2025 ECHO Fiyat Tahmini: Olgunlaşan kripto piyasasında ECHO Token’ın gelecekteki değerini etkileyen başlıca faktörler

Giriş: ECHO’nun Piyasa Konumu ve Yatırım Değeri

Echo (ECHO), Move tabanlı bir Bitcoin staking ve likidite altyapısı olarak, piyasaya çıktığı günden bu yana Bitcoin varlıklarının likiditesini artırmak için kritik bir rol üstleniyor. 2025 yılı itibarıyla Echo’nun piyasa değeri 8.182.720 $’a ulaştı; yaklaşık 208.000.000 dolaşımdaki token ile fiyatı 0,03934 $ seviyesinde. “Bitcoin Likidite Artırıcı” olarak bilinen bu varlık, kurumsal ve bireysel Bitcoin sahipleri için yenilikçi yeniden staking çözümleri sunarak önemli bir ilerleme kaydediyor.

Bu makalede, Echo’nun 2025-2030 yılları arasındaki fiyat hareketleri, geçmiş trendler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler ışığında profesyonel fiyat tahminleri ve yatırımcılara yönelik pratik stratejiler kapsamlı biçimde analiz edilecektir.

I. ECHO Fiyat Geçmişi İncelemesi ve Güncel Piyasa Durumu

ECHO Tarihsel Fiyat Gelişimi

- 2025 Temmuz: ECHO, 0,07526 $ ile tüm zamanların en yüksek seviyesine ulaşarak proje adına önemli bir kilometre taşı elde etti

- 2025 Temmuz: Sadece birkaç gün sonra ECHO, keskin bir düşüşle 0,015 $ ile tüm zamanların en düşük seviyesini gördü

- 2025 Ekim: ECHO toparlanarak fiyatı 0,03934 $ civarında istikrar kazandı

ECHO Güncel Piyasa Durumu

09 Ekim 2025 itibarıyla ECHO, 0,03934 $ seviyesinde işlem görüyor. Token son 24 saatte %5,95 oranında değer kaybetti ve kısa vadeli düşüş eğilimi gösteriyor. Ancak, son bir haftada %2,53’lük artış ve son 30 günde %25,86’lık yükselişle uzun vadede olumlu bir büyüme sergiliyor.

ECHO’nun güncel piyasa değeri 8.182.720 $ olup, küresel kripto para listesinde 1.531. sırada bulunuyor. Token’ın dolaşımdaki miktarı 208.000.000, toplam arzı ise 1.000.000.000 olup, dolaşım oranı %20,8’dir.

ECHO’nun 24 saatlik işlem hacmi 57.393,57 $ ile piyasada orta düzeyde bir hareketlilik gösteriyor. Token fiyatı şu anda tüm zamanların en düşük seviyesine daha yakın olup, piyasa koşulları iyileşirse ileride büyüme potansiyeli bulunuyor.

