Joban

Master Trader di Strategi saya berfokus pada volatilitas mid-cap dan disiplin.

Joban

#TariffTensionsHitCryptoMarket

Pasar keuangan global sekali lagi menghadapi gelombang turbulensi saat ketegangan tarif yang meningkat menyebar ke seluruh ekonomi dan pasar kripto merasakan dampaknya. Sementara cryptocurrency pernah dipandang sebagai aset yang terlepas dari tekanan makroekonomi tradisional, peristiwa terbaru membuktikan bahwa aset digital sangat terkait erat dengan kebijakan perdagangan global, sentimen investor, dan risiko geopolitik. Saat tarif meningkat antara ekonomi utama, ketidakpastian membentuk ulang aliran modal, selera risiko, dan pergerakan harga di seluruh lanskap

Lihat AsliPasar keuangan global sekali lagi menghadapi gelombang turbulensi saat ketegangan tarif yang meningkat menyebar ke seluruh ekonomi dan pasar kripto merasakan dampaknya. Sementara cryptocurrency pernah dipandang sebagai aset yang terlepas dari tekanan makroekonomi tradisional, peristiwa terbaru membuktikan bahwa aset digital sangat terkait erat dengan kebijakan perdagangan global, sentimen investor, dan risiko geopolitik. Saat tarif meningkat antara ekonomi utama, ketidakpastian membentuk ulang aliran modal, selera risiko, dan pergerakan harga di seluruh lanskap

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

Pembaharuan Harga Bitcoin (BTC) – Hari Ini

💰 Harga Saat Ini:

- $41.500 hingga $43.000 USD (perkiraan)

- ₨11,6M hingga ₨12,0M PKR (perkiraan)

📊 Perubahan 24H:

- +1,5% hingga +3% (menunjukkan pasar yang sedikit bullish)

📉 Rendah / Tinggi 24H:

- Rendah: $40.800

- Tinggi: $43.400

📈 Tren Pasar:

- Jangka pendek: Bullish, mungkin sideways

- BTC mempertahankan kekuatan di atas level support utama

💰 Harga Saat Ini:

- $41.500 hingga $43.000 USD (perkiraan)

- ₨11,6M hingga ₨12,0M PKR (perkiraan)

📊 Perubahan 24H:

- +1,5% hingga +3% (menunjukkan pasar yang sedikit bullish)

📉 Rendah / Tinggi 24H:

- Rendah: $40.800

- Tinggi: $43.400

📈 Tren Pasar:

- Jangka pendek: Bullish, mungkin sideways

- BTC mempertahankan kekuatan di atas level support utama

BTC2,12%

- Hadiah

- 1

- 1

- Posting ulang

- Bagikan

LittleQueen :

:

Selamat Tahun Baru! 🤑$FOGO Investasikan hanya 1 atau 2 persen dari portofolio Anda dalam peluncuran baru apa pun untuk meminimalkan kerugian, karena koin penipuan baru diluncurkan setiap hari. Dengan cara ini, uang Anda akan aman, dan Anda tetap dapat menikmati sensasi potensi keuntungan dan kerugian.

FOGO2,21%

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

$DEEP Ini memecah struktur dengan bersih dan didorong dengan kekuatan, sekarang bertahan di atas zona breakout, yang terasa seperti momentum sepenuhnya dalam kendali.

Zona Beli: 0.0535 – 0.0550

TP1: 0.0585

TP2: 0.0620

TP3: 0.0680

Stop: 0.0510

Tren kuat, penarikan kembali cepat dibeli, dan kelanjutan tampak hidup.

Ayo kita mulai

Zona Beli: 0.0535 – 0.0550

TP1: 0.0585

TP2: 0.0620

TP3: 0.0680

Stop: 0.0510

Tren kuat, penarikan kembali cepat dibeli, dan kelanjutan tampak hidup.

Ayo kita mulai

DEEP-0,24%

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

🚨 Acara Kripto Hari Ini - 9 Jan 2026 🚨

🔴 Data Non-Farm Payrolls AS (NFP) & Data Lapangan Kerja @ 13:30 UTC - Katalis makro utama! Bisa menyebabkan volatilitas BTC/ETH yang besar.

