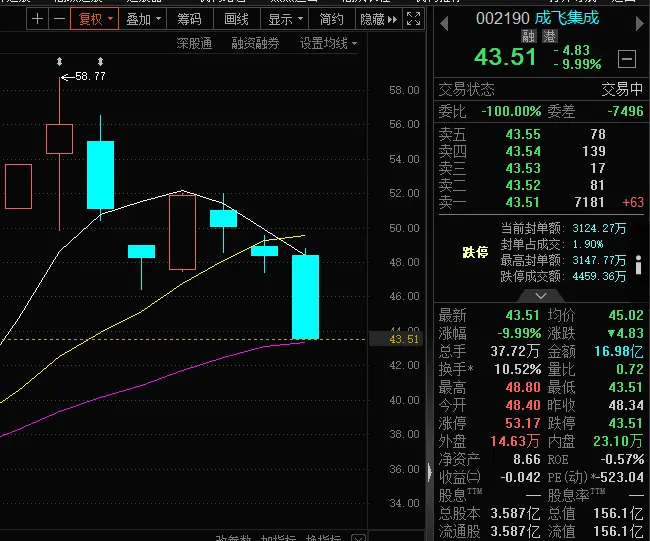

During the bull run, there have been many falls, but from the perspective of ETF fund flows, investor sentiment has not been significantly affected.

On August 27 and 28, the A-shares first experienced a high followed by a fall, with 4,700 stocks declining. The next day saw a V-shaped reversal, with Cambrian challenging Kweichow Moutai to become the new stock king. Amidst the ups and downs, ETF funds made structural switches between broad-based and thematic investments, but there was no evident panic selling.

Retail investors should learn to cut high and low; every pullback is an opportunity to

View OriginalOn August 27 and 28, the A-shares first experienced a high followed by a fall, with 4,700 stocks declining. The next day saw a V-shaped reversal, with Cambrian challenging Kweichow Moutai to become the new stock king. Amidst the ups and downs, ETF funds made structural switches between broad-based and thematic investments, but there was no evident panic selling.

Retail investors should learn to cut high and low; every pullback is an opportunity to