2025 GTBTC Price Prediction: Bullish Outlook as Institutional Adoption Accelerates

Introduction: GTBTC's Market Position and Investment Value

Gate Wrapped BTC (GTBTC), as an on-chain BTC yield-generating asset, has achieved significant milestones since its inception. As of 2025, GTBTC's market capitalization has reached $288,331,617, with a circulating supply of approximately 3,003.90180236 tokens, and a price hovering around $95,985.7. This asset, known as a "BTC yield-generating token," is playing an increasingly crucial role in both CeFi and DeFi scenarios.

This article will comprehensively analyze GTBTC's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic environment to provide investors with professional price predictions and practical investment strategies.

I. GTBTC Price History Review and Current Market Status

GTBTC Historical Price Evolution

- 2023: GTBTC launched by Gate Web3, initial price established

- 2024: Widespread adoption in CeFi and DeFi scenarios, price steadily increased

- 2025: Market volatility, price peaked at $125,918.6 on October 6th, then declined to $94,388.8 on November 14th

GTBTC Current Market Situation

GTBTC is currently trading at $95,985.7, experiencing a 1.04% decrease in the last 24 hours. The token has a market capitalization of $288,331,617.23, ranking 204th in the crypto market. The circulating supply matches the total supply at 3,003.90180236 GTBTC. Over the past week, GTBTC has seen a significant drop of 6.56%, and a more substantial decline of 13.91% over the last 30 days. The current price is 23.77% below its all-time high of $125,918.6, recorded on October 6, 2025. The market sentiment for GTBTC is currently in a state of extreme fear, with a VIX index of 10, indicating high investor anxiety.

Click to view the current GTBTC market price

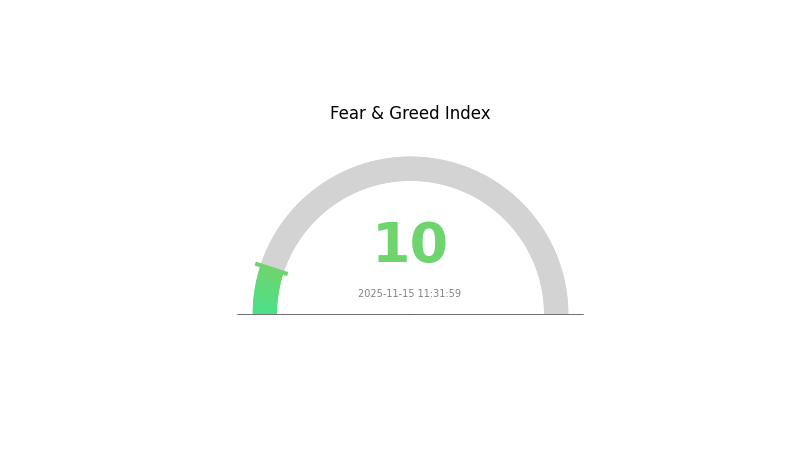

GTBTC Market Sentiment Indicator

2025-11-15 Fear and Greed Index: 10 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the sentiment index at a mere 10. This level of fear often signals a potential buying opportunity for contrarian investors. However, it's crucial to remember that market bottoms can persist. Wise investors may consider dollar-cost averaging strategies during such periods of pessimism. As always, thorough research and risk management are essential before making any investment decisions in the volatile crypto market.

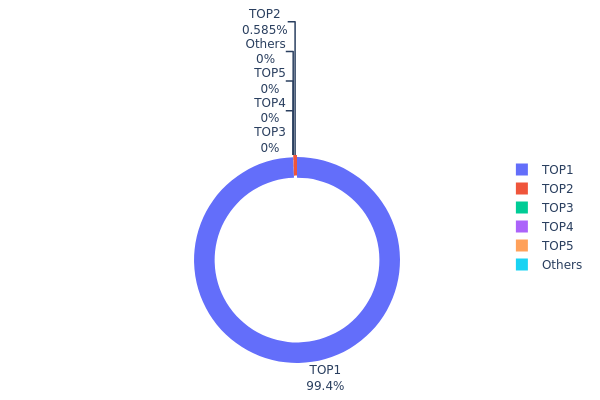

GTBTC Holdings Distribution

The address holdings distribution data for GTBTC reveals a highly concentrated ownership structure. The top address holds an overwhelming 99.41% of the total supply, with 894.61 GTBTC tokens. This extreme concentration indicates a significant centralization of control within a single entity or wallet.

The second-largest holder possesses only 0.58% of the supply, while the remaining addresses shown have negligible or zero holdings. This stark imbalance in token distribution raises concerns about the asset's decentralization and market dynamics. Such a concentrated ownership structure could potentially lead to increased volatility and susceptibility to price manipulation, as large movements from the dominant address could significantly impact the market.

This distribution pattern suggests that GTBTC's on-chain structure may be less stable and more prone to sudden shifts if the major holder decides to move their assets. It also implies a low level of token dispersion among users, which could affect liquidity and overall market participation.

