHI Current Market Status

As of December 25, 2025, MICHI is trading at $0.004959, reflecting the ongoing market downturn. The token demonstrates the following characteristics:

Price Performance Metrics:

- 1-hour change: +1.37%

- 24-hour change: +0.24%

- 7-day change: -12.93%

- 30-day change: -23.54%

- 1-year change: -96.32%

Market Capitalization Data:

- Current market cap: $2,756,066.88

- Fully diluted valuation: $2,756,066.88

- 24-hour trading volume: $13,421.41

- Market dominance: 0.000086%

Supply Metrics:

- Circulating supply: 555,770,695 MICHI (55.58% of max supply)

- Total supply: 555,770,695 MICHI

- Maximum supply: 1,000,000,000 MICHI

- Token holders: 44,875

Market Position:

- Ranking: #1931 in overall cryptocurrency market cap

- Trading on Gate.com with confirmed market data

- Built on Solana blockchain using SPL token standard

The current market sentiment reflects extreme fear conditions, with MICHI experiencing substantial losses from its November peak.

Visit MICHI market price on Gate.com for real-time updates

MICHI Market Sentiment Indicator

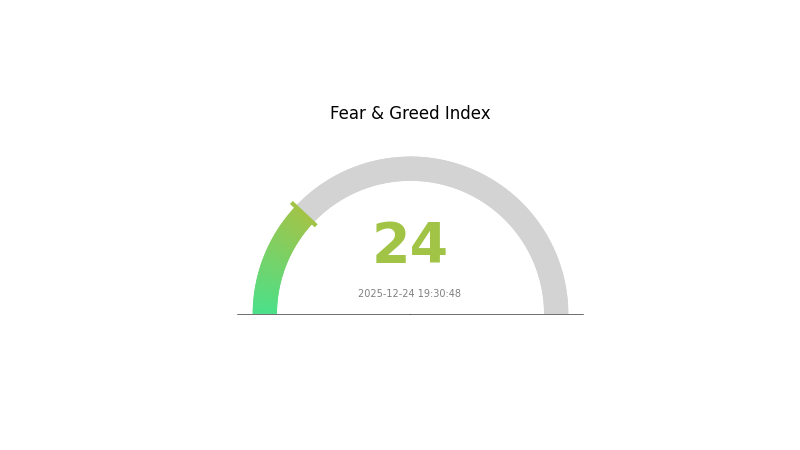

2025-12-24 Fear and Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index plummeting to 24. This indicates widespread panic and pessimism among investors. Market participants are heavily risk-averse, with selling pressure dominating trading activity. Such extreme conditions often present contrarian opportunities for long-term investors, as historically, these fear capitulation phases can mark potential market bottoms. However, exercise caution and conduct thorough research before making investment decisions on Gate.com or any platform.

MICHI Holdings Distribution

The address holdings distribution chart provides a comprehensive view of how MICHI tokens are distributed across the blockchain network, revealing the concentration of ownership among top holders and the proportion held by dispersed retail participants. This metric serves as a critical indicator of token decentralization, market structure stability, and potential vulnerability to large-scale sell-offs or price manipulation.

MICHI currently exhibits moderate concentration characteristics in its holder distribution. The top five addresses collectively control approximately 34.97% of the total token supply, with the largest holder commanding 19.85% of all tokens in circulation. While this concentration level is not extreme, the leading address holding over 110 million MICHI tokens represents a notable concentration point that warrants attention. The second and third-largest holders maintain positions of 8.56% and 2.34% respectively, demonstrating a gradual distribution curve. Importantly, the remaining 65.03% of tokens are distributed among other addresses, indicating that a substantial majority of MICHI's supply is held across a broader network of participants, which provides some degree of decentralization safeguard.

From a market structure perspective, MICHI's current distribution pattern suggests moderate risk regarding potential price volatility. While the dominance of the largest holder could theoretically enable significant market influence through coordinated large transactions, the substantial portion held by dispersed addresses acts as a stabilizing factor. The distribution reflects a relatively healthy balance between whale concentration and retail participation, suggesting that the token has achieved reasonable decentralization maturity. However, the top five holders' combined stake of approximately 35% indicates that concentrated holder actions could materially impact short-term price dynamics and market sentiment.

Visit MICHI Holdings Distribution on Gate.com for real-time data

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 5Q544f...pge4j1 | 110328.65K | 19.85% |

| 2 | FixDET...Stuuph | 47581.21K | 8.56% |

| 3 | ASTyfS...g7iaJZ | 13009.26K | 2.34% |

| 4 | 2UL8hb...LqkhNL | 12081.57K | 2.17% |

| 5 | E2RvJg...qnatYy | 11410.25K | 2.05% |

| - | Others | 361347.23K | 65.03% |

Core Factors Influencing MICHI's Future Price

Macroeconomic Environment

-

Monetary Policy Impact: Federal Reserve policy expectations directly influence MICHI's price movement. Market sentiment is heavily influenced by monetary policy trends and interest rate movements, which affect the broader cryptocurrency market.

