2025 AURASOL Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: AURASOL's Market Position and Investment Value

AURASOL (AURA) as a memecoin on the Solana blockchain, has captured significant attention since its launch on May 30, 2024. By 2025, AURASOL's market capitalization has reached $32,771,042, with a circulating supply of approximately 963,285,636 tokens, and a price hovering around $0.03402. This asset, dubbed the "social clout coin," is playing an increasingly crucial role in the realm of social media-driven cryptocurrencies.

This article will comprehensively analyze AURASOL's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

I. AURASOL Price History Review and Current Market Status

AURASOL Historical Price Evolution

- 2024: Launched on May 30th, capturing the viral "aura" concept from TikTok and Instagram

- 2025 June: Reached all-time high of $0.29951

- 2025 November: Hit all-time low of $0.0304 amidst market downturn

AURASOL Current Market Situation

AURASOL is currently trading at $0.03402, experiencing a 9% decrease in the last 24 hours. The token has seen significant volatility, with a 40.38% decline over the past week and a 57.22% drop in the last 30 days. Despite these short-term losses, AURASOL has shown an 18.79% increase over the past year. The current market capitalization stands at $32,770,977, ranking 732nd in the cryptocurrency market. With a circulating supply of 963,285,636 AURASOL tokens, the project has reached 96.33% of its maximum supply of 1 billion tokens. The 24-hour trading volume is $147,538, indicating moderate market activity. The overall market sentiment appears bearish in the short term, but the long-term performance remains positive compared to a year ago.

Click to view the current AURASOL market price

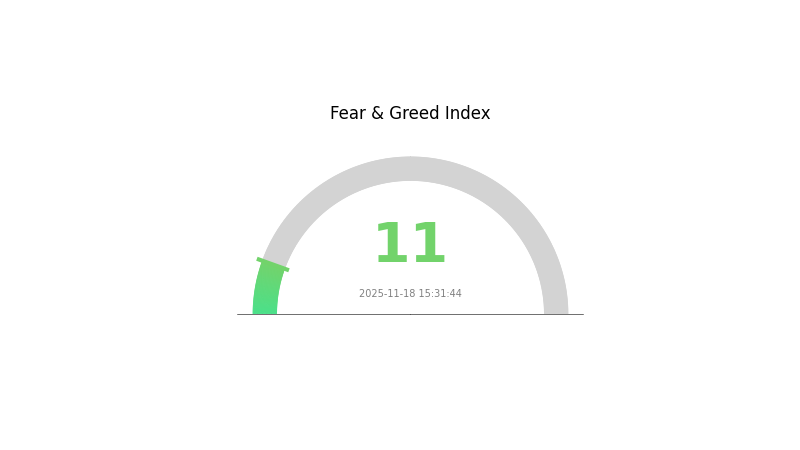

AURASOL Market Sentiment Indicator

2025-11-18 Fear and Greed Index: 11 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is gripped by extreme fear today, with the sentiment index plummeting to 11. This level of pessimism often signals a potential buying opportunity for contrarian investors. However, it's crucial to approach with caution and conduct thorough research. Remember, market cycles are natural, and extreme fear doesn't last forever. Stay informed, manage your risk, and consider dollar-cost averaging if you decide to enter the market during these turbulent times.

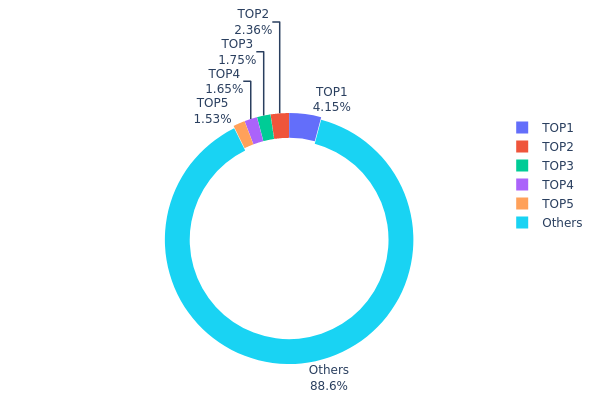

AURASOL Holdings Distribution

The address holdings distribution data for AURASOL reveals a relatively decentralized token ownership structure. The top 5 addresses collectively hold 11.41% of the total supply, with the largest single address controlling 4.14%. This distribution pattern suggests a moderate level of concentration, which is not uncommon in the cryptocurrency market.

The majority of AURASOL tokens (88.59%) are distributed among numerous smaller holders, indicating a broad base of ownership. This dispersion of tokens among a large number of addresses can be viewed as a positive factor for market stability and resistance to price manipulation. However, it's important to note that the top holders still have significant influence, particularly the largest address with over 39 million tokens.

While the current distribution appears reasonably balanced, market participants should remain vigilant. Any significant changes in the holdings of top addresses could potentially impact price movements and overall market dynamics. The relatively dispersed nature of AURASOL's token distribution suggests a fair degree of decentralization, which may contribute to the project's long-term sustainability and governance structure.

Click to view the current AURASOL Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 5Q544f...pge4j1 | 39950.87K | 4.14% |

| 2 | ASTyfS...g7iaJZ | 22717.87K | 2.35% |

| 3 | 6Bp46X...hK3wHz | 16813.88K | 1.74% |

| 4 | 5PAhQi...cnPRj5 | 15929.24K | 1.65% |

| 5 | 7o1UnD...71yEBs | 14740.33K | 1.53% |

| - | Others | 853133.45K | 88.59% |

II. Key Factors Affecting AURASOL's Future Price

Institutional and Whale Dynamics

- Enterprise Adoption: Notable companies adopting AURASOL include Gate.com, which has integrated AURASOL into its Alpha platform for airdrops and trading.