Güncel ECHO piyasa fiyatını görmek için tıklayın

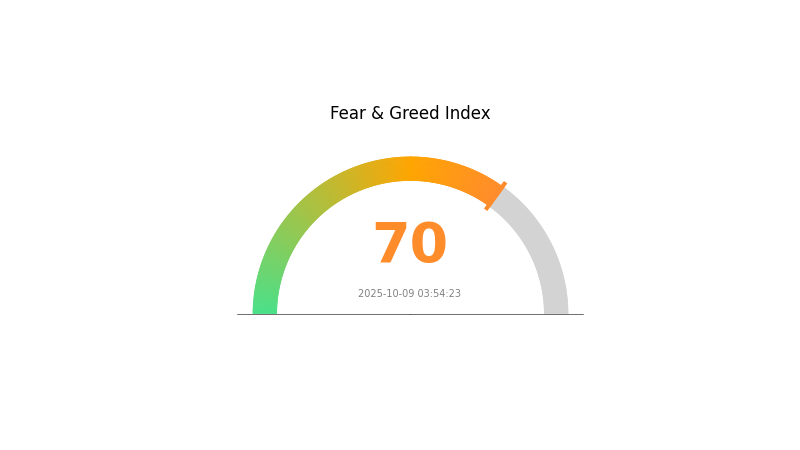

ECHO Piyasa Duyarlılık Endeksi

09 Ekim 2025 Korku ve Açgözlülük Endeksi: 70 (Açgözlülük)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Kripto piyasasında şu anda iyimser bir hava hâkim. Korku ve Açgözlülük Endeksi 70 seviyesinde ve Açgözlülük durumunu gösteriyor. Bu, yatırımcıların güveninin arttığını ve piyasada yükseliş beklentisiyle hareket ettiğini işaret ediyor. Ancak aşırı açgözlülük, zaman zaman piyasa düzeltmelerine neden olabilir. Yatırımcılar portföylerini çeşitlendirmeli, önemli direnç seviyelerini ve piyasayı etkileyebilecek katalizörleri takip etmelidir. Her zaman kendi araştırmanızı yapın ve sorumlu şekilde yatırım yapın.

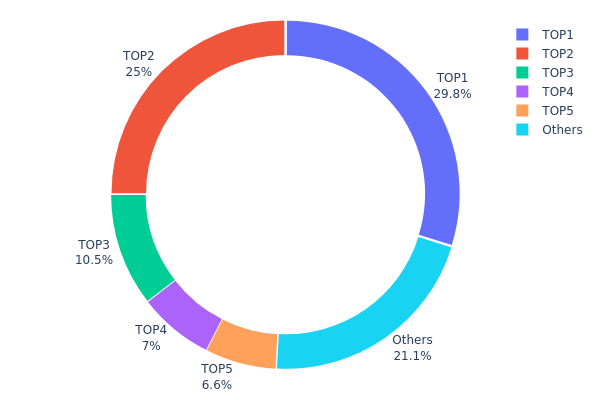

ECHO Varlık Dağılımı

ECHO’nun adres varlık dağılımı verileri, sahipliğin oldukça yoğunlaştığını gösteriyor. İlk beş adres, toplam arzın %78,94’ünü kontrol ediyor ve en büyük sahip tüm tokenların %29,82’sine sahip. Bu denli yoğunlaşma, merkeziyetsizlik ve piyasada olası manipülasyon açısından endişe yaratıyor.

Böyle bir dağılım, piyasa dinamiklerini doğrudan etkileyebilir. Büyük sahipler fiyat hareketlerinde ciddi bir etki yaratabilir ve bu da volatilitenin artmasına yol açabilir. Ayrıca, büyük ölçekli işlemler ECHO ekosisteminin genel istikrarı için risk oluşturabilir ve token fiyatını ciddi biçimde etkileyebilir.

Bu dağılım modeli, ECHO’nun zincir üstü yapısının ideal merkeziyetsizlikten uzak olduğunu ortaya koyuyor. Kısa vadede fiyat istikrarı sağlayabilse de, projenin uzun vadeli dayanıklılığı ve piyasa manipülasyonu riskinin azaltılması için daha geniş bir token dağılımına ihtiyaç var.

Güncel ECHO Varlık Dağılımı için tıklayın

| Sıra | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0x12b7...c13cdf | 298.176,04K | 29,82% |

| 2 | 0x2bd1...cb19e9 | 250.024,71K | 25,00% |

| 3 | 0x4d59...f57fd5 | 105.161,77K | 10,52% |

| 4 | 0xc9db...d3246b | 70.000,00K | 7,00% |

| 5 | 0x57de...ed04c1 | 66.000,00K | 6,60% |

| - | Diğerleri | 210.637,48K | 21,06% |

II. ECHO’nun Gelecek Fiyatını Etkileyen Temel Faktörler

Kurumsal ve Balina Hareketleri

- Kurumsal Varlıklar: Büyük kurumlar ECHO’ya giderek daha fazla ilgi gösteriyor ve bu da daha büyük sermaye girişlerine yol açabilir.

- Kurumsal Benimseme: Bazı şirketler ECHO teknolojisini çeşitli uygulamalar için değerlendiriyor ve bu da talebi artırabilir.

Makroekonomik Koşullar

- Para Politikası Etkisi: Merkez bankalarının faiz ve likidite politikaları, yatırımcıların alternatif varlıklara yönelmesiyle ECHO fiyatını etkileyebilir.