🟡 Pengumuman Kandidat Ketua Fed yang Diharapkan - Pilihan dovish = Bullish untuk aset risiko?

🟢 Putusan Mahkamah Agung AS tentang Tarif Trump - Potensi injeksi likuiditas lebih dari $100Miliar?

Perhatikan pasar dengan saksama! 📈

#Crypto #Bitcoin #Ethereum #NFP

Lihat Asli🔴 Data Non-Farm Payrolls AS (NFP) & Data Lapangan Kerja @ 13:30 UTC - Katalis makro utama! Bisa menyebabkan volatilitas BTC/ETH yang besar.

🟡 Pengumuman Kandidat Ketua Fed yang Diharapkan - Pilihan dovish = Bullish untuk aset risiko?

🟢 Putusan Mahkamah Agung AS tentang Tarif Trump - Potensi injeksi likuiditas lebih dari $100Miliar?

Perhatikan pasar dengan saksama! 📈

#Crypto #Bitcoin #Ethereum #NFP

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

$LUNC 1,01 triliun terbakar 🔥

Kapitalisasi pasar 255 juta.

Kekuatan dalam diri ✨ 🌠 membangun secara perlahan dan hati-hati naik ke LUNC untuk maju ⏩ mencapai kejayaan yang hilang di masa lalu.

Rintangan utama adalah pasokan dalam triliunan tetapi membangun ekosistem adopsi yang luas dan keandalan yang dibangun dapat menarik pembeli baru untuk menanamkan uang di sistem guna memperkuat LUNC.

#dyor

Kapitalisasi pasar 255 juta.

Kekuatan dalam diri ✨ 🌠 membangun secara perlahan dan hati-hati naik ke LUNC untuk maju ⏩ mencapai kejayaan yang hilang di masa lalu.

Rintangan utama adalah pasokan dalam triliunan tetapi membangun ekosistem adopsi yang luas dan keandalan yang dibangun dapat menarik pembeli baru untuk menanamkan uang di sistem guna memperkuat LUNC.

#dyor

LUNC3,4%

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

Aktivitas paus di pasar cryptocurrency telah meningkat secara signifikan dalam beberapa jam terakhir. Menurut data on-chain, investor dengan volume tinggi telah melakukan transfer besar dari beberapa aset crypto utama, terutama Bitcoin dan Ethereum.

Menurut data, seorang paus menyetor 10.169 ETH, senilai sekitar $29,77 juta, ke Binance, mendapatkan keuntungan total sebesar $11,36 juta. Diketahui bahwa investor ini sebelumnya telah menarik 19.505,5 ETH ($48,69 juta) dari bursa dan melakukan staking, kemudian menginvestasikan kembali 20.269 ETH ($60,05 juta) ke bursa tersebut, menghasilkan pend

Lihat AsliMenurut data, seorang paus menyetor 10.169 ETH, senilai sekitar $29,77 juta, ke Binance, mendapatkan keuntungan total sebesar $11,36 juta. Diketahui bahwa investor ini sebelumnya telah menarik 19.505,5 ETH ($48,69 juta) dari bursa dan melakukan staking, kemudian menginvestasikan kembali 20.269 ETH ($60,05 juta) ke bursa tersebut, menghasilkan pend

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

Cuplikan Pasar Saat Ini: Ethereum diperdagangkan mendekati $3.100, menunjukkan ketahanan meskipun tren volume yang rendah dan ketidakpastian makro.

🔎 1. Arus Masuk Bersih Melonjak: $ETH Melihat Permintaan On‑Chain yang Meningkat

Data on‑chain terbaru menunjukkan pergeseran signifikan dalam aliran bersih Ethereum, dengan $960 juta dalam arus masuk bersih tercatat pada Desember, merupakan flip positif pertama sejak pertengahan 2025.

Pengamatan Utama:

Dari Juli hingga November 2025, aliran pertukaran ETH bersih negatif, menunjukkan akumulasi pemegang atau rotasi modal di tempat lain.

Desember

🔎 1. Arus Masuk Bersih Melonjak: $ETH Melihat Permintaan On‑Chain yang Meningkat

Data on‑chain terbaru menunjukkan pergeseran signifikan dalam aliran bersih Ethereum, dengan $960 juta dalam arus masuk bersih tercatat pada Desember, merupakan flip positif pertama sejak pertengahan 2025.

