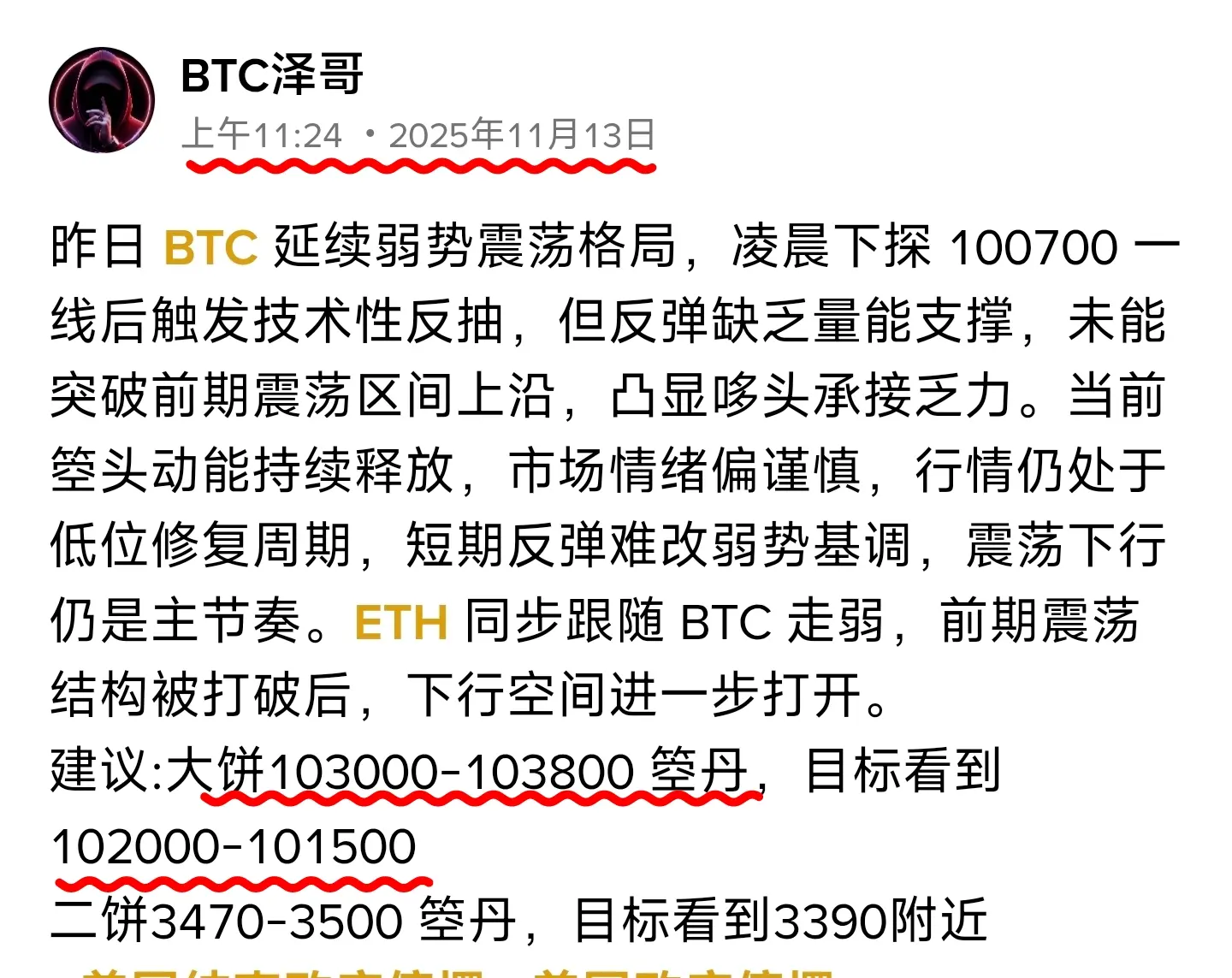

From the perspective of key resistance levels, the 100,000 integer mark has formed a clear and strong suppression. Combined with the current market's insufficient trading volume and the continuous lack of enthusiasm, before the price effectively breaks through and holds above the 100,000 mark, the "main strategy" remains the core operational direction.

It is recommended to establish a position in the range of 96650-97000 for Bitcoin.

The target is looking towards the range of 94380-93880.

Two coins 3200~3230 resistance level, target 3150~3170

#Gate10月透明度报告出炉 #CoinDesk10月Gate战绩来袭 #美国结束政府停摆

View OriginalIt is recommended to establish a position in the range of 96650-97000 for Bitcoin.

The target is looking towards the range of 94380-93880.

Two coins 3200~3230 resistance level, target 3150~3170

#Gate10月透明度报告出炉 #CoinDesk10月Gate战绩来袭 #美国结束政府停摆