- Enflasyona Karşı Koruma: ECHO’nun yüksek enflasyon ortamında koruma aracı olarak potansiyeli ön plana çıkabilir.

Teknolojik Gelişim ve Ekosistem İnşası

- Ekosistem Uygulamaları: ECHO platformunda DApp ve ekosistem projelerinin gelişimi, tokenın kullanım alanını ve değerini artırabilir.

III. ECHO Fiyat Tahmini 2025-2030

2025 Görünümü

- Temkinli tahmin: 0,03422 $ - 0,03933 $

- Tarafsız tahmin: 0,03933 $ - 0,0468 $

- İyimser tahmin: 0,0468 $ - 0,05 $ (güçlü piyasa ivmesi gerekli)

2027-2028 Görünümü

- Piyasa evresi: Potansiyel büyüme dönemi

- Fiyat aralığı tahmini:

- 2027: 0,04358 $ - 0,06835 $

- 2028: 0,03359 $ - 0,08369 $

- Temel katalizörler: Artan benimseme, teknolojik gelişmeler

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,05919 $ - 0,07737 $ (istikrarlı piyasa büyümesi varsayımıyla)

- İyimser senaryo: 0,07737 $ - 0,08356 $ (olumlu piyasa koşulları varsayımıyla)

- Dönüştürücü senaryo: 0,08356 $ - 0,09 $ (olağanüstü piyasa performansı ve yaygın benimseme ile)

- 31 Aralık 2030: ECHO 0,07737 $ (2025’e göre %96 yükseliş)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 0,0468 | 0,03933 | 0,03422 | 0 |

| 2026 | 0,05599 | 0,04307 | 0,03445 | 9 |

| 2027 | 0,06835 | 0,04953 | 0,04358 | 25 |

| 2028 | 0,08369 | 0,05894 | 0,03359 | 49 |

| 2029 | 0,08344 | 0,07131 | 0,05919 | 81 |

| 2030 | 0,08356 | 0,07737 | 0,06964 | 96 |

IV. ECHO Profesyonel Yatırım Stratejisi ve Risk Yönetimi

ECHO Yatırım Yöntemi

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcılar: Bitcoin ekosistem yatırımcıları ve kurumsal ortaklar

- İşlem önerileri:

- Piyasa düşüşlerinde ECHO token biriktirin

- ECHO tokenlarını stake ederek getiri elde edin

- Tokenları güvenli, saklayıcı olmayan cüzdanlarda saklayın

(2) Aktif Al-Sat Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalama: Kısa ve uzun vadeli trendleri izleyin

- RSI: Aşırı alım ve aşırı satım bölgelerini tespit edin

- Dalgalı al-sat için ana noktalar:

- Risk yönetimi için stop-loss emirleri koyun

- Belirlenen fiyat hedeflerinde kâr alın

ECHO Risk Yönetim Çerçevesi

(1) Varlık Dağıtım İlkeleri

- Temkinli yatırımcılar: %1-3

- Agresif yatırımcılar: %5-10

- Profesyonel yatırımcılar: %10-15

(2) Riskten Korunma Çözümleri

- Diversifikasyon: Kripto yatırımlarınızı birden fazla varlık arasında dağıtın

- Stop-loss emirleri: Potansiyel kayıpları sınırlamak için uygulayın

(3) Güvenli Saklama Yöntemleri

- Sıcak cüzdan önerisi: Gate web3 cüzdanı

- Soğuk saklama: Uzun vadeli tutumlar için donanım cüzdanı

- Güvenlik önlemleri: İki faktörlü kimlik doğrulama etkinleştirin, güçlü şifreler kullanın

V. ECHO Olası Riskler ve Zorluklar

ECHO Piyasa Riskleri

- Yüksek volatilite: Kripto piyasalarında sık görülen sert fiyat dalgalanmaları

- Sınırlı likidite: Büyük işlemlerin gerçekleştirilmesinde zorluk yaşanabilir

- Piyasa duyarlılığı: Yatırımcı psikolojisindeki ani değişimlere açık

ECHO Regülasyon Riskleri

- Belirsiz düzenlemeler: Bitcoin ekosistemini etkileyebilecek olası yasal değişiklikler

