K366366k

Belum ada konten

K366366k

Hari ini tanggal 9 Februari harga BTC 69650\n1. Sejujurnya, berdasarkan biaya posisi dari BlackRock dan MicroStrategy, saya tidak bisa membayangkan pasar akan mengikuti siklus bull dan bear selama 4 tahun, tetapi cara lain tidak bisa menjelaskan tren saat ini. Setidaknya saat ini saya masih cukup bingung, siapa sebenarnya yang mengendalikan pasar, bahkan BlackRock pun tidak termasuk?\n2. Dari segi tren, BTC tetap dalam pola bearish, rebound harian sering kali dipakai untuk shorting. Grup TG setiap hari ada order, yang berminat bisa bergabung ke TG

BTC3,57%

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

Memprediksi ujung penurunan satu hari sebelumnya, membeli posisi panjang dan dihancurkan habis-habisan, hari yang gagal, istirahat satu hari

Lihat Asli- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

Hari ini tanggal 5 Desember harga BTC 70100 sedang sakit, mengunggah ulang video

Lihat Asli- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

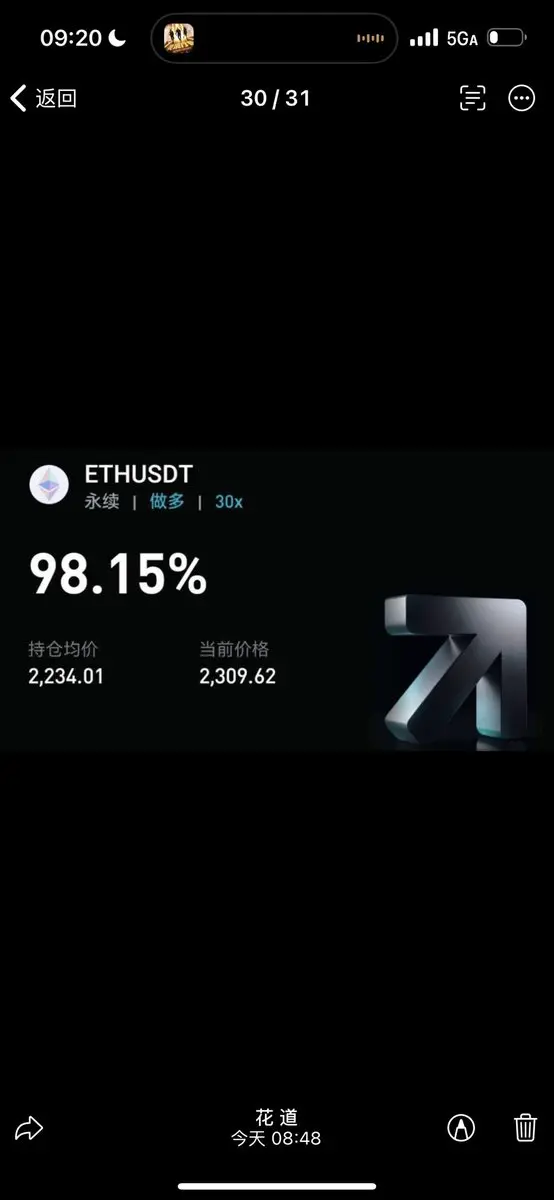

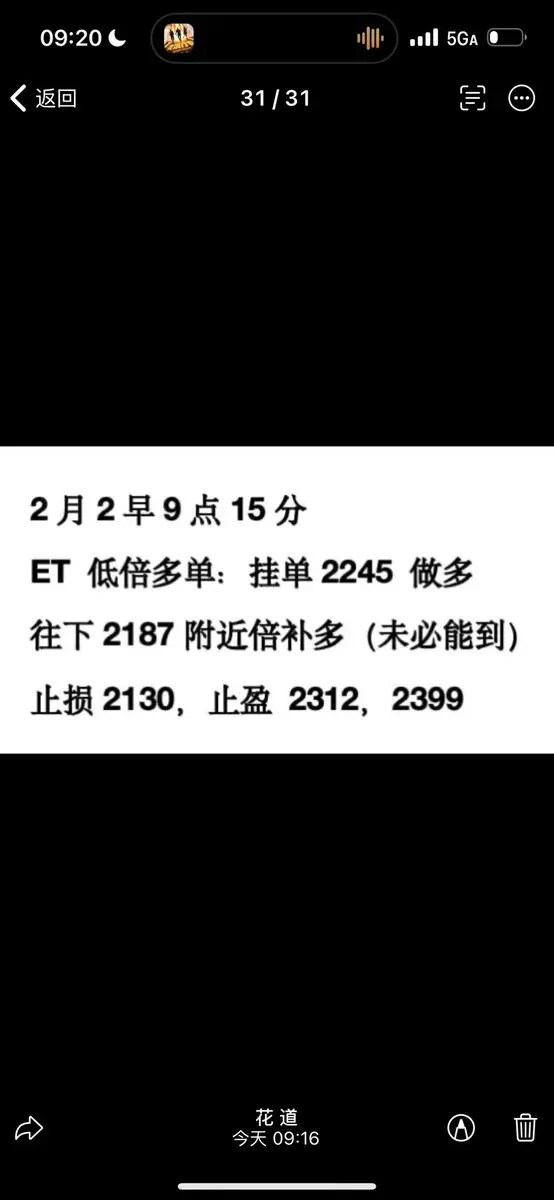

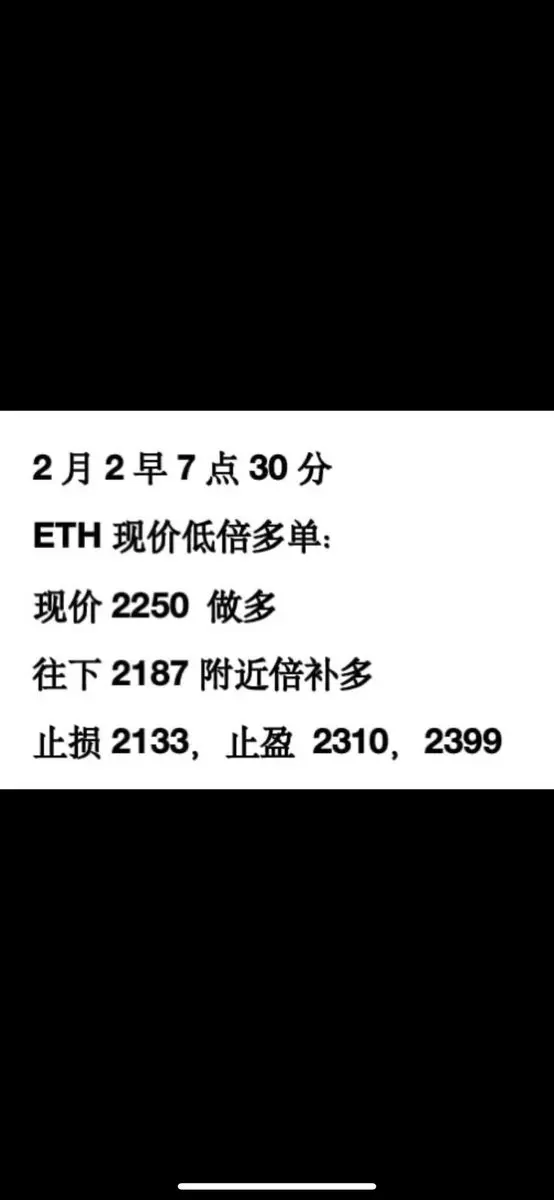

Pesanan pertama sudah mendapatkan keuntungan, ini adalah pesanan kedua, bersiap-siaplah

Lihat Asli

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

Buat satu transaksi, apakah ada yang bangun pagi? Kalau mau mendapatkan keuntungan, harus berani mengambil peluang sejak dini. Jangan ragu untuk mencoba dan berinovasi, karena keberhasilan sering kali dimulai dari langkah kecil yang berani. Apakah Anda siap untuk memulai hari ini dan meraih peluang yang ada?

Lihat Asli

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