Pengamatan Utama:

Dari Juli hingga November 2025, aliran pertukaran ETH bersih negatif, menunjukkan akumulasi pemegang atau rotasi modal di tempat lain.

Desember

ETH1,04%

- Hadiah

- 1

- 1

- Posting ulang

- Bagikan

NingxiFour :

:

Tahun Baru Kaya Mendadak 🤑- Hadiah

- suka

- 2

- Posting ulang

- Bagikan

GateUser-78989d9a :

:

Koin seribu kali kemungkinan besar akan menjadi raja koin tahun iniLihat Lebih Banyak

$AIAV jangan lupa masuk di 0.075..kita terbang bersama teman-teman 🚀💯🤑

Lihat Asli

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

Berikut ringkasan pembaruan pasar kripto terbaru (hari ini) — harga, berita utama, dan tren:

📈 Ikhtisar Harga Pasar

Bitcoin (BTC): Sekitar $BTC 91.282( — tetap stabil dengan pergerakan intraday yang modest.

Ethereum )ETH$ETH : Sekitar (3.140) — sedikit perubahan, menunjukkan kestabilan.

Solana $SOL SOL(: Sekitar )134$7Wallet — aksi harga yang modest.

XRP: Sekitar $2,09 — pergerakan positif kecil.

)Catatan: Ini adalah angka pasar langsung dari pasar kripto utama.$7M

📰 Berita Utama Kripto Hari Ini

Sorotan Berita Kripto Terbaru Hari Ini

blockchainreporter

Berita Pasar Kripto Hari Ini: )Pe

Lihat Asli📈 Ikhtisar Harga Pasar

Bitcoin (BTC): Sekitar $BTC 91.282( — tetap stabil dengan pergerakan intraday yang modest.

Ethereum )ETH$ETH : Sekitar (3.140) — sedikit perubahan, menunjukkan kestabilan.

Solana $SOL SOL(: Sekitar )134$7Wallet — aksi harga yang modest.

XRP: Sekitar $2,09 — pergerakan positif kecil.

)Catatan: Ini adalah angka pasar langsung dari pasar kripto utama.$7M

📰 Berita Utama Kripto Hari Ini

Sorotan Berita Kripto Terbaru Hari Ini

blockchainreporter

Berita Pasar Kripto Hari Ini: )Pe

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

- Hadiah

- 1

- Komentar

- Posting ulang

- Bagikan

Bitcoin tetap berada dalam kisaran antara ~$86K–$90K, dengan resistansi di dekat ~$92K–$95K dan dukungan di zona $80K yang lebih rendah. Menembus di atas resistansi dapat menandakan reli jangka pendek, sementara penurunan di bawah dukungan berisiko mengalami penurunan lebih lanjut.

Sinyal teknikal beragam: beberapa grafik jangka pendek menunjukkan pergerakan datar atau momentum yang lemah setelah penurunan Oktober dari puncak sebelumnya. $BTC $SWELL L $STRK

Lihat AsliSinyal teknikal beragam: beberapa grafik jangka pendek menunjukkan pergerakan datar atau momentum yang lemah setelah penurunan Oktober dari puncak sebelumnya. $BTC $SWELL L $STRK