- Sınır ötesi kısıtlamalar: Farklı ülkelerde değişen yasal durum

- Uyum gereksinimleri: Kripto projeleri için gelişen KYC/AML standartları

ECHO Teknik Riskleri

- Akıllı sözleşme açıkları: Protokoldeki potansiyel zaafiyetler

- Ölçeklenebilirlik sorunları: Artan işlem hacmini yönetmede olası kısıtlar

- Uyumluluk sorunları: Diğer blockchain ağlarıyla entegrasyon endişeleri

VI. Sonuç ve Eylem Önerileri

ECHO Yatırım Değeri Değerlendirmesi

ECHO, Bitcoin staking ve likidite altyapısında uzun vadeli büyüme potansiyeline sahip benzersiz bir fırsat sunuyor. Yatırımcılar kısa vadeli volatilite ve düzenleyici belirsizliklerin farkında olmalı.

ECHO Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük pozisyonlarla başlayın ve Bitcoin ekosistemi hakkında bilgi edinin ✅ Deneyimli yatırımcılar: Kripto portföyünün bir bölümünü ECHO’ya ayırmayı değerlendirin ✅ Kurumsal yatırımcılar: Yenilikçi yeniden staking çözümleri ve BTC varlık likiditesi için ECHO’yu inceleyin

ECHO Alım-Satım Katılım Yöntemleri

- Spot işlemler: Gate.com üzerinden ECHO token alıp satabilirsiniz

- Staking: Getiri elde etmek için staking programlarına katılın

- DeFi entegrasyonu: ECHO’yu merkeziyetsiz finans protokollerinde kullanın (uygun olduğunda)

Kripto para yatırımları son derece yüksek risk içerir ve bu makale yatırım tavsiyesi niteliğinde değildir. Yatırım kararlarınızı kendi risk toleransınıza göre dikkatlice alın ve profesyonel finansal danışmanlara başvurun. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

Sıkça Sorulan Sorular

Hangi kripto paranın en yüksek fiyat tahmini var?

2025 yılı itibarıyla en yüksek fiyat tahmini yapılan kripto para Bitcoin (BTC)’dir. Kurumsal benimsemenin artması ve arzın sınırlı olması büyümeyi destekliyor; analistler önemli fiyat artışları öngörmektedir.

Echo Energy için hisse fiyatı tahmini nedir?

Echo Energy’nin hisse fiyatının, teknik analiz ve gelir projeksiyonlarına göre 1.394 GBX seviyesine çıkması beklenmektedir.

Kripto dünyasında ECHO nedir?

Echo, kripto para ve gerçek dünya varlıklarını bir araya getiren tokenlaştırılmış bir yatırım platformudur. Dijital ve fiziksel varlıkların güvenli ve kolay entegrasyonunu hedefler ve yatırım fırsatlarını sadeleştirir.

2025 için gerçekçi XRP fiyat tahmini nedir?

Mevcut trendler dikkate alındığında XRP’nin 2025’te 10-13 $ aralığına ulaşması bekleniyor; bu tahmin, blockchain güncellemeleri, artan benimseme ve kurumsal katılımın sürmesi varsayımıyla yapılmaktadır.

2025'in En İyi Bitcoin Staking Platformları: Yüksek Getiri ve Güvenlik Analizi

BTC staking nedir: 2025'te Bitcoin staking getirileri ve risklerinin analizi

2025 BB Fiyat Tahmini: Piyasa Trendleri ve Potansiyel Büyüme Faktörlerinin Analizi

Babylon (BABY) iyi bir yatırım mı?: Yükselen bu kripto paranın potansiyelini ve risklerini değerlendirme

2025 GTBTC Fiyat Tahmini: Kurumsal Benimsemenin Hızlanmasıyla Yükseliş Eğilimi

Dropee Günlük Kombinasyonu 11 Aralık 2025

Tomarket Günlük Kombinasyonu 11 Aralık 2025

Merkeziyetsiz Finans'ta Geçici Kayıp Nedir?

Kripto Parada Çifte Harcama: Önleme Stratejileri

Kripto Ticaretinde Wyckoff Yönteminin Anlaşılması