Hari ini 26 Januari, harga BTC 878401, secara makro, kelompok penyerang kapal induk mendekati Iran, China mengganti Wakil Ketua Komisi Militer konservatif, memperkuat posisi kaum muda dan pendukung perang. Seorang saudara dari pasukan saya memberi tahu saya, sekelompok mayor dan kolonel yang sangat cemas membutuhkan kenaikan pangkat berdasarkan prestasi militer. Jadi emas dan perak mencapai rekor tertinggi baru, sangat jelas persiapan perang telah dimulai. 2, BTC masih akan terus berfluktuasi, tetapi pada posisi ini tidak akan terjadi penurunan besar, tidak lagi bisa diprediksi turun.

BTC3,57%

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

Pengingat teman, catatan pesanan adalah pesanan agresif, pesanan dengan leverage tinggi yang secara dasar menunjukkan bahwa akan segera mendapatkan keuntungan, dengan leverage 30 kali lipat, setidaknya setengah dari keuntungan harus direalisasikan saat mencapai target take profit pertama, sisanya atur untuk melindungi modal!! Jika sudah paham, tekan 11

Lihat Asli

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

26 Januari pukul 3 pagi kirimkan order short agresif kecil: short ETH dengan leverage tinggi di kisaran 2909~2922, stop loss di 2946, take profit di 2881, 2853 berlaku sampai pukul 8 malam, jika melewati waktu, batalkan order, jika melewati waktu harus atur ulang posisi.

ETH5,67%

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

Yayasan WLFI sangat mungkin membeli kembali EGL1, kompetisi perdagangan dalam sistem USD1 dengan EGL1 selalu menjadi proyek unggulan, EGL1 seharusnya telah dibeli kembali oleh para pelaku pasar, peluang untuk mengambil posisi kontrak. Tempatkan stop loss di 0.028 untuk ikut serta

Lihat Asli- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

Topik Trending

Lihat Lebih Banyak64.44K Popularitas

401 Popularitas

288 Popularitas

48.7K Popularitas

104 Popularitas

Hot Gate Fun

Lihat Lebih Banyak- MC:$2.49KHolder:20.06%

- MC:$0.1Holder:10.00%

- MC:$0.1Holder:10.00%

- MC:$0.1Holder:10.00%

- MC:$0.1Holder:10.00%

Sematkan