- Hadiah

- 1

- Komentar

- Posting ulang

- Bagikan

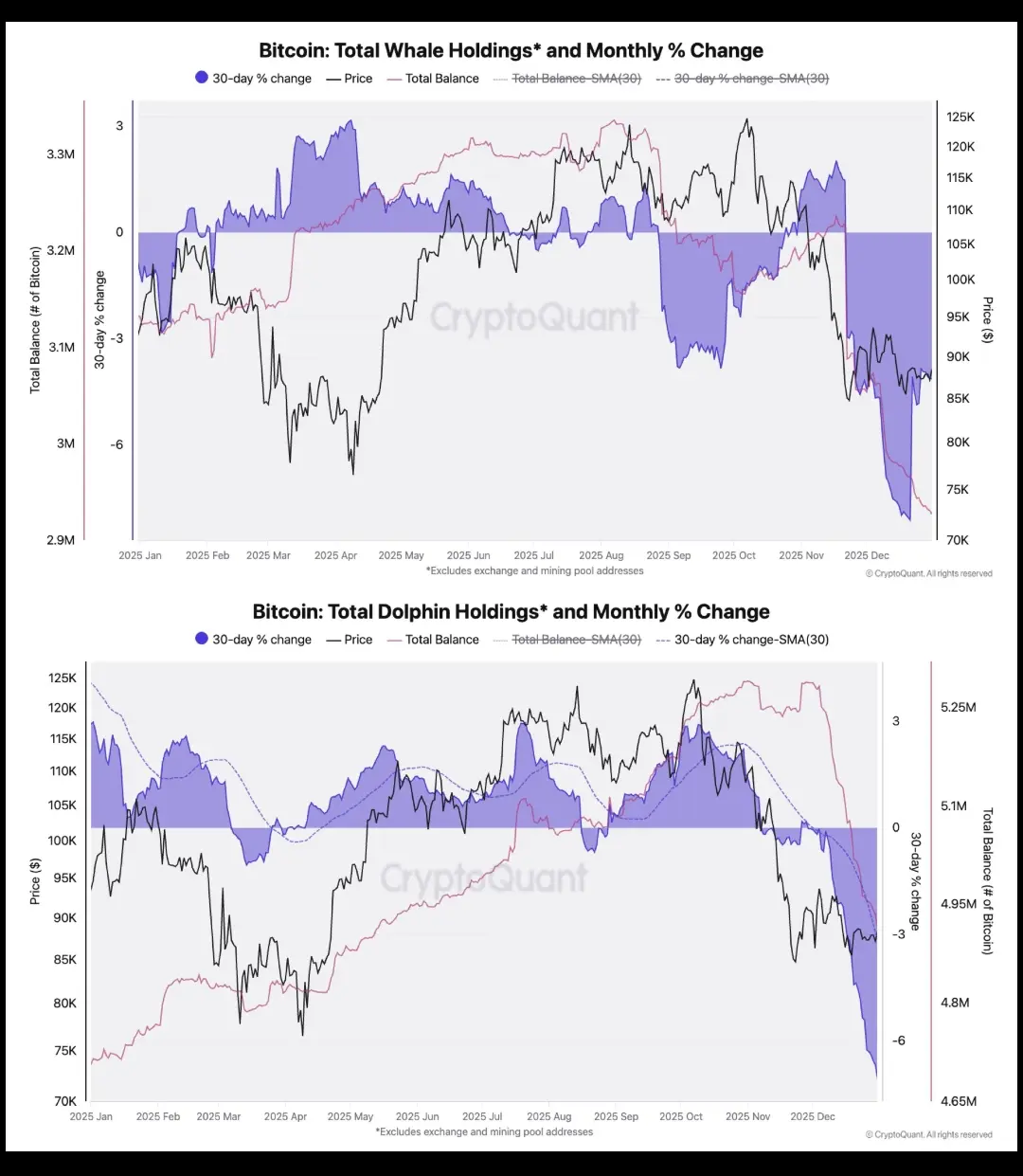

$BTC perdagangan mendekati $90K, tetapi narasi “paus sedang mengakumulasi” tampaknya berlebihan.

CryptoQuant mengatakan sebagian besar data dipengaruhi oleh konsolidasi dompet pertukaran, dengan pemegang besar masih secara bersih mendistribusikan dan saldo menurun di tengah keluar ETF.

Perpindahan yang tenang ini adalah dengan pemegang jangka panjang yang menjadi pembeli bersih, mengurangi tekanan jual meskipun harga belum sepenuhnya mencerminkan hal tersebut

$ETH $SOL

Lihat AsliCryptoQuant mengatakan sebagian besar data dipengaruhi oleh konsolidasi dompet pertukaran, dengan pemegang besar masih secara bersih mendistribusikan dan saldo menurun di tengah keluar ETF.

Perpindahan yang tenang ini adalah dengan pemegang jangka panjang yang menjadi pembeli bersih, mengurangi tekanan jual meskipun harga belum sepenuhnya mencerminkan hal tersebut

$ETH $SOL

- Hadiah

- 1

- Komentar

- Posting ulang

- Bagikan

🎆🚀 Top Kripto yang Perlu Diperhatikan Sebelum 2026 — XRP, Bitcoin & Ethereum Memimpin Daftar

Seiring mendekatnya Malam Tahun Baru 2025, investor kripto sedang menilai kembali portofolio mereka dan memposisikan diri untuk siklus pasar berikutnya. Di antara banyak pilihan, Bitcoin (BTC), Ethereum (ETH), dan XRP terus menonjol sebagai pesaing utama menjelang 2026.