-

Supply and Demand Dynamics: Market supply and demand relationships play a crucial role in determining MICHI's price trajectory. The balance between buyer and seller pressure significantly impacts price volatility.

Technology Development and Ecosystem Building

-

AI Integration: MICHI is positioned as an AI-driven personal assistant in the smart home sector, representing the convergence of artificial intelligence technology with blockchain applications. This technological integration enhances the project's utility and market appeal.

-

Community Activity: As of 2025, MICHI has established itself as an important member of the meme coin ecosystem with 45,279 token holders and an active community of enthusiasts. Community engagement and social sentiment are key drivers of price movement.

Market Sentiment Factors

-

Retail Trading Behavior: Market psychology plays a significant role, with retail traders typically following tokens that have not yet experienced significant gains. This creates natural sector rotation dynamics that can be observed through holding data analysis.

-

Social Media Effects: Viral trends and social media momentum can amplify price movements, particularly in the meme coin sector. Market participants closely monitor social sentiment and trending topics as indicators of potential price direction.

-

Regulatory Environment: Policy monitoring and regulatory developments remain important factors for price discovery and market stability in the cryptocurrency space.

Three、2025-2030 MICHI Price Forecast

2025 Outlook

- Conservative Forecast: $0.00292 - $0.00495

- Neutral Forecast: $0.00495

- Optimistic Forecast: $0.00658 (requires sustained market sentiment and positive ecosystem developments)

2026-2027 Mid-term Outlook

- Market Phase Expectation: Gradual recovery and consolidation phase with moderate growth momentum

- Price Range Forecast:

- 2026: $0.00375 - $0.00669

- 2027: $0.00330 - $0.00847

- Key Catalysts: Project milestone achievements, increased utility adoption, broader market recovery, and enhanced liquidity on platforms like Gate.com

2028-2030 Long-term Outlook

- Base Case: $0.00404 - $0.00838 in 2028, progressing to $0.00788 - $0.01163 by 2030 (assumes steady ecosystem development and stable market conditions)

- Optimistic Case: $0.00838 - $0.01046 by 2029 (contingent on accelerated adoption and positive regulatory environment)

- Transformation Case: $0.01163+ by 2030 (assumes breakthrough in protocol functionality, significant institutional participation, and mainstream market integration)

- 2030-12-31: MICHI experiences 84% cumulative appreciation (steady growth trajectory validated)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00658 | 0.00495 | 0.00292 | 0 |

| 2026 | 0.00669 | 0.00577 | 0.00375 | 16 |

| 2027 | 0.00847 | 0.00623 | 0.0033 | 25 |

| 2028 | 0.00838 | 0.00735 | 0.00404 | 48 |

| 2029 | 0.01046 | 0.00786 | 0.00692 | 58 |

| 2030 | 0.01163 | 0.00916 | 0.00788 | 84 |

MICHI Investment Strategy and Risk Management Report

IV. MICHI Professional Investment Strategy and Risk Management

MICHI Investment Methodology

(1) Long-term Holding Strategy

- Target Audience: Community-driven investors and meme culture enthusiasts with medium to long-term investment horizons

- Operational Recommendations:

- Accumulate MICHI tokens during market downturns, leveraging the current 96.32% yearly decline as a potential entry opportunity for patient investors

- Hold positions through market cycles while monitoring community engagement metrics and social sentiment

- Maintain a long-term perspective recognizing that meme tokens derive value from sustained community participation and cultural relevance

(2) Active Trading Strategy

- Technical Analysis Approach:

- Price Action Analysis: Monitor the 24-hour trading range ($0.00456 - $0.005099) and identify support/resistance levels based on historical price movements

- Volatility Metrics: Track the 1-hour momentum indicator (currently +1.37%) to identify short-term trading opportunities

- Wave Trading Key Points:

- Capitalize on intraday volatility, particularly around the current 24-hour high of $0.005099

- Exercise caution given the significant year-over-year depreciation, which signals heightened market risk

MICHI Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% portfolio allocation maximum

- Active Investors: 2-5% portfolio allocation

- Experienced Traders: 5-10% portfolio allocation for speculative positions

(2) Risk Hedging Approaches

- Position Sizing: Implement strict position sizing protocols, limiting individual trade sizes to protect against sudden price movements

- Diversification Strategy: Maintain exposure to multiple asset classes rather than concentrating investments solely in meme tokens