Macroeconomic Environment

- Monetary Policy Impact: The cautious signals from the Federal Reserve may increase the attractiveness of cryptocurrencies like AURASOL.

- Inflation Hedging Properties: With rising oil prices and stable bond yields, AURASOL, like other cryptocurrencies, may be seen as a potential hedge against inflation.

- Geopolitical Factors: International market trends, such as the movement of funds from altcoins to Bitcoin, could indirectly affect AURASOL's price.

Technological Development and Ecosystem Building

- Ecosystem Applications: Gate.com's Alpha web version supports trading of various tokens on different blockchains, potentially including AURASOL, which could enhance its liquidity and accessibility.

III. AURASOL Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.0228 - $0.03

- Neutral prediction: $0.03 - $0.04

- Optimistic prediction: $0.04 - $0.04975 (requires favorable market conditions and increased adoption)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $0.03123 - $0.06611

- 2028: $0.03486 - $0.08272

- Key catalysts: Technological advancements, wider market recognition, and potential partnerships

2029-2030 Long-term Outlook

- Base scenario: $0.06637 - $0.09 (assuming steady market growth and adoption)

- Optimistic scenario: $0.09 - $0.11258 (assuming strong market performance and increased utility)

- Transformative scenario: $0.11258+ (under extremely favorable market conditions and breakthrough developments)

- 2030-12-31: AURASOL $0.11258 (potential peak price based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.04975 | 0.03455 | 0.0228 | 1 |

| 2026 | 0.06196 | 0.04215 | 0.0215 | 23 |

| 2027 | 0.06611 | 0.05206 | 0.03123 | 53 |

| 2028 | 0.08272 | 0.05908 | 0.03486 | 73 |

| 2029 | 0.09713 | 0.0709 | 0.04325 | 108 |

| 2030 | 0.11258 | 0.08402 | 0.06637 | 146 |

IV. Professional Investment Strategies and Risk Management for AURASOL

AURASOL Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a high interest in meme cryptocurrencies

- Operation suggestions:

- Accumulate AURASOL during market dips

- Set a long-term price target and stick to it

- Store tokens in a secure Solana-compatible wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Relative Strength Index (RSI): Use to identify overbought and oversold conditions

- Moving Averages: Utilize for trend identification and potential entry/exit points

- Key points for swing trading:

- Monitor social media trends and community engagement

- Set strict stop-loss orders to manage risk

AURASOL Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across various cryptocurrencies and asset classes

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet supporting Solana tokens

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for AURASOL

AURASOL Market Risks

- High volatility: Meme coins are subject to extreme price swings

- Speculative nature: Price often driven by hype rather than fundamentals

- Limited use case: Lack of utility may impact long-term value

AURASOL Regulatory Risks

- Uncertain regulatory environment: Potential for stricter regulations on meme coins

- Platform risk: Dependence on Solana blockchain and its regulatory status

- Marketing restrictions: Possible limitations on social media promotion

AURASOL Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the token contract

- Solana network issues: Reliance on Solana's performance and stability

- Wallet compatibility: Limited support from some wallets due to SPL-20 token standard

VI. Conclusion and Action Recommendations

AURASOL Investment Value Assessment

AURASOL presents a high-risk, high-reward opportunity in the meme coin space. While it has shown significant growth potential, its long-term value proposition remains uncertain due to its speculative nature and limited utility.

AURASOL Investment Recommendations

✅ Beginners: Consider small, experimental positions with funds you can afford to lose ✅ Experienced investors: Implement strict risk management and consider short-term trading strategies ✅ Institutional investors: Approach with caution, potentially as part of a diversified crypto portfolio

AURASOL Trading Participation Methods

- Spot trading: Buy and sell AURASOL on supported exchanges like Gate.com

- Social trading: Follow and copy successful AURASOL traders on social trading platforms

- DeFi liquidity provision: Participate in liquidity pools on Solana-based decentralized exchanges

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the price prediction for Aura?

Aura's price is predicted to reach $0.05439 by November 15, 2025, based on current market trends and analysis.

What is the price prediction for Aureal One in 2030?

Based on recent analysis, the price prediction for Aureal One in 2030 is 0.0003204 USD.

What is AURA's all-time high price?

AURA's all-time high price was $0.239828, reached on July 23, 2025.

What is the price of Aurasol coin?

As of November 18, 2025, the price of Aurasol coin is $0.03924, showing a 1.30% change in the last 24 hours.

2025 SLERF Price Prediction: Analyzing Market Trends and Future Growth Potential in the Expanding Digital Asset Ecosystem

2025 FWOG Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2025 SLERF Price Prediction: Expert Analysis and Market Forecast for Solana's Leading Meme Token

2025 QKA Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

2025 NOBODY Price Prediction: Will the Token Reach New Highs Amid Market Volatility?

2025 CHILLGUY Price Prediction: Will This Viral Meme Coin Reach New Highs or Face a Market Correction?

TradFi Opens the Door to Cryptocurrencies: What It Means for Markets in 2026

TradFi Embraces Digital Assets as Japan Signals a New Era of Financial Integration

Is cryptocurrency mining legal in Germany?

Fear Market in Cryptocurrency: How to Navigate Extreme Sentiment and Find Opportunities

Coincheck: A Japan-Based Digital Currency Exchange