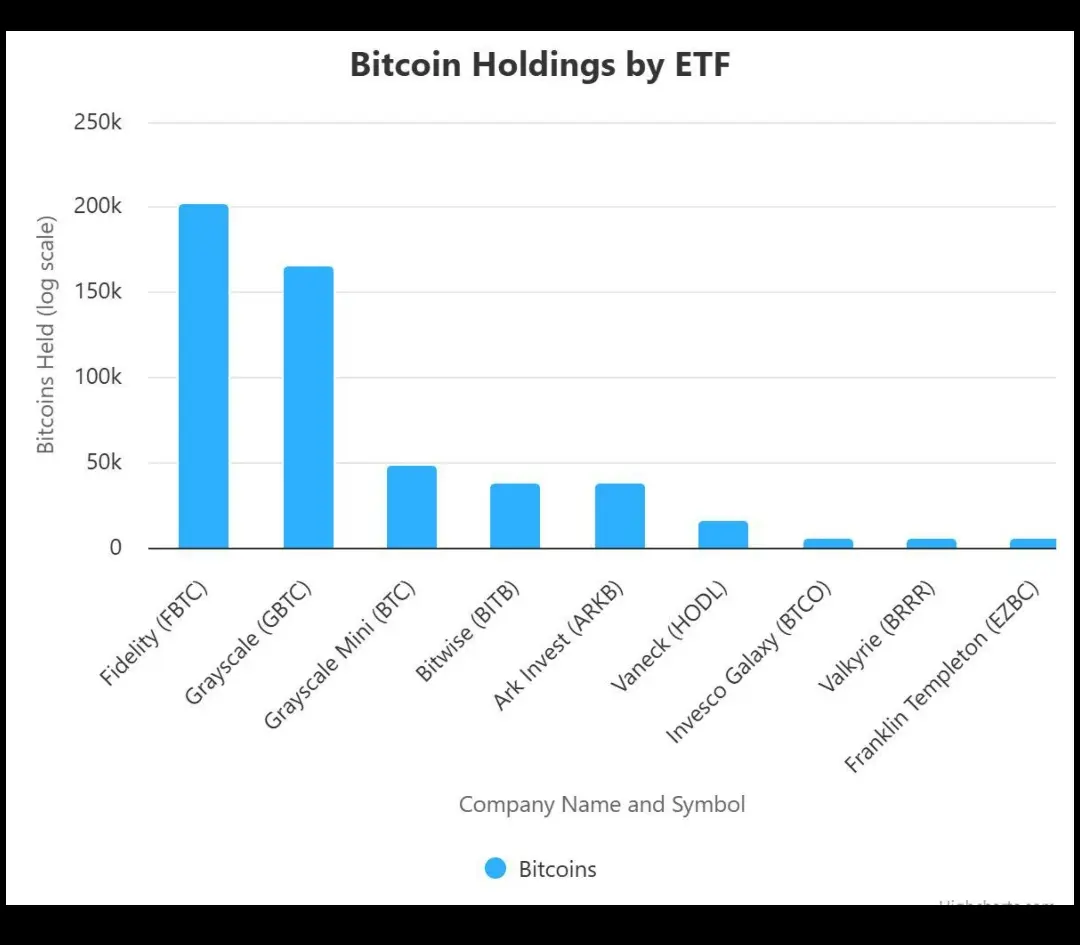

💎 Bitcoin (BTC): Penopang Pasar

Bitcoin tetap menjadi tulang punggung pasar kripto. Adopsi institusional yang kuat dan perannya sebagai penyimpan nilai digital menjadikan BTC pilihan utama bagi investor yang mencari stabilitas dan pe

Lihat AsliSeiring mendekatnya Malam Tahun Baru 2025, investor kripto sedang menilai kembali portofolio mereka dan memposisikan diri untuk siklus pasar berikutnya. Di antara banyak pilihan, Bitcoin (BTC), Ethereum (ETH), dan XRP terus menonjol sebagai pesaing utama menjelang 2026.