(3) Secure Storage Options

- Non-Custodial Wallets: Utilize self-custody solutions with strong security protocols for long-term MICHI holdings

- Exchange Storage: For active traders, Gate.com provides reliable custody services with insurance protections

- Security Considerations: Never share private keys or seed phrases, enable multi-factor authentication on all accounts, and regularly audit wallet access patterns

V. MICHI Potential Risks and Challenges

MICHI Market Risk

- Extreme Volatility: MICHI exhibits severe price fluctuation with a 96.32% decline over one year, creating substantial downside risk for investors

- Liquidity Risk: With a 24-hour trading volume of only $13,421 and 44,875 token holders, liquidity is limited, potentially causing slippage during large trades

- Meme Token Dependency: As a meme-based asset on Solana blockchain, MICHI's value is intrinsically tied to internet trends and cultural sentiment, which are inherently unpredictable

MICHI Regulatory Risk

- Evolving Classification: Regulatory authorities worldwide continue developing frameworks for meme tokens and non-utility digital assets, creating potential compliance uncertainties

- Jurisdiction Variations: Different countries maintain divergent regulatory approaches toward cryptocurrency holdings and trading, potentially affecting accessibility

- Future Compliance Requirements: Enhanced regulatory scrutiny on meme tokens could impose restrictions on trading venues or impose tax obligations on holders

MICHI Technical Risk

- Solana Blockchain Dependency: MICHI's functionality relies entirely on the Solana network's stability and operational performance

- Smart Contract Risk: Potential vulnerabilities in token contract mechanics could expose holders to technical failure or loss of funds

- Network Congestion: During periods of high network activity, transaction execution may experience delays or increased costs on the Solana blockchain

VI. Conclusion and Action Recommendations

MICHI Investment Value Assessment

MICHI represents a speculative meme token with significant community backing but substantial downside risk. The 96.32% annual decline underscores the extreme volatility characteristic of meme-based cryptocurrencies. While the project benefits from association with internet culture and maintains an active holder base of 44,875 addresses, the token's value proposition remains primarily sentiment-driven rather than fundamentals-based. Current market valuation of approximately $2.76 million reflects modest capitalization within the broader cryptocurrency ecosystem.

MICHI Investment Recommendations

✅ Beginners: Start with minimal allocations (under 1% of portfolio) exclusively with capital you can afford to lose completely. Focus on understanding meme token dynamics before expanding positions.

✅ Experienced Investors: Implement tactical trading strategies around identified support/resistance levels while maintaining strict stop-loss orders. Consider MICHI as a speculative allocation within a diversified portfolio.

✅ Institutional Investors: Exercise extreme caution given the limited liquidity and lack of institutional-grade fundamentals. Any exposure should be negligible relative to overall portfolio size.

MICHI Trading Participation Methods

- Direct Token Purchase: Acquire MICHI directly through Gate.com with SOL (Solana) as the primary trading pair

- Spot Trading: Execute buy and sell orders on Gate.com's spot trading platform with real-time price discovery

- Portfolio Management: Monitor holdings through Gate.com's integrated wallet and position tracking tools

Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. Investors must conduct independent due diligence and consult qualified financial advisors before making investment decisions. Never invest more than you can afford to lose completely. Meme tokens, in particular, exhibit unpredictable price movements driven primarily by sentiment rather than fundamental value creation.

FAQ

What is the price prediction for Michi in 2025?

Michi is forecasted to trade between $0.003284 and $0.01306 in 2025, based on current market trends and technical analysis.

Is Michi a good investment?

Michi presents a high-risk opportunity with significant growth potential for long-term investors. Its low current valuation and emerging utility in the Web3 ecosystem offer attractive entry points for those with high risk tolerance seeking exponential returns.

Is Michi a meme coin?

Yes, Michi is a meme coin that is community-driven with no intrinsic value or financial return expectations. It operates as a decentralized community project powered by its holders.

2025 SLERF Price Prediction: Analyzing Market Trends and Future Growth Potential in the Expanding Digital Asset Ecosystem

2025 AURASOL Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 FWOG Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2025 SLERF Price Prediction: Expert Analysis and Market Forecast for Solana's Leading Meme Token

2025 QKA Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

2025 NOBODY Price Prediction: Will the Token Reach New Highs Amid Market Volatility?

TradFi Embraces Digital Assets as Japan Signals a New Era of Financial Integration

Is cryptocurrency mining legal in Germany?

Fear Market in Cryptocurrency: How to Navigate Extreme Sentiment and Find Opportunities

Coincheck: A Japan-Based Digital Currency Exchange

SEI Price Analysis: Technical Formation Indicating Potential Bullish Breakout