Click to view the current GTBTC Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xc882...84f071 | 894.61 | 99.41% |

| 2 | 0x0d07...b492fe | 5.26 | 0.58% |

| 3 | 0xec5d...4fc679 | 0.00 | 0.00% |

| 4 | 0xbcd2...a17645 | 0.00 | 0.00% |

| 5 | 0xeec9...423a35 | 0.00 | 0.00% |

| - | Others | -0 | 0.010000000000005% |

II. Key Factors Influencing Future GTBTC Prices

Macroeconomic Environment

- Inflation Hedging Properties: As a cryptocurrency, GTBTC may potentially serve as a hedge against inflation in certain economic conditions.

Technological Development and Ecosystem Building

- Ecosystem Applications: The growth of decentralized applications (DApps) and ecosystem projects built on or related to GTBTC could influence its future value and adoption.

III. GTBTC Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $87,354 - $95,994

- Neutral prediction: $95,994 - $107,033

- Optimistic prediction: $107,033 - $118,072 (requires continued institutional adoption)

2027-2028 Outlook

- Market stage expectation: Potential bull market phase

- Price range forecast:

- 2027: $102,195 - $152,629

- 2028: $119,847 - $201,172

- Key catalysts: Increased mainstream acceptance, technological advancements

2029-2030 Long-term Outlook

- Base scenario: $171,923 - $212,325 (assuming steady market growth)

- Optimistic scenario: $212,325 - $252,727 (with accelerated adoption and favorable regulations)

- Transformative scenario: $252,667+ (under extremely favorable conditions and widespread integration)

- 2030-11-15: GTBTC $212,325 (potential stabilization after significant growth)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 118072.25 | 95993.7 | 87354.27 | 0 |

| 2026 | 158408.8 | 107032.98 | 89907.7 | 11 |

| 2027 | 152629.02 | 132720.89 | 102195.09 | 38 |

| 2028 | 201171.69 | 142674.96 | 119846.96 | 48 |

| 2029 | 252727.28 | 171923.32 | 94557.83 | 79 |

| 2030 | 252667.11 | 212325.3 | 140134.7 | 121 |

IV. GTBTC Professional Investment Strategies and Risk Management

GTBTC Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Conservative investors seeking BTC exposure with yield

- Operation suggestions:

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short and long-term trends

- RSI: Identify overbought/oversold conditions

- Key points for swing trading:

- Track BTC price movements closely

- Monitor GTBTC/BTC ratio for arbitrage opportunities

GTBTC Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of portfolio

- Moderate investors: 3-5% of portfolio

- Aggressive investors: 5-10% of portfolio

(2) Risk Hedging Solutions

- Diversification: Balance GTBTC with other crypto assets

- Stop-loss orders: Set predetermined exit points

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage option: Hardware wallet for large holdings

- Security precautions: Enable 2FA, use unique passwords

V. Potential Risks and Challenges for GTBTC

GTBTC Market Risks

- Bitcoin price volatility: GTBTC value closely tied to BTC

- Liquidity risk: Potential challenges in large-scale trading

- Yield fluctuations: Changes in staking rewards may impact returns

GTBTC Regulatory Risks

- Regulatory uncertainty: Evolving crypto regulations may affect GTBTC

- Cross-border restrictions: Potential limitations on international trading

- Tax implications: Unclear tax treatment of yield-bearing assets

GTBTC Technical Risks

- Smart contract vulnerabilities: Potential issues in underlying code

- Blockchain network congestion: May affect minting/redemption process

- Custody risks: Reliance on Gate.com's security measures

VI. Conclusion and Action Recommendations

GTBTC Investment Value Assessment

GTBTC offers a unique proposition for BTC holders seeking yield, but carries inherent risks associated with cryptocurrencies and yield-bearing assets. Long-term potential is tied to BTC adoption and Gate.com's platform stability.

GTBTC Investment Recommendations

✅ Beginners: Start with small allocations, focus on learning the mechanics ✅ Experienced investors: Consider as part of a diversified crypto portfolio ✅ Institutional investors: Evaluate for yield enhancement on BTC holdings

GTBTC Participation Methods

- Direct purchase: Buy GTBTC on Gate.com spot market

- BTC staking: Mint GTBTC by staking BTC on Gate.com

- DeFi integration: Utilize GTBTC in supported DeFi protocols

Cryptocurrency investments are extremely high-risk. This article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How many GBTC equals 1 Bitcoin?

GBTC shares are designed to track Bitcoin's price. Typically, 1,000 GBTC shares represent about 1 Bitcoin, though this ratio may vary slightly due to market factors.

Is grayscale a good buy?

Grayscale can be a good buy for investors seeking exposure to crypto assets through a regulated investment vehicle. It offers a way to invest in digital currencies without direct ownership, potentially reducing some risks associated with crypto investing.

How much will $1 Bitcoin be worth in 2025?

Based on current trends and expert predictions, $1 Bitcoin could be worth approximately $100,000 to $150,000 by 2025, reflecting significant growth in the cryptocurrency market.

Why is GBTC dropping?

GBTC is dropping due to market volatility, increased competition from spot Bitcoin ETFs, and potential investor concerns about its premium/discount to NAV. Regulatory uncertainties and overall crypto market trends may also be contributing factors.

Share

Content