💎 Bitcoin (BTC): Penopang Pasar

Bitcoin tetap menjadi tulang punggung pasar kripto. Adopsi institusional yang kuat dan perannya sebagai penyimpan nilai digital menjadikan BTC pilihan utama bagi investor yang mencari stabilitas dan pe

- Hadiah

- 1

- 1

- Posting ulang

- Bagikan

AsterMattu :

:

GOGOGO 2026 👊$BTC

Bitcoin tetap berada dalam kisaran dekat area $88.000–$90.000 setelah penurunan tajam dari wilayah $100K . Harga terus membentuk higher low di bawah garis tren menurun saat pasar menunggu arahnya.

Bitcoin (BTC) terus diperdagangkan dalam kisaran yang menyempit di dekat $88.000–$90.000, mengkonsolidasikan setelah penurunan tajam dari wilayah $100.000 awal bulan ini. Pasar menunjukkan momentum yang relatif tenang, dengan harga yang terkonsentrasi di dalam struktur ketat yang mencerminkan ketidakpastian setelah penjualan sebelumnya. Volume perdagangan tetap moderat, dan lingkungan yang lebi

Bitcoin tetap berada dalam kisaran dekat area $88.000–$90.000 setelah penurunan tajam dari wilayah $100K . Harga terus membentuk higher low di bawah garis tren menurun saat pasar menunggu arahnya.

Bitcoin (BTC) terus diperdagangkan dalam kisaran yang menyempit di dekat $88.000–$90.000, mengkonsolidasikan setelah penurunan tajam dari wilayah $100.000 awal bulan ini. Pasar menunjukkan momentum yang relatif tenang, dengan harga yang terkonsentrasi di dalam struktur ketat yang mencerminkan ketidakpastian setelah penjualan sebelumnya. Volume perdagangan tetap moderat, dan lingkungan yang lebi

BTC2,12%

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

Aplikasi The Gate telah sepenuhnya ditingkatkan, dan kami mengundang Anda untuk berbagi pengalaman Anda. Perbarui ke versi terbaru dan selesaikan survei untuk menerima hadiah airdrop sebesar 10–50 USDT. Selain itu, ikuti kegiatan deposit dan trading untuk berbagi hadiah sebesar 50.000 USDT. Nikmati pengalaman baru dan buka kunci berbagai hadiah. https://www.gate.com/campaigns/3624?ref=UVZAUQwM&ref_type=132

Lihat Asli

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

#Gate 2025 Year-End Community Gala#

Penghargaan Akhir Tahun untuk Streamer Teratas & Pembuat Konten

Siapa yang akan menjadi Streamer Teratas Tahun ini? Siapa yang akan menduduki posisi teratas di papan peringkat Pembuat Konten? Bergabunglah dengan saya dalam pemungutan suara untuk mendukung streamer dan pembuat konten favorit Anda, dan saksikan kebangkitan bintang komunitas!

https://www.gate.com/activities/community-vote-2025?ref=UVZAUQwM&refType=2&refUid=6767852&ref_type=165&utm_cmp=xjdtmcgP

Lihat AsliPenghargaan Akhir Tahun untuk Streamer Teratas & Pembuat Konten

Siapa yang akan menjadi Streamer Teratas Tahun ini? Siapa yang akan menduduki posisi teratas di papan peringkat Pembuat Konten? Bergabunglah dengan saya dalam pemungutan suara untuk mendukung streamer dan pembuat konten favorit Anda, dan saksikan kebangkitan bintang komunitas!

https://www.gate.com/activities/community-vote-2025?ref=UVZAUQwM&refType=2&refUid=6767852&ref_type=165&utm_cmp=xjdtmcgP

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

Topik Trending

Lihat Lebih Banyak93.95K Popularitas

10.39K Popularitas

9.8K Popularitas

56.5K Popularitas

5.46K Popularitas

Hot Gate Fun

Lihat Lebih Banyak- MC:$0.1Holder:10.00%

- MC:$0.1Holder:10.00%

- MC:$0.1Holder:00.00%

- MC:$0.1Holder:10.00%

- MC:$0.1Holder:00.00%